|

市場調查報告書

商品編碼

1403946

製造業中的物聯網 (IoT) -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Internet-of-Things (IoT) In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

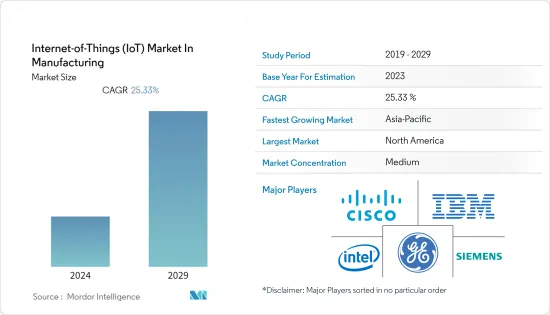

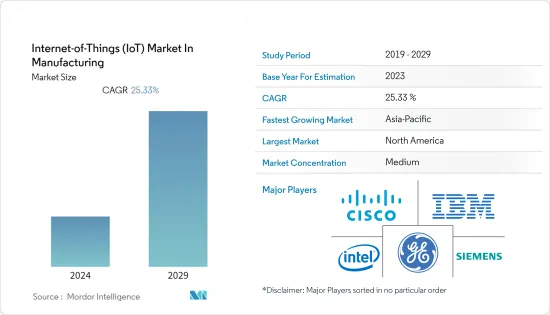

製造業物聯網 (IoT) 市場預計將從 2024 年的 3900 億美元成長到 2029 年的 1.2 兆美元,預測期內(2024-2029 年)複合年成長率為 25.33%。

過去二十年來,隨著對可追溯性和透明度的需求不斷成長,公司已開始使其產品生產流程變得透明。透過物聯網設備進行資料收集和分析,使製造商的整個流程變得無縫。

主要亮點

- 推動物聯網發展的因素包括強調預防性維護、提高生產效率以及簡化製造基礎設施管理。物聯網為製造商提供了前所未有的可見性、洞察力和控制力。透過簡化生產程序、減少停機時間、提高職場安全性和實現預測性維護,該技術有可能徹底改變工業部門。

- 隨著車間、供應鏈和產品上聯網感測器數量的增加,製造商正在轉向新一代系統,其中機器、系統、資產和物體可以自動即時相互通訊。連網型設備的普及正在整個價值鏈的多個製造和供應鏈環節中找到適用性。

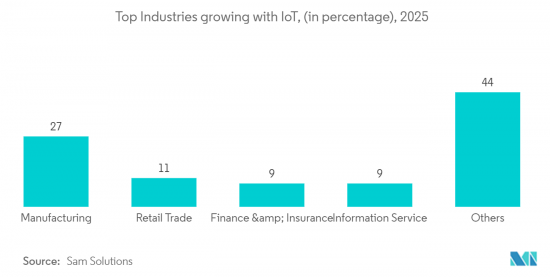

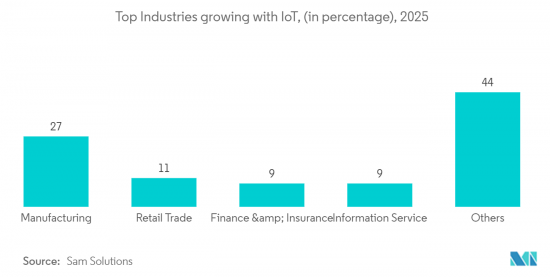

- 製造業中的物聯網 (IoT) 可以幫助工廠的生產流程,因為物聯網設備會自動追蹤開發週期並追蹤倉庫和庫存。這是過去幾十年來物聯網設備投資激增的原因之一。製造、物流和運輸領域的物聯網可能會成長。

- 物聯網被廣泛認為是一項將顯著改善製造業的先進技術。可以整合所有工業部門的組件,例如感測器、處理單元、通訊和執行器。這種完全整合的智慧資訊物理系統將創造新的製造市場和商業性前景,為第四次工業革命鋪路。為工業帶來了巨大的潛力。

- COVID-19大流行加速了物聯網 (IoT) 技術在製造業的採用,促進了創新、效率和彈性。物聯網可以繼續改變製造業,簡化流程,並為更永續和數位互聯的未來做出貢獻。

製造業物聯網 (IoT) 市場趨勢

供應鍊和物流管理應用推動市場成長

- 行動裝置和感測器(包括 RFID 和 GPS)的引入正在擾亂追蹤庫存和倉庫資產的供應鏈。

- 行動技術使企業能夠監控設備、庫存和業務。透過提供整個供應鏈的即時資料,資產智慧使公司能夠提高其專業知識和能力。這些解決方案支援了運輸和物流行業的進步,但當與物聯網 (IoT) 等實行技術結合時,它們可以提供更多資產智慧並幫助用戶做出更明智的決策。

- 物流中心、倉庫和堆場是供應鏈中最重要的生態系統部分。如果公司能夠提高這些組件的效能,那麼他們還可以提高業務效率。物流業將越來越依賴物聯網,倉庫將依靠雲端來追蹤庫存、車輛和設備。透過 RFID 標籤連接的大量機器使這成為可能。包裹和托盤在本地層面進行交互,基於企業的伺服器在全球層面持續監控其移動和移動進展。

- RFID標籤等追蹤設備可以透過收集生產、保存期限、製造日期、售後服務狀態和保固期等資訊,更有效地監控制造過程中的供應鏈。

- 根據 SAS 研究所的數據,英國可能是製造業的最大受益者,物聯網佔經濟的約 40.32 億英鎊。同樣,其他經濟體預計將大力投資供應鏈自動化,以加速製造業中物聯網的採用。

北美是最大市場

- 製造業物聯網 (IoT) 市場主要由北美主導。該地區是美國和加拿大等新興經濟體的所在地,它們大力投資於市場相關的研發活動,從而為新技術的開發做出了貢獻。隨著行動性、巨量資料和物聯網等趨勢技術的早期採用,製造商渴望將物聯網技術整合到他們的流程中。

- 連網型設備和資料流已經應用於製造業。因此,可以降低基礎設施成本並加快交付時間。為了保持競爭,製造商正在利用物聯網和分析來營運和改善其業務。在美國,大約 35% 的製造商收集並使用智慧感測器產生的資料來改善製造流程。

- 一項調查顯示,大約 34% 的製造商認為美國製造商應該將物聯網涵蓋業務中。對於製造商來說,物聯網已經成為一個生態系統,它結合了軟體、雲端運算和分析工具,將不同來源的原始資料轉化為有意義的預測,並將其顯示在易於使用的介面中。未來五年,自動化領域的連網設備數量預計將增加50個。

- 北美憑藉其技術力、強大的基礎設施、多元化的產業和支持生態系統,成為全球最大的製造業物聯網 (IoT) 市場。隨著該地區在創新和數位轉型方面保持領先地位,物聯網在製造業中的使用預計將繼續成長,進一步鞏固其作為全球最大物聯網市場的地位。

製造業物聯網 (IoT) 產業概覽

製造業的物聯網 (IoT) 市場具有凝聚力和連貫性。隨著公司選擇物聯網作為其製造設備的推動者,後工業 4.0 市場開始變得更具吸引力。此外,市場也變得越來越分散。該市場的主要企業包括思科系統公司、通用電氣公司、英特爾公司、IBM公司、AT&T公司、高通公司和西門子公司。

- 2022 年 6 月 - 領先的 LabOps 智慧技術平台 Elemental Machines 和下一代製造執行系統 (MES) 開發商 MasterControl 正在利用兩項最尖端科技幫助生物製造商消除手動資料收集。宣佈建立戰略合作夥伴關係,幫助實現自動化、提高資料、確保合規性並加速細胞和基因療法等先進生技藥品的生產。

- 2022 年5 月- 全球最大的RFID 和數位ID 解決方案供應商艾利丹尼森公司和物聯網先驅Wiliot 正在將物聯網擴展到新的水平,並推出造福人類和環境的新物聯網創新。我們宣布了一項策略聯盟開啟新時代。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 市場定義和範圍

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 資料分析的快速成長和技術進步

- 改善供應鏈管理和物流,降低營運成本

- 市場抑制因素

- 缺乏標準化介面,限制整合和可擴展性

- 安全和隱私問題

- 機會

- 物聯網和巨量資料的融合對於智慧製造的未來至關重要

- COVID-19 對資料中心服務市場的影響

第6章 重大技術投入

- 雲端技術

- 人工智慧

- 網路安全

- 數位服務

- 產業政策

第7章市場區隔

- 透過軟體

- 應用程式安全

- 資料管理與分析

- 監控

- 網路管理

- 其他軟體

- 依連通性(定性分析)

- 衛星網路

- 蜂巢式網路

- RFID

- NFC

- Wi-Fi

- 其他連接

- 按服務

- 專業的

- 系統整合與部署

- 管理

- 其他服務

- 按用途(定性分析)

- 流程最佳化

- 預測性維護

- 資產管理

- 勞動力管理

- 緊急/事故管理

- 物流/供應鏈管理

- 庫存控制

- 按行業分類

- 車

- 食品/農業設備

- 工業設備

- 電子/通訊設備

- 化工/材料設備

- 其他最終用戶(按行業)

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 北美洲

第8章競爭形勢

- 公司簡介

- Cisco Systems Inc.

- General Electric

- Intel Corporation

- IBM Corporation

- Verizon Communication Inc.

- AT&T Inc.

- Qualcomm

- Siemens AG

- Microsoft Corporation

- SAP SE

第9章投資分析

第10章市場機會與未來趨勢

The Internet-of-Things (IoT) Market in Manufacturing is expected to grow from USD 0.39 trillion in 2024 to USD 1.2 trillion by 2029, at a CAGR of 25.33% during the forecast period (2024-2029).

With the increasing demand in the last two decades for traceability and transparency, companies have started making the processes involved in the production of their products transparent. Data collection and analysis through IoT devices make the whole process seamless for manufacturers.

Key Highlights

- Some of the drivers that have fueled the IoT's growth include a greater emphasis on preventative maintenance, increased production effectiveness, and streamlining the management of manufacturing infrastructure. Manufacturers have unprecedented visibility, insight, and control thanks to the IoT. By streamlining production procedures, cutting downtime, enhancing workplace safety, and enabling predictive maintenance, this technology has the potential to transform the industrial sector completely.

- As the number of networked sensors in production, the supply chain, and products grows, manufacturers are moving into a new generation of systems that let machines, systems, assets, and things talk to each other automatically and in real time.The pervasiveness of connected devices is finding applicability across multiple manufacturing and supply chain segments throughout the value chain.

- IoT in manufacturing can help the flow of production in a plant because IoT devices automatically track development cycles and keep track of warehouses and stock. It is one of the reasons that investments in IoT devices have skyrocketed over the past few decades. IoT in manufacturing, logistics, and transportation will grow.

- IoT is widely recognized as a advanced technology that significantly improves the manufacturing sector. It can integrate every industrial sector's components, including sensors, processing units, communication, and actuation devices. This fully integrated smart cyber-physical system creates new manufacturing markets and commercial prospects and sets the path for the fourth industrial revolution. It creates significant potential for the industrial industry.

- The COVID-19 pandemic expedited the implementation of IoT technology in the manufacturing industry, promoting innovation, efficiency and resilience. IoT is equipped to continue driving transformational changes in the manufacturing industry, streamlining processes and contributing to a more sustainable and digitally linked future.

Internet of Things (IoT) in Manufacturing Market Trends

Supply Chain and Logistics Management Application to Spur Growth in the Market Studied

- There has been a substantial change in the supply chain with the adoption of mobile devices and sensors, including RFID and GPS, to track inventory and warehouse assets.

- Mobile technologies allow businesses to monitor equipment, inventory, and business operations. By giving them real-time data across their entire supply chain, asset intelligence enables enterprises to boost their expertise and capacity. Although these solutions have helped the transportation and logistics industries advance over time, combining them with enabling technologies like the Internet of Things (IoT) can provide even more asset intelligence and help users make more educated decisions.

- Distribution centers, warehouses, and yards are the most important ecosystem parts of the supply chain.If a business is able to improve the performance of these components, the effectiveness of its operations will also improve. The logistics industry would increasingly rely on IoT, and warehouses would use the cloud to track their inventory, cars, and equipment. Numerous machines connected via RFID tags make this possible. The packages and pallets would interact with one another on a local level, while a company-based server would continuously monitor their movements and travel progress on a global level.

- Improved inventory management is a major outcome of IoT adoption in the manufacturing industries, made possible by the availability of real-time object visibility and the capability to track and maintain inventories.Using tracking devices, like RFID tags, to collect information about production, expiration dates, manufacture dates, after-sales status, and warranty periods could make supply chain monitoring during manufacturing more effective.

- According to the SAS Institute, the United Kingdom may benefit the most from the manufacturing sector, with IoT accounting for approximately GBP 4,032 million of the total economy. Similarly, other economies are expected to invest heavily in the automation of the supply chain, thereby driving IoT adoption in the overall manufacturing sector.

North America to be the Largest Market

- North America mainly dominates the market for IoT in manufacturing. This region has developed economies, like the United States and Canada, which heavily invest in R&D activities related to the market, thus contributing to the development of new technologies. With the early adoption of trending technologies like mobility, big data, and IoT, manufacturers are eager to integrate IoT technologies into their processes.

- Connected devices and data flow are already finding applications in manufacturing. Therefore, accelerated deliveries can now be expected as the infrastructure cost is reduced. In order to stay competitive, manufacturers are leveraging IoT and analytics to run and improve businesses. In the United States, about 35% of manufacturers collect and use data generated from smart sensors to enhance manufacturing processes.

- According to a study, around 34% of the manufacturers believe that US manufacturers must adopt IoT in their operations. For manufacturers, IoT has become an ecosystem where software, cloud computing, and analytics tools are combined to turn raw data from different sources into meaningful predictions and present them in easy-to-use interfaces. By next five years, the number of connected devices in the automation sector is expected to increase by 50.

- North America's technological prowess, solid infrastructure, variety of industries and supportive ecosystem have helped it take the lead as the world's largest market for the manufacturing sector of Internet of Things (IoT). The use of IoT in manufacturing is anticipated to continue to grow as the region maintains its dominance in technical innovation and digital transformation, further strengthening its position as the world's largest IoT market,

Internet of Things (IoT) in Manufacturing Industry Overview

The Internet-of-Things (IoT) market in manufacturing is cohesive and coherent. The market after Industry 4.0 has started to be more attractive, as companies are opting for IoT as enablers in their manufacturing units. Moreover, the market is inclined toward fragmentation. Some of the key players in the market are Cisco Systems Inc., General Electric, Intel Corporation, IBM Corporation, AT&T Inc., Qualcomm, and Siemens AG, among others.

- June 2022 - Elemental Machines, a leading LabOps Intelligence technology platform, and MasterControl, a developer of a next-generation manufacturing execution system (MES), announced a strategic partnership utilizing two cutting-edge technologies to assist bio manufacturers in automating manual data collection, enhancing data integrity, guaranteeing compliance, and accelerating production for advanced biologics like cell and gene therapies.

- May 2022- The world's largest supplier of RFID and digital ID solutions, Avery Dennison Corporation, and the Internet of Things pioneer, Wiliot, announced a strategic alliance to expand the IoT to the next level and usher in a new era of IoT that benefits people and the environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth and Technological Advancements in Data Analytics

- 5.1.2 Improved Supply Chain Management and Logistics at Lower Operational Costs

- 5.2 Market Restraints

- 5.2.1 Lack of Standardized Interfaces and Limited Integration and Scalability

- 5.2.2 Security and Privacy Issues

- 5.3 Opportunities

- 5.3.1 Intersection of IoT and Big Data Essential to the Future of Smart Manufacturing

- 5.4 Impact of COVID-19 on Data Center Services Market

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

- 6.5 Industry Policies

7 MARKET SEGMENTATION

- 7.1 By Software

- 7.1.1 Application Security

- 7.1.2 Data Management and Analytics

- 7.1.3 Monitoring

- 7.1.4 Network Management

- 7.1.5 Other Software

- 7.2 By Connectivity (Qualitative Analysis)

- 7.2.1 Satellite Network

- 7.2.2 Cellular Network

- 7.2.3 RFID

- 7.2.4 NFC

- 7.2.5 Wi-Fi

- 7.2.6 Other Connectivities

- 7.3 By Services

- 7.3.1 Professional

- 7.3.2 System Integration and Deployment

- 7.3.3 Managed

- 7.3.4 Other Services

- 7.4 By Application (Qualitative Analysis)

- 7.4.1 Process Optimization

- 7.4.2 Predictive Maintenance

- 7.4.3 Asset Management

- 7.4.4 Workforce Management

- 7.4.5 Emergency and Incident Management

- 7.4.6 Logistics and Supply Chain Management

- 7.4.7 Inventory Management

- 7.5 By End-user Vertical

- 7.5.1 Automotive

- 7.5.2 Food and Agriculture Equipment

- 7.5.3 Industrial Equipment

- 7.5.4 Electronics and Communication Equipment

- 7.5.5 Chemicals and Materials Equipment

- 7.5.6 Other End-user Verticals

- 7.6 Geography

- 7.6.1 North America

- 7.6.1.1 United States

- 7.6.1.2 Canada

- 7.6.1.3 Rest of North America

- 7.6.2 Europe

- 7.6.2.1 Germany

- 7.6.2.2 UK

- 7.6.2.3 France

- 7.6.2.4 Spain

- 7.6.2.5 Rest of Europe

- 7.6.3 Asia-Pacific

- 7.6.3.1 China

- 7.6.3.2 Japan

- 7.6.3.3 India

- 7.6.3.4 Rest of Asia-Pacific

- 7.6.4 Latin America

- 7.6.4.1 Brazil

- 7.6.4.2 Mexico

- 7.6.4.3 Argentina

- 7.6.4.4 Rest of Latin America

- 7.6.5 Middle East and Africa

- 7.6.5.1 UAE

- 7.6.5.2 Saudi Arabia

- 7.6.5.3 South Africa

- 7.6.5.4 Rest of Middle East and Africa

- 7.6.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Cisco Systems Inc.

- 8.1.2 General Electric

- 8.1.3 Intel Corporation

- 8.1.4 IBM Corporation

- 8.1.5 Verizon Communication Inc.

- 8.1.6 AT&T Inc.

- 8.1.7 Qualcomm

- 8.1.8 Siemens AG

- 8.1.9 Microsoft Corporation

- 8.1.10 SAP SE