|

市場調查報告書

商品編碼

1403918

纖維增強混凝土(FRC) -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Fiber Reinforced Concrete (FRC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

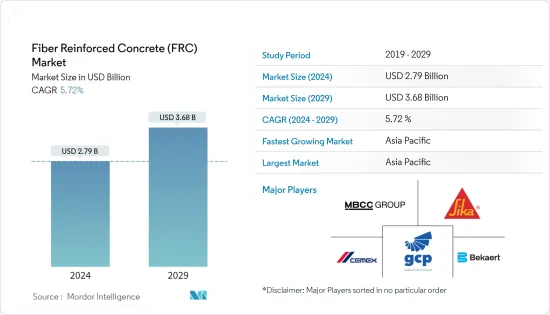

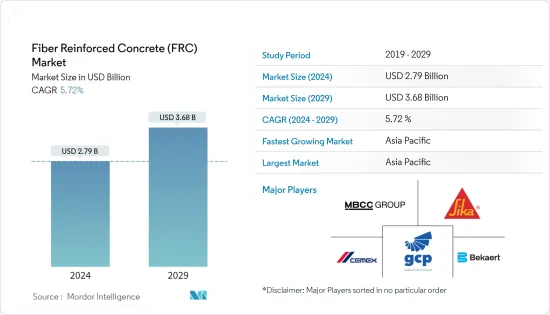

預計2024年纖維增強混凝土市場規模為27.9億美元,預計到2029年將達到36.8億美元,在預測期內(2024-2029年)複合年成長率為5.72%。

COVID-19的爆發對2020年的市場產生了負面影響。新大流行(COVID-19) 大流行的爆發已導致全球建築工程暫停,特別是在中國和印度等主要建築中心。然而,由於全球建築業的成長,預計市場在預測期內將穩定成長。

主要亮點

- 短期內,建築業需求的增加和交通基礎設施計劃需求的增加預計將推動市場成長。

- 另一方面,即用型混凝土絞線的供應可能會阻礙纖維增強混凝土市場的成長。

- 此外,即將到來的全球基礎設施計劃可能會在預測期內為受訪市場提供機會。

- 在預測期內,由於建設活動的快速增加,預計亞太地區將主導全球市場。

纖維增強混凝土市場趨勢

建築和施工領域主導市場

- 纖維增強混凝土用於各種住宅和商業應用。纖維增強混凝土用於住宅和商業建築中梁、基礎、牆壁和凸起板的結構加固。也用於商業建築、購物中心等的地板、樓板、停車場、鋼骨甲板、高架框架等。

- 根據牛津經濟研究院預測,在中國、美國、印度等超級大國建築市場的推動下,2022年全球建築業價值將達到9.7兆美元,預計2037年將達到13.9兆美元。

- 此外,未來15年,全球前10個建築市場國家的建築工程總量預計將佔全球建築市場總量的70%。

- 人口成長趨勢、從家鄉向服務業集群的遷移以及核心家庭的日益成長趨勢是推動世界各地住宅建設的因素。

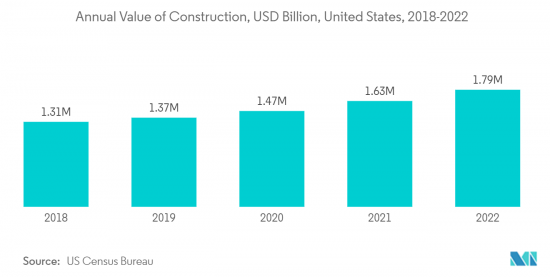

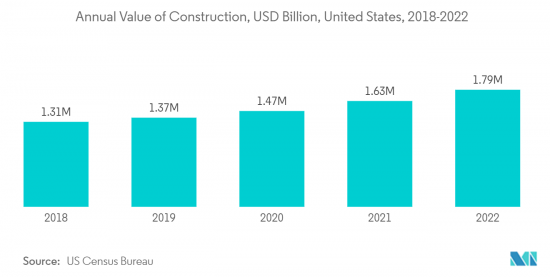

- 美國建築業是北美最大的。根據美國人口普查局的數據,2022年美國年度建築業價值達17,920億美元,而2021年為16,264億美元,成長率為10.2%。

- 此外,2022 年美國住宅建築年產值為 9,080 億美元,而 2021 年為 8,020 億美元。 2022 年,該國非住宅建築價值為 8,840 億美元,而 2021 年為 8,230 億美元。

- 德國政府在德國黑森州法蘭克福-費興海姆開始興建佔地10.7公頃的費興海姆數位公園,總占地面積10萬平方公尺,投資11.79億美元。預計2021年第三季度動工,2028年季度完工。

- 因此,對全球建設活動的需求不斷增加,預計將在預測期內推動纖維增強混凝土市場的發展。

亞太地區在預測期內主導市場

- 由於交通、建築和施工行業需求的增加,中國、印度和印尼等亞太國家的纖維混凝土消費水準預計將穩定上升。

- 亞太地區是道路和高速公路建設計劃成長最快的地區。中國正在增加道路建設和維護方面的支出。此外,該國還有許多正在進行和即將進行的道路和高速公路建設計劃。

- 亞太地區的建築業是世界上最大的。由於人口成長、中等收入階層的壯大和都市化,它正在以健康的速度成長。在中國和印度不斷擴大的住宅建築市場的推動下,亞太地區預計將出現最高的成長。

- 根據中國國家統計局的數據,建築業產值將從2021年的29.3兆元(4.2兆美元)增加至2022年的31.2兆元(4.5兆美元)。預計到 2030 年,中國將在建築上花費近 13 兆美元,這使得纖維增強混凝土材料的前景樂觀。

- 中國「十四五」規劃重點在於能源、運輸、水利系統、新型都市化等新型基礎建設計劃。據計算,「十四五」期間(2021-2025年)新基建投資總額將達到約27兆元(4.2兆美元)。

- 此外,該國可支配收入的增加正在推動購物中心、酒店和辦公室等豪華商業空間的成長。中國是購物中心建設領先的國家之一。

- 中國約有4,000家購物中心,預計到2025年還將開幕7,000家。此外,武漢佛山外灘中心T1等辦公室的建設也有望促進市場研究。該計劃的建設工作預計將於2021年第三季度開始,並於2025年季度完工。

- 印度目前擁有世界第五大地鐵網路,很快就會超越日本、韓國等已開發國家,成為第三大地鐵網路。截至2022年9月,地鐵網路達到810公里,在印度20個城市營運。

- 此外,2022 年 9 月,印度政府核准在古瓦哈提現有的 Saraighat 大橋附近建造一座橫跨雅魯藏布江的鐵路兼公路大橋,耗資 99.675 億印度盧比(1.2227 億美元),NHAI 和鐵路部決定分擔負擔。因此,新基建計劃的實施將帶動國內纖維混凝土市場。

- 因此,隨著此類投資以及基礎設施和建設計劃的增加,預計該地區對纖維增強混凝土的需求在預測期內將穩定成長。

纖維混凝土產業概況

纖維混凝土市場是一個綜合市場,少數企業佔據了市場需求的較大佔有率。市場主要企業(排名不分先後)包括 CEMEX、SAB de CV、Sika AG、Bekaert、GCP Applied Technologies Inc. 和 MBCC Group。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建築業的需求增加

- 交通基礎建設計劃增加

- 抑制因素

- 可得性即用型混凝土絞線

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 類型

- 天然纖維

- 合成纖維

- 玻璃纖維

- 鋼纖維

- 其他類型

- 最終用戶產業

- 基礎設施

- 建築/施工

- 採礦/隧道

- 工業地板

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章競爭形勢

- 合併、收購、合資、合夥和協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AWI Licensing LLC

- Bekaert

- Cemex SAB De CV

- Formglas Products Ltd.

- GCP Applied Technologies Inc.(Saint-gobain)

- Krampeharex Gmbh & Co. Kg

- MBCC Group

- Nycon

- Sika AG

- The Euclid Chemical Company

第7章 市場機會及未來趨勢

- 未來的全球基礎建設計劃

- 其他機會

The Fiber Reinforced Concrete Market size is estimated at USD 2.79 billion in 2024, and is expected to reach USD 3.68 billion by 2029, growing at a CAGR of 5.72% during the forecast period (2024-2029).

The COVID-19 outbreak negatively impacted the market in 2020. With the COVID-19 pandemic's beginning, construction work stopped worldwide, especially in major construction hubs like China and India. However, the market was projected to grow steadily in the forecast period due to global construction sector growth.

Key Highlights

- Over the short term, the increasing demand from the construction sector and rising demand for transport infrastructure projects are expected to drive the market's growth.

- On the flip side, the availability of ready-to-use concrete strands will likely hinder the growth of the fiber-reinforced concrete market.

- Moreover, upcoming global infrastructure projects are likely to provide opportunities for the studied market during the forecast period.

- During the forecast period, the Asia-Pacific region is expected to dominate the global market due to the exponentially increasing construction activities in the region.

Fiber Reinforced Concrete Market Trends

Building & Construction Segment to Dominate the Market

- Fiber-reinforced concrete is used in various residential and commercial applications. The fiber-reinforced concrete is used in the structural reinforcement of beams, foundations, walls, and elevated slabs of residential and commercial buildings. It is also used for floors, slabs, parking areas, steel decks, elevated frameworks in commercial buildings, and shopping centers.

- According to Oxford Economics, the global construction industry was valued at USD 9.7 trillion in 2022 and is estimated to reach USD 13.9 trillion by 2037, driven by superpower construction markets, such as China, the United States, and India.

- Furthermore, all construction work done over the next 15 years by the world's top 10 construction markets is expected to account for 70% of the total global construction market.

- Growth in population growth, migration from hometowns to service sector clusters, and the growing trend of nuclear families are some factors driving residential construction worldwide.

- The construction industry in the United States is the largest in North America. According to the US Census Bureau, the annual construction in the United States accounted for USD 1,792 billion in 2022, compared to USD 1,626.4 billion in 2021, at a growth rate of 10.2%.

- Moreover, the annual value of residential construction output in the United States was valued at USD 908 billion in 2022, compared to USD 802 billion in 2021. The annual non-residential construction in the country was valued at USD 884 billion in 2022, compared to USD 823 billion in 2021.

- The German government initiated the construction of the Digital Park Fechenheim on an area of 10.7 hectares, with a gross floor area of 100,000 square meters in Frankfurt-Fechenheim, Hesse, Germany, with an investment of USD 1,179 million. The construction work started in Q3 2021 and is expected to be completed in Q4 2028.

- Therefore, the growing demand from building and construction activities around the globe is estimated to drive the market for fiber-reinforced concrete during the forecast period.

Asia-Pacific Region to Dominate the Market in the forecast period

- The consumption levels of fiber-reinforced concrete in Asia-Pacific countries, such as China, India, and Indonesia, are expected to rise robustly, owing to the increasing demand from the transportation, building, and construction industries.

- Asia-Pacific is the fastest-growing region for road and highway construction projects. China has increased its road construction and maintenance spending. Further, the country has many ongoing and upcoming road and highway construction projects.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for fiber-reinforced concrete materials.

- China's 14th Five-Year Plan focuses on new infrastructure projects in energy, transportation, water systems, and new urbanization. According to estimates, overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will reach roughly CNY 27 trillion (USD 4.2 trillion).

- Further, the increasing disposable income in the country has triggered the growth of lavish commercial spaces like malls, hotels, offices, and others. China is one of the leading countries in shopping center construction.

- China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025. Moreover, the construction of office spaces such as Wuhan Fosun Bund Center T1 in China is expected to boost the market studied. Construction work for the project started in Q3 2021 and is forecast to be completed in Q4 2025.

- India currently has the fifth-largest metro network in the world and will soon overtake advanced economies such as Japan and South Korea to become the third-largest network. As of September 2022, the Metro rail network reached 810 km and is operational in 20 cities in India.

- Furthermore, in September 2022, the Indian government approved rail-cum-road bridge across the Brahmaputra river near the existing Saraighat bridge at Guwahati at a cost of INR 9,967.5 million (USD 122.27 million), which NHAI & Ministry of Railways will share. Thus, the implementation of new infrastructural projects will drive the market for fiber-reinforced concrete in the country.

- Therefore, with all such investments and an increasing number of infrastructure and construction projects, the demand for fiber-reinforced concrete will likely increase at a robust rate in the region during the forecast period.

Fiber Reinforced Concrete Industry Overview

The fiber reinforced concrete market is consolidated in nature, with few players accounting for a significant share of the market demand. Some of the major players (not in any particular order) in the market include CEMEX, S.A.B. de C.V., Sika AG, Bekaert, GCP Applied Technologies Inc., and MBCC Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From the Construction Sector

- 4.1.2 Increasing Transport Infrastructure Projects

- 4.2 Restraints

- 4.2.1 Availability of Ready-to-use Concrete Strands

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Natural Fiber

- 5.1.2 Synthetic Fiber

- 5.1.3 Glass Fiber

- 5.1.4 Steel Fiber

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Infrastructure

- 5.2.2 Building and Construction

- 5.2.3 Mining and Tunnel

- 5.2.4 Industrial Flooring

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AWI Licensing LLC

- 6.4.2 Bekaert

- 6.4.3 Cemex S.A.B. De C.V.

- 6.4.4 Formglas Products Ltd.

- 6.4.5 GCP Applied Technologies Inc. (Saint-gobain)

- 6.4.6 Krampeharex Gmbh & Co. Kg

- 6.4.7 MBCC Group

- 6.4.8 Nycon

- 6.4.9 Sika AG

- 6.4.10 The Euclid Chemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Global Infrastructure Projects

- 7.2 Other Opportunities