|

市場調查報告書

商品編碼

1403868

汽車網路安全:市場佔有率分析、產業趨勢/統計、2024 年至 2029 年成長預測Cybersecurity For Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

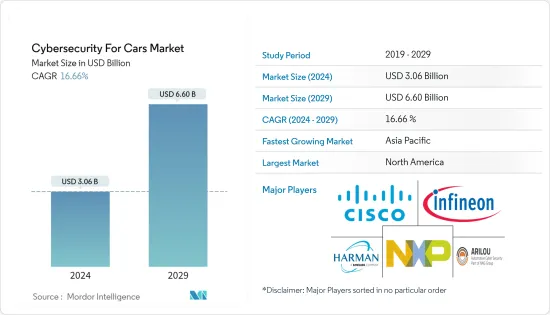

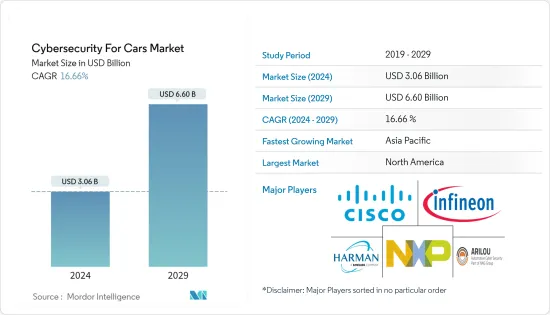

汽車網路安全市場規模預計到 2024 年將達到 30.6 億美元,預計到 2029 年將達到 66 億美元,在預測期內(2024-2029 年)複合年成長率為 16.66%。

隨著聯網汽車的出現以及小客車對相關解決方案的需求不斷增加,針對聯網汽車的攻擊越來越多,從而增加了對網路安全的需求。汽車產業網路安全解決方案供應商Upstream Auto表示,未來五年汽車產業可能因網路攻擊而面臨240億美元的損失。

主要亮點

- 汽車網路安全涉及複雜的系統,這些系統不斷分析和監控車輛資料,以發現詐欺的存取或惡意活動的徵兆。這些先進的系統採用入侵偵測和防禦系統 (IDPS)、異常偵測演算法、安全通訊協定和無線更新等技術。機器學習演算法的出現為透過分析車輛產生的大量資料中的模式來即時偵測未知攻擊和零時差攻擊開闢了新的可能性。

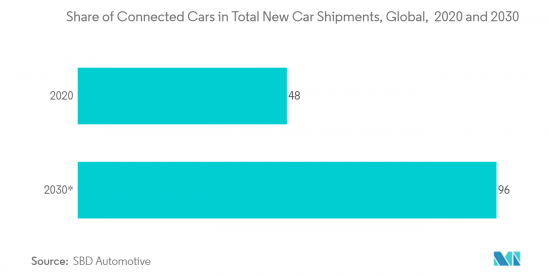

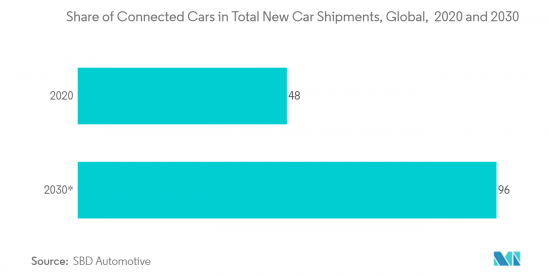

- 連網型車輛功能的動態特性對網路安全需求有重大影響。隨著聯網汽車出現新的連網型和後續服務,它們也引入了可能危及車輛安全的新攻擊媒介。

- 全球領先的汽車製造商正在選擇區塊鏈、5G、人工智慧等尖端網路安全技術來應對故障和網路攻擊等安全風險。然而,隨著技術的發展,汽車網路安全已擴展到包括車輛防盜系統和源自量子物理應用的量子密碼學(QC)以及密碼雜湊函數(CHF),後者可提高私人和公共場所的安全性。公共區塊鏈。)和其他新趨勢。

- 最大的挑戰之一是現代汽車的複雜性。現今的汽車擁有各種電控系統(ECU),每個單元負責多種功能,例如安全功能、引擎控制和資訊娛樂系統。這些 ECU 透過各種網路相互通訊通訊與外部設備通訊,因此很難保護每個入口點免受潛在攻擊。

- 由於COVID-19的爆發,汽車產業一直是對最終用戶產生負面影響的產業之一。這也對汽車網路安全市場的需求產生了負面影響。在最初的供應和製造中斷之後,汽車產業正在經歷需求衝擊,由於就地避難的限制,復甦時間不確定。由於固定成本削減的空間有限,一些OEM需要更多的流動性來應對長期的收益短缺,這對市場產生了影響。德國汽車研究中心預計,西歐汽車市場大約需要10年才能再次達到2019年的規模。

汽車網路安全市場趨勢

由於汽車中安裝的技術的增加,安全威脅的增加預計將推動該市場的發展。

- 汽車產業面臨數位化的重大挑戰,包括來自多個互聯來源的巨量資料。巨量資料持續成長,使得分析和保護連網型汽車免受網路威脅變得越來越困難。消除資料混亂並識別潛在攻擊的唯一方法是利用人工智慧和機器學習技術對資料進行行為分析。

- 針對連網型汽車產業的網路攻擊呈指數級成長,這一點非常顯著。 2010年至2018年,汽車領域網路攻擊增加了6倍,2018年黑帽攻擊數量超過白帽攻擊。 Upstream 的2022 年全球汽車網路安全報告對900 多起汽車網路安全事件進行了深入研究,其中包括2021 年超過240 起複雜的攻擊,其中84.5% 的汽車攻擊是遠端進行的,其中高達40.1% 的事件集中在後端伺服器攻擊。

- 2022年,我國將訂定汽車資料管理試驗規定,保護個人和組織的資料資料開發和利用。 。

- 此外,研究發現,中國智慧網聯汽車每天收集至少10TB的資料,包括駕駛人和乘客的臉部資訊、動作、視覺、聲音以及車輛的地理位置資料,包括目標位置、內部情況等。車輛的內部環境以及車外的環境。

- 隨著聯網汽車感測器的迅速普及,駭客可以從車輛系統竊取個人識別資訊(PII)。越多製造商發布與汽車通訊的行動應用程式,它們就越成為惡意行為者的目標。

- 以緊湊型五門掀背式電動車(BEV) 日產 Leaf 為例,安全測試人員展示了詐欺的存取權限,可以遠端控制加熱方向盤、座椅、風扇和空調。人們也擔心 Android 和 iOS 行動作業系統中越來越多的安全漏洞。在這些情況下,需要強大的汽車網路安全系統。

預計北美將佔據較大市場佔有率

- 美國運輸安全管理局 (NHTSA) 是監督聯網汽車安全和安全標準的地區監管機構之一,宣布了其 5G FAST 計劃。該計劃包括更新基礎設施政策、普及頻譜引入市場、對過時的法規進行現代化改造、在車對一切 (V2X) 環境中交換資料以及透過高速通訊實現車對車 (V2V)。它包括三個重要內容:支持這種資料交換允許自動駕駛車輛接受超出汽車感測器物理範圍的資料。

- 北美是主要的汽車市場之一,對聯網汽車有著巨大的需求。與全球市場一樣,該地區自 2019 年以來需求有所下降,但預計未來幾年需求將會復甦。例如,根據 BEA 的數據,2021 年美國零售為 1,490 萬輛。

- 此外,預計在未來三年內,美國銷售的超過 85% 的汽車將透過網路獲得安全保護。通用汽車的OnStar平台是美國使用最廣泛的軟體平台和安全系統之一。該國不斷上升的普及和普及正在增加對網路安全的需求。

- 此外,日本品牌在美國的汽車銷量成長了8.6%,市場佔有率擴大至38.5%,為2010年以來的最高水準。歐洲品牌成長10.5%,市場佔有率成長0.7個百分點至10.6%,創年度新高,首次達到兩位數。韓國品牌佔據市場主導地位,成長1.5個百分點,達9.9%。

- 該地區汽車產業對電子產品的需求正在快速成長。汽車中電子產品使用的增加增加了汽車遭受駭客攻擊的可能性。針對遠端資訊處理、資訊娛樂、動力傳動系統電子設備、車身電子設備、通訊電子設備和 ADAS 系統中使用的電子元件的網路攻擊很常見。因此,該地區的相關人員已開始投資網路安全解決方案,以提供強大的汽車電子平台。

汽車網路安全產業概述

汽車網路安全市場競爭非常激烈,國內外都有許多大大小小的參與者。市場似乎適度集中,主要企業不斷採取產品和服務創新等策略來克服汽車面臨的最新威脅。該市場的主要企業包括Cisco、英飛凌科技公司、恩智浦半導體公司和哈曼國際工業公司。

2022 年 1 月,服務於行動產業的科技公司偉世通 (Visteon) 在 CES Tour 2022 上宣布推出 AllGo 應用程式商店,作為行動產業不斷成長的聯網汽車技術的最新解決方案之一。 AllGo 應用程式商店的開發是為了滿足世界對在創新的駕駛座中安全、便捷地存取基於應用程式的內容日益成長的需求。

2022 年 4 月,思科和通用汽車將合作實現性能測試車輛開發資料開發流程的現代化和自動化,並縮短可量產車輛的上市時間。透過使用思科的無線網路架構在通用汽車米爾福德試驗場進行即時生產前性能測試,多個通用汽車測試工程師可以在測試運行期間同時主動監控數百個資料通道,並且可以觀察運行參數並修改運行測試以最佳化結果。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 市場抑制因素

第6章市場區隔

- 按解決方案類型

- 基於軟體

- 基於硬體

- 專業的服務

- 一體化

- 其他解決方案

- 按安全類型

- 網路安全

- 應用程式安全

- 雲端安全

- 其他安全

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Cisco Systems Inc

- Infineon Technologies AG

- NXP Semiconductors NV

- Harman International Industries Inc.(Samsung)

- Arilou Technologies Ltd.

- Visteon Corporation

- Continental AG

- Escrypt GmbH

- Argus Cybersecurity Ltd.

- Secunet AG

- Delphi Automotive PLC

- Denso Corporation

- Honeywell International Inc.

- Karamba Security Ltd.

第8章投資分析

第9章市場的未來

The Cybersecurity For Cars Market size is estimated at USD 3.06 billion in 2024, and is expected to reach USD 6.60 billion by 2029, growing at a CAGR of 16.66% during the forecast period (2024-2029).

The advent of connected cars and increasing demand for a relevant solution in passenger vecles is driving the need for cybersecurity, as more and more attacks are being carried out on connected cars. According to Upstream Auto, a cybersecurity solutions provider for the automotive industry, the auto industry might face a loss of USD 24 billion over the next five years due to cyberattacks.

Key Highlights

- Automotive cybersecurity involves complex systems that continuously analyze and monitor vehicle data for any signs of unauthorized access or malicious activity. These advanced systems employ technologies like intrusion detection and prevention systems (IDPS), anomaly detection algorithms, secure communication protocols, and over-the-air updates. The emergence of machine learning algorithms has extended new possibilities for detecting unknown or zero-day attacks in real time by analyzing patterns in vast amounts of data generated by vehicles.

- The dynamic nature of the connected vehicle features is significantly influencing the demand for cybersecurity. With every new connected entity or late service for connected cars, a new attack vector is also created from which the vehicle's security can be compromised.

- Major automotive players worldwide have opted for state-of-the-art cyber-security technologies such as blockchain, 5G, and artificial intelligence for security risks like malfunctions or cyber-attacks. However, with the technology growing, automotive cyber-security is also witnessing newer trends like Quantum Cryptography (QC) - borne out of the application of Vehicle Anti-theft Systems and quantum physics, Cryptographic Hash Functions (CHF) - providing improved security in private and public blockchains.

- One major challenge is the complexity of modern vehicles. Today's cars have various electronic control units (ECUs), each responsible for multiple functions such as safety features, engine control, and infotainment systems. These ECUs communicate with each other and external devices through different networks, making securing every entry point from potential attacks challenging.

- With the outbreak of COVID-19, the automotive industry was one industry that negatively affected end-users. This also negatively impacted the demand for the cybersecurity market for cars. After initial supply and manufacturing disruptions, the automotive industry is experiencing a demand shock with an uncertain recovery timeline due to shelter-in-place regulations. With limited room to cut fixed costs, some OEMs needed more liquidity to power through a long period of missing revenues, which affected the market. According to Germany's Center for Automotive Research, the Western European automobile market will need about ten years to reach the size of 2019 again.

Cybersecurity For Cars Market Trends

Rising Security Threats as More Technologies Get Integrated Into Cars is Expected to Drive the Market

- The automotive industry faces a significant challenge due to digitalization, such as big data coming from multiple connected sources. It is only getting bigger, making it increasingly difficult to analyze and protect the connected car against cyber threats. The only way to cut through the data clutter and identify potential attacks is by leveraging artificial intelligence and machine learning technologies for behavioral analysis of the data.

- The rapid growth in cyberattacks on the connected automotive industry is increasing significantly. From 2010 to 2018, the cyberattacks in the automotive sector increased by six times, and black hat attacks exceeded the number of white hats in 2018. Upstream's 2022 Global Automotive Cybersecurity Report includes a detailed examination of over 900 automotive cybersecurity events, including the Advanced sophistication of 2021's 240+ attacks; 84.5% of automotive attacks were carried out remotely, and a staggering 40.1% of incidents focused on back-end servers attacks.

- In 2022, China published a trial regulation on vehicle data management to standardize vehicle data processing to protect the lawful rights and interests of individuals and organizations, protect national security and public interest, and promote rational development and utilization of data collected from automobiles.

- Additionally, According to the survey, China ICVs collect at least 10 TB of data per day, with the data including not only information about the driver and passengers' facial expressions, movements, sight, and voices but also the vehicle's geographic position, interior, and exterior environment, and use of the Internet of Vehicles (IoV) to strengthen vehicle data security management to prevent and fix these security issues and potential threats.

- As sensors increase rapidly in connected vehicles, hackers can potentially steal personally identifiable information (PII) from the vehicle's systems, such as personal trip and location data, entertainment preferences, and even financial information. The more manufacturers release mobile apps for communicating with cars, the more they become targets for adverse factors.

- In the case of the Nissan Leaf, a compact five-door hatchback battery electric vehicle (BEV), security testers demonstrated how they could gain unauthorized access to control the heated steering wheel, seats, fans, and aircon remotely. The increasing security vulnerabilities in the Android and iOS mobile operating systems are also becoming a concern. These instances would require a need for robust cybersecurity systems for cars.

North America is Expected to Hold Significant Market Share

- The National Highway Transportation Safety Administration (NHTSA) is one of the regulatory bodies in the region overseeing the standards in security and safety of connected cars and released the 5G FAST Plan. This plan incorporates three key components: updating infrastructure policy, pushing more spectrum into the marketplace, modernizing outdated regulations, Vehicle-to-Everything (V2X) environment data exchange, and High-speed communications support Vehicle-to-Vehicle (V2V). Such data exchange allows autonomous vehicles to accept data beyond their onboard sensors' physical range.

- North America is one of the major automotive markets and holds a significant demand for connected cars; the region has observed a slump in demand similar to the global market since 2019; however, the demand is expected to pick up over the coming years. For instance, according to BEA, in 2021, the US's light-vehicle retail sales stood at 14.9 million units.

- Moreover, over the next three years, it is predicted that over 85% of the cars sold in the US are anticipated to be secured over the Internet. General Motors' OnStar platform was one of the country's most widely used software platforms and security systems. The country's growing adoption and penetration rates augment the demand for cybersecurity.

- Furthermore, US car sales of Japanese brands are up 8.6%, increasing their market share to 38.5%, the highest since 2010. European brands are up 10.5%, increasing their market share by 0.7 percentage points to 10.6%, a new yearly high and the first time they have reached double digits. South Korean brands surpass all others, increasing their market share by 1.5 percentage points to 9.9%.

- The demand for electronics in the automobile industry in this region has expanded rapidly. The increased usage of electronics in vehicles has rendered them more vulnerable to hackers. Cyberattacks are common on electronic components used in telematics, infotainment, powertrain electronics, body electronics, communication electronics, and ADAS systems. As a result, stakeholders across this region have begun investing in cybersecurity solutions to provide robust electronic automobile platforms.

Cybersecurity For Cars Industry Overview

The cybersecurity market for cars is highly competitive due to the presence of many small and large players operating in domestic and international markets. The market appears to be moderately concentrated, with the key players adopting strategies like product and service innovation to overcome the latest threats faced by automobiles continually. Some of the significant players in the market are Cisco Systems, Inc., Infineon Technologies, NXP Semiconductors NV, and Harman International Industries Inc., among others.

In January 2022, Visteon, a technology company servicing the mobility industry, announced the AllGo App Store as one of the latest solutions in its growing range of connected car technologies for the mobility sector at CES® 2022. The AllGo App Store was created to fulfill the expanding global demand for secure and convenient access to app-based content in an innovative, connected cockpit.

In April 2022, Cisco and General Motors are collaborating to modernize and automate the development process for vehicle development data for performance testing, reducing time-to-market for commercially ready automobiles. Using Cisco's wireless network architecture for real-time, pre-production performance testing at GM Milford Proving Ground enables multiple GM test engineers to actively monitor several hundred data channels concurrently during a test run, observe vehicle operation parameters, and modify the test being run to optimize results.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 By Type of Solution

- 6.1.1 Software-Based

- 6.1.2 Hardware-Based

- 6.1.3 Professional Service

- 6.1.4 Integration

- 6.1.5 Other Types of Solution

- 6.2 By Type of Security

- 6.2.1 Network Security

- 6.2.2 Application Security

- 6.2.3 Cloud Security

- 6.2.4 Other Types of Security

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc

- 7.1.2 Infineon Technologies AG

- 7.1.3 NXP Semiconductors NV

- 7.1.4 Harman International Industries Inc. (Samsung)

- 7.1.5 Arilou Technologies Ltd.

- 7.1.6 Visteon Corporation

- 7.1.7 Continental AG

- 7.1.8 Escrypt GmbH

- 7.1.9 Argus Cybersecurity Ltd.

- 7.1.10 Secunet AG

- 7.1.11 Delphi Automotive PLC

- 7.1.12 Denso Corporation

- 7.1.13 Honeywell International Inc.

- 7.1.14 Karamba Security Ltd.