|

市場調查報告書

商品編碼

1403139

超音波感測器 -市場佔有率分析、行業趨勢/統計、2024-2029 年成長預測Ultrasonic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

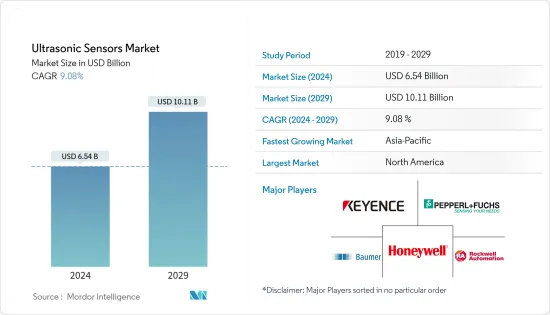

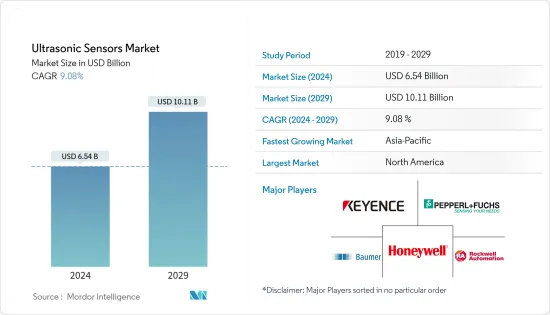

超音波感測器市場規模預計到2024年為65.4億美元,預計到2029年將達到101.1億美元,在預測期內(2024-2029年)複合年成長率為9.08%。

主要亮點

- 超音波感測器廣泛用於固體和液體的非接觸式檢測。這些感測器的工作頻率高於 20kHz,超出了人類聽覺範圍。超音波感測器廣泛應用於機器人、自動導引車和無人機,在各種應用中都很常見。超音波感測器提供相對準確的測量,誤差通常在 1% 以內。超音波感測器每秒可以進行多次測量,因此刷新率很快。此外,它們通常相當便宜,因為它們不需要稀有材料。

- 隨著汽車、醫療、機器處理等高成長領域的增強應用的興起,以及基於指紋的應用在消費產品中的發展勢頭強勁,調查市場的成長是積極的,預計將出現巨大的成長。這些感測器依靠規模經濟來提供比其他感測器更好的成本績效。

- 憑藉即時視覺化功能,該感測器還可用於組織切片檢查採樣和治療,同時定位目標器官。這些感測器也用於診斷腎臟、肝臟、胰臟和膽囊等內臟器官,並監測孕婦胎兒的生長和健康狀況。

- 超音波感測器用於汽車功能,例如巡航控制、駕駛員輔助和防盜系統。此外,它們也用於各種應用,例如物料搬運領域的距離測量。超音波感測器製造商提供多種超音波感測器,具有開放式結構、防水和外殼等附加功能,以減少損壞。因此,由於 ADAS 系統的預期成長,超音波感測器將成比例成長。

- 市場證實了產品的開發和研究。例如,2022年11月,Ultraleap為元宇宙和汽車非接觸式控制器的虛擬實境系統開發了新的超音波感測器和換能器。各公司和組織的這些努力預計將有助於增加市場對超音波感測器的需求。

- 然而,超音波感測器有限的檢測範圍可能會限制其在需要更廣泛檢測範圍的某些應用中的有效性。它還存在技術限制,例如容易受到溫度和濕度等環境因素的影響。這些限制會影響感測器讀數的可靠性和準確性。

- 此外,與其他類型的感測器相比,超音波感測器相對昂貴。這種成本因素可能會拖累一些公司和產業,特別是在需要大規模部署感測器時。

超音波感測器市場趨勢

汽車產業對超音波感測器產生巨大需求

- 隨著汽車產量和銷售量的增加以及客戶支出的增加,汽車產業預計將為全球超音波感測器市場的成長機會做出貢獻。例如,根據 OICA 的數據,2022 年印度的汽車產量將達到 550 萬輛左右,高於 2021 年的 440 萬輛。

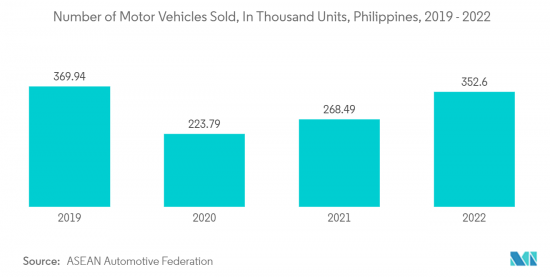

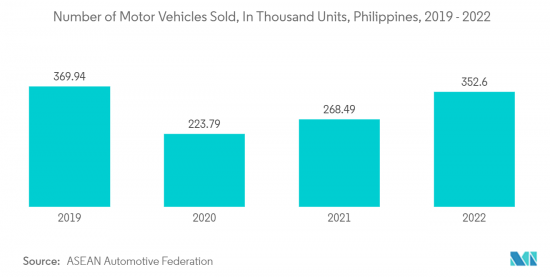

- 亞太地區的汽車銷量正在成長。例如,根據東協汽車聯合會的數據,菲律賓 2022 年售出約 352,600 輛汽車,高於 2021 年的 268,490 輛。

- 超音波感測器在汽車領域有多種應用,包括停車輔助、安全警報、防撞、物體偵測和自動煞車系統。它在駕駛輔助系統和自動駕駛系統的開發中發揮著至關重要的作用。

- 超音波感測器也用於測量物體的距離。這些具有遠距雷達功能的感測器現已整合到汽車巡航控制系統中,以避免汽車之間的碰撞。它們也用於後端距離檢測、停車輔助和車輛煞車控制。

- 這些感測器用於具有自動駕駛能力和先進功能的車輛的汽車感測系統。這些系統依靠超音波感測器來測量物體與車輛的相對距離。

- 此外,感測器供應商還提供多種具有增強功能的超音波感測器,例如開放式結構、防水和外殼以減少損壞。這樣,隨著 ADAS 系統的增加,對超音波感測器的需求可能會相應增加。

- 此外,汽車製造商正在整合自動化技術,以提高消費者的舒適度、便利性和安全性。隨著自動駕駛普及變得越來越流行,並且安裝碰撞偵測系統來防止汽車碰撞,預計全球對超音波感測器的需求將會加速。

亞太地區佔主要市場佔有率

- 亞太地區是超音波感測器市場的主要製造和消費國。該地區的市場滲透率相對較高,多家汽車製造商和製造巨頭推動了該市場的發展。

- 根據《智慧製造「十三五」規劃》,中國的目標是在2025年建立智慧型製造體系並實現重點產業轉型。在2020年全國人民代表大會上,中國共產黨將加倍推行「中國標準2035」和「中國製造2025」計劃,並斥資約1.4兆美元用於數位基礎設施公共支出計畫。宣布有可能。

- 中國的新基建計劃為全球企業提供了許多機會。因此,超音波感測器在汽車和工業等各個領域的採用預計將擴大,從而支持該地區的市場成長。

- 該地區的參與企業都專注於產品創新。例如,總公司中國福建省廈門市的Ursalink利用其MB7380(5m)和MB7383(10m)超音波感測器開發了物聯網級測量解決方案。 Ursalink 提供超音波液位感測器。

- 日本是市場研究的重要地區,因為它是許多汽車製造商和電子製造業的所在地。政府對自動駕駛汽車部署的日益重視預計也將擴大市場潛力。日本國家政策局宣布將取消禁止 SAE 4 級自動駕駛汽車在日本道路上行駛的禁令。這項政策變更將從 2023 年 4 月起允許自動駕駛汽車進行有限運行。印度的目標是到 2025 年在 40 個地區提供基於 AV 的 4 級行動服務,到 2030 年在 100 多個地區提供基於 AV 的行動服務。

- 印度製造計畫將使印度成為世界地圖上的製造地,並使印度經濟獲得全球認可。此外,印度政府的目標是到2025年經濟規模達到5兆美元,其中製造業價值可能達到1兆美元。印度製造、印度技能和數位印度等旗艦計畫的融合將是實現這一目標和推動印度市場的關鍵。

- 亞太地區包括韓國、印尼和台灣。韓國在半導體行業的強大影響力以及擴大半導體、電子和零件製造的努力預計將有助於提高該國的超音波感測器市場佔有率。

超音波感測器產業概況

超音波感測器市場競爭激烈且分散。市場參與企業致力於研究,透過提供創新產品來贏得競爭。該市場的主要企業包括西門子公司、倍加福公司、霍尼韋爾國際公司、堡盟有限公司、羅克韋爾自動化公司和村田製作所。

- 2023 年 2 月,PiL Sensoren GmbH 客製化了實績的感測器系列 P47 的新型號變體。這款高精度超音波感測器適用於距離和物位測量等基本應用,測量範圍高達 5,000 mm。此外,聲音的強度使得能夠可靠地偵測甚至很小的物體。

- 2022年2月,美國著名超音波感測器製造商Migatron Corp.宣布成立美國著名超音波感測器製造商Migatron Corp.,旨在解決高速計數、液位、以及許多其他製程控制領域。我們發布了兩種新的感測器型號。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第 2 章執行摘要

第3章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估主要宏觀經濟趨勢的影響

第4章市場動態

- 市場促進因素

- 各工業領域的應用

- 對汽車自主安全系統的需求不斷增加

- 市場抑制因素

- 操作問題和技術限制

- 高成本

第5章市場區隔

- 依技術

- 體壓電換能器

- 微機械超音波換能器 (MUT)

- 按行業分類

- 車

- 消費者使用

- 工業的

- 醫療保健

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區 中東/非洲

- 北美洲

第6章競爭形勢

- 公司簡介

- Keyence Corporation

- Pepperl+Fuchs AG

- Honeywell International Inc.

- Baumer Ltd

- Rockwell Automation Inc.

- Murata Manufacturing Co. Ltd

- Omron Corporation

- Sick AG

- Banner Engineering Corp.

- Balluff Inc.

- Robert Bosch GmbH

- Qualcomm Incorporated

- TDK Corporation

- Sensata Technologies

- TE Connectivity

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 49922

The Ultrasonic Sensors Market size is estimated at USD 6.54 billion in 2024, and is expected to reach USD 10.11 billion by 2029, growing at a CAGR of 9.08% during the forecast period (2024-2029).

Key Highlights

- Ultrasonic sensors are widely utilized for non-contact detection of solid and liquid state objects. These sensors operate at frequencies higher than 20 kHz, above the sonic range audible to humans. Widely used in robots, autonomous guided vehicles, and drones, ultrasonic sensors are common in a range of applications. Ultrasonic sensors provide relatively precise measurements, with errors usually within 1%. They can make many measurements per second, yielding quick refresh rates. Additionally, they are usually quite cheap because they do not need rare materials.

- The growth of the market studied is positive and is anticipated to grow enormously due to the emergence of enhanced applications in high-growth sectors like automotive, healthcare, and machine handling, along with the fingerprint-based application that is gaining momentum in consumer products. These sensors deliver better price performance than other sensors by relying on economies of scale advantages.

- Owing to their real-time visualization ability, sensors can also be used for tissue biopsy sampling or therapeutics while locating target organs. These sensors are also used to diagnose internal organs, including the kidneys, liver, pancreas, and gallbladder, or to observe pregnant women's fetal growth and health condition.

- Automotive functions like cruise control, driver assistance, and anti-theft systems use ultrasonic sensors. Additionally, they are also being used in various applications for distance measurement in the material handling sectors. Ultrasonic sensor manufacturers have offered multiple variants of ultrasonic sensors with additional capabilities like open structures, waterproofing, and external casing to reduce damage. Thus, ultrasonic sensors will also witness a proportional rise with the expected increase in ADAS systems.

- The market is witnessing product developments and research. For instance, in Nov 2022, Ultraleap developed a new ultrasonic sensor and transducer for virtual reality systems for the metaverse and touchless controllers in vehicles. Such initiatives by various companies and organizations are expected to contribute to the increase in the demand for ultrasonic sensors in the market.

- However, the limited detection range of the ultrasonic sensors could restrict their effectiveness in certain applications where a wider range of detection is required. They may also have certain technological limitations, like susceptibility to interface from environmental factors like temperature, humidity, etc. These limitations can affect the reliability and accuracy of the sensor readings.

- Further, ultrasonic sensors can be relatively expensive compared to other types of sensors. This cost factor might be a restraint for some businesses or industries, especially when large-scale deployment of sensors is required.

Ultrasonic Sensors Market Trends

Automotive Industry to Create Huge Demand for Ultrasonic Sensors

- With the increasing production and sales of automobiles and increased customer expenditures, the automobile industry is expected to contribute to global growth opportunities for the Global Ultrasonic Sensors Market. For instance, according to OICA, the motor vehicle production volume in India in 2022 was approximately 5.5 million motor vehicles, an increase from 4.4 million in 2021.

- The Asia-Pacific region is witnessing increased sales of automobiles. For instance, according to the ASEAN Automotive Federation, in 2022, around 352.6 thousand motor vehicles were sold in the Philippines, an increase from 268.49 thousand in 2021.

- Ultrasonic sensors offer several applications in the automotive sector, such as parking assistance, safety alarms, collision avoidance, object detection, and automatic braking systems. They play an essential role in developing driver assistance and self-driving systems.

- Ultrasonic sensors are also used to measure the distance of objects. These sensors with long-range radar capabilities are now being integrated with the cruise control systems of automobiles to avoid collisions between vehicles. They are also used at the rear end for detecting distances, parking assistance, and automobile braking control.

- These sensors are used in onboard sensing systems in cars with autonomous and advanced features. These systems rely on ultrasonic sensors for measuring the relative distances of objects from the vehicle.

- Additionally, sensor vendors offer several ultrasonic sensors with increased capabilities like open structures, waterproofing, and external casing to reduce damage. Thus, ultrasonic sensors may witness proportional demand growth with the expected hike in ADAS systems.

- Moreover, automotive manufacturers are integrating automation technology to increase consumers' comfort, convenience, and safety. The increasing penetration of self-driving cars and the installation of collision detection systems to prevent automobiles are anticipated to accelerate the demand for ultrasonic sensors around the globe.

Asia-Pacific to Account for a Significant Share in the Market

- Asia-Pacific is a major manufacturer and consumer in the ultrasonic sensors market. Market penetration is relatively high in this region, and several automotive and manufacturing giants are boosting the market.

- According to the 13th Five-Year Plan of Smart Manufacturing, China is aiming to establish its intelligent manufacturing system and transform critical industries by 2025. At the 2020 National People's Congress, the CCP announced that, in addition to doubling down on its China Standards 2035 and Made in China 2025 initiatives, it might spend approximately USD 1.4 trillion on a digital infrastructure public spending program.

- China's New Infrastructure initiative presents several opportunities for global companies. Thus, the adoption of ultrasonic sensors in different sectors, such as automotive and industrial, is expected to grow, boosting the market's growth in the region.

- Players in the region are focusing on product innovation. For instance, a Xiamen, Fujian Province, China-based company, Ursalink, developed an IoT-level measurement solution working with its MB7380 (5m) and MB7383 (10m) ultrasonic sensors. Ursalink offers ultrasonic-level sensors.

- The presence of multiple automobile manufacturers and the electronic product manufacturing industry makes Japan a significant region for the market studied. The increasing focus of governments on deploying autonomous vehicles is also expected to create scope for the market. Japan's National Policy Agency announced it would lift the ban preventing SAE Level 4 autonomous vehicles from operating on Japanese roads. The policy change will allow autonomous vehicles to operate in a limited capacity from April 2023. The country aims to offer mobility services using Level 4 AVs in 40 areas by 2025 and in more than 100 areas by 2030.

- The 'Make in India' program places India on the world map as a manufacturing hub and gives global recognition to the Indian economy. Moreover, India's government aims for a USD 5 trillion economy by 2025, of which manufacturing may be worth USD 1 trillion. The convergence of flagship programs, such as Make in India with Skill India and Digital India, may be key to achieving this goal, thereby driving the country's market.

- The other countries considered in the Asia-Pacific region are South Korea, Indonesia, and Taiwan. The substantial presence in the semiconductor industry and South Korea's efforts to increase the manufacturing of semiconductors, electronics, and components are projected to contribute to the country's market share of ultrasonic sensors.

Ultrasonic Sensors Industry Overview

The ultrasonic sensors market is highly competitive and fragmented. The players in the market are engaging in research to achieve a competitive edge by offering innovative products. Some of the key players in the market are Siemens AG, Pepperl+Fuchs, Honeywell International Inc., Baumer Ltd., Rockwell Automation, and Murata Manufacturing Co. Ltd.

- In February 2023, PiL Sensoren GmbH customized a novel model variant of the proven sensor series P47. The high-precision ultrasonic sensors are predestined for basic applications like distance and level measurements in the measuring range of up to 5,000mm. They also provide reliable detection of even small objects due to their sound intensity.

- In February 2022, Migatron Corp., a prominent USA ultrasonic sensor manufacturer, launched two new sensor models aimed at displacement measurement and proximity detection tasks for production line applications like high-speed counting, liquid level, and many other areas of process control.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Buyers

- 3.2.2 Bargaining Power of Suppliers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Industry Value Chain Analysis

- 3.4 An Assessment of the Impact of Key Macroeconomic Trends

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Applications over Diverse Industrial Areas

- 4.1.2 Increasing demand for autonomous safety systems in vehicles

- 4.2 Market Restraints

- 4.2.1 Operational Issues and Technological Limitations

- 4.2.2 High Cost

5 Market SEGMENTATION

- 5.1 By Technology

- 5.1.1 Bulk Piezoelectric Transducer

- 5.1.2 Micromachined Ultrasound Transducers (MUT)

- 5.2 By End-user Vertical

- 5.2.1 Automotive

- 5.2.2 Consumer

- 5.2.3 Industrial

- 5.2.4 Medical

- 5.2.5 Other End-user Verticals

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Keyence Corporation

- 6.1.2 Pepperl+Fuchs AG

- 6.1.3 Honeywell International Inc.

- 6.1.4 Baumer Ltd

- 6.1.5 Rockwell Automation Inc.

- 6.1.6 Murata Manufacturing Co. Ltd

- 6.1.7 Omron Corporation

- 6.1.8 Sick AG

- 6.1.9 Banner Engineering Corp.

- 6.1.10 Balluff Inc.

- 6.1.11 Robert Bosch GmbH

- 6.1.12 Qualcomm Incorporated

- 6.1.13 TDK Corporation

- 6.1.14 Sensata Technologies

- 6.1.15 TE Connectivity

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219