|

市場調查報告書

商品編碼

1403118

智慧交通:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Smart Transportation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

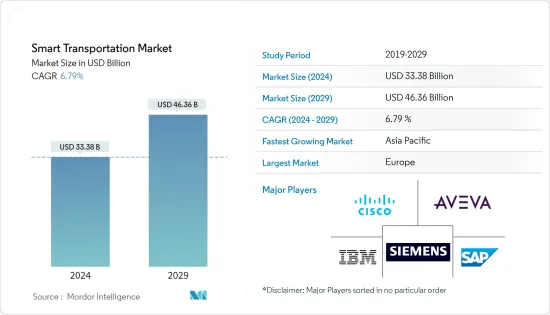

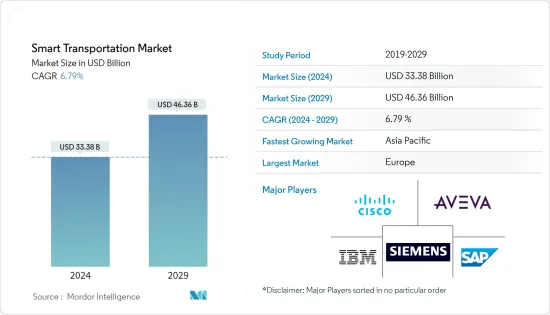

智慧交通市場規模預計到2024年為333.8億美元,預計到2029年將達到463.6億美元,在預測期內(2024-2029年)可望複合年成長率為6.79%。

交通量的增加、旨在減少溫室氣體影響的政府措施、城市計劃數量的增加、特大城市的崛起、都市化和人口成長是推動市場成長的因素。聯合國預計,2030年,全球70%以上的人口將實現城市化,印度將有7億人居住在城市。這些預測為規劃、設計和建立一個生態學和經濟永續的新印度提供了獨特的機會。此外,都市化正在推動世界各地的國家經濟發展,因為世界75%的經濟生產發生在城市。

主要亮點

- 日益成長的都市化反映了世界城市日益複雜的情況,包括其交通需求。運輸市場面臨的主要挑戰之一是解決這種複雜性。在預測期內,物聯網和連接設備的成長趨勢可能會與智慧城市計劃一起持續下去。特別是,由於智慧家庭、智慧電錶、智慧交通和智慧照明等透過物聯網相互通訊的連網產品的使用越來越多,預計該市場將會擴大。此外,預計到2025年將有超過26個智慧城市,其中大部分位於北美和歐洲,人工智慧和物聯網技術在智慧城市的採用是主要推動力。

- 創新城市發展的主要目標之一是智慧運輸,包括交通。建構高效、靈活、一體化的交通網路對於智慧運輸至關重要。智慧運輸是現代城市中心的重要發展驅動力,有潛力改善遊客和居民的日常生活。到 2040 年,城市預計將容納世界人口的 65%。城市交通管理優先考慮健康的交通途徑,例如步行和騎自行車。移動管理還可以最大限度地減少碳排放,並為當地社區提供最佳的交通流量分析。

- 人口從郊區和農村地區快速遷移到城市,以及人口向大城市中心集中,加劇了交通堵塞。由於道路設計不佳和城市規劃不完善,城市變得更加密集,城市擁擠現像日益嚴重。例如,2022 年,美國駕駛者平均在交通中損失 51 小時,即每週約 1 小時。根據行動分析公司 Inrix 的 2022 年全球交通記分卡,這比以前多了 15 個小時,美國駕駛者在交通上浪費的每一個小時的成本為 869 美元。

- 此外,2022 年 4 月,電子和資訊技術部 (MeitY) 在智慧型運輸系統(ITS) 下啟動了多項應用程式,作為 InTranSE-II 計劃的一部分,以改善印度的交通狀況。印度專用的 ADAS(高級駕駛輔助系統)、匯流排訊號優先系統和 CoSMiC(通用智慧物聯網連接)軟體是 CDAC(高級運算開發中心)和 IIT-M(印度馬德拉斯理工學院)的合資企業。設計的。 Mahindra & Mahindra 是該計劃的工業合作夥伴。政府宣稱 ODAWS 的目的是改善高速公路基礎設施。

- 然而,由於需要標準化策略,智慧交通涉及軟體、硬體、行動網路組件等許多混合方面,由多家廠商生產,引發了相容性問題。此外,各國的通訊協定差異很大,這使得製造商確保其產品獲得全球認可成為一項挑戰。

- 在後 COVID-19 的情況下,公共運輸、基於感測器的技術和票務技術對生物識別、整合、非接觸式和行動付款的採用不斷成長的需求可能會對市場產生積極影響。此外,各公司的發展也預計將推動智慧交通的需求。

智慧交通市場趨勢

不斷發展的都市化、特大城市和人口成長推動市場

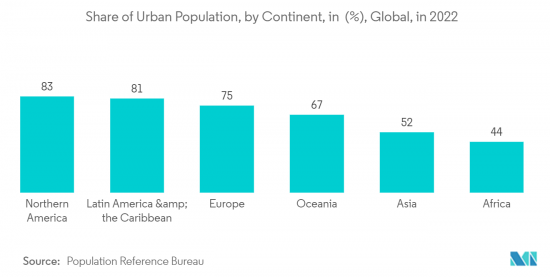

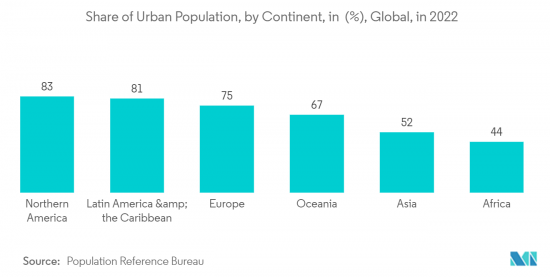

- 人口的增加以及都市化和大城市的增加是推動市場的關鍵因素。此外,隨著人口成長和都市化,許多城市將面臨交通挑戰,增加了對智慧交通的需求。例如,根據人口研究所的數據,2022年全球都市化為57%。北美是都市化最高的地區,五分之四以上的人口居住在都市區。

- 世界上一半以上的城市人口居住在亞洲,而印度和中國等一些國家僅都市區就已有約 10 億人。其他城市人口相對較多的地區是北美、歐洲和非洲。都市化的不斷加快意味著世界城市交通變得更加複雜。解決這些複雜性是這些地區交通市場面臨的關鍵挑戰之一。例如,根據聯合國的數據,到2050年,68%的人將居住在都市區。

- 城市人口成長對大眾交通工具基礎設施帶來巨大壓力。大城市的居民可能期望公共運輸快速、有效率、負擔得起、安全且環保。提供此類交通基礎設施是未來城市面臨的關鍵挑戰之一。此外,快速的都市化導致嚴重的交通堵塞、嚴重的安全問題和不斷擴大的城市差距。為了克服這些挑戰,透過彈性網路控制提供即時運動和交通資訊的智慧交通解決方案近年來在許多高度都市化的城市中獲得了廣泛的歡迎。

- 此外,都市區和特大城市也面臨交通堵塞加劇、污染物排放增加和燃料資源枯竭等交通相關問題,這對大都市的整體福祉產生負面影響。為了使交通管理更加有效,世界各地的一些城市正在透過採用智慧交通系統將其現有系統智慧化。

- 此外,城市交通對於提高任何城市公民的生活品質至關重要。如今,世界城市的規模已擴大到令人難以置信的規模。世界大城市的日益成熟以及交通領域技術領域的多重創新進一步推動了市場的成長。

亞太地區預計將錄得最快成長

- 中國最近在其「十四五」規劃(2021-2025)中提供了綜合交通運輸系統概述。報告指出,2025年,中國將大力發展智慧型交通、生態交通,運輸業整體運能、服務品質和效率顯著提升。該計劃旨在改善交通運輸業的公路、鐵路、港口和水路以及所涉及的技術和人力資源。因此,它將支持都市化的成長、消費需求和要素供給的變動。

- 由於物聯網(IoT)等智慧交通網路的引入,智慧交通在日本迅速擴張。智慧交通網路需要包含雲端、感測器和資料通訊等技術的物聯網架構。近年來的快速改進使得增強的設備通訊成為可能。

- 澳洲正在開發與駕駛員和基礎設施提供者互動的交通管理技術,以減少交通堵塞並改善安全和交通條件。該國擁有多樣化且複雜的交通基礎設施網路,對智慧交通技術不斷成長的需求為參與企業該國市場提供了機會。

- 亞太地區的其他地區由新加坡、印度和韓國等許多新興國家組成。這些國家正在興起智慧城市,交通領域也擴大採用智慧型技術,以提高交通效率,為技術供應商創造市場機會。

- 亞太地區國家也透過投資和夥伴關係相互幫助以開拓市場。例如,2022年12月,印度和韓國從韓國經濟發展合作基金(EDCF)獲得了149.5億印度盧比(1.8314億美元)的貸款,用於在那格浦爾-孟買高速公路上建造智慧型交通系統。

智慧交通產業概況

由於智慧交通產業的市場滲透率相對較低,企業正在透過提供針對特定細分市場的產品和解決方案,甚至為個人客戶量身打造產品來增加差異化和價格實現,我們正在做好準備。智慧交通和商業領域的主要參與企業,如思科、SAP SE 和 IBM,正致力於拓展新領域。這些公司在開發新穎和原創的想法以擴展其在智慧交通領域的產品線方面有著實績。總體而言,產業競爭對手之間的敵對行動預計在預測期內將會加劇。

- 2022 年 11 月 - 阿爾斯通與哈薩克鐵路公司 (KTZ) 簽署合作協議。阿爾斯通和 KTZ 加強了在 KTZ火車頭更新和維護支援方面的合作夥伴關係,其中包括下一代火車頭KZ8A。目前,已有90台貨運火車頭和39台客運火車頭投入商業營運,並計劃製造並交付KTZ 160台貨運火車頭和80台客運火車頭。

- 2022 年 10 月——西門子與 16 家合作夥伴啟動了計劃,旨在增強區域鐵路自主營運中的人工智慧,計劃運行至 2024年終。該計劃的預算為 2,300 萬歐元(2,500 萬美元),屬於德國政府資助的「safe.trAIn」計劃。滿足這種高度控制和標準化環境下的要求可以顯著提高區域鐵路運輸的效率和永續性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- 宏觀經濟走勢對市場的影響

- 技術簡介

第5章市場動態

- 市場促進因素

- 都市化的進步、特大城市的增加和人口的成長

- 政府加強交通基礎設施的舉措

- 市場抑制因素

- 引進資金要求高

第6章市場區隔

- 按用途

- 交通管理

- 道路安全和安保

- 停車場管理

- 公共運輸

- 車用通訊系統

- 貨物運輸

- 其他應用

- 依產品類型

- 高階旅客資訊系統 (ATIS)

- 先進運輸管理系統(ATMS)

- 智慧型運輸定價系統 (ATPS)

- 先進大眾交通工具系統 (APTS)

- 協同車輛系統

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第7章競爭形勢

- 公司簡介

- Cisco Systems Inc.

- SAP SE

- IBM Corporation

- AVEVA Group PLC

- Siemens Corporation

- Oracle Corporation

- Alstom

- Advantech Co. Ltd

- Orange SA

- Huawei Technologies Co. Ltd

- Hitachi Ltd

第8章投資分析

第9章 市場的未來

The Smart Transportation Market size is estimated at USD 33.38 billion in 2024, and is expected to reach USD 46.36 billion by 2029, growing at a CAGR of 6.79% during the forecast period (2024-2029).

Increasing traffic volume, government initiatives aimed at decreasing the effects of greenhouse emissions, rising city projects, and the rise of megacities, urbanization, and population are some factors driving the market growth. The UN forecasts estimate that more than 70% of the world population will be urbanized by 2030, wherein 700 million people will reside in cities in India. These predictions serve as a unique opportunity to plan, design, and build an ecologically and economically sustainable new India. Additionally, urbanization has boosted national economies across the globe, as 75% of global economic production takes place in the cities.

Key Highlights

- Increasing urbanization reflects the growing complexities in cities worldwide, with transportation needs being one of them. One of the primary issues the transportation market faces is resolving this complexity. The trend of a rising number of IoT and linked devices will continue with smart city projects during the projection period. The increased use of linked products like smart homes, smart meters, smart transportation, and smart lighting, among others that use IoT to communicate with one another, is expected to drive market expansion. In addition, it is predicted that by 2025, there will be more than 26 smart cities, with the majority existing in North America and Europe, delivering a significant drive to AI and IoT technology for adoption in smart cities.

- One of the primary objectives of innovative city development is smart mobility, which includes transportation. Creating efficient, flexible, and integrated transportation networks is vital to smart mobility. Smart mobility is a significant development driver in modern urban centers and may improve tourists' and inhabitants' everyday lives. By 2040, cities are expected to accommodate 65% of the world's population. Healthy modes of transportation, such as walking and cycling, are prioritized in urban mobility management. Mobility management also minimizes carbon emissions and provides communities with optimal traffic flow analysis.

- Traffic congestion is increasing due to exponential growth in suburban and rural populations relocating to cities and an equivalent increase in population concentration around metropolitan centers. Vehicle congestion in cities has increased as cities have grown in density, assisted by insufficient roadway designs and bad urban planning. For example, in 2022, the average American motorist wasted 51 hours in traffic congestion, or approximately an hour each week. This is 15 hours longer lost to traffic than previously, and all that time squandered in traffic jams costs the typical American motorist USD 869 in lost time, according to the mobility analytics firm Inrix's 2022 Global Traffic Scorecard.

- Further, in April 2022, the Ministry of Electronics and Information Technology (MeitY) launched several applications under the Intelligent Transportation System (ITS) as part of the InTranSE- II program to improve India's traffic scenario. An indigenous Onboard Driver Assistance and Warning System (ODAWS), Bus Signal Priority System, and Common SMart IoT Connectiv (CoSMiC) software were designed as a joint enterprise by the Centre for Development of Advanced Computing (CDAC) and the Indian Institute of Technology Madras (IIT-M). Mahindra and Mahindra was the industrial collaborator for the project. The government declared that ODAWS aims to improve the highway infrastructure as the number of vehicles and road speed has increased, exacerbating safety concerns.

- However, due to the need for a standardized strategy, smart transportation mixed with numerous aspects, such as software, hardware, and mobile network components, are produced by multiple manufacturers, resulting in compatibility concerns. Furthermore, communication protocols range significantly among nations, posing challenges for manufacturers in terms of worldwide acceptance of their products.

- In the post-COVID-19 scenario, rising demand for biometric, integrated, contactless, mobile payment adoption, sensor-based technology, and ticketing technologies throughout public transit will positively impact the market. Moreover, the development by various companies is also expected to boost the demand for smart transportation.

Smart Transportation Market Trends

Rise of Urbanization, Increasing Mega Cities and Population Drives the Market

- The population growth, coupled with the increasing urbanization rate and megacities, is the primary factor driving the market. Moreover, as the population grows and urbanizes, many cities will face transportation challenges, thus driving the demand for smart transportation. For instance, according to the Population Reference Bureau, in 2022, the degree of urbanization worldwide was 57%. North America was the region with the highest level of urbanization, with over four-fifths of the population residing in urban areas.

- More than half the world's urban population resides in Asia, where some countries, like India and China, already have about a billion people living in cities alone. The other regions with relatively high urban populations are North America, Europe, and Africa. Increasing urbanization indicates the rising complexities in the transportation of cities worldwide. Resolving these complexities is one of the significant challenges faced by the transport markets across these areas. For instance, according to the United Nations, people living in urban areas are expected to reach 68% by 2050.

- Urban population growth will significantly pressure public transport infrastructure. Residents of big cities will expect public transport that is fast, efficient, affordable, safe, and environmentally friendly. Delivering such transportation infrastructure will be one of the critical challenges confronting future cities. Furthermore, rapid urbanization has brought heavy traffic congestion, serious safety issues, and growing urban inequality. Smart transportation solutions have gained significant traction in the past few years across many highly urbanized cities to overcome such challenges by delivering real-time travel and traffic information with resilient network control.

- Furthermore, besides increasing traffic congestion, the urban areas and megacities face several other transport-related problems, such as growing emissions of pollutants and depleting fuel resources that adversely impact the overall well-being of any major city. To make transport management more effective, several cities worldwide are trying to create intelligence into existing systems by adopting smart transportation systems, which is expected to drive the market's growth at a rapid pace.

- Moreover, urban transportation is becoming crucial for a better quality of life for citizens in any city. Today cities worldwide are expanding to incredible sizes. The rising maturation rate of megacities worldwide and multiple innovations taking place in the technology field for the transportation sector are further driving the market's growth.

Asia Pacific is Expected to Register Fastest Growth

- China outlined a recent comprehensive transportation system in the 14th Five-Year Plan (2021-2025). According to the circular, by 2025, China will have made achievements in pursuing intelligent and green transportation, as well as significant advances in overall competence, service quality, and efficiency of the transportation industry. This plan aims to improve the transportation industry's roads, trains, ports, and waterways and the technology and human resources involved. As a result, this will support growth in urbanization, consumer demand, and factor supply movements.

- Smart transportation is quickly expanding in Japan with the introduction of smart transportation networks, such as the Internet of Things (IoT). Smart transportation networks require IoT architecture, which includes technologies such as the cloud, sensors, and data communication. Rapid improvements in recent years have made it feasible to enhance device communication.

- Australia has been developing traffic management technologies interacting with drivers and infrastructure operators to reduce traffic congestion and enhance safety and traffic conditions. The country has a diverse and complex transportation infrastructure network, creating an opportunity for the market players in the country due to the increasing demand for smart transportation technologies.

- The rest of Asia-Pacific consists of many emerging countries, including Singapore, India, and South Korea. The emergence of smart cities in these countries is increasing the adoption of intelligent technologies in transportation to enhance traffic efficiencies, creating a market opportunity for technology providers.

- Countries in the region are also helping each other by investing and partnering in the market adoption in Asia-Pacific. For instance, in December 2022, India and South Korea agreed to a loan of INR 1,495 crore (USD 183.14 million) from the Economic Development Cooperation Fund (EDCF) of the Republic of Korea to construct an intelligent transport system on the Nagpur-Mumbai Expressway.

Smart Transportation Industry Overview

As the market penetration of the smart transportation industry is relatively low, firms are poised to offer products and solutions that are tailor-made to specific segments and even customize products for individual customers, enhancing differentiation and price realization. The major participants in the smart transportation business, like Cisco, SAP SE, IBM, etc., are focusing on growing their operations in new areas. These companies have a track history of developing novel and inventive ideas to expand their product lines in the smart transportation sector. Overall, the industry's intensity of competitive rivalry is expected to be high during the forecast period.

- November 2022 - Alstom and Kazakhstan Railways (KTZ) signed a cooperation agreement. Alstom and KTZ strengthened their partnership in the renewal of KTZ's locomotive fleet and maintenance support, which includes the next-generation locomotive KZ8A. Currently, 90 freight and 39 passenger locomotives are in commercial service, with 160 freight and 80 passenger locomotives scheduled to be manufactured and delivered for KTZ.

- October 2022 - Siemens and 16 partners started a project likely to last through the end of 2024 to enhance artificial intelligence in the autonomous operation of regional trains. A budget of EUR 23 million (USD 25 million) within the German government-funded "safe.trAIn" project is available for this project. Meeting the requirements in this highly governed and standardized environment can significantly improve the efficiency and sustainability of regional railway transportation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise of Urbanization and Increasing Mega Cities and Increasing Population

- 5.1.2 Government Initiatives to Enhance the Transportation Infrastructure

- 5.2 Market Restraints

- 5.2.1 High Capital Required for Deployment

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Traffic Management

- 6.1.2 Road Safety and Security

- 6.1.3 Parking Management

- 6.1.4 Public Transport

- 6.1.5 Automotive Telematics

- 6.1.6 Freight

- 6.1.7 Other Applications

- 6.2 By Product Type

- 6.2.1 Advanced Traveler Information Systems (ATIS)

- 6.2.2 Advanced Transportation Management Systems (ATMS)

- 6.2.3 Advanced Transportation Pricing Systems (ATPS)

- 6.2.4 Advanced Public Transportation Systems (APTS)

- 6.2.5 Cooperative Vehicle Systems

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Australia

- 6.3.3.4 Rest of the Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 South Africa

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 SAP SE

- 7.1.3 IBM Corporation

- 7.1.4 AVEVA Group PLC

- 7.1.5 Siemens Corporation

- 7.1.6 Oracle Corporation

- 7.1.7 Alstom

- 7.1.8 Advantech Co. Ltd

- 7.1.9 Orange SA

- 7.1.10 Huawei Technologies Co. Ltd

- 7.1.11 Hitachi Ltd