|

市場調查報告書

商品編碼

1403099

物聯網 (IoT):市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Internet Of Things (IoT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

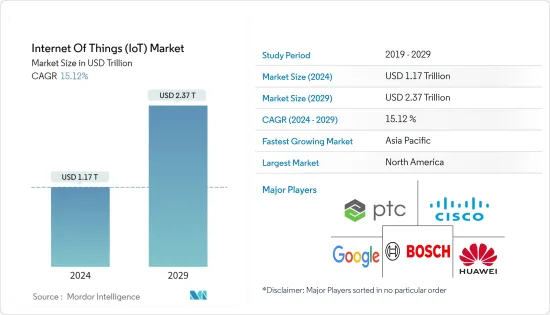

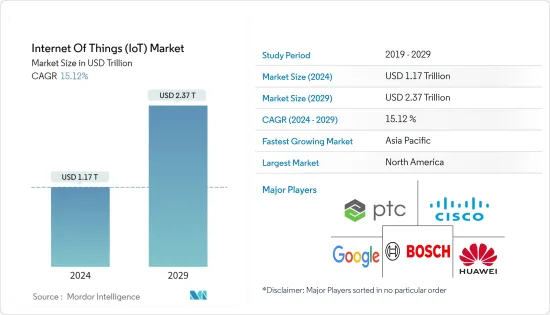

物聯網市場規模預計到 2024 年為 1.17 兆美元,預計到 2029 年將達到 2.37 兆美元,在預測期內(2024-2029 年)複合年成長率為 15.12%。

在 COVID-19 大流行期間,市場供應商正在與多個組織合作,提供新技術支援的解決方案,以幫助醫療保健組織有效克服危機。例如,1 月下旬,上海公共衛生臨床中心 (SPHCC) 開始使用加州互聯連線健診新興企業VivaLNK 的連續體溫測量設備來監測 COVID-19 患者,使看護者面臨暴露於病毒的風險。

主要亮點

- 物聯網技術是各種組織數位轉型的基石,使他們能夠建立和追蹤新的業務模型以及升級現有流程。企業和服務供應商將物聯網視為加強數位轉型和提高業務效率的關鍵推動因素。物聯網技術在製造、汽車和醫療保健等最終用戶行業中的日益採用正在積極推動市場成長。傳統製造業正在經歷數位轉型,物聯網正在推動智慧型互聯的下一次工業革命。這正在改變行業處理系統和機械中日益複雜的流程的方式,以提高效率並減少停機時間。

- 工業 4.0 和物聯網是整個物流鏈開發、生產和管理的新技術方法的核心,即智慧工廠自動化。隨著工業4.0 和物聯網(IoT) 的普及,製造業發生了巨大轉變,正在推動向敏捷、智慧和創新技術的轉變,透過機器人技術補充和增強人類勞動力,並透過減少工業事故的技術推動生產。流程失敗,需要企業採取方法。隨著連網型設備和感測器的高採用率以及 M2M通訊的可用性,製造中產生的資料點數量正在迅速增加。這些資料點可以是任何東西,從衡量材料經歷一個加工週期所需時間的指標到計算汽車行業材料應力能力等複雜的數據。

- 根據 Zebra 的製造願景研究,基於物聯網和 RFID 的智慧資產追蹤解決方案預計到 2022 年將取代基於電子表格的傳統方法。根據工業IoT(IIoT) 公司 Microsoft 的一項研究,85% 的公司至少擁有一個 IIoT 用例計劃。隨著 94% 的受訪者聲稱將在 2021 年實施 IIoT 策略,這一數字可能還會增加。

- 現場設備、感測器和機器人的進步預計將進一步擴大市場範圍。物聯網技術正在克服製造業的勞動力短缺問題。對於越來越多的組織來說,利用機器人化等工業 4.0 技術正在成為日常業務的一部分。根據國際機器人聯合會預測,協作機器人市場預計兩年內將達到123億美元。智慧型機器人與工人一起工作,大多數工廠工人都可以對其進行編程,以承擔最日常和最繁瑣的任務並準確地交貨。

- 機器人在製造業中的使用越來越多,因為它們易於訓練,並且可以在潛在危險的情況下取代機器人,使職場環境對人類更安全。高度可訓練和協作的機器人可以在危險或不合適的情況下取代人類,為人類提供更安全的職場環境。例如,採礦場使用的自動自卸自動卸貨卡車可以由操作員遠端控制,因此無需人類駕駛人。

物聯網 (IoT) 市場趨勢

零售業將經歷顯著成長

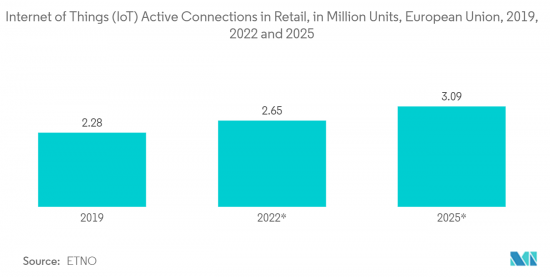

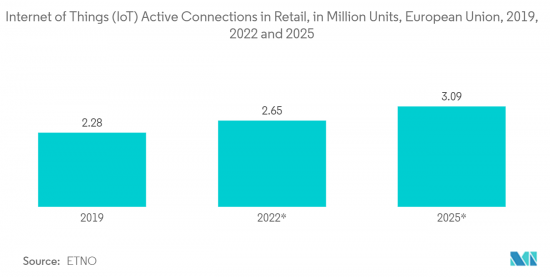

- 零售業正在增加商家和最終消費者對連網型設備的使用。電子商務的使用和可支配收入的增加正在支持超級市場和大賣場的成長。軟體和數位化的使用以及必要的網際網路接入展現了物聯網設備在市場類別中的市場潛力。

- 物聯網預計也將在多個領域帶來變革,例如補充倉儲設施。包括三星和 LG 在內的主要電子製造商正在發布連網型冰箱等產品,這些產品可以自動重新訂購起司或牛奶等缺貨的產品。

- 此外,智慧型手機的普及和網路購物的便利性也增加了電子商務平台的使用。由於對資料分析和分析整合的需求不斷增加,預計該市場將會成長。

- 零售商的物聯網重要應用包括供應鏈、聯網消費者和智慧商店應用。零售商正在轉向支援物聯網的解決方案來幫助提高客戶參與、增加收益並降低成本。

北美實現顯著成長

- 聯網汽車、智慧型能源計劃、家庭自動化以及對智慧製造的關注正在推動物聯網在該地區主要收益終端用戶產業中發揮越來越大的作用。北美可能是這方面的重要市場。該地區物聯網的擴張也得益於各工業部門的快速數位化和技術突破。

- SAS Software 等公司推動的人工智慧和物聯網整合是下一波基於物聯網的人工智慧浪潮,是預計從正在改變美國製造業的當前技術中出現的未來技術之一。在美國,公共產業部門目前面臨巨大壓力。美國能源資訊署預測,儘管國內可再生能源生產大幅成長,但 2017 年全球能源需求仍將成長 48%。

- 該地區率先採用了基於容器的雲端應用程式,為配置提供了彈性和效能。集中式或基於邊緣的物聯網部署正在逐漸習慣於基於容器的雲端配置。例如,VMware發布了VMware Tanzu,這是一個控制Kubernetes容器分發的雲端平台。

- 此外,該地區也是許多開發創新物聯網晶片解決方案的新興企業的所在地。例如,美國新興企業Wiliot 基於無電池藍牙技術創建物聯網晶片,用於製造、材料回收、零售和資產分配。這些藍牙標籤包含感測器、低功耗處理器和基於無線電波的能源採集電路。新興企業使用的無電池技術的價格要低得多。

物聯網 (IoT) 產業概述

物聯網(IoT)市場競爭激烈,國內外市場有許多大大小小的公司。由於技術的高度存在,市場似乎是分散的。產品創新和併購是市場參與企業典型的兩個重要手段。市場參與企業的主要例子包括甲骨文公司、思科系統公司、Google公司、IBM公司和微軟公司。

2023年4月,高通宣布推出尖端物聯網解決方案,支援新的工業應用並協助擴展物聯網生態系統。最新的物聯網解決方案為智慧建築、企業、零售和工業自動化等各種物聯網使用案例提供卓越的效能、先進的連接性和下一代處理能力。

2022 年 11 月,德克薩斯(TI) 宣布將為 Wi-Fi 和 Thread SimpleLink 無線微控制器 (MCU) 推出一款支援 Matter 的新軟體開發套件,以簡化Matter 協定在物聯網(IoT) 應用中的採用。該軟體以 TI 與連接標準聯盟的密切合作以及 2.4GHz 連接領域的創新為基礎。使用新的軟體和無線 MCU,工程師可以創建超低功耗、安全、電池供電的智慧家庭和工業自動化物聯網應用,這些應用可與獨特生態系統中的設備無縫連接。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場概況

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 法律規範

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 連網型設備的採用增加和技術的普及

- 資料分析的快速成長和技術進步

- 市場抑制因素

- 資料安全和隱私、設備連接和互通性問題

第 6 章 物聯網使用案例

第7章市場區隔

- 按成分

- 硬體

- 軟體/平台

- 連接性

- 服務

- 按最終用戶產業

- 製造業

- 運輸

- 衛生保健

- 零售

- 能源/公用事業

- 住宅產業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第8章競爭形勢

- 公司簡介

- Huawei Technologies Co. Ltd

- Robert Bosch GmbH

- Google Inc.

- Cisco Systems Inc.

- PTC Inc.

- Siemens AG

- Honeywell International Inc.

- Koninklijke Philips NV

- Aeris Communications Inc.

- Amazon Web Services Inc.

- IBM Corporation

- Microsoft Corporation

- General Electric Company

- Fujitsu Ltd

- Oracle Corporation

- SAP SE

- AT&T Inc.

- Wipro Ltd

第9章投資分析

第10章市場的未來

The Internet Of Things Market size is estimated at USD 1.17 trillion in 2024, and is expected to reach USD 2.37 trillion by 2029, growing at a CAGR of 15.12% during the forecast period (2024-2029).

During the COVID-19 pandemic, the vendors in the market are collaborating with several organizations to offer emerging technology-enabled solutions to healthcare organizations to help them overcome the crisis effectively. For instance, at the end of January, the Shanghai Public Health Clinical Center (SPHCC) used the California-based connected health startup VivaLNK's continuous temperature measuring device to monitor COVID-19 patients, reducing the risks of caregivers being exposed to the virus.

Key Highlights

- IoT technology is the keystone for various organizations to digitally transform, thus empowering them to upgrade the existing processes by creating and tracking new business models. Enterprises and service providers have considered IoT the key enabler to augment digital transformation and unlock operational efficiencies. The growing adoption of IoT technology across end-user industries, such as manufacturing, automotive, and healthcare, is positively driving the market's growth. With the traditional manufacturing sector amid a digital transformation, IoT is fueling the next industrial revolution of intelligent connectivity. This is changing how industries approach increasingly complex processes of systems and machines to improve efficiency and reduce downtime.

- Industry 4.0 and IoT are central to new technological approaches for developing, producing, and managing the entire logistics chain, otherwise known as smart factory automation. Massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with robotics and reduce industrial accidents caused by process failure. With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a surge in data points generated in the manufacturing industry. These data points can be of various kinds, ranging from a metric describing the time taken for the material to pass through one process cycle to a more advanced one, such as calculating the material stress capability in the automotive industry.

- According to Zebra's Manufacturing Vision Study, smart asset tracking solutions based on IoT and RFID are expected to overtake traditional, spreadsheet-based methods by 2022. A study by the Industrial IoT (IIoT) company Microsoft Corporation found that 85% of companies have at least one IIoT use case project. This number may increase, as 94% of respondents claimed they would implement IIoT strategies in 2021.

- The advancements in field devices, sensors, and robots are expected to expand the scope of the market further. IoT technologies are overcoming the labor shortage in the manufacturing sector. For more and more organizations, using Industry 4.0 technologies, like robotization, is part of day-to-day operations. According to the International Federation of Robotics, the market for collaborative robots is expected to reach USD 12.3 billion in two years. Intelligent robots work alongside workers and can be programmed by most factory workers to take on the most routine, tedious tasks and deliver accurately.

- They are increasingly used in the manufacturing industry as they are easy to train and make workplace environments safer for humans by taking their place in potentially dangerous situations. Highly trainable and collaborative, robots also deliver safer working environments for humans by switching places with them in dangerous or unsuitable situations. For instance, autonomous dump trucks used at mining sites can be remotely controlled by operators, eliminating the need for human drivers.

Internet of Things (IoT) Market Trends

The Retail Segment to Witness a Significant Growth

- Both merchants and the end consumers it serves have boosted their use of connected devices in the retail industry. The use of e-commerce and the rise in disposable income support the growth of supermarkets and hypermarkets. The usage of software and digitalization, along with the required internet access, presents a market potential for IoT devices in the market category.

- IoT is also anticipated to transition significantly in several domains, including replenishing inventory in storage facilities. Major electronics producers are releasing products like connected refrigerators that can automatically reorder cheese, milk, or any other item that is running low, including Samsung and LG.

- Moreover, there is an increase in the use of e-commerce platforms owing to the growing smartphone penetration and the ease of online shopping. Due to the increasing need for data analysis and analytics integration, the market is expected to grow.

- The critical applications of IoT for retailers include the supply chain, connected consumers, and smart-store applications. Retailers are turning to IoT-enabled solutions, as they help them improve customer engagement while increasing revenues and reducing costs.

North America to Witness a Significant Growth

- The deployment of connected vehicles, projects utilizing smart energy, home automation, and a focus on smart manufacturing are driving the expanding role of IoT among the region's crucial revenue-generating end-user industries. North America is likely a significant market in this regard. The expansion of IoT in this area has also been aided by fast digitalization across industry sectors and technological breakthroughs.

- The convergence of AI and IoT, promoted by firms like SAS Software as the next wave of IoT-based AI, is among the future technologies that are anticipated to arise out of the present technologies that are altering manufacturing in the United States. The utility sector is currently under intense pressure in the US. The US Energy Information Administration predicted worldwide energy demand will increase by 48% in 17 years, even though domestic energy production from renewable resources has expanded dramatically.

- The area is a pioneer in adopting container-based cloud applications that give deployments more flexibility and performance. Any centralized or edge IoT deployment is becoming accustomed to container-based cloud deployments. For instance, VMware introduced VMware Tanzu, a cloud platform that controls Kubernetes' container distribution.

- Additionally, the region is home to many startups developing ground-breaking IoT chip solutions. For example, a US startup, Wiliot, creates IoT chips based on Bluetooth technology without needing batteries for manufacturing, material recycling, retail, and asset distribution. These Bluetooth tags incorporate sensors, a low-power processor, and radio wave-based energy harvesting circuitry. The battery-free technology used by the startup offers much lower prices.

Internet of Things (IoT) Industry Overview

The Internet of Things (IoT) market is highly competitive owing to many large and small players operating in the domestic and international markets. Due to the high presence of technology, the market seems to be fragmented. Product innovation and mergers and acquisitions are two important methods the leading market participants use. Oracle Corporation, Cisco Systems Inc., Google Inc., IBM Corporation, and Microsoft Corporation are a few of the market's main participants.

In April 2023, Qualcomm introduced cutting-edge IoT solutions to enable new industrial applications and help scale the IoT ecosystem. The latest IoT solutions deliver superior performance, advanced connectivity, and next-gen processing for a wide range of IoT use cases for smart buildings, enterprises, retail, and industrial automation.

In November 2022, Texas Instruments (TI) introduced new Matter-enabled software development kits for Wi-Fi and Thread SimpleLink wireless microcontrollers (MCUs) that will streamline the adoption of the Matter protocol in the Internet of Things (IoT) applications. The software builds on TI's close involvement with the Connectivity Standards Alliance and innovation in the 2.4-GHz connectivity space, where engineers can use the new software and wireless MCUs to create ultra-low-power and secure, battery-powered smart home and industrial automation IoT applications that seamlessly connect with devices across proprietary ecosystems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Regulatory Framework

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Connected Devices and Technology Proliferation

- 5.1.2 Rapid Growth and Technological Advancements in Data Analytics

- 5.2 Market Restraints

- 5.2.1 Issues Related to Security and Privacy of Data and Connectivity of Devices and Interoperability

6 USE CASES OF IoT

7 MARKET SEGMENTATION

- 7.1 By Component

- 7.1.1 Hardware

- 7.1.2 Software/Platform

- 7.1.3 Connectivity

- 7.1.4 Services

- 7.2 By End-user Industry

- 7.2.1 Manufacturing

- 7.2.2 Transportation

- 7.2.3 Healthcare

- 7.2.4 Retail

- 7.2.5 Energy and Utilities

- 7.2.6 Residential

- 7.2.7 Other End-user Industries

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Huawei Technologies Co. Ltd

- 8.1.2 Robert Bosch GmbH

- 8.1.3 Google Inc.

- 8.1.4 Cisco Systems Inc.

- 8.1.5 PTC Inc.

- 8.1.6 Siemens AG

- 8.1.7 Honeywell International Inc.

- 8.1.8 Koninklijke Philips NV

- 8.1.9 Aeris Communications Inc.

- 8.1.10 Amazon Web Services Inc.

- 8.1.11 IBM Corporation

- 8.1.12 Microsoft Corporation

- 8.1.13 General Electric Company

- 8.1.14 Fujitsu Ltd

- 8.1.15 Oracle Corporation

- 8.1.16 SAP SE

- 8.1.17 AT&T Inc.

- 8.1.18 Wipro Ltd