|

市場調查報告書

商品編碼

1403091

能源產業虛擬桌面-市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Desktop Virtualization In Energy Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

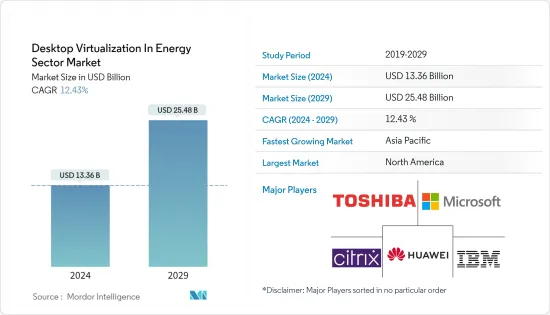

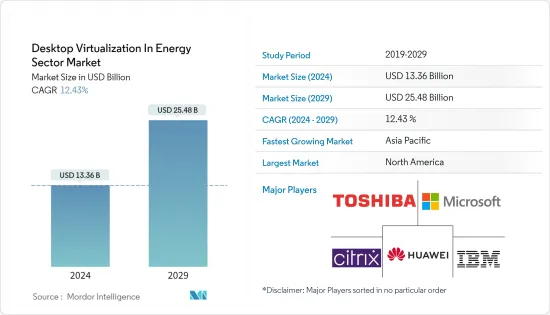

預計2024年能源領域虛擬桌面市場規模為133.6億美元,2029年將達254.8億美元,複合年成長率預估為12.43%。

在能源領域,基礎設施經常受到遠端控制和監控。虛擬桌面使員工能夠安全地遠端存取關鍵系統和資料,從而提高業務效率。

主要亮點

- 隨著能源需求的增加,能源公司被要求降低營運成本並簡化業務流程。透過將桌面環境和資料集中在安全伺服器上,虛擬桌面可以增強資料安全性和合規性。

- 雲端基礎的虛擬桌面允許能源部門員工從任何有網路連接的地方存取虛擬桌面和關鍵應用程式。雲端基礎的解決方案提供強大的災害復原功能。如果發生災難或系統故障,能源公司可以從異地雲端備份中快速恢復虛擬桌面環境和資料。

- 能源公司通常需要快速回應不斷變化的業務需求。無論您是派遣團隊前往遠端鑽井現場,還是讓您的工程師從其他位置存取資料,虛擬桌面都可以讓您彈性適應這些不斷變化的環境。

- 基礎設施的限制迫使工人從事傳統工作。在能源領域,複雜且成熟的平台已經在本地部署,遷移到雲端需要時間。對雲端基礎的員工資料的安全和隱私的擔憂預計將阻礙市場成長。

- 基於人工智慧的勞動力分析解決方案、不斷增加的勞動力資料來源以及對大量資料的存取預計將為市場參與企業創造利潤豐厚的機會。自 COVID-19 以來,隨著多家公司轉向遠距工作,市場一直備受關注。封鎖和社交距離準則迫使許多公司立即做出必要的調整,並建立必要的電腦基礎設施來支援遠端工作人員。在能源領域,企業長期以來一直在使用虛擬桌面解決方案。

能源領域虛擬桌面市場趨勢

雲端部署模式部分預計將佔據主要市場佔有率

- 能源產業的各種公司正在使用雲端運算來降低營運成本。雲端託管的易於部署、可存取性和彈性預計將推動組織採用雲端運算。雲端部署包括DaaS(桌面即服務)、WaaS(工作空間即服務)和SaaS(應用程式/軟體即服務)等服務模式。虛擬桌面作為雲端網路上的服務提供,所有運算和支援基礎設施均由服務供應商在雲端部署中託管。

- 透過雲端進行的應用程式串流在能源產業越來越受歡迎,許多公司選擇獨立的應用程式服務。雲端在能源領域受到青睞,因為它提供了更好的可擴展性、資料管理和成本節約。

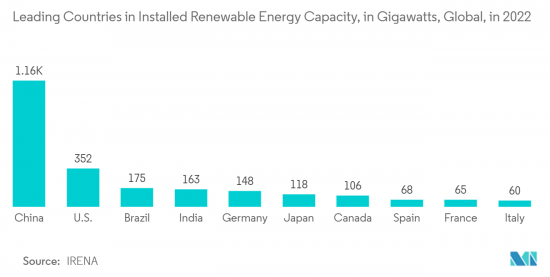

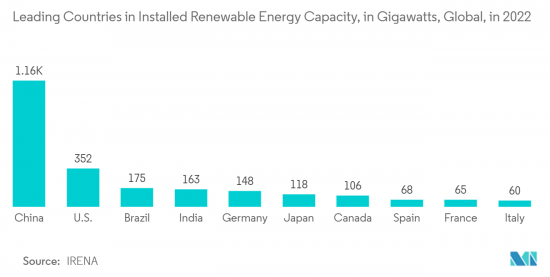

- 根據國際可再生能源機構的數據,2022年全球水力發電裝置容量達到1,393吉瓦(GW),較2021年成長2.19%。由於未來水力發電發電工程和技術進步,水電裝置容量預計將增加。此外,2022年引進可再生能源的領先國家是中國、美國和巴西。在可再生能源裝置方面,中國以約1,161吉瓦位居第一。

- 雲端部署提供了滿足由於水力發電容量增加而增加的運算需求所需的彈性和可擴展性。這使得組織可以根據需要配置和取消配置虛擬桌面和資源,以適應計劃的成長。

- 虛擬桌面的雲端部署支援遠端存取關鍵應用程式和資料。工程師可以在任何有網路連接的地方進行操作,管理人員可以安全地監控和管理水力發電計劃,從而提高業務效率並減少對現場人員的需求。此外,2022年8月,印度政府宣佈在尼泊爾開發兩個水力發電發電工程,分別為西塞蒂發電工程和塞蒂河水力發電發電工程。這些計劃的總營運成本預計約為24億美元。這些新興市場的開拓為能源領域虛擬桌面市場的雲端部署提供了型態。

亞太地區預計將佔據主要市場佔有率

- 亞太地區公司早期採用新技術並投資於能源領域是全球主導地位的關鍵驅動力。主要雲端服務供應商在亞太地區雲端基礎的虛擬桌面採用的成長中發揮著重要作用。亞太地區的能源公司透過由智慧電網技術等新產品和服務支援的複雜基礎設施網路來傳輸、分配和儲存能源。

- 截至2022年,中國在可再生能源部署方面處於世界領先地位。 2022年可再生能源發電總量將達到1,160.8GW,與前一年同期比較成長約13.4%。水力發電、太陽能和風電是該國主要的再生能源來源。

- 印度政府設定了2022年安裝175GW可再生能源裝置的目標,其中包括100GW太陽能發電、60GW風電、10GW生物發電和5GW小型水力。此外,印度新能源和可再生能源部預計到2022年將在可再生能源、電動車、太陽能設備製造和生態氫能方面投資150億美元。

- 此外,印度政府正在大力投資可再生能源以減少碳排放,實施各種大型永續電力計劃,並專注於發展綠色能源。截至 2021 年,印度可再生能源裝置容量已達到 147 吉瓦,該國的目標是到 2030 年可再生能源裝置容量約為 450 吉瓦 (GW)。

- 日本政府也計劃在2030年將二氧化碳排放減少50%,到2050年實現碳中和。 2022年9月,EcoPower Investment (GPI) 選擇GE再生能源作為位於青森縣西津輕區深浦町的深浦風力發電廠的營運商。該計劃將包括 19 台 GE 4.2-117 陸上風力渦輪機,也是 GE 在日本的第三個計劃。

能源領域的虛擬桌面虛擬化

能源領域的虛擬桌面市場較為分散,主要參與者包括思傑系統公司、東芝公司、IBM公司、華為科技公司和微軟公司。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023 年 8 月,戴爾科技集團宣布透過虛擬架構支援向可再生能源的轉變。經過戴爾驗證的 Energy Edge 設計可為動態且多樣化的可再生能源環境中的電網營運商提供安全性和控制力。為了滿足這些需求,變電站營運商擴大使用虛擬來實現自動化、控制和管理。虛擬平台提供了快速響應不穩定和不斷發展的網格中的新挑戰的彈性。

2022 年 5 月,Citrix 的 DaaS(桌面即服務)平台與雲端供應商整合,讓企業可以選擇託管其虛擬桌面產品。 Citrix Systems, Inc. 與 Google Cloud 合作,讓已在本地使用 Citrix VDI 技術的公司更輕鬆地切換到 Google Cloud 上託管的 Citrix DaaS。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 雲端運算的進步和遠端存取的需求推動市場成長

- 市場抑制因素

- 基礎設施限制阻礙市場擴張

第6章市場區隔

- 透過桌面交付平台

- 託管虛擬桌面 (HVD)

- 託管共用桌面 (HSD)

- 依實施型態

- 本地

- 雲

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區 中東/非洲

第7章競爭形勢

- 公司簡介

- Citrix Systems Inc.

- Toshiba Corporation

- IBM Corporation

- Huawei Technologies Co. Ltd

- Microsoft Corporation

- Parallels International GmbH

- Dell Inc.

- NComputing

- Ericom Software Inc.

- Vmware Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Desktop Virtualization In Energy Sector Market size is estimated at USD 13.36 billion in 2024, and is expected to reach USD 25.48 billion by 2029, growing at a CAGR of 12.43% during the forecast period (2024-2029).

The energy sector often involves remote operations and monitoring of infrastructure. Desktop virtualization allows employees to access critical systems and data securely from remote locations, improving operational efficiency.

Key Highlights

- The increasing energy demand necessitates energy companies to reduce operating costs and streamline business processes. By centralizing desktop environments and data on secure servers, desktop virtualization can enhance data security and compliance, which is crucial in the energy sector due to sensitive information and regulatory requirements.

- Cloud-based desktop virtualization allows energy sector employees to access their virtual desktops and critical applications from anywhere with an Internet connection. Cloud-based solutions offer robust disaster recovery capabilities. In a disaster or system failure, energy companies can quickly recover their virtual desktop environments and data from off-site cloud backups.

- Energy companies often need to respond quickly to changing operational requirements. Whether deploying a team to a remote drilling site or providing engineers with access to data from a different location, desktop virtualization offers the flexibility to adapt to these changing circumstances.

- Infrastructural constraints compel the workers to work traditionally. The energy sector already has complex and established platforms that are on-premise, and moving them to the cloud is time-consuming. Concerns about the security and privacy of cloud-based worker data are expected to hamper the market growth.

- AI-based workforce analytics solutions, an increasing number of workforce data sources, and the accessibility of vast data are expected to create lucrative opportunities for the players in the market. The market has been brought to focus since COVID-19 because various businesses have moved to remote working. The lockdown and social distancing guidelines forced many businesses to make the necessary adjustments immediately and build the computer infrastructure needed to support their remote workers. Businesses have been using desktop virtualization solutions in the energy sector for a long time.

Desktop Virtualization In Energy Sector Market Trends

Cloud Deployment Mode Segment is Expected to Hold Significant Market Share

- Various energy sector organizations are using cloud computing to reduce businesses' operational costs. Easy implementation, accessibility, and flexibility of cloud hosting are expected to drive organizations' adoption of cloud computing. Cloud deployment includes service models, such as Desktop-as-a-Service (DaaS), Workspace-as-a-Service (WaaS), and Application/Software-as-a-Service (SaaS). Desktop virtualization is offered as a service over cloud networks, with all computing and supporting infrastructure hosted on the service provider's end in the cloud deployment mode, which makes the migration of data between working environments easy.

- Application streaming over the cloud is gaining popularity in the energy sector industry, with many businesses choosing standalone application services. Cloud is preferred across energy sector industries, providing better scalability, data management, and cost savings.

- According to the International Renewable Energy Agency, in 2022, the global hydropower installed capacity reached 1393 gigawatts (GW), representing a rise of 2.19% compared to 2021. The hydropower installed capacity is expected to grow with the upcoming hydro projects and technological advancements. Furthermore, the leading countries for installed renewable energy in 2022 were China, the United States, and Brazil. China was in first place in renewable energy installations, with a capacity of around 1,161 gigawatts.

- Cloud deployment offers the flexibility and scalability required to accommodate the increasing computing demands of expanding hydropower capacity. It allows organizations to provision and de-provision virtual desktops and resources as needed, aligning with the project's growth.

- Cloud deployment of virtual desktops enables remote access to critical applications and data. Engineers operate, and managers can securely monitor and manage hydro projects from anywhere with an internet connection, improving operational efficiency and reducing the need for on-site personnel. Moreover, in August 2022, the Government of India announced the development of two hydropower projects in Nepal, namely the West Seti Hydropower Project and the Seti River Hydropower Project. The total cost of these projects is expected to be around USD 2.4 billion. Such developments provide opportunities for the cloud deployment mode of the desktop virtualization market in the energy sector.

Asia Pacific is Expected to Hold Significant Market Share

- Organizations in the Asia Pacific region companies early adoption of new technologies and investments in energy sectors are the primary driving force behind global dominance. Large cloud service providers play a significant role in the region's growth of cloud-based desktop virtualization deployment. The energy companies in the Asia Pacific region further transmit, distribute, and store energy through complex infrastructure networks supported by emerging products and services such as smart grid technologies.

- As of 2022, China is the global leader in renewable energy deployment. The country's total renewable energy capacity reached 1160.8 GW in 2022, representing an increase of approximately 13.4 percent compared to the previous year. Hydropower, solar, and wind are the major renewable energy sources in the country.

- The Government of India has set a target of installing 175 GW of renewable energy capacity by FY 2022, including 100 GW from solar, 60 GW from wind, 10 GW from bio-power, and 5 GW from small hydropower. Moreover, the Indian Ministry for New and Renewable Energy expects investment of USD 15 billion in renewable energy, electric vehicles, manufacturing of solar equipment, and green hydrogen in 2022.

- In addition, the Government of India is investing heavily in renewable energy to reduce carbon emissions, undertaking various large-scale sustainable power projects, and promoting green energy heavily. As of 2021, India's installed renewable energy capacity stood at 147 GW, and the country is targeting about 450 Gigawatt (GW) of installed renewable energy capacity by 2030, which will directly aid the market.

- Japan's government has also targeted reducing carbon emissions to 50 percent by 2030 and achieving carbon neutrality by 2050. In September 2022, Green Power Investment (GPI) chose GE Renewable Energy as the provider for the Fukaura Wind Farm in Fukaura Town, Nishi Tsugaru District, Aomori Prefecture, Japan. The project, which will include 19 units of GE's 4.2-117 onshore wind turbines, is GE's third in Japan.

Desktop Virtualization In Energy Sector Industry Overview

The desktop virtualization market in the energy sector is fragmented, with the presence of major players like Citrix Systems Inc., Toshiba Corporation, IBM Corporation, Huawei Technologies Co. Ltd, and Microsoft Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In August 2023, Dell Technologies announced its support for the shift to renewable energy with virtualized architecture. Dell-validated design for Energy Edge offers grid operators security and control in dynamic, diverse renewable energy environments. To meet these demands, substation operators increasingly use virtualization for automation, control, and management. A virtualized platform provides the flexibility to quickly respond to new challenges in a volatile, evolving grid.

In May 2022 - Citrix's Desktop as a Service (Daas) platform collaborated with cloud providers, giving businesses a choice of host for their virtual desktop products. Citrix Systems, Inc. partnered with Google Cloud and believed that this would make it simpler for businesses already utilizing Citrix VDI technology on-premises to switch to Citrix DaaS hosted on Google Cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Cloud and Need for Remote Accessibility is Driving the Market Growth

- 5.2 Market Restraints

- 5.2.1 Infrastructural Constraints is Discouraging the Market Expansion

6 MARKET SEGMENTATION

- 6.1 By Desktop Delivery Platform

- 6.1.1 Hosted Virtual Desktop (HVD)

- 6.1.2 Hosted Shared Desktop (HSD)

- 6.2 By Deployment Mode

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Citrix Systems Inc.

- 7.1.2 Toshiba Corporation

- 7.1.3 IBM Corporation

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 Microsoft Corporation

- 7.1.6 Parallels International GmbH

- 7.1.7 Dell Inc.

- 7.1.8 NComputing

- 7.1.9 Ericom Software Inc.

- 7.1.10 Vmware Inc.