|

市場調查報告書

商品編碼

1403077

雲端資料庫安全-市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Cloud-based Database Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

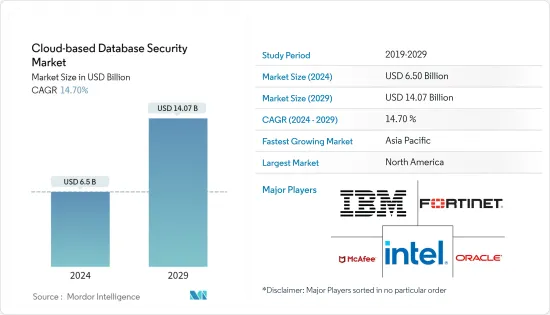

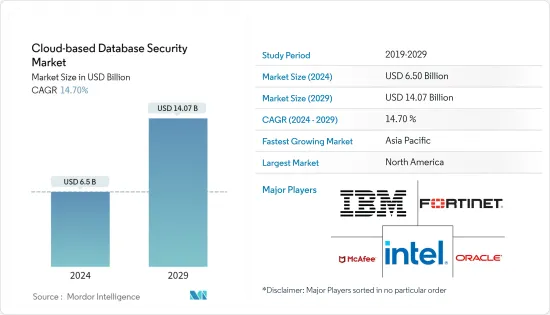

預計到 2024 年,雲端資料庫安全市場規模將達到 65 億美元,預計到 2029 年將達到 140.7 億美元,在預測期內(2024-2029 年)複合年成長率為 14.70%。

雲端資料庫安全解決方案透過提供工具和技術來保護資料庫及其資料免受各種威脅(包括詐欺的存取、資料外洩和內部攻擊),從而解決這些問題。

主要亮點

- 引人注目的資料外洩和網路攻擊提高了人們對保護敏感資料重要性的認知。企業正在尋找強大的安全解決方案來保護資料庫。

- 許多公司正在將其基礎設施遷移到雲端平台,增加了對專為雲端環境設計的安全解決方案的需求。

- 資訊密集型應用程式產生的資料量不斷增加是基於雲端的資料庫安全市場的主要驅動力。隨著越來越多的公司採用數位技術和資料主導策略,生成、處理和儲存的資料量呈指數級成長。

- 缺乏對資料位置的控制阻礙了雲端資料庫安全市場的成長。當組織將資料遷移到雲端時,這種擔憂主要出現。這可能需要對資料儲存位置進行直接實體控制,這可能會導致安全性和合規性問題。

- 隨著企業意識到對靈活、可擴展的雲端基礎設施的需求,COVID-19大流行加速了數位轉型。隨著雲端採用率的快速成長,對基於雲端的環境(包括資料庫)量身定做的安全解決方案的需求也在增加。

- 隨著遠距工作、數位轉型和雲端採用繼續塑造新冠肺炎 (COVID-19) 後的業務環境,人們持續關注保護基於雲端的資料庫。

雲端資料庫安全市場趨勢

醫療終端用戶預計將佔據主要市場佔有率

- 醫療保健產業已成為基於雲端的資料安全市場的重要最終用戶領域。醫療保健組織處理大量敏感的病患資料、電子健康記錄(EHR) 和其他關鍵健康資訊。隨著這些組織擴大採用雲端技術來提高效率、協作和可訪問性,他們需要強大的基於雲端的資料庫安全解決方案。

- 醫療產業受到嚴格的資料隱私法規的約束,例如美國健康保險互通性和課責法案 (HIPAA)。該法規要求醫療機構實施嚴格的安全措施來保護患者資料,因此基於雲端的資料庫安全解決方案至關重要。

- 據美國衛生與公眾服務部稱,截至 2023 年 5 月,美國健康資料外洩的風險不斷增加,可能對受影響方造成重大傷害。 2015 年,美國醫療保健領域發生的重大資料外洩事件發生在美國健康保險公司 Anthem Inc.,當時犯罪駭客竊取了影響 7,880 萬人的個人資料。

- 基於雲端的解決方案可以遠端存取患者資料,這對於遠端醫療和遠端患者監護至關重要。安全存取控制和加密對於建立病患資訊的機密性和完整性至關重要。

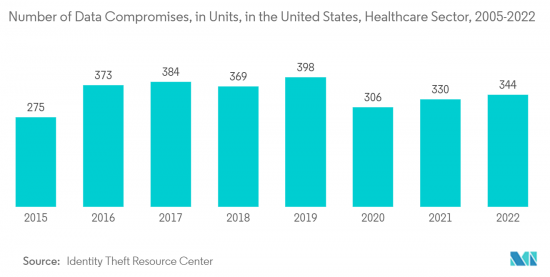

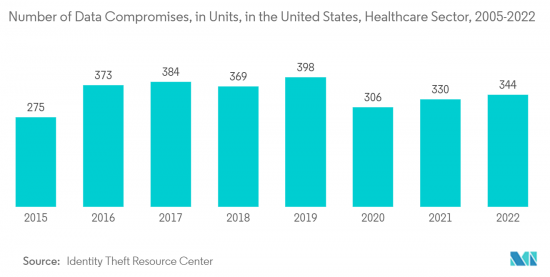

- 由於患者資料的重要性,醫療產業成為勒索軟體攻擊的目標。基於雲端的資料庫安全解決方案可以幫助預防和減輕這些攻擊。根據 Identity Theft Resource 的數據,2022 年美國醫療保健產業發生了 340 多起資料外洩事件。自 2005 年以來,這一數字顯著增加,當時該行業僅發生了 16 起資料外洩事件。 2019年,這一數字達到了歷史最高的398例。

亞太地區預計將佔據主要市場佔有率

- 亞太地區基於雲端的資料庫安全市場正在經歷顯著成長。該地區各行業正在採用雲端技術,增加了對保護雲端資料庫的安全解決方案的需求。

- 該地區許多國家正在經歷快速的數位轉型,並採用雲端處理來實現IT基礎設施的現代化。這種轉變導致更多地採用基於雲端的資料庫,並增加了安全性問題。

- 此外,2023 年 7 月,微軟揭露了有關中國參與者活動的資訊。 Microsoft 已追蹤 Strom-0558 存取影響約 25 家公司(包括政府機構)的電子郵件帳戶,並連接到據信與這些組織相關的個人的消費者帳戶。

- 隨著數位服務、電子商務和線上平台的擴展,產生和儲存的資料量顯著增加。基於雲端的資料庫在處理如此大規模的資料集時因其可擴展性而受到青睞,而確保安全性也變得極為重要。

- 亞太地區是全球電子商務和金融市場最大的發源地之一。這些行業處理大量敏感的客戶資料,使它們容易成為網路攻擊的目標。安全的雲端資料庫支援安全的遠端資料訪問

- 雲端服務供應商已在亞太地區擴張,使企業更容易獲得基於雲端的解決方案。這促進了雲端資料庫的廣泛普及,以及隨之而來的安全需求。

雲端資料庫安全產業概況

雲端資料庫安全市場高度分散,IBM Corporation、Fortinet Technologies Inc.、Intel Security Group、McAfee Inc. 和 Oracle Pvt. Ltd. 等主要公司都在關注雲端資料庫安全市場。市場參與企業正在採取聯盟和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

2023 年 6 月, Oracle透過新的歐盟主權雲端支援歐洲資料隱私和主權要求。 EU Sovereign Cloud 為Oracle雲端基礎設施服務提供與Oracle商業雲端區域相同的服務等級協定和更低的價格。新主權雲完全位於歐盟境內,獨立於Oracle的其他雲端區域,使客戶能夠更好地控制資料。

2023 年 4 月,IBM 發布了一款安全套件,專注於統一和加速整個事件生命週期的安全分析師體驗。 IBM Security QRadar Suite 代表了 QRadar 品牌的永續和擴展,在產品組合創新方面進行了大量投資,以涵蓋所有關鍵威脅偵測、調查和回應功能。 IBM QRadar Suite 在開放的基礎上運行,專為混合雲端工作負載而設計。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 資訊應用產生的資料量不斷增加推動市場成長

- 市場抑制因素

- 不可控的資料定位是市場阻礙因素

第6章市場區隔

- 按發展

- 民眾

- 私人的

- 混合

- 按行業分類

- BFSI

- 零售

- 政府機關

- 醫療保健

- 資訊科技/通訊

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- IBM Corporation

- Fortinet Technologies Inc.

- Intel Security Group

- McAfee Inc.

- Oracle Pvt. Ltd

- Imperva Inc.

- NetLib Security Inc.

- The Hewlett-Packard Company

- Trustwave Holdings, Inc.

- Informatica LLC

- Voltage Security Inc.

- Axis Technology LLC

- Amazon Web Services

第8章投資分析

第9章 市場機會及未來趨勢

The Cloud-based Database Security Market size is estimated at USD 6.5 billion in 2024, and is expected to reach USD 14.07 billion by 2029, growing at a CAGR of 14.70% during the forecast period (2024-2029).

Cloud-based database security solutions address these concerns by providing tools and technologies to protect databases and their data from various threats, such as unauthorized access, data breaches, and insider attacks.

Key Highlights

- High-profile data breaches and cyberattacks have increased awareness about the importance of securing sensitive data. Organizations were looking for robust security solutions to safeguard their databases.

- Many businesses were transitioning their infrastructure to cloud platforms, leading to a higher demand for security solutions that are specifically designed for cloud environments.

- The increasing volumes of data generated from information-intensive applications have been a significant driver for the cloud-based database security market. As more businesses adopt digital technologies and data-driven strategies, the amount of data generated, processed, and stored has grown exponentially.

- The loss of control over data location hinders the growth of the cloud-based database security market. This concern primarily revolves around when organizations move their data to the cloud. They may need direct physical control over where their data is stored, which can lead to security and compliance issues.

- The COVID-19 pandemic accelerated digital transformation efforts as businesses recognized the need for flexible and scalable cloud infrastructure. This surge in cloud adoption cloud has correspondingly increased the demand for security solutions tailored to cloud-based environments, including databases.

- In the post-COVID-19 period, the sustainable focus on securing cloud-based databases as remote work, digital transformation, and cloud adoption continues to shape the business landscape.

Cloud-based Database Security Market Trends

Healthcare End-user Vertical is Expected to Hold Significant Market Share

- The healthcare industry has been a significant end-user segment in the cloud-based data security market. Healthcare organizations handle huge amounts of sensitive patient data, electronic health records (EHRs), and other critical medical information. As these organizations increasingly adopt cloud technologies to improve efficiency, collaboration, and accessibility, robust cloud-based database security solutions are needed.

- The healthcare industry is subjected to strict data privacy regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States. The regulation requires healthcare organizations to implement stringent security measures to protect patient data, making cloud-based database security solutions essential.

- According to the U.S. Department of Health and Human Services, As of May 2023, Healthcare data breaches in the United States are a constantly increasing risk with the potential for significant damages to affected parties. The major recorded U.S. data breach in the healthcare sector at Anthem Inc. was in 2015, a health insurance provider in the United States, when criminal hackers stole personal data affecting 78.8 million individuals.

- Cloud-based solutions enable remote access to patient data, which is crucial for telemedicine and remote patient monitoring. Secure access controls and encryption are essential to establish the confidentiality and integrity of patient information.

- The healthcare industry has been a target for ransomware attacks owing to the critical nature of patient data. Cloud-based database security solutions play a role in preventing and mitigating such attacks. According to Identity Theft Resource, In 2022, in the United States, there were more than 340 incidents of data compromises in the healthcare sector. This indicates a significant growth since 2005 when the industry saw only 16 cases of data compromises in the country. In 2019, this number reached its all-time highest, 398 in total.

Asia Pacific is Expected to Hold Significant Market Share

- The Asia-Pacific region was experiencing significant growth in the cloud-based database security market. Adopting cloud technologies across various industries in this region drives the demand for security solutions to protect cloud-based databases.

- Many countries in the region were undergoing rapid digital transformation, embracing cloud computing to modernize their IT infrastructure. This shift led to increased adoption of cloud-based databases and raised security concerns.

- Furthermore, in July 2023, Microsoft disclosed information about a Chinese actor's activities. Microsoft is tracking Strom-0558 as having access to email accounts impacting around 25 businesses, including government entities, and connected consumer accounts of persons possibly associated with these organizations.

- With the expansion of digital services, e-commerce, and online platforms, there was a substantial increase in the volume of data generated and stored. Cloud-based databases were preferred for their scalability to handle these large datasets, and ensuring their security became crucial.

- Asia Pacific is one of the largest home to global e-commerce and financial markets. These industries handle massive amounts of sensitive customer data, making them prime cyberattack targets. Secure cloud-based database to support secure remote data access.

- Cloud service providers were expanding their operations in the Asia-Pacific region, making it easier for organizations to access cloud-based solutions. This contributed to the adoption of cloud databases, accompanied by the need for security.

Cloud-based Database Security Industry Overview

The cloud-based database security market is highly fragmented with the presence of major players like IBM Corporation, Fortinet Technologies Inc., Intel Security Group, McAfee Inc., and Oracle Pvt. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In June 2023, Oracle assisted European data privacy and sovereignty requirements with the new EU sovereign cloud. EU Sovereign Cloud offers Oracle Cloud Infrastructure services at the same service level agreements and low prices as Oracle's commercial cloud regions. New Sovereign Cloud is entirely within the EU and is separate from Oracle's other cloud regions, giving customers more data control.

In April 2023, IBM launched a security suite focused on unifying and accelerating the security analyst experience throughout the incident lifecycle. The IBM Security QRadar Suite represents a sustainable development and extension of the QRadar brand, encompassing all key threat detection, investigation, and response capabilities, with considerable investment in portfolio innovation. The IBM QRadar Suite operates on an open basis and has been designed specifically for hybrid cloud workloads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes of Data Being Generated from Information-Escalated Applications is Driving the Market Growth

- 5.2 Market Restraints

- 5.2.1 Loss of Control over Data Location Hinders the Market

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Public

- 6.1.2 Private

- 6.1.3 Hybrid

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Government

- 6.2.4 Healthcare

- 6.2.5 IT and Telecom

- 6.2.6 Manufacturing

- 6.2.7 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Fortinet Technologies Inc.

- 7.1.3 Intel Security Group

- 7.1.4 McAfee Inc.

- 7.1.5 Oracle Pvt. Ltd

- 7.1.6 Imperva Inc.

- 7.1.7 NetLib Security Inc.

- 7.1.8 The Hewlett-Packard Company

- 7.1.9 Trustwave Holdings, Inc.

- 7.1.10 Informatica LLC

- 7.1.11 Voltage Security Inc.

- 7.1.12 Axis Technology LLC

- 7.1.13 Amazon Web Services