|

市場調查報告書

商品編碼

1403044

X光設備製造:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029X-ray Machine Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

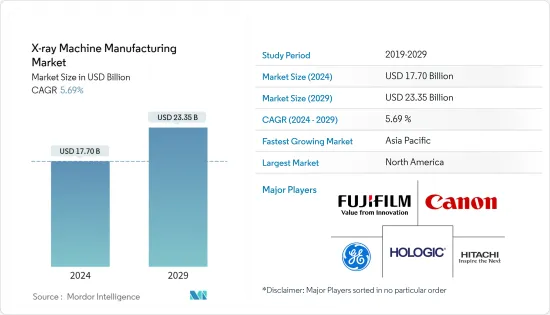

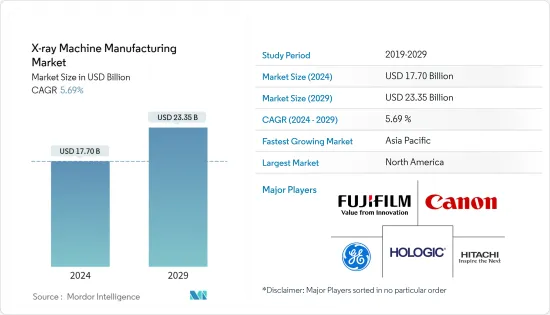

X光設備製造市場規模預計到2024年為177億美元,預計到2029年將達到233.5億美元,在預測期內(2024-2029年)複合年成長率為5.69%。

主要亮點

- 世界高齡化以及新型、改進和技術先進的X光設備的商業化預計將推動需求。

- 由於先進診斷設備研發投入的增加以及全球各醫療機構需求的增加, X光設備製造市場預計未來幾年將大幅成長,預計成長可期。此外,心血管、呼吸系統、胃腸道、泌尿生殖系統等多種疾病的盛行率不斷上升也是主要促進因素之一。

- 除上述因素外,與非法運輸武器、販毒等一系列威脅和活動相關的安全疑慮不斷上升也是推動X光篩檢系統需求的主要因素。這些因素正在推動X光設備的採用率。

- 醫療產業正在逐漸從類比X光設備過渡到數位 X 光系統。從類比X光設備的原因X光設備數位X光設備減少了輻射劑量,提高了影像質量,並透過減少停機時間來改善治療效果。醫院和其他醫療機構重視數位 X 光系統的安裝,因為它們優於類比和 CR 系統。隨著政府支付改革推動從類比 X 光系統向數位 X 光系統的轉變,醫療機構和其他機構正在優先考慮數位 X 光系統。

- 但另一方面,高昂的設備成本以及X光設備的輻射風險可能會在一定程度上阻礙醫用X光領域的發展。

- COVID-19 顯著活性化了市場活動。這是由於疫情導致全球健康問題出現前所未有的大規模激增。大流行增加了世界各地對醫學影像處理服務的需求。世界各地的居家照護組織和製造商已將重點轉向提供緊急和非醫療支援服務。同時,由於供應鏈限制,製造商的銷售量微乎其微。

X光設備製造市場趨勢

醫療領域可望佔據較大市場佔有率

- 由於技術進步使 X 光檢測更安全、更有效且更易於使用,醫療產業將為未來的成長做好準備。近年來,世界已走向自動化。 X光設備的未來充滿希望,這在一定程度上要歸功於人工智慧的進步。

- 此外,收入的增加、優質醫療設施的便利性以及個人健康和醫療保健意識的增強是支持印度等新興國家醫療保健產業成長的因素。此外,印度政府計劃在2025年將公共衛生支出增加至GDP的2.5%。此舉也可能鼓勵其他新興經濟體增加支出。

- 此外,醫療保險的普及也推動了醫療支出的增加。同時,人們對價格實惠、高品質的醫療服務的需求不斷成長,未來醫療保險的普及可望大幅提升。急劇上升的醫療費用和新疾病的負擔,加上政府津貼較低,正在推動健康保險的需求。

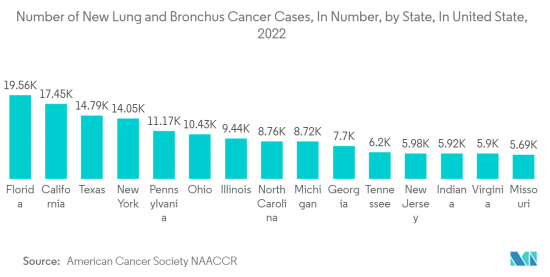

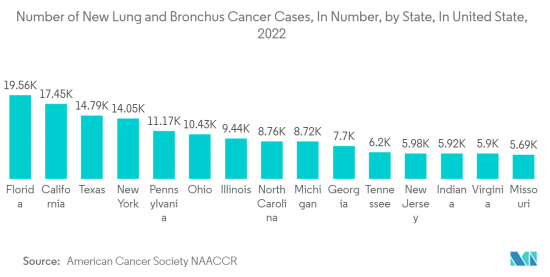

- 胸部 X 光檢查通常是診斷肺癌的第一個檢查。全球肺癌和支氣管癌發生率不斷上升,增加了對X光設備製造市場的需求。根據NAACCR估計,2022年美國將新增236,740例肺癌和支氣管癌病例。據估計,佛羅裡達州的此類病例數量最多。

預計北美將佔據最大的市場佔有率

- X光設備市場預計將受益於該地區醫療和工業領域對成像技術不斷成長的需求。隨著北美地區對醫療診斷成像的需求增加,對支援數位影像處理的X光設備的需求也很高。由於消費者的可支配收入和健康保險較高,美國是最大的醫學影像處理市場。

- 美國人口老化不斷加劇,久坐的生活方式和不健康的飲食習慣導致的慢性病迅速增加。此外,醫療基礎設施新興市場的開拓和醫療設施的增加預計將推動美國醫用X光設備市場的需求。

- 該地區的主要企業也在該地區進行策略聯盟、收購和產品推出,以維持其市場地位。 2022年7月,Canon醫療美國公司宣布收購診斷影像設備經銷商NXC Imaging。 NXC總公司明尼蘇達州明尼阿波利斯,是資本醫療設備的經銷商和服務供應商,包括 MRI、CT、血管、超音波、X 光和 C 型臂。

- 慢性病的增加增加了篩檢技術對於適當和及時的治療和護理的重要性。 X光檢查對於外分泌胰臟、肺、骨、腹部疾病等慢性疾病的診斷有重要作用。

- Canon Inc.表示,在人口高齡化和早期發現慢性疾病的需求的推動下,醫療診斷影像預計在未來與前一年同期比較大幅成長。此外,該美國還重組了在美國的醫療業務策略,因為這是未來成長的巨大機會。因此,這些趨勢預計將為市場帶來新的機會。

X光設備製造業概況

X光設備製造市場高度分散,Canon Inc.、FUJIFILM Holdings公司、GE醫療公司、日立醫療公司和Hologic公司等主要企業進入該市場。這些市場領導正在採取各種策略舉措,包括聯盟和收購,以擴大產品系列建立永續的競爭優勢。

2022 年 11 月,GE Medical 與 MediView XR 合作,共同開發突破性技術。這項創新為介入性 X 光成像設備提供了擴增實境(AR)抬頭顯示器。 OmnifyXR 解決方案無縫整合了 Microsoft 的 HoloLens 技術和 MediView 的臨床擴增實境專業知識,充分利用了 GE Medical 在介入影像方面的能力。

2022 年 7 月,西門子醫療推出了最先進的行動 X 光系統。這款先進的系統支援透過 Mobilett Impact 在病患床邊執行完整的影像工作流程。該設備將攜帶式床邊 X光系統的優點與無縫數位整合相結合,同時保持經濟的成本結構。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 更多採用數位 X 光系統

- 政府監管和投資改善基礎設施

- 市場抑制因素

- 設備高成本

第 6 章 技術概覽

第7章市場區隔

- 依產品類型

- 固定式

- 攜帶的

- 依技術

- 模擬

- 數位的

- 按最終用戶

- 醫療保健

- 運輸/物流

- 政府機關

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 其他地區

- 北美洲

第8章競爭形勢

- 公司簡介

- Canon Inc.

- Fujifilm Holdings Corporation

- GE Healthcare

- Hitachi Medical Corporation

- Hologic Inc.

- Philips Healthcare

- Shimadzu Corporation

- Siemens AG

- Vision Medicaid Equipment Private Limited

- Hindrays

第9章投資分析

第10章市場機會與未來趨勢

The X-ray Machine Manufacturing Market size is estimated at USD 17.70 billion in 2024, and is expected to reach USD 23.35 billion by 2029, growing at a CAGR of 5.69% during the forecast period (2024-2029).

Key Highlights

- The global aging population and commercialization of new, improved, and technologically advanced x-ray machines are expected to fuel the demand.

- The x-ray machine manufacturing market is analyzed to witness substantial growth in the coming years owing to the increasing investments in R&D of advanced diagnostic machines coupled with growing demand from various healthcare organizations across the world. Moreover, the rising incidence of cardiovascular, respiratory, gastrointestinal, genitourinary, and several other disorders is one of the major driving factors.

- In addition to the above factors, the rising security concerns related to consecutive threats and activities, such as illegal arms shipping and drug trafficking, are the other key factors driving the demand for x-ray security screening systems. The factor above is, thereby, contributing to the higher adoption rate of X-ray machines.

- The healthcare industry is gradually shifting from analog x-ray equipment to digital x-ray systems. The change from analog to digital x-ray equipment is attributed to digital systems' reduced radiation dosage, increased picture quality, and better outcomes with less downtime. Due to the advantages of digital x-ray systems over analog or CR systems, hospitals and other healthcare institutions are emphasizing their installation. Because government payment reforms have aided the transition of analog x-ray systems to digital x-ray systems, healthcare facilities prioritize installing digital x-ray systems, among others.

- However, on the other hand, high equipment costs and the risk of radiation exposure from the x-ray machines might hinder the medical x-ray segment's growth to some extent in the foreseeable future.

- COVID-19 significantly increased market activity. This was due to the pandemic's large and unprecedented surge in global health issues. The pandemic raised the demand for medical imaging services from all around the globe. Home care organizations and manufacturers worldwide shifted their attention to the availability of emergency and non-medical support services. On the other hand, manufacturers experienced minimal sales due to supply chain constraints.

X-ray Machine Manufacturing Market Trends

Healthcare Sector is Expected to Hold a Significant Market Share

- The healthcare industry is expected to witness growth in the future, owing to the advancements in technology (x-ray detection has evolved to become safer, more effective, and easy to use). In recent times, the world has been moving toward automation. With the developments in artificial intelligence in the scenario, the future of x-ray machines is expected to be promising.

- Further, in developing countries like India, increasing incomes, easier access to high-quality healthcare facilities, and greater awareness of personal health and hygiene are the factors supporting the growth of the healthcare industry. In addition, the Government of India plans to increase public healthcare expenditure by 2.5% of the country's GDP by 2025. This move would also encourage other emerging economies to increase their expenditures.

- Additionally, the greater penetration of health insurance aided the rise in healthcare expenditure. Along with that, with the increasing demand for affordable and quality healthcare, the penetration of health insurance is poised to grow exponentially in the future. The rising healthcare costs and the burden of new diseases, coupled with low government funding, are helping to increase the demand for health insurance coverage.

- The chest X-ray is usually the first test used to diagnose lung cancer. The increase in the number of lung and bronchus cancer throughout the globe increase demand for the X-ray machine manufacturing market. According to NAACCR, it is estimated that there have been 236,740 new cases of lung and bronchus cancer in the United States in 2022. The highest number of these cases is estimated in Florida.

North America is Expected to Hold to Largest Market Share in the Studied Market

- The market for x-ray machines is anticipated to benefit from the increasing demand for imaging technologies in the medical and industrial sectors in the region. Due to the rising need for medical diagnostic imaging in North America, the demand for x-ray machines with digital imaging support is also high. The United States is the largest medical imaging market due to consumers' high disposable income and health insurance.

- The United States is witnessing an increase in the geriatric population and a surge in chronic diseases due to sedentary lifestyles and unhealthy eating habits. Moreover, rising medical infrastructure developments and increased medical facilities are expected to propel the demand for the medical x-ray machines market in America.

- The key players in the region are also making strategic partnerships, acquisitions, and product launches in this region to retain their market position. In July 2022, Canon Medical USA announced the acquisition of NXC Imaging, a distributor of imaging equipment. NXC is a distributor and service provider of capital medical equipment, including MRI, CT, vascular, ultrasound, x-ray, and C-arms, based in Minneapolis, Minnesota.

- The rise in chronic diseases is pushing the importance of screening techniques for the right and timely treatment and care. X-ray plays a crucial role in chronic disease diagnosis, like diseases of the exocrine pancreas, lungs, bones, and abdomen.

- According to Canon Inc., medical imaging is anticipated to expand Y-o-Y significantly by the next two years, fueled by the aging population and the requirement for early-stage detection of chronic disease. Moreover, the United States represents an enormous opportunity for future growth, due to which the company realigned its medical business strategy in the country. Hence, such trends are expected to create scope for the market.

X-ray Machine Manufacturing Industry Overview

The X-ray machine manufacturing market features significant fragmentation, with key industry players such as Canon Inc., Fujifilm Holdings Corporation, GE Healthcare, Hitachi Medical Corporation, and Hologic Inc., among others. These market leaders employ various strategic initiatives, including partnerships and acquisitions, to expand their product portfolios and establish a sustainable competitive edge.

In November 2022, GE Healthcare joined forces with MediView XR to collaborate on groundbreaking technology. This innovation delivers an augmented reality heads-up display for interventional X-ray imaging devices. The OmnifyXR solution seamlessly integrates Microsoft's HoloLens technology with MediView's clinical augmented reality expertise and leverages GE Healthcare's capabilities in interventional imaging.

In July 2022, Siemens Healthcare introduced a cutting-edge mobile x-ray system. This advanced system enables a complete imaging workflow to be conducted at the patient's bedside, courtesy of the Mobilett Impact. This device combines the benefits of a portable X-ray system for bedside imaging with seamless digital integration, all while maintaining an economical cost structure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Adoption of Digital X-ray Systems

- 5.1.2 Government Regulations and Investments to Improve Infrastructure

- 5.2 Market Restraints

- 5.2.1 High Cost of the Equipment

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Product Type

- 7.1.1 Stationary

- 7.1.2 Portable

- 7.2 By Technology

- 7.2.1 Analog

- 7.2.2 Digital

- 7.3 By End-user

- 7.3.1 Healthcare

- 7.3.2 Transportation and Logistics

- 7.3.3 Government

- 7.3.4 Other End-users

- 7.4 Geography

- 7.4.1 North America

- 7.4.1.1 United States

- 7.4.1.2 Canada

- 7.4.2 Europe

- 7.4.2.1 United Kingdom

- 7.4.2.2 Germany

- 7.4.2.3 France

- 7.4.2.4 Rest of Europe

- 7.4.3 Asia-Pacific

- 7.4.3.1 China

- 7.4.3.2 Japan

- 7.4.3.3 India

- 7.4.3.4 South Korea

- 7.4.3.5 Rest of Asia-Pacific

- 7.4.4 Rest of the World

- 7.4.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Canon Inc.

- 8.1.2 Fujifilm Holdings Corporation

- 8.1.3 GE Healthcare

- 8.1.4 Hitachi Medical Corporation

- 8.1.5 Hologic Inc.

- 8.1.6 Philips Healthcare

- 8.1.7 Shimadzu Corporation

- 8.1.8 Siemens AG

- 8.1.9 Vision Medicaid Equipment Private Limited

- 8.1.10 Hindrays

![X光鏡鏡片市場[類型:一維、2D;表面形狀:平面、拋物面、橢球面、球面等;和材料:玻璃和金屬] - 全球產業分析、規模、佔有率、成長、趨勢和預測,2023-2031 年](/sample/img/cover/42/1459743.png)