|

市場調查報告書

商品編碼

1403029

數位鑑識 -市場佔有率分析、行業趨勢和統計數據、2024 年至 2029 年的成長預測Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

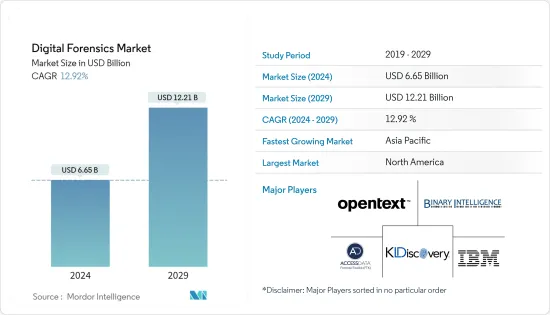

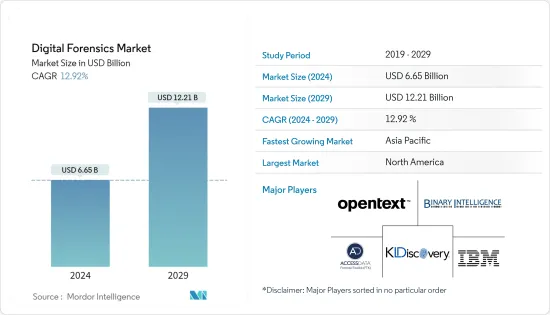

數位鑑識市場規模預計到 2024 年為 66.5 億美元,預計到 2029 年將達到 122.1 億美元,在預測期內(2024-2029 年)複合年成長率為 12.92%。

主要亮點

- 物聯網(IoT)設備的大量使用,加上嚴格的政府法規和企業網路攻擊案例數量的增加等因素,預計將在預測期內推動對數位取證軟體的需求。

- 數位鑑識已經從應對輕微電腦犯罪發展到調查對世界產生重大影響的複雜國際事件。數位取證涉及對數位設備上發現的材料進行恢復和調查,這些材料通常與電腦犯罪有關。

- 大多數取證涉及桌上型電腦、筆記型電腦和相關介質,例如硬碟、軟碟和光碟。然而,其他型態的數位鑑識,例如行動電話和其他手持設備,在數位管理和保存方面變得越來越普及。由於物聯網設備的進步,包括傳統犯罪實驗室基礎設施、對企業部門的滲透率提高以及網路攻擊和犯罪的增加,數位取證的採用正在擴大。例如,根據網路犯罪申訴中心 (ICC) 和聯邦調查局 (FBI) 的數據,IC3 收到了 43,300 起線上身分竊盜案件的報告。網路釣魚和類似詐騙以 241,342 起事件位居第一。

- 此外,隨著世界各地的企業走向數位化,雲端的採用率正在上升,BYOD 等政策在許多行業中脫穎而出。雲端運算應用程式的興起允許從任何地方存取文件和其他資料,這使得企業可以更輕鬆地在不同地點的不同團隊之間進行協作。因此,連接到公司的設備越多,駭客可以用來滲透公司網路的資源就越多。

- 組織內缺乏熟練的專業人員和缺乏預先規劃的投資可能會抑制市場,除非他們能夠投資於能夠檢測、分析和重建資料的最佳數位取證供應商。其他因素,例如缺乏專業技能、使用專有作業系統以及新行動應用程式中的高水準加密可能會阻礙市場成長。

- 隨著組織從傳統的職場方法過渡到遵守社交距離和自我隔離等法律和社會目標的在家工作,COVID-19 導致對遠距工作解決方案的需求激增。在此期間,組織經歷了巨大的壓力和危機,新的詐欺和醜聞風險出現,內部控制落後於不斷變化的威脅,並且法證調查的需求增加。

數位取證市場的趨勢

行動取證類型細分市場預計將佔據主要市場佔有率

- 行動取證是數位鑑識的重要類型之一,專門調查和分析智慧型手機和平板電腦等設備。這包括恢復、保存和分析行動裝置中的數位證據以協助調查。

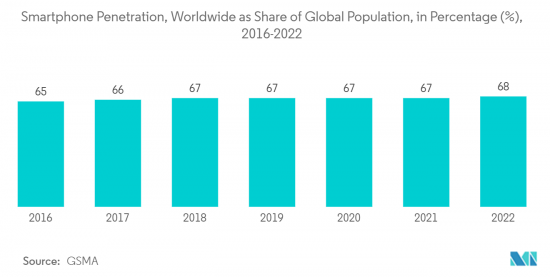

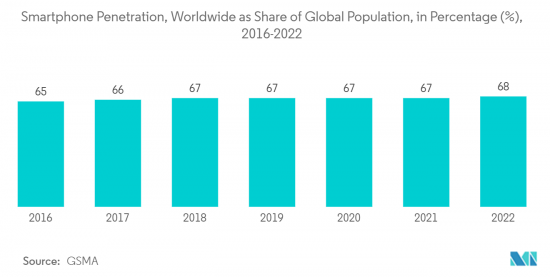

- 根據GSMA預測,2022年全球智慧型手機普及預計為68%,較2018年有所成長,智慧型手機用戶數量預計為63億,世界人口預計約74億。隨著行動裝置變得越來越普及,各種專門的行動取證工具和技術正在開發中。

- 隨著行動裝置擴大在個人和工作用途之間切換,資料流也可能會快速成長。行動取證過程主要旨在以允許證據以健康狀態保存的方式從設備中恢復數位證據或相關資料。行動取證流程具有精確的規則,允許分離、扣押、傳輸和儲存資料,以便分析和證明安全地源自行動裝置的數位證據。行動裝置包括平板電腦、行動電話、PDA 和其他類似的個人使用裝置。

- 在行動取證中,證據來源包括裝置的外部和內部記憶體、SIM 卡、手機訊號塔和網路伺服器。 SIM 卡和專有作業系統的嚴格安全性可能會阻礙證據取得。這些行動裝置上的資料是個人的。因此,這些資訊對於法醫調查人員極為重要。為了獲得此類證據而不被篡改,物理獲取這些設備至關重要。

- 此外,設備的激增、社會證據的重要性、巨量資料的興起和行動惡意軟體預計將成為未來幾年行動取證解決方案的關鍵驅動力。行動取證領域正在不斷被研究,但雲端處理介入生態系統以及行動企業解決方案的演進,特別是行動裝置管理和BYOD等新概念,正在為該領域帶來新的機會及挑戰。

預計北美將佔據較大市場佔有率

- 由於經濟強勁、技術進步和網路犯罪高發,北美在全球數位取證市場中佔有重要佔有率。由於網路威脅的增加、監管合規性要求以及有效數位調查的需要,該市場正在經歷穩定成長。

- 執法和政府部門是北美數位鑑識服務和解決方案的主要消費者。執法機構使用數位鑑識來調查網路犯罪、詐騙、智慧財產權竊盜和其他涉及數位證據的犯罪活動。

- 預計北美將在數位鑑識市場中佔據顯著佔有率,允許政府和私人公民在刑事和民事案件中利用該技術。聯邦調查局和州警等機構使用這項技術來抓捕參與線上非法活動的犯罪者和恐怖分子。類似的調查也適用於私人公司。取證領域的技術進步、網路犯罪的增加和複雜的竊盜機制預計將增加對數位取證市場的投資。

- 美國組織和個人的網路威脅和攻擊呈上升趨勢。根據身分盜竊資源中心的數據,2022 年美國將發生 1,802 起資料外洩事件,影響 4.2214 億人。

- 北美處於數位取證創新的前沿。該地區擁有多家領先的技術公司、研究機構和法醫實驗室,為先進工具和技術的開發做出了貢獻。這包括行動取證、雲端取證、基於人工智慧 (AI) 的分析和取證資料分析的進步。

數位取證產業概述

數位鑑識市場高度分散,主要參與者包括 IBM Corporation、Binary Intelligence LLC、Guidance Software Inc. (OpenText)、AccessData Group LLC 和 KLDiscovery Inc.。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023 年 10 月,Softcell 和 Binalyze 宣佈建立策略合作夥伴關係,在印度提供數位鑑識和事件回應解決方案。這兩個以安全為重點的領先組織的合作預計將推動數位取證事件回應和網路安全能力的顯著進步。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 物聯網設備的日益普及推動了對數位取證解決方案和服務的需求

- 網路取證可望佔據主要市場佔有率

- 市場挑戰

- 組織內缺乏熟練的專業人員和預先規劃

第6章市場區隔

- 按成分

- 硬體

- 軟體

- 服務

- 按類型

- 行動取證

- 電腦取證

- 網路取證

- 其他類型

- 按行業分類

- 政府和執法部門

- BFSI

- 資訊科技和電訊

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- IBM Corporation

- Binary Intelligence LLC

- Guidance Software Inc.(Opentext)

- AccessData Group LLC

- KLDiscovery Inc.

- Paraben Corporation

- FireEye Inc.

- LogRhythm Inc.

- Cisco Systems Inc.

- Oxygen Forensics Inc.

- MSAB Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Digital Forensics Market size is estimated at USD 6.65 billion in 2024, and is expected to reach USD 12.21 billion by 2029, growing at a CAGR of 12.92% during the forecast period (2024-2029).

Key Highlights

- The massive use of Internet of Things (IoT) devices coupled with factors such as stringent government regulations and increasing cyber-attack instances on enterprises are expected to drive the demand for digital forensics software during the forecast period.

- Digital forensics has grown from addressing minor computer crimes to investigating complex international cases that significantly affect the world. Digital forensics includes recovering and investigating material found in digital devices, often concerning computer crimes.

- Most forensics are oriented toward desktops, laptops, and associated media, including hard drives, floppy disks, and optical discs. However, other forms of digital forensics, such as mobile phones and other handheld devices, are becoming increasingly popular for digital curation and preservation. The adoption of digital forensics is growing due to the advancements in IoT devices, such as traditional crime lab infrastructure, increasing penetration in corporate sectors, and the rise in cyber attacks and crimes. For instance, according to the Internet Crime Complaint Center (ICC) and Federal Bureau of Investigation (FBI), 43,300 cases of online identity theft were reported to the IC3. Phishing and similar fraud ranked first, with 2,41,342 complaints.

- Additionally, as enterprises worldwide are transforming digitally, cloud adoption has been on the rise, which brings policies, such as BYOD, to the forefront in many industries. The increase in cloud computing applications providing access to files and other data from anywhere has made collaboration for different teams from different locations simpler for companies. Therefore, if more devices are connected to an enterprise, more sources would be available for hackers to intrude into the enterprise networks.

- Lack of skilled professionals and preplanning investments among Organizations could restrain the market unless the organization could invest in the best digital forensic vendors who could able to detect, analyze and reconstruct the data and make the enterprises follow a proactive approach for threat protection and digital forensics where there is a chance for the market growth. Other factors, such as lack of specialized skills, usage of proprietary operating systems, and high level of encryption in new mobile applications, may hinder the market's growth.

- During COVID-19, the demand for remote working solutions surged due to the organization's transition from conventional workplace methods to working from home by complying with legal and societal goals, such as social distancing and self-isolation. During this period, significant organizational stress and crisis, newer fraud and misconduct risks emerged, internal controls lagged behind the evolving threats, and the need for forensic investigations increased.

Digital Forensics Market Trends

Mobile Forensics Type Segment is Expected to Hold Significant Market Share

- Mobile forensics is an important type of digital forensics, specifically examining and analyzing devices such as smartphones and tablets. It involves recovering, preserving, and analyzing digital evidence from mobile devices to aid the investigation.

- According to GSMA, The global smartphone penetration rate was estimated at 68 percent in 2022, which increased from 2018, with an estimated 6.3 billion smartphone subscriptions globally and a global population of around 7.4 billion. The increasing prevalence of mobile devices has led to the development of diverse and specialized mobile forensic tools and techniques.

- As mobile devices increasingly gravitate between personal and professional use, the data streams may also witness rapid growth. The mobile forensics process primarily aims to recover digital evidence or any relevant data from the device in a way that may preserve the evidence in a sound condition. The mobile forensic processes have precise rules that can isolate, seize, transport, and store data for analysis and prove digital evidence safely originating from mobile devices. Mobile devices include tablets, cellphones, PDAs, and other similar personal use equipment.

- In mobile forensics, evidence sources include the device's external and internal memory, SIM cards, cell towers, and network servers. The strong security of the SIM cards and the proprietary operating systems may obstruct evidence acquisition. The data on these mobile devices are personal. Therefore, the information becomes very crucial for forensic investigators. The physical acquisition of these devices has become essential to obtain this evidence without alteration.

- Moreover, increasing devices, the importance of social evidence, the increase in big data, and mobile malware are expected to become the major driving factors for mobile forensic solutions in the coming years. Although the field of mobile forensics is under continuous research, newer concepts, such as the involvement of cloud computing in the ecosystem and the evolution of mobile enterprise solutions, particularly mobile device management and BYOD, have brought new opportunities and issues to the sector.

North America is Expected to Hold Significant Market Share

- North America holds a considerable share of the global digital forensics market due to its robust economy, technological advancements, and high incidences of cybercrime. The market has been experiencing steady growth, driven by increasing cyber threats, regulatory compliance requirements, and the need for effective digital investigations.

- The law enforcement and government sectors are North America's primary digital forensics services and solutions consumers. Law enforcement agencies rely on digital forensics to investigate cybercrimes, fraud, intellectual property theft, and other criminal activities involving digital evidence.

- North America is expected to have a prominent share in the digital forensics market, where governments and private citizens can use this technology for criminal and civil cases. Agencies, like the FBI and State Police departments, are using this technology to catch criminals and terrorists involved in illegal activities online. In the private sector, this system is used for similar investigations inside the companies. The technological advancements in the forensics department and the growth in cybercrimes and advanced theft mechanisms are expected to increase investments in the digital forensics market.

- The growing number of cyber threats and attacks by organizations and individuals is increasing in the United States. According to the Identity Theft Resource Center, the number of data compromises and individuals impacted in the United States in 2022 was 1,802 and 422.14 million, respectively.

- North America is at the forefront of technological innovations in digital forensics. The region houses several leading technology companies, research institutions, and forensic laboratories that contribute to developing advanced tools and techniques. This includes advancements in mobile forensics, cloud forensics, artificial intelligence (AI)-based analytics, and forensic data analytics.

Digital Forensics Industry Overview

The Digital Forensics Market is highly fragmented, with the presence of major players like IBM Corporation, Binary Intelligence LLC, Guidance Software Inc. (OpenText), AccessData Group LLC, and KLDiscovery Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In October 2023, Softcell and Binalyze announced a strategic partnership to offer digital forensics and incident response solutions in India. The collaboration of these two security-centric advanced organizations is anticipated to boost noteworthy advancements in digital forensics incident response and cybersecurity competencies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of IoT Devices Driving Demand for Digital Forensics Solutions and Services

- 5.1.2 Network Forensics is Expected to Hold a Significant Market Share

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Professionals and Preplanning among Organizations

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Service

- 6.2 By Type

- 6.2.1 Mobile Forensics

- 6.2.2 Computer Forensics

- 6.2.3 Network Forensics

- 6.2.4 Other Types

- 6.3 By End-user Vertical

- 6.3.1 Government and Law Enforcement Agencies

- 6.3.2 BFSI

- 6.3.3 IT and Telecom

- 6.3.4 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Binary Intelligence LLC

- 7.1.3 Guidance Software Inc. (Opentext)

- 7.1.4 AccessData Group LLC

- 7.1.5 KLDiscovery Inc.

- 7.1.6 Paraben Corporation

- 7.1.7 FireEye Inc.

- 7.1.8 LogRhythm Inc.

- 7.1.9 Cisco Systems Inc.

- 7.1.10 Oxygen Forensics Inc.

- 7.1.11 MSAB Inc.