|

市場調查報告書

商品編碼

1402984

汽車微型馬達:市場佔有率分析、產業趨勢/統計、2024年至2029年成長預測Automotive Micro Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

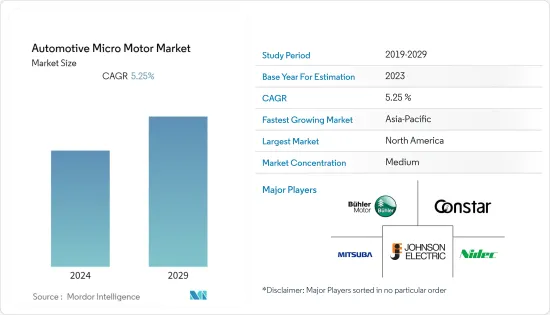

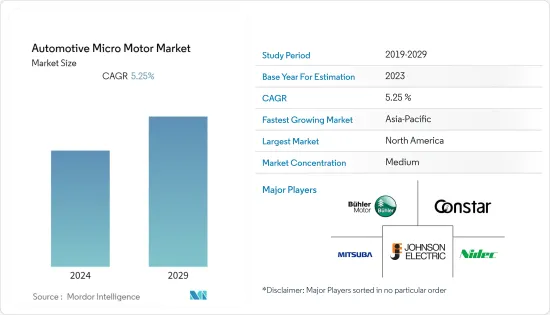

汽車微型馬達市場規模為154.2億美元,預計在預測期內複合年成長率為5.25%,超過199.2億美元的淨估值。

從長遠來看,消費者對豪華車偏好的上升、政府積極推動電動車減少二氧化碳排放,以及無刷微馬達技術的進步,都將有助於全球汽車微型馬達技術的成長。馬達市場快速成長。汽車微型馬達可用於汽車系統,例如電動天窗和電力天線。因此,隨著人均可支配收入的增加,消費者更青睞具有天窗等先進功能的車型,從而帶動了汽車微型馬達市場的成長。

汽車功能的進步,例如自動通風口運動使空氣通過水管以避免損壞(腐蝕、散熱器中的氣穴)、前後鏡控制以及所有細分市場的座椅調節,使汽車微型電機滿足了需求及其品質生產。萬寶至馬達為小型電動車設計了兩款馬達(IS-94BZA 和 IS-92BZA)。新產品重量輕、結構緊湊、高功率、效率高。

按地區分類,亞太地區汽車微型馬達市場預計將快速成長。設計更小、更有效率的馬達的最新發展正在為汽車行業創造機會。此外,北美和歐洲對汽車微型馬達的需求預計將激增,因為它們用於電動天窗等各種汽車應用。此外,由於其重量輕,汽車製造商的需求量很大,預計各種先進的直流無刷微型馬達將引入市場。

汽車微馬達市場趨勢

直流微馬達領域將在預測期內主導市場

在全球範圍內,各大汽車製造商對微型馬達的需求量龐大。各種應用對汽車零件的需求正在穩步成長。對直流和有刷微型馬達的需求正在推動市場上各種微型馬達的採用。汽車座椅配備微型電機,增強按摩功能。 ORVM、電動車窗等是採用率較高的微型馬達的主要使用案例。因此,隨著智慧技術在汽車領域的擴展,需求似乎變得更加有效。

主要製造商正在專注於生產功耗更低的直流微馬達。直流微馬達因其響應時間快、啟動功率高而普遍成為汽車領域的首選產品。此外,各種標準電壓的可用性和易於安裝的機制也導致對該產品的需求增加。未來幾年,無刷直流微型馬達的整合和開發預計將因其降低成本的能力而受到關注。無刷微馬達在擋風玻璃雨刷、電動車窗和電動座椅調節器等汽車應用中受到青睞,推動了該領域的需求。

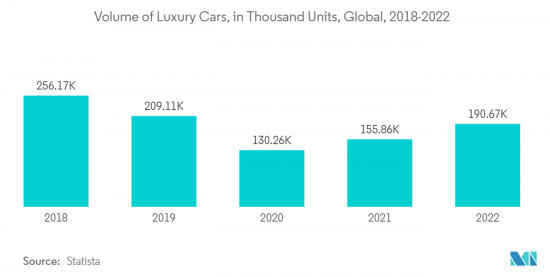

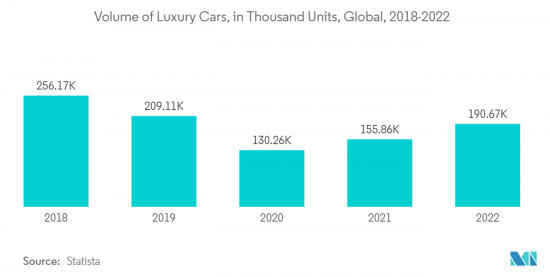

汽車製造商在高階汽車零件中使用直流微型馬達很常見。因此,SUV、MPV等豪華車需求的增加以及市場上電動車採用率的上升預計將對汽車微型馬達市場的快速成長做出積極貢獻。 2022年,全球豪華車總數將達19萬輛,2021年為15.5萬輛。隨著先進高階車型的上市,直流微馬達市場的需求預計將在預測期內快速成長。

亞太地區將在預測期內經歷最高的成長

亞太地區都市化的提高和消費者人均可支配收入的增加正在推動豪華汽車市場的成長,導致汽車中電動天窗等多種零件的使用,從而導致對微型馬達的需求增加。電動車在印度和中國的日益普及也推動了對用於提高客戶便利性的各種部件的微型馬達的需求,例如電動車窗和電動座椅調節器。

近年來,由於生產成本低廉,中國等國家的汽車產量大幅增加。此外,中國也是最大的汽車及汽車零件出口國之一。該地區汽車產量的增加預計將提振該地區小客車的需求,進而預計將對汽車微型馬達的成長產生正面影響。根據國際能源總署(IEA)預測,2022年中國電動車銷量將達600萬輛,而2021年為330萬輛,2021年至2022年年與前一年同期比較率為81.8%。由於電動車行業的光明前景以及消費者對奢侈品偏好的變化,亞太汽車微型馬達市場預計將快速成長。

日本是預計推動亞太地區成長的主要企業的所在地,包括日本電產株式會社、萬寶至汽車公司和三葉株式會社。此外,印度和東協等新興國家被認為對微特電機有全球需求。

汽車微馬達產業概況

由於生態系統中存在各種國際和國內參與企業,微型馬達市場適度分散且競爭激烈。主要企業包括布勒電機有限公司、Constar MicroMotor、德昌電機控股有限公司、三葉株式會社、日本電產株式會社、萬寶至電機、Maxon Motors 和 Assun Motor。這些公司擁有強大的研發能力,可以滿足全球需求。此外,廣泛的供應鏈和分銷網路幫助這些公司在市場上獲得吸引力。

2023 年 4 月,本田獎勵2022 年品質和交付卓越公司。該公司表示,三葉公司是主要供應商,因為該汽車製造商致力於在 2022 年擴大製造能力。

2022年10月,微型馬達和小型電動馬達製造商萬寶至馬達宣布了一項標準化其製造流程的策略,同時引入「五地區管理結構」以進行全球擴張。該公司的目標是擴大其在全部區域的微型馬達和小型馬達的生產能力。

隨著市場技術的快速進步,各種先進的無刷直流微型馬達不斷推出,加劇了產業的競爭。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 豪華車和高級車的需求增加

- 市場抑制因素

- 技術創新推動微型馬達價格上漲

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模-美元)

- 按功耗

- 11V以下

- 12~24V

- 25~48V

- 48V以上

- 依馬達類型

- DC馬達

- AC馬達

- 依技術類型

- 有刷微型電機

- 無刷微型電機

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 中東和非洲其他地區

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Buhler Motor GmbH

- Constar MicroMotor

- Johnson Electric Holdings Limited

- Mabuchi Motor

- Maxon Motors AG

- Mitsuba Corporation

- NIDEC Corporation

- Wellings Holding Ltd.

- Assun Motor

- Denso Corporation

第7章 市場機會及未來趨勢

- 電動車產業的成長推動市場成長

The automotive micromotors market is valued at USD 15.42 billion and is anticipated to surpass a net valuation of USD 19.92 billion, registering a CAGR growth of 5.25% over the forecast period.

Over the long term, the consumers' increasing preference towards availing luxury cars, the government's aggressive focus on promoting electric vehicles to reduce carbon emissions, and advancement in brushless micromotors technology are contributing to the surging growth of the automotive micromotors market all over the world. Automotive micromotors find their potential use case in automotive systems such as electric sunroofs and power antennae, among other components. Therefore, with the rise in per-capita disposable income, consumers are increasingly preferring to avail of vehicle models that possess advanced features such as a sunroof, which, in turn, is aiding the growth of the automotive micromotors market.

Advancements in automotive features, such as automatic air vent movement for passing air in water distribution pipes to avoid damage (corrosion, air pockets in radiators), front and rear mirror control, and seat adjustments in all segments, are driving the demand for automotive micromotors and their mass production. Mabuchi Motor designed two motors (IS-94BZA and IS-92BZA) for light electric vehicles. The new products achieve lightweight, compactness, high output, and high efficiency.

Based on geography, the Asia-Pacific region is anticipated to be the fastest-growing market for automotive micromotors, owing to the increased demand for electric vehicles and consumer's shifting preference towards availing luxury and premium cars such as sports utility vehicles (SUVs). The recent developments in designing compact and high-efficiency motors have created opportunities in the automobile industry. The demand for automotive micromotors in the North American and the European region is also expected to showcase surging growth due to their usage in various automotive applications, such as electric sunroofs. Further, the market is expected to witness the launch of various advanced DC brushless micromotors owing to their lightweight capability, which is in heavy demand by auto manufacturers.

Automotive Micro Motor Market Trends

DC Micromotors Segment to Dominate the Market during the Forecast Period

Globally, micromotors are witnessing extreme demand from key automotive manufacturers. The demand for automotive parts and components is growing steadily for various applications. The demand for DC and brushed micromotors is driving the adoption of different micromotors in the market. Automotive seats are now offered with micromotors to enhance massager capabilities. ORVM, power windows, etc., are some of the key use cases of micromotors witnessing higher adoption rates. Thus, demand seems much more effective with the expansion of smart technologies in the automotive sector.

Key manufacturers are much more inclined toward manufacturing DC micro-motors that consume minimal power than their counterparts. DC micromotors are generally the preferred product in the automotive domain as they provide faster response time and have high startup power. Further, its availability in various standard voltage and simpler installation mechanisms leads to the increasing demand for the product. In the coming years, the integration and development of brushless DC micro motors are expected to gain traction due to their cost-saving capability. Brushless micromotors are preferred in automotive applications such as windshield wipers, power windows, and power seat adjusters, which is fostering the demand for this segment.

The usage of DC micro-motors in luxury vehicle components is common among auto manufacturers. Therefore, the increasing demand for luxury cars such as SUVs and MPVs, coupled with the rising adoption rate of electric vehicles in the market, is anticipated to positively contribute to the surging growth of the automotive micro motors market. In 2022, the overall volume of luxury cars worldwide touched 190 thousand units, compared to 155 thousand units in 2021. With the launch of advanced luxury models in the market, the demand for the DC micromotors segment is anticipated to witness surging growth during the forecast period.

Asia-Pacific to Witness Highest Growth during the Forecast Period

The rising urbanization rate, coupled with the growing per capita disposable income of consumers in the Asia-Pacific region, is fostering the growth of the luxury vehicles market, which, in turn, is leading to the increased demand for automotive micromotors owing to its usage in several components such as electric sunroof. Coupled with that, the rising adoption of electric vehicles in India and China is also driving the demand for micromotors due to their use case in various components such as power windows, power seat adjusters, etc., which assists in enhancing the convenience of customers.

In recent years, due to the low production costs in countries such as China, vehicle production has gone up substantially. Moreover, China is also one of the largest exporters of automobiles and automotive components. Increasing car production in the region is expected to boost the demand for passenger cars in the region, which in turn is expected to positively impact the growth of automotive micromotors. According to the International Energy Agency, electric vehicle sales in China touched 6 million units in 2022, compared to 3.3 million units in 2021, representing a Y-o-Y growth of 81.8% between 2021 and 2022. With the positive outlook of the electric vehicle industry and the consumers's shifting preference towards availing luxury products in their vehicles, the automotive micromotors market in the Asia-Pacific region is anticipated to witness surging growth.

In addition, Japan is anticipated to hold future lucrative opportunities after China in Asia-Pacific; Japan is well equipped with key players, including Nidec Corporation, Mabuchi Motors, and Mitsuba Corporation, which are expected to boost growth in the region. Moreover, emerging economies, including India and ASEAN, are further evaluated to have the demand for micromotors globally.

Automotive Micro Motor Industry Overview

The micromotors market is moderately fragmented and highly competitive due to the presence of various international and domestic players operating in the ecosystem. Some of the major players include Buhler Motor GmbH, Constar MicroMotor, Johnson Electric Holdings Limited, Mitsuba Corporation, Nidec Corporation, Mabuchi Motor, Maxon Motors, and Assun Motor, among others. These companies have robust R&D capabilities to cater to the global demand. In addition, an extensive supply chain and distribution network help these businesses gain traction in the market.

In April 2023, Honda honored Mitsuba Corporation, a manufacturing company specializing in motors and micromotors, among other parts and components, for excellence in quality and delivery for the year 2022. The company stated that Mitsuba Corporation had been an instrumental supplier in 2022, which helped the auto manufacturer to focus on expanding its manufacturing capacity.

In October 2022, Mabuchi Motor, a micromotor, and small electric motor manufacturing company, announced its strategy to implement a "Five Region Management Structure" for its global expansion while standardizing its manufacturing process. The company aims to expand its manufacturing capacity of micro motors and small electric motors across the ASEAN region.

The market is expected to witness the launch of various advanced brushless DC micromotors with the rapid advancement in technology as the players try to gain a competitive edge in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Luxury and Premium Cars

- 4.2 Market Restraints

- 4.2.1 Increasing Prices of Micromotors owing to Constant Transformation in Technology

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Power Consumption

- 5.1.1 Less than 11V

- 5.1.2 12V-24V

- 5.1.3 25V-48V

- 5.1.4 More than 48V

- 5.2 By Motor Type

- 5.2.1 DC Motor

- 5.2.2 AC Motor

- 5.3 By Technology Type

- 5.3.1 Brushed Micromotor

- 5.3.2 Brushless Micromotor

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Turkey

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Buhler Motor GmbH

- 6.2.2 Constar MicroMotor

- 6.2.3 Johnson Electric Holdings Limited

- 6.2.4 Mabuchi Motor

- 6.2.5 Maxon Motors AG

- 6.2.6 Mitsuba Corporation

- 6.2.7 NIDEC Corporation

- 6.2.8 Wellings Holding Ltd.

- 6.2.9 Assun Motor

- 6.2.10 Denso Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Electric Vehicle Industry to Foster the Market Growth