|

市場調查報告書

商品編碼

1332534

支付安全的市場規模和份額分析 - 增長趨勢和預測(2023-2028)Payment Security Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

支付安全市場規模預計將從 2023 年的 234.8 億美元增長到 2028 年的 481.4 億美元,預測期內(2023-2028 年)複合年增長率為 15.44%。

安全的支付處理有助於在線支付、客戶數據和其他敏感信息的高效傳輸。 它還可以保護支付數據免受欺詐和其他安全問題的影響。

主要亮點

- 由於在線購物和交易的快速轉變、複雜的數據盜竊和支付欺詐的增加以及人們對支付安全和PCI DSS(支付卡行業數據安全標準)合規計劃的認識不斷增強,支付安全解決方案變得越來越重要. 由於幾個重要因素,它的需求量很大。

- 此外,由於信用卡/借記卡支付、移動錢包和互聯網支付等數字支付的增長,預計支付安全市場在預測期內將在全球範圍內擴張。

- TPP 增加了網上商店支付欺詐的風險,因此對支付服務的需求不斷增加。 安全措施另一個因素是安全技術的引入,例如安全套接字層(SSL)協議,它使用加密算法來確保傳輸數據的機密性。

- 此外,支付安全模型中日益增多的缺陷為蠕蟲、木馬、網絡釣魚、病毒、拒絕服務攻擊、交易中毒、垃圾郵件發送者、未經授權的訪問、盜竊和欺詐提供了新的攻擊平台。風險正在增加。

- 隨著全球越來越多的人使用在線支付服務以及更多行業需要高安全性交易處理系統,COVID-19 疫情將對支付安全市場的增長率產生積極影響。

支付安全市場趨勢

零售業實現高增長

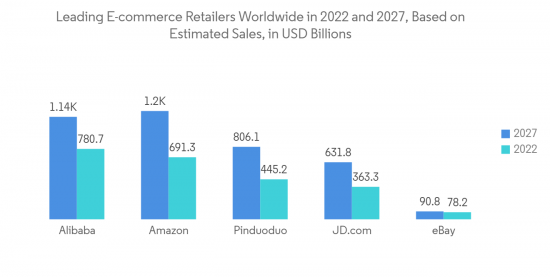

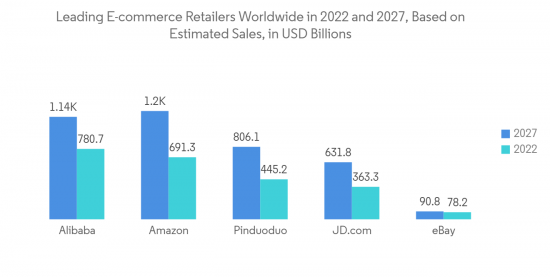

- 移動支付在零售行業尤其是電子商務領域的使用不斷增加,支付安全市場也在不斷擴大。 手機銀行和移動支付安全已成為消費者和金融服務提供商關注的重點,為移動支付安全軟件市場帶來了增長空間。 美國和中國等主要國家的零售電子商務銷售正在經歷顯著增長。

- 政府的支持、智能手機普及率的提高以及應用程序的使用都促進了零售電子商務銷售額的快速增長。 隨著購物體驗的改善,這一趨勢可能會進一步加速。

- 電子商務給零售業帶來了新的機遇。 在線渠道現在已成為零售商客戶體驗的重要組成部分,因為它們可以顯著降低實體店的運營成本和銷售波動性。

- 由於零售行業經常成為網絡攻擊的目標,因此對強大的支付安全解決方案的需求不斷增加,預計將支持該行業未來的收入增長。

- 由於移動技術的持續增長,以及雲、分析、社交和移動支付等補充技術的支持,預計該市場將繼續擴大。

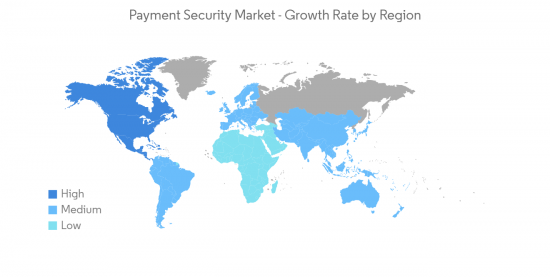

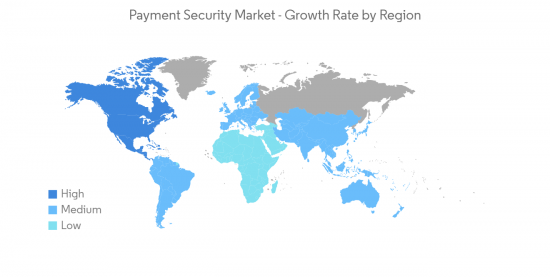

北美市場份額最大

- 北美強大的財務基礎使公司能夠大力投資尖端產品和技術,從而為在北美運營的公司提供市場競爭優勢。

- 此外,該地區存在多家支付安全供應商,例如 Cyber□□Source Corporation、Elavon Inc.、Geobridge Corporation 和 TNS Inc.,也是影響該地區行業的另一個因素。

- 越來越多的企業使用在線支付處理器的新興市場、端到端加密支付安全技術的快速採用以及具有自動欺詐檢測和用戶友好型支付界面開發功能的可靠平台,這些都是促成這一趨勢的因素。該地區的市場收入增長。

- 此外,該地區不斷變化的零售市場和不斷增長的電子商務銷售額是快速支付解決方案需求不斷增長的主要原因,這反過來又推動了對支付安全行業的需求。

- 普通客戶會同時使用多張卡,在線支付的增長速度是零售支付的四倍。 這些因素,加上信用卡市場的蓬勃發展,為支付安全創造了市場機會。

- 隨著消費者接受移動支付,該地區數字支付的使用不斷增加。 當地經濟增長的主要推動力之一是蓬勃發展的零售業。

支付安全行業概述

由於國內外運營商眾多,支付安全市場競爭非常激烈。 技術進步和併購是行業主要競爭對手的主要策略,行業集中度中等。 市場參與者的主要例子包括 Cyber□□Source Corporation、Braintree Payment Solutions, LLC、Ingenico Group 和 Elavon Inc.。

- 2022 年 11 月 - Bluefin Payment Systems LLC 宣布收購 TECS Payment Systems,Bluefin 和 TECS 攜手合作,為 55 個國家/地區的 34,000 家關聯商戶和近 300 個國際合作夥伴提供支持。 這一戰略夥伴關係將擴大兩個組織的全球影響力。 TECS 現有的支付和數據安全套件將與 Bluefin 及其為其客戶提供的全渠道支付和 smartPOS 功能集成。

- 2022 年 9 月 - Elavon Inc. 為北美小企業主推出了 talech Register。 talech Register 是下一代一體化支付和業務分析平台,使小企業主能夠更好地管理其運營,使他們能夠通過註冊公司 AMI 解決其業務中所有復雜的支付、銀行業務和運營需求..

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章研究方法

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 行業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的對抗關係

- 工業價值鏈分析

第5章市場動態

- 市場驅動因素

- 擴大數字支付的引入範圍

- 電子商務欺詐行為增加

- 市場製約因素

- 對在線支付缺乏信任

- 新冠肺炎 (COVID-19) 對行業的影響

第6章市場細分

- 平台

- 移動基地

- 基於網絡

- 其他平台

- 最終用戶行業

- 移動基地

- 零售

- 醫療保健

- IT/通信

- 旅遊/酒店業

- 其他最終用戶行業

- 地區

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭態勢

- 公司簡介

- CyberSource Corporation(Visa Inc.)

- Bluefin Payment Systems LLC

- Braintree Payment Solutions LLC

- Elavon Inc.

- SecurionPay

- Broadcom Inc.

- Signified Inc.

- TokenEx Inc.

- TNS Inc.

- Shift4 Corporation

第8章 投資分析

第9章 市場機會與將來動向

The Payment Security Market size is expected to grow from USD 23.48 billion in 2023 to USD 48.14 billion by 2028, at a CAGR of 15.44% during the forecast period (2023-2028).

Secure payment processing facilitates the efficient transfer of online payments, client data, and other sensitive information. It protects payment data against fraud and other security issues.

Key Highlights

- Payment security solutions are in high demand due to several important factors, including the quick shift to online shopping and transactions, the rise in sophisticated data thefts and payment frauds, and the rising awareness of payment security and Payment Card Industry Data Security Standard (PCI DSS) compliance programs.

- Due to the rise in digital payments, such as credit/debit payments, mobile wallets, and internet payments, it is also projected that the market for payment security would expand globally over the course of the projection period.

- Demand for payment services is increasing due to the TPP's increased risk of payment fraud for online shops. Security measures Another factor is implementing security technologies, such as the Secure Sockets Layer (SSL) protocol, which ensures the confidentiality of transmitted data due to the encryption algorithm.

- Moreover, growing flaws in payment security models provide worms, Trojan horses, phishing, viruses, denial of service attacks, transaction poisoning, and spammers with new attack platforms, increasing the risk of unauthorized access, theft, and fraud.

- The COVID-19 pandemic is anticipated to favorably affect the growth rate of the payment security market since more people are using online payment services globally, and more industries need high-security transaction processing systems.

Payment Security Market Trends

Retail Sector to Witness High Growth

- The market for payment security is growing as mobile payments are increasingly used in retail, particularly in the e-commerce sector. The security of mobile banking and payments has become a significant area of concern for consumers and financial service providers, giving the market for mobile payment security software room to grow. Major economies like the United States and China have significantly increased retail e-commerce sales.

- Government support, rising smartphone penetration, and application usage all contribute to the rapid expansion of retail e-commerce sales. The prospect of an improved shopping experience is likely to accelerate this trend.

- E-commerce has created new opportunities for the retail industry. Online channels are now an essential element of the customer experience for retailers as they help significantly lower operational expenses and sales fluctuations in physical locations.

- Since the retail industry is a frequent target of cyberattacks, there is an increasing need for solid payment security solutions, which are anticipated to support segment revenue growth in the future.

- The market is predicted to continue to expand due to the continued growth of mobile technologies, which are supported by the complementary technologies of cloud, analytics, and social, mobile payments.

North America occupies the Largest Market Share

- The robust financial standing of North America allows it to make significant investments in cutting-edge products and technologies, giving the businesses operating here a competitive edge in the market.

- Also, the existence of multiple payment security vendors in the region among them CyberSource Corporation, Elavon Inc., Geobridge Corporation, and TNS Inc. is one of the factors influencing the industry in this area.

- The rise in businesses using online payment processors, the quick adoption of end-to-end encrypted payment security technologies, and the development of reliable platforms with automated fraud detection and user-friendly payment interfaces are all factors that have contributed to the region's market's revenue growth.

- Moreover, The key reason for the increase in demand for a quick payment solution, which in turn fuels the need for the payment security industry, is the changing retail market and rising E-commerce sales in this region.

- The average customer uses multiple cards concurrently, and online payments are growing four times faster than retail payments. These factors, combined with the booming credit card market, present a market opportunity for payment security.

- The region is seeing a rise in the use of digital payments due to consumer acceptance of mobile payments. One of the main factors for the growth drivers for the local economy is the thriving retail sector.

Payment Security Industry Overview

The payment security market is highly competitive due to the presence of numerous players conducting business both domestically and internationally. Technology advancements and mergers & acquisitions are the main methods used by the leading competitors in the industry, which appears to be moderately concentrated. CyberSource Corporation, Braintree Payment Solutions, LLC, Ingenico Group, and Elavon Inc. are a few of the market's key participants.

- November 2022 - Bluefin Payment Systems LLC announced the acquisition of TECS Payment Systems, Bluefin and TECS will work together to support 34,000 linked merchants and around 300 international partners across 55 countries. The strategic alliance broadens both organizations' global reach. The company's existing payment and data security suite will be integrated with omnichannel payments and smartPOS capabilities for Bluefin and its clients.

- September 2022 - Elavon Inc has launched talech Register for North American small business owners, where talech Register is the next-generation, all-in-one payments and business analytics platform that empowers small business owners to better manage their operations, through register company amis to tackle all the complex payments, banking and operational needs of bussiness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Digital Payment Modes

- 5.1.2 Increase in Fraudulent Activities in E-commerce

- 5.2 Market Restraints

- 5.2.1 Lack of Trust in Online Payment Modes

- 5.3 Impact of COVID-19 on the industry

6 MARKET SEGMENTATION

- 6.1 Platform

- 6.1.1 Mobile Based

- 6.1.2 Web Based

- 6.1.3 Other Platforms

- 6.2 End-user Industry

- 6.2.1 Mobile Based

- 6.2.2 Retail

- 6.2.3 Healthcare

- 6.2.4 IT and Telecom

- 6.2.5 Travel and Hospitality

- 6.2.6 Other End-user Industry

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CyberSource Corporation (Visa Inc.)

- 7.1.2 Bluefin Payment Systems LLC

- 7.1.3 Braintree Payment Solutions LLC

- 7.1.4 Elavon Inc.

- 7.1.5 SecurionPay

- 7.1.6 Broadcom Inc.

- 7.1.7 Signified Inc.

- 7.1.8 TokenEx Inc.

- 7.1.9 TNS Inc.

- 7.1.10 Shift4 Corporation

![支付安全市場 - 按組件(解決方案 [加密令牌化、詐欺檢測和預防、生物識別認證]、服務)、按組織規模(中小企業、大型組織)、按最終用戶和預測,2023 - 2032 年](/sample/img/cover/42/1395086.png)