|

市場調查報告書

商品編碼

1332474

分析設備市場規模和份額分析-增長趨勢和預測(2023-2028)Analytical Instrumentation Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

分析儀器市場規模預計將從 2023 年的 494.7 億美元增長到 2028 年的 662.7 億美元,預測期內(2023-2028 年)複合年增長率為 6.02%。

對產品質量的日益關注、研發投入的增加以及嚴格的政府法規是推動分析儀器市場增長的主要因素。 客戶意識的提高(尤其是在新興地區)以及跨學科分析儀器的需求預計將促進市場增長。 有關藥品安全的嚴格監管、對食品質量的日益關注、原油和頁巖氣產量的增加以及質譜儀的技術進步將推動市場增長。

主要亮點

- 生物製藥行業在研究市場的發展中也發揮著重要作用。 隨著對藥品質量生產的日益關注,生物加工行業也逐漸成為研究市場的重要投資者。

- 2022 年 1 月,富士膠片宣佈為其北卡羅來納州工廠新增 89,000 平方英尺的實驗室空間。 該設施將包括分析儀器、高通量生物加工設備和自動化技術,以支持過程表徵計劃。 此次擴張將使 Fujifilm Geosynth Biotechnologies 能夠進一步協助合作夥伴指導臨床工藝開發,從而創建更強大的商業流程。

- 最終用戶行業的自動化刺激了所研究市場的發展。 為電動汽車、手機、能源系統和其他系統開發電池的公司依靠分析儀器來增加存儲容量和輸出,創造更高效、更清潔和更安全的能源。 公司使用電子顯微鏡技術來了解原子級結構,並使用光譜工具來發現材料中導致缺陷和低效率的關鍵變化。

- 元素分析光譜儀廣泛應用於環境、石化、食品安全、冶金、地球化學、臨床/毒理學研究等領域。 這些產品廣泛應用於中國、印度和拉丁美洲等市場,以支持遵守日益嚴格的國際環境和消費者安全法規。 安捷倫科技(Agilent Technologies)、賽默飛世爾科技(Thermo Fisher Scientific) 和島津製作所(Shimadzu Corporation) 是接受調查的主要供應商之一,它們越來越多地投資於市場開發和市場拓展。

- 但是,分析設備的高成本限制了市場的增長。 除了設備成本外,其他各種成本,如員工勞動力成本、維護成本和實驗室成本也限制了市場的增長。 此外,不斷增加的特性和功能、技術進步和創新系統正在推高分析設備的成本。 例如,高效液相色譜 (HPLC) 的成本在 12,000 美元至 50,000 美元之間。 一個 90L 的色譜柱和裝柱站的成本約為 200,000 美元。

- 新冠肺炎 (COVID-19) 疫情的爆發在所研究的市場中創造了巨大的需求。 在 COVID-19 疫情期間,對加速研究的需求顯著增加,公眾期望科學界取得前所未有的進展。

分析儀器市場趨勢

生命科學領域預計將佔據較大市場份額

- 生命科學在分析儀器行業中所佔份額最大,佔整個行業的四分之一。 生命科學包括超過十三個不同的技術領域,並涵蓋使用分析工具的各種應用,特別是光譜學、原子光譜學和分子光譜學。 它為通用儀器應用和利基研究系統提供了巨大的增長機會。

- 對下一代測序 (NGS) 的需求持續強勁,影響著測序領域並推動了對核酸樣品製備領域的強勁需求。 隨著基因組技術已經超越基礎研究並進入生物醫學領域,這種增長在公共和私營部門都很顯著。

- 如此巨大的增長預計將為分析儀器解決方案帶來巨大需求,因為它們可以幫助製藥公司遵守嚴格的藥品安全法規。

- 該市場呈現出多項戰略發展,例如新產品開發、合併和合作夥伴關係,表明該細分市場越來越多地採用分析工具。

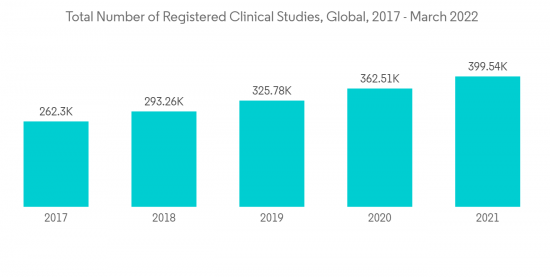

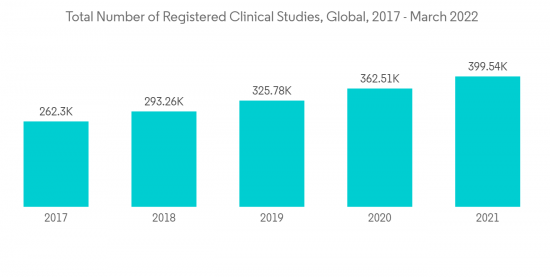

- 藥物發現和臨床研究需要各種複雜的診斷設備、分析設備、先進的醫療設備、檢測設備和許多其他專業產品。 由於加速研究的需求不斷增長以及社會對科學界前所未有的進步的期望,COVID-19 大流行給市場帶來了巨大的需求。

- 因此,隨著臨床研究和藥物發現活動的增加,生命科學行業對分析儀器的需求預計也會增長。

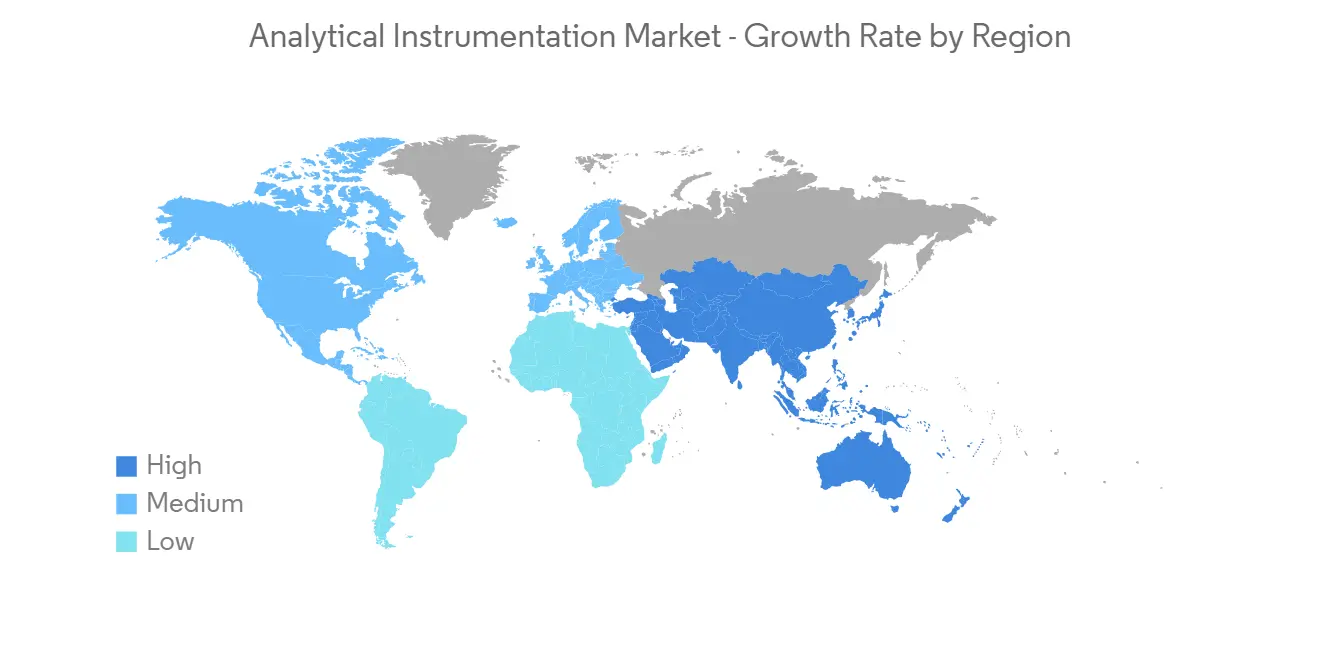

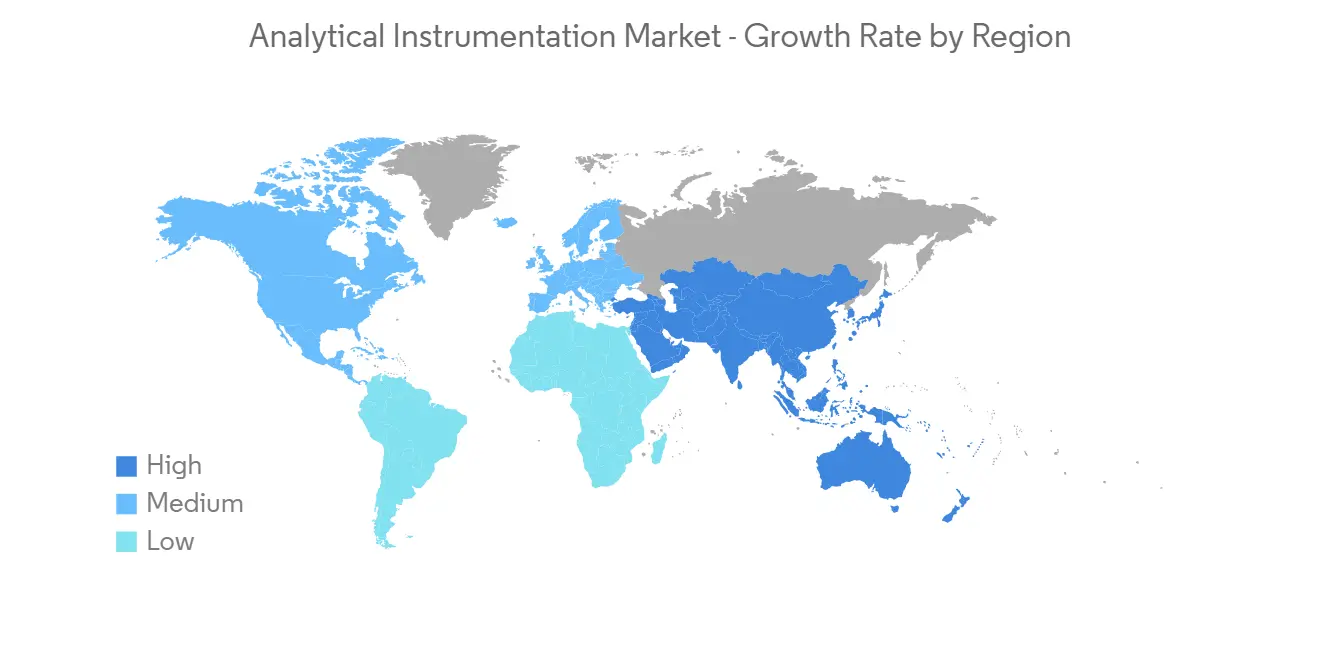

預計市場將高速增長的亞太地區

- 亞太地區對分析儀器的需求正在顯著增長。 具體來說,這些產品用於解決氣候變化、人口老齡化、糧食生產和新能源問題。 分析設備供應商也通過本地分銷和直銷來響應市場需求。 中美之間的貿易爭端還導致多家公司將部分生產和供應鏈轉移到中國境外,以避免業務運營受到干擾。

- 生命科學是中國政府在分析設備方面取得顯著增長的領域之一。 “十三五”期間,我國生命科學產業實現中高速增長。 中國政府宣布下一個五年計劃將包括在未來20年內向精準醫療行業投資約90億美元。 此外,尚無特定的抗病毒治療方法被證明對 COVID-19 有效。 中國使用抗病毒藥物、不同藥物和中藥的組合。 然而,目前的療法主要基於過去的經驗,顯示出治療流感和其他病毒感染的臨床療效。

- 該地區擁有眾多國家,從先進技術中心到新興經濟體。 新加坡、韓國、台灣和澳大利亞等國家已經在製藥、生物技術、半導體和採礦等行業的世界舞台上發揮著重要作用。 這些國家的增長得益於大量外國投資和融入全球供應鏈的理想地點。 許多人預計該地區國家很快就能與中國、日本和其他國際參與者競爭。

- 由於對測試和研發活動的投資不斷增加,印度等國家也躋身分析儀器行業的新興市場之列。 不斷擴大的最終用戶行業意識的提高也推動了對該市場的投資。 因此,進入世紀之交以來,中國的分析設備市場經歷了快速增長。 然而,在過去幾年中,變化的速度已放緩至低個位數,利潤率繼續萎縮。 儘管私營公司的收入仍在增長,但來自政府機構和私營部門的採購壓力正在損害私營公司的利潤。

- 根據印度分析儀器協會 (IAIA) 的數據,印度目前約佔全球分析儀器市場的 2-3%。 然而,印度規模很小,尤其是在液相色譜儀和質譜儀等高端儀器的製造方面。

- IAIA 對由於政府缺乏對該國分析儀器行業的支持而導致利潤率下降和增長率放緩表示擔憂,並建議政府機構提出緊急干預建議。

分析行業概述

分析儀器市場分散,存在大量初級和中小型供應商,具體情況取決於地點。 雖然市場上的主要供應商已經獲得了更詳細的產品組合併滿足不同客戶的需求,但較小的供應商在利基領域開展業務,提供定制和客戶特定訂單。 主要參與者包括安捷倫科技公司、馬爾文帕納科有限公司(思百吉公司)、珀金埃爾默公司、賽默飛世爾科技公司和島津公司。

- 2022 年 2 月 - Sartorius AG 宣布收購 Novasep 的色譜部門。 收購的產品組合包括用於寡核甘酸、□和胰島素等小型生物製劑的色譜系統,以及用於連續生物製劑生產的創新系統。

- 2022 年 1 月 - 布魯克公司宣布收購 Prolab Instruments GmbH,這是一家專門從事低流量、高精度液相色譜技術和系統的瑞士技術公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 工業價值鏈分析

- 行業吸引力 - 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第五章市場動態

- 市場驅動因素

- 精準醫療的發展

- 市場製約因素

- 初始成本高

第六章 COVID-19 對行業的影響評估

第七章市場細分

- 產品類型

- 色譜法

- 分子分析光譜

- 元素分析光譜

- 質譜分析

- 分析顯微鏡

- 其他產品類型

- 最終用戶

- 生命科學

- 化學/石油化學

- 石油和天然氣

- 材料科學

- 食品檢驗

- 供水和污水處理

- 其他最終用戶

- 地區

- 北美

- 歐洲

- 亞太地區

- 世界其他地區

第8章競爭態勢

- 供應商排名分析

- Chromatography

- Mass Spectroscopy Market

- Molecular Analysis Spectrometers

- Elemental Analysis Spectrometers

- 企業檔案

- Agilent Technologies Inc.

- Bruker Corporation

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corporation

- Malvern Panalytical Ltd(Spectris company)

- Mettler Toledo International Inc.

- Waters Corp.

- Bio-Rad Laboratories Inc.

第9章 投資分析

第10章 市場展望

The Analytical Instrumentation Market size is expected to grow from USD 49.47 billion in 2023 to USD 66.27 billion by 2028, at a CAGR of 6.02% during the forecast period (2023-2028).

The increasing concern for product quality, increasing investments in R&D, and stringent government regulations are the major factors driving the analytical instrumentation market growth. Increasing customer awareness, especially in emerging regions, and the need for analytical instruments across multiple sectors are expected to expand the market growth. Stringent regulations on drug safety, increasing focus on the quality of food products, expansion of crude and shale gas production, and technological advancements in mass spectrometers would aid the market growth.

Key Highlights

- The biopharmaceutical industry also plays a significant role in developing the studied market. With a rising emphasis on pharmaceutical quality production, the bioprocessing sector is also emerging as a substantial investor in the market studied.

- In January 2022, Fujifilm announced the addition of an additional 89,000 sq. ft of laboratory space at its North Carolina facility, which will feature analytical instrumentation, high throughput bioprocessing equipment, and automation technologies to support the process characterization program. This expansion will also allow Fujifilm Diosynth Biotechnologies to help its partners further in guiding clinical process development that can create more robust commercial processes.

- Automation across the end-user industries fueled the development in the market studied. Companies developing batteries for electric vehicles, mobile phones, energy systems, and other systems rely on analytical instruments to enhance storage potential and output, creating a more efficient, cleaner, and safer energy source. Companies use electron microscopy technologies to understand structures that level down at the atomic scale and spectroscopy tools to discover critical changes in materials that cause defects and inefficiency.

- Elemental analysis spectrometers are finding applications in environmental, petrochemical, food safety, metallurgical, geochemical, and clinical/toxicology research. These products are widely used in markets such as China, India, and Latin America, to support compliance with increasingly stringent international environmental and consumer safety regulations. Agilent Technologies Inc., Thermo Fisher Scientific, and Shimadzu Corporation, among others, are some significant vendors in the market studied, which are also increasingly investing in the market development and expansion of market scope.

- However, the high cost of analytical instruments restrains the growth of the studied market. Along with the cost of instruments, various other costs, such as staffing, maintenance, and laboratory expenses, are also restraining the market's growth. Moreover, the advancement in features and functionalities, technological advances, and innovative systems are adding to the cost of analytical instruments. For instance, high-performance liquid chromatography (HPLC) ranges from USD 12,000 to USD 50,000. The 90-L column and packing station costs about USD 200,000.

- The COVID-19 outbreak resulted in significant demand in the market studied. The need for accelerated research significantly increased during the COVID-19 epidemic, and the public expects unprecedented progress from the scientific community.

Analytical Instrumentation Market Trends

Life Sciences Segment Expected to Hold Significant Market Share

- Life sciences account for the largest analytical instrument industry share, representing a quarter of the entire industry. Life sciences comprise more than 13 individual technology segments, encompassing various applications using analytical tools such as spectrometry, atomic spectroscopy, and molecular spectroscopy, among others. It provides significant opportunities for the growth of both general instrument applications and niche research systems.

- Demand for Next Generation Sequencing (NGS) continues to flourish, impacting the sequencing segment and driving strong demand in the nucleic acid sample preparation segment. This growth was evident in the public and private sectors, as genomics technology went beyond basic research to reach the biomedical domain.

- Such tremendous growth is expected to create a significant demand for analytical instrumentation solutions, as it helps pharmaceutical companies comply with stringent regulations on drug safety.

- The market is witnessing several strategic developments, such as new product developments, mergers, and collaboration, that suggest an increase in the adoption of the analytical tool in the segment.

- Drug discovery and clinical research require various complex diagnostic instruments, analytical instruments, advanced medical devices, testing equipment, and many other specialized products. The COVID-19 pandemic resulted in significant demand in the market due to the growing need for accelerated research and public expectations of unprecedented progress from the scientific community.

- Hence, the demand for analytical instrumentation in the life sciences industry is expected to grow with increasing clinical research and drug discovery activities.

Asia-Pacific Region Expected to Witness High Market Growth

- The demand for analytical instrumentation is growing significantly in the Asia-Pacific region. Specifically, the area utilized these products to address climate change, an aging population, food production, and newer energy sources. Analytical instrumentation vendors have also responded to the market demand via distribution by local companies and direct sales. Also, due to the trade tensions between the US and China, multiple companies have shifted some of their production and supply chains to countries outside China to circumvent disruption in business operations.

- One sector that received significant growth for analytical instruments from the Chinese government is life sciences. Within the 13th Five-Year Plan period, the life sciences industry in China registered medium-to-high-speed growth. China's government announced that it would further include a commitment to invest around USD 9 billion over the next 20 years in the precision medicine industry in its next five-year plan. Moreover, there is no specific antiviral treatment that is proven to be effective for COVID-19. Combinations of antivirals, different drugs, and traditional Chinese medicine are used in China. However, current treatment options are mainly based on previous experience showing clinical benefits in treating influenza and other viral infections.

- The region is home to several highly diverse countries ranging from advanced technological hubs to emerging economies. Countries like Singapore, South Korea, Taiwan, and Australia are already significant players on the world stage in industries like pharmaceuticals, biotechnology, semiconductors, and mining. The growth lifted in these countries due to substantial foreign investment and an ideal location to integrate into global supply chains. Many expect countries in the region to be competitive with China, Japan, and other international players shortly.

- Countries such as India have also been among the emerging markets in the analytical instrumentation industry owing to higher investment in testing and R&D activities. The growing awareness among the country's expanding end-user industries is also driving investment in the market studied. Therefore, the country's analytical instruments market witnessed exponential growth since the turn of the century. However, in the past 2-3 years, the pace of change slowed down to high single digits, and ever-thinning margins impacted the industry. Procurement pressures from government organizations and the private sector are taking a toll on the companies' bottom lines, though top lines are still growing.

- According to the Indian Analytical Instrument Association (IAIA), the country presently accounts for about 2-3% of the global analytical instrumentation market. However, India is at a very micro-scale in manufacturing, especially for high-end equipment, like liquid chromatography and mass spectrometry.

- Expressing concern over the declining margins and slow growth rate due to the lack of government support for the country's analytical instrument industry, IAIA suggested immediate intervention of the government organizations to support the much-needed boost to the analytical instrument manufacturing sector in the country.

Analytical Instrumentation Industry Overview

The analytical instruments market is fragmented and is home to numerous primary and smaller vendors depending on the location. The major vendors in the market garner more in-depth product portfolios, catering to different customer requirements, whereas smaller vendors operate in niche segments, providing customizations and customer-specific orders. Key players include Agilent Technologies Inc., Malvern Panalytical Ltd (Spectris Company), PerkinElmer Inc., Thermo Fisher Scientific, and Shimadzu Corporation.

- February 2022 - Sartorius AG announced the acquisition of Novasep's chromatography division. The portfolio acquired encompasses chromatography systems suited for smaller biomolecules, such as oligonucleotides, peptides, and insulin, and innovative systems for continuous biologics manufacturing.

- January 2022 - Bruker Corporation announced the acquisition of Prolab Instruments GmbH, a Swiss technology company specializing in low-flow, high-precision liquid chromatography technology and systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of Precision Medicine

- 5.2 Market Restraint

- 5.2.1 High Initial Cost

6 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE INDUSTRY

7 MARKET SEGMENTATION

- 7.1 Product Type

- 7.1.1 Chromatography

- 7.1.2 Molecular Analysis Spectroscopy

- 7.1.3 Elemental Analysis Spectroscopy

- 7.1.4 Mass Spectroscopy

- 7.1.5 Analytical Microscopes

- 7.1.6 Other Product Types

- 7.2 End User

- 7.2.1 Life Sciences

- 7.2.2 Chemical and Petrochemical

- 7.2.3 Oil and Gas

- 7.2.4 Material Sciences

- 7.2.5 Food Testing

- 7.2.6 Water and Wastewater

- 7.2.7 Other End Users

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Vendor Ranking Analysis

- 8.1.1 Chromatography

- 8.1.2 Mass Spectroscopy Market

- 8.1.3 Molecular Analysis Spectrometers

- 8.1.4 Elemental Analysis Spectrometers

- 8.2 Company Profiles

- 8.2.1 Agilent Technologies Inc.

- 8.2.2 Bruker Corporation

- 8.2.3 PerkinElmer Inc.

- 8.2.4 Thermo Fisher Scientific Inc.

- 8.2.5 Shimadzu Corporation

- 8.2.6 Malvern Panalytical Ltd (Spectris company)

- 8.2.7 Mettler Toledo International Inc.

- 8.2.8 Waters Corp.

- 8.2.9 Bio-Rad Laboratories Inc.