|

市場調查報告書

商品編碼

1331237

聚偏氟乙烯 (PVDF) 市場規模和份額分析 - 增長趨勢和預測(2023-2029)Polyvinylidene Fluoride (PVDF) Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

聚偏二氟乙烯(PVDF)的全球市場規模預計將從2023年的67.21千噸增長到2028年的152千噸,在預測期內(2023-2029年)複合年增長率為17.73% 。

主要亮點

- 工業和機械行業是最大的最終用戶行業。 由於塗層和襯裡應用對 PVDF 樹脂的高需求,工業和機械行業佔據了最大的市場份額。

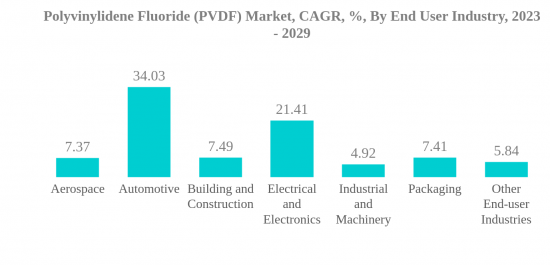

- 汽車是一個快速發展的最終用戶行業。 在汽車行業,PVDF材料在電池和電動汽車中的使用越來越多,預計將為市場增長創造機會。

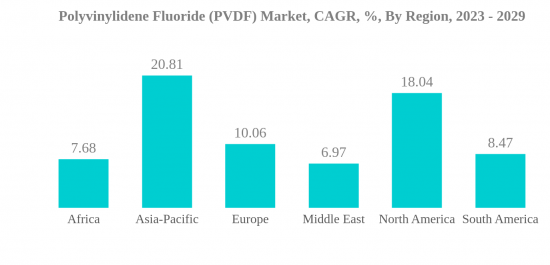

- 亞太地區是最大的地區。 亞太地區以印度、中國、日本和韓國等主要新興經濟體為主導。 這些國家也是PVDF在汽車、食品和飲料等領域的最大消費國。

- 亞太地區是一個快速發展的地區。 亞太地區汽車、建築、包裝等各行業投資大幅增長。 亞太地區預計將成為增長最快的市場。

聚偏二氟乙烯 (PVDF) 市場趨勢

汽車行業需求的擴大推動市場增長

- PVDF 是一種高度非反應性含氟聚合物,具有紫外線穩定性、耐化學性、耐磨性和阻燃性。 通常用於需要最高純度零件的應用。 PVDF是最常用的含氟聚合物之一,到2022年將佔全氟聚合物子樹脂類型總消費量的16.21%。

- PVDF 具有柔韌性、重量輕、導熱性低、耐化學腐蝕和耐高溫等理想特性,使電氣和電子行業成為按價值計算最大的消費者。 PVDF 通常用作電纜的絕緣材料。 它作為電池(包括鋰離子電池)絕緣材料的用途也在擴大。 由於鋰離子電池和電纜絕緣材料需求的快速增長,預計在預測期內(2023-2029年)該行業的PVDF需求價值複合年增長率為21.42%。

- 按價值計算,工業機械領域是 PVDF 的第二大消費者。 PVDF因其高拉伸強度、耐輻射、耐磨性和化學特性而成為該領域的首選。 例如,在化學加工工業中,PVDF用於軸承、容器、管道、管件、隔離閥、襯裡、泵葉輪殼等。 也用作設備的耐腐蝕、防水塗層。

- 汽車行業是增長最快的消費領域,預測期內價值複合年增長率預計為 34.03%。 制動管、車底緊固件、門檻板和尾燈罩對 PVDF 塗層的需求不斷增長,這主要是由於其卓越的耐腐蝕性和耐化學性。

非洲未來可能成為主要市場

- 2022年,全球PVDF市場佔全球含氟聚合物市場的12.21%。 全球PVDF的主要消費地區是亞太地區和北美。

- 亞太地區是 PVDF 最大的消費國,預計在預測期內價值複合年增長率為 20.81%。 中國和日本等國家是PVDF的主要用戶,到2022年分別佔PVDF市場總收入份額的60%和17%。 我國工業機械行業是PVDF的主要消費大國。 近年來,我國大力投資發展先進機床,包括高速、精密機床,以及智能、數字化製造技術。 政府的目標是到2025年使中國成為先進製造業的世界領先者。 政府制定了智能製造五年發展規劃,目標是實現70%大型企業數字化。

- 北美是第二大消費國,預計在預測期內的複合年增長率為 18.04%。 這一增長預計將受到該地區電氣和電子設備製造投資增加的推動。 施耐德將在2022年投資1億美元,增加該地區的電氣產品產量。 美國是該地區PVDF的主要消費國之一,市場收入份額為92%。 這是由該地區電子行業推動的,預計在預測期內,電子行業的價值複合年增長率為 17.19%。

聚偏二氟乙烯 (PVDF) 行業概覽

聚偏氟乙烯(PVDF)市場整合度較高,前五名企業佔比77.03%。 該市場的主要參與者是(按字母順序排列)阿科瑪、東岳集團、吳羽株式會社、中化集團和索爾維。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第 2 章報告要約

第 3 章簡介

- 研究假設和市場定義

- 調查範圍

- 調查方法

第 4 章主要行業趨勢

- 最終用戶趨勢

- 監管框架

- 價值鍊和分銷渠道分析

第 5 章市場細分

- 最終用戶行業

- 航空航天

- 汽車

- 建築/施工

- 電氣/電子

- 工業/機械

- 包裝

- 其他最終用戶行業

- 地區

- 非洲

- 按國家/地區

- 尼日利亞

- 南非

- 其他非洲

- 亞太地區

- 按國家/地區

- 澳大利亞

- 中國

- 印度

- 日本

- 馬來西亞

- 韓國

- 其他亞太地區

- 歐洲

- 按國家/地區

- 法國

- 德國

- 意大利

- 俄羅斯

- 英國

- 歐洲其他地區

- 中東

- 按國家/地區

- 沙特阿拉伯

- 阿拉伯聯合酋長國

- 其他中東地區

- 北美

- 按國家/地區

- 加拿大

- 墨西哥

- 美國

- 南美洲

- 按國家/地區

- 阿根廷

- 巴西

- 南美洲其他地區

- 非洲

第 6 章競爭態勢

- 主要戰略趨勢

- 市場份額分析

- 公司情況

- 公司簡介

- 3M

- Arkema

- Dongyue Group

- Hubei Everflon Polymer CO., Ltd.

- KUREHA CORPORATION

- RTP Company

- Sinochem

- Solvay

- Zhejiang Juhua Co., Ltd.

- ZheJiang Yonghe Refrigerant Co.,Ltd

第 7 章首席執行官面臨的關鍵戰略問題

第 8 章附錄

- 世界概覽

- 摘要

- 五力分析框架

- 世界價值鏈分析

- 市場動態 (DRO)

- 來源和參考文獻

- 圖表列表

- 主要見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 62721

The Global Polyvinylidene Fluoride (PVDF) Market size is expected to grow from 67.21 Kilo metric tons in 2023 to 152 Kilo metric tons by 2028, at a CAGR of 17.73% during the forecast period (2023-2029).

Key Highlights

- Industrial and Machinery is the Largest End User Industry. The industrial and machinery industry registered the largest market share due to the high demand for PVDF resin for coating and lining applications.

- Automotive is the Fastest-growing End User Industry. The increasing usage of PVDF materials in batteries and electric vehicles in the automobile industry is likely to create opportunities for market growth.

- Asia-Pacific is the Largest Region. Asia-Pacific was driven by major developing economies like India, China, Japan, and South Korea. These countries also happen to be the largest consumers of PVDF in automotive, food and beverages, etc.

- Asia-Pacific is the Fastest-growing Region. Asia-Pacific witnessed a significant increase in investments in various industries, including automotive, construction, packaging, etc. It is projected to have the fastest growth in the market.

Polyvinylidene Fluoride (PVDF) Market Trends

GROWING DEMAND FROM THE AUTOMOTIVE INDUSTRY TO LEAD THE MARKET'S GROWTH

- PVDF is known as a highly non-reactive fluoropolymer with UV stability and resistance to chemicals, abrasion, and flame. It is often used in applications that require components of the highest purity levels. PVDF is one of the most frequently used fluoropolymers, accounting for 16.21% of the total consumption of all fluoropolymer sub-resin types in 2022.

- The electrical and electronics segment is the largest consumer of PVDF in terms of value due to its desired properties like flexibility, lightweight nature, low thermal conductivity, chemical corrosion resistance, and heat resistance. PVDF is commonly used as insulation on electrical cables. Its application as an insulating material in batteries, including lithium-ion batteries, has also grown. Owing to the rapidly growing demand for lithium-ion batteries and cable insulations, the demand for PVDF from the segment is expected to record a CAGR of 21.42% in terms of value during the forecast period (2023-2029).

- The industrial machinery segment is the second-largest consumer of PVDF in terms of value. Its high tensile strength, resistance to radiation, abrasion, and chemical properties make it a preferred material in this segment. For instance, in the chemical processing industry, PVDF is used in bearings, vessels, pipes, pipe fittings, isolation valves, linings, and pump impeller casing. It is also used as a corrosion and water-resistance coating for equipment.

- The automotive segment is the fastest-growing consumer, with an expected CAGR of 34.03% in terms of value during the forecast period. The demand for PVDF coating in brake tubes, underbody fasteners, rocker panels, and tail lamp housings is growing, primarily due to its excellent corrosion and chemical resistance.

AFRICA MAY BECOME A MAJOR MARKET IN THE FUTURE

- The global PVDF market accounted for 12.21% of the global fluoropolymers market in 2022. Asia-Pacific and North America are among the major consumers of PVDF globally.

- Asia-Pacific is the largest consumer of PVDF and is expected to record a CAGR of 20.81% in terms of value during the forecast period. Countries like China and Japan majorly utilize PVDF, occupying 60% and 17%, respectively, of the total PVDF market share in terms of revenue in 2022. China's industrial machinery industry is the major consumer of PVDF. In recent years, China has invested heavily in the development of advanced machine tools, such as high-speed and precision machine tools, as well as smart and digitalized manufacturing technologies. The government aims to make China a world leader in advanced manufacturing by 2025. The government has set a five-year plan for smart manufacturing development, with the goal of digitizing 70% of its large enterprises.

- North America is the second-largest consumer and is projected to record a CAGR of 18.04% in terms of value during the forecast period. This growth is expected due to the rising investments in the region's electrical and electronics manufacturing. Schneider invested USD 100 million in 2022 to increase the production of electrical goods in the region. The United States is among the major consumers of PVDF in the region, with a market revenue share of 92%, owing to its electronics industry, which is predicted to record a CAGR of 17.19% in terms of value during the forecast period.

Polyvinylidene Fluoride (PVDF) Industry Overview

The Polyvinylidene Fluoride (PVDF) Market is fairly consolidated, with the top five companies occupying 77.03%. The major players in this market are Arkema, Dongyue Group, KUREHA CORPORATION, Sinochem and Solvay (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 By Country

- 5.2.1.1.1 Nigeria

- 5.2.1.1.2 South Africa

- 5.2.1.1.3 Rest of Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 By Country

- 5.2.2.1.1 Australia

- 5.2.2.1.2 China

- 5.2.2.1.3 India

- 5.2.2.1.4 Japan

- 5.2.2.1.5 Malaysia

- 5.2.2.1.6 South Korea

- 5.2.2.1.7 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 By Country

- 5.2.3.1.1 France

- 5.2.3.1.2 Germany

- 5.2.3.1.3 Italy

- 5.2.3.1.4 Russia

- 5.2.3.1.5 United Kingdom

- 5.2.3.1.6 Rest of Europe

- 5.2.4 Middle East

- 5.2.4.1 By Country

- 5.2.4.1.1 Saudi Arabia

- 5.2.4.1.2 United Arab Emirates

- 5.2.4.1.3 Rest of Middle East

- 5.2.5 North America

- 5.2.5.1 By Country

- 5.2.5.1.1 Canada

- 5.2.5.1.2 Mexico

- 5.2.5.1.3 United States

- 5.2.6 South America

- 5.2.6.1 By Country

- 5.2.6.1.1 Argentina

- 5.2.6.1.2 Brazil

- 5.2.6.1.3 Rest of South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Dongyue Group

- 6.4.4 Hubei Everflon Polymer CO., Ltd.

- 6.4.5 KUREHA CORPORATION

- 6.4.6 RTP Company

- 6.4.7 Sinochem

- 6.4.8 Solvay

- 6.4.9 Zhejiang Juhua Co., Ltd.

- 6.4.10 ZheJiang Yonghe Refrigerant Co.,Ltd

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219