|

市場調查報告書

商品編碼

1326430

液晶聚合物 (LCP) 市場規模和份額分析 - 增長趨勢和預測 (2023-2029)Liquid Crystal Polymers (LCP) Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

全球液晶聚合物(LCP)市場規模預計將從2023年的65.52千噸擴大到2028年的83.74千噸,預測期內復合年增長率為5.03%。

主要亮點

- 電氣/電子是最大的終端用戶行業,LCP 複合材料因其快速的技術創新、介電性能和耐化學性而主要用於電子行業。 因此,該行業的市場佔有率最高。

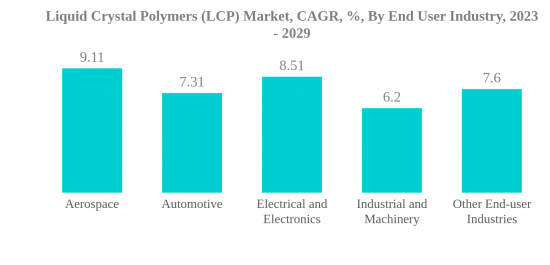

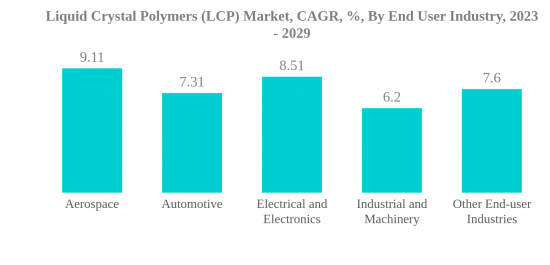

- 航空航天是一個快速發展的最終用戶行業。 LCP用於航空航天工業的微電子領域。 因此,該細分市場預計將成為市場上增長最快的細分市場。

- 亞太地區是最大的地區。 亞太地區主要由中國、印度、日本和韓國等新興經濟體推動。 亞太地區電子行業的複合年增長率預計為6.63%,使亞太地區成為市場上最大的地區。

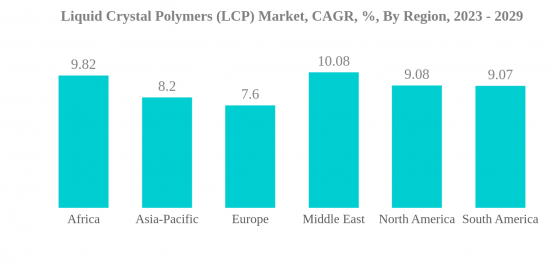

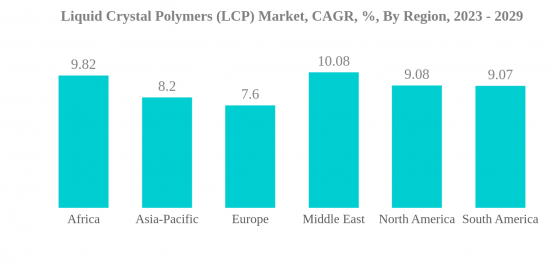

- 中東是一個快速發展的地區。 預測期內,電子產品產量預計將保持約8.7%的複合年增長率,其中中東預計將成為增長最快的地區。

液晶聚合物(LCP)市場趨勢

電子行業技術創新步伐加快,市場需求拉動

- 液晶聚合物 (LCP) 具有多種特性,包括抗蠕變性、耐化學性、抗衝擊性和耐磨性。 LCP還具有高介電性能和機械強度,這就是它廣泛應用於電子、航空航天和工業機械行業的原因。 2022年LCP市場佔全球工程塑料收入的0.65%。

- 2022 年 LCP 樹脂的最大消費者是電氣和電子行業。 消費電子產品中使用高強度、輕質材料的趨勢不斷增加,預計將推動對 LCP 樹脂的需求。 預計到2023年底,全球消費電子行業收入將達到1.1萬億美元,到2027年每年增長2.17%。

- 到 2022 年,工業機械行業將成為全球第二大 LCP 樹脂消費國。 疫情後快速城市化趨勢的增強以及機床和結構設備的海外出口復蘇推動了2022年工業機械產量的增長,導致LCP樹脂消費量大幅增加。 2022年全球LCP市場工業機械領域價值同比增長19.20%。

- 就收入而言,航空航天業是增長最快的最終用戶行業。 按價值計算,預測期內的複合年增長率預計為 9.11%,這是由於飛機零部件產量增加,以滿足對輕量化和省油飛機不斷增長的需求,導致未來 LCP 的消耗增加。被認為是為了 航空航天業生產收入預計到 2029 年將達到 7230 億美元,而 2022 年將達到 4660 億美元。

亞太地區將在未來幾年主導全球 LCP 市場

- 液晶聚合物 (LCP) 在亞太地區、北美和南美等地區廣泛用於各種應用,包括暴露在高溫下的薄壁精密零件。 LCP 的一些主要應用是最終用戶行業,例如汽車、電氣/電子和工業機械。 2022年液晶聚合物(LCP)佔全球工程塑料市場銷售份額的0.65%。

- 2022 年亞太地區的價值同比增長 3.70%。 這是由電氣/電子行業和汽車行業推動的,這兩個行業分別佔這些最終用戶行業對 LCP 的全球需求的 75.96% 和 69.59%。 由於採用在家工作模式的公司和設立家庭辦公室的人們對技術、遊戲機和電子設備的需求增加,LCP 的全球市場可能會擴大。

- 2022 年,北美是 LCP 消費者的第二大地區,銷售份額為 14.27%。 該地區在汽車和電子等工業領域的最終用戶應用數量最多,因此佔據了全球LCP消費量的壓倒性份額。 例如,到2022年,該地區佔全球汽車產量的份額將為10.09%,電子元件產量的份額將為9.92%。

- 在電氣和電子行業的推動下,非洲是增長第二快的地區,預計 2023 年的價值將比 2022 年增長 9.82%。 韓國領先的電氣和電子品牌在非洲站穩了腳跟,其中三星占據了智能手機市場35%的份額。 三星是埃塞俄比亞和蘇丹機電產品製造和組裝的主要投資者。

液晶聚合物 (LCP) 行業概覽

液晶聚合物(LCP)市場高度整合,前五名企業佔比80.34%。 該市場的主要參與者包括(按字母順序排列)塞拉尼斯公司、大賽璐公司、深圳沃特高新材料、索爾維和住友化學。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第 2 章報告要約

第 3 章簡介

- 研究假設和市場定義

- 調查範圍

- 調查方法

第 4 章主要行業趨勢

- 最終用戶趨勢

- 監管框架

- 價值鍊和分銷渠道分析

第 5 章市場細分

- 最終用戶行業

- 航空航天

- 汽車

- 電氣/電子

- 工業/機械

- 其他最終用戶行業

- 地區

- 非洲

- 按國家/地區

- 尼日利亞

- 南非

- 其他非洲

- 亞太地區

- 按國家/地區

- 澳大利亞

- 中國

- 印度

- 日本

- 馬來西亞

- 韓國

- 其他亞太地區

- 歐洲

- 按國家/地區

- 法國

- 德國

- 意大利

- 俄羅斯

- 英國

- 歐洲其他地區

- 中東

- 按國家/地區

- 沙特阿拉伯

- 阿拉伯聯合酋長國

- 其他中東地區

- 北美

- 按國家/地區

- 加拿大

- 墨西哥

- 美國

- 南美洲

- 按國家/地區

- 阿根廷

- 巴西

- 南美洲其他地區

- 非洲

第 6 章競爭態勢

- 主要戰略趨勢

- 市場份額分析

- 公司情況

- 公司簡介

- Celanese Corporation

- Daicel Corporation

- Kingfa SCI. & TECH. CO., LTD.

- Ningbo Jujia New Material Technology Co., Ltd

- Shanghai PRET Composite Material Co., Ltd.

- Shenzhen WOTE Advanced Materials Co.,Ltd.

- Solvay

- Sumitomo Chemical Co., Ltd.

- TORAY INDUSTRIES, INC.

- UENO FINE CHEMICALS INDUSTRY, LTD.

第 7 章首席執行官面臨的關鍵戰略問題

第 8 章附錄

簡介目錄

Product Code: 47397

The Global Liquid Crystal Polymer (Lcp) Market size is expected to grow from 65.52 kilo metric tons in 2023 to 83.74 kilo metric tons by 2028, at a CAGR of 5.03% during the forecast period.

Key Highlights

- Electrical and Electronics is the Largest End User Industry. Composites of LCP are majorly used in the electronics industry due to rapid innovation, their dielectric properties, and their chemical resistance. Thus, the industry occupied the highest share.

- Aerospace is the Fastest-growing End User Industry. LCP is adopted in microelectronics in the aerospace industry. Thus, the segment is anticipated to witness the fastest growth in the market.

- Asia-Pacific is the Largest Region. Asia-Pacific is majorly driven by emerging economies such as China, India, Japan, and South Korea. Its electronics industry is expected to witness a CAGR of 6.63%, making Asia-Pacific the largest region in the market.

- Middle East is the Fastest-growing Region. With electronics production expected to register a faster CAGR of around 8.7% during the forecast period, the Middle East is projected to be the fastest-growing region.

Liquid Crystal Polymers (LCP) Market Trends

RAPID PACE OF TECHNOLOGICAL INNOVATIONS IN THE ELECTRONICS INDUSTRY TO BOOST MARKET DEMAND

- Liquid crystal polymers (LCP) exhibit versatile properties like resistance to creep, chemicals, impact, and abrasion. LCPs also have high dielectric and mechanical strength, due to which they are used widely in the electronics, aerospace, and industrial machinery industries. The LCP market accounted for 0.65% of the revenue of global engineering plastics in 2022.

- The electrical and electronics industry was the largest consumer of LCP resins in 2022. The rising trend of using high-strength and lightweight materials in consumer electronics is expected to drive the demand for LCP resin. Revenue of the global consumer electronics industry is projected to reach USD 1.10 trillion by the end of 2023 and grow annually by 2.17% till 2027.

- The industrial machinery industry was the second-largest consumer of LCP resin globally in 2022. The growing trends of rapid urbanization and restoration of offshore exports for machine tools and structural equipment post-pandemic boosted the production of industrial machinery in 2022, resulting in a surge in the consumption of LCP resins. The industrial machinery segment of the global LCP market witnessed a growth of 19.20% by value in 2022 compared to the previous year.

- The aerospace industry is the fastest-growing end-user segment in terms of revenue. It is expected to witness a CAGR of 9.11% by value during the forecast period, which can be attributed to the increased production of aircraft components to cater to the growing demand for lighter and more fuel-efficient aircraft that will increase the consumption of LCP in the future. Aerospace production revenue is expected to reach USD 723 billion by 2029 compared to USD 466 billion in 2022.

ASIA-PACIFIC REGION TO DOMINATE THE GLOBAL LCP MARKET OVER THE COMING YEARS

- Liquid crystal polymers are extensively used for various applications, such as in thin-walled high-precision parts exposed to high heat, in regions such as Asia-Pacific, North America, and South America. Some of LCP's key applications are in the automotive, electrical and electronic, and industrial machinery end-user industries. Liquid crystal polymers accounted for a 0.65% share of the global engineering plastics market in 2022 by revenue.

- Asia-Pacific witnessed a 3.70% growth in value in 2022 over the previous year. This could be attributed to the electrical and electronics and automotive industries, which accounted for value shares of 75.96% and 69.59%, respectively, of the global demand for LCP from these end-user industries. With an increase in the demand for technology, gaming consoles, and electronic devices due to companies adopting work-from-home models and people setting up home offices, the global LCP market is likely to increase.

- In 2022, North America was the second-largest regional consumer of LCP, with a share of 14.27% by revenue. The region holds a predominant share in the global consumption of LCP as it accounts for the highest number of end-user applications in industry segments such as automotive and electronics. For example, the region accounted for a 10.09% share of global vehicle production and a 9.92% share of global electronic component production in 2022.

- Africa is the second fastest-growing region, and it is expected to grow by 9.82% by value in 2023 compared to 2022, led by the electrical and electronics industry. The major South Korean electrical and electronics brands have a strong foothold in Africa, with Samsung accounting for 35% of the smartphone market. Samsung is the leading investor in the manufacturing and assembly of electronic machinery goods in Ethiopia and Sudan.

Liquid Crystal Polymers (LCP) Industry Overview

The Liquid Crystal Polymers (LCP) Market is fairly consolidated, with the top five companies occupying 80.34%. The major players in this market are Celanese Corporation, Daicel Corporation, Shenzhen WOTE Advanced Materials Co.,Ltd., Solvay and Sumitomo Chemical Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Electrical and Electronics

- 5.1.4 Industrial and Machinery

- 5.1.5 Other End-user Industries

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 By Country

- 5.2.1.1.1 Nigeria

- 5.2.1.1.2 South Africa

- 5.2.1.1.3 Rest of Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 By Country

- 5.2.2.1.1 Australia

- 5.2.2.1.2 China

- 5.2.2.1.3 India

- 5.2.2.1.4 Japan

- 5.2.2.1.5 Malaysia

- 5.2.2.1.6 South Korea

- 5.2.2.1.7 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 By Country

- 5.2.3.1.1 France

- 5.2.3.1.2 Germany

- 5.2.3.1.3 Italy

- 5.2.3.1.4 Russia

- 5.2.3.1.5 United Kingdom

- 5.2.3.1.6 Rest of Europe

- 5.2.4 Middle East

- 5.2.4.1 By Country

- 5.2.4.1.1 Saudi Arabia

- 5.2.4.1.2 United Arab Emirates

- 5.2.4.1.3 Rest of Middle East

- 5.2.5 North America

- 5.2.5.1 By Country

- 5.2.5.1.1 Canada

- 5.2.5.1.2 Mexico

- 5.2.5.1.3 United States

- 5.2.6 South America

- 5.2.6.1 By Country

- 5.2.6.1.1 Argentina

- 5.2.6.1.2 Brazil

- 5.2.6.1.3 Rest of South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 Daicel Corporation

- 6.4.3 Kingfa SCI. & TECH. CO., LTD.

- 6.4.4 Ningbo Jujia New Material Technology Co., Ltd

- 6.4.5 Shanghai PRET Composite Material Co., Ltd.

- 6.4.6 Shenzhen WOTE Advanced Materials Co.,Ltd.

- 6.4.7 Solvay

- 6.4.8 Sumitomo Chemical Co., Ltd.

- 6.4.9 TORAY INDUSTRIES, INC.

- 6.4.10 UENO FINE CHEMICALS INDUSTRY, LTD.

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219

![液晶聚合物 [LCP] 的全球市場(類型:溶致 LCP、熱致 LCP、盤狀柱狀 LCP、金屬致 LCP)——行業分析、規模、份額、增長、趨勢、預測,2022-2031 年](/sample/img/cover/42/1229504.png)