|

市場調查報告書

商品編碼

1273444

蛋白 A 樹脂市場 - 增長、趨勢和預測 (2023-2028)Protein A Resin Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,蛋白 A 樹脂市場預計將以 8.5% 左右的複合年增長率增長。

COVID-19 疾病的出現對大流行期間的市場增長產生了顯著影響。 這種突然爆發對生產有效診斷和高度安全的 COVID-19 治療產生了前所未有的需求。 這種情況吸引了市場參與者採用蛋白 A 樹脂生產 COVID-19 疫苗,從而影響了市場的增長。 例如,2021 年 2 月,Prepligen 與 Navigo Proteins 合作開發了一種專有純化樹脂,即 NGL COVID-19 Spike 蛋白親和樹脂。 該樹脂用於純化 COVID-19 疫苗,並用於與結合受體結合域的 SARS-CoV-2 刺突蛋白結合。 因此,這些發展對大流行期間的市場增長產生了決定性影響。 此外,預計 SARS-CoV-2 病毒突變株的出現將繼續維持對蛋白 A 樹脂的需求,從而促進預測期內的市場增長。

蛋白 A 樹脂市場的增長在很大程度上是由全球慢性病負擔的增加以及對治療慢性病的抗體療法的需求不斷增長所推動的。. 此外,蛋白A樹脂在診斷各種慢性病方面的功效也有望推動市場增長。 例如,2021 年 5 月發表的一篇 NCBI 論文提到使用低成本的熱泳適體傳感器 (TAS) 來分析血漿 EV 的癌症相關蛋白譜,而不受可溶性蛋白的干擾。它已經做到了。 這表明蛋白質分析在區分轉移性乳腺癌、非轉移性乳腺癌和健康供體 (HD) 方面具有 91.1% 的高精度。 因此,證明蛋白 A 樹脂在癌症診斷中的有效性的研究有望促進市場增長。

此外,慢性病負擔的增加也有望促進市場增長。 例如,根據 2022 年 2 月發布的 WHO 情況說明書,估計 2021 年美國將有 190 萬新診斷的癌症患者。 另據介紹,全球每年約有40萬兒童患上癌症。 宮頸癌在 23 個國家最常見,包括埃斯瓦蒂尼、印度、南非和南美洲。 還有許多癌症,例如乳腺癌、肺癌、結直腸癌和前列腺癌。

雖然有幾個因素促進了市場增長,但與蛋白 A 樹脂相關的高成本預計會在預測期內阻礙市場增長。

蛋白A樹脂市場趨勢

預計製藥和生物製藥公司將主導最終用戶領域

蛋白質分析在製藥和生物製藥行業的藥物發現和開發中發揮著非常重要的作用,因為製藥和生物製藥公司主要以蛋白質為目標。 蛋白質分析的常見應用包括目標識別和表徵、從現成的生物體液中鑑定功效和毒性生物標誌物,以及研究功效和毒性的機制。由於生物製藥項目中正在進行的大量藥物開發項目,預計將有顯著增長.

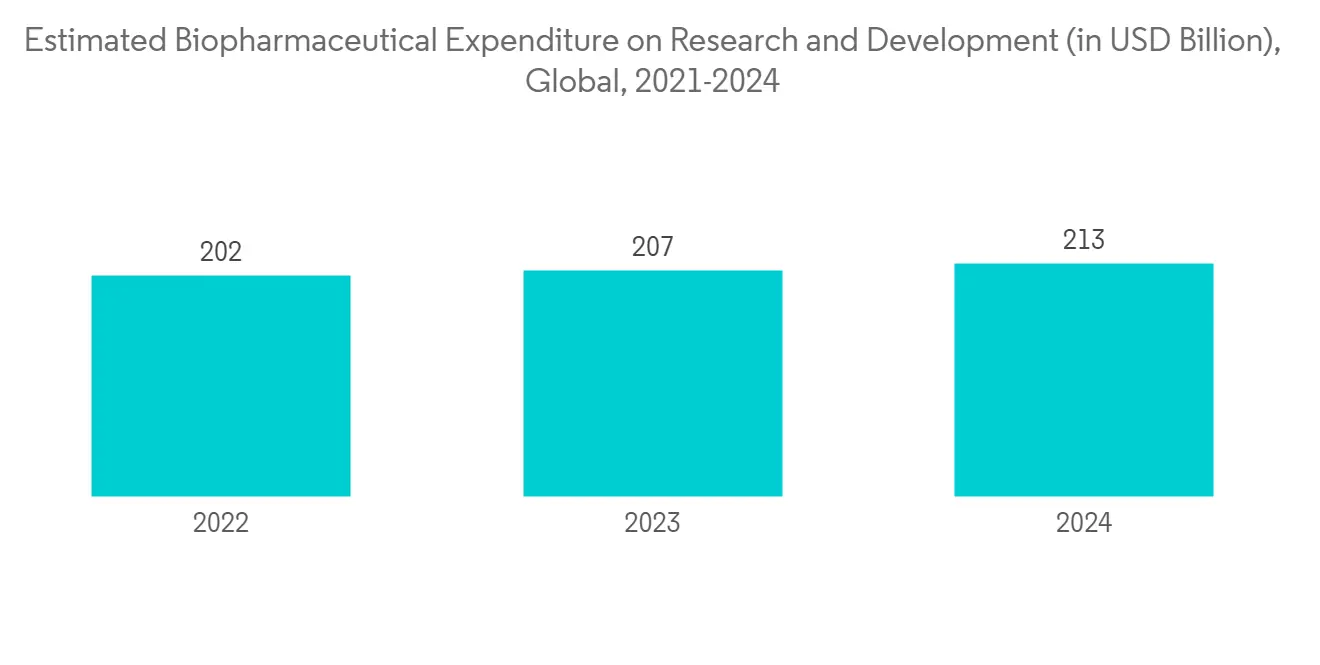

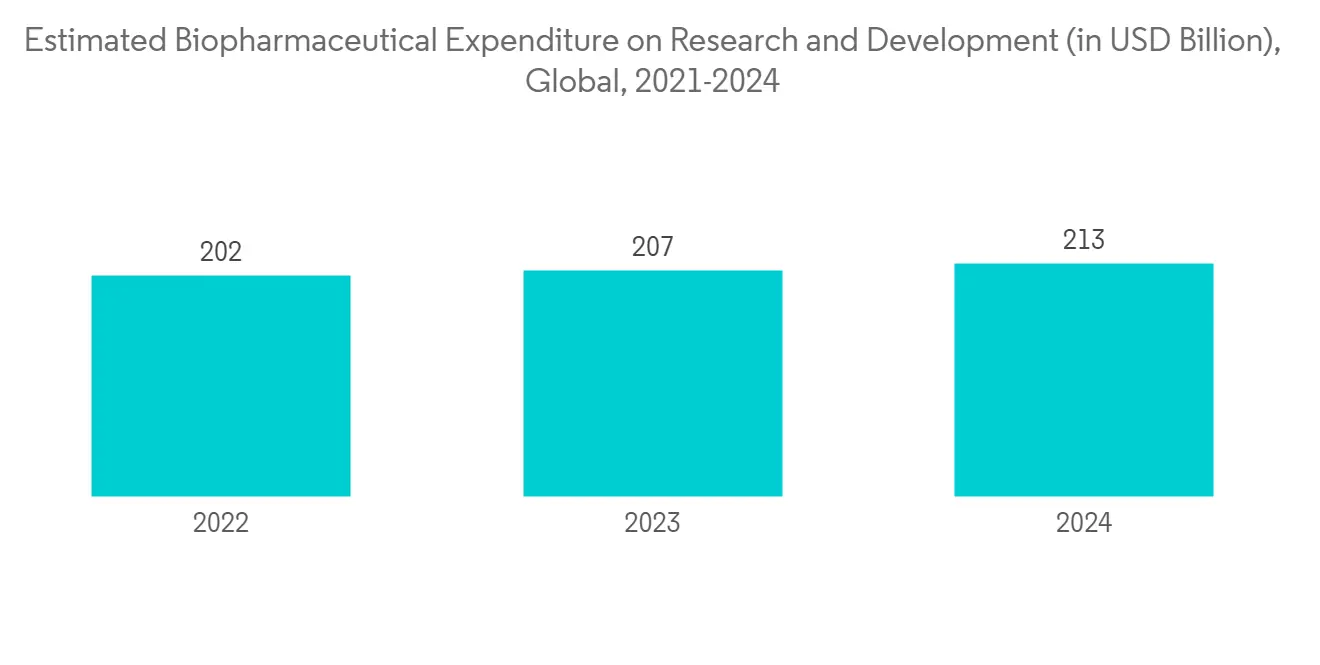

政府增加對藥物研發的資助以及分析儀器領域的技術進步預計將推動研究領域的增長。 此外,生命科學研發支出的增加、藥物發現的進展、色譜法的採用增加等是推動製藥和生物製藥行業蛋白 A 樹脂市場增長的主要因素。 例如,EFPIA 在 2022 年發布的數據中提到,2021 年歐洲製藥業的研發支出為 4150 萬歐元(4460 萬美元)。 預計如此高的醫藥支出將推動藥物開發研究和各種診斷測試對蛋白 A 樹脂的需求,從而推動研究領域的增長。

此外,為滿足製藥和生物製藥行業的需求而增加的產品發布預計也將促進市場增長。 例如,2021 年 9 月,漂萊特將推出兩款新的下一代層析樹脂 Praesto Jetted A50 HipH 和 Praesto Jetted dt 18-,以解決其包括抗體、疫苗和基因療法在內的生物分子管道的多樣性,並發布了一張 DVD。

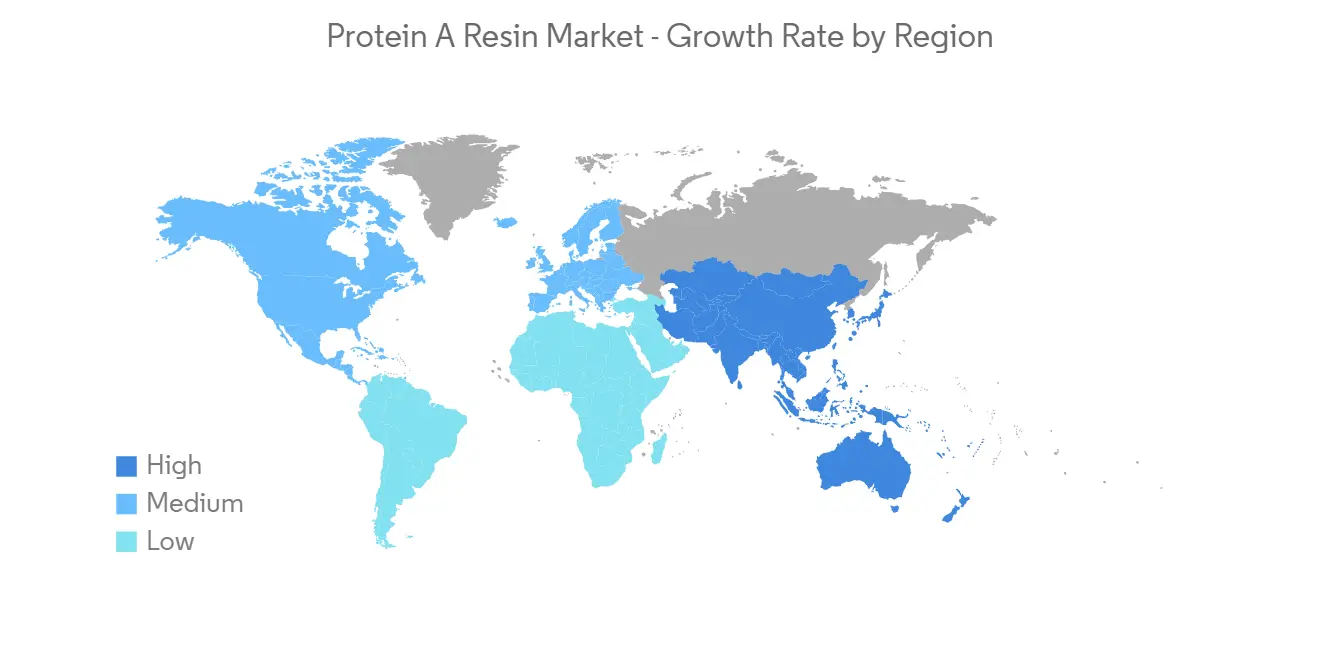

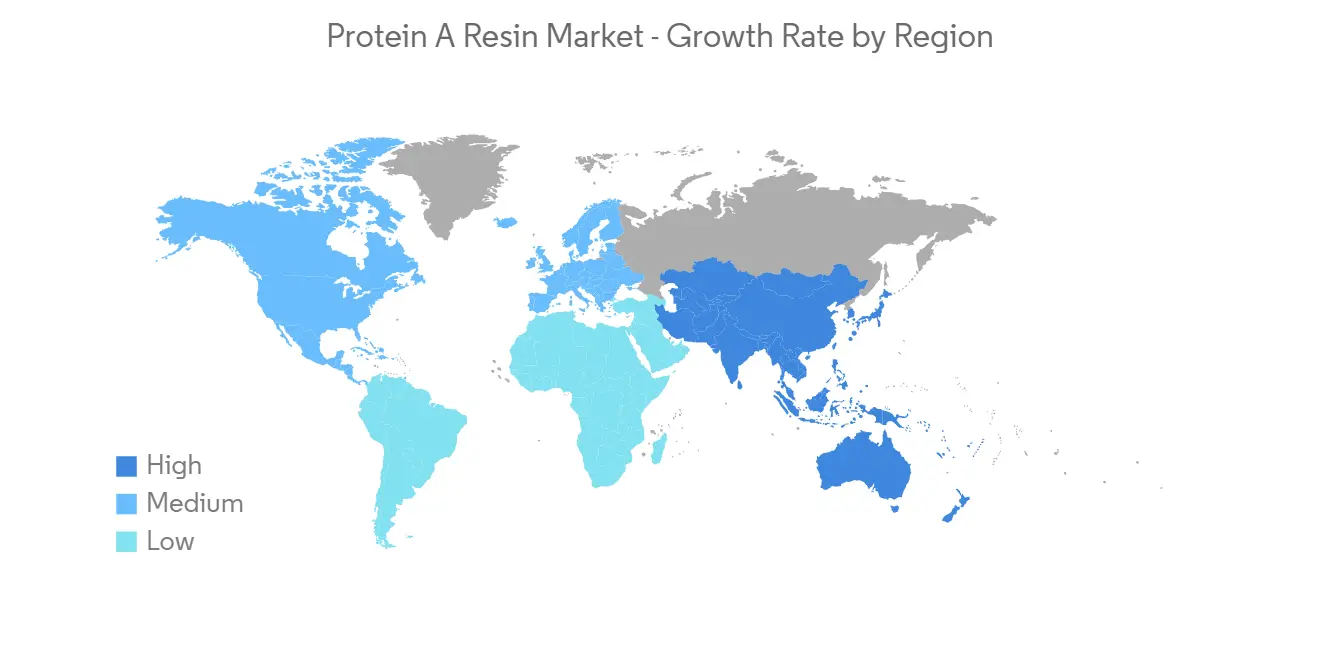

預計在預測期內北美將佔據很大的市場份額

由於傳染病和慢性病負擔加重、研究市場的技術進步以及製藥和生物研究的研發支出增加等因素,預計北美地區的蛋白 A 樹脂市場將保持良好增長.增加。 預計主要市場參與者的產品發布和戰略舉措也將有助於市場增長。

例如,根據美國癌症協會公佈的2022年數據,2021年美國估計將有190萬新診斷的癌症患者。 而根據加拿大公共衛生署2021年10月公佈的數據,約有五分之二的加拿大人一生中會被診斷出患有癌症,估計2021年將有229,000名加拿大人被診斷出患有癌症。 肺癌、乳腺癌、結直腸癌和前列腺癌仍然是最常診斷的癌症,預計到 2021 年將佔所有癌症診斷的約 46%。 北美國家慢性病患病率如此之高,預計將有助於對用於診斷目的和開發適當治療方法的蛋白 A 樹脂的需求,並促進市場增長。

另一方面,各種市場參與者增加產品發布以滿足對蛋白 A 樹脂不斷增長的需求,預計也將促進該地區的市場增長。 例如,2022 年 3 月,Sengenics 宣布了一項自身抗體分析服務——“Pan-Autoimmune Protein Array 1.0”,用於有效識別和量化自身抗體疾病生物標誌物特徵。 這是一種基於蛋白質微陣列的多重免疫測定,利用 Sengenics 的 KREX 蛋白質折疊技術和優化的計算分析。

蛋白A樹脂行業概況

蛋白 A 樹脂市場由全球參與者主導,競爭適中。 公司正在採取措施增加其在蛋白 A 樹脂市場的影響力。 預計將主導蛋白 A 樹脂市場的主要參與者是 Thermofisher Scientific Inc.、GE Healthcare、Merck KGaA、Agarose Beads Technologies、Bio-Rad Laboratories, Inc、Expedon Ltd.、Genscript Corporation、Novasep、Purolite Lifescience、Repligen。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 抗體需求增加

- 啟動藥物發現和研發活動

- 市場製約因素

- 蛋白 A 樹脂成本高

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分(市場規模、價值)

- 按產品分類

- 基於瓊脂糖的蛋白質

- 基於玻璃或二氧化矽的蛋白質

- 基於有機聚合物的蛋白質

- 通過使用

- 抗體純化

- 免疫沉澱

- 最終用戶

- 製藥和生物製藥公司

- 研究機構等

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- Agarose Beads Technologies

- Bio-Rad Laboratories, Inc.

- Expedeon Ltd.

- GE Healthcare

- Genscript Corporation

- Merck KGaA

- Novasep

- Purolite Lifesciences

- Repligen

- Thermofisher Scientific Inc.

- Tosoh Bioscience

- Kaneka Corporation

- JSR Life Sciences

第7章 市場機會與將來動向

The protein A resin market is expected to register a CAGR of around 8.5% over the forecast period.

The emergence of the COVID-19 disease had a notable impact on the growth of the market over the pandemic period. This sudden outbreak led to unprecedented demand for effective diagnostics and highly safe manufacturing of COVID-19 therapeutics. Such circumstances have lured the market players to adopt protein A resin in the manufacture of COVID-19 vaccines, thereby impacting the market growth. For instance, in February 2021, Prepligen collaborated with Navigo Proteins and developed a unique purification resin, NGL COVID-19 Spike Protein Affinity Resin. The resin is used to purify COVID-19 vaccines and is used in binding to the SARS-CoV-2 spike protein binding to the receptor binding domain. Thus, these developments have had a crucial impact on the growth of the market over the pandemic period. In addition, the demand for protein A resin is expected to remain intact due to the emergence of mutant strains of the SARS-CoV-2 virus, thereby contributing to the growth of the market over the forecast period.

The growth of the protein A resin market is majorly attributed to the increasing burden of chronic diseases across the globe and the rising demand for therapeutics for antibodies in order to treat chronic disorders. Additionally, the efficacy of protein A-resin in the diagnosis of various chronic diseases is also expected to boost the growth of the market. For instance, an NCBI article published in May 2021, mentioned that a low-cost thermophoretic aptasensor (TAS) is used to profile cancer-associated protein profiles of plasma EVs without the interference of soluble proteins. This demonstrated that protein analysis has a high accuracy of 91.1% for discrimination of metastatic breast cancer, non-metastatic breast cancer, and healthy donors (HD). Thus, studies proving the efficiency of protein A resin in cancer diagnosis are expected to contribute to the growth of the market.

Additionally, the rising burden of chronic diseases is also expected to contribute to the growth of the market. For instance, as per a WHO factsheet published in February 2022, in 2021, there were an estimated 1.9 million new cancer cases diagnosed in the United States. The report also mentioned that each year, approximately 400,000 children develop cancer globally. Cervical cancer is the most common in 23 countries such as Eswatini, India, South Africa, Latin America, and others. The most common cancers are breast, lung, colon and rectum, and prostate cancers.

While several factors contribute to the growth of the market, the high cost associated with protein A-resin is expected to impede the growth of the market over the forecast period.

Protein A Resin Market Trends

Pharmaceutical and Biopharmaceutical Companies are Expected to Dominate the End User Segment

Pharmaceutical and biopharmaceutical companies mainly use proteins as the principal target, and thus, protein analysis has a very important role in drug discovery and development in the pharma and biotech industries. The common application of protein analysis involves target identification, evaluation, identification of efficacy and toxicity biomarkers from readily accessible biological fluids, and investigations into mechanisms of drug action or toxicity, among others, which in turn is expected to grow significantly due to a large number of ongoing drug development projects in the pharmaceutical and biopharmaceutical projects across the world.

A rise in government funding for pharmaceutical research and development and technological advancements in the area of analytical instruments are expected to drive the growth of the studied segment. Also, increasing life science R&D expenditure, progressing drug discovery, and an increase in the adoption of chromatography are key factors driving the growth of the protein A resins market in the pharmaceutical and biopharmaceutical industries. For instance, the data published by EFPIA in 2022 mentioned that the research and development expenditure of the pharmaceutical industry in Europe in 2021 was EUR 41.5 million (USD 44.6 million). Such high pharmaceutical expenditures are expected to drive the demand for protein A resin in drug development research and the development of various diagnostic tests, thereby boosting the growth of the studied segment.

Additionally, increasing product launches in order to address the demand from the pharmaceutical and biopharmaceutical industries are also expected to contribute to the growth of the market. For instance, in September 2021, Purolite launched two novel next-generation chromatography resins, Praesto Jetted A50 HipH, and Praesto Jetted dt 18-DVD to address the diversity of biomolecule pipelines of antibodies, vaccines, and gene therapy.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

The market for protein A resin in the North American region is expected to experience lucrative growth owing to the factors such as the rising burden of infectious and chronic diseases, technological advancements in the studied market, and increasing research and development expenditure on pharmaceutical and biological research. In addition, the product launches and strategic initiatives by key market players will also contribute to the market growth.

For instance, according to the American Cancer Society Inc., data published in 2022, in 2021, there were an estimated 1.9 million new cancer cases diagnosed in the United States. In addition, according to the Public Health Agency of Canada data published in October 2021, approximately 2 in 5 Canadians were diagnosed with cancer in their lifetime, and in 2021, an estimated 229,000 Canadians were diagnosed with cancer. The report also mentioned that lung, breast, colorectal, and prostate cancers were expected to remain the most commonly diagnosed cancers, accounting for nearly 46% of all cancer diagnoses in 2021. Such a high prevalence of chronic diseases in North American countries is expected to contribute to the demand for protein A resin for diagnostic purposes and the development of appropriate therapies, thereby boosting the market growth.

On the other hand, the rising product launches by various market players to meet the growing demand for protein A resin is also expected to fuel the market growth in this region. For instance, in March 2022, Sengenics launched an autoantibody profiling service - the 'Pan-Autoimmune Protein Array 1.0' for efficient identification and quantitation of autoantibody disease biomarker signatures. It is a protein microarray-based, multiplexed immunoassay which utilizes Sengenics' KREX protein folding technology and optimized computational analysis.

Protein A Resin Industry Overview

The protein A resin market is moderately competitive, with a presence of mostly global companies. Companies are taking the initiative to grow their presence in the Protein A Resin market. Key players expected to dominate the Protein A Resin market are Thermofisher Scientific Inc., GE Healthcare, Merck KGaA, Agarose Beads Technologies, Bio-Rad Laboratories, Inc., Expedeon Ltd., Genscript Corporation, Novasep, Purolite Lifescience, and Repligen.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Antibodies

- 4.2.2 Increasing Number of Drug Discoveries and R&D Activities

- 4.3 Market Restraints

- 4.3.1 High Cost Associated With Protein A Resin

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size - Value in USD million)

- 5.1 By Product

- 5.1.1 Agarose -based Protein

- 5.1.2 Glass or Silica-based Protein

- 5.1.3 Organic Polymer-based Protein

- 5.2 By Application

- 5.2.1 Antibody Purification

- 5.2.2 Immunoprecipitation

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biopharmaceutical Companies

- 5.3.2 Research Laboratories

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Agarose Beads Technologies

- 6.1.2 Bio-Rad Laboratories, Inc.

- 6.1.3 Expedeon Ltd.

- 6.1.4 GE Healthcare

- 6.1.5 Genscript Corporation

- 6.1.6 Merck KGaA

- 6.1.7 Novasep

- 6.1.8 Purolite Lifesciences

- 6.1.9 Repligen

- 6.1.10 Thermofisher Scientific Inc.

- 6.1.11 Tosoh Bioscience

- 6.1.12 Kaneka Corporation

- 6.1.13 JSR Life Sciences