|

市場調查報告書

商品編碼

1273375

鐵粉市場 - 增長、趨勢和預測 (2023-2028)Iron Powder Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

在預測期內,全球鐵粉市場預計將以超過 4% 的複合年增長率增長。

主要亮點

- COVID-19 對 2020 年的市場產生了負面影響。 不過,預計市場將在2022年達到疫情前的水平,並繼續保持穩定增長。

- 汽車行業對鐵粉的需求不斷增長預計將在預測期內推動市場。 另一方面,高製造成本預計會阻礙市場增長。

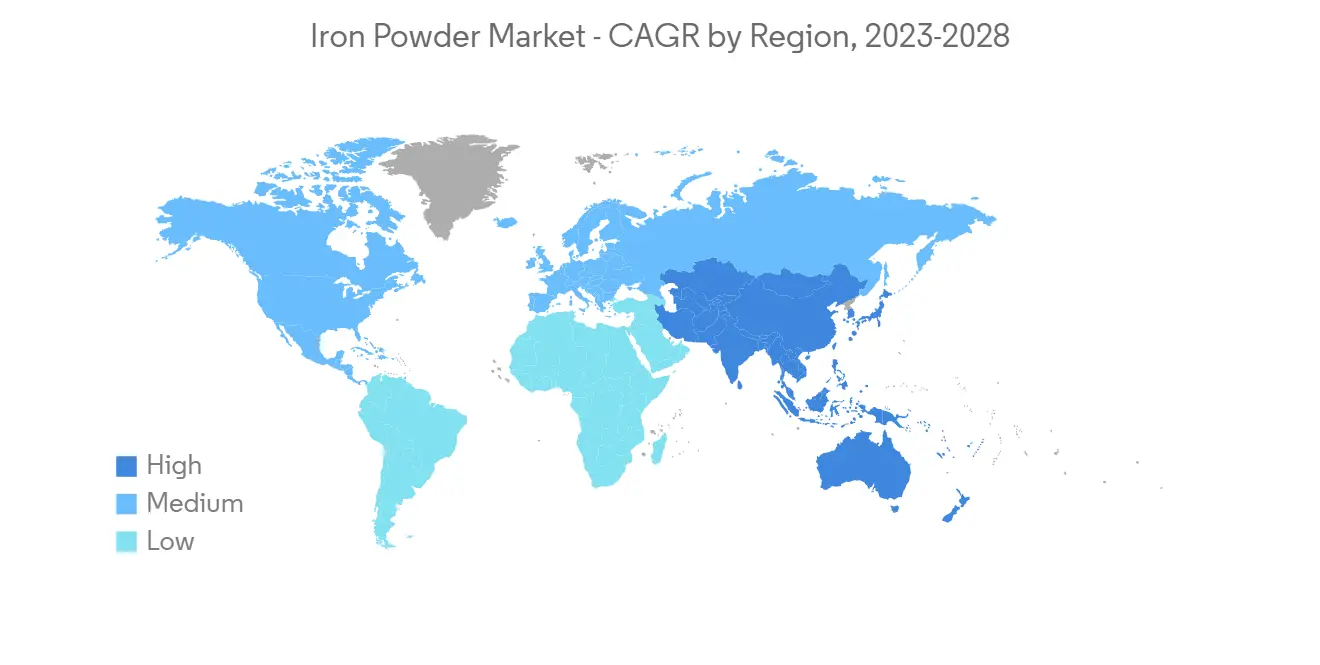

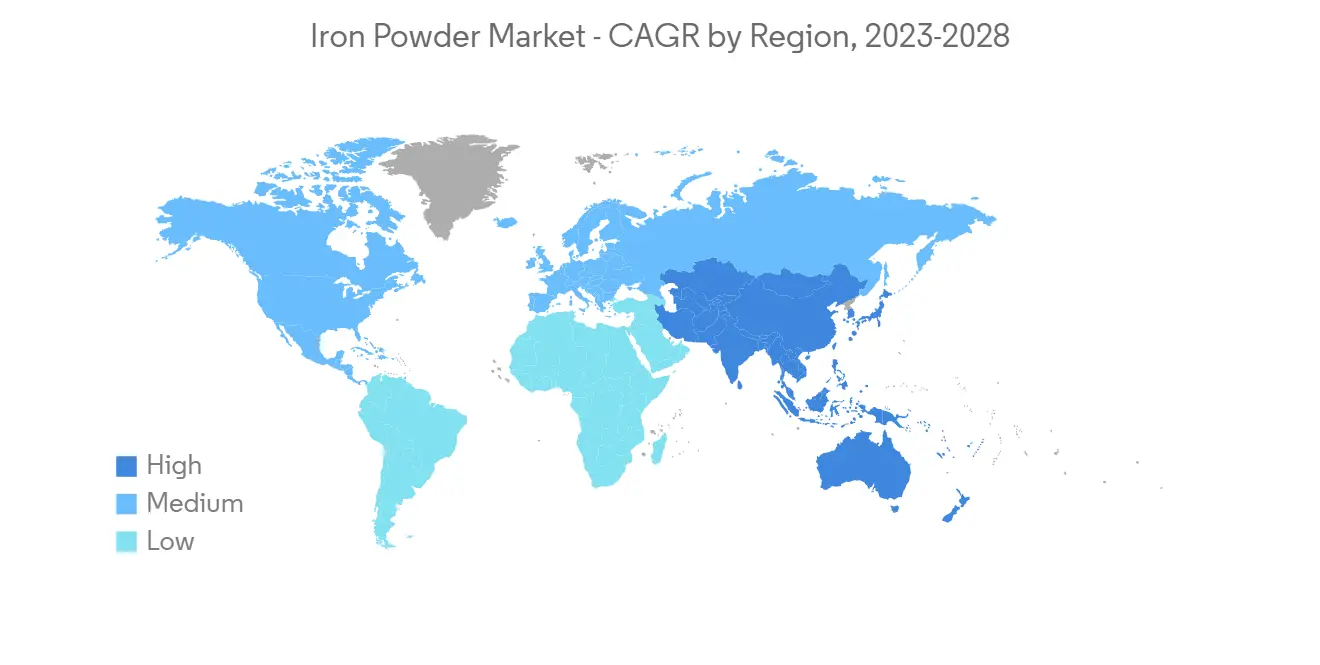

- 作為工業化石燃料的可持續替代品,鐵粉越來越受歡迎,預計這將帶來市場機遇。 亞太地區主導著全球市場,中國、印度和日本等國家的消費量最大。

鐵粉市場趨勢

汽車行業的高需求

- 鐵粉是由各種鐵顆粒形成的。 鐵粉的粒徑從 20 到 200 微米不等。 鐵粉有還原鐵粉、霧化鐵粉、電解鐵粉三種。 鐵粉的主要用途是汽車零部件。 鐵粉用作摩擦材料的填料,例如汽車零部件製造商 (OEM) 和售後市場的剎車片和離合器。

- 它還廣泛用於製造變速箱和發動機應用中常見的燒結零件。 預計中國汽車工業的擴張將有利於鐵粉的需求。 根據國際汽車製造商協會 (OICA) 的數據,中國是最大的汽車生產國。 2021 年僅中國就將生產 26,082,220 輛汽車。

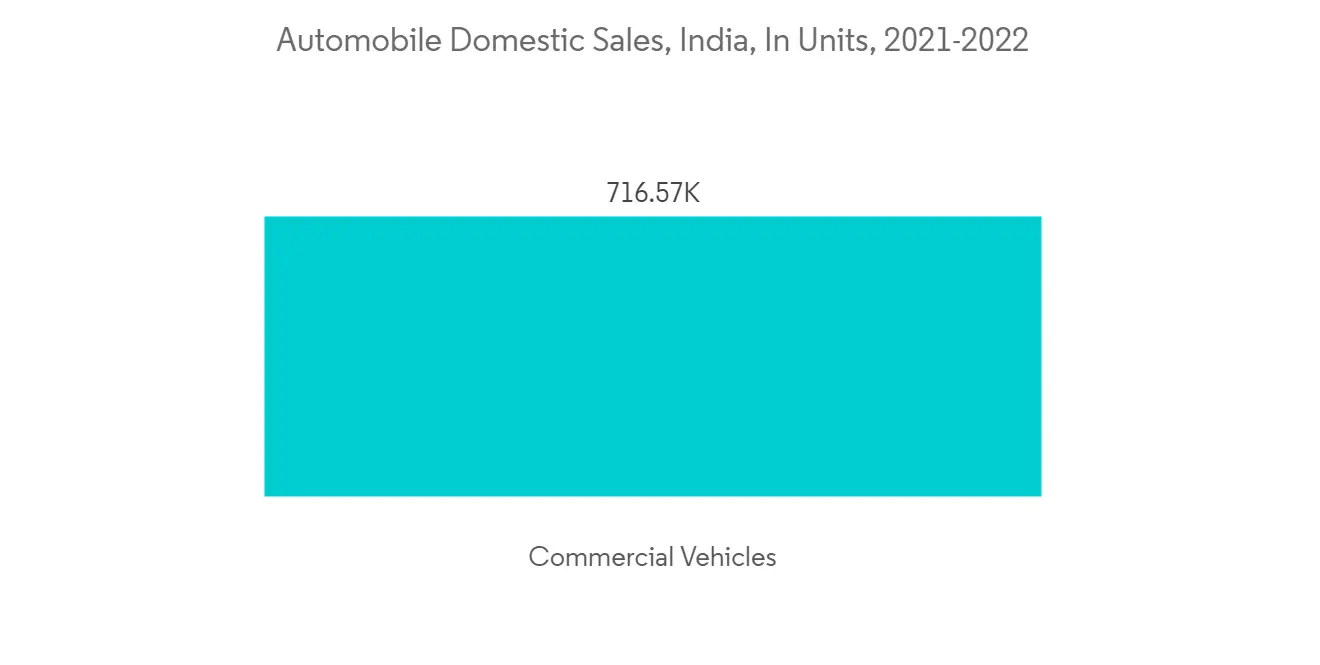

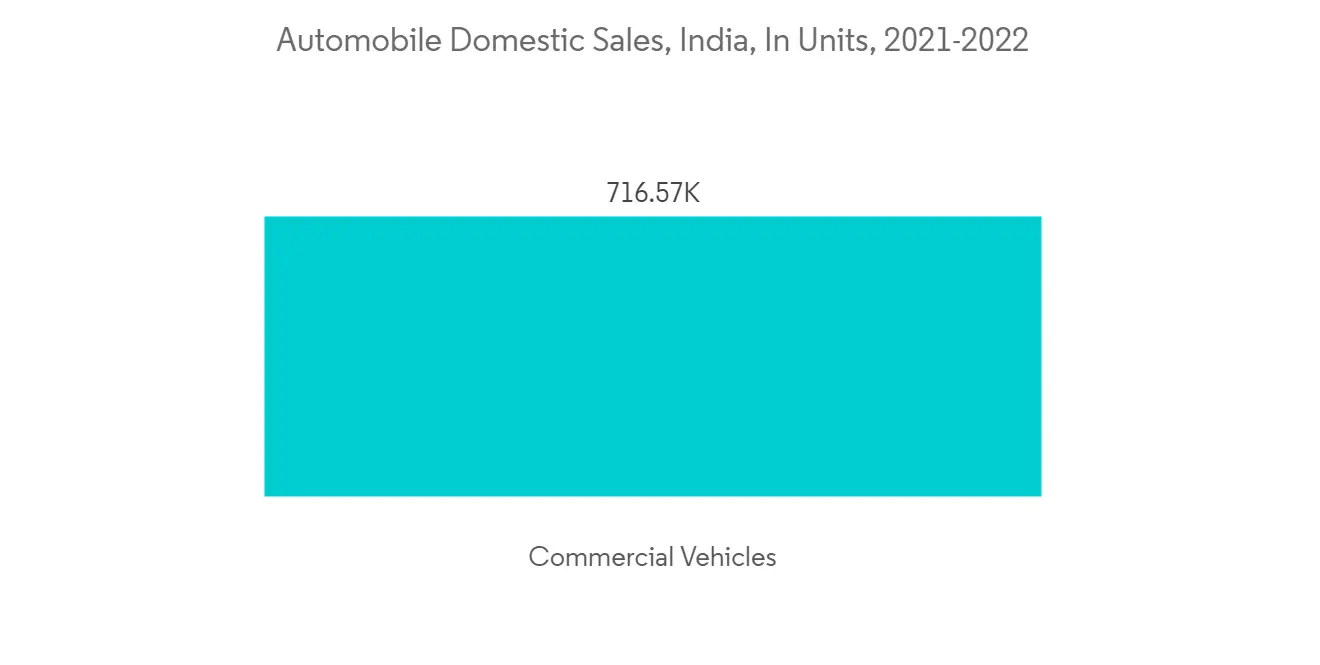

- 在印度,乘用車和商用車的銷量大幅增長。 例如,2021-2022年國內乘用車銷量為3,069,499輛,較2020-21年增長13%。

- 此外,該國生產的乘用車數量顯著增加。 例如,根據印度汽車製造商協會(SIAM)發布的最新數據,2021-2022 年乘用車產量將達到 3,650,698 輛,較 2020-21 年增長 19%。

- 因此,隨著汽車行業的擴張,在預測期內對鐵粉的需求將隨之增加。

亞太地區主導鐵粉市場

- 過去幾年,亞太地區一直是最大的鐵粉市場。 亞太地區各國不斷發展的汽車工業正在推動對該市場的研究。 人口快速增長和可支配收入增加是推動該地區汽車需求的兩個主要原因。

- 鐵粉在汽車行業中用於製造各種零部件,例如軸承、齒輪、凸輪軸皮帶輪和曲軸鏈輪。 此外,在結構件的製造中,鐵粉用於切割和焊接等操作。

- 根據中國汽車工業協會 (CAAM) 的數據,2022 年 12 月,中國的新電動汽車 (NEV) 產量與去年同月相比增長了 96.9%。 如此一來,電動汽車市場的擴大有望增加對鐵粉的需求。

- 此外,馬來西亞和菲律賓等國家/地區的摩托車和踏板車產量顯著增加。 例如,菲律賓2021年將生產867,453輛摩托車和踏板車,比2020年增長32%。 因此,我們正在積極推動市場的增長。

- 因此,隨著該地區汽車、冶金和其他幾個行業的擴張,鐵粉的需求預計將大幅增加。

鐵粉行業概況

全球鐵粉市場本質上是整合的。 市場上的主要參與者包括 Hoganas AB、Rio Tinto Metal Powders、Kobe Steel Ltd.、JFE Steel Corporation、Industrial Metal Powders (India) Pvt.Ltd。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 汽車行業對鐵粉的需求不斷擴大

- 其他司機

- 約束因素

- 製造成本高

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 類型

- 還原鐵粉

- 霧化鐵粉

- 電解鐵粉

- 最終用戶

- 汽車

- 化學

- 一般工業

- 食物

- 其他最終用戶

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 意大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- American Elements

- Ashland

- ATI

- BASF SE

- Belmont Metals

- CNPC POWDER

- Hoganas AB

- INDUSTRIAL METAL POWDERS(INDIA)PVT.LTD.

- JFE Steel Corporation

- KOBE STEEL, LTD.

- Laiwu Iron & Steel Group Lunan Mining Co Ltd

- Pometon Powder

- Rio Tinto Metal Powders

第七章市場機會與未來趨勢

- 作為工業化石燃料的可持續替代品,鐵粉越來越受歡迎

簡介目錄

Product Code: 70904

The global iron powder market is projected to register a CAGR of more than 4% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The increasing demand for iron powders from the automotive industry is expected to drive the market during the forecast period. On the other hand, the high cost of production is expected to hinder the market's growth.

- The rising popularity of powdered iron as a sustainable fuel to replace industrial fossil fuels is expected to act as a market opportunity. The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Iron Powder Market Trends

High Demand from Automotive Segment

- Iron powder is formed from various iron particles. The particle size of iron powder varies from 20-200 micrometers. Iron powder is commercially available in three types - reduced iron powder, atomized powder, and electrolyte iron powder. Iron powder serves automobile parts majorly. Iron powder is used as a filler in friction materials in automotive original equipment manufacturers (OEMs) and aftermarket brake pads and clutches.

- They are also extensively used in manufacturing sintered parts, which are common in transmission and engine applications. The expansion of the automotive segment in China is anticipated to benefit the demand for iron powders. According to the International Organization of Motor Vehicle Manufacturers (French: Organisation Internationale des Constructeurs d'Automobiles) (OICA), China is the largest producer of automobiles. The country alone produced 2,60,82,220 units of vehicles in 2021.

- Also, India witnessed a significant increase in the sales of passenger vehicles and commercial vehicles. For instance, the domestic sales of passenger vehicles were 3,069,499 for 2021-2022, representing an increase of 13% compared to 2020-21.

- Furthermore, the country witnessed a significant increase in the production of passenger vehicles. For instance, according to the latest data published by the Society of Indian Automobile Manufacturers (SIAM), the production of passenger vehicles reached 3,650,698 for 2021-2022, representing an increase of 19% compared to 2020-21.

- Thus, with expanding automotive industry, the demand for iron powders subsequently increases during the forecast period.

Asia-Pacific to Dominate the Iron Powder Market

- Asia-Pacific accounted for the largest iron powder market in the past few years. The growing automotive industry in various countries in the Asia-Pacific region is driving the market studied. Rapid population expansion and increased disposable income are two major reasons driving up demand for vehicles in the region.

- Powdered iron is used in the automotive industry to manufacture a variety of parts and components, including bearings, gears, camshaft pulleys, and crankshaft sprockets. Additionally, the fabrication of structural parts employs powdered iron for cutting, welding, and other tasks.

- According to the China Association of Automobile Manufacturing (CAAM), the country's production of new electric vehicles (NEVs) witnessed a year-on-year increase of 96.9 percent in December 2022. Thus, the expanding electric vehicle market is expected to increase the demand for iron powders.

- Furthermore, in countries such as Malaysia, the Philippines, and others, the production of motorcycles and scooters increased significantly. For instance, the Philippines produced 867,453 motorcycles and scooters in 2021, up 32% compared to 2020. As a result, it positively boosts the market growth.

- Hence, with the expanding automotive, metallurgy, and several other industries in the region, the demand for powdered iron is expected to increase significantly.

Iron Powder Industry Overview

The global iron powder market is consolidated in nature. Some of the major players in the market include Hoganas AB, Rio Tinto Metal Powders, Kobe Steel, Ltd., JFE Steel Corporation, and Industrial Metal Powders (India) Pvt.Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Iron Powders from the Automotive Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Production

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Reduced Iron Powder

- 5.1.2 Atomized Iron Powder

- 5.1.3 Electrolytic Iron Powder

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Chemical

- 5.2.3 General Industrial

- 5.2.4 Food

- 5.2.5 Other End-users

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 France

- 5.3.3.3 Germany

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Elements

- 6.4.2 Ashland

- 6.4.3 ATI

- 6.4.4 BASF SE

- 6.4.5 Belmont Metals

- 6.4.6 CNPC POWDER

- 6.4.7 Hoganas AB

- 6.4.8 INDUSTRIAL METAL POWDERS (INDIA) PVT.LTD.

- 6.4.9 JFE Steel Corporation

- 6.4.10 KOBE STEEL, LTD.

- 6.4.11 Laiwu Iron & Steel Group Lunan Mining Co Ltd

- 6.4.12 Pometon Powder

- 6.4.13 Rio Tinto Metal Powders

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Popularity of Powdered Iron as a Sustainable Fuel to Replace Industrial Fossil Fuels

02-2729-4219

+886-2-2729-4219