|

市場調查報告書

商品編碼

1273354

透明質酸□市場 - 增長、趨勢和預測 (2023-2028)Hyaluronidase Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

主要亮點

在預測期內,透明質酸□市場預計將以 8.5% 的複合年增長率增長

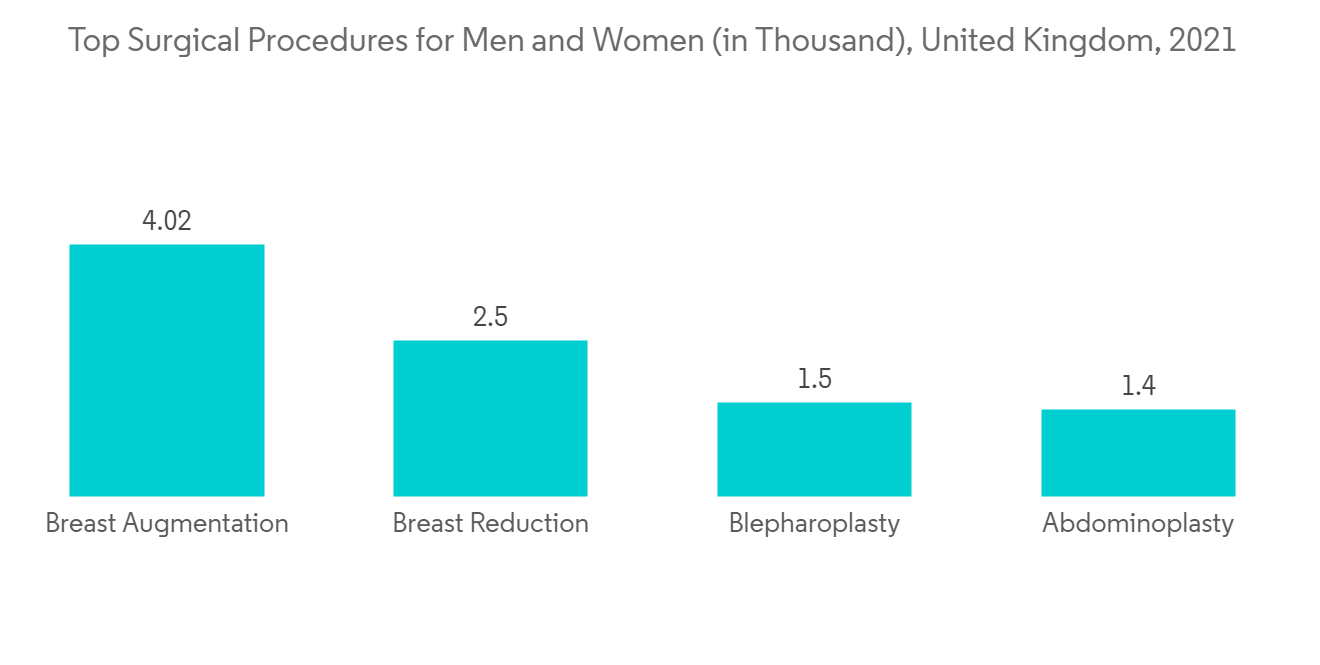

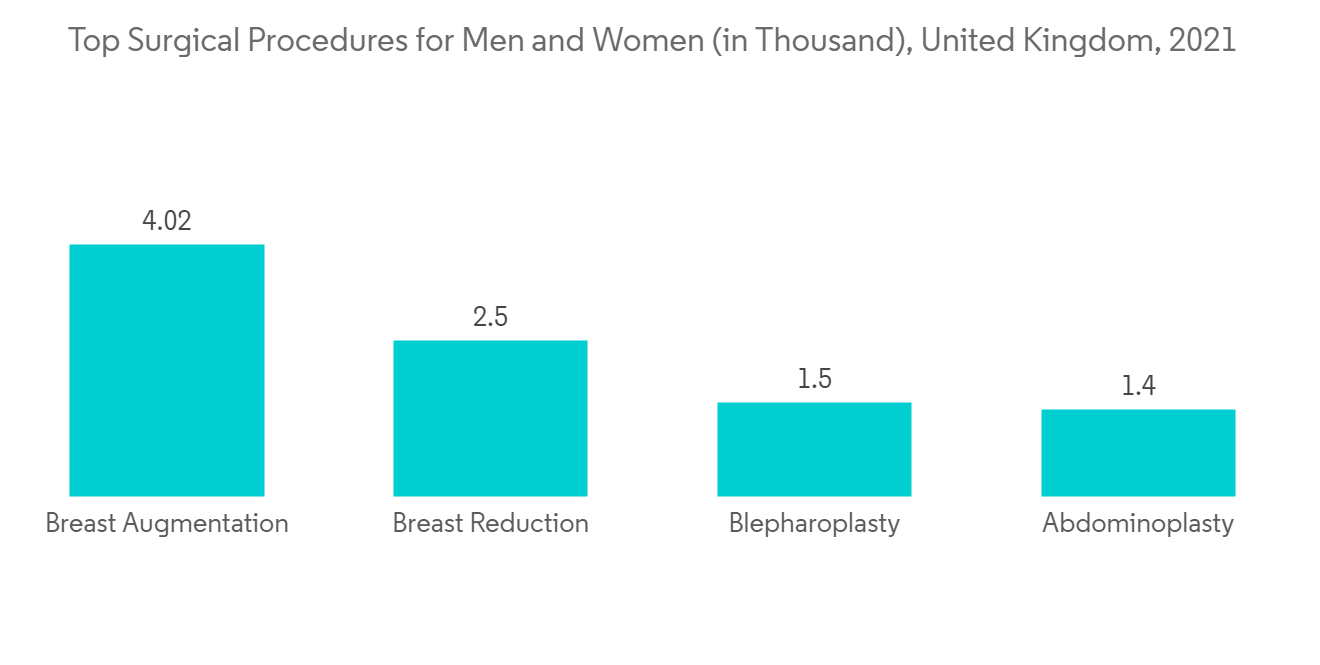

COVID-19 大流行對透明質酸□市場產生了重大影響。 例如,英國美容整形外科醫生協會 (BAAPS) 2021 年的一篇文章稱,前一年整容手術減少了 27%。 由於大多數整容手術都使用透明質酸□,可以說整容手術的減少減少了對透明質酸□的需求,從而影響了研究市場的增長。 然而,在目前的情況下,與大流行初期相比,由於 COVID-19 患者減少而恢復手術預計會增加對透明質酸□的需求。 因此,預計該市場在預測期內將出現顯著增長。

隨著越來越多的修復手術使用透明質酸□,以及越來越多的人想要微創美容治療,所調查的市場正在增長。 例如,《美容整形外科》雜誌 2022 年 12 月的一篇文章指出,透明質酸□療法可以糾正過度注射的填充劑,甚至可以溶解皮下結節。 皮膚科醫生可以使用透明質酸□來糾正和逆轉基於透明質酸的填充劑治療失敗的影響。 因此,由於這些優勢,對透明質酸□的需求不斷增加,從而推動了研究市場的增長。

隨著越來越多的人想要不需要大量手術的美容治療,市場也在不斷增長。 例如,美國整形外科醫師協會 (ASPS) 於 2022 年 2 月報告稱,2020 年美國進行了 13,281,235 例微創整容手術。 肉毒桿菌毒素仍然是最受歡迎的手術,有 440 萬,其次是軟組織填充劑(340 萬)和激光換膚(997,245)。 同一份文件還報告稱,2020 年對男性和女性進行的微創整容手術總數分別為 820,123 例和 104,290,662 例。 因此,微創手術的引入增加了對透明質酸□的需求。

此外,2021 年,全球對整容手術的需求激增。 例如,意大利製藥公司美納裡尼集團在 2021 年對印度 100 名皮膚科醫生和整形外科醫生進行的一項調查中,65% 的受訪者表示,面部整形手術是印度最受歡迎的手術。同意這是整容,自全球 COVID-19 流行病開始以來,由於希望在社交媒體上看起來漂亮,37% 的受訪者觀察到整容手術的需求增加。 因此,人們對整容手術的認識不斷提高,這增加了對透明質酸□的需求,從而推動了所研究市場的增長。

換句話說,隨著透明質酸□越來越多地用於翻修手術以及人們希望微創整容手術,預計未來幾年市場將顯著增長。 然而,透明質酸□的不利影響也可能減緩所研究市場的增長。

透明質酸□市場趨勢

動物來源的透明質酸□部分預計在預測期內將出現顯著增長。

大多數已獲批准和上市的透明質酸□品牌均來自動物。 這就是為什麼動物來源的透明質酸□具有很高的市場份額。 牛和豬是一些最廣泛使用的動物來源的透明質酸□。 Hydase (PrimaPharma)、Vitrase (Bausch & Lomb Incorporated) 和 Amphadase (Amphastar Pharmaceuticals, Inc) 是製造商生產的一些品牌。

此外,動物源性透明質酸□市場不斷湧現出許多新產品,推動了該細分市場的增長。 例如,2021 年 8 月,Meso Esthetic 開始銷售含有透明質酸的保濕液,可保持皮膚濕潤。 這些發展正在推動這一領域的增長。

此外,動物透明質酸□優於合成類型這一事實似乎也促進了所研究細分市場的增長。 根據 NCBI 於 2021 年 4 月發表的一篇論文,美國每年進行超過 107,000 次皮膚填充手術。 因此,大量的皮膚填充手術將增加對動物源性透明質酸□的需求,這將導致該細分市場的增長。

因此,動物源性透明質酸□的優勢以及大多數產品都含有動物源性透明質酸□這一事實正在推動這一細分市場的增長。

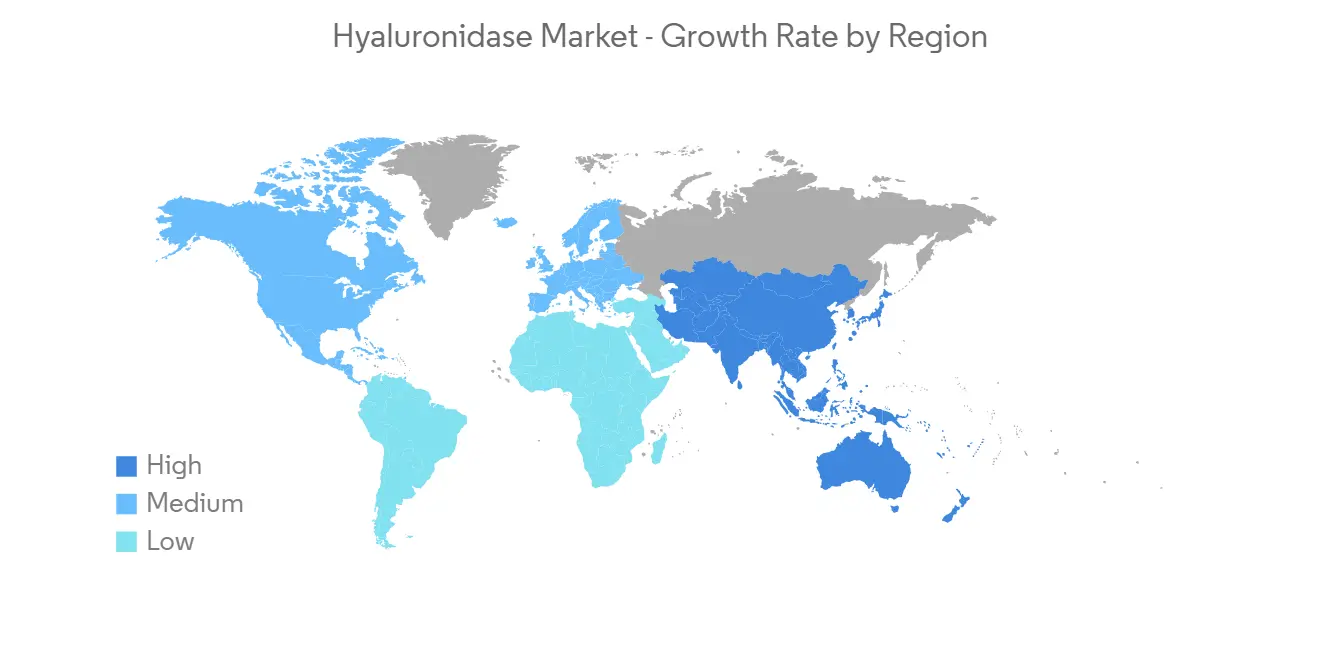

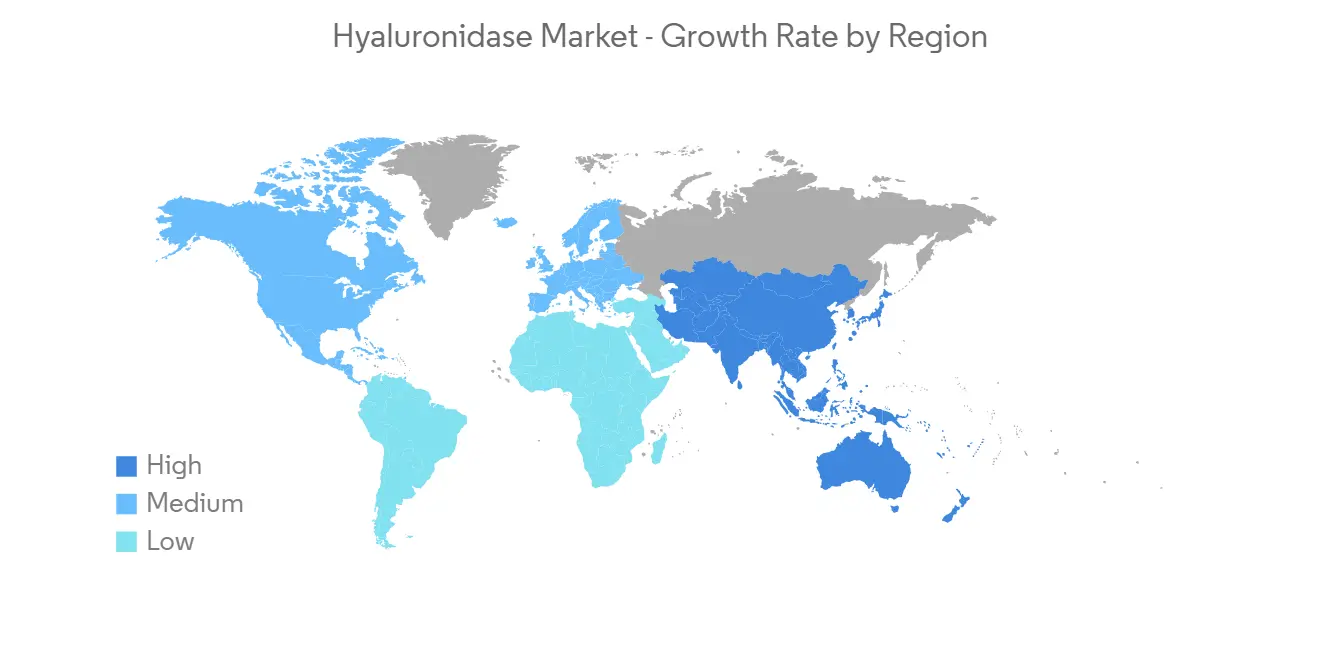

北美預計在預測期內將顯著增長。

由於生產這些產品的大公司數量眾多、進行高級治療的人數眾多以及開出這些治療處方的皮膚科診所數量眾多,預計北美在全球透明質酸□市場中佔有很大份額。 不斷上升的醫療成本和改善的醫療基礎設施也非常有利於擴大整個區域市場。

研究市場正在增長,因為越來越多的人正在接受整容手術。 例如,2022 年 1 月,美學協會宣布,到 2021 年,美國外科手術將增長 54%,非外科手術將增長 44%。 消息人士還表示,2021 年美國將進行 3,651,223 次神經毒素手術、1,857,339 次真皮填充術和 1,390,149 次皮膚治療。 因此,可以說,在美國進行的大量非手術手術增加了對透明質酸的需求,推動了該地區研究市場的增長。

同樣,美容整形外科雜誌 2021 年 9 月的一篇文章認為,乳房固定手術具有適應性,並且在墨西哥越來越受歡迎。 預計此類程序的增加將有助於未來幾年市場的增長。

此外,2022 年 3 月,致力於改善嚴重自身免疫性疾病患者生活的全球免疫公司 Argenx SE 將推出針對全身性重症肌無力 (gMG) 的皮下治療。(SC) Phase 報告了有利的頂線數據3 ADAPT-SC 試驗測試 efgartigimod (1000mg efgartigimod-PH20)。 Argenx 已向 USFDA 提交了生物製品許可申請( BLA )。 因此,透明質酸□在治療各種疾病中的應用正在推動該地區的市場增長。

因此,透明質酸□的大量應用和整容手術的盛行正在推動該地區研究市場的增長。

透明質酸□行業概況

透明質酸□市場競爭適中,由幾家主要參與者組成。 目前主導市場的公司包括 PrimaPharma, Inc.、Amphastar Pharmaceuticals, Inc.、Bausch & Lomb Incorporated、Halozyme, Inc.、Sun Pharmaceutical Industries Ltd.、Stemcell Technologies, Inc.、The Cooper Companies, Inc. Ltd.、Valeant Pharmaceuticals 、CBC Pharma 和 Genomic Solutions。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 擴大透明質酸□在矯正手術中的應用

- 對微創美容治療的需求不斷增長

- 市場製約因素

- 與透明質酸□相關的副作用

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按類型

- 動物透明質酸□

- 合成透明質酸□

- 通過使用

- 化療

- 體外受精

- 眼科

- 皮膚科

- 其他用途

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- PrimaPharma, Inc

- Amphastar Pharmaceuticals, Inc.

- Bausch & Lomb Incorporated

- Halozyme, Inc.

- Sun Pharmaceutical Industries Ltd.

- Stemcell Technologies, Inc.

- The Cooper Companies, Inc.

- Shreya Life Sciences Pvt. Ltd.

- Valeant Pharmaceuticals

- CBC Pharma

- Genomic Solutions

第7章 市場機會與將來動向

Key Highlights

During the time frame of the forecast, the hyaluronidase market is expected to register a CAGR of 8.5%.

The COVID-19 pandemic had a significant impact on the hyaluronidase market. For instance, a 2021 article by the British Association of Aesthetic Plastic Surgeons (BAAPS) stated that there was a 27% decrease in cosmetic surgical procedures in the previous year.Since most of the aesthetic surgical procedures utilize hyaluronidase, a decrease in aesthetic surgical procedures decreased the demand for hyaluronidase and thereby impacted the growth of the studied market. However, in the current scenario, it is anticipated that the resumption of surgical procedures due to the reduction of COVID-19 cases may increase the demand for hyaluronidase compared to the beginning of the pandemic. Thus, the studied market is expected to witness significant growth over the forecast period.

The studied market is growing because more and more correction procedures are using hyaluronidase and more and more people want minimally invasive cosmetic treatments.For example, a December 2022 article in the journal Aesthetic Plastic Surgery said that hyaluronidase therapy can fix fillers that were injected too much and also help dissolve subcutaneous nodules.Dermatologists can use Hyaluronidase to correct and reverse the effects of failed hyaluronic acid-based filler treatments.Thus, due to these benefits, the demand for hyaluronidase is constantly increasing, thereby driving the growth of the studied market.

The market is also growing because more and more people want cosmetic treatments that don't require a lot of surgery.For example, the American Society of Plastic Surgeons (ASPS) reported in February 2022 that 13,281,235 minimally invasive cosmetic procedures were done in the United States in 2020. Botulinum toxin remained the most popular procedure with 4.4 million procedures, followed by soft tissue filler (3.4 million) and laser skin resurfacing (997,245).The source also reported that the total minimally invasive cosmetic procedures performed on males and females in 2020 were 820,123 and 10,429,962, respectively. Thus, the adoption of minimally invasive procedures is increasing the demand for hyaluronidase.

Furthermore, there has been a surge in demand for cosmetic procedures worldwide in 2021. For instance, a survey conducted in 2021 by the Menarini Group, an Italian pharmaceutical company, among 100 dermatologists and plastic surgeons across India revealed that 65% of the respondents agreed that a facelift is the most sought-after facial aesthetic procedure in India, and 37% of the respondents have observed an increased demand for aesthetic procedures since the onset of the global COVID-19 pandemic, with the desire to look good on social media. Thus, there has been a rise in awareness among people about aesthetic procedures, which is increasing the demand for hyaluronidase and thereby driving the growth of the studied market.

So, the market is expected to grow a lot over the next few years because hyaluronidase is being used more and more in corrective procedures and because people want less invasive cosmetic treatments. But the bad effects of hyaluronidase could slow the growth of the market that was studied.

Hyaluronidase Market Trends

Animal Derived Hyaluronidase Segment is Expected to Witness Significant Growth Over the Forecast Period.

Most of the approved and sold brands of hyaluronidase come from animal sources. This is why animal-based hyaluronidase has a high market share. Bovine and porcine are some of the most widely used animal sources. Hydase (PrimaPharma), Vitrase (Bausch & Lomb Incorporated), and Amphadase (Amphastar Pharmaceuticals, Inc.) are some of the brands manufactured by manufacturers.

Also, there have been a lot of new products on the animal-derived hyaluronidase market, which has helped this segment grow.For example, in August 2021, Mesoestectic started selling a line of moisturizing solutions that contain hyaluronic acid to keep the skin hydrated.Thus, such developments are driving the growth of this segment.

Also, the fact that animal-based hyaluronidase is better than synthetic types is likely to help the studied segment grow. In the United States, more than 107,000 dermal filler surgeries are done each year, according to an article published by the NCBI in April 2021. So, a high number of dermal filler surgeries are likely to increase the need for hyaluronidase from animals, which will help this segment grow.

Therefore, the advantages of animal-based hyaluronidase and the fact that the majority of products contain animal-based hyaluronidase are driving this segment's growth.

North America is Expected to Witness Significant Growth Over the Forecast Period.

North America is expected to have a big share of the global hyaluronidase market because it has a lot of big companies that make these products, a lot of people who use advanced treatments, and a lot of dermatology clinics that prescribe these treatments. The fact that healthcare costs are rising and there is a well-established healthcare infrastructure is also very beneficial to the expansion of the regional market as a whole.

The study market is growing because more and more people are getting cosmetic surgery.For example, the Aesthetic Society said in January 2022 that in the United States, surgical procedures went up by 54% and non-surgical procedures went up by 44% in 2021. The source also said that in the United States in 2021, there would be 3,651,223 neurotoxin procedures, 1,857,339 dermal filler procedures, and 1,390,149 skin treatment procedures.So, the high number of non-surgical procedures done in the United States is increasing the demand for hyaluronidase and driving the growth of the studied market in the region.

In a similar vein, an article by Aesthetic Plastic Surgery from September 2021 claimed that mastopexy procedures were adaptable and increasing in popularity in Mexico.During the next few years, the increase in these kinds of procedures is likely to help the market grow.

Also in March 2022, Argenx SE, a global immunology company that works to improve the lives of people with severe autoimmune diseases, reported positive topline data from the Phase 3 ADAPT-SC study testing subcutaneous (SC) efgartigimod (1000 mg efgartigimod-PH20) as a treatment for generalized myasthenia gravis (gMG).Argenx submitted a biologics license application (BLA) to the USFDA. Thus, such applications of hyaluronidase in the treatment of various diseases are driving the growth of the market in the region.

As a result, the numerous applications for hyaluronidase and the prevalence of cosmetic procedures are driving the growth of the studied market in the area.

Hyaluronidase Industry Overview

The hyaluronidase market is moderately competitive and consists of a few major players. Some of the companies that are currently dominating the market are PrimaPharma, Inc., Amphastar Pharmaceuticals, Inc., Bausch & Lomb Incorporated, Halozyme, Inc., Sun Pharmaceutical Industries Ltd., Stemcell Technologies, Inc., The Cooper Companies, Inc., Shreya Life Sciences Pvt. Ltd., Valeant Pharmaceuticals, CBC Pharma, and Genomic Solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Penetration of Hyaluronidase in Correction Procedures

- 4.2.2 Rising Demand for Minimally Invasive Aesthetic Treatments

- 4.3 Market Restraints

- 4.3.1 Adverse Effects Associated With Hyaluronidases

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Animal-Derived Hyaluronidase

- 5.1.2 Synthetic Hyaluronidase

- 5.2 By Application

- 5.2.1 Chemotherapy

- 5.2.2 In Vitro Fertilization

- 5.2.3 Ophthalmology

- 5.2.4 Dermatology

- 5.2.5 Others Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PrimaPharma, Inc

- 6.1.2 Amphastar Pharmaceuticals, Inc.

- 6.1.3 Bausch & Lomb Incorporated

- 6.1.4 Halozyme, Inc.

- 6.1.5 Sun Pharmaceutical Industries Ltd.

- 6.1.6 Stemcell Technologies, Inc.

- 6.1.7 The Cooper Companies, Inc.

- 6.1.8 Shreya Life Sciences Pvt. Ltd.

- 6.1.9 Valeant Pharmaceuticals

- 6.1.10 CBC Pharma

- 6.1.11 Genomic Solutions