|

市場調查報告書

商品編碼

1273314

電活性聚合物市場 - 增長、趨勢和預測 (2023-2028)Electroactive Polymer Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計在預測期內,電活性聚合物市場的複合年增長率將超過 5%。

主要亮點

- COVID-19 對 2020 年的市場產生了負面影響。 但市場將在2022年達到疫情前水平,有望繼續穩步增長。

- 電氣和電子行業的增長預計將推動預測期內的市場增長。 然而,電活性聚合物的提取很困難並且通常對環境有害。 然而,電活性聚合物產品的不當處置會危害環境,預計會減緩市場擴張。

- 仿生和假肌肉在使用電活性聚合物治療複雜醫學問題方面的重要性與日俱增,預計這將為未來五年的電活性聚合物市場提供機會。 預計北美地區將主導全球電活性聚合物市場。

電活性聚合物的市場趨勢

執行器和傳感器主導市場

- 執行器和傳感器有望獲得優勢,因為它們廣泛用於敏感的電氣/電子和塑料部件。 這是為了防止灰塵吸附和靜電放電。 本徵導電聚合物包括聚塞吩、聚苯胺、聚□咯和聚乙炔。

- 導電聚合物因其電子導電性和相對較高的可逆離子存儲容量而被用於傳感器。 電活性聚合物允許在低電壓下進行大的機電彎曲和拉伸。 此外,柔軟靈活的結構也有助於您高效地工作。

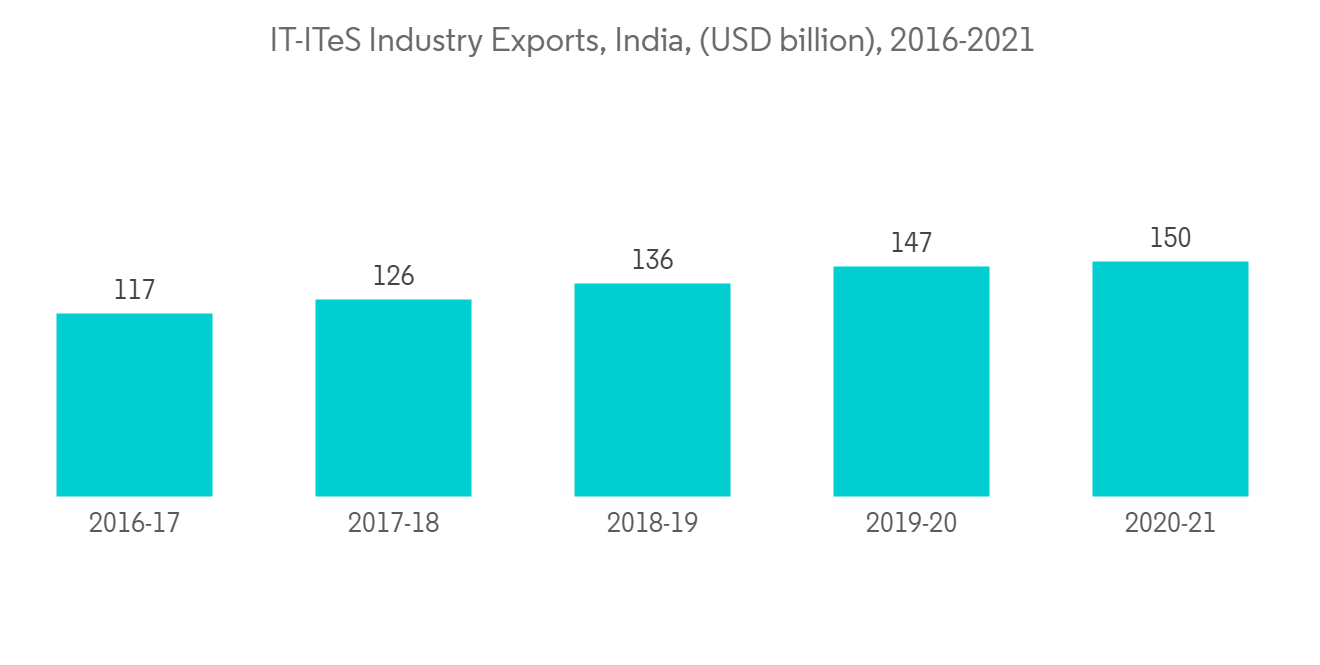

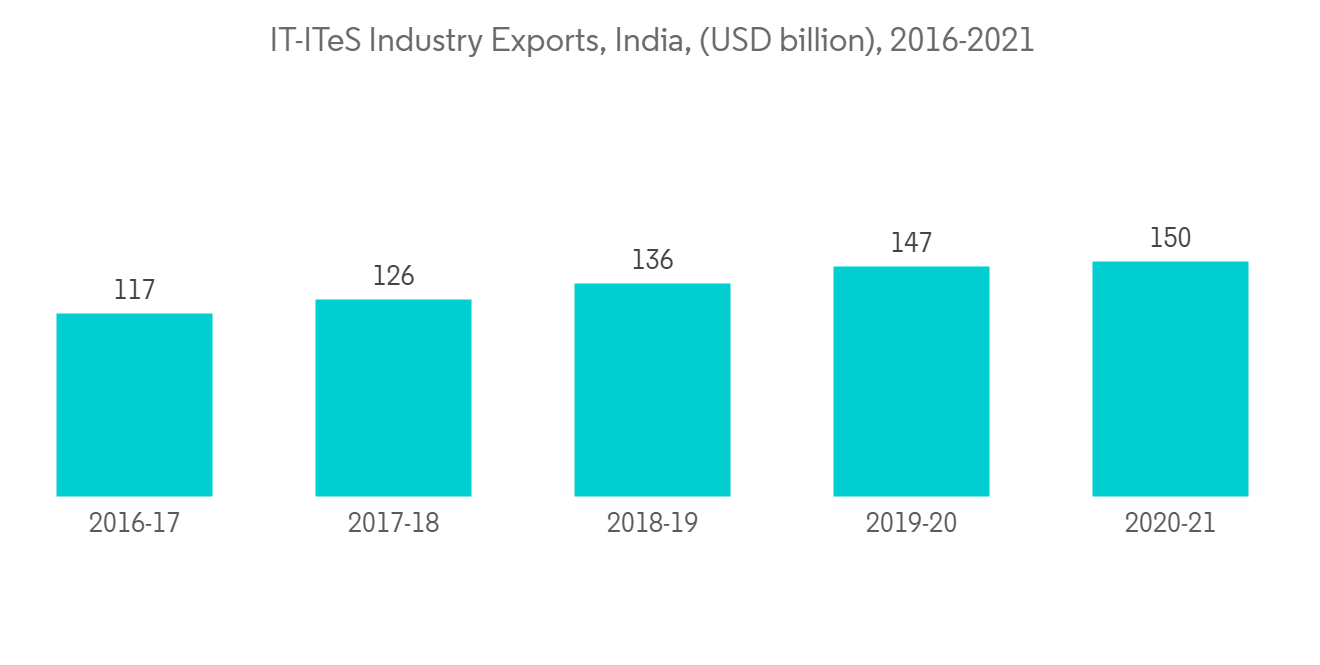

- 印度計劃到 2026 年在電氣和電子設備製造領域投資 3000 億美元,根據電子和 IT 部的“擴大和深化電子製造的行動呼籲”研究預計將在 2026 年期間使電活性聚合物市場受益預測期。

- 根據印度品牌資產基金會 (IBEF) 的數據,印度在 2022 年 9 月出口了價值 20.907 億美元的電子產品,同比增長 71.99%。 該行業的主要出口項目包括手機、消費電子產品(電視、音頻)、IT硬件(筆記本電腦、平板電腦)、工業電子產品和汽車電子產品,這些產品正在推動市場的增長。

- 上述所有因素預計將在預測期內推動電活性聚合物市場。

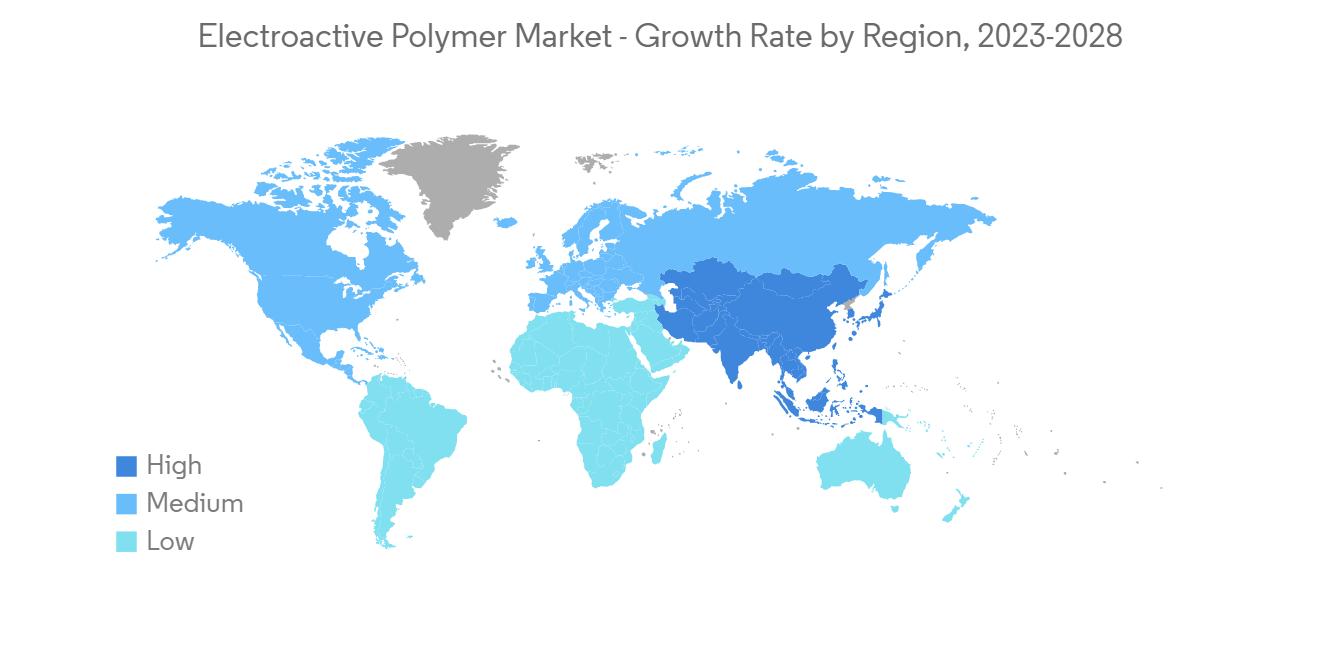

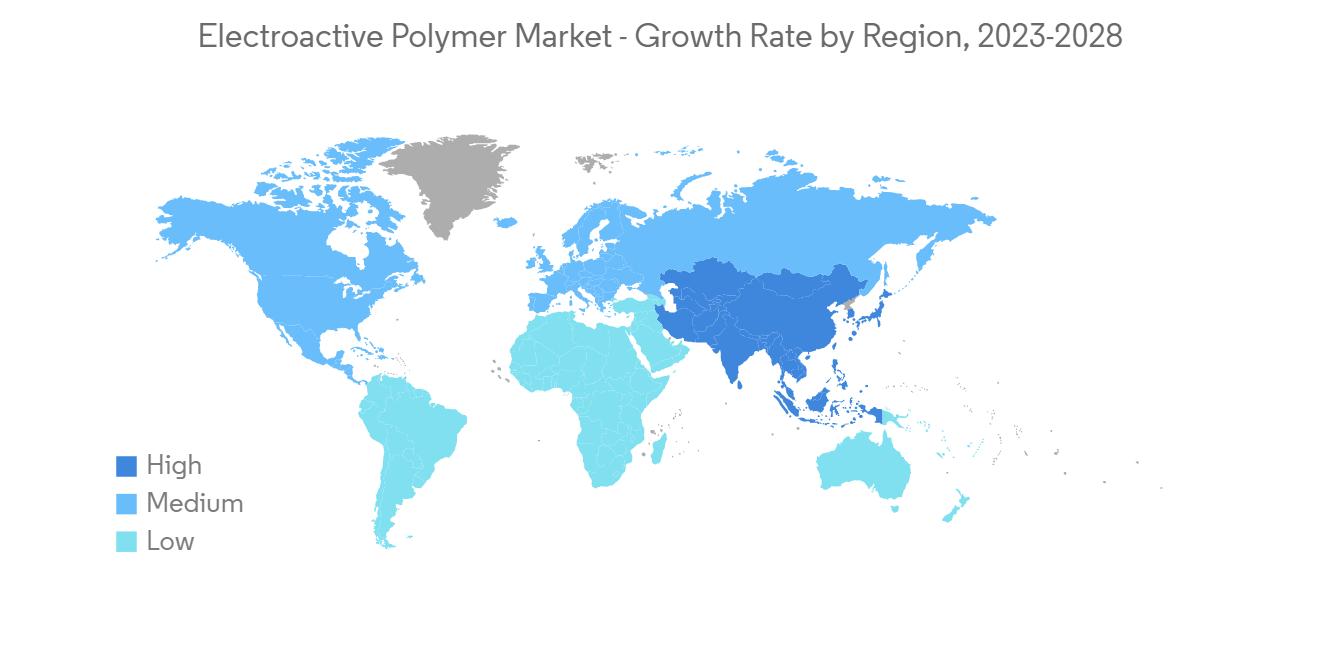

亞太地區主導市場

- 亞太地區是電活性聚合物的最大市場。 電子產品產量的增加以及消費者對日常電器和小工具小型化的偏好不斷變化等因素正在推動該地區對電活性聚合物的需求。

- 就需求而言,該地區的電子產品在消費電子市場領域的增長率最高。 隨著中產階級可支配收入的增加,對電子產品的需求預計將穩步增長,從而推動所研究的市場。

- 中國是世界上最大的電子產品製造基地。 電線、電纜、計算設備和其他個人設備等電子產品的電子產品增長最快。 在預測期內,該國將服務於一個巨大的市場,因為它滿足國內對電子產品的需求,並向其他國家出口電子產品。

- 根據中國國家統計局 (NBS) 的數據,2021 年中國電子製造業整體利潤同比增長 38.9%,這對市場增長產生了積極影響。

- 此外,根據日本電子和信息技術產業協會 (JEITIA) 的數據,日本電子行業的總產值到 2021 年將增長近 10%,達到約 1000 億美元。 該行業包括電子設備、組件、消費電子和工業電子產品。

- 因此,由於上述原因,亞太地區有望在預測期內主導所研究的市場。

電活性聚合物行業概況

全球電活性聚合物市場就其本質而言是部分整合的。 市場參與者包括 Solvay、The Lubrizol Corporation、Parker Hannifin Corp.、Premix Group 和 Arkema。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 不斷發展的電氣和電子行業

- 其他司機

- 約束因素

- 因電活性聚合物產品處置不當造成的環境損害

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 類型

- 導電塑料

- 導電聚合物

- 固有耗散聚合物

- 用法

- 執行器/傳感器

- 能源生產

- 汽車設備

- 電池

- 假肢

- 機器人

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- Parker Hannifin Corp

- PolyOne Corporation

- 3M

- Kenner Material and System Co. Ltd.

- Solvay

- The Lubrizol Corporation

- Premix Group

- Arkema

- Merck

- NOVASENTIS, INC.

- Wacker Chemie AG

第七章市場機會與未來趨勢

- 在生物信息學和人造肌肉中更多地使用電活性聚合物

簡介目錄

Product Code: 69496

The electroactive polymer market is projected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The growing electrical and electronics industry is expected to drive market growth during the forecast period. However, it is difficult to extract the electroactive polymer, and it is usually harmful to the environment. However, improper disposal of electroactive polymer products could harm the environment, which is anticipated to slow the market's expansion.

- The rising significance of biomimetic and fake muscles for handling complex medical issues using electroactive polymer will likely provide opportunities for the electroactive polymer market over the next five years. The North American region is expected to dominate the global electroactive polymer market.

Electroactive Polymer Market Trends

Actuators and Sensors to Dominate the Market

- Actuators and sensors are expected to dominate due to their wide usage in electrical and electronic components of sensitive electronics and plastic parts. This is due to their ability to prevent dust attraction and electrostatic discharge. Inherently conductive polymers include polythiophenes, polyanilines, polypyrroles, and polyacetylenes.

- Conductive polymers are used in sensors as these are electronically conductive with relatively high and reversible ion storage capacity. The usage of electroactive polymers provides large electromechanical bending at low voltages. Moreover, their soft and flexible structures also help in working efficiently.

- According to the Ministry of Electronics and IT's 'A call to action for broadening and deepening electronics manufacturing' study, India intends to generate USD 300 billion in electrical and electronics manufacturing by 2026, benefiting the market for electroactive polymers during the forecast period.

- According to India Brand Equity Foundation (IBEF), India exported USD 2,009.07 million worth of electronics in September 2022, up 71.99% year over year. Key export items in this industry include mobile phones, consumer electronics (TV and audio), IT hardware (laptops, tablets), industrial electronics, and auto electronics, supporting the market growth.

- All the aforementioned factors are expected to drive the electroactive polymer market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is the largest market for electroactive polymers. Factors such as increasing production of electronic devices and changing consumer preference towards miniaturization of daily use of consumer electronics and gadgets have been driving the electroactive polymer requirements in the region.

- Electronic products in the region have the highest growth rates in the consumer electronics segment of the market in terms of demand. With the increase in the disposable incomes of the middle-class population, the demand for electronic products is projected to increase steadily, thereby driving the market studied.

- China has the world's largest electronics production base. Electronic products, such as wires, cables, computing devices, and other personal devices, recorded the highest growth in electronics. The country serves the domestic demand for electronics and exports electronic output to other countries, thus, providing a huge market during the forecast period.

- According to the National Bureau of Statistics (NBS) of China, the overall profit of China's electronics manufacturing businesses increased by 38.9 percent year on year in 2021, thus positively impacting the market's growth.

- Furthermore, according to Japan Electronics and Information Technology Industries Association (JEITIA), the overall production value of the Japan electronics sector increased by almost 10% to around USD 100 billion in 2021. The sector includes electronic devices, components, and consumer and industrial electronic equipment.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market studied during the forecast period.

Electroactive Polymer Industry Overview

The global electroactive polymer market is partially consolidated in nature. Some of the major players in the market include Solvay, The Lubrizol Corporation, Parker Hannifin Corp., Premix Group, and Arkema, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Electrical and Electronics Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Hazard Caused by Improper Disposal of Electroactive Polymer Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Vlaue)

- 5.1 Type

- 5.1.1 Conductive Plastics

- 5.1.2 Inherently Conductive Polymer

- 5.1.3 Inherently Dissipative Polymer

- 5.2 Application

- 5.2.1 Actuators and Sensors

- 5.2.2 Energy Generation

- 5.2.3 Automotive Devices

- 5.2.4 Batteries

- 5.2.5 Prosthetics

- 5.2.6 Robotics

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Parker Hannifin Corp

- 6.4.2 PolyOne Corporation

- 6.4.3 3M

- 6.4.4 Kenner Material and System Co. Ltd.

- 6.4.5 Solvay

- 6.4.6 The Lubrizol Corporation

- 6.4.7 Premix Group

- 6.4.8 Arkema

- 6.4.9 Merck

- 6.4.10 NOVASENTIS, INC.

- 6.4.11 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Use of Electroactive Polymer for Biometric and Artificial Muscles

02-2729-4219

+886-2-2729-4219

![可拉伸和共形電子產品中電活性聚合物的全球市場:趨勢、機遇和競爭分析 [2023-2028]](/sample/img/cover/42/1272746.png)