|

市場調查報告書

商品編碼

1272666

2-乙基己醇市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)2-Ethyl Hexanol Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

在預測期內,2-乙基己醇市場的複合年增長率預計將超過 5%。

主要亮點

- COVID-19 對 2020 年的市場產生了負面影響。 不過,預計市場將在2022年達到疫情前水平,並繼續穩步增長。

- 油漆和塗料、粘合劑和建築行業對丙烯酸 2-乙基己醇的需求不斷增長,預計將在預測期內推動市場發展。 另一方面,北美和歐洲等地區對增塑劑的使用限制可能會阻礙市場擴張。

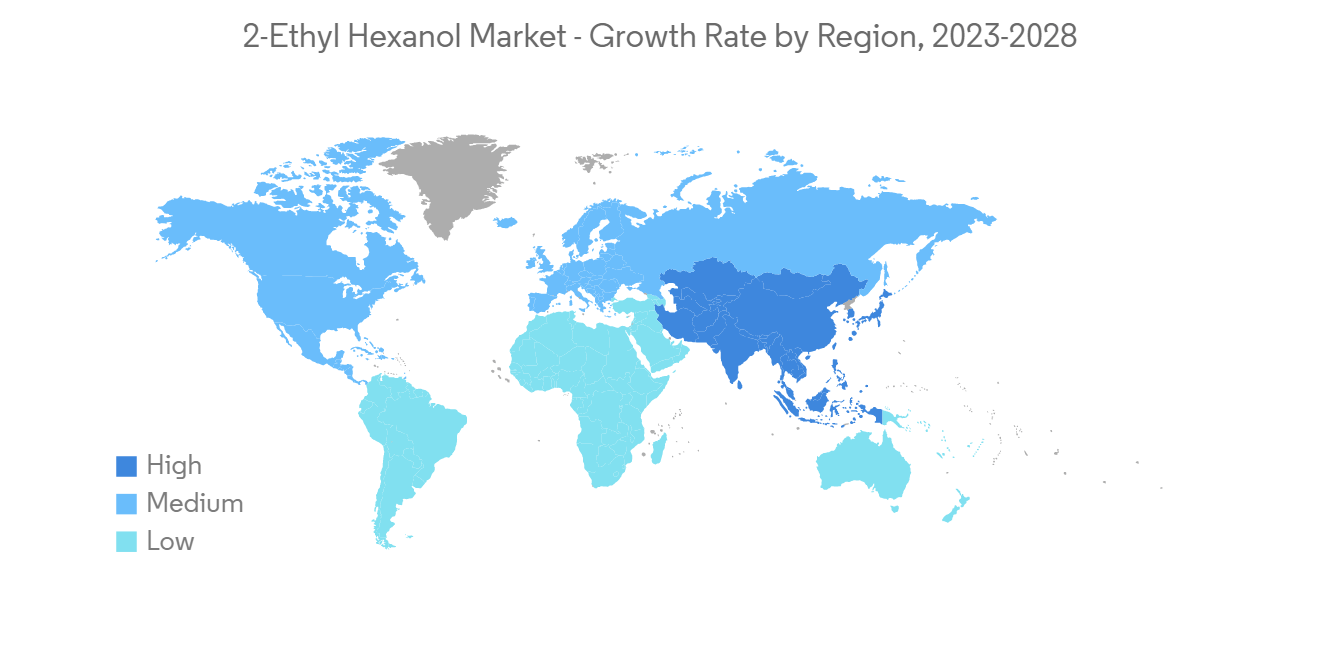

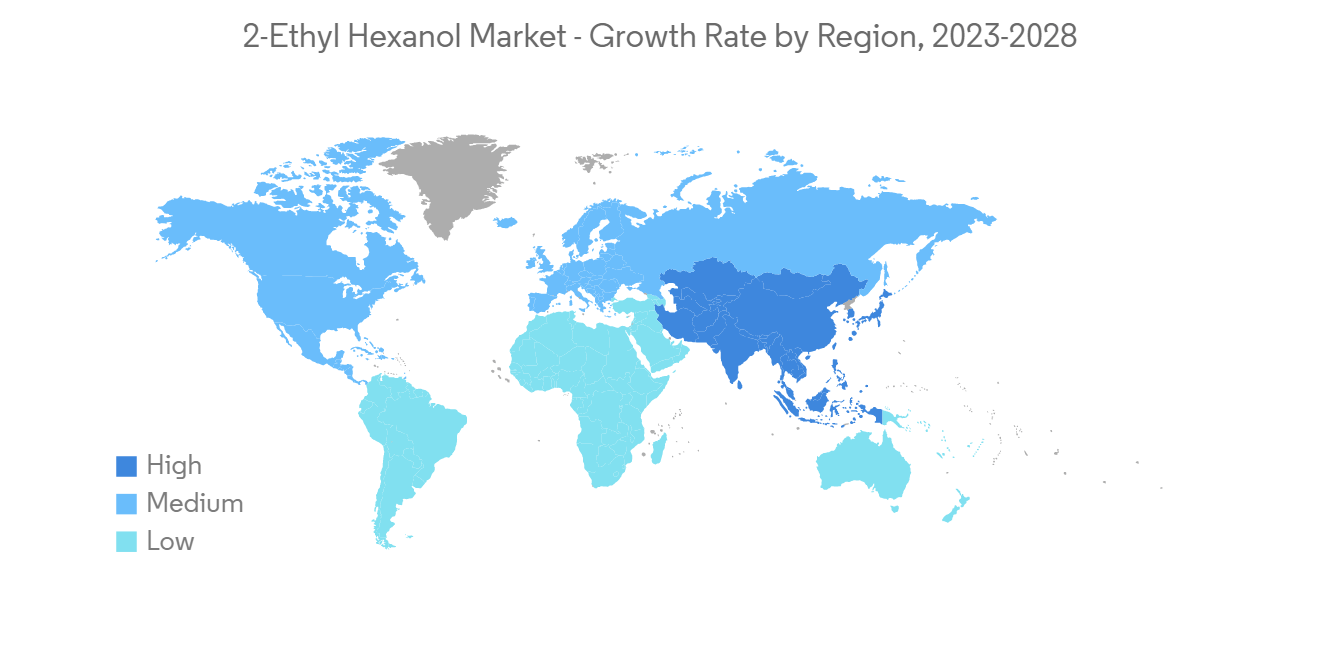

- 預計未來幾年,各行業對化學品的需求不斷增長,將為 2-乙基己醇市場帶來機遇。 亞太地區在全球市場佔據主導地位,中國、印度和日本等國家是最大的消費者。

2-乙基己醇市場走勢

對丙烯酸 2-EH 的需求增長推動了市場

- 預計在預測期內,各最終用戶行業對丙烯酸 2-乙基己酯的需求將增加市場產品需求。 2-乙基己基丙烯酸酯用於生產油漆和塗料、建築材料和粘合劑。 此外,丙烯酸 2-乙基己酯在壓敏粘合劑、乳膠、油漆、紡織品和皮革飾面以及紙張塗料的樹脂中用作增塑共聚單體。

- 由於住宅和商業建築活動的增加,全球油漆和塗料市場正在擴大,預計這將推動建築工程對丙烯酸 2-乙基己酯的需求。 例如,中國的增長主要是由住宅和商業地產的快速擴張推動的。 中國鼓勵並持續推進城鎮化進程,預計到 2030 年城鎮化比例將達到 70%。

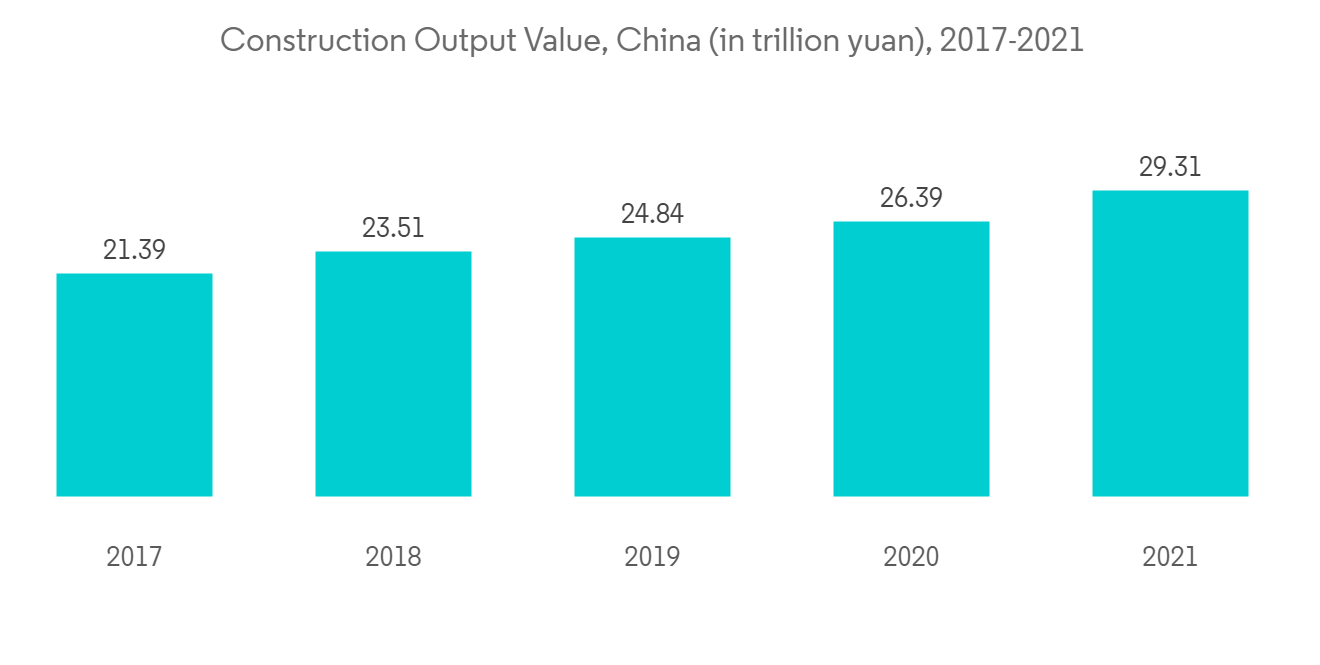

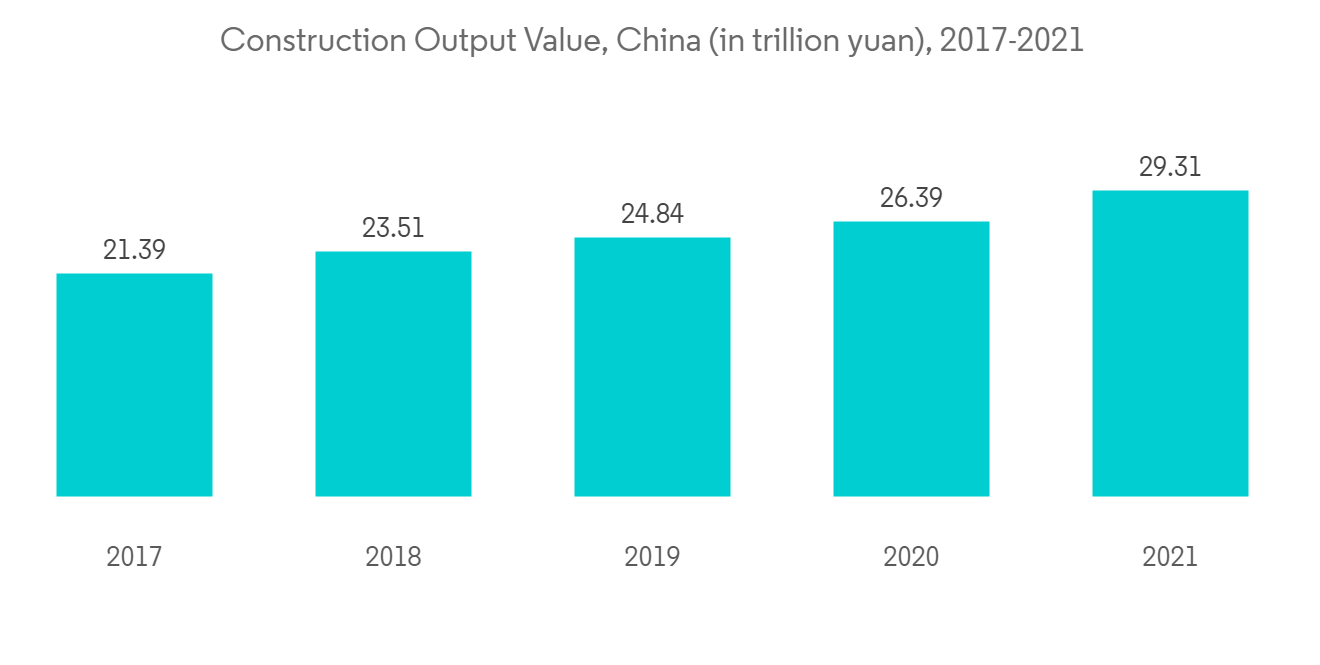

- 此外,中國的建築產值將在 2021 年達到頂峰,達到約 4.21 萬億美元。 因此,這些因素往往會增加全球對丙烯酸 2-乙基己酯的需求。 預計所有上述因素將在預測期內推動全球 2-乙基己醇市場。

亞太地區需求旺盛

- 預計在預測期內,亞太地區將佔據 2-乙基己醇市場的最大市場份額。 隨著油漆、塗層劑和粘合劑等行業的擴張,預計該地區的市場將會增長。

- 中國的建築活動顯著增加,導致建築應用對 2-乙基己醇的需求激增。 例如,中國是購物中心建設蓬勃發展的國家之一。 中國約有 4,000 家購物中心,預計到 2025 年還將新增 7,000 家。

- 此外,包裝行業是粘合劑的最大消費者,包裝行業的增長有望推動這一市場。 食品和飲料、化妝品、消費品和文具等終端用戶對包裝領域的需求強勁。

- 在印度,包裝類別是最高的最終用戶類別,約佔粘合劑總用戶的 67%,支持了預測期內的市場增長。 因此,預計在預測期內,各行業不斷增長的需求將推動該地區的市場。

2-乙基己醇行業概況

2-乙基己醇市場因其性質而部分合併。 市場上的主要參與者包括 Ineos、三菱化學公司、SABIC、伊士曼化學公司和陶氏化學公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 對 2-EH 丙烯酸酯的需求不斷擴大

- 增塑劑消耗量增加

- 約束因素

- 北美和歐洲等地區限制使用增塑劑

- 其他限制

- 行業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 申請

- 增塑劑

- 2-EH 丙烯酸酯

- 2-EH硝酸鹽

- 其他用途

- 最終用戶

- 油漆和塗料

- 粘合劑

- 工業化學品

- 其他最終用戶

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 西班牙

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 阿拉伯聯合酋長國

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- Dow

- BASF SE

- Eastman Chemical Company

- SABIC

- Mitsubishi Chemical Corporation

- LG Chem

- INEOS

- NAN YA PLASTICS CORPORATION

- OQ Chemicals GmbH

- Elekeiroz

第七章市場機會與未來趨勢

- 各個工業領域對化學品的需求不斷增長

簡介目錄

Product Code: 69091

The market for 2-ethyl hexanol is projected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- Increasing demand for 2-ethyl hexanol acrylate from the paint and coatings, adhesive, and construction industries is expected to drive the market during the forecast period. On the other hand, the market expansion is likely to be hampered by the restricted use of plasticizers in various regions, such as North America and Europe.

- The rising demand for chemicals across various industries is expected to provide opportunities for the 2-ethyl hexanol market in the coming years. The Asia-Pacific region dominates the market worldwide, with countries like China, India, and Japan being the biggest consumers.

2-Ethyl Hexanol Market Trends

Increasing Demand for 2-EH Acrylate to Propel the Market

- The demand for 2-ethylhexyl acrylate from various end-user industries is predicted to increase the product demand in the market during the forecast period. 2-ethylhexyl acrylate is used to manufacture paint and coatings, and construction and adhesives materials. Further, 2-ethylhexyl acrylate serves as a plasticizing co-monomer in resins for pressure-sensitive adhesives, latex, paints, textile and leather finishes, and coatings for paper.

- The global paints and coatings market is expanding owing to growing residential and commercial construction activities, which is expected to drive the demand for 2-ethylhexyl acrylate in construction work. For example, China's growth is fueled mainly by rapid residential and commercial building expansion. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030.

- Also, China's construction output peaked in 2021 at a value of about USD 4.21 trillion. As a result, these factors tend to increase the demand for 2-ethylhexyl acrylate across the globe. All the aforementioned factors are expected to drive the global 2-ethyl hexanol market during the forecast period.

Asia-Pacific to Witness Strong Demand

- Asia-Pacific is expected to have the largest market share in the 2-ethyl hexanol market during the forecast period. With the expanding industries such as paints and coatings, adhesives, etc., the market is expected to bloom across the region.

- China experienced a significant increase in construction activities, resulting in a surge in demand for 2-ethyl hexanol in construction applications. For example, China is one of the leading countries with respect to the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- Furthermore, the packaging segment is the largest consumer of adhesives; thereby growing packaging industry is expected to drive the concerned market. Packaging is witnessing strong demand from end-user industries, such as food and beverages, cosmetics, consumer goods, stationery, etc.

- In India, the packaging category is the highest end-user category, holding about 67% of total adhesive users, supporting the market growth during the forecast period. Thus, the rising demand from various industries is expected to drive the market in the region during the forecast period.

2-Ethyl Hexanol Industry Overview

The 2-ethyl hexanol market is partially consolidated in nature. Some of the major players in the market include Ineos, Mitsubishi Chemical Corporation, SABIC, Eastman Chemical Company, and Dow, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for 2-EH Acrylate

- 4.1.2 Increasing Consumption of Plasticizers

- 4.2 Restraints

- 4.2.1 Restricted Use of Plasticizers in Various Regions, such as North America and Europe

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Applications

- 5.1.1 Plasticizers

- 5.1.2 2-EH Acrylate

- 5.1.3 2-EH Nitrate

- 5.1.4 Other Applications

- 5.2 End-User

- 5.2.1 Paint and Coatings

- 5.2.2 Adhesives

- 5.2.3 Industrial Chemicals

- 5.2.4 Other End-Users

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Aregentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dow

- 6.4.2 BASF SE

- 6.4.3 Eastman Chemical Company

- 6.4.4 SABIC

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 LG Chem

- 6.4.7 INEOS

- 6.4.8 NAN YA PLASTICS CORPORATION

- 6.4.9 OQ Chemicals GmbH

- 6.4.10 Elekeiroz

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Rising Demand for Chemicals Across Various Industries

02-2729-4219

+886-2-2729-4219