|

市場調查報告書

商品編碼

1244376

全球造紙機械市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Paper Industry Machinery Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球造紙機械市場預計將以 4.9% 的複合年增長率增長。

可持續造紙機和工藝將繼續推動市場發展。 包裝行業需求將繼續看好造紙行業機械市場。 此外,全球電子商務和在線零售商正在推動紙張消耗量的增加,從而推動對造紙機械的需求。 俄烏戰爭正在影響整個包裝生態系統。

主要亮點

- 世界各地的消費者越來越意識到包裝對環境的影響,並正在將他們的購買習慣轉向更環保的選擇。 消費者、政府和媒體正在向製造商施加壓力,要求他們的產品、包裝和流程更加環保。 人們希望為環保包裝支付更多費用。 由於這些趨勢,造紙機市場有望增長。

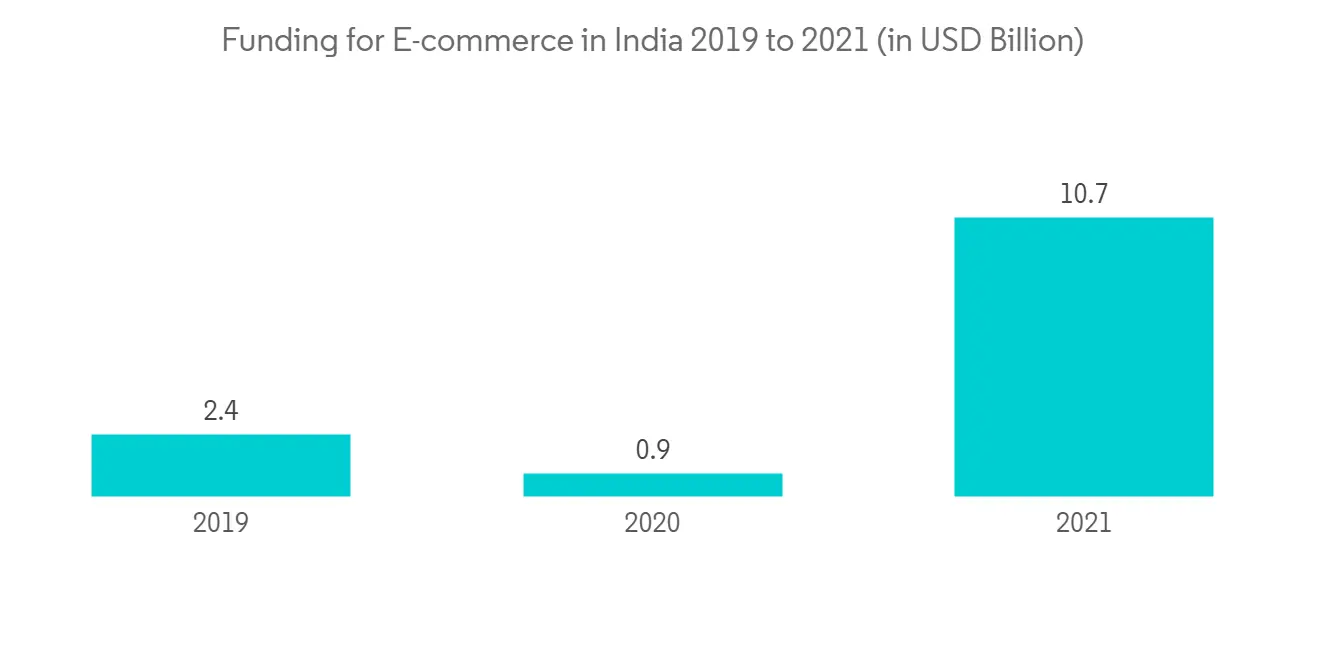

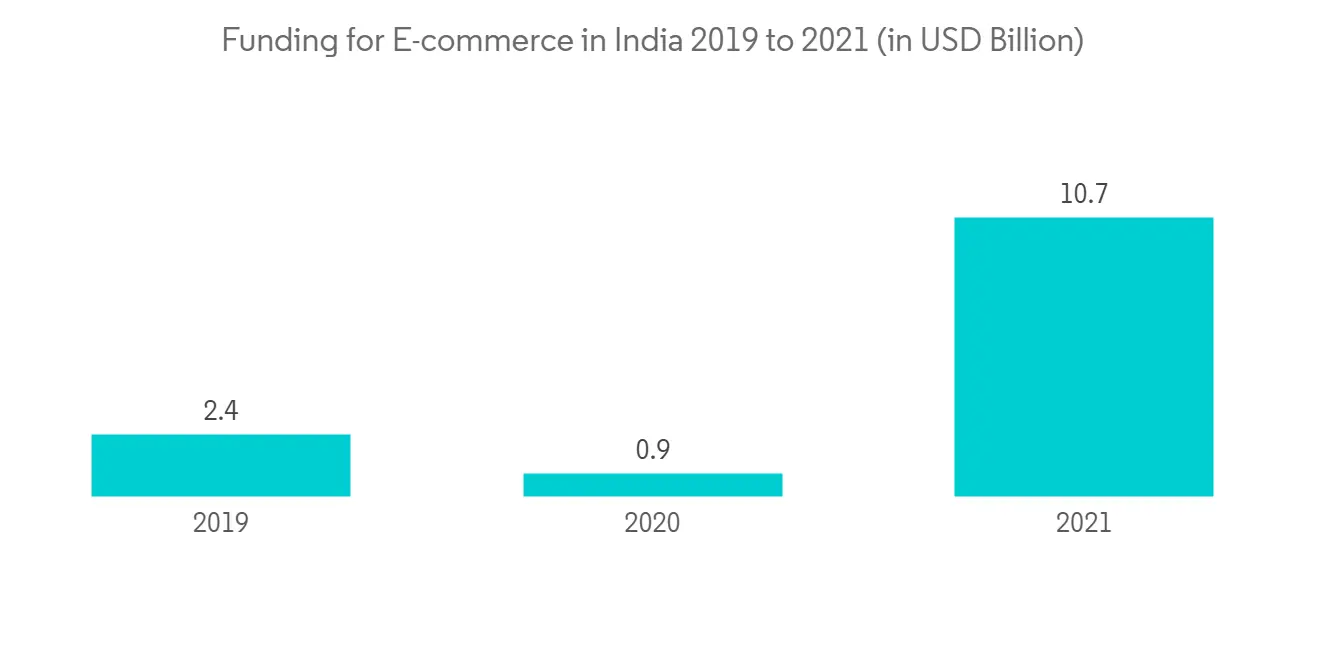

- 另一個廣泛依賴造紙機械市場的最終用戶是零售業。 電子商務行業在過去五年中翻了一番,亞馬遜與超過 5000 萬的 Prime 會員保持同步。 由於快速城市化以及互聯網和智能手機的普及,預計中國和印度等經濟區的電子商務市場將保持高速增長。 據 IBEF 預測,到 2026 年底,印度電商市場規模有望達到 2000 億美元。

- 此外,紙漿和造紙製造商增加的生態和經濟效益有望推動造紙機械市場的發展。 據估計,由於人口增長,醫院部門的擴張將增加對造紙機的需求。 個人衛生意識的提高推動了世界各地對餐巾紙的需求。 家庭、餐館和其他商業和住宅空間對餐巾紙的需求不斷增加,預計將推動造紙機械市場。

- 根據世界野生動物組織的數據,造紙業佔木材消耗量的 13-15%,佔全球貿易工業木材的 33-40%,用於辦公用紙、目錄紙、光面紙,我們製造紙巾和紙質包裝等物品。 然而,儘管對紙包裝的需求不斷增加,但不負責任的砍伐森林將在不久的將來導致原材料流失,嚴重影響造紙工業機械市場。

- 在許多國家/地區,為遏制 COVID-19 的傳播而實施的封鎖期間,造紙業受到了重視。 大流行通過增強每個國家的電子商務部門的活力並將其覆蓋範圍擴大到老年人口,提高了對電子商務套餐的需求。 根據經濟合作與發展組織 (OCED) 的數據,從 2020 年 2 月到 2020 年 4 月,美國電子商務平台的銷售額增長了 14.8%。 而俄烏戰爭正在影響整個包裝生態系統。

造紙行業機械市場趨勢

電子商務領域的需求推動市場

- 電子商務行業在發達國家和新興國家/地區都在穩步發展,因為可以在一個平台上以相對較低的價格獲得多種產品。 紙張的應用包括用於各種最終用途行業的包裝、印刷產品和運輸貨物。

- 在過去幾年中,全球範圍內的電子商務銷售額增長更快。 電子商務使製造商能夠在比以前更大的平台上銷售他們的產品,從而在地域上擴大他們的客戶群並推動造紙工業機械市場的增長。

- 該行業的公司將新產品創新作為業務擴張的一部分。 例如,2022 年 5 月,Sitma Machinery 推出了 E-Wrap,這是一種用於電子商務應用的紙包裝機,它利用熱封紙並可以掃描 3D 對象來創建定制包裝。 據 Sitma 稱,E-Wrap 旨在滿足物流部門在速度和效率方面的需求。 該裝置可以集成到具有不同佈局的生產車間和樞紐中,並且可以與用於貼標和稱重的裝置結合使用。

- 電子商務包裝變得更具保護性和效率,可以確保供應商為客戶提供的質量。 較小的包裹允許郵政和送貨人員將更多產品裝載到他們的卡車上,減少碳足跡並節省時間。 現在越來越多的紙板箱送到您家門口而不是店面,該行業預計會有更多人繼續回收利用。

- 根據 2023 年瓦楞紙包裝的未來,電子商務正在成為瓦楞紙市場的一個重要且高速增長的機會。 儘管最近的經濟放緩對電子商務包裝/零售銷售產生了負面影響,但電子商務零售額繼續增長,為紙包裝供應商提供了巨大的潛力。

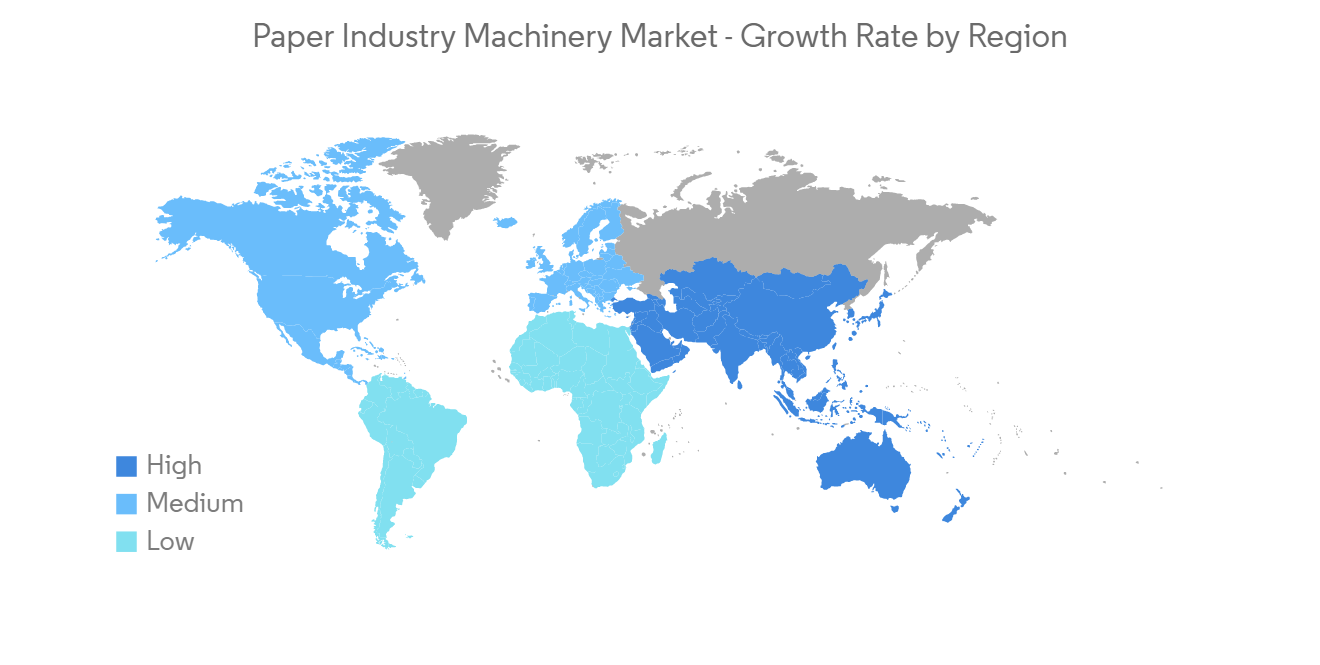

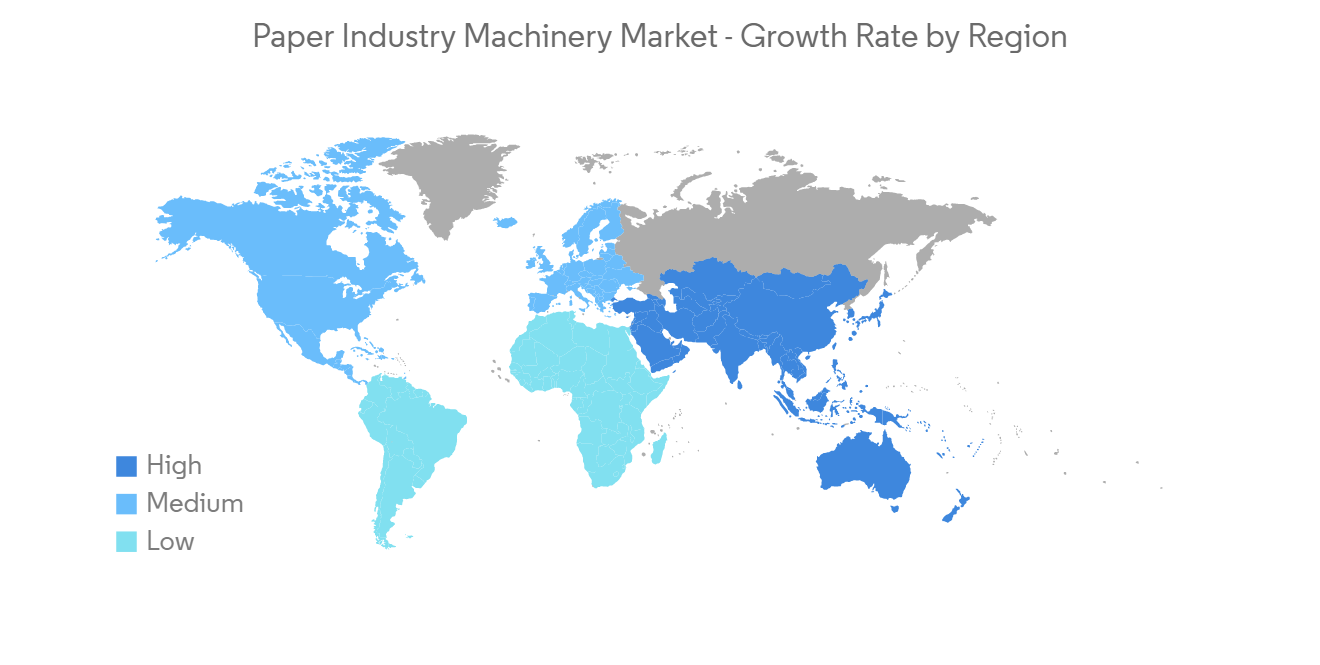

亞太地區增長最快

- 在亞太地區,包裝在商品買賣過程中發揮著重要作用。 此外,在家訂購雜貨變得越來越普遍,導致該地區對先進包裝的需求不斷增長。

- 各國政府和其他公共機構已採取多項舉措來減少全球塑料袋的使用。 世界各地的塑料禁令正在推動紙包裝產品的市場。 因此,這將提振造紙工業機械市場。

- 印度政府工商部正在敦促電子商務行業逐步停止在產品包裝中使用一次性塑料。 鼓勵公司開發可持續的包裝方法,推動對某些塗層紙產品的有利需求條件。

- 隨著電子商務、食品和飲料、快速消費品和製藥領域對包裝的需求增加,包裝紙的應用也在增加。 例如,2022 年 4 月,Scan Machineries 為西孟加拉邦西裡古裡的 Kanha Paper Mills 推出了一台新的 200TPD 造紙機。 可生產的紙種有Testliner、Fluting Medium、Kraft Paper和White Top,紙幅在pop reeler上為4100mm。

- 公司對人工智能、高級軟件和其他尖端技術進行戰略性投資。 包裝機械行業的創新將在世界各個地區不斷增加。 許多公司也在朝著更多的定制方向發展,以實現創新的包裝配置,從而吸引和區分他們的客戶。

造紙機械行業概況

包裝工業機械市場適度細分。 市場上的主要參與者是 ABB Ltd、Beston Group、Mitsubishi HiTec Paper、MAN Energy Solution 和 Parason Group。 市場參與者正專注於創新、兼併或收購,以增加他們在全球的品牌影響力。

2022 年 1 月,ABB 宣布推出高性能紅外反射式 (HPIR-R) 濕度傳感器,該傳感器每秒可提供高達 5,000 次測量,以實現最快、最準確的濕度監測。 該傳感器提供準確、高分辨率的測量,使工廠能夠在降低運營成本的同時提高產量。 這種先進的專利技術使紙漿、紙張和紙板製造商能夠準確確定水分含量、改進 CD 曲線、提高最終產品質量並減少廢品。

2022 年 1 月,Satya Industries 在其位於旁遮普邦的 Muktsar 工廠成功推出了新型書寫紙和印刷紙機 (PM4)。 據報導,這台由 Allimand Group 提供的造紙機將使 Satia Industries 的產能增加 300TPD。 該公司此前曾披露計劃將其目前的木漿產能擴大至300噸/天,目前的草漿產能從200噸/天擴大至250噸/天,安德裡茨提供的脫墨紙漿生產線備用產能為150噸/天。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 產業吸引力 - 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 關於 COVID-19 對市場的影響

第 5 章市場動態

- 市場驅動因素

- 來自電子商務領域的強勁需求

- 提高衛生和環境意識

- 市場挑戰

- 森林砍伐對折疊紙盒的影響

第 6 章市場細分

- 按機器類型

- 木材加工機械和其他紙漿製造機械

- 轉換機

- 造紙機

- 整理機

- 其他機器類型(零件、附件等)

- 按最終用戶行業

- 包裝行業

- 紙漿和造紙業

- 印刷媒體行業

- 食品和飲料行業

- 其他最終用戶行業

- 按地區

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Beston Group Co., Ltd

- ABB Ltd.

- HOBEMA Machine Factory

- S. L. Paper Machines LLP

- Parason Group

- Popp Maschinenbau GmbH

- Unique Fluid Controls

- MAN Energy Solutions

- Baosuo Paper Machinery Manufacture Co. Ltd

- Mitsubishi HiTec Paper

第8章 投資分析

第9章 市場未來

Paper Industry Machinery Market is anticipated to grow at a CAGR of 4.9% over the forecast period. Sustainable paper machines and processes will continue to drive the market. Demand in the packaging industry will continue to favor the paper industry machinery market. Additionally, global e-commerce and online retailers are contributing to increased paper consumption, driving the demand for paper machines. The Russia-Ukraine war has affected the overall packaging ecosystem.

Key Highlights

- Consumers worldwide, becoming more conscious of the environmental hazards of packaging, are shifting their purchasing habits to more environmentally friendly options. Consumers, the government, and the media are putting pressure on manufacturers to make their products, packaging, and processes more environmentally friendly. People are willing to pay more for environmentally friendly packaging. The paper industry machinery market will grow as a result of these trends.

- Another end-user that relies extensively on the paper machinery market is the retail industry. E-commerce as an industry has doubled in the last five years, with Amazon setting the pace with more than 50 million prime subscribers. In economies such as China and India the e-commerce market is expected to retain a high growth because of rising internet and smartphone penetration, coupled with rapid urbanization. According to IBEF, the Indian e-commerce market is expected to reach USD 200 billion by the end of 2026.

- Further, an increase in ecological and economic advantages by pulp and paper manufacturers is expected to boost the paper-making machines market. Expansion of the hospitality sector due to an increase in population is estimated to grow the demand for paper-making machines. The rise in awareness about personal hygiene fuels the need for paper napkins worldwide. Increasing demand for paper napkins at homes, restaurants, and other commercial and residential spaces is expected to drive the paper industry machinery market.

- According to the World Wildlife Organization, the paper industry sector accounts for 13-15% of total wood consumption and uses between 33-40% of all industrial wood traded globally, making items such as office and catalog paper, glossy paper, tissue, and paper-based packaging. However, despite increased demand for paper packaging, irresponsible deforestation will severely impact the paper industry machinery market by causing a loss of raw materials in the near future.

- Many nations considered the paper industry crucial during lockdowns to help limit the spread of the COVID-19. The pandemic boosted the need for e-commerce packaging by increasing the vitality of the e-commerce sector across countries and broadening its reach to the older customer group. According to the Organization for Economic Cooperation and Development (OCED), sales on e-commerce platforms climbed by 14.8% in the United States between February and April 2020. Also, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Paper Industry Machinery Market Trends

Demand from E-Commerce Sector to Drive the Market

- The e-commerce industry is experiencing robust growth in both developed and developing countries due to the availability of a wide range of products on one platform at a relatively low cost. Paper applications include packaging and printed products used in various end-user industries and for shipping goods.

- E-commerce sales have grown more in the last few years around the globe. E-commerce allows manufacturers to sell their products on a larger platform than before, thereby increasing their customer base geographically and driving the growth of the paper industry machinery market.

- Companies in this field focus on innovating new products as part of their business expansion. For instance, in May 2022, Sitma Machinery has launched E-Wrap, a paper wrapping machine aimed at e-commerce applications that can utilize heat-sealable paper and scan 3D objects to create customized packaging. According to Sitma, E-Wrap is designed to fulfill the demands of the logistics sector in terms of speed and efficiency. The unit can be integrated into various production settings and hubs with different layouts and combined with units for labeling and weighing.

- E-commerce packaging is becoming more protective and more efficient to ensure the quality of its suppliers for its customers. Smaller packaging allows postal and delivery personnel to load more products onto trucks, resulting in lower carbon emissions and shorter time. Now that more cardboard boxes are arriving on doorsteps rather than in stores, the sector is counting on more people to keep up with recycling.

- E-commerce is becoming a substantial and high-growth opportunity for the corrugated packaging market, according to The Future of Corrugated Packaging 2023. Despite the recent economic slowdown, which has negatively influenced e-commerce package/retail sales, e-commerce retail sales have continued to rise, providing significant potential for paper packaging suppliers.

Asia-Pacific Region To See Fastest Growth

- Packaging plays a vital role in Asia-Pacific during the process of buying and selling goods. Additionally, the growing popularity of ordering groceries from home has increased the demand for packaging advancements in the region.

- Governments and other recognized entities are undertaking several initiatives to reduce the use of plastic bags around the globe. Plastic bans around the world are driving the market for paper packaging products. Therefore, this will leverage the market for paper industry machinery market.

- The Ministry of Commerce and Industry, Government of India, has urged the e-commerce industries to gradually eliminate the use of single-use plastic in product packaging. Companies have been advised to develop sustainable packing measures, spelling favorable demand conditions for certain coated paper products.

- Packaging paper is witnessing a rise with the growing need for packaging from e-commerce, food &beverage products, FMCG, and the pharmaceutical sector. For instance, in April 2022, Scan Machineries launched a new 200TPD paper machine for Kanha Paper Mills in Siliguri, West Bengal. The grades of paper that can be produced are Test Liner, Fluting Medium, Kraft Paper, and White Top, with paper width at Pope Reeler being 4100 mm.

- Companies invest strategically in artificial intelligence, advanced software, and other cutting-edge technologies. Innovation in the packaging machinery industry will continue to rise in various regions around the world. In addition, many companies are moving to greater customization to create innovative packaging configurations that attract customers and differentiate themselves.

Paper Industry Machinery Industry Overview

The packaging Industry Machinery Market is moderately fragmented. Some of the major players in the market are ABB Ltd, Beston Group Co., Ltd, Mitsubishi HiTec Paper, MAN Energy Solution, and Parason Group. The players in the market are focusing on innovations, mergers, or acquisitions to enhance their brand presence across the globe.

In January 2022, ABB released its High-Performance Infrared-Reflection (HPIR-R) moisture sensor, which delivers the fastest, most precise moisture monitoring, taking up to 5,000 measurements per second. The sensor provides an accurate, high-resolution measurement that enables mills to increase throughput while decreasing operating costs. This advanced, patented technology will allow pulp, paper, and board producers to know the precise moisture levels, and improve their CD profiles, enhancing end-product quality with fewer rejects.

In January 2022, At its Muktsar factory in Punjab, Satia Industries successfully launched a brand-new Writing & Printing Paper Machine (PM4). According to reports, the paper machine provided by Allimand Group would increase Satia Industries' output capacity by 300 TPD. The company previously disclosed plans to expand its current wood pulping capacity to 300 TPD, its current straw pulping capacity from 200 to 250 TPD, and a deinked pulp line with a standby capacity of 150 TPD supplied by ANDRITZ.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from the E-Commerce Sector

- 5.1.2 Rise in Awareness about Hygiene and Environment

- 5.2 Market Challenges

- 5.2.1 Impact of Deforestation on Paper Packaging

6 Market Segmentation

- 6.1 By Machinery Type

- 6.1.1 Wood Preparation Machinery and Other Pulp Mill Machinery

- 6.1.2 Converting Machinery

- 6.1.3 Paper Prodcution Machinery

- 6.1.4 Finishing Machinery

- 6.1.5 Other Machinery Types (Parts and attachments, etc.)

- 6.2 By End-User Industry

- 6.2.1 Packaging Industry

- 6.2.2 Pulp & Papers Industry

- 6.2.3 Print Media Industry

- 6.2.4 Food & Beverage Industry

- 6.2.5 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Beston Group Co., Ltd

- 7.1.2 ABB Ltd.

- 7.1.3 HOBEMA Machine Factory

- 7.1.4 S. L. Paper Machines LLP

- 7.1.5 Parason Group

- 7.1.6 Popp Maschinenbau GmbH

- 7.1.7 Unique Fluid Controls

- 7.1.8 MAN Energy Solutions

- 7.1.9 Baosuo Paper Machinery Manufacture Co. Ltd

- 7.1.10 Mitsubishi HiTec Paper