|

市場調查報告書

商品編碼

1244366

全球水產養殖疫苗市場——增長、趨勢、COVID-19 影響和預測 (2023-2028)Aquaculture Vaccines Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球水產養殖疫苗市場預計將以 6.2% 的複合年增長率增長。

COVID-19 大流行對動物產業產生了巨大影響。 由於封鎖,動物飼料和其他食品以及基本動物藥品的物流和供應鏈受到了重大影響,影響了所研究的市場。

根據 2021 年 9 月發布的海洋政策研究報告,COVID-19 大流行將導致運輸成本增加(比正常情況高出約 20-60%),市場 COVID-19 對水產養殖疫苗市場產生了重大影響. 此外,第二波和第三波COVID-19感染在各國連續發生,預計短期內市場將不景氣。 然而,隨著限制措施的放鬆,市場有望在預測期內逐漸好轉並恢復到大流行前的增長水平。

水生動物消費量的增加正在推動水產養殖業的增長,水產養殖疫苗預計將成為市場的主要增長動力,因為它們可以減少感染機會並提高產品產量,預測期預計將推動日本水產養殖疫苗市場的增長。

例如,根據聯合國糧農組織(FAO)2022年的報告,全球水生動物產量約為1.78億噸,佔總產量的63%(1.12億噸)。)在海洋中收穫(70% 來自圈養漁業,30% 來自水產養殖),37%(6600 萬噸)在內陸水域收穫(83% 來自水產養殖,17% 來自圈養漁業)。 此外,根據同一份文件,全球海產品消費量正在增加,預計這將進一步推動水產養殖產量的增長。 消費量從 1961 年的 9 公斤增加到近幾十年來的 20.2 公斤,影響人均海產品消費量的最大因素是供應增加、消費者偏好改變、技術發展和收入增加。 因此,新興市場水產養殖業有望推動對更高產量的水產養殖疫苗的需求,預計將在預測期內推動水產養殖疫苗市場的增長。

預計會對水產養殖疫苗市場的增長產生重大影響的其他因素包括傳染病在水生動物中的流行以及尋求抗擊這些疾病的市場參與者。 例如,2022 年 2 月 Frontiers 發表的一項研究發現,異尖線蟲在中國各地的魚類中呈地方性流行,匯總發病率為 45.5%,其中鮮魚發病率最高(58.1%)。 東海魚類異尖線蟲患病率最高(76.8%),中國東部地區患病率最高(55.3%)。 因此,由於該疾病的高流行率,預計對水產養殖疫苗的需求將增加,從而推動市場走向增長

此外,新的養殖疫苗進入市場有望進一步推動市場增長

。例如,2021 年 4 月,印度農業研究委員會 - 苦鹹水水產養殖中央研究所 (ICAR-CIBA) 報告說,許多海水、鹹水和淡水魚受到影響,幼蟲期和早期幼蟲期最多。重組疫苗 CIBA-Nodavac-R,針對病毒性神經壞死 (VNN),其死亡率為 100%。 同樣,2021 年 10 月,孟加拉國錫爾赫特農業大學 (SAU) 的一位教授開發了一種魚類口服疫苗,可以保護不同種類的魚類免受細菌性疾病的侵害並提高其產量。 該疫苗可混入魚飼料後使用。

因此,由於上述因素,水產養殖疫苗市場有望在預測期內實現增長

。但是,在未來五年內,對疫苗的嚴格監管可能會減緩所研究市場的增長。

水產養殖疫苗的市場趨勢

在預測期內,活疫苗類型預計將佔水產疫苗市場的很大份額

活疫苗包含仍然可以在宿主(接受者)體內繁殖的活的減毒微生物

。該生物體已“減毒”,這意味著它已失去大部分致病能力,但仍保留一定程度的免疫原性。 活疫苗比滅活疫苗更具免疫原性,並以類似於自然感染的方式激發各種免疫反應。我可以。 因此,活疫苗被廣泛用於賦予免疫力,活疫苗有望佔據很大的市場份額。

除了傳統的疫苗生產方法外,各大公司還在使用病原體分子工程等先進技術生產活疫苗。 預計這一領域的發現將推動這一領域的增長。 例如,在 iScience 於 2021 年 7 月發表的一項研究中,100% 感染了基因缺失活減毒疫苗候選者(ORF022L)的魚在傳染性脾壞死病毒(ISKNV)攻擊中存活下來,並且 ORF022L 顯示出抗 ISKNV 特異性抗體. 誘導免疫相關基因的反應和上調。

未來幾年,活疫苗領域有望佔據較大份額。

預計在預測期內,亞太地區將佔

水產養殖疫苗市場的很大份額。亞太地區擁有印度和中國等主要水產養殖生產國,預計將佔據水產養殖疫苗市場的很大份額,因為它擁有該地區最大的水產養殖業之一

> 將是根據聯合國糧農組織(FAO)2022年報告,亞洲國家是主要生產國,佔所有水生動物漁業和水產養殖產量的70%,在過去20年中,亞洲和非洲水產養殖產量翻了一番。 因此,作為最大的水產養殖生產區,該地區對水產養殖疫苗的需求很高,預計將推動研究市場的增長。

在亞太地區,根據聯合國糧農組織2022年報告,中國約佔世界漁業和水產養殖產量的35%,在全球水產養殖生產市場份額最高,有望成為主要市場. 此外,中國的水產養殖業正在擴張,這有望推動中國水產養殖疫苗市場的增長。 例如,2022年5月,中國將啟用國新一號,這是世界上最大的浮式養魚場之一,每年可生產3700噸魚(長250米,寬45米,排水能力13萬噸,15用於生產的大型坦克)。)推出。

因此,受上述因素影響,亞太地區在全球漁業和水產養殖產量中所佔份額最高,水產養殖用疫苗需求量大,預計將佔據很大的疫苗市場份額人類使用。

水產疫苗行業概況

水產養殖疫苗市場正在整合,一些主要參與者由於在水產養殖疫苗行業的重要參與,目前主導著市場。 水產養殖疫苗市場的主要參與者包括 Merck & Co., Inc.、Zoetis (PharmaQ)、Hipra、Technovax 和 Elanco。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 新興國家的水產養殖業增加

- 關於水產動物傳染病多發及新產品開發

- 由於抗生素耐藥性而迅速引入疫苗

- 市場製約因素

- 嚴格的疫苗生產法規

- 波特的五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(按金額計算的市場規模 - 百萬美元

- 按疫苗類型

- 直播

- 停用

- 其他疫苗類型

- 按管理類型

- 口服

- 沉浸

- 注射

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 世界其他地方

- 北美

第六章競爭格局

- 公司簡介

- Hipra

- Merck & Co. Inc.

- KBNP

- Nisseiken Co., Ltd.

- KoVax Ltd.

- Kyoritsuseiyaku Corporation

- Elanco

- Vaxxinova International BV

- Kyoto Biken Laboratories, Inc.

第7章 市場機會與今後動向

During the time frame of the forecast, the aquaculture vaccines market is expected to register a CAGR of 6.2%.

The COVID-19 pandemic had a significant impact on the animal industry, as due to the lockdown there was a significant impact on the logistics and supply chain of not only the essential pharmaceutical products for animals but also feed and other food items for animals, which affected the studied market. According to a Marine Policy research study published in September 2021, the COVID-19 pandemic affected the aquaculture industry in a variety of ways, including disruption in logistics and supply chains, which resulted in increased transportation costs (approximately 20-60% higher than usual), a decrease in market demand for fish, cancellation of orders from foreign buyers, an increase in input and maintenance costs, a labor shortage, and all these, COVID-19 had a significant impact on the aquaculture vaccine market. Also, with the consecutive second and third waves of COVID-19 infections in various countries, the market is set to observe sluggish growth in the short-term period. However, the market is expected to improve gradually and return to pre-pandemic growth levels in the forecast period due to an ease in lockdown restrictions.

The increasing consumption of aquatic animals is propelling the growth of the aquaculture industry, which is expected to be a primary growth factor for the market as aquaculture vaccines reduce the chance of infection and increase the yield of the product, which is expected to fuel growth in the aquaculture vaccines market over the forecast period. For instance, according to the 2022 report of the Food and Agriculture Organization (FAO) of the United Nations, the global production of aquatic animals stood at approximately 178 million tons, and of the total production, 63% (112 million tons) was harvested in marine waters (70% from capture fisheries and 30% from aquaculture) and 37% (66 million tons) in inland waters (83% from aquaculture and 17 percent from capture fisheries). Further, as per the same source, the global consumption of aquatic food is increasing, which is expected to further boost growth in aquaculture production. Consumption has increased from 9 kg in 1961 to 20.2 kg in recent decades, with the factors that have had the greatest impact on per capita consumption of aquatic foods being increasing supplies, shifting consumer preferences, technological developments, and rising incomes.Thus, the growing aquaculture industry is expected to drive the demand for aquaculture vaccines for a greater yield, which is expected to fuel growth in the aquaculture vaccines market over the forecast period.

Other factors that are expected to have a significant impact on the growth of the aquaculture vaccines market include the high prevalence of infectious diseases among aquatic animals and new product developments launched by the players in the market to tackle these diseases. For instance, according to a research study published in February 2022 by Frontiers, the anisakid nematodes were prevalent in fish across China, with a pooled incidence of 45.5%, and the incidence percentage for fresh fish was the greatest (58.1%). Fish from the East China Sea had the highest prevalence of anisakid nematodes (76.8%), while Eastern China had the highest prevalence rate (55.3%). Hence, due to the high prevalence of diseases, the demand for aquaculture vaccines is expected to grow, therefore propelling the market toward growth.

In addition to this, the launch of new aquaculture vaccines on the market is further expected to boost market growth. For instance, in April 2021, the Indian Council of Agriculture Research-Central Institute of Brackishwater Aquaculture (ICAR-CIBA) launched a recombinant vaccine called CIBA-Nodavac-R against viral nervous necrosis (VNN) that affects many marine, brackishwater, and freshwater fish, causing up to 100 percent mortality in larval and early juvenile stages. Similarly, in October 2021, a professor from Sylhet Agriculture University (SAU) in Bangladesh developed an oral vaccine for fish that can protect different species of fish from bacterial diseases and boost their production. The vaccine can be applied to the fish after mixing it with their feed.

Therefore, due to the above-mentioned factors, the aquaculture vaccines market is expected to grow over the forecast period. But strict regulations about vaccines are likely to slow the growth of the studied market over the next five years.

Aquaculture Vaccine Market Trends

Live Vaccine Type Segment is Expected to Hold a Significant Share in the Aquaculture Vaccines Market Over the Forecast Period

Live vaccinations include living, attenuated microbes that can still reproduce in the host (vaccinee). The microbes are "weak," which means they retain some immunogenic qualities while having lost much of their ability to cause disease. Live vaccinations often exhibit substantially higher immunogenicity than inactivated vaccines because they more closely mimic natural infection by activating a variety of immunologic responses, and in most cases, just one vaccination is enough to produce long-lasting, and occasionally even lifetime, immunity. Thus, the live vaccine type is widely used in administering immunity, due to which the live vaccine segment is expected to hold a significant share of the studied market.

In addition to the traditional ways of making vaccines, key players are also using advanced technologies, such as molecular manipulation of pathogens, to make live vaccines. Positive results from research studies in this area are expected to help the segment grow. For example, a research study published by iScience in July 2021 showed that 100% of the gene-deleted live attenuated candidate vaccine (ORF022L)-infected fish survived the infectious spleen and kidney necrosis virus (ISKNV) challenge, and ORF022L caused an anti-ISKNV specific antibody response and upregulation of immune-related genes.

Because of all of these things, the live vaccine segment is expected to have a large share of the market over the next few years.

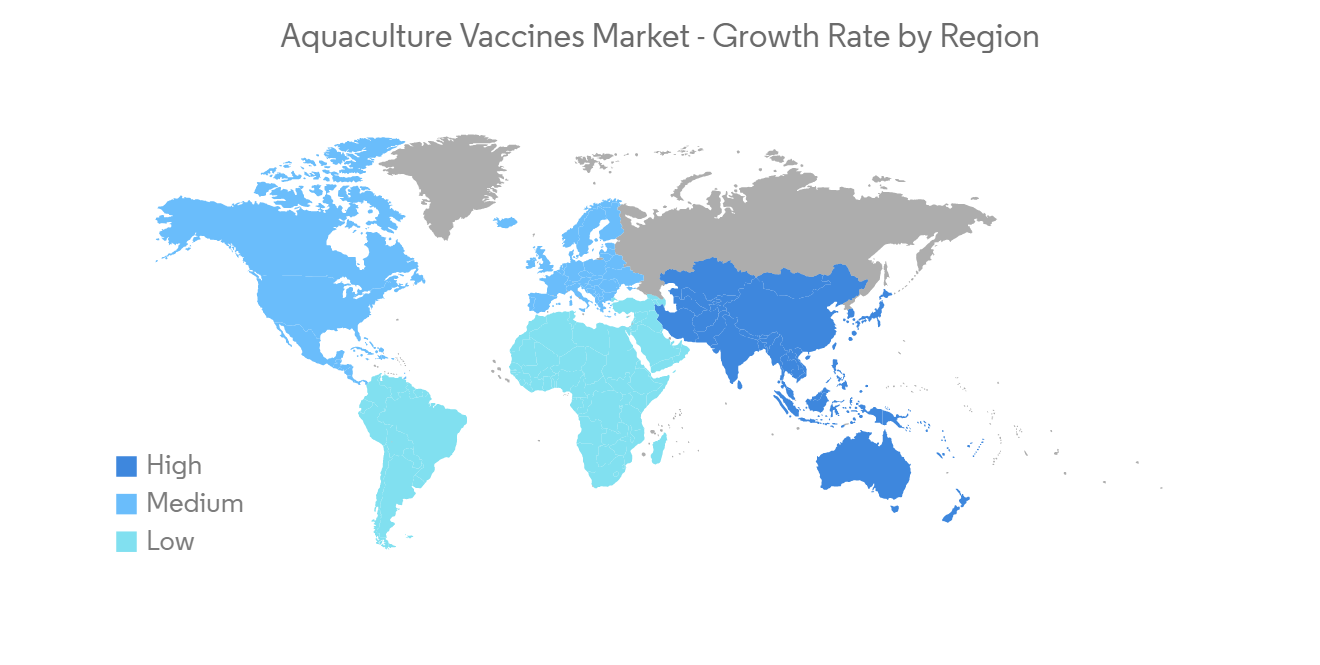

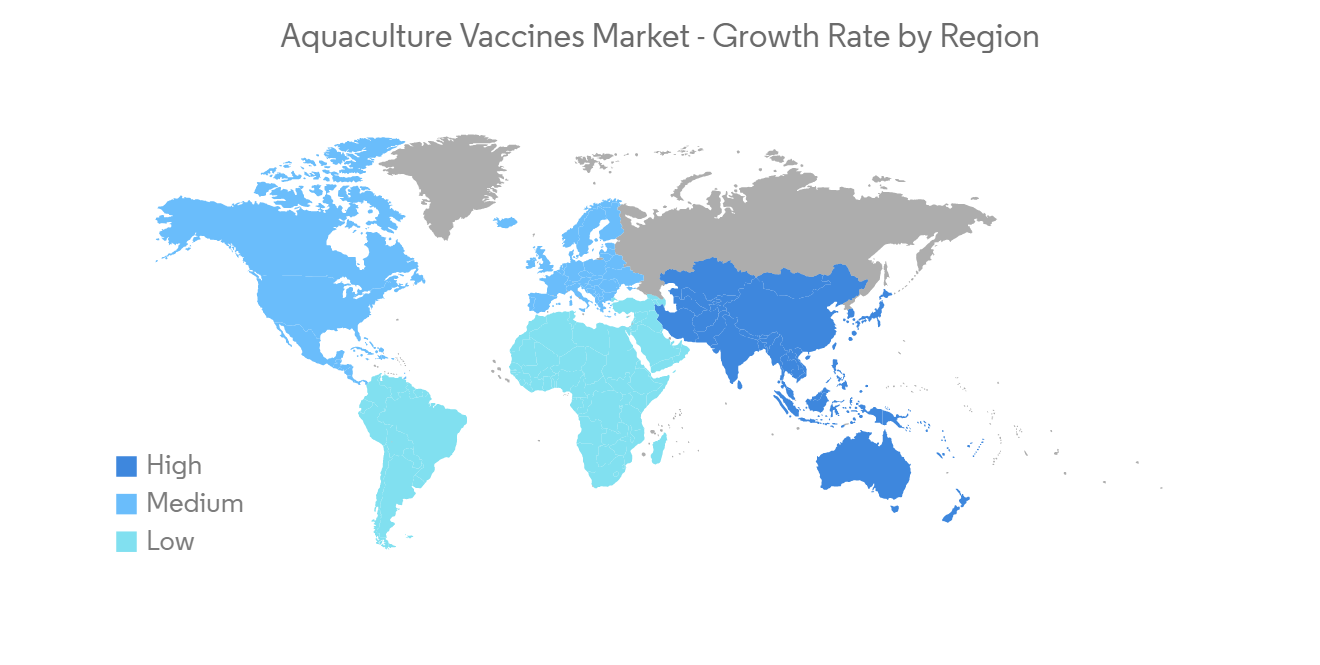

Asia-Pacific Region is Expected to Occupy a Significant Share in the Aquaculture Vaccines Market Over the Forecast Period

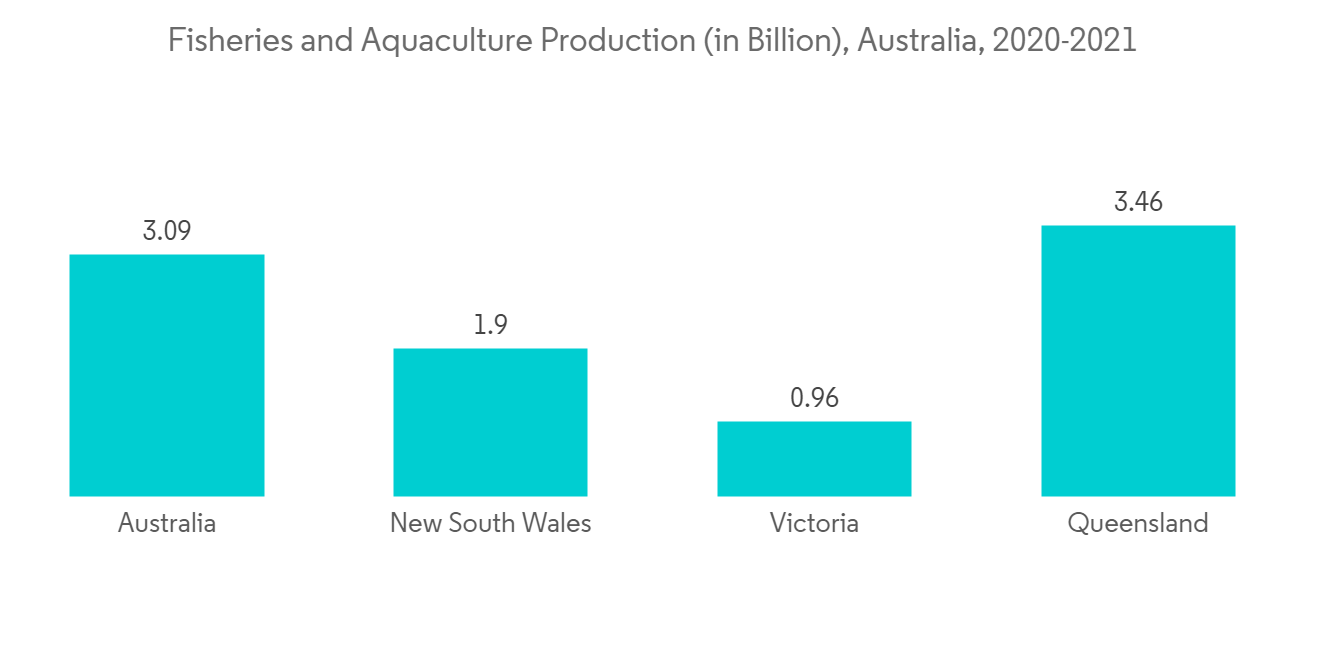

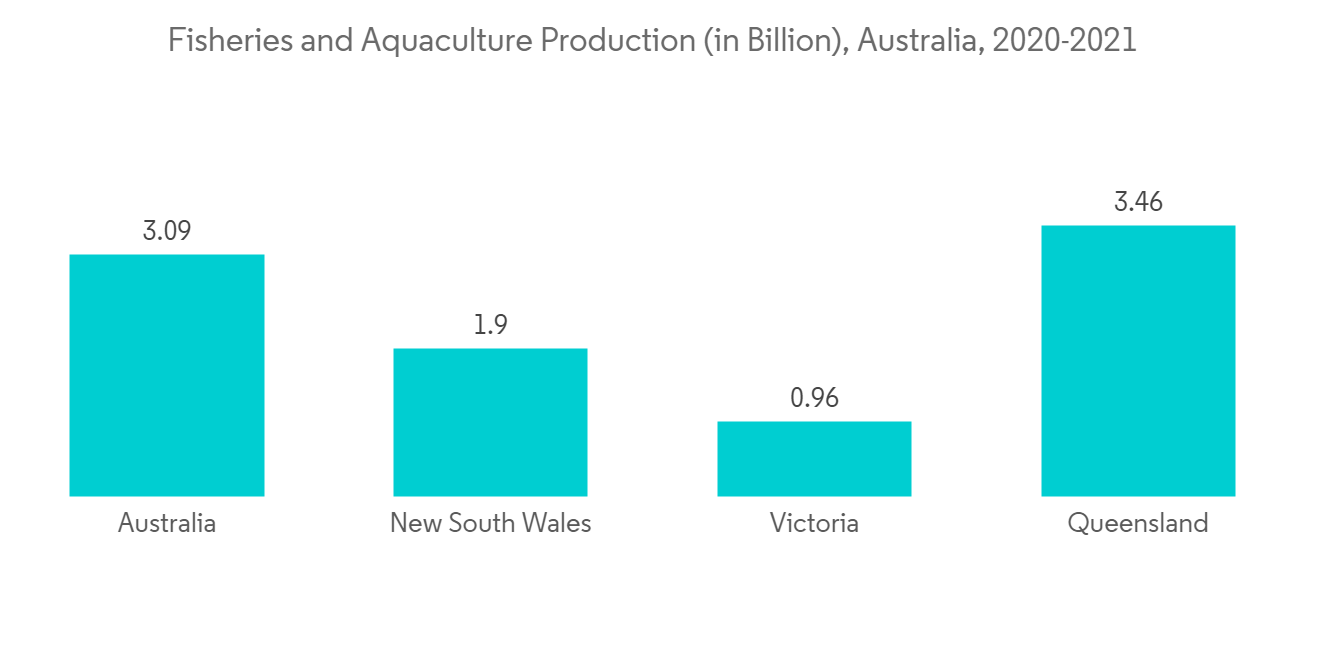

The Asia-Pacific region is expected to hold a significant share of the aquaculture vaccines market due to the presence of one of the region's largest aquaculture industries, with major aquaculture-producing countries such as India and China.According to the 2022 report of the Food and Agriculture Organization (FAO) of the United Nations, Asian countries were the main producers, accounting for 70% of the total fisheries and aquaculture production of aquatic animals, and in the last 20 years, aquaculture production has doubled in Asia and Africa. Hence, due to being the largest aquaculture production region, the demand for aquaculture vaccines is expected to be high in the region, which is expected to boost growth in the studied market.

In the Asia-Pacific region, China is expected to be a major market owing to its highest share in the global aquaculture production market with about 35% of the global fisheries and aquaculture production, as per the 2022 report of the FAO of the United Nations. Furthermore, the aquaculture industry in China is expanding, which is expected to drive growth in the aquaculture vaccine market in the country. For instance, in May 2022, China launched one of the world's largest floating fish farms that can produce 3,700 tons of fish every year, called Guoxin 1, which is 250 meters (820 feet) long and 45 meters wide with a displacement of 130,000 tons and contains 15 huge tanks for production.

Therefore, due to the above-mentioned factors, the demand for aquaculture vaccines is expected to be high in the Asia-Pacific region due to the highest share in global fisheries and aquaculture production, and hence, the region is expected to hold a significant share in the aquaculture vaccines market over the forecast period.

Aquaculture Vaccine Industry Overview

The aquaculture vaccines market is consolidated, and a few of the major players are currently dominating the market due to their immense involvement in the aquaculture vaccines industry. Some of the key companies in the aquaculture vaccines market are Merck & Co., Inc., Zoetis (PharmaQ), Hipra, Technovax, and Elanco, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Aquaculture Farming in Developing Countries

- 4.2.2 High Prevalence of Infectious Diseases in Aquatic Animals and New Product Development

- 4.2.3 Surge in Adoption of Vaccines due to Antibiotic Resistance

- 4.3 Market Restraints

- 4.3.1 Stringent Manufacturing Regulations Associated with Vaccines

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million

- 5.1 By Vaccine Type

- 5.1.1 Live

- 5.1.2 Inactivated

- 5.1.3 Other Vaccine Types

- 5.2 By Type of Administration

- 5.2.1 Oral

- 5.2.2 Immersion

- 5.2.3 Injected

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hipra

- 6.1.2 Merck & Co. Inc.

- 6.1.3 KBNP

- 6.1.4 Nisseiken Co., Ltd.

- 6.1.5 KoVax Ltd.

- 6.1.6 Kyoritsuseiyaku Corporation

- 6.1.7 Elanco

- 6.1.8 Vaxxinova International BV

- 6.1.9 Kyoto Biken Laboratories, Inc.