|

市場調查報告書

商品編碼

1237863

肺部給藥系統市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Pulmonary Drug Delivery Systems Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,肺部給藥系統市場預計將以 4% 的複合年增長率註冊。

COVID-19 影響了肺部給藥系統市場的增長。 已發現患有哮喘和慢性阻塞性肺病 (COPD) 等呼吸系統疾病的患者感染冠狀病毒的風險增加。 出於這個原因,對合適的藥物輸送系統的需求不斷增加,以向患者給藥肺部藥物。 例如,2022 年 3 月發表在 Pulmonary Medicine 上的一篇論文證實,COPD 患者感染冠狀病毒後的預後更差。 生物因素也使 COPD 患者更容易受到病毒感染,更容易受到 COVID-19 的病理生理影響,如微血栓形成、肺內分流和隨後的細菌感染。 因此,COPD 患者感染 COVID-19 的風險增加,增加了對吸入器和霧化器的需求,這影響了大流行期間對藥物輸送系統的需求。 因此,雖然 COVID-19 大流行最初對市場產生了積極影響,但隨著大流行的消退,它現在已經失去了吸引力。 然而,預計在預測期內將穩定增長。

呼吸系統疾病患病率增加、技術進步以及越來越傾向於將肺部藥物輸送作為藥物輸送的替代途徑等因素正在推動市場的增長。

哮喘、慢性阻塞性肺病等呼吸系統疾病的患病率和發病率正在迅速增加,預計這將增加對肺部給藥系統的需求,從而推動市場增長。我來了。 例如,根據 ERS □□Journal 發表的一篇論文,到 2022 年 8 月,到 2050 年將有大約 6.456 億人(4.544 億男性和 1.912 億女性)患上 COPD。據稱,全球患病率相對於 2019 年將增加 36%。前一年。 因此,慢性阻塞性肺病這一嚴重的公共衛生問題的患病率預計會上升,尤其是在新興國家,這將推動對霧化器和吸入器等各種藥物輸送系統的需求。 預計這將在預測期內推動市場增長。

此外,由於肺泡表面積大、載藥效率高,肺部血管數量多,是藥物吸收的理想部位,肺部給藥優於傳統給藥途徑。 .

此外,預計在預測期內,公司在開發新型藥物輸送系統方面的活動增加以及產品發布的增加也將推動肺部藥物輸送系統市場的增長。 例如,2021 年 6 月,Glenmark Pharma 在英國推出了用於治療慢性阻塞性肺疾病 (COPD) 的塞托溴銨乾粉吸入器 Tiogiva。 2021 年 3 月,PARI Pharma GmbH 獲得了 LAMIRA 霧化器系統在日本的上市許可,用於遞送 Insmed 的藥物 ARIKAYCE(阿米卡星脂質體吸入懸浮液)。

因此,由於呼吸系統疾病的高負擔和產品發布的增加等因素,預計所研究的市場在預測期內將會增長。 然而,預計在預測期內,有關藥物輸送系統批准的監管問題將阻礙肺部藥物輸送系統市場的增長。

肺部給藥系統市場趨勢

COPD(慢性阻塞性肺病)細分市場預計在預測期內將出現顯著增長

在預測期內,慢性阻塞性肺病領域的肺部給藥系統市場預計將出現顯著增長。 市場增長是由慢性阻塞性肺病在人群中日益加重的負擔和對創新藥物輸送系統不斷增長的需求推動的。

此外,由於與年齡相關的肺結構和功能變化,人口老齡化更容易患上慢性阻塞性肺病,預計在預測期內也將增加對 COPD 治療領域的需求。 例如,根據聯合國人口基金公佈的2022年統計數據,可知到2022年,居住在日本的總人口中約有59%是15至64歲的老年人。 據同一消息來源稱,到 2022 年,29% 的人口將超過 65 歲。

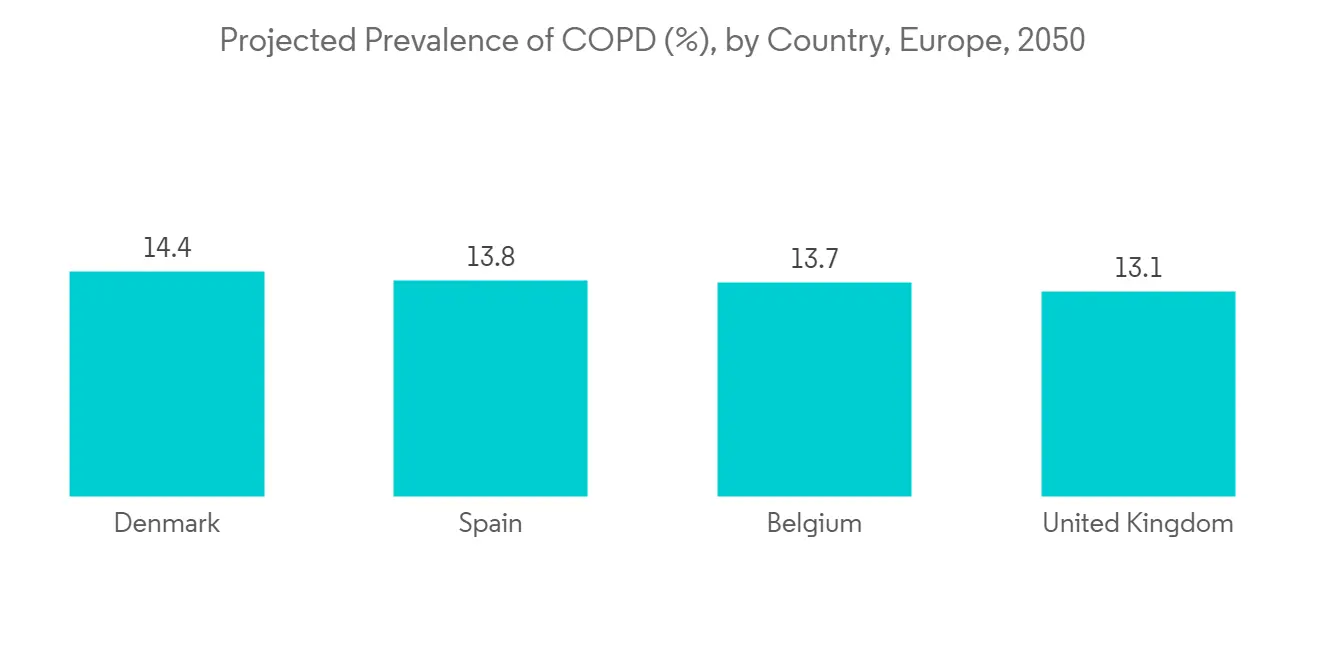

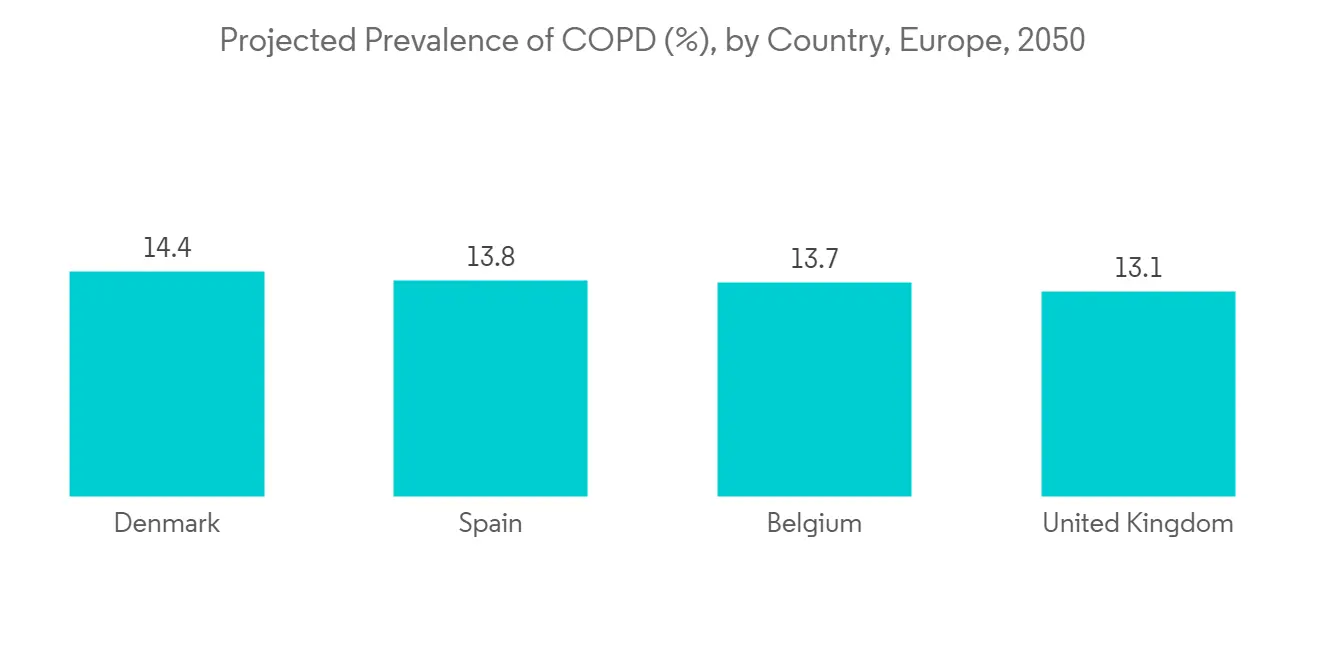

COPD 患病率和發病率的增加是推動肺部藥物輸送系統需求的主要因素,從而推動了這一領域的增長。 根據 2021 年 7 月發表在《歐洲呼吸雜誌》上的研究結果,由於吸煙和空氣污染等風險因素增加,歐洲(包括荷蘭)的慢性阻塞性肺病 (COPD) 患病率正在上升。預計 此外,根據 2021 年 11 月發表在《歐洲呼吸雜誌》上的一篇論文,預計到 2050 年將有約 49,453,852 名歐洲人患有慢性阻塞性肺病,而 2020 年這一數字為 36,580,965 人。 預計這將在預測期內推動細分市場的增長。

此外,該領域研發活動的增加和產品發布的增加預計將促進慢性阻塞性肺疾病領域的增長。 例如,2022 年 4 月,葛蘭素史克製藥公司推出了 Trelegy Ellipta,這是一種每日一次的吸入式單藥三聯療法 (SITT),用於治療印度慢性阻塞性肺病患者。 2021 年 10 月,Glenmark 在西班牙推出了塞托溴銨乾粉吸入器(DPI)的生物等效物,用於治療慢性阻塞性肺病(COPD)。

因此,由於慢性阻塞性肺病負擔加重和產品發布增加等因素,預計該細分市場在預測期內將會增長。

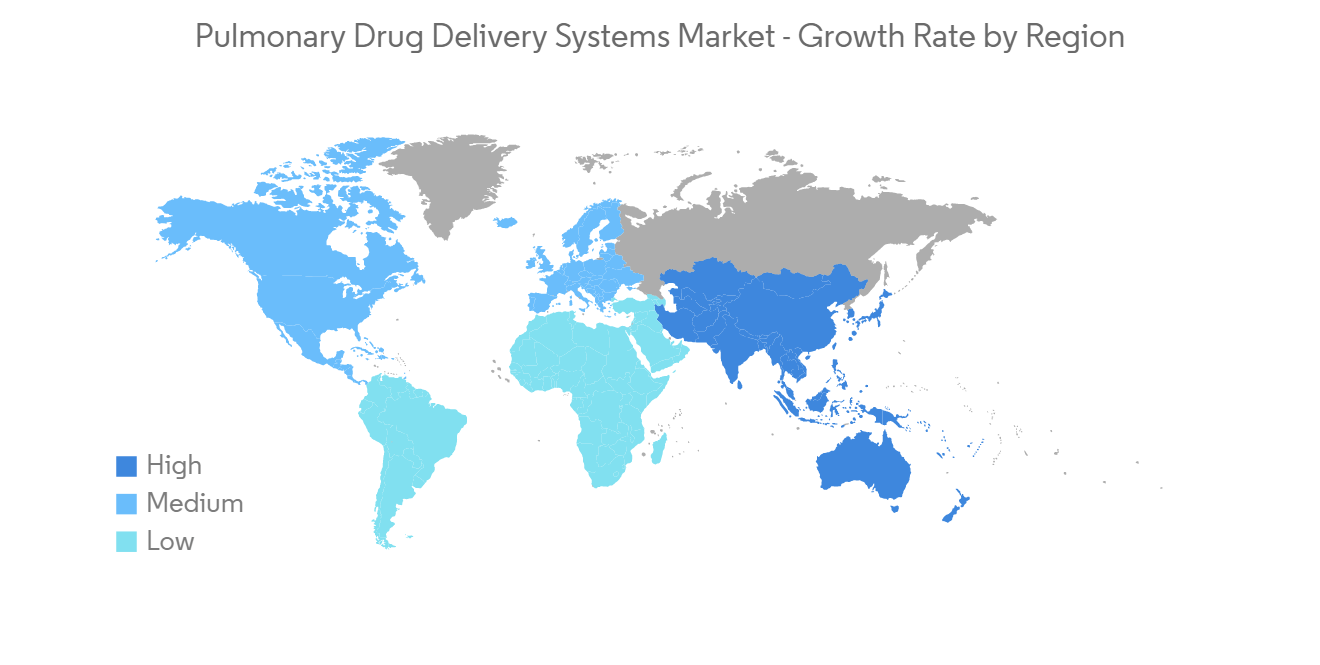

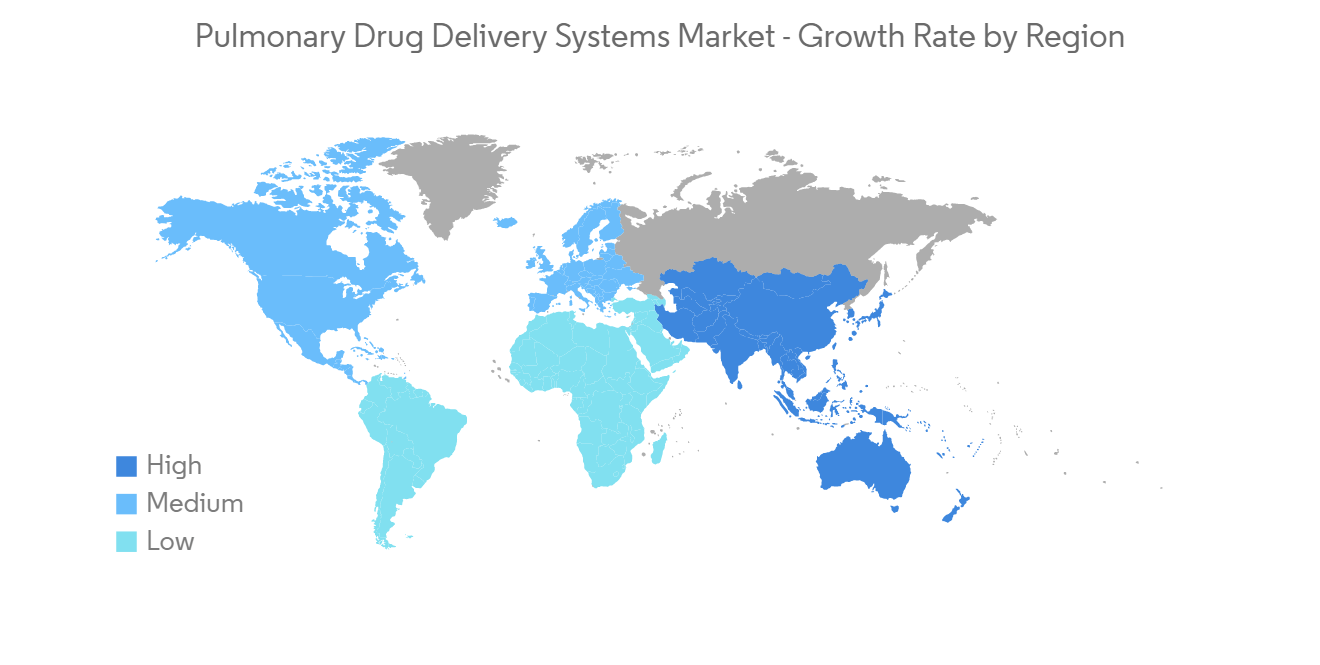

北美將佔很大份額,預計在預測期內保持不變

在北美,諸如哮喘、過敏性鼻炎和慢性阻塞性肺病等呼吸系統疾病增加、老年人口增加、對診斷設備的需求增加、醫療保健支出增加、可支配收入高等因素預計在預測期內,肺部給藥系統將實現健康增長。

呼吸系統疾病負擔的增加是推動對用於治療各種疾病的藥物輸送系統的需求的主要因素,從而促進了市場增長。 例如,MDPI 於 2021 年 11 月發表的一篇文章發現,墨西哥城患有哮喘的兒童與呼吸系統問題和交通相關的空氣污染顯著相關,加劇了患者的哮喘病情。 而根據IQAir公佈的數據,2021年8月,墨西哥城美國AQI值為74,表明2021年初空氣污染水平為“中等”。 此外,如該文獻所示,汽車尾氣中的一氧化碳、碳氫化合物、氮氧化物等“光化學氧化煙霧”的成分相當多地排放到大氣中。 預計空氣污染物排放量的增加會導致各種呼吸道過敏,例如哮喘和過敏性鼻炎。 因此,對創新和有效的肺部藥物輸送系統(如計量吸入器和霧化器)的需求不斷增加,預計將推動市場增長。

此外,政府和非政府組織的不斷努力也提高了整體銷售額。 例如,CDC 的國家哮喘控制計劃 (NACP) 提供資金來教育哮喘患者。 預計這些努力將提高人們對哮喘的認識,增加需求以及採用吸入器治療哮喘,並推動市場增長。

此外,專注於開發有效肺部藥物的主要國內市場參與者的存在以及越來越多地採用各種業務戰略(例如協議、收購、合作夥伴關係和增加產品發布)的情況顯而易見,預計將推動市場增長. 例如,2022 年 3 月,美國 FDA 批准了一種藥物,用於治療 6 歲及以上患者的哮喘,以及維持治療和減少慢性阻塞性肺疾病 (COPD) 患者的氣流阻塞加重,包括慢性支氣管炎和/或肺氣腫。批准了 Simcicort(布地奈德,富馬酸福特羅二水合物)吸入氣霧劑的第一個仿製藥。

因此,在研究期間,呼吸系統疾病負擔的增加以及該國企業活動和產品發布的增加將顯著推動北美地區市場。

肺部給藥系統市場競爭者分析

肺部藥物輸送系統市場競爭適中,由幾家大型企業組成。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 技術進步

- 呼吸系統疾病增加,人們越來越關注肺部藥物輸送作為藥物輸送的替代途徑

- 市場製約因素

- 關於批准給藥裝置的嚴格規定

- 波特的五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(市場規模 - 百萬美元)

- 按產品分類

- 乾粉吸入

- 定量噴霧器

- 霧化器

- 噴射霧化器

- 軟霧霧化器

- 超聲波霧化器

- 通過申請

- 囊性纖維化

- 支氣管哮喘

- 過敏性鼻炎

- 慢性阻塞性肺疾病

- 其他用途

- 最終用戶

- 醫院

- 診斷中心

- 其他最終用戶

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Koninklijke Philips NV

- GlaxoSmithKline PLC

- 3M

- Novartis AG

- Boehringer Ingelheim International GmbH

- AstraZeneca

- Cipla Inc.

- Merck & Co.

- GF Health Products Inc.

- Aerogen

- PARI GmbH

- Gilbert Technologies

第七章市場機會與未來趨勢

The pulmonary drug delivery systems market is expected to register a CAGR of 4% during the forecast period.

COVID-19 impacted the growth of the pulmonary drug delivery systems market. Patients suffering from respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD) were at high risk of getting coronavirus infection. This has increased the demand for proper drug delivery systems for administering pulmonary drugs to patients. For instance, according to an article published in Pulmonary Medicine, in March 2022, it was observed that COPD patients have worse outcomes from the coronavirus infection. Also, due to biological factors, COPD patients are more likely to acquire viral infections and suffer from COVID-19's pathophysiological effects, such as micro thrombosis, intrapulmonary shunting, and subsequent bacterial infection. Thus, the increasing risk of developing COVID-19 infection among COPD patients increased the demand for inhalers and nebulizers, which impacted the demand for drug delivery systems during the pandemic. Hence, the COVID-19 pandemic had a favorable impact on the market initially; currently, as the pandemic has subsided, the market has lost some traction. However, it is expected to have stable growth during the forecast period.

Factors such as the increasing incidence of respiratory diseases, growing technological advancements, and rising preference for pulmonary drug delivery as an alternate route of drug delivery are boosting market growth.

The prevalence and incidence of respiratory diseases such as asthma, chronic obstructive pulmonary diseases, and others among the population are increasing rapidly, which is anticipated to increase the demand for pulmonary drug delivery systems, hence propelling market growth. For instance, according to an article published in ERS Journal, in August 2022, it was projected that about 645.6 million people (454.4 million men and 191.2 million women) are expected to have COPD by 2050, representing a 36% relative increase in global prevalence as compared to the previous year. Thus, the prevalence of COPD, a serious public health issue, is expected to rise, especially in emerging countries which is anticipated to increase the demand for different drug delivery systems such as nebulizers and inhalers. This is expected to fuel the market growth over the forecast period.

In addition, pulmonary drug delivery methods are preferred to conventional drug administration approaches due to the large surface area of the alveolar sacs, the high drug loading efficiency, and the high vascularization of the lung, which makes it an ideal site for drug absorption.

Furthermore, the rising company activities in developing novel drug delivery systems and increasing product launches are also expected to increase the growth of the pulmonary drug delivery systems market over the forecast period. For instance, in June 2021, Glenmark Pharma launched Tiotropium Bromide Dry Powder Inhaler, Tiogiva, used in the treatment of chronic obstructive pulmonary disease (COPD) in the United Kingdom. Also, in March 2021, PARI Pharma GmbH received the market authorization of the LAMIRA Nebulizer System for the delivery of Insmed's drug product ARIKAYCE (amikacin liposome inhalation suspension) in Japan.

Therefore, owing to factors such as the high burden of respiratory diseases among the population and increasing product launches, the studied market is expected to grow over the forecast period. However, the regulatory issues regarding the approval for drug delivery systems are likely to hamper the growth of the pulmonary drug delivery systems market over the forecast period.

Pulmonary Drug Delivery Systems Market Trends

COPD Segment Expected to Register Significant Growth Over the Forecast Period

The chronic obstructive pulmonary diseases segment is expected to witness significant growth in the pulmonary drug delivery systems market over the forecast period. The factors attributing to the market growth are the increasing burden of COPD among the population and the growing demand for innovative drug delivery systems.

In addition, the rising geriatric population who are more prone to develop chronic obstructive pulmonary disease diseases due to the age-associated changes in the structure and function of the lung is also expected to increase the demand for the COPD drug segment over the forecast period. For instance, according to the 2022 statistics published by the United Nations Population Fund, about 59% of the total population living in Japan was aged between 15 and 64 in 2022. In addition, as per the same source, 29% of the population was aged 65 years and above in 2022.

The increasing prevalence and incidence of COPD is the key factor driving the demand for pulmonary drug delivery systems, hence propelling the segment's growth. According to a research study published in European Respiratory Journal in July 2021, it was found that the prevalence of chronic obstructive pulmonary disease (COPD) is anticipated to increase in Europe (including the Netherlands) due to rising risk factors like smoking and air pollution. Also, as per an article published in the European Respiratory Journal in November 2021, about 49,453,852 European are expected to suffer from COPD by 2050 as compared to 36,580,965 in 2020. This is expected to fuel the segment growth over the forecast period.

Moreover, the growing R&D activities and increasing product launches in the segment are expected to augment the growth of the chronic obstructive pulmonary diseases segment. For instance, in April 2022, GlaxoSmithKline Pharmaceuticals launched Trelegy Ellipta, a once-daily single-inhaler triple therapy (SITT) for treating patients suffering from chronic obstructive pulmonary diseases in India. Also, in October 2021, Glenmark launched a bioequivalent version of the Tiotropium Bromide dry powder inhaler (DPI) to treat chronic obstructive pulmonary disease (COPD) in Spain.

Therefore, owing to the factors such as the high burden of COPD and increasing product launches, the studied segment is expected to grow over the forecast period.

North America Holds Significant Share and Expected to do the Same in the Forecast Period

North America is expected to witness healthy growth in the pulmonary drug delivery systems over the forecast period owing to factors such as the increasing incidences of respiratory diseases such as asthma, allergic rhinitis, COPD, and others, the rising geriatric population, growing demand for diagnostic devices, increasing healthcare expenditure, and high disposable income.

The rising burden of respiratory diseases among the population is the key factor driving the demand for drug-delivery systems for treating various conditions, hence boosting market growth. For instance, according to an article published by MDPI in November 2021, it was observed that children with asthma in Mexico City are significantly correlated with respiratory problems and traffic-related air pollution, worsening the asthmatic condition in patients. Also, per the data published by IQAir, in August 2021, the US AQI value for Mexico City was 74, indicating "Moderate" levels of air pollution at the beginning of 2021. In addition, as per the same source, the components of "photochemical oxidizing smog" are discharged into the atmosphere in substantial amounts, including carbon monoxide, hydrocarbons, and nitrogen oxides from the exhaust of automobiles. Thus, the increasing discharge of pollutants in the air is expected to cause various respiratory allergies such as asthma, allergic rhinitis, and others among the population. This is anticipated to propel the demand for innovative and effective pulmonary drug delivery systems such as metered dose inhalers or nebulizers, hence bolstering market growth.

Furthermore, the rise in the number of initiatives undertaken by government and non-government organizations is increasing the overall revenue. For instance, CDC's National Asthma Control Program (NACP) provides funds for educating asthma-affected patients. Such initiatives are likely to increase awareness about asthma, which will increase the demand as well as the adoption of inhalers treating asthma, thereby propelling market growth.

Moreover, the presence of key market players in the country focusing on the development of effective pulmonary drugs as well as the rising adoption of various business strategies such as agreements, acquisitions, partnerships, and increasing product launches, are likely to boost the growth of the market. For instance, in March 2022, the US FDA approved the first generic of Symbicort (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol for the treatment of asthma in patients six years of age and older and the maintenance treatment of airflow obstruction and reducing exacerbations for patients with chronic obstructive pulmonary disease (COPD), including chronic bronchitis and/or emphysema.

Therefore, the rising burden of respiratory diseases and increasing company activities and product launches in the country will significantly drive the market in the North American region during the study period.

Pulmonary Drug Delivery Systems Market Competitor Analysis

The pulmonary drug delivery systems market is moderately competitive and consists of several major players. Some of the companies which are currently dominating the market are Koninklijke Philips NV, GlaxoSmithKline PLC, 3M, Novartis AG, Boehringer Ingelheim International GmbH, AstraZeneca, Cipla Inc., Merck & Co., and GF Health Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements

- 4.2.2 Increasing Incidence of Respiratory Diseases and Growing Preference for Pulmonary Drug Delivery as an Alternate Route of Drug Delivery

- 4.3 Market Restraints

- 4.3.1 Strict Regulations for Drug Delivery Devices Approval

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Product

- 5.1.1 Dry Powder Inhalers

- 5.1.2 Metered Dose Inhalers

- 5.1.3 Nebulizers

- 5.1.3.1 Jet Nebulizers

- 5.1.3.2 Soft Mist Nebulizers

- 5.1.3.3 Ultrasonic Nebulizers

- 5.2 By Application

- 5.2.1 Cystic Fibrosis

- 5.2.2 Asthma

- 5.2.3 Allergic Rhinitis

- 5.2.4 COPD

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic Centers

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Koninklijke Philips NV

- 6.1.2 GlaxoSmithKline PLC

- 6.1.3 3M

- 6.1.4 Novartis AG

- 6.1.5 Boehringer Ingelheim International GmbH

- 6.1.6 AstraZeneca

- 6.1.7 Cipla Inc.

- 6.1.8 Merck & Co.

- 6.1.9 GF Health Products Inc.

- 6.1.10 Aerogen

- 6.1.11 PARI GmbH

- 6.1.12 Gilbert Technologies