|

市場調查報告書

商品編碼

1237856

自動化輸血系統市場-增長、趨勢和預測 (2023-2028)Auto-Transfusion Systems Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,自動輸血系統市場預計將以 5.2% 的複合年增長率增長。

由於外科手術的減少,COVID-19 在大流行期間對市場增長產生了重大影響。 這主要是由於世界各國政府實施的封鎖限制導致非擇期手術暫時中止或推遲。 大流行早期的這些情況影響了對自動輸血系統的需求,從而影響了市場增長。 然而,放鬆管制後手術的恢復增加了對自動輸血系統的需求,目前的市場情況預計將在預測期內推動市場增長。

市場增長的主要驅動力是由於慢性病和生活方式病的流行,外科手術的數量不斷增加。 例如,根據 Moncloa Palace 於 2022 年 5 月發布的一份報告,2021 年西班牙將進行大約 4,781 例移植手術,比上一年的移植活動增加 8%。 此外,根據 NFHS 2021 年 11 月發布的統計數據,到 2021 年,城市地區剖腹產的比例將達到 3.2%,而農村地區的剖腹產比例將達到 17.6%。 如此大量的手術預計將推動對自動輸血系統的需求並促進市場增長。 此外,自體輸血系統的廣泛使用也推動了市場的增長,因為獻血和異體血液的稀缺對於淨化患者的血液非常有用。 例如,美國紅十字會在 2022 年 1 月發布的數據顯示,自大流行開始以來,獻血人數下降了 10%。

此外,市場參與者的努力,如合作夥伴關係、聯合研究開發自動輸血系統和提供安全有效的自動輸血系統,也有望在預測期內促進市場增長。 例如,2022 年 5 月,Vetellus Specialties Ltd 與自動化輸血設備製造商 Euroset s.r.l 簽署了一份為期五年的合同。 該協議包括向 Eurosets 供應 Vertullus PC 技術塗層,用於心肺旁路裝置等設備。 因此,上述因素,如手術次數多、獻血和異體血液稀缺,以及產品批准率上升,預計將在預測期內推動市場增長。 然而,自動輸血設備的高成本和與程序相關的風險預計將在預測期內抑制市場增長。

自動輸血系統市場趨勢

預計在預測期內,心臟外科領域將佔據很大的市場份額

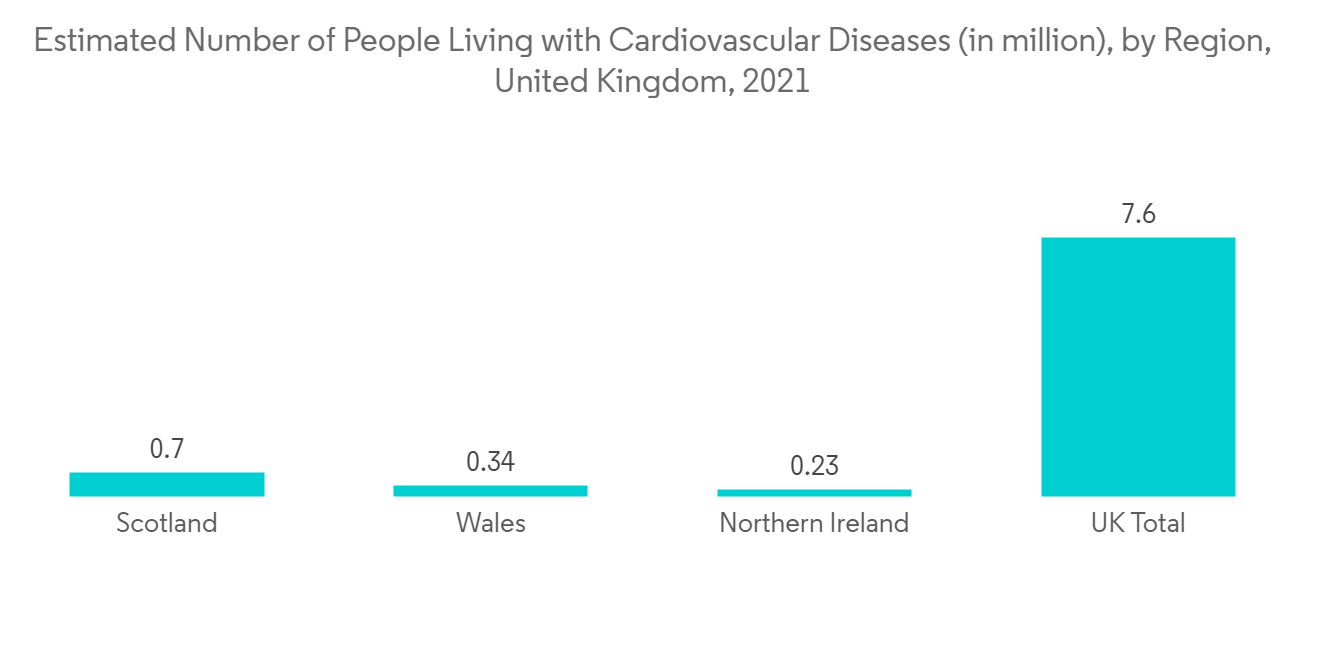

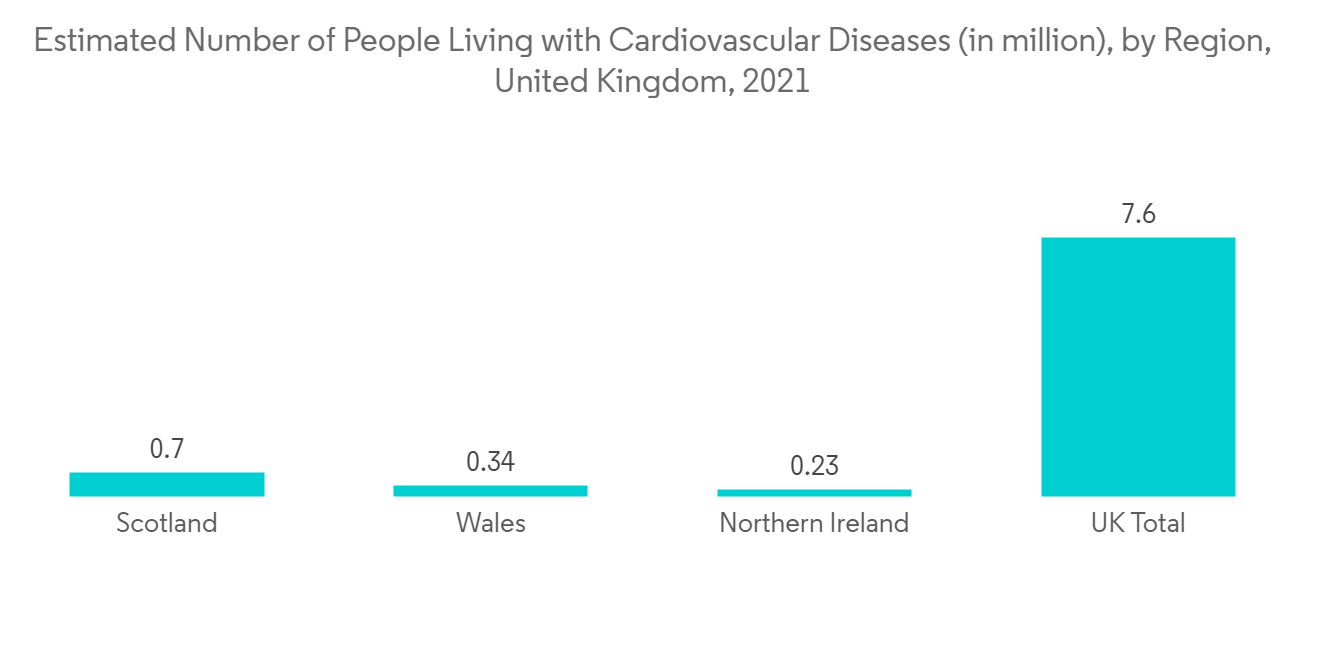

由於心髒病患病率的增加和心血管手術期間自體輸血的提倡,預計心臟手術部分將在所研究的市場中佔據很大份額。 例如,根據 BHF 2022 年 1 月的報告,截至 2021 年 11 月底,英國有近 284,000 人在等待時間敏感的心臟手術或其他心臟手術。 同樣,BHF 2022 年 8 月的一份報告指出,英國有超過 760 萬人患有心髒病和循環系統疾病。 因此,大量需要心臟手術的患者預計會增加對自動輸血系統的需求,預計這將有助於預測期內的細分市場增長。

此外,根據 NCBI 在 2022 年 8 月發表的一篇文章,2021 年德國將有大約 29,947 例孤立的冠狀動脈旁路移植術、36,714 例孤立的心臟瓣膜手術和 750 例輔助裝置植入物被註冊。 此外,根據國際組織和移植登記處(IRODAT)2022年公佈的數據,2021年的心臟移植數量為中國738例,日本59例,澳大利亞116例。 大量此類心血管手術導致大量使用自動輸血系統,這有助於市場的增長。 此外,捐贈血液和同種異體血液的日益稀缺也推動了這一領域的增長。 因此,由於上述因素,該部分在市場中佔有很大份額,預計在預測期內將會增長。

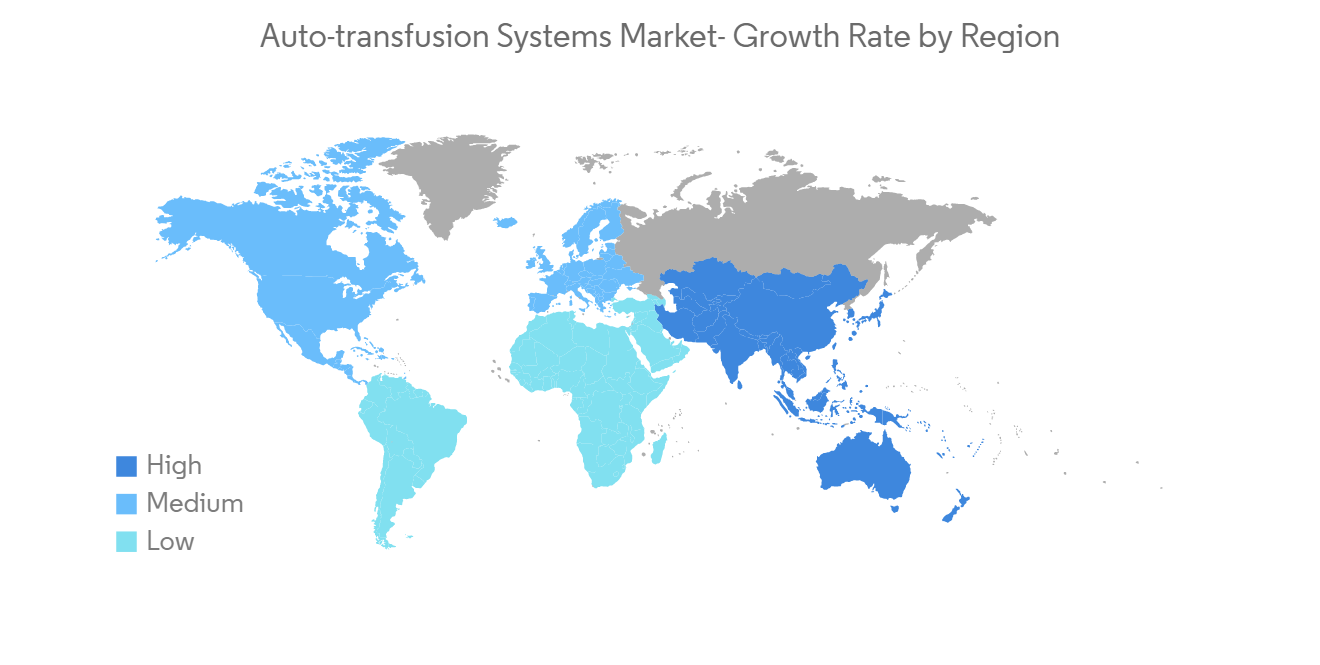

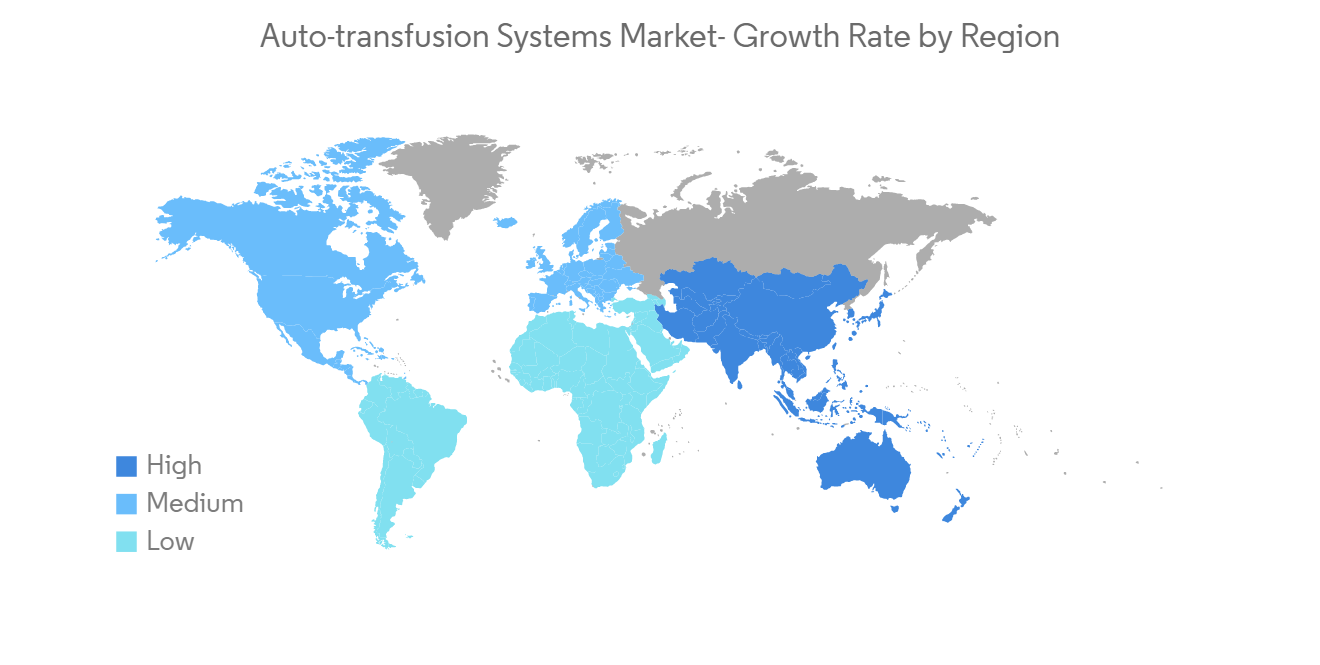

預計在預測期內,北美將佔據很大的市場份額。

在預測期內,預計北美將主導整個市場。 推動市場增長的因素包括主要參與者的存在、該地區的大量手術以及完善的醫療基礎設施。 例如,根據 IRODAT 2022 年發布的數據,2021 年美國大約進行了 19,519 例腎臟移植、8,667 例肝臟移植和 3,863 例心臟移植。 同樣,根據阿拉巴馬大學 2021 年 11 月的一篇論文,美國每年進行近 350,000 例冠狀動脈旁路移植術 (CABG) 手術。 因此,預計大量心血管手術將推動外科手術中對自動輸血系統的需求,從而推動市場增長。

此外,加拿大有許多需要外科手術的慢性病,□□因此對自動輸血系統的需求預計將推動加拿大的市場增長。 例如,根據加拿大政府2021年7月更新的數據,預計到2021年,整個加拿大將有630萬年滿65歲的加拿大人患有慢性病。 因此,加拿大老年人口的慢性病(主要需要手術干預)可能會導致對自動輸血系統的高需求,從而推動市場增長。

此外,北美主要參與者的市場戰略,如收購、合併和聯盟,以提供先進有效的自動化輸血系統,預計也將有助於該地區的市場增長。 例如,2021 年 10 月,Morgan Stanley Infrastructure 與 Specialty Care 合作並收購了 Specialty Care,以改善患者護理結果並發展公司。 Specialty Care 在美國提供自體輸血系統服務。 因此,上述因素,如外科手術數量多和慢性病增加,預計將在預測期內促進該地區的市場增長。

其他福利。

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 研究假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 手術次數增加

- 獻血短缺/同種異體血液短缺

- 市場製約因素

- 自體輸血系統成本高

- 與自體輸血相關的風險

- 波特的五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(按金額計算的市場規模 - 百萬美元)

- 按產品類型

- 設備

- 消耗品

- 通過申請

- 心臟外科

- 骨科手術

- 器官移植

- 其他

- 最終用戶

- 醫院

- 門診手術中心

- 其他

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Becton, Dickinson and Company

- Beijing ZKSK Technology Co., Ltd.

- Braile Biomedica

- Zimmer Biomet

- Medtronic Plc

- LivaNova PLC

- Redax Spa

- Gen World Medical Devices

- Haemonetics Corporation

- Teleflex Incorporated

- Fresenius Kabi

- Soma Tech INTL

第七章市場機會與未來趨勢

The auto-transfusion Systems market is projected to grow with a CAGR of 5.2% over the forecast period.

COVID-19 had a significant impact on the growth of the market during the pandemic period due to the reduction of surgical procedures. This was mainly due to the temporary suspension and postponement of non-elective surgeries due to the lockdown restriction by various governments across the world. These scenarios during the initial phase of the pandemic impacted the demand for auto-transfusion systems, thereby impacting the market's growth. However, the resumption of surgeries after the relaxation of regulations led to the growing demand for autotransfusion systems, and the current market scenario is expected to drive the growth of the market over the forecast period.

The major factor attributing to the growth of the market is the increase in the number of surgical procedures which can be attributed to the growing prevalence of chronic disease and lifestyle diseases. For instance, as per a report published by Moncloa Palace in May 2022, about 4,781 transplants were performed in Spain in 2021, an increase of 8% compared to transplant activity in the previous year. Moreover, as per the NFHS statistics released in November 2021, in India, 3.2% of births were delivered by cesarean section in urban areas, while 17.6% of births were delivered by cesarean section in rural areas till 2021. Such high surgical volume is expected to drive the demand for autotransfusion systems, thereby contributing to the growth of the market. Furthermore, the scarcity of donated blood or allogeneic blood is also boosting the market's growth owing to the extensive use of autotransfusion systems as they are highly useful in the purification of a patient's blood. For instance, according to the data published by the American Red Cross Society in January 2022, the red cross has experienced a 10% decline in the number of people donating blood since the beginning of the pandemic.

Additionally, the market player's initiatives such as partnerships, and collaborations to develop autotransfusion systems and provide safe and effective auto-transfusion systems are also expected to contribute to the growth of the market over the forecast period. For instance, in May 2022, Vetellus Specialities Ltd signed a five-year agreement with Euroset s.r.l, manufacturer of autotransfusion devices. The deal includes the supply of Vertullus PC technology coating to Eurosets for the application of equipment used in cardiopulmonary bypass surgery devices and others. Thus, the above-mentioned factors such as the high volume of surgeries, scarcity of donated blood or allogenic blood, and rising product approvals are expected to drive the growth of the market during the forecast period. However, the high cost of the auto-transfusion devices and the risk associated with the procedure are expected to restrain the market growth over the forecast period.

Auto-transfusion Systems Market Trends

Cardiac Surgeries Segment is Expected to Hold Significant Share in the Market Over the Forecast Period

The cardiac surgeries segment is expected to occupy a significant share of the studied market due to the increasing prevalence of cardiac diseases and recommendations for autologous transfusion during cardiovascular surgeries. For instance, according to BHF January 2022 report, nearly 284,000 people were waiting for time-critical heart operations and other heart procedures at the end of November 2021 in the United Kingdom. Similarly, the BHF report on August 2022 mentioned that over 7.6 million people in the United Kingdom are living with heart or circulatory disease. Hence, the high volume of patients in need of cardiac surgeries is expected to drive the demand for autotransfusion systems, thereby contributing to segment growth over the forecast period.

Furthermore, according to the article published by NCBI in August 2022, approximately 29,947 isolated coronary artery bypass grafting procedures, 36,714 isolated heart valve procedures, and 750 assist device implantations were registered in Germany in 2021. Additionally, the data published by International Registry in Organ Donation and Transplantation (IRODAT) in 2022 stated that the number of heart transplants in China was 738, 59 in Japan, and 116 in Australia in 2021. Such a high number of cardiovascular surgeries leads to the extensive usage of auto-transfusion systems, thereby contributing to the growth of the market. Furthermore, the growth of the segment is also increasing due to the growing inadequacy of donated blood or allogenic blood. Therefore, owing to the above-mentioned factors, the segment is expected to occupy a significant share of the market and grow over the forecast period.

North America is Expected to Hold Significant Share in the Market Over the Forecast Period

North America is expected to dominate the overall market, throughout the forecast period. The market growth is due to factors such as the presence of key players, a high number of surgeries in the region, and established healthcare infrastructure. For instance, as per the data published by IRODAT in 2022, in the United States, nearly 19,519 kidney transplants, 8,667 liver transplants, and 3,863 heart transplants were performed in 2021. Similarly, as per the article published by the University of Alabama in November 2021, nearly 350,000 Coronary Artery Bypass Graft (CABG) Surgeries are done each year in the United States. Hence, the high volume of cardiovascular procedures is expected to give rise to the demand for autotransfusion systems in surgical procedures, thereby boosting market growth.

Also, the demand for auto-transfusion systems due to the prevalence of chronic diseases among the Canadian population which may require surgical attention is expected to drive the growth of the market in Canada. For instance, as per data updated by the government of Canada in July 2021, overall, 6.3 million population of age 65 or more were estimated to be living with chronic conditions in 2021 in Canada. Thus, the chronic conditions among the elderly population in Canada mostly requiring surgical procedures are expected to result in high demand for autotransfusion systems, thereby propelling the market growth.

Moreover, the key player's market strategies such as acquisition, mergers, and collaborations in North America to provide advanced and effective autotransfusion systems are also expected to contribute to the growth of the market in this region. For instance, in October 2021, Morgan Stanley Infrastructure partnered and acquired Speciality Care Inc., to improve patient care outcomes and the company's growth. SpecialtyCare company provides autotransfusion system services in the United States. Thus, the above-mentioned factors such high volume of surgical procedures and the rise in chronic diseases are expected to contribute to the growth of the market over the forecast period in this region.

Auto-transfusion Systems Market Competitor Analysis

The Auto-transfusion Systems market is moderately competitive and consists of several major players. Some of the companies which are currently dominating the market are Becton, Dickinson and Company, Beijing ZKSK Technology Co., Ltd., Braile Biomedica, Haemonetics Corporation, LivaNova PLC, Medtronic, Redax, Teleflex Incorporated, Zimmer Biomet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Surgical Procedures

- 4.2.2 Scarcity of Donated Blood/Allogenic Blood

- 4.3 Market Restraints

- 4.3.1 High Costs Associated With Autotransfusion Systems

- 4.3.2 Risks Associated With Autotransfusion

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Devices

- 5.1.2 Consumables

- 5.2 By Application

- 5.2.1 Cardiac Surgeries

- 5.2.2 Orthopedic Surgeries

- 5.2.3 Organ Transplantation

- 5.2.4 Others

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Becton, Dickinson and Company

- 6.1.2 Beijing ZKSK Technology Co., Ltd.

- 6.1.3 Braile Biomedica

- 6.1.4 Zimmer Biomet

- 6.1.5 Medtronic Plc

- 6.1.6 LivaNova PLC

- 6.1.7 Redax Spa

- 6.1.8 Gen World Medical Devices

- 6.1.9 Haemonetics Corporation

- 6.1.10 Teleflex Incorporated

- 6.1.11 Fresenius Kabi

- 6.1.12 Soma Tech INTL