|

市場調查報告書

商品編碼

1237849

表面處理化學品市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Surface Treatment Chemicals Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計在預測期內,表面處理化學品市場的複合年增長率將超過 5%。

COVID-19 的爆發對錶面處理化學品的市場增長產生了積極影響。 在 COVID-19 大流行期間,開發了新的表面處理化學品來對抗病毒。 例如,ALANOD GmbH 的 MIRO UV-C 產品可有效破壞 COVID-19 病毒,並用作消毒設備的反射材料。 另一項重大進展是可用於製造針對 COVID-19 病毒的面罩的高性能醫療級透明薄膜。

主要亮點

- 短期內,在消費者需求和使用表面處理化學品減輕傳染病影響的推動下,汽車行業的增長將推動預測期內的市場增長。

- 但是,人們越來越擔心化學表面處理的影響,這促使人們從化學品轉向生物基(綠色)產品,以遵守引入該行業的法規。 環境可持續性、能源效率和多種應用能力可能會限制製造商開發利基產品,進一步阻礙市場增長。

- 但是,表面處理化學品在商業和住宅基礎設施建設中的使用,以及對生物基和無鉻表面處理化學品日益增長的興趣,將為未來提供充足的增長機會。 預計市場將在預測期內創造有利可圖的機會。

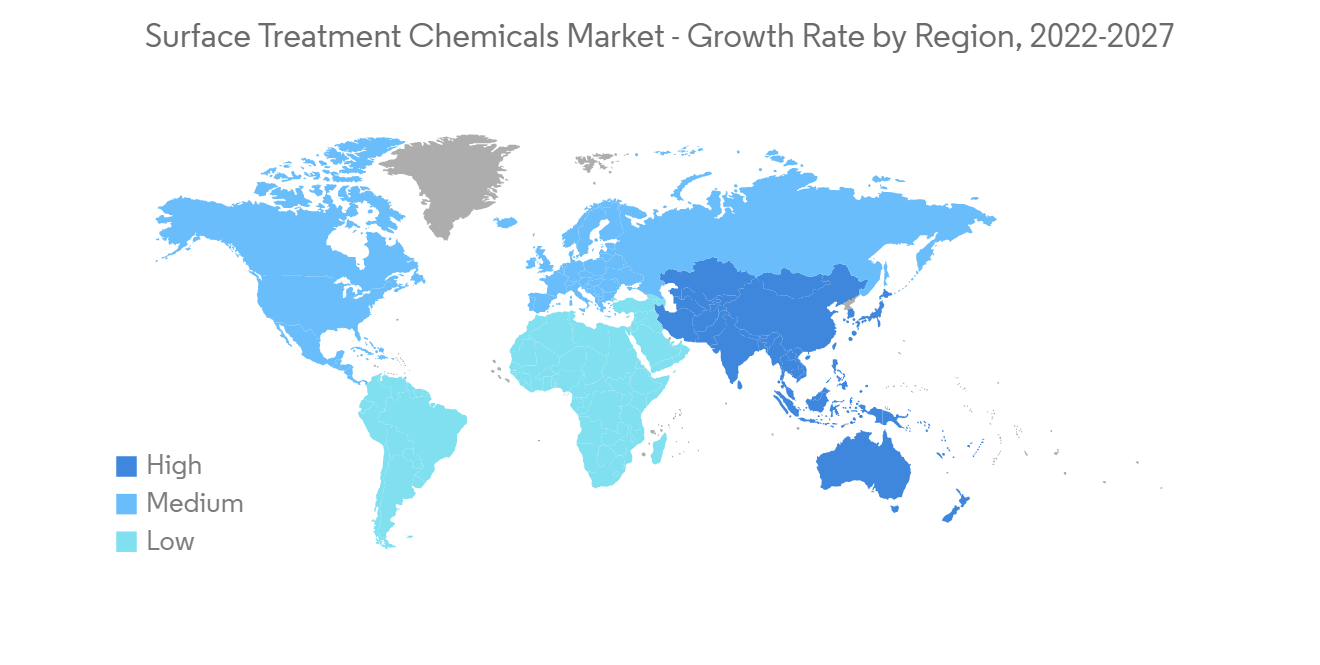

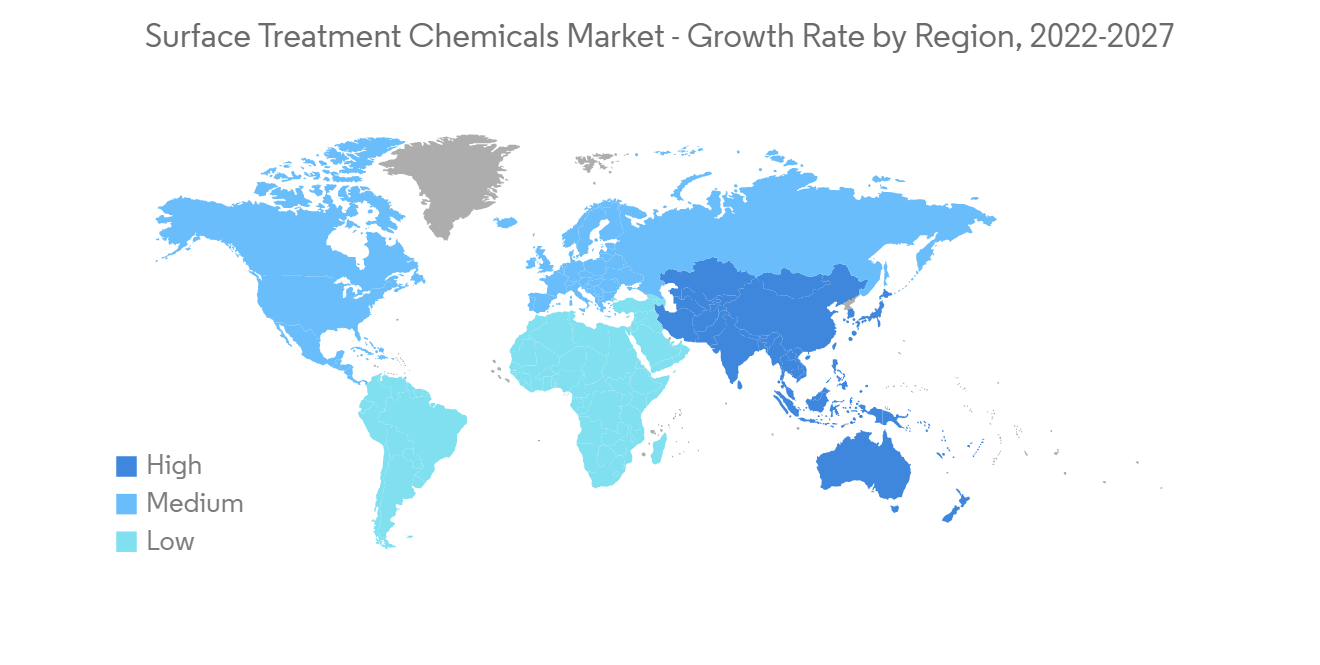

- 在收入和預測方面,預計亞太地區將在預測期內主導全球市場,在全球表面處理化學品市場中佔據最高市場份額。

表面處理化學品市場趨勢

汽車及交通裝備領域有望佔據較大份額

- 隨著電動汽車、輕型汽車、自動駕駛汽車、人工智能、互聯互通等領域的進步,汽車行業正處於最具顛覆性的旅程中。 事實證明,用於製造車輛及其部件的材料對於實現車輛的整體性能至關重要。

- 表面處理化學品被認為對汽車零部件的整體性能有重大影響。

- 在其他行業中,長期以來,汽車行業對錶面處理化學品的需求最大。 所有主要公司都為汽車行業提供表面處理化學品。

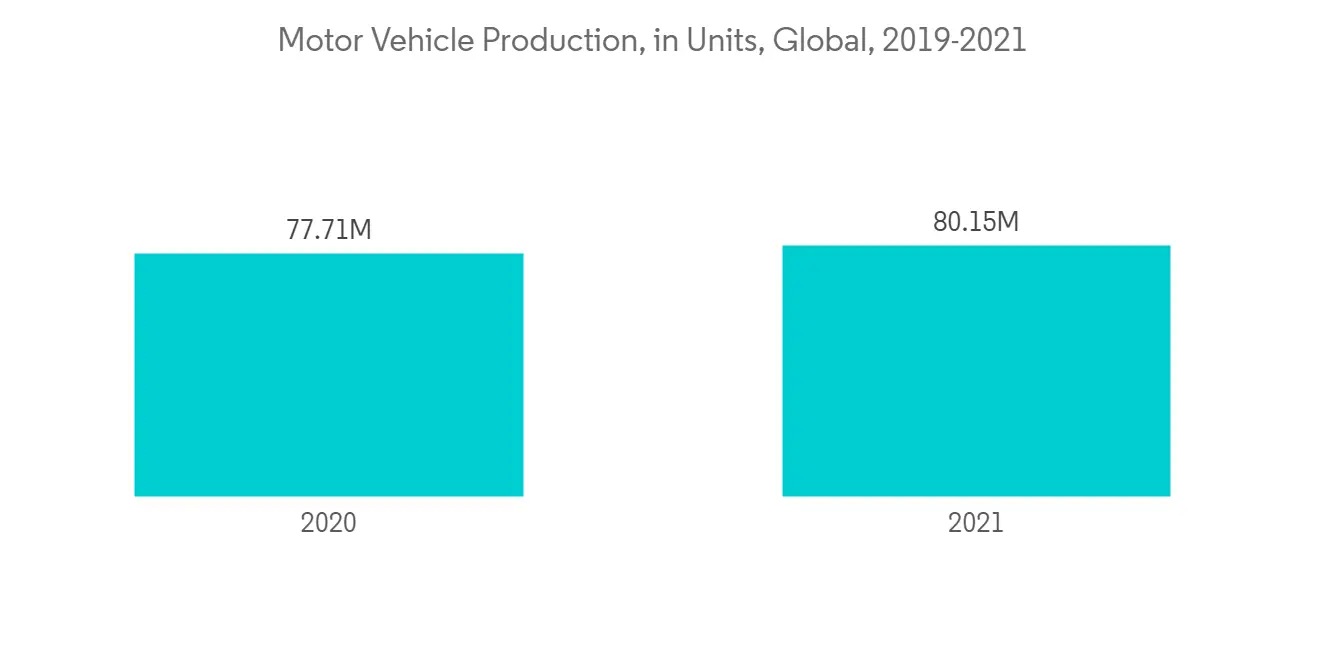

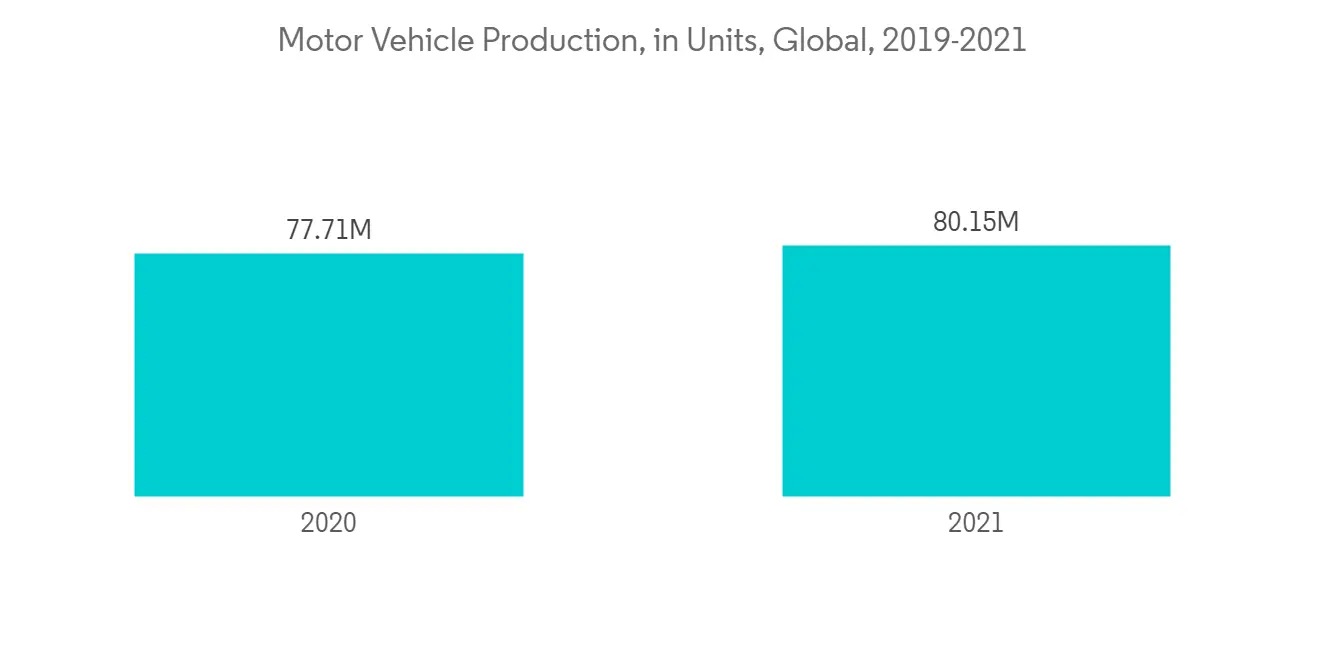

- 根據國際汽車製造商組織 (OICA) 的數據,2021 年全球汽車產量約為 8015 萬輛,而 2020 年為 7771 萬輛。

- 根據世界貿易組織 (WTO) 的數據,2021 年汽車產品的進口額約為 2860 億美元,其中美國是第二大進口國。 與此同時,該國出口了價值約 1260 億美元的汽車產品。

- 上述所有因素預計將推動汽車和運輸行業,從而在預測期內增加對錶面處理化學品的需求。

亞太地區主導市場

- 亞太地區在市場份額和市場收入方面主導著表面處理化學品市場。 預計該地區將在預測期內繼續保持其主導地位。

- 在該地區,尤其是在中國,表面處理化學品不僅用於住宅,還用於商業設施的建設,預計這將推動該地區的市場。

- 木材、玻璃、珠寶和醫療等多個行業對耐用、耐磨產品的需求不斷增長。 在建築行業評價中,該產品的需求量很大。 隨著汽車行業的擴張,表面處理化學品正在經歷更大的擴張。

- 根據中國國家統計局的數據,中國建築業繼續擴張,預計 2021 年總產值將達到約 25.9 萬億元人民幣(3.82 萬億美元)。。 借助城市化的興起,中國建築業同年創造了超過 29 萬億元人民幣(4.28 萬億美元)的產值。

- 根據國際汽車建設組織 (OICA) 的數據,中國的汽車產量將從 2020 年的 2522 萬輛增長到 2021 年的 2608 萬輛。

- 工業化也在影響市場需求。 重型設備需要定期保護,因此生產商對其進行表面處理以防止生鏽和其他損壞。

- 此外,印度和日本等國家/地區也為所研究市場的增長做出了貢獻。 因此,預計在預測期內,表面處理化學品市場的需求將進一步增加。

表面處理化學品市場競爭分析

表面處理化學品市場本質上是分散的。 市場上的主要製造商包括 PPG Industries Inc.、Atotech Deutschland GmbH、Henkel AG &、DOW、Chemetall Inc. 等(排名不分先後)。

其他福利。

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 司機

- 汽車行業的發展

- 關於使用表面處理化學品來減少傳染病的影響

- 約束因素

- 從化學產品轉向生物基(綠色)產品

- 關於有害鉻成分排放的嚴格環境法規

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 化學類型

- 電鍍化學品

- 清潔工

- 轉化膜

- 其他(冷卻水、脫漆劑等)

- 基材

- 金屬

- 塑料

- 其他基材(玻璃、合金、木材)

- 最終用戶行業

- 汽車和運輸設備

- 建築

- 電子產品

- 工業機械

- 其他(油氣管道、電力、彈藥、包裝等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 南非

- 沙特阿拉伯

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要參與者採用的策略

- 公司簡介

- Aalberts Surface Technologies

- ALANOD GmbH & Co. KG

- Atotech

- Atotech Deutschland GmbH

- Bulk Chemicals Inc.

- Chemetall Inc.

- ChemTech Surface Finishing Pvt. Ltd.

- DOW

- Henkel AG & Co. Ltd.

- IONICS

- Nippon Paint Holdings Co., Ltd.

- OC Oerlikon Management AG

- PPG Industries Inc.

- Quaker Chemical Corporation

- The Sherwin-Williams Company

- YUKEN Surface Technology, S.A. de C.V.

第七章市場機會與未來趨勢

- 關於表面處理劑在建築行業的使用

- 對生物基和無鉻表面處理化學品的興趣與日俱增

- 印刷線路板表面處理化學品的消耗量增加

The Surface Treatment Chemicals market is expected to register a CAGR of over 5% during the forecast period.

The outbreak of COVID-19 has positively impacted the market growth for surface treatment chemicals. During the COVID-19 pandemic, new surface treatment chemicals were developed to counteract the virus. For example, ALANOD GmbH's MIRO UV-C product effectively destroyed the COVID-19 virus and is utilized as a material for reflectors in sanitizing equipment. Another significant development in the fight against the COVID-19 virus has been the availability of high-performance and medical-grade transparent film to produce face shields.

Key Highlights

- Over the short term, the growth in the automotive industry due to the demand for consumers and the use of surface treatment chemicals to reduce the impact of infections is propelling the market growth during the forecast period.

- However, the growth in concerns regarding the effects of chemical surface treatment has led to the shift from chemicals to bio-based (green) products to abide by the regulations brought into the industry. Environmental sustainability, energy efficiency, and multiple application capabilities restrain manufacturers in niche product development and will further hamper market growth.

- Nevertheless, using surface-treating chemicals in construction for commercial and residential infrastructure and growing interest in bio-based and chromium-free surface-treatment chemicals will provide ample growth opportunities in the future. They will likely create lucrative opportunities for the market over the forecast period.

- In terms of revenue, Asia-Pacific is expected to dominate the global market during the forecast period and dominate the highest market share in the global surface treatment chemicals market.

Surface Treatment Chemicals Market Trends

The Automotive and Transport Segment is Anticipated to Hold a Significant Share

- The automotive sector is through the most disruptive journey, with advances in electric vehicles, lightweight vehicles, autonomous vehicles, artificial intelligence, and connectivity. The materials used to manufacture automobiles and their components proved critical in achieving overall vehicle performance.

- Surface treatment chemicals are thought to have a significant impact on the overall performance of automobile parts.

- Among numerous industries, the automotive industry has long been the most significant demand generator for surface treatment chemicals. All the major firms supply surface treatment chemicals to the car sector.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), world motor vehicle production in 2021 was about 80.15 million, compared to 77.71 million units in 2020.

- According to the World Trade Organization (WTO), with a value of about USD 286 billion in 2021, the United States was the second largest importer of automotive products. Simultaneously, the country exported automotive products worth around USD 126 billion.

- All the factors above are expected to drive the automotive and transport segment, enhancing the demand for surface treatment chemicals during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominates the surface treatment chemicals market in terms of market share and market revenue. The region is set to continue to flourish in its dominance over the forecast period.

- The growing adoption of surface treatment chemicals in construction for commercial as well as residential infrastructure in the region, especially in China, is expected to boost the market in the region.

- Rising demand for long-lasting and wear-resistant products is employed in a variety of industries, including wood, glass, jewelry, medicine, and others. In construction ratings, the product is in high demand. Surface treatment chemicals are experiencing greater expansion as the automobile sector expands.

- According to the National Bureau of Statistics of China, China's construction industry has been continuously expanding, with a total production value of roughly CNY 25.9 trillion (USD 3.82 trillion) in 2021. Taking advantage of growing urbanization, China's construction sector generated more than CNY 29 trillion (USD 4.28 trillion) in production that year.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), motor vehicle production in China was 26.08 million units in 2021, compared to 25.22 million units in 2020.

- The industrialization has also had an impact on market demand. Heavy machinery requires regular protection, so producers coat it with surface treatment chemicals to prevent rust and other problems.

- Furthermore, countries like India and Japan have also been contributing to the growth of the market studied. This is expected to further drive the demand for the surface treatment chemicals market over the forecast period.

Surface Treatment Chemicals Market Competitor Analysis

The Surface Treatment Chemicals market is fragmented in nature. Some major manufacturers in the market include PPG Industries Inc., Atotech Deutschland GmbH, Henkel AG & Co. Ltd., DOW, Chemetall Inc., and others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth in the Automotive Industry

- 4.1.2 The Use of Surface Treatment Chemicals to Reduce the Impact of Infections

- 4.2 Restraints

- 4.2.1 Shift from Chemicals to Bio-based (Green) Products

- 4.2.2 Strict Environmental Regulations for the Emission of Hazardous Chromium Components

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemicals Type

- 5.1.1 Plating Chemicals

- 5.1.2 Cleaners

- 5.1.3 Conversion Coatings

- 5.1.4 Other Chemical Types (Coolants, Paint Strippers)

- 5.2 Base Material

- 5.2.1 Metals

- 5.2.2 Plastics

- 5.2.3 Other Base Materials (Glass, Alloys, Wood)

- 5.3 End-User Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Construction

- 5.3.3 Electronics

- 5.3.4 Industrial Machinery

- 5.3.5 Others (Oil and Gas Pipeline, Power, Military, Packaging, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aalberts Surface Technologies

- 6.4.2 ALANOD GmbH & Co. KG

- 6.4.3 Atotech

- 6.4.4 Atotech Deutschland GmbH

- 6.4.5 Bulk Chemicals Inc.

- 6.4.6 Chemetall Inc.

- 6.4.7 ChemTech Surface Finishing Pvt. Ltd.

- 6.4.8 DOW

- 6.4.9 Henkel AG & Co. Ltd.

- 6.4.10 IONICS

- 6.4.11 Nippon Paint Holdings Co., Ltd.

- 6.4.12 OC Oerlikon Management AG

- 6.4.13 PPG Industries Inc.

- 6.4.14 Quaker Chemical Corporation

- 6.4.15 The Sherwin-Williams Company

- 6.4.16 YUKEN Surface Technology, S.A. de C.V.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Surface-treating Chemicals in Construction

- 7.2 Growing Interest in Bio-Based and Chromium-Free Surface Treatment Chemicals

- 7.3 Increasing Surface Treatment Chemical Consumption in Printed Circuit Boards