|

市場調查報告書

商品編碼

1237838

線性低密度聚乙烯 (LLDPE) 市場 - 增長、趨勢、COVID-19 的影響和預測 (2023-2028)Linear Low-Density Polyethylene (Lldpe) Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球線性低密度聚乙烯 (LLDPE) 市場預計將以超過 5% 的複合年增長率增長。

由於 COVID-19 的影響,線性低密度聚乙烯生產和乙烯原料供應鏈受到嚴重影響,但最終將在 2021 年恢復。 由於衛生和安全問題,包裝行業出現了巨大的激增,這將增加對 LLDPE 市場的需求,預計 2022 年將進一步復甦。 汽車、醫療保健、電子商務和包裝行業是線性低密度聚乙烯的主要終端用戶行業。

主要亮點

- 推動所研究市場增長的主要因素是對包裝的需求不斷增加以及對薄膜和片材的需求激增。

- 另一方面,在預測期內,用其他聚乙烯產品替代和禁止使用塑料將降低市場增長。

- 茂金屬線性低密度聚乙烯 (mLLDPE) 由於其比 LLDPE 更好的抗滲透性,因此在未來可能會帶來機會。

線性低密度聚乙烯 (LLDPE) 的市場趨勢

LLDPE薄膜需求增加

- 線性低密度聚乙烯 (LLDPE) 具有較高的衝擊強度、抗拉強度、抗穿刺性和伸長率等特性,因此被用於包裝行業。

- 食品和飲料製造商在包裝中使用 LLDPE 薄膜來保護產品免受有害化學物質的侵害並降低水分含量。 近年來,由於全球預蒸和預蒸製品的增加,LLDPE的市場份額猛增。

- 可支配收入的增加以及對快餐和送餐服務的日益偏好導致對 LLDPE 薄膜的需求不斷增長。

- 在經歷了 2020 年的低迷之後,由於 COVID-19 影響了許多最終用途行業,全球包裝行業在 2021 年恢復了穩定增長。

- 包裝是LLDPE薄膜最廣泛的應用。 中國、美國、日本、印度和德國是世界上包裝工業增長速度最快的國家之一。

- 電子商務行業的快速增長與電子商務包裝中對 LLDPE 的需求直接相關。

- 預計在預測期內,上述所有因素都會對包裝行業對 LLDPE 薄膜的需求產生重大影響。

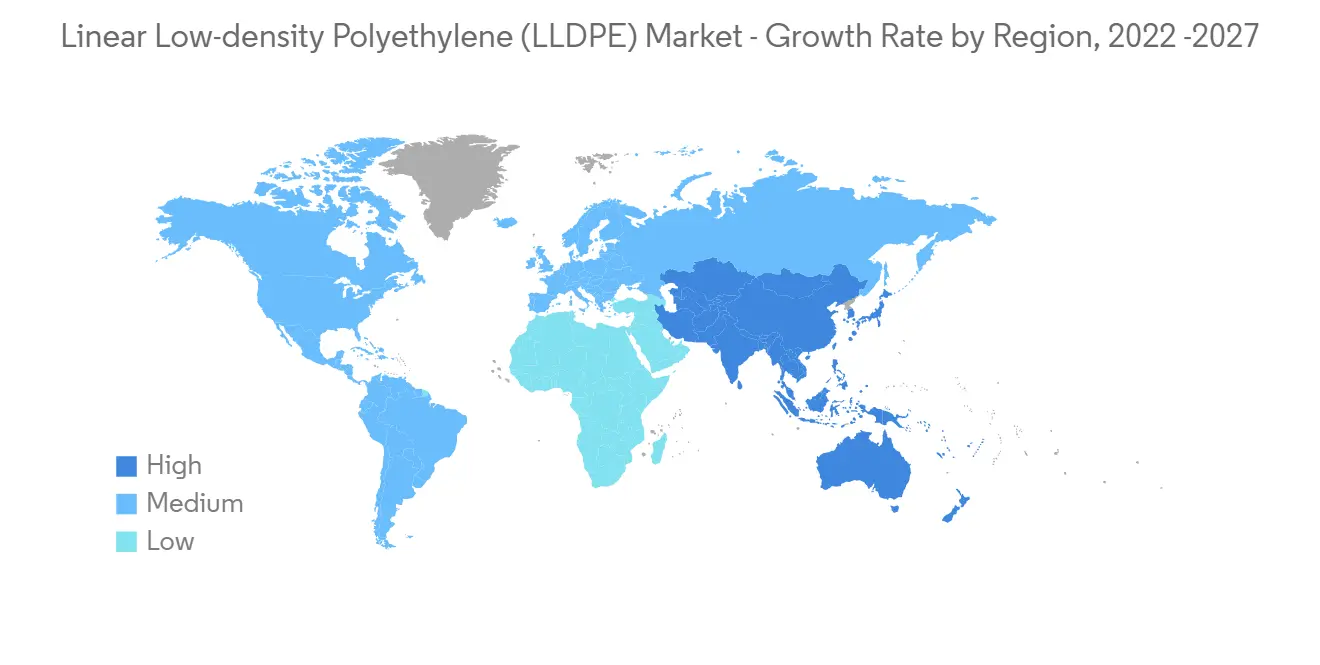

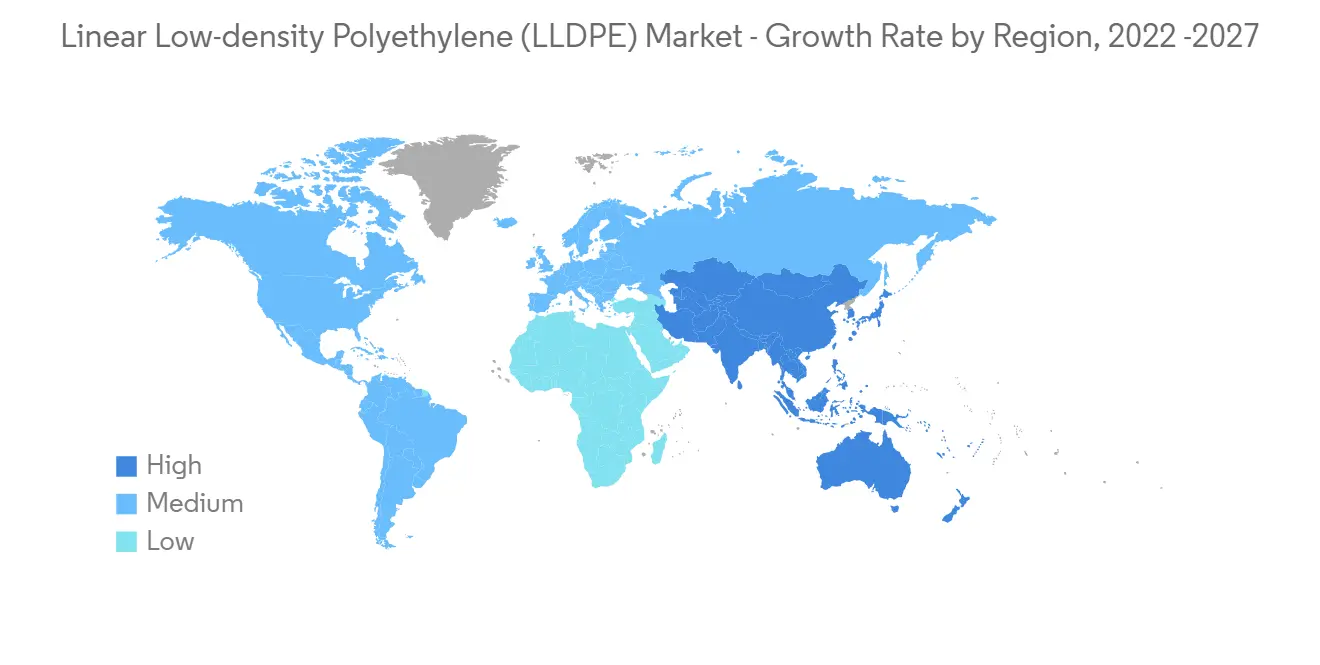

亞太地區主導市場

- 由於快速工業化和對基於 LLDPE 的包裝材料的需求不斷增長,亞太地區在線性低密度聚乙烯 (LLDPE) 市場中佔有最大份額。 在亞洲市場,隨著製藥、食品加工和汽車行業製造活動的加強,包裝業務正在快速擴張。

- 預計到 2025 年,中國包裝行業的複合年增長率將達到驚人的近 6.8%,達到 2000 億美元。 包裝行業的這種勢頭有望提振該國對 LLDPE 的市場需求。

- 在包裝行業,主要使用 LLDPE 薄膜。 LLDPE還用於注塑製造,如汽車塑料部件、玩具和水瓶。 注塑成型的增加也將增加LLDPE市場。

- 據 OICA 稱,亞太地區的汽車塑料零部件市場有望增長。 2021年中國汽車產量將達到2608萬美元。 據估計,汽車產量的增加將推動所研究市場的需求。

- 印度的食品加工是最大的包裝消費者,佔 45%,其次是藥品和個人護理產品。 這些最終用戶群不斷增長的需求創造了巨大的擴張潛力。

- 由於這些因素,預計線性低密度聚乙烯市場在預測期內將在亞太地區享有高需求。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 司機

- 包裝行業的需求增加

- 對薄膜和片材的需求激增

- 約束因素

- 用其他聚乙烯產品替代

- 工業價值鏈分析

- 搬運工五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品和替代服務的威脅

- 競爭程度

第 5 章市場細分

- 申請

- 電影

- 成型

- 注塑成型

- 其他應用程序類型

- 最終用戶行業

- 農業

- 電氣/電子

- 包裝

- 建築

- 其他最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要參與者採用的策略

- 公司簡介

- Chevron Phillips Chemical Company

- CNPC

- Exxon Mobil Corporation

- Formosa Plastic Corporation

- INEOS

- LG Chem

- Lyonde Bassells Industries Holdings BV

- Mitsubishi Chemicals

- Nova Chemicals Corporate

- Reliance Industries Limited

- SABIC

- SINOPEC

- The Dow Chemical Company

第七章市場機會與未來趨勢

- 製藥行業對 LLDPE 的需求不斷擴大

The Global Linear Low-density Polyethylene (LLDPE) market is estimated to register a CAGR of over 5% during the forecast period. Due to the impact of COVID-19, linear low-density polyethylene production and the ethylene raw material supply chain were highly affected but eventually recovered in 2021. Due to hygiene and safety concerns, the packaging industry has seen an enormous surge, thereby increasing the demand for the LLDPE market, which is expected to recover further in 2022. The automotive, healthcare, e-commerce, and packaging industries are among the major end-user industries of linear low-density polyethylene.

Key Highlights

- The major factors driving the growth of the market studied are the rise in demand for packaging and surging demand for film and sheets.

- On the flip side, substituting other polyethylene products and banning plastics reduce market growth during the forecast period.

- The development of Metallocene linear low-density polyethylene (mLLDPE) is likely to act as an opportunity in the future, mLLDPE has relatively more puncture resistance than LLDPE.

Linear Low-density Polyethylene Market Trends

Rise in Demand for LLDPE Films

- Linear low-density polyethylene is used in the packaging industry because of its properties, such as higher impact strength, tensile strength, puncture resistance, elongation, etc.

- Food and beverage manufacturing companies use LLDPE films for packaging to secure their product from harmful chemicals and less moisture content. The recent increase in ready-to-eat and pre-cooked products globally has surged LLDPE's market share.

- The growth in disposable income and the increasing preference for fast food and food delivery services contributed to increasing demand for LLDPE films.

- Following a dip in 2020, the global packaging industry resumed steady growth in 2021, as COVID-19 affected numerous end-use sectors.

- Packaging is the most extensive application of LLDPE films. China, the United States, Japan, India, and Germany are amongst the top countries with the fastest growth rate in the packaging industry across the world.

- Rapid growth in the e-commerce industry directly correlates to the LLDPE demand for e-commerce packaging.

- All the above factors are expected to significantly impact the demand for LLDPE films from the packaging industry during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region accounts for the largest share of the Linear low-density polyethylene (LLDPE) market, owing to rapid industrialization and rising LLDPE-based packaging material demand in the region. The packaging business in the Asian market is expanding at a rapid pace with the increased manufacturing activities in the pharmaceutical, food processing, and automotive industries.

- The packaging industry in China is expected to register tremendous growth with a CAGR of nearly 6.8%, reaching USD 0.2 trillion by 2025. This positive momentum in the packaging industry is expected to boost the market demand for LLDPE in the country.

- The packaging industry primarily uses LLDPE films. LLDPE is also used in the injection molding manufacturing sectors in automotive plastic parts, toys, and water bottles. An increase in injection molding also increases the LLDPE market.

- According to the OICA, the Asia-Pacific automotive plastic parts market is expected to grow. In 2021, automotive production in China reached USD 26.08 million. The increase in automotive production is estimated to drive the demand for the market studied.

- Indian food processing is the largest consumer of packaging at 45%, followed by pharmaceuticals and personal care products. Increasing demand from these end-user segments is creating a huge potential for expansion.

- Due to all these factors, the market for linear low-density polyethylene is expected to have a high demand in the Asia-Pacific region during the forecast period.

Linear Low-density Polyethylene Market Competitor Analysis

The Linear low-density polyethylene LLDPE market is partially consolidated in nature. Some of the major players in the market include INEOS, Formosa Plastic Corporation, Dow, Mitsubishi Chemicals, LG Chem, Exxon Mobil Corporation, SINOPEC, SABIC, Lyondellbasell Industries Holdings BV, Reliance Industries Limited, and Chevron Phillips Chemical Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase Demand from the Packaging Industry

- 4.1.2 Surging Demand for Film and Sheets

- 4.2 Restraints

- 4.2.1 Substitution of Other Polyethylene Products

- 4.3 Industry Value Chain Analysis

- 4.4 Poter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Thret of Substitute products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Films

- 5.1.2 Molding

- 5.1.3 Injection Molding

- 5.1.4 Other Application Types

- 5.2 End-user Industry

- 5.2.1 Agricultute

- 5.2.2 Electrical and Electronics

- 5.2.3 Packaging

- 5.2.4 Constrution

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Phillips Chemical Company

- 6.4.2 CNPC

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 Formosa Plastic Corporation

- 6.4.5 INEOS

- 6.4.6 LG Chem

- 6.4.7 Lyonde Bassells Industries Holdings BV

- 6.4.8 Mitsubishi Chemicals

- 6.4.9 Nova Chemicals Corporate

- 6.4.10 Reliance Industries Limited

- 6.4.11 SABIC

- 6.4.12 SINOPEC

- 6.4.13 The Dow Chemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for LLDPE in the Pharmaceutical Industry