|

市場調查報告書

商品編碼

1237832

電動汽車電機微控制器市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Electric Vehicle Motor Micro Controller Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

目前,電動汽車電機微控制器市場規模為33.6億美元,預計未來5年將達到69.3億美元,複合年增長率為15.58%。

由於全球冠狀病毒大流行,電動汽車電機微控制器市場受到嚴重停產、銷量下降和汽車生產停頓的不利影響。 EVM(電動汽車電機)控制器市場受到封鎖實施和冠狀病毒世界迅速蔓延的沉重打擊。 汽車行業的製造商正在彌補因生態系統中斷和電動汽車銷量下降而造成的損失。

與此同時,雖然全球汽車行業正在從 COVID-19 的銷量下滑中復蘇,但另一場危機正在阻礙其複蘇。 全球半導體短缺可能會擾亂全球汽車生產並延遲新車銷售。 微控制器是現代信息娛樂系統、ADAS(高級駕駛輔助系統)、ABS(防抱死制動系統)和其他電子穩定係統中使用的電子控制單元的重要組成部分,其短缺導致汽車製造商被迫減產。 因此,汽車製造商正在暫停某些地區的生產,直到短缺情況有所改善。 另一方面,預計市場將在不久的將來快速發展。

隨著自動化的進步,對負責自動化汽車任務的微控制器的需求量很大。 MCU 在汽車中用於執行自動化任務,例如將電力分配到車輛的各個部分、保持排氣系統清潔以及減少燃料使用。 電動汽車以其重量輕、性能高、油耗低等優點在發展中國家越來越受歡迎。 由於排放量低,電池驅動的電動汽車越來越受到消費者的歡迎。 為了在電動汽車中使用最先進的組件,主要汽車製造商正在投資並提高產能。

此外,隨著車輛的電氣化,對專為電動汽車 (EV) 要求量身定制的新型專用 MCU 的需求不斷增長。 行業公司正在開發尖端產品並大力投資研發以滿足對電動汽車的需求激增。

電動汽車電機微控制器的市場趨勢

電動汽車在全球日益普及

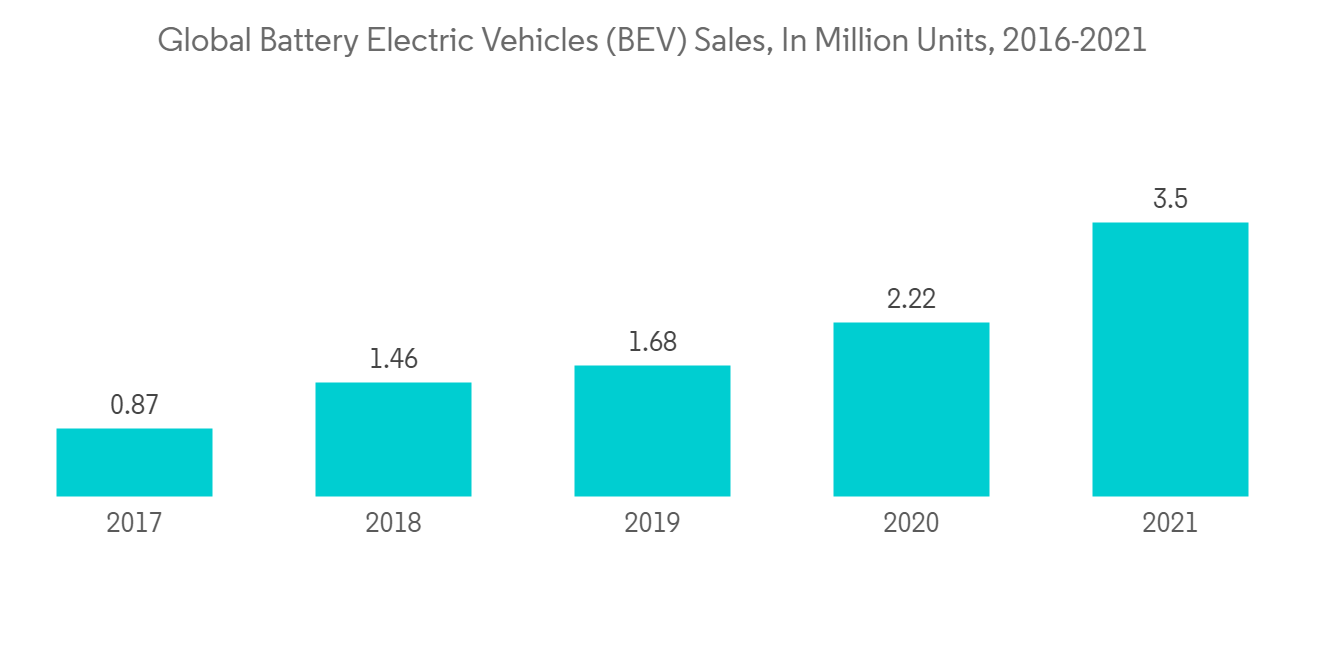

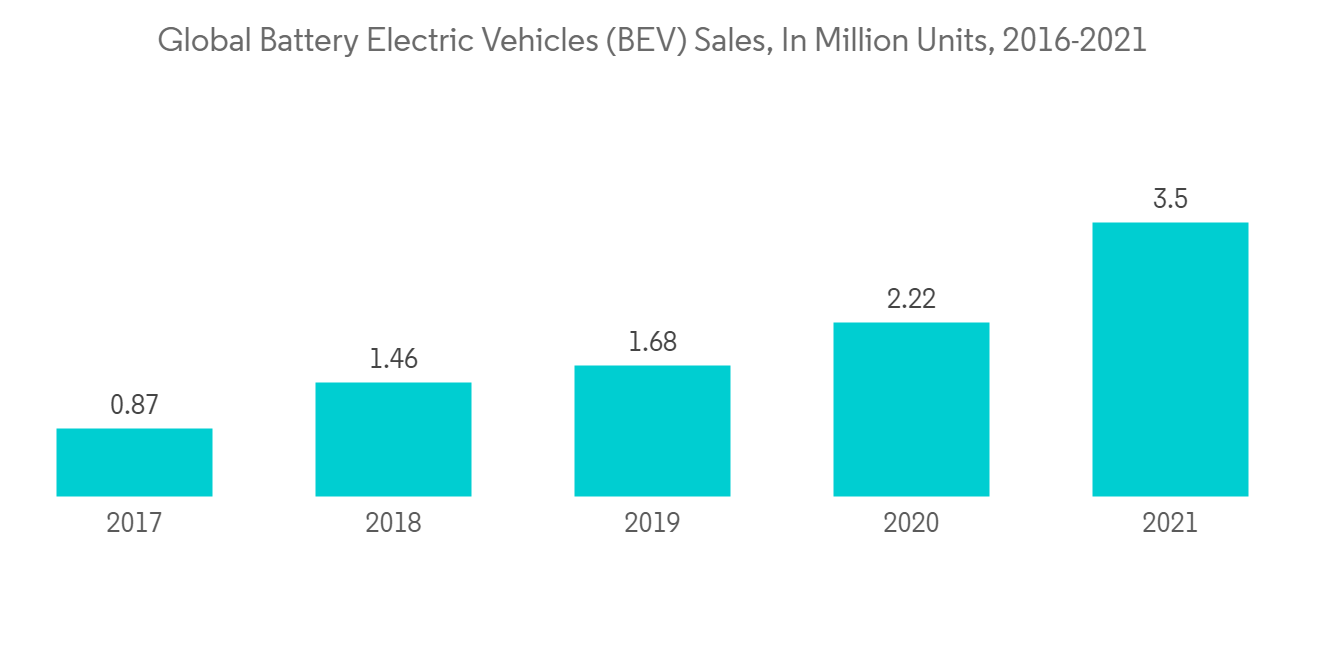

BEV 和 PHEV 銷量的增長,以及由於材料和包裝改進的進步而導致的動力總成部件成本的降低正在推動市場。 此外,由於電池成本高昂,需要加強車輛性能和電力電子。

此外,世界各國政府正在實施各種計劃和政策,以鼓勵消費者選擇電動汽車而非傳統汽車。 加州的 ZEV 計劃旨在到 2025 年擁有 150 萬輛電動汽車,這就是鼓勵購買電動汽車的此類舉措之一。 此外,印度、中國、英國、韓國、法國、德國、挪威、荷蘭等國也採取了各種優惠措施。

COVID-19 傳播後,電動汽車銷量大幅增加。 世界各地的政府封鎖令經濟放緩,並損害了電動汽車和充電基礎設施系統的銷售。 逆變器和鋰離子電池組等附加組件的可用性受到影響。 電動汽車的一個重要組成部分是功率逆變器。 電動汽車的一個組成部分是功率逆變器,它將電池的能量轉換為使用牽引電機來推動車輛。

電動汽車製造商面臨消費者接受度的重大挑戰。 缺乏充電基礎設施和電動汽車的高成本(電動汽車的成本與入門級豪華車大致相同)使消費者不願購買電動汽車,儘管它們提供了好處。 由於 COVID-19,包括印度在內的多個國家/地區被迫擱置了建造 50,000 多個充電站和改善其充電基礎設施的計劃。

重要的是,一些原始設備製造商打算重組其產品線以生產電動汽車。 例如,General Motors在 2021 年宣布,到 2025 年將在電動和自動駕駛汽車上投入 200 億美元。 到2023年,公司計劃推出20款電動汽車新車型,每年在中國和美國銷售超過100萬輛電動汽車。

到 2024 年,Volkswagen計劃在其大眾市場品牌的電動汽車上投資 360 億美元。 Volkswagen聲稱,到 2025 年,電動汽車將佔全球銷量的 25% 以上。

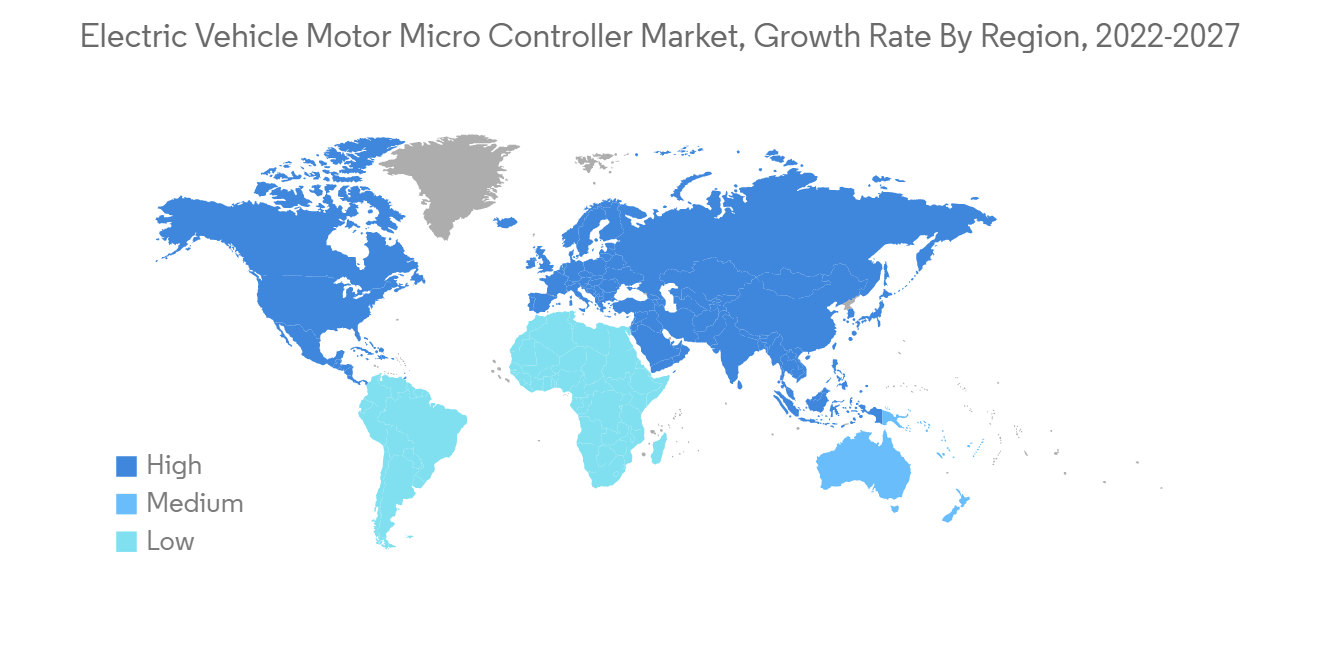

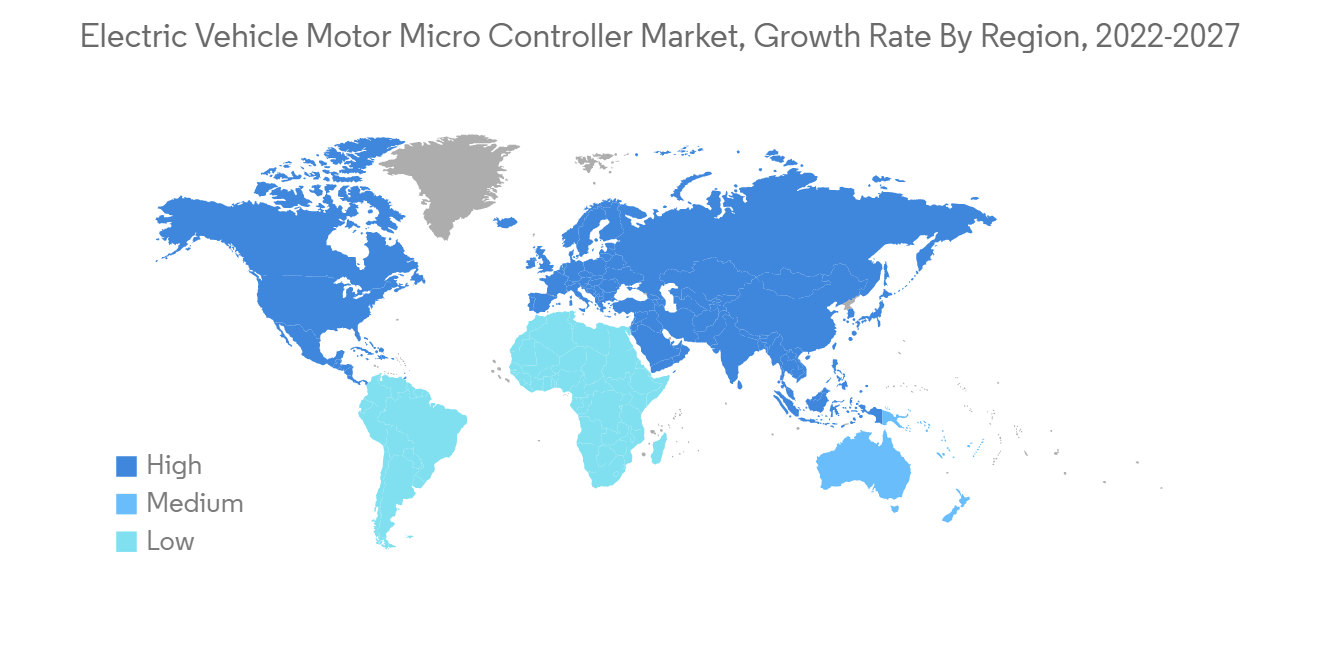

亞太地區引領市場

全球電動汽車市場以亞太地區為主。 預計該市場在預測期內將顯著增長,中國將引領電動汽車的銷售。

中國和日本正在支持最先進電動汽車的開發和技術進步。 印度尼西亞等國家也在實施重要的電動汽車項目。

中國是全球電動汽車行業的主要參與者。 此外,中國政府正在鼓勵人們引進電動汽車。 該國計劃到 2040 年完全轉向電動汽車。 中國的電動乘用車市場也是世界上最大的市場之一,並且近年來一直呈上升趨勢。 預計在預測期內也將有更高的增長,這將對電動汽車連接器的需求產生有利影響。

隨著形勢趨於正常化,日本對電動汽車的需求也出現增長跡象。 合作夥伴關係、合資企業和合併預計將促進日本電動汽車零部件的銷售,以滿足不斷增長的需求。

- 2022 年 4 月:HONDA與General Motors合作開發經濟實惠的電動汽車。 該汽車製造商計劃基於General Motors的 Ultium EV 電池構建新架構,主要用於小型跨界 SUV。

印度的電動汽車市場正處於增長階段。 TATA、Mahindra 和 MG 等印度汽車製造商正在努力提供價格適中的電動汽車。 此外,政府還支持電動汽車以減少該國的溫室氣體排放。

韓國政府為未來十年的電動汽車行業設定了雄心勃勃的目標。 該國大力投資於車輛和支持它們的基礎設施。 例如,韓國政府也對購買電動汽車進行補貼。 首爾政府為每輛電動汽車提供大約 7,500 美元的補貼。

汽車製造商也在投資擴大對電動汽車不斷增長的需求。 例如:

- 現代計劃投資 160 億美元,以在 2023 年之前擴大其全球市場份額。 隨著新產品的製造和推出,預計未來幾年對微控制器的需求將會增長。

電動汽車電機微控制器市場競爭者分析

電動汽車電機微控制器市場包括 Continental AG、Infineon Technologies AG、Toyota Industries Corporation、Robert Bosch GmbH 和 BorgWarner Inc 等知名企業。 競爭、消費者偏好的頻繁變化以及技術的快速進步預計將在預測期內威脅到市場的增長。

全球電動汽車電機微控制器市場的主要參與者正在通過併購和建設新設施來擴大影響力。 例如:

- 2022年10月:根據GreatWall公告,芯東半導體科技將在江蘇省無錫市成立,由WEI董事長建軍和聞盛科技(天津)(Wensheng Technology)牽頭。 該合資企業註冊資本為人民幣 5000 萬元(約合 420 萬美元),主要從事集成電路設計和微控制器生產。

其他福利。

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場驅動因素

- 市場製約因素

- 搬運工 5 力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分

- 按類型

- 交流永磁同步電機控制器

- 交流異步電機控制器

- 直流電機控制器

- 功率輸出

- 1~20KW

- 21~40KW

- 41~80KW

- 80KW以上

- 按推進類型

- 插電式混合動力車

- 純電動車

- 燃料電池電動車

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 俄羅斯

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳大利亞

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美

第六章競爭格局

- 供應商市場份額

- 公司簡介

- BorgWarner Inc.

- Continental AG

- Delphi Technologies PLC.

- Denso Corporation

- FUJITSU

- Hitachi Automotive Systems

- Mitsubishi Electric

- Robert Bosch GmbH

- Siemens AG

- Texas Instruments

- Toyota Industries Corporation

- Infineon Technology AG

- Delta Electronics

- Renesas Electronics Corporation

第七章市場機會與未來趨勢

Currently, the Electric Vehicle Motor Micro Controller Market is valued at USD 3.36 Billion and is expected to reach USD 6.93 Billion over the next five years at a CAGR of 15.58%.

The global coronavirus pandemic has had a negative impact on the market for Electric Vehicle Motor (EVM) controllers due to severe lockdowns, decreased sales, and a halt in automobile production. The market for Electric Vehicle Motor (EVM) controllers has suffered due to the widespread implementation of lockdowns and the rapid global spread of the coronavirus. Manufacturers in the automotive industry are making up for losses caused by the disruption of the ecosystem and the decline in sales of electric vehicles.

On the other hand, while the global automotive industry is recovering from the COVID-19 sales drop, another crisis is preventing its revival. Production of automobiles around the world is disrupted by a worldwide shortage of semiconductors, which may delay the sales of new vehicles. The scarcity of microcontrollers, which are an essential component of the electronic control units that are utilized in contemporary infotainment systems, Advanced Driver Assist Systems (ADAS), Anti-lock Braking Systems (ABS), and other electronic stability systems, has forced automobile manufacturers to reduce production. As a result, automakers halt production at specific locations until the shortage improves. On the other hand, the market is anticipated to move quickly in the near future.

Microcontrollers that are in charge of automating vehicle tasks are in high demand due to the development of automation. MCUs are employed in automobiles to carry out automatic tasks like distributing electricity to various vehicle components, keeping the exhaust system clean, and lowering fuel usage. Due to their low weight, high performance, and low fuel consumption, electric cars are becoming increasingly popular in developing nations. Battery-powered electric vehicles are becoming increasingly popular with consumers due to their low emissions. To use cutting-edge components for electric vehicles, major automakers are investing and expanding their production capacity.

Additionally, as vehicles become electrified, there is a growing demand for fresh, specialized MCUs that are tailored to meet the requirements of Electric Vehicles (EVs). Companies in the industry are developing cutting-edge goods and funding great R&D efforts to meet the spike in demand for EVs.

Electric Vehicle Motor Micro Controller Market Trends

Increased Electric Vehicle Adoption Globally

The market is being driven by increased sales of BEVs and PHEVs, as well as lower costs for powertrain components due to material advancements and improved packaging arrangement. In addition, the high cost of batteries has necessitated enhancements to vehicle performance as well as power electronics.

In addition, various programs and policies have been implemented by governments worldwide to encourage consumers to choose electric vehicles over conventional ones. The California ZEV program, which aims to have 1.5 million electric vehicles on the road by 2025, is one such initiative that encourages the purchase of electric vehicles. India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands are additional nations that provide various incentives.

After COVID-19 spread, sales of electric vehicles increased significantly. Lockdowns imposed by governments worldwide have slowed the economy and hurt sales of electric vehicles and charging infrastructure systems. The availability of additional components, such as inverters and lithium-ion battery packs, was affected. An integral component of electric vehicles is a power inverter. It uses a traction motor to propel the vehicle by converting energy from the batteries.

Manufacturers of electric vehicles have faced a significant challenge in gaining consumer acceptance. Due to factors such as a lack of charging infrastructure and the high cost of EVs (EV costs are almost the same as those of entry-level luxury cars), consumers have been reluctant to purchase electric vehicles despite the benefits they provide. Due to COVID-19, several nations, including India, had to put their plans to construct over 50,000 charging stations and improve the charging infrastructure on hold.

Significantly, several OEMs intend to restructure their product lines solely to produce electric automobiles. For instance, General Motors announced in 2021 that by 2025, it would spend USD 20 billion on electric and autonomous vehicles. By 2023, the company intends to introduce 20 new electric models and sell more than 1 million electric cars annually in China and the United States.

By 2024, Volkswagen intends to invest USD 36 billion in electric vehicles across its mass-market brands. The business claims that by 2025, electric vehicles will account for at least 25% of its global sales.

Asia-Pacific is Leading the Market

Asia-Pacific accounts for the majority of the global market for electric vehicles. Over the forecast period, the market is expected to grow significantly, with China leading the sales of electric vehicles.

China and Japan support cutting-edge electric vehicle development and technological advancement. Significant electric mobility projects are also being implemented in nations like Indonesia.

China is a key player in the global electric vehicle industry. Moreover, the government of China is encouraging people to adopt electric vehicles. The country is planning to switch to electric mobility by 2040 completely. The Chinese electric passenger car market is also one of the largest worldwide and has been increasing over the last few years. It is expected to grow higher in the forecast period, which will also positively impact the demand for electric vehicle connectors.

As the situation is normalizing, the demand for electric vehicles in Japan shows signs of growth. To cater to the rising demand, partnerships, ventures, and mergers are expected to boost the sales of electric cars components in Japan; for instance,

- April 2022: Honda partnered with General Motors to develop affordable electric vehicles. Automakers plan to create a new architecture based on GM's Ultium EV battery, primarily for small crossover SUVs.

The Indian electric vehicle market is in its growing stage. Automobile manufacturers in India, such as TATA, Mahindra, MG, etc., are taking initiatives to provide affordable electric driving options. Moreover, the government is also supporting electric mobility to reduce the exhaust emissions of greenhouse gases in the country.

The South Korean government has set high goals for its electric vehicle industry over the next ten years. The country is making heavy investments in vehicles and infrastructure to support them. For instance, the government of South Korea is also supporting the purchase of electric cars with a subsidy. The Seoul government is providing a subsidy of approximately USD 7,500 for each electric passenger car.

Car manufacturers are also investing to scale up the growing demand for electric vehicles. For instance,

- Hyundai Motors plans to invest USD 16 billion to increase its market share in the world by 2023. With the increase in the manufacturing and launching of new products, the demand for microcontrollers is bound to grow in the upcoming years.

Electric Vehicle Motor Micro Controller Market Competitor Analysis

The Electric Vehicle Motor Micro Controller Market has a presence of prominent players like Continental AG, Infineon Technologies AG, Toyota Industries Corporation, Robert Bosch GmbH, BorgWarner Inc., etc. The competition, frequent changes in consumer preferences, and rapid technological advancements are expected to pose a threat to the market's growth during the forecast period.

Major players in the global market for Electric Vehicle Motor (EVM) controllers are expanding their presence through mergers and acquisitions or the construction of new facilities. For instance,

- October 2022: Xindong Semiconductor Technology Co., Ltd. will be established in Wuxi, Jiangsu, with Jianjun WEI, its chairman, and Wensheng Technology (Tianjin) Co., Ltd. (Wensheng Technology), according to Great Wall Motor's announcement. With a registered capital of CNY 50 million (around USD 4.20 million), the joint venture will primarily focus on integrated circuit design and the production of microcontrollers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 AC Permanent Magnet Synchronous Motor Controller

- 5.1.2 AC Asynchronous Motor Controller

- 5.1.3 DC Motor Controller

- 5.2 Power Output

- 5.2.1 1 to 20 KW

- 5.2.2 21 to 40 KW

- 5.2.3 41 to 80 KW

- 5.2.4 Above 80 KW

- 5.3 By Propulsion Type

- 5.3.1 Plug-in Hybrid Vehicle

- 5.3.2 Battery Electric Vehicle

- 5.3.3 Fuel Cell Electric Vehicle

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 BorgWarner Inc.

- 6.2.2 Continental AG

- 6.2.3 Delphi Technologies PLC.

- 6.2.4 Denso Corporation

- 6.2.5 FUJITSU

- 6.2.6 Hitachi Automotive Systems

- 6.2.7 Mitsubishi Electric

- 6.2.8 Robert Bosch GmbH

- 6.2.9 Siemens AG

- 6.2.10 Texas Instruments

- 6.2.11 Toyota Industries Corporation

- 6.2.12 Infineon Technology AG

- 6.2.13 Delta Electronics

- 6.2.14 Renesas Electronics Corporation