|

市場調查報告書

商品編碼

1435802

活性矽酸鈣:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Active Calcium Silicate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

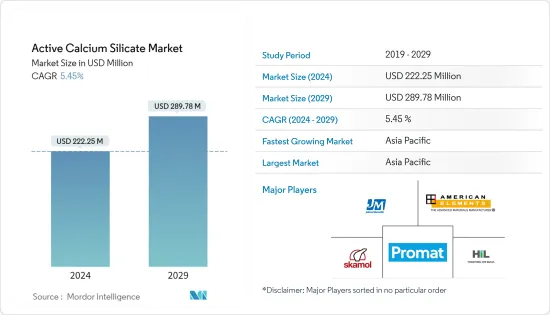

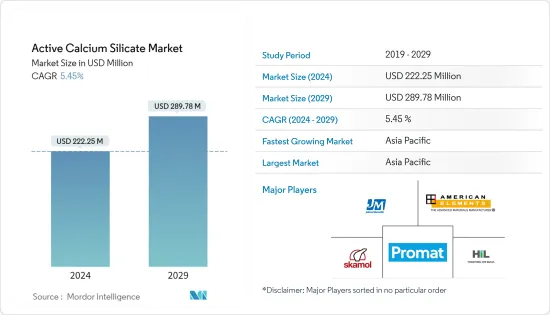

活性矽酸鈣市場規模預計到2024年為2.2225億美元,預計到2029年將達到2.8978億美元,在預測期內(2024-2029年)增加545萬美元,複合年成長率預計為% 。

新型冠狀病毒感染疾病(COVID-19)的爆發導致世界各地的國家封鎖,擾亂了製造活動和供應鏈,並導致生產停止,這對 2020 年的市場產生了負面影響。然而,情況在2021年開始好轉,恢復了市場的成長軌跡。

主要亮點

- 推動所研究市場的主要因素是亞太地區建設產業需求的增加以及陶瓷業使用量的增加。

- 另一方面,有關產品允許暴露限值的嚴格規定是阻礙市場成長的主要限制因素。

- 對吸聲和耐高溫應用的需求不斷成長預計將為市場成長提供各種利潤豐厚的機會。

- 從應用來看,由於各國政府對商業、住宅和工業建築中防火材料的使用提案了嚴格的規定,因此預計防火領域在預測期內將大幅成長。

- 亞太地區在全球市場中佔據主導地位,其中中國、印度和東南亞國協國家的消費量最大。

活性矽酸鈣市場趨勢

保溫、防火領域需求不斷擴大

- 活性矽酸鈣由於其特性而被廣泛應用於建築領域,該產品用於黏合、隔熱、膨脹和防火應用。增加建築支出以提高住宅、商業和工業計劃的品質正在增加該領域正在研究的市場需求。

- 活性矽酸鈣不易燃,即使在潮濕條件下也能保持優異的尺寸穩定性。在牆板和隔音磚的製造中擴大使用活性矽酸鈣,以提供優異的吸聲性能。

- 各國政府強調嚴格的環境法規,旨在預防火災、減少火災危害、加強緊急救援、保護人身和財產安全、維護公共。

- 建築法規適用於新建築的建設以及建築擴建和材料的變更。這些建築結構安全法正迅速應用於內表面,以防止火災危險,從而增加了對活性矽酸鈣等防火產品的需求。

- 根據《全球建築展望》和《牛津經濟》的數據,到2030年,全球整體建築業產值預計將達到15.5兆美元,其中中國、美國和印度處於領先地位,佔成長的57%。

- 根據房屋抵押貸款銀行家協會(MBA)的預測,到2023年,美國單戶住宅的數量預計將達到121萬套。

- 美國擁有龐大的建築業,擁有超過 760 萬名員工。根據美國人口普查局的數據,2022年建築業價值為17,929億美元,比2021年的16,264億美元成長10.2%。

- 由於活性矽酸鈣的上述所有因素,預計其市場在預測期內將快速成長。

亞太地區主導市場

- 預計亞太地區在預測期內將主導活性矽酸鈣市場。中國和印度等國家對建築、消防、水泥和陶瓷等各種應用的活性矽酸鈣的需求不斷增加,增加了該地區對活性矽酸鈣的需求。

- 有關產品標準和品質的規則和法規的製定預計將促進區域成長。對活性矽酸鈣等防火覆層產品的需求預計將推動市場需求,以防止煙霧、火焰和火勢蔓延。

- 近年來,由於經濟快速成長、都市化加快以及基礎設施支出增加,亞太地區的建築業經歷了穩定成長。外國公司在亞太地區的存在不斷增加,也創造了建造新辦公室、大樓、生產廠房等的需求,從而促進了該地區建築業的成長,從而增加了產量活性矽酸鈣,有刺激性。本地市場。

- 中國已經制定了一系列消防安全法規,從預防和緩解火災的政策性法規到與消防設施和監控流程要求相關的具體標準。關於消防安全的最新法律是《建築消防安全設計規範》(GB50016-2014)。它結合了原有規範和高層建築消防設計規定,增加了與其他標準通訊協定的一致性和相容性。這些規定促進了該地區活性矽酸鈣的吸收。

- 根據印度品牌股權基金會(IBEF)預測,到2030年,印度房地產業規模預計將達到1兆美元,到2025年對該國GDP的貢獻率約為13%。這可能會增加對活性矽酸鈣的需求並推動其市場。區域性的。

- 由於公共和私人基礎設施以及商業計劃投資的增加,預計未來五年該國的建築業將適度擴張。預計2023年和2024年GDP佔有率將增加,分別達到2,217.5億美元和2,252億美元。

- 在東南亞基礎設施投資方面,日本仍然是無可爭議的領導者,這是一個重要的經濟和外交政策目標,並對抗北京在該地區日益成長的影響力。東京是這個快速發展地區的最大投資者,日本金融家目前正在參與基礎建設計劃。

- 在亞太地區營運的一些主要企業包括 Promat、2K Technologies、HIL Limited 和 MLA Group of Industries。

- 上述因素和政府支持將有助於預測期內活性矽酸鈣需求的增加。

活性矽酸鈣產業概況

全球活性矽酸鈣市場較為分散,少數大型企業控制相當大的佔有率。主要公司包括 Promat International (Etex)、Skamol Group、American Elements、HIL Limited 和 Johns Manville(未另說明)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區建築業需求不斷成長

- 陶瓷業的應用不斷增加

- 其他司機

- 抑制因素

- 關於產品允許接觸限值的嚴格規定

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 目的

- 絕緣

- 消防

- 油漆/塗料

- 陶瓷

- 水泥

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- American Elements

- HIL Limited

- Johns Manville

- MLA Group of Industries

- Promat International(Etex)

- Ramco Industries Limited

- Sibelco

- Skamol Group

- Weifang Hongyuan Chemical Co., Ltd.

- Xella Group

第7章 市場機會及未來趨勢

The Active Calcium Silicate Market size is estimated at USD 222.25 million in 2024, and is expected to reach USD 289.78 million by 2029, growing at a CAGR of 5.45% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- Major factors driving the market studied are growing demand from the construction industry in Asia-Pacific and increasing usage in the ceramic industry.

- On the flip side, stringent regulations about the permissible exposure limit of the product are the major restraints hindering the market's growth.

- Growing demand for sound adsorption and high temperature-resistance applications is expected to offer various lucrative opportunities for market growth.

- By application, the fire protection segment is expected to grow significantly during the forecast period owing to stringent regulations proposed by various governments to use fire protection materials in commercial, residential, and industrial buildings.

- Asia-Pacific dominated the global market with the largest consumption from the countries such as China, India, and ASEAN Countries.

Active Calcium Silicate Market Trends

Growing Demand from Insulation and Fire Protection Segment

- Active calcium silicate is widely used in the building and construction segment owing to its properties which leads the product to be used for adhesion, insulation, intumescence, and fire resistance applications. Growing construction spending to upgrade the quality of residential, commercial, and industrial projects is boosting the demand for the market studied in the sector.

- Active calcium silicate is non-combustible and retains its excellent dimensional stability even in damp and humid conditions. The increasing usage of active calcium silicate in producing wallboard and acoustic tiles can offer excellent sound adsorption properties.

- The government has been emphasizing stringent environmental regulations to prevent fire and reduce the harm caused by fire hazards, improving emergency rescue, safeguarding personal safety and security of property, as well as maintaining public security.

- Building Regulations apply to the construction of new buildings and extensions and material alterations to the buildings. These safety laws on building construction have been followed rapidly in the interior surfaces for protection against fire hazards, leading to enhanced demand for fire protection products such as active calcium silicate.

- According to Global Construction Perspectives and Oxford Economics, the volume of construction output is expected to reach USD 15.5 trillion worldwide by 2030, with three countries - China, the United States, and India leading the way and accounting for 57% of all global growth.

- According to the Mortgage Bankers Association (MBA) forecasts, single-family housing is expected to be 1.210 million in the United States in 2023.

- The United States boasts a colossal construction sector with over 7.6 million employees. According to U.S. Census Bureau, in 2022, the value of construction was USD 1,792.9 billion, a 10.2% increase over the USD 1,626.4 billion spent in 2021.

- Owing to all the factors mentioned above for active calcium silicate, its market is expected to grow rapidly over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for active calcium silicate during the forecast period. In countries like China and India, owing to the increase in the demand for active calcium silicates from various applications in building & construction, fire protection, cement, and ceramics, the demand for active calcium silicate has been increasing in the region.

- Enactment of rules and regulations about product standards and quality is expected to drive regional growth. Demand for fireproofing cladding products such as active calcium silicate for prevention against smoke, flames, and fire spread should boost market demand.

- The construction sector of Asia-Pacific has been witnessing steady growth, in the recent past, owing to the presence of fast-growing economies, rapid urbanization, and rising infrastructure spending. The increasing presence of foreign companies in the Asia-Pacific region has also created the demand for the construction of new offices, buildings, production houses, etc., thereby driving the growth of the construction sector in the region and consequently stimulating the active calcium silicate market in the region.

- China has already established a set of fire safety regulations, from policy-based regulations about fire prevention and reduction to specific standards related to the requirements for fire safety facilities and monitoring processes. The updated law relating to fire safety is the Code for Fire Protection Design of Buildings (GB50016-2014), which combines the original specification and the Code of Fire Protection Design of tall buildings to increase consistency and compatibility with other standard protocols. Such regulations boost the uptake of active calcium silicate in the region.

- According to the Indian Brand Equity Foundation (IBEF), the Indian real estate industry will likely reach USD 1 trillion by 2030 and contribute approximately 13% to the country's GDP by 2025. This will likely increase the demand for active calcium silicate and propel its market in the region.

- The construction sector in the country is expected to expand at a moderate pace over the next five years, owing to the increasing investments in public and private infrastructure and commercial projects. The GDP shares in 2023 and 2024 are expected to enhance, reaching USD 221.75 billion and USD 225.20 billion, respectively.

- Regarding infrastructure investment in Southeast Asia, Japan remains the undisputed leader, not only to counter Beijing's growing influence in the region but also to serve as an important economic and foreign policy goal. Tokyo is the largest investor in this rapidly developing region, and Japanese financiers are now involved in infrastructure projects.

- Some major companies operating in the Asia-Pacific region are - Promat, 2K Technologies, HIL Limited, and MLA Group of Industries.

- The abovementioned factors and government support contribute to the increasing demand for active calcium silicate during the forecast period.

Active Calcium Silicate Industry Overview

The global active calcium silicate market is fragmented with a few major players dominating a significant portion. Some of the major companies are Promat International (Etex), Skamol Group, American Elements, HIL Limited, and Johns Manville (not in any particular).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Industry in Asia-Pacific

- 4.1.2 Increasing Usage in the Ceramic Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Pertaining to Permissible Exposure Limit of the Product

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Insulation

- 5.1.2 Fire Protection

- 5.1.3 Paints & Coatings

- 5.1.4 Ceramics

- 5.1.5 Cement

- 5.1.6 Others

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Elements

- 6.4.2 HIL Limited

- 6.4.3 Johns Manville

- 6.4.4 MLA Group of Industries

- 6.4.5 Promat International (Etex)

- 6.4.6 Ramco Industries Limited

- 6.4.7 Sibelco

- 6.4.8 Skamol Group

- 6.4.9 Weifang Hongyuan Chemical Co., Ltd.

- 6.4.10 Xella Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Sound Adsorption and High Temperature-Resistance Applications

- 7.2 Other Opportunities