|

市場調查報告書

商品編碼

1406064

氟介面活性劑-市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Fluorosurfactant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

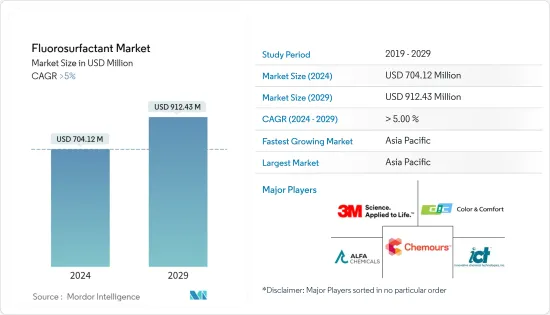

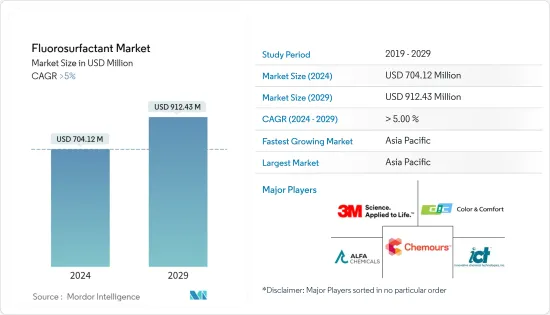

氟化介面活性劑市場規模預計2024年為7.0412億美元,預計到2029年將達到9.1243億美元,預測期內(2024-2029年)複合年成長率為5,預計成長超過%。

介面活性劑市場受到了 COVID-19 大流行的負面影響,由於油漆、被覆劑和清潔劑行業由於遏制措施和經濟中斷而被迫放慢生產,生產和運輸放緩。目前市場正從疫情中恢復。預計2022年市場將達到疫情前水準並持續穩定成長。

由於油漆和塗料行業的需求不斷增加,介面活性劑市場預計在預測期內將成長。

另一方面,與烴基和矽基介面活性劑相比,價格較高阻礙了市場成長。

此外,介面活性劑因其對腐蝕性化學品的高穩定性、高介電強度等而被用於電子塗料,預計將在預測期內創造市場機會。

亞太地區在全球整體市場中佔據主導地位,其中消費量最高的國家是中國、印度和日本。

介面活性劑的市場趨勢

油漆和塗料行業的需求不斷增加

- 介面活性劑是具有疏水部分和親水部分的兩雙親性分子。疏水尾部是碳氟化合物,親水部分根據電荷進行表徵。

- 介面活性劑通常稱為介面活性劑,可降低液體和氣體之間、液體和固體之間或兩個不混溶相之間的表面張力。這降低了漆膜的表面張力,從而獲得更光滑、更好的漆面。

- 介面活性劑可改善顏料和基材的潤濕性和流平性,提供較長的開放時間。由於氟的電負性高,且氟與碳原子之間的鍵非常穩定,因此氟基界面介面活性劑比其他介面活性劑更穩定,適用於各種條件,是優選的,很少見。

- 根據美國人口普查局的數據,2022 年私人建築價值為 14,342 億美元,比 2021 年的 12,795 億美元成長 11.7%。 2022年住宅建設支出為8,991億美元,比2021年的7,937億美元成長13.3%。因此,建設活動的擴張預計將推動市場成長。

- 此外,過去30年中國油漆和塗料行業的銷售成長領先世界其他地區。由於建設活動的增加,這一時期的快速都市化將國內建築塗料行業推向了新的高度。

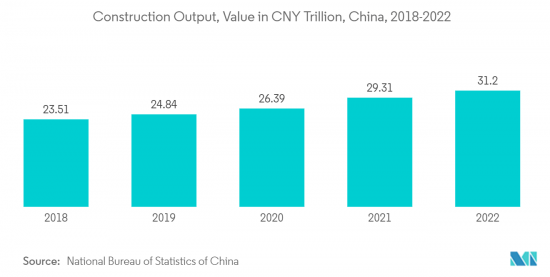

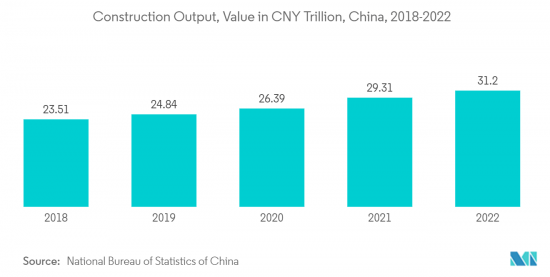

- 根據中國國家統計局的數據,中國的建築產值將於 2022 年達到峰值,達到約 31.2 兆元(約 4.61 兆美元)。結果,這些因素往往會增加市場需求。

- 此外,德國擁有歐洲最大的建築業。中國建設產業持續溫和成長,主要得益於新建住宅建設項目數量的增加。該國擁有歐洲大陸最大的建築存量,預計這一趨勢在可預見的未來將持續下去。德國的目標是到 2050 年擁有近乎氣候中立的建築群,作為轉型為永續能源系統的一部分。

- 由於上述因素,預計市場在預測期內將快速成長。

亞太地區主導市場

- 由於中國、印度和日本等國家的需求不斷增加,預計亞太地區將在預測期內主導介面活性劑市場。

- 介面活性劑廣泛應用於油漆和塗料行業。亞太地區建築和施工對油漆和塗料的需求不斷成長預計將推動市場發展。

- 在電子商務和辦公空間需求增加的推動下,中國擁有龐大的建築業。正因為如此,中國的商業建設不斷增加。例如,中國是購物中心建設的領先國家之一。中國約有4,000家購物中心,預計到2025年還將開幕7,000家。這支持了預測期內的市場成長。

- 此外,印度正在擴大其商業部門。該國正在進行多個計劃。例如,價值9億美元的CommerzIII商業辦公室綜合大樓於2022年第一季動工。該計劃涉及在孟買戈爾岡建造一座43層的商業辦公綜合體,允許占地面積為2,60,128平方公尺。該計劃預計將於 2027 年第四季完成,為預測期內的市場成長做出貢獻。

- 除了油漆和塗料外,介面活性劑也廣泛應用於石油和天然氣領域。印度石油和天然氣部預計,2022年該國石油產品產量將超過2.543億噸,比2021年的2.335億噸增加8%以上。預計這將支持市場成長。

- 所有上述因素預計將在預測期內推動亞太地區介面活性劑市場的成長。

介面活性劑產業概況

介面活性劑市場因其性質而部分分散。研究市場中的主要企業(排名不分先後)包括 3M、Innovative Chemical Technologies、DIC CORPORATION、The Chemours Company、Alfa Chemicals 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 油漆和塗料行業的需求不斷增加

- 擴大介面活性劑在油田的使用

- 其他司機

- 抑制因素

- 與其他介面活性劑相比價格高

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 類型

- 陰離子

- 陽離子

- 非離子型

- 雙性戀

- 目的

- 油漆/被覆劑

- 清潔劑/清洗劑

- 油和氣

- 阻燃劑

- 黏劑

- 其他應用(汽車、電子等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Alfa Chemicals

- CYTONIX

- DIC CORPORATION

- DYNAX

- Innovative Chemical Technologies

- MAFLON SpA

- Merck KGaA

- TCI EUROPE NV

- The Chemours Company

第7章 市場機會及未來趨勢

- 電子領域介面活性劑的使用增加

- 其他機會

The Fluorosurfactant Market size is estimated at USD 704.12 million in 2024, and is expected to reach USD 912.43 million by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The fluorosurfactant market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries, such as paints and coatings, detergents, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

The fluorosurfactant market is expected to grow during the forecast period owing to the increasing demand from the paints and coatings industry.

On the flip side, higher price when compared to hydrocarbon and silicone-based surfactants, is hindering the market growth.

Further, the use of fluorosurfactants in electronic coatings, owing to their high stability to aggressive chemicals, high dielectric strength, etc., is predicted to generate a market opportunity during the forecast period.

Asia-Pacific region dominates the market across the globe, with the largest consumption from countries such as China, India, and Japan.

Fluorosurfactant Market Trends

Growing Demand from the Paints and Coatings Industry

- Fluorosurfactants are amphiphilic molecules that have hydrophobic and hydrophilic parts. The hydrophobic tail is a fluorocarbon, and the hydrophilic part is characterized based on charge.

- Surfactants, often called surface-active agents, lower the surface tension between a liquid and a gas, or between a liquid and a solid, or between two immiscible phases. This lowers the surface tension of a coating, thus offering a smoother and excellent finish.

- Fluorosurfactant improves pigment and substrate wetting and leveling characteristics and provides high open time. Because of the high electronegativity of fluorine and the highly stable bond between fluorine and carbon atoms, fluorosurfactants are more stable, suitable for various conditions, and are more favored than other surfactants.

- In the United States, according to the US Census Bureau, the value of private construction in 2022 stood at USD 1,434.2 billion, 11.7% higher than USD 1,279.5 billion in 2021. Residential construction spending in 2022 was USD 899.1 billion, up 13.3% from USD 793.7 billion in 2021. Thus, the growing construction activities are anticipated to fuel the market growth.

- Further, China's paints and coating industry has outperformed the rest of the world in terms of volume growth over the last 30 years. Rapid urbanization during this time has boosted the domestic architectural coating sector to new heights owing to increasing construction activities.

- According to the National Bureau of Statistics of China, China's construction output peaked in 2022 at a value of about CNY 31.20 (~USD 4.61 trillion). As a result, these factors tend to increase the market demand.

- Moreover, Germany has the largest construction industry in Europe. The country's construction industry has been growing slowly, which is majorly driven by the increasing number of new residential construction activities. The country is home to the continent's largest building stock and is expected to continue in the foreseeable future. Germany aims to have an almost climate-neutral building stock by 2050 as part of its ongoing transition to a sustainable energy system.

- Owing to all the factors mentioned above, its market is expected to grow rapidly over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for fluorosurfactants during the forecast period due to an increase in demand from countries like China, India, and Japan.

- Fluorosurfactants are widely used in the paints and coatings industry. The increase in demand for paints and coatings in building and construction in the Asia-Pacific region is expected to drive the market.

- China hosts a vast construction sector owing to the rising demand from e-commerce, office space requirements, etc. This has resulted in increased commercial construction in China. For example, China is one of the leading countries concerning the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025. Thereby supporting the market growth during the forecast period.

- Furthermore, India is expanding its commercial sector. Several projects have been going on in the country. For instance, the CommerzIII Commercial Office Complex construction worth USD 900 million started in Q1 2022. The project involves the construction of a 43-story commercial office complex with a permissible floor area of 2,60,128 square meters in Goregaon, Mumbai. The project is expected to be completed in Q4 2027, thus benefitting the market growth during the forecast period.

- Apart from paints and coatings, fluorosurfactants are widely used in the oil and gas sector. According to the Ministry of Petroleum and Natural Gas (India), the production volume of petroleum products in the country was more than 254.3 million metric tons in 2022, reflecting an increase of more than 8% compared to 233.5 million metric tons in 2021. This, in turn, is likely to support the market growth.

- All the factors mentioned above are likely to fuel the growth of the Asia-Pacific fluorosurfactants market over the forecast period.

Fluorosurfactant Industry Overview

The fluorosurfactant market is partially fragmented in nature. The major players in the studied market (not in any particular order) include 3M, Innovative Chemical Technologies, DIC CORPORATION, The Chemours Company, and Alfa Chemicals, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand From the Paints and Coatings Industry

- 4.1.2 Increasing Application of Flurosurfactants in Oil Field

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Price Compared to Other Surfactants

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Anionic

- 5.1.2 Cationic

- 5.1.3 Non-ionic

- 5.1.4 Amphoteric

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Detergents and Cleaning Agents

- 5.2.3 Oil and Gas

- 5.2.4 Flame Retardants

- 5.2.5 Adhesives

- 5.2.6 Other Applications (Automotive, Electronics, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Alfa Chemicals

- 6.4.3 CYTONIX

- 6.4.4 DIC CORPORATION

- 6.4.5 DYNAX

- 6.4.6 Innovative Chemical Technologies

- 6.4.7 MAFLON S.p.A.

- 6.4.8 Merck KGaA

- 6.4.9 TCI EUROPE N.V.

- 6.4.10 The Chemours Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Use of Fluorosurfactants in Electronics Sector

- 7.2 Other Opportunities