|

市場調查報告書

商品編碼

1273485

鞣劑市場——增長、趨勢和預測 (2023-2028)Tanning Agents Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計在預測期內,全球鞣劑市場的複合年增長率將超過 6%。

COVID-19 對 2020 年的市場產生了負面影響。 然而,現在估計已達到大流行前的水平,市場有望穩步增長。

主要亮點

- 在預測期內,對優質皮革的需求激增預計將推動市場增長。

- 高昂的運營成本和嚴格的環境法規預計會阻礙市場增長。

- 增加研發投資以開發替代製革技術可能會在未來幾年帶來市場機遇。

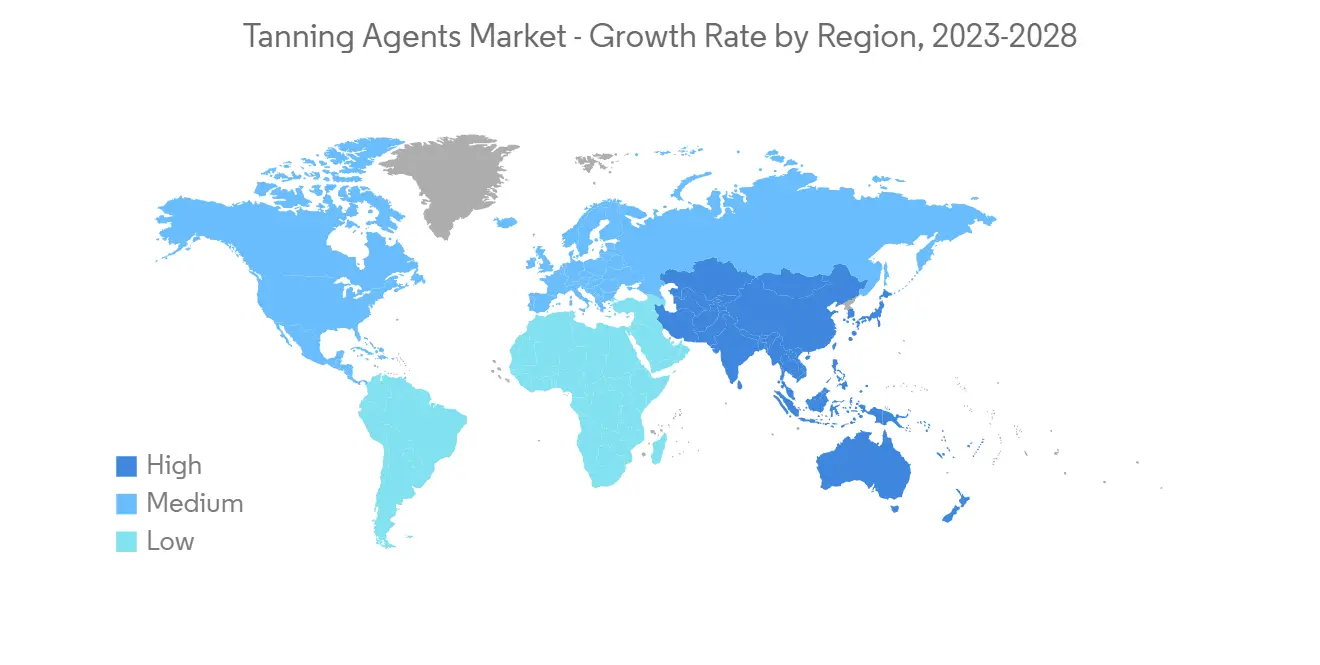

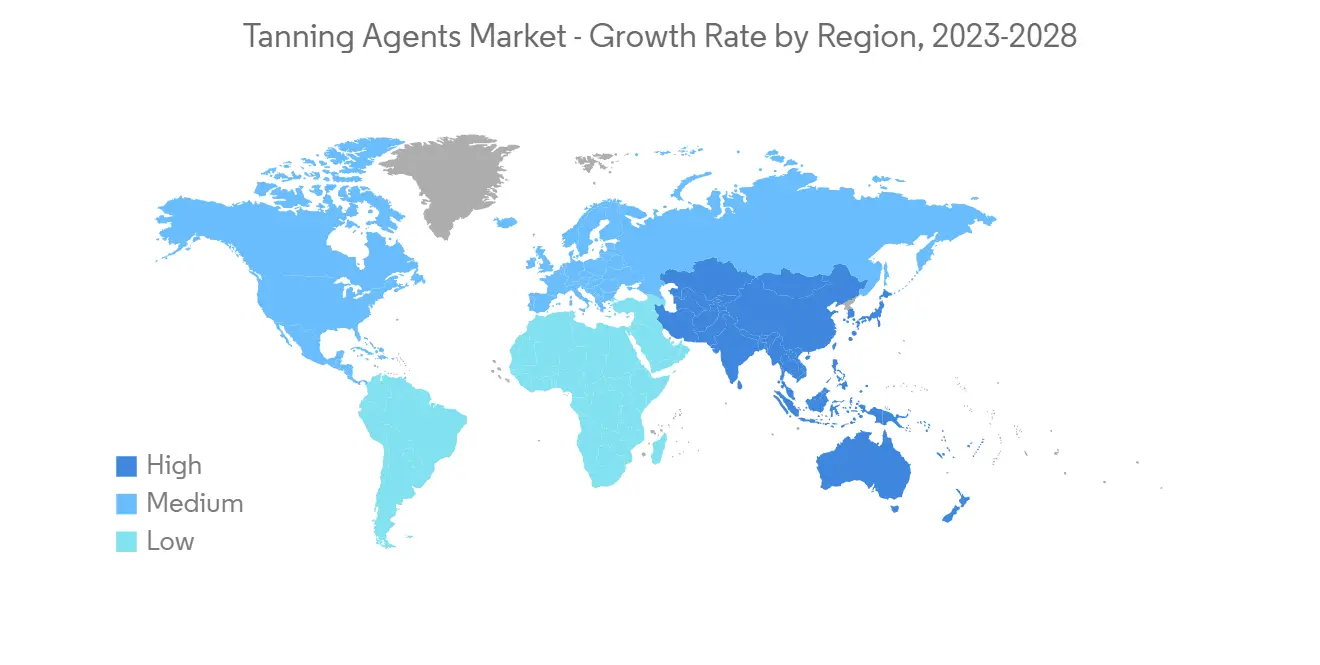

- 亞太地區主導市場,預計在預測期內將繼續保持最高的複合年增長率。

鞣劑市場趨勢

皮革鞣製——應用領域增長最快

- 鞣劑市場中增長最快的應用是皮革鞣製。 鞣製是加工生皮和毛皮以製成皮革的過程。 這個過程創造了一種柔軟、耐用和靈活的材料。

- 在皮革的鞣製過程中使用了各種材料。 鐵、鋁、鈦、鋯和鉻是典型的例子。 鉻鞣因其在高溫下的高拉伸強度和收縮性能而被廣泛使用。

- 鞣製皮革產品廣泛用於各種最終用戶行業,例如製鞋業和包裝業。

- 根據印度工業和內部貿易發展部的數據,2021 財年,皮鞋為印度的皮革出口貢獻了約 15 億美元。 同年皮革出口總值約為 37 億美元,從而支持了預測期內的市場增長。

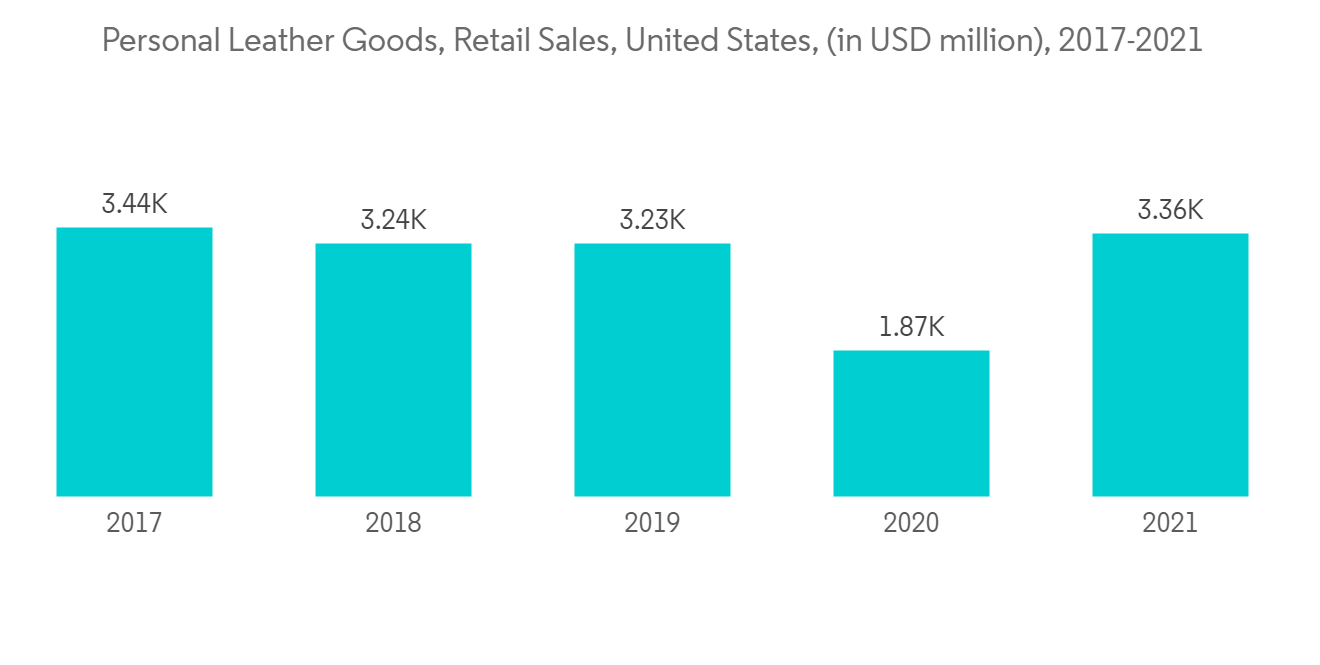

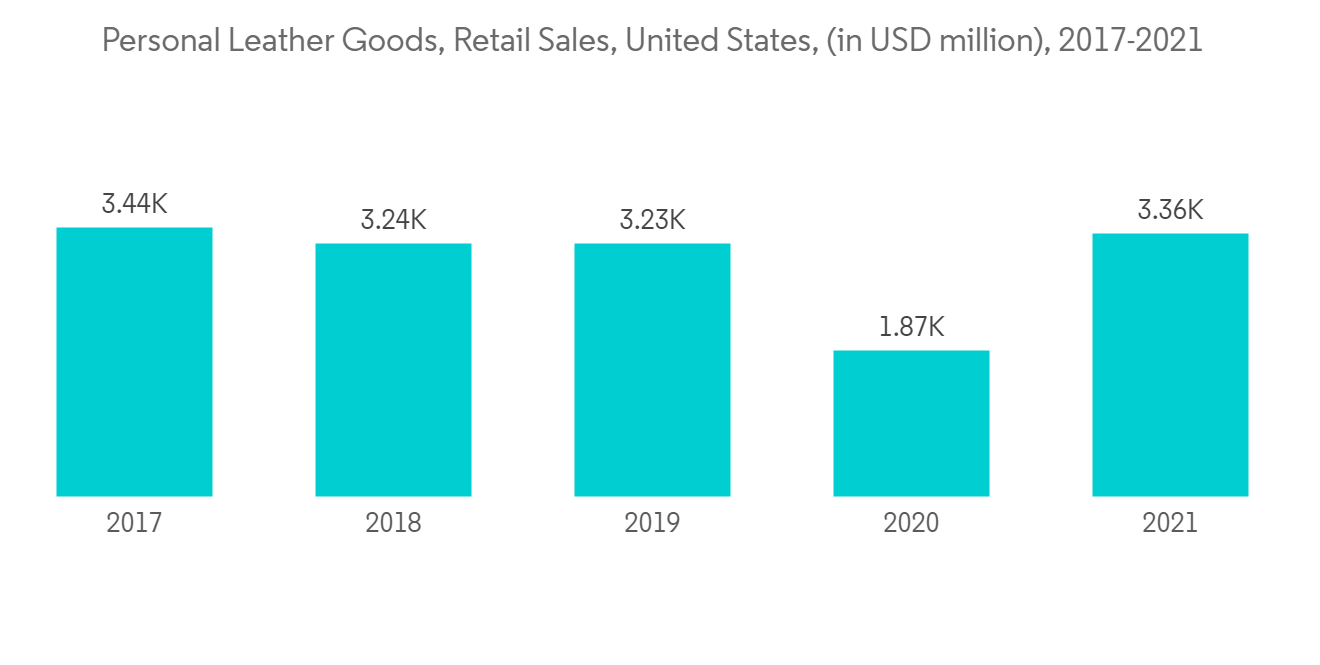

- 此外,根據旅遊用品協會的數據,從 2020 年到 2021 年,美國個人皮革製品的零售額增長了 80% 以上,從 19 億美元增至約 34 億美元。 因此,它將積極增加市場的增長。

- 由於這些因素,預計在預測期內,全球鞣劑市場將出現增長。

亞太地區主導市場

- 亞太地區主導著全球市場。 中國、印度、日本和韓國等國家不斷發展的鞋類和個人護理行業正在增加鞣劑的消耗。

- 個人護理是中國和印度等國家/地區增長最快的行業之一。 例如,印度的電子行業是世界上發展最快的行業之一。

- 隨著零售店和精品店的貨架空間增加,印度的個人護理和化妝品行業預計將繼續增長。 因此,它將支持市場的增長。

- 得益於 100% 外商直接投資 (FDI)、無需工業許可證以及從手動生產工藝向自動化生產工藝的技術轉換等有利的政府政策,國內電子製造業正在穩步擴張。

- 根據經濟產業省的一份報告,到 2021 年,中國美容和個人護理 (BPC) 行業的產值預計將超過 100 億美元,這將推動市場的增長。

- 此外,中國是世界上最大的鞋類生產國。 2021 年全球生產的鞋類中有近 54.1% 將在中國製造。 到 2021 年,中國將生產全球一半以上的鞋子。 因此,它將積極增加市場的增長。

- 考慮到所有這些因素,預計該地區的鞣劑市場在預測期內將穩步增長。

鞣劑行業概覽

鞣劑市場就其本質而言是部分整合的。 市場參與者包括 BASF SE、LANXESS、Merck KGaA、Leather International、CLARIANT 等(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 對優質皮革的需求快速增長

- 其他司機

- 約束因素

- 運營成本高

- 嚴格的環境法規

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 類型

- 無機材料

- 鉻

- 鋯

- 其他

- 醛鞣劑

- 甲醛

- 戊二醛

- 其他

- 植物鞣劑

- 其他類型

- 無機材料

- 用法

- 鞣革

- 防曬霜、個人護理產品

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- ANGUS Chemical Company

- BASF SE

- Chemtan Company, Inc.

- CLARIANT

- Ecopell GmbH

- LANXESS

- Leather International

- Merck KGaA

- SCHILL+SEILACHER GMBH

- Silvateam S.p.a.

- TRUMPLER GmbH & Co. KG

- Viswaat Chemicals Limited

- VOLPKER SPEZIALPRODUKTE GMBH

- Smit & Zoon

第七章市場機會與未來趨勢

- 增加研發投資以開發替代製革技術

簡介目錄

Product Code: 61794

The global tanning agents market is anticipated to register a CAGR of more than 6% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market is now estimated to reached pre-pandemic levels and is expected to grow steadily.

Key Highlights

- The rapid increase in demand for high-quality leather is expected to drive market growth during the forecast period.

- High operational costs and stringent environmental regulations are anticipated to hinder the market's growth.

- An increase in investment in R&D to develop alternate tanning technologies will likely create opportunities for the market in the coming years.

- Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Tanning Agents Market Trends

Leather Tanning - The Fastest Growing Segment by Application

- The fastest-growing application in the tanning agents market is the leather-tanning application. Leather tanning involves treating the skins and hides of skins to produce leather. The process produces soft, durable, and flexible material.

- Various materials are used in the tanning process of leather. Most are iron, aluminum, titanium, zirconium, and chromium. Chrome tanning is widely employed due to its high tensile strength and high-temperature shrinkage property.

- Leather-tanned products are widely used in various end-user industries, such as the footwear and packing industry.

- According to the Department for Promotion of Industry and Internal Trade (India), in the fiscal year 2021, leather footwear contributed to around USD 1.5 billion of India's leather exports. That year, total leather exports were around USD 3.7 billion, thus, supporting the market growth during the forecast period.

- Furthermore, according to the Travel Goods Association, retail sales of personal leather items in the United States increased by over 80% from 2020 to 2021, from USD 1.9 billion to approximately USD 3.4 billion. Thus, positively increasing the growth of the market.

- Owing to all these factors, the market for tanning agents will likely grow worldwide during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the global market. With growing footwear and personal care industries in countries like China, India, Japan, and South Korea, the consumption of tanning agents is increasing.

- Personal care is one of the fastest-growing sectors in countries like China and India. For example, the Indian electronics industry is one of the fastest-growing industries globally.

- India's personal care and cosmetics sector is expected to grow continuously, with increasing shelf space in retail stores and boutiques. It will, thus, support the growth of the market.

- The domestic electronics manufacturing sector is expanding at a steady rate, owing to favorable government policies such as 100% foreign direct investment (FDI), no requirement for industrial licenses, and the technological transformation from manual to automatic production processes.

- According to a Ministry of Economy and Industry report, the country's beauty and personal care (BPC) industry was expected to reach more than USD 10 billion by 2021, driving the market's growth.

- Furthermore, China is the world's largest producer of footwear. Almost 54.1% of the footwear produced worldwide in 2021 was produced in China. China manufactured more than half of the world's shoes in 2021. Hence, positively increasing the market growth.

- Due to all such factors, the region's tanning agents market is expected to grow steadily during the forecast period.

Tanning Agents Industry Overview

The tanning agents market is partially consolidated in nature. Some of the major players in the market include BASF SE, LANXESS, Merck KGaA, Leather International, and CLARIANT, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Increase in Demand for High Quality Leather

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Operational costs

- 4.2.2 Stringent Environment Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Inorganic Materials

- 5.1.1.1 Chromium

- 5.1.1.2 Zirconium

- 5.1.1.3 Others

- 5.1.2 Aldehyde Tanning Agents

- 5.1.2.1 Formaldehyde

- 5.1.2.2 Glutaraldehyde

- 5.1.2.3 Others

- 5.1.3 Vegetable Tanning Agents

- 5.1.4 Other Types

- 5.1.1 Inorganic Materials

- 5.2 Application

- 5.2.1 Leather tanning

- 5.2.2 Sun Tanning and Personal Care Products

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ANGUS Chemical Company

- 6.4.2 BASF SE

- 6.4.3 Chemtan Company, Inc.

- 6.4.4 CLARIANT

- 6.4.5 Ecopell GmbH

- 6.4.6 LANXESS

- 6.4.7 Leather International

- 6.4.8 Merck KGaA

- 6.4.9 SCHILL+SEILACHER GMBH

- 6.4.10 Silvateam S.p.a.

- 6.4.11 TRUMPLER GmbH & Co. KG

- 6.4.12 Viswaat Chemicals Limited

- 6.4.13 VOLPKER SPEZIALPRODUKTE GMBH

- 6.4.14 Smit & Zoon

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Investment of R&D to Develop Alternate Tanning Technologies

02-2729-4219

+886-2-2729-4219