|

市場調查報告書

商品編碼

1273467

檸檬酸鈉市場-增長、趨勢、COVID-19 影響和預測 (2023-2028)Sodium Citrate Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球檸檬酸鈉市場預計將實現健康增長,預計複合年增長率超過 3%。

COVID-19 對 2020 年的市場產生了負面影響。 由於大流行的情況,世界上多個國家/地區已進入封鎖狀態以遏制病毒的傳播。 然而,這種情況將在 2021 年恢復,有助於預測期內研究的市場增長。

主要亮點

- 市場增長的主要驅動力是食品和飲料消費量的增加。

- 與長期使用相關的健康問題可能會阻礙市場增長。

- 醫療行業不斷增長的需求預計也將推動未來幾年的市場增長。

- 亞太地區主導市場,預計在預測期內將繼續保持最高的複合年增長率。

檸檬酸鈉市場趨勢

食品和飲料領域主導市場

- 檸檬酸鈉主要用作食品添加劑,用於調味和保存食品。 檸檬酸鈉在一些蘇打水中用作調味劑。

- 此外,檸檬酸鈉在許多現成飲料、明膠混合物、冰淇淋、加工奶酪、糖果等中用作調味劑。 此外,檸檬酸鈉既可用於含水也可用於無水。

- 此外,檸檬酸鈉與檸檬酸結合用作緩沖劑,可在許多食品和飲料應用中保持 pH 值。 也用於嬰兒用品、彩妝用品、沐浴用品、染髮劑、染髮劑、護膚品等各種化妝品中。

- 2022 年,全球化妝品市場同比增長將超過 16%。 截至 2021 年,法國化妝品公司歐萊雅的收入約為 350 億美元,成為全球領先的美容產品製造商之一。

- 檸檬酸鈉是檸檬酸的天然鈉鹽。 保留了檸檬酸的酸味,用作酸味添加劑和食品防腐劑。 主要用於不含酒精的飲料,尤其是檸檬酸橙軟飲料。 它還用作酸度調節劑和穩定劑。

- 食品和飲料行業是一個利潤豐厚的行業,尤其是在亞太地區和海灣合作委員會(主要是阿聯酋)。 阿聯酋對食品和飲料的需求正在迅速增長,預計這一趨勢將在未來幾年持續下去。

- 根據迪拜經濟和旅遊部的數據,迪拜有 13,000 家餐飲店。 阿聯酋的食品和飲料貿易穩步增長,2021 年前九個月達到 200 億美元。

- 由於這些因素,預計檸檬酸鈉市場在預測期內將在全球範圍內增長。

亞太地區主導市場

- 由於中國和印度等國家/地區的食品和飲料、醫療和個人護理行業的需求不斷增長,預計亞太地區將主導該市場。

- 中國是世界上最大的食品和飲料進口國。 2022年12月,中國軟飲料產量約為1380萬噸,同比增長4.6%。

- 在製藥工業中,它控制 pH 值,可用作鹼化劑和緩沖劑、乳化劑、多價螯合劑、利尿劑和祛痰劑。 它還可以作為抗凝血劑來抽血。

- 中國是世界第二大醫藥市場。 加入世界貿易組織(WTO)後,中國醫藥行業得到快速發展。 截至2021年,中國將佔全球醫藥市場的12%,僅次於佔全球總銷售額40%的美國。

- 2021年,中國氫氧化鈉產量將超過3800萬噸,其次是日本416萬噸,韓國223萬噸。

- 根據工業和信息化部的數據,2022 年 1 月至 4 月,主要飲料企業的飲料產量將達到 5790 萬噸,比 2021 年同期增長 1%。

- 目前,與發達國家和其他新興經濟體相比,個人護理產品在印度的滲透率相對較低。 然而,隨著印度經濟環境的改善和印度民眾購買力的增強,個人護理產品在該國的滲透率有望提高。

- 由於這些因素,預計亞太地區的檸檬酸鈉市場在預測期內將穩定增長。

檸檬酸鈉行業概況

檸檬酸鈉市場具有部分整合的性質。 市場參與者包括 Pan Chem Corporation、Jungbunzlauer Suisse AG、Cargill, Incorporated、ADM 和 ATPGroup。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 增加食品和飲料的消費

- 醫療行業的需求不斷增加

- 約束因素

- 與長期使用相關的健康問題

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格趨勢分析

- 貿易分析

第 5 章市場細分

- 年級

- 食物

- 醫藥

- 工業

- 申請

- 用於食物和飲料

- 醫藥

- 化妝品

- 肥皂/清潔劑

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額分析

- 主要公司採用的策略

- 公司簡介

- ADM

- ATPGroup

- Cargill, Incorporated

- COFCO

- FBC Industries

- Foodchem International Corporation

- FUSO CHEMICAL CO., LTD.

- Gadot Biochemical Industries LTD.

- HUANGSHI XINGHUA BIOCHEMICAL CO.LTD.

- HUNAN DONGTING CITRIC ACID CHEMICALS CO., LTD.

- Jungbunzlauer Suisse AG

- Juxian Hongde Citric Acid Co., Ltd

- Lianyungang Mupro Food

- natural biological group

- Pan Chem Corporation

- S.A. Citrique Belge N.V.

- Tate & Lyle

第7章 市場機會與未來動向

The global sodium citrate market is estimated to register healthy growth, at an estimated CAGR of over 3%, over the forecast period.

COVID-19 negatively impacted the market in 2020. Several countries worldwide went into lockdown to curb the virus spreading due to the pandemic scenarios. However, the condition recovered in 2021, benefiting the market growth studied over the forecast period.

Key Highlights

- The primary factor driving the studied market's growth is the growing consumption of packed food & beverages.

- Health issues associated with long-term usage will likely hinder the market's growth.

- Increasing demand from the medical industry is also likely to augment the market growth in the coming years.

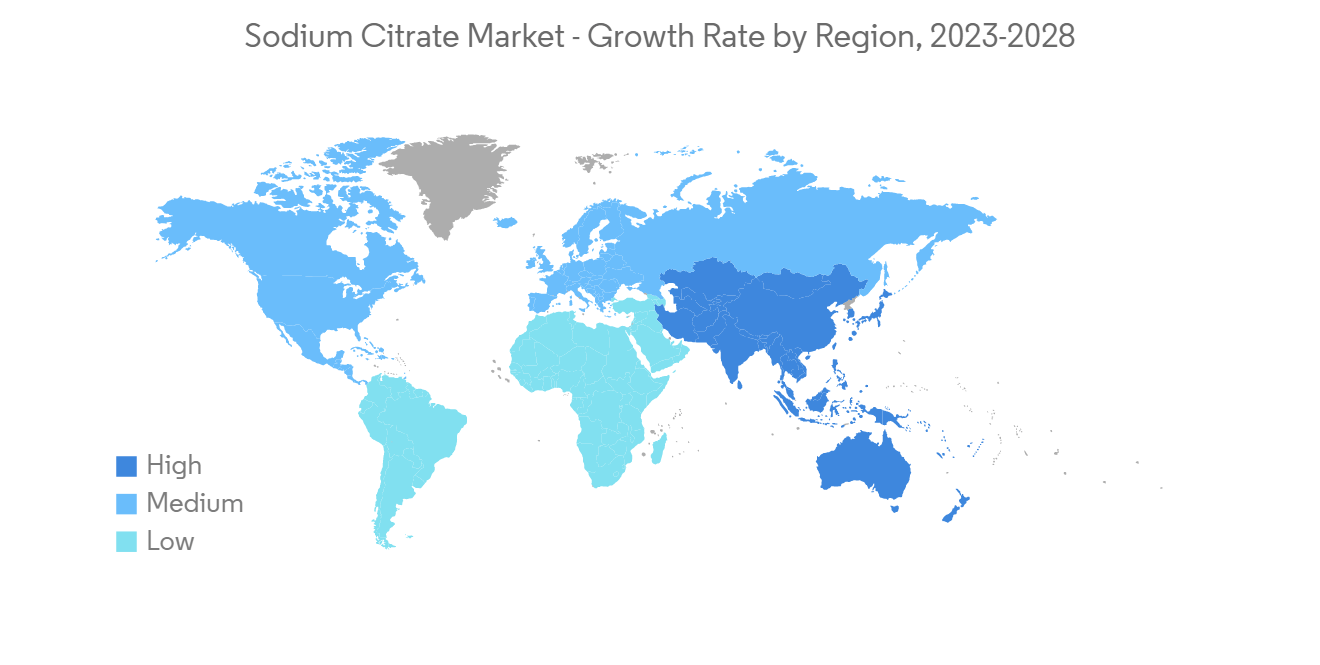

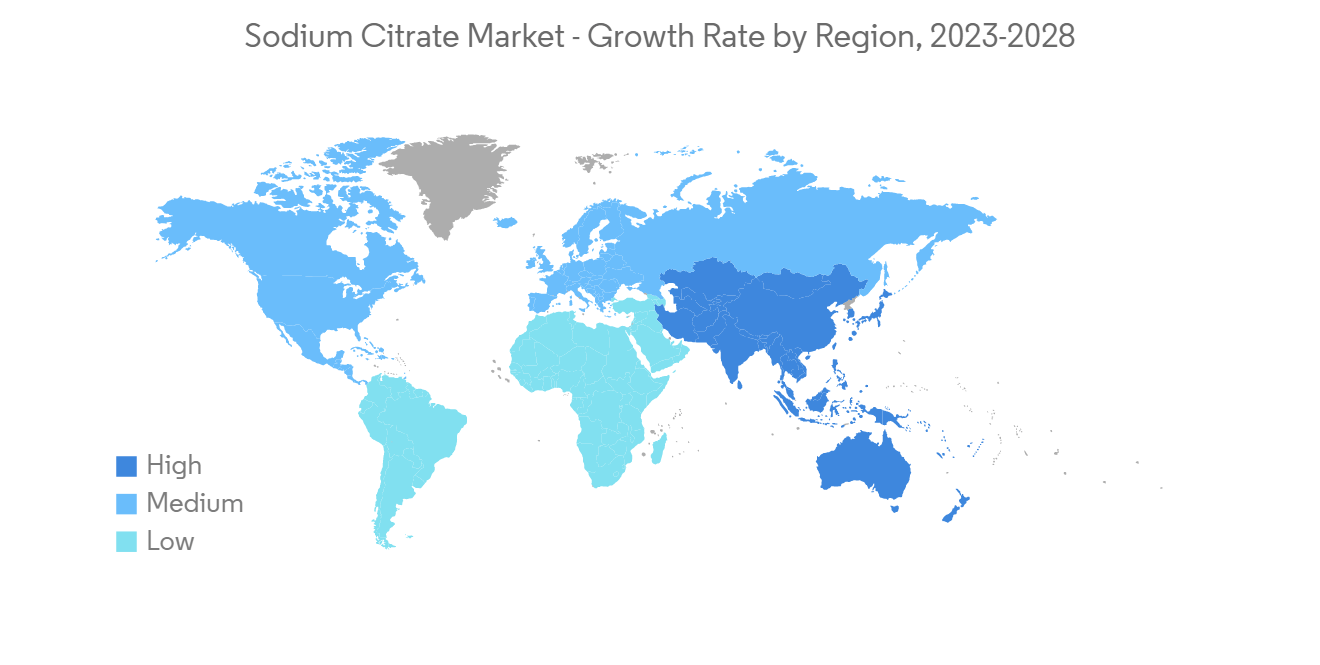

- Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Sodium Citrate Market Trends

Food and Beverages Segment to Dominate the Market

- Sodium citrate is primarily used as a food additive to flavor or preserve food. In certain types of club soda, sodium citrate is used as a flavoring agent.

- In addition, sodium citrate is used as a flavoring agent in many ready-to-drink beverages, gelatin mix, ice creams, processed cheese, and sweets, among many others. Moreover, sodium citrate is used in both hydrous & anhydrous forms.

- Furthermore, sodium citrate is combined with citric acid as a buffering agent to maintain pH in many food & beverage applications. It is used in various cosmetic products, including baby products, make-up, bath products, hair dyes and colors, and skin care products.

- In 2022, the global cosmetics market experienced growth of over 16% in comparison to the previous year. As of 2021, the French cosmetics company L'Oreal was the leading beauty manufacturer in the world, generating revenues of about USD 35 billion.

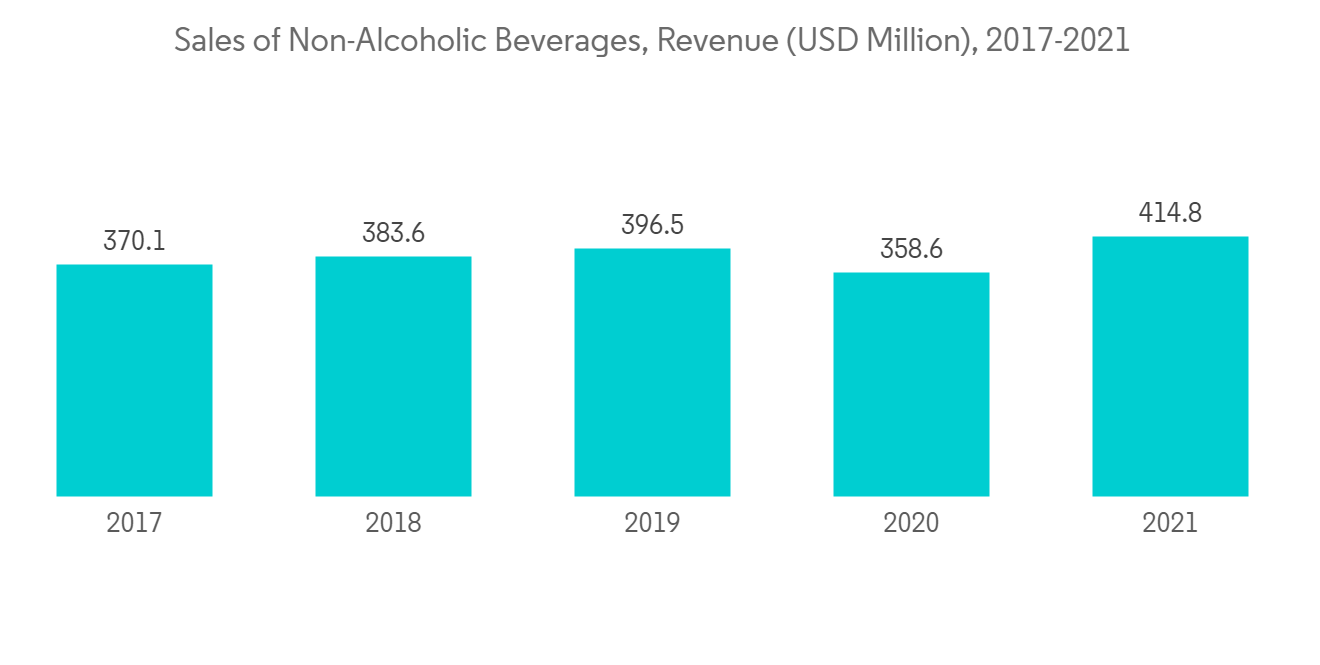

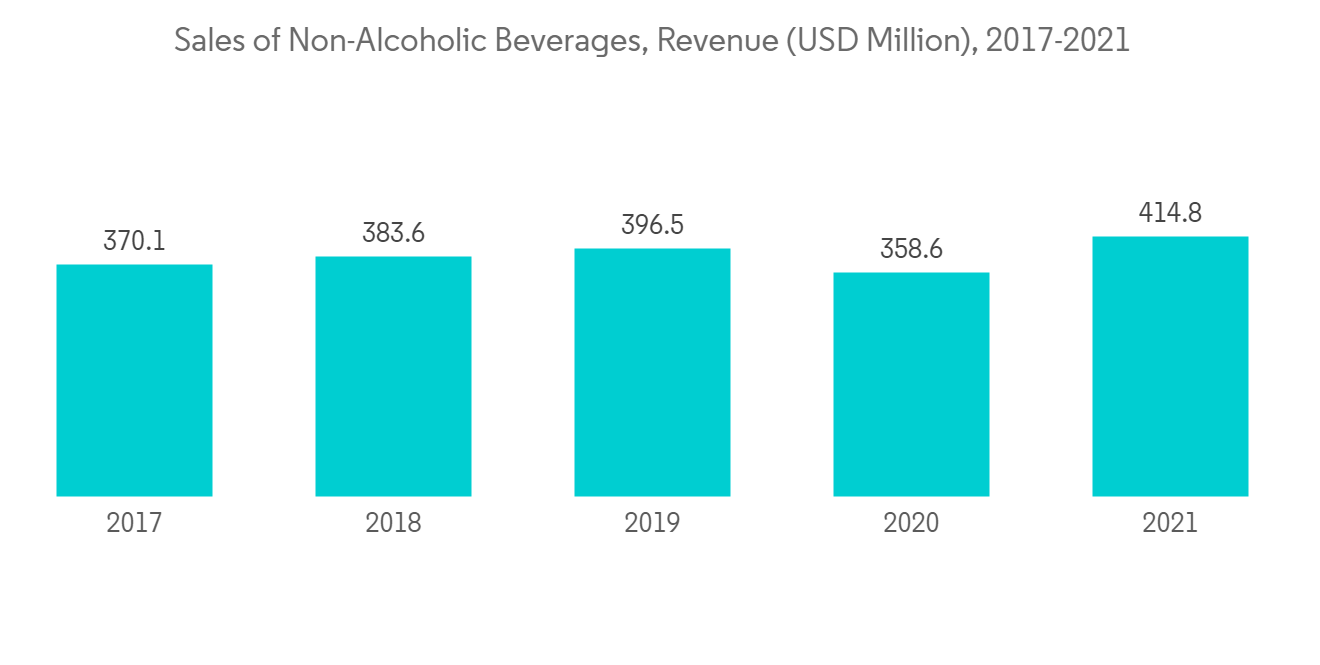

- Sodium Citrate is the natural sodium salt of citric acid. It retains citric acid's sour taste and is used as a sour salt flavor additive and food preservative. It is majorly used in non-alcoholic beverages, specifically lemon-lime soft drinks. It is also used to control acidity and acts as a stabilizer.

- According to the estimates by Statista, the non-alcoholic drinks market amounts to USD 1.48 tons in 2023 and is expected to grow annually by 4.65% by 2027.

- The food & beverage industry is lucrative, especially in Asia-Pacific and GCC (primarily in UAE). The demand for food & beverage products is increasing rapidly in the UAE, which is anticipated to continue in the next few years.

- According to the Dubai Department of Economy and Tourism, Dubai includes 13,000 food and beverage outlets. The UAE's Food and beverage trade increased steadily, reaching USD 20 billion in the first nine months of 2021.

- Owing to all these factors, the market for sodium citrate will likely grow worldwide during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market owing to the increasing demand from the food & beverage, medical, and personal care industries in the countries such as China and India.

- China is the world's largest importer of both food and beverages. In December 2022, approximately 13.8 million metric tons of soft drinks were produced in China, indicating a 4.6% increase compared to the same period of the previous year.

- In the pharmaceutical industry, it controls pH and can be used as an alkalizing and buffering agent, emulsifier, sequestering agent, diuretic and expectorant. Also, it acts as an anticoagulant for blood withdrawal.

- China is the second-largest market for pharmaceuticals globally. China's pharmaceutical industry experienced rapid progress when the country entered the World Trade Organization. As of 2021, China holds 12% of the global pharmaceutical market, following the United States, responsible for 40% of the total revenue worldwide.

- In 2021, China produced over 38 million metric tons of sodium hydroxide, followed by Japan with 4.16 million metric tons and South Korea with 2.23 million metric tons.

- According to the Ministry of Industry and Information Technology, in January-April 2022, major beverage firms produced 57.9 million tons of beverages, up 1% from the same period in 2021.

- Presently, the penetration of personal care products in India is comparatively lower than in developed or other developing economies. However, improving the economic environment and increasing purchasing power of the Indian population is expected to increase the personal care products adoption in the country.

- Due to all such factors, the sodium citrate market in the Asia-Pacific region is expected to grow steadily during the forecast period.

Sodium Citrate Industry Overview

The sodium citrate market is partially consolidated in nature. Some of the major players in the market include Pan Chem Corporation, Jungbunzlauer Suisse AG, Cargill, Incorporated, ADM, and ATPGroup, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Consumption of Packed Food & Beverages

- 4.1.2 Increasing Demand from the Medical Industry

- 4.2 Restraints

- 4.2.1 Health Issues Associated with Long-term Usage

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trend Analysis

- 4.6 Trade Analysis

5 MARKET SEGMENTATION

- 5.1 Grade

- 5.1.1 Food

- 5.1.2 Pharmaceutical

- 5.1.3 Industrial

- 5.2 Application

- 5.2.1 Food and Beverages

- 5.2.2 Pharmaceuticals

- 5.2.3 Cosmetics

- 5.2.4 Soaps and Detergents

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 ATPGroup

- 6.4.3 Cargill, Incorporated

- 6.4.4 COFCO

- 6.4.5 FBC Industries

- 6.4.6 Foodchem International Corporation

- 6.4.7 FUSO CHEMICAL CO., LTD.

- 6.4.8 Gadot Biochemical Industries LTD.

- 6.4.9 HUANGSHI XINGHUA BIOCHEMICAL CO.LTD.

- 6.4.10 HUNAN DONGTING CITRIC ACID CHEMICALS CO., LTD.

- 6.4.11 Jungbunzlauer Suisse AG

- 6.4.12 Juxian Hongde Citric Acid Co., Ltd

- 6.4.13 Lianyungang Mupro Food

- 6.4.14 natural biological group

- 6.4.15 Pan Chem Corporation

- 6.4.16 S.A. Citrique Belge N.V.

- 6.4.17 Tate & Lyle