|

市場調查報告書

商品編碼

1273481

超導材料市場——增長、趨勢、COVID-19 的影響、預測 (2023-2028)Superconducting Materials Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球超導材料市場預計將以超過 10% 的複合年增長率增長。

COVID-19 大流行對全球超導材料市場的增長造成了負面影響,因為它對供應鏈活動造成了相當大的破壞,並減少了商品、貨物和服務的生產。 然而,該行業在 2021 年捲土重來。

主要亮點

- 醫療機械和設備支出的增加正在推動市場。

- 另一方面,釔等原材料供應不足阻礙了市場增長。

- 不過,我們相信它會在未來創造有利可圖的機會,因為它可以為電力和高場磁鐵技術帶來變革。

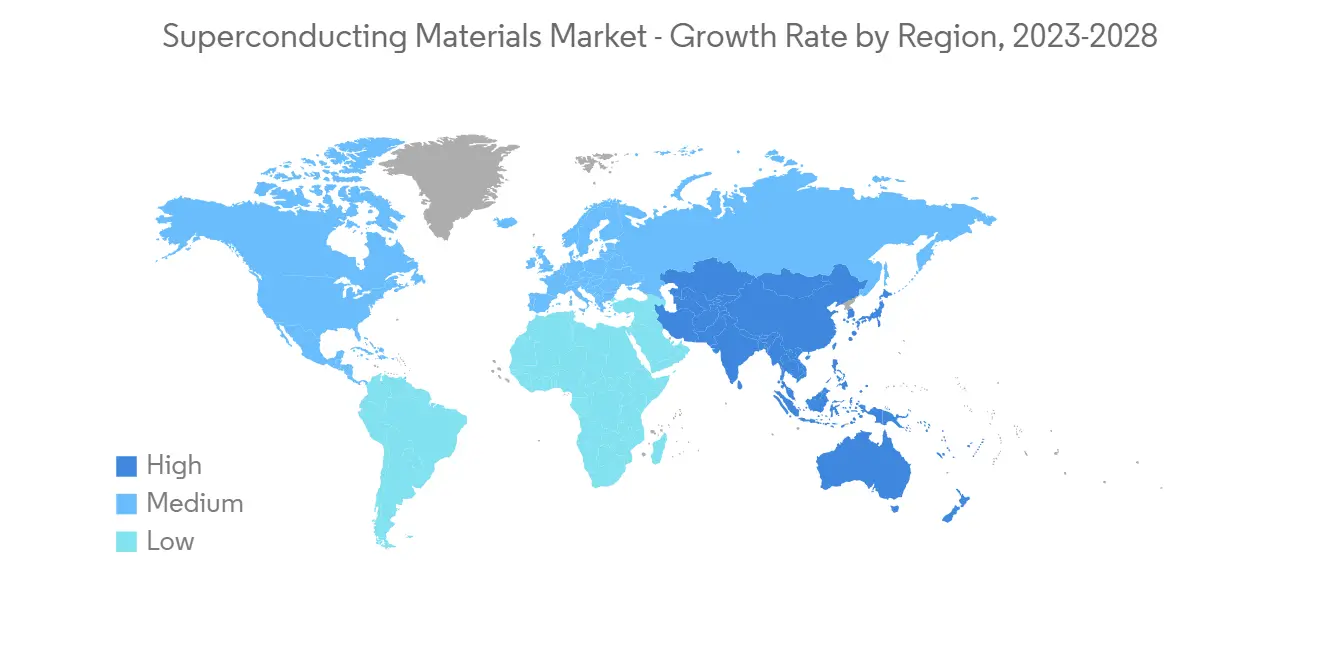

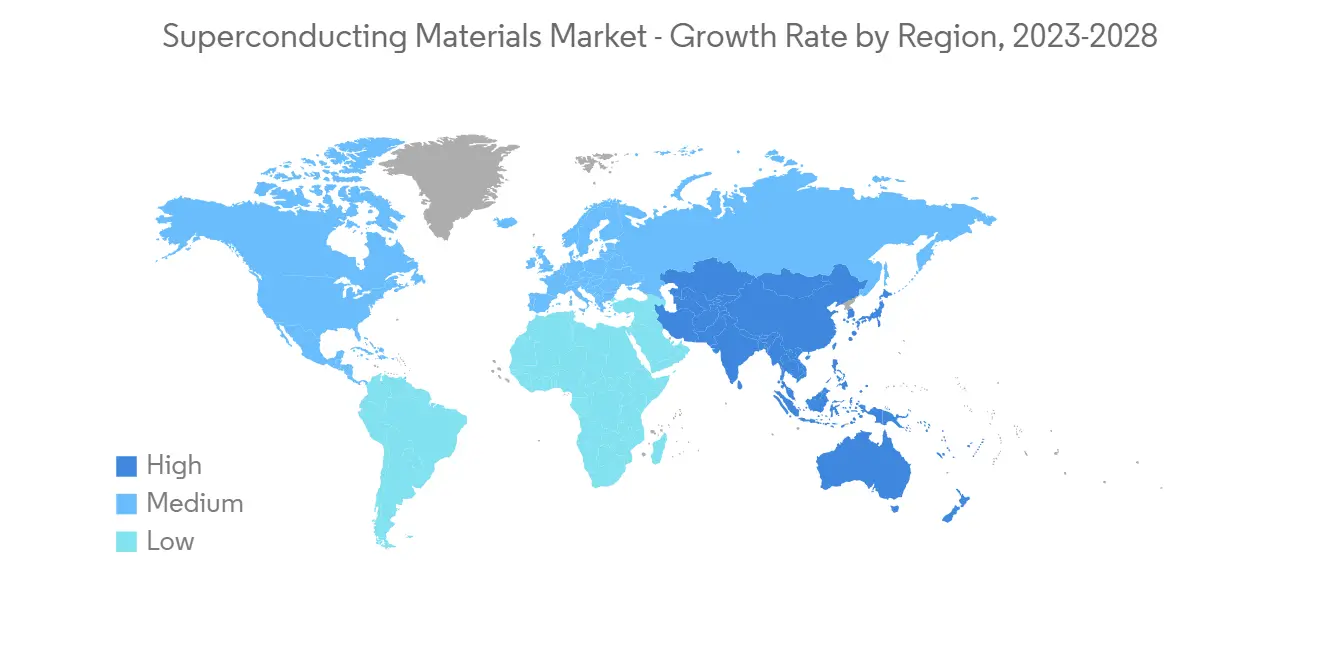

- 亞太地區的市場份額最高,預計在預測期內將繼續主導市場。

超導材料市場趨勢

醫療板塊有望主導市場

- 目前,醫療領域在全球超導材料市場佔有率最高。

- 近年來,由於世界各地日益嚴重的健康問題,對磁共振成像 (MRI) 的需求急劇增加。 MRI設備還需要超導材料提供能量以維持大磁場。 超導材料試圖使導線的電阻幾乎為零。

- 由於美國和加拿大等國家/地區的老年人口眾多,北美在磁共振成像 (MRI) 市場中佔有最大的市場份額。 例如,根據醫療保險和醫療補助服務中心 (CMS) 的數據,到 2021 年,美國政府將花費 4.1 萬億美元用於醫療保健,以改善和維持公共衛生實踐。 因此,美國和加拿大等國家增加醫療保健支出將使公共醫療機構能夠部署先進的 MRI 系統,這估計會為這些國家的超導材料市場創造需求。。

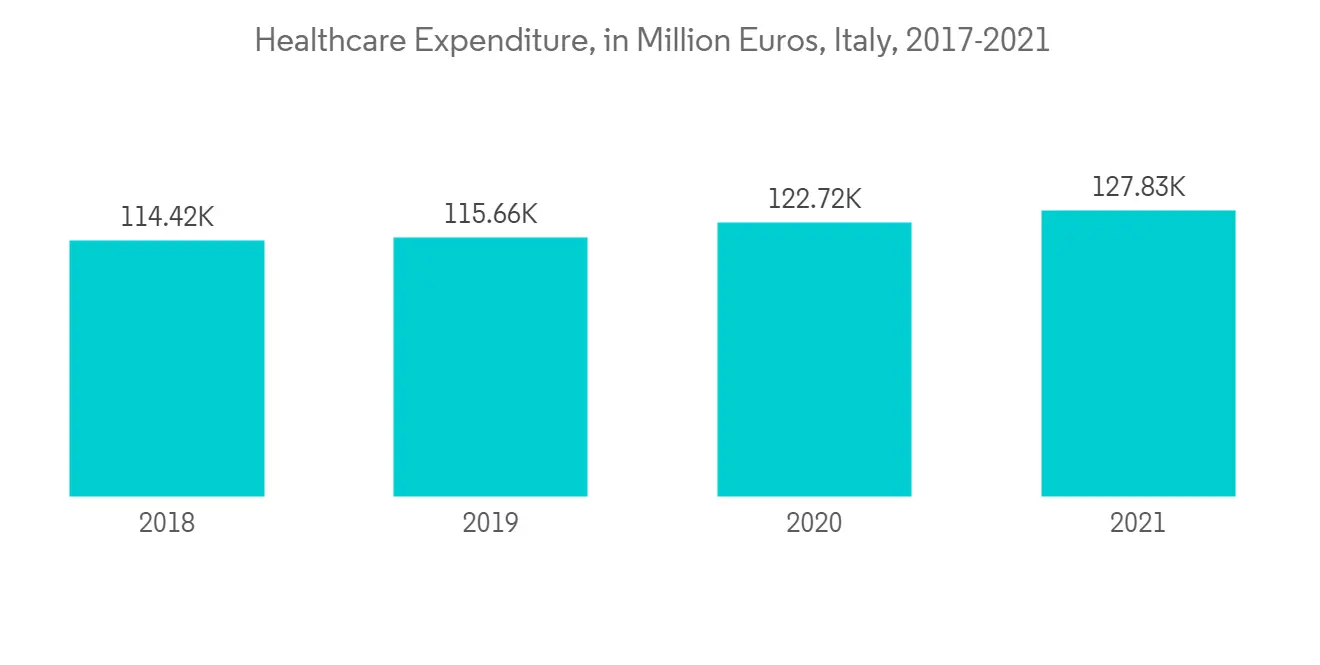

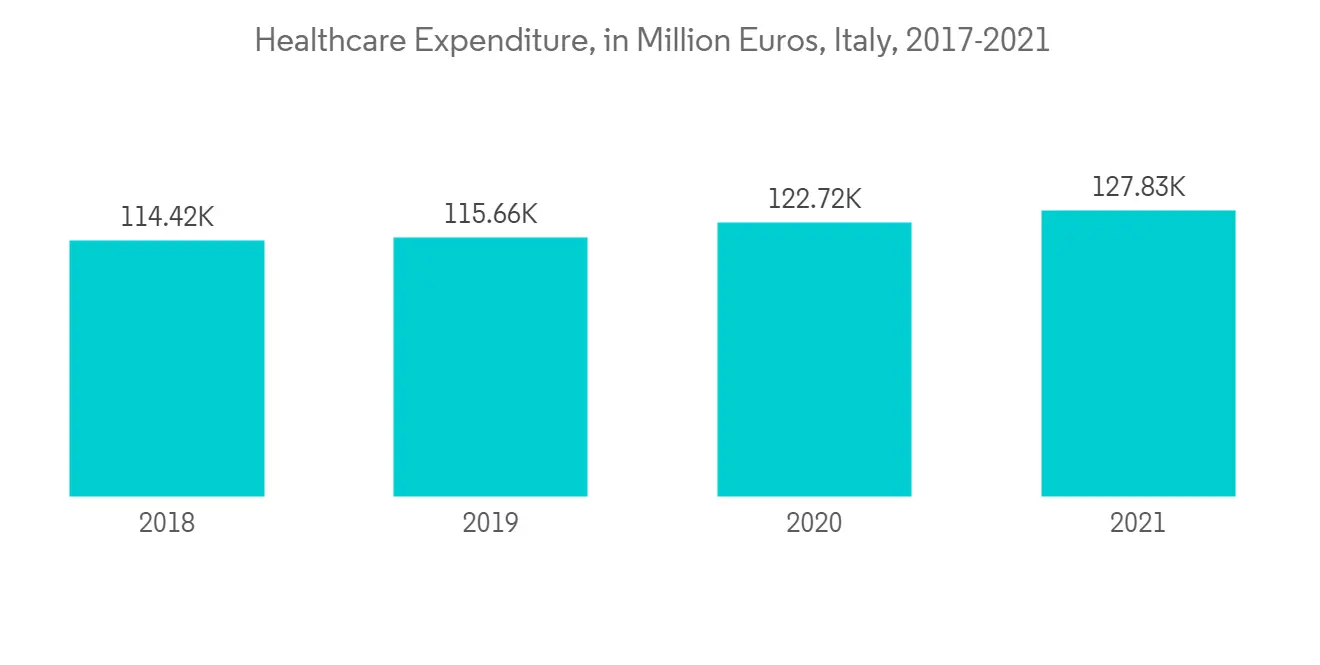

- 此外,一些發展中國家的政府正在增加醫療部門的支出,以提高設備的效率。 例如,根據經濟合作與發展組織 (OECD) 的數據,意大利的磁共振成像 (MRI) 掃描儀數量將在 2021 年增加 169 台,比 2020 年增長 9.1%。

- 由於上述因素,預計醫療領域在預測期內對超導材料的需求最高。

亞太地區主導市場

- 近年來,亞太地區對超導材料的需求增長顯著。

- 需求激增的主要原因是該地區電氣和電子產品的增加。

- 在中國和印度,由於政府對電氣和電子行業增產的大力支持,預計對超導材料的需求將大幅增長。 例如,2021年中國電子製造企業利潤總額將達到8283億元人民幣(1283.5億美元),同比增長38.9%。

- 此外,在印度,2021 財年消費電子產品的產值為 7050 億印度盧比(95.3 億美元),與 2020 年相比下降了 12.9%。 產值下降是由於冠狀病毒大流行的影響。

- 此外,亞太地區的醫療保健行業近年來增長顯著,這可能會推動所研究的市場。 例如,印度的醫療保健部門支出從 2020 年的 273 萬億盧比(369.2 億美元)增加到 2021 年的 472 萬億盧比(638.3 億美元),增幅約為 73%。 因此,估計醫療部門支出的增加將在該國創造對超導材料的需求。

- 因此,由於上述因素,預計亞太地區在預測期內的增長率最高。

超導材料行業概況

超導材料市場具有適度的綜合性。 主要公司包括(排名不分先後)evico GmbH、Hitachi、NEXANS、SuperPower Inc. 和 Sumitomo Electric Industries, Ltd。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 醫療設備支出增加

- 電子行業不斷擴大的需求

- 阻礙因素

- 釔等原材料供應不足

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 買方/消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(市場規模:基於金額)

- 產品類型

- 低溫超導材料 (LTS)

- 高溫超導材料 (HTS)

- 最終用戶行業

- 醫療

- 電子產品

- 其他最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 世界其他地方

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- evico GMBH

- Hitachi, Ltd.

- Hyper Tech Research, Inc.

- JAPAN SUPERCONDUCTOR TECHNOLOGY, INC.(JASTEC)

- MetOx Technologies, Inc.

- NEXANS

- Sumitomo Electric Industries, Ltd.

- Super Conductor Materials Inc.

- Superconductor Technologies Inc.

- SuperPower Inc.

- Western Superconducting Technologies Co,Ltd.

第七章市場機會與未來趨勢

- 改變電源和高場磁鐵技術的潛力

The global superconducting materials market is expected to grow with a CAGR greater than 10% during the forecast period.

The COVID-19 pandemic negatively hampered the global superconducting materials market growth due to considerable disruption in the supply chain activities and reduced the production of commodities, goods, and services. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Increasing expenditures on medical machinery and equipment are driving the market.

- On the flip side, inadequate availability of feedstock materials such as Yttrium is hindering the growth of the market studied.

- However, the potential to bring changes to electric power and high-field magnet technology shall create a lucrative opportunity in the future.

- Asia-Pacific accounted for the highest share of the market and is likely to continue dominating the market during the forecast period.

Superconducting Materials Market Trends

Medical Sector is Expected to Dominate the Market

- Currently, the medical sector accounts for the highest market share of the global market for superconducting materials.

- Magnetic resonance imaging (MRI) machines have seen a surge in demand in recent years owing to rising health issues and concerns worldwide. Moreover, superconducting materials are required in MRI machines to provide energy to maintain large magnetic fields. Superconducting materials try to reduce the resistance in the wires to almost zero.

- Due to factors such as a large elderly population in countries such as the United States and Canada, North America includes the largest market share in the magnetic resonance imaging (MRI) market. For instance, in 2021, according to the Center for Medicare and Medicaid Services (CMS), the US government spent USD 4.1 trillion in the healthcare sector to improve and maintain public health activities. Therefore, increased expenditure on healthcare by countries such as the US and Canada, which enable public healthcare providers to adopt advanced MRI systems, is estimated to create demand for the superconducting materials market in the countries.

- Also, governments in several developing countries have increased their medical sector expenditures to improve equipment efficiency. For instance, according to the Organization for Economic Co-operation and Development (OECD), the number of magnetic resonance imaging (MRI) scanners in Italy increased by 169 in 2021, which shows an increase of 9.1% compared with 2020.

- Owing to the abovementioned factors, the medical sector is expected to witness the highest demand for superconducting materials during the forecast period.

Asia-Pacific to Dominate the Market

- In the recent past, there is a significant growth in the demand for superconducting materials in the Asia-Pacific region.

- The surge in demand is largely attributed to the region's increasing electrical and electronics products.

- China and India are expected to witness strong growth in the demand for superconducting materials, owing to favorable government support to increase production in the electrical and electronics industry. For instance, in 2021, the total profit of electronics manufacturing enterprises in China grew by 38.9% from the previous year, reaching CNY 828.3 billion (USD 128.35 billion).

- Moreover, in India, the production value of consumer electronics in India amounted to INR 705 billion (USD 9.53 billion) in the fiscal year 2021, which shows a decrease of 12.9% compared with 2020. The drop in production value was due to the impact of the coronavirus pandemic.

- Additionally, the medical industry in the Asia-Pacific region witnessed major growth in recent years, which is likely to drive the market studied. For instance, India's health sector expenditure increased from INR 2.73 lakh crore (USD 36.92 billion) in 2020 to INR 4.72 lakh crore (USD 63.83 billion) in 2021, an increase of nearly 73%. Therefore, increasing expenditure in the health sector is estimated to create demand for superconducting materials in the country.

- Hence, due to the abovementioned factors, Asia-Pacific will likely witness the highest growth rate during the forecast period.

Superconducting Materials Industry Overview

The superconducting materials market is moderately consolidated in nature. The major companies include (not in a particular order) evico GmbH, Hitachi, Ltd., NEXANS, SuperPower Inc., and Sumitomo Electric Industries, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Expenditures on Medical Machinery and Equipment

- 4.1.2 Growing Demand from the Electronics Industry

- 4.2 Restraints

- 4.2.1 Inadequate Availability of Feedstock Materials such as Yttrium

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Low-temperature Superconducting Materials (LTS)

- 5.1.2 High-temperature Superconducting Materials (HTS)

- 5.2 End-user Industry

- 5.2.1 Medical

- 5.2.2 Electronics

- 5.2.3 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) ** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 evico GMBH

- 6.4.2 Hitachi, Ltd.

- 6.4.3 Hyper Tech Research, Inc.

- 6.4.4 JAPAN SUPERCONDUCTOR TECHNOLOGY, INC. (JASTEC)

- 6.4.5 MetOx Technologies, Inc.

- 6.4.6 NEXANS

- 6.4.7 Sumitomo Electric Industries, Ltd.

- 6.4.8 Super Conductor Materials Inc.

- 6.4.9 Superconductor Technologies Inc.

- 6.4.10 SuperPower Inc.

- 6.4.11 Western Superconducting Technologies Co,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential to Bring Changes to Electric Power and High-field Magnet Technology

![超導材料市場 - 按產品(低溫、高溫)、最終用戶(醫療、研發[核融合]、電子、運輸、能源、電力)和全球預測,2023 年至 2032 年](/sample/img/cover/42/1399724.png)