|

市場調查報告書

商品編碼

1357223

全球視訊監控市場(2023-2028)The Global Video Surveillance Business 2023 to 2028 |

||||||

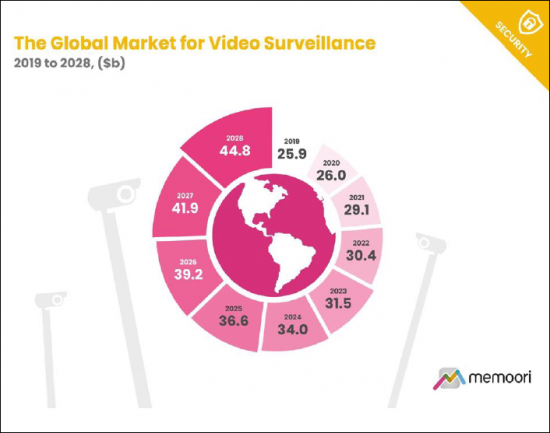

- 2022 年全球視訊監控設備和軟體收入 (FGP) 預計將達到 304 億美元。與 2021 年相比,這是 4.5% 的健康成長,儘管低於 2021 年受疫情影響的 11.7% 的復甦。預計到 2028 年將達到 448 億美元,2022 年至 2028 年複合年增長率為 5.7%。

- 過去幾年,市場上採用邊緣處理功能的人工智慧相機的數量大幅增加。最新預測顯示,內建人工智慧功能的網路安全攝影機出貨比例將從2022年的18%左右穩定上升到2028年的50%以上。

- 多個相互關聯的因素正在推動全球視訊監控解決方案的需求不斷增長。犯罪和恐怖分子的威脅日益嚴重,迫使公私機構加強安全監控。然而,視訊監控產業在疫情復甦期間面臨供應鏈中斷、產品短缺和成本上漲的問題。需求激增超過了製造商的生產能力,尤其是半導體等關鍵零件。

中國和西方之間的地緣政治緊張局勢正在刺激市場,尤其是影響中國主要廠商海康威視和大華。美國禁止政府機構購買設備,出口管制限制獲得美國技術和進入美國資本市場。美國及其盟國對資料安全、人權問題和智慧財產權做法表示擔憂。

本報告研究和分析了全球視訊監控市場,提供當前市場狀況和未來預測,包括市場規模和結構、主要成長動力以及併購和投資的影響。

目錄

前言

執行摘要

第一章 視訊監控業務架構及形態

- 視訊監控市場結構

- 公司分類及市佔率

- 市場動態(波特五力分析)

- 銷售/分銷管道

第二章 視訊監控市場

- 採用和投資視訊監控

- 市場管理狀況

- 關鍵採用驅動因素

- 實體安全支出計劃和預算

- 視訊監控市場規模及成長預測

- 市場規模、成長與趨勢:依主要地區劃分

- 北美

- 拉丁美洲/加勒比海地區

- 中國

- 亞太其他地區

- 歐洲

- 中東/非洲

- 市場規模與趨勢:依產業劃分

- 辦公室

- 醫療保健

- 教育

- 零售

- 款待

- 行業

- 公共基礎設施/城市監控

- 數據中心

- 航運

- 錄影機

- 視訊監控攝影機

- 市場規模及成長趨勢

- 市場動態

- 主要公司和供應商格局

- 隨身攜帶的相機

- 市場規模及成長趨勢

- 市場動態

- 主要公司和供應商格局

- 熱像儀

- 市場規模及成長趨勢

- 市場動態

- 主要公司和供應商格局

- 視訊監控軟體分析

- 市場規模及成長趨勢

- 市場動態

- 主要公司和供應商格局

- VSaaS/雲

- 市場動態

- VSaaS商業模式及競爭格局

- 技術和操作考慮

- 成本和監管因素

- 視訊儲存硬體服務

- 市場規模及成長趨勢

- 市場動態

- 主要公司和供應商格局

第3章 IP連線/物聯網

- IP與物聯網的融合

- 支援物聯網的視訊監控的優勢

- 物聯網的成長與採用趨勢

- 採用物聯網的挑戰

- 系統整合商的角色

第 4 章 人工智慧與機器學習

- 市場成長與採用

- 應用程式和用例

- 安全與安保相關應用

- 具有更廣泛益處的其他用途

- 編碼/壓縮

- 邊緣設備和硬體推動者

- 硬體賦能:AI晶片、AI NVR、AI攝影機

- 人工智慧晶片

- AI網路錄影機(NVR)

- 人工智慧相機

- AI供應商格局

- 新產品發布

第 5 章無線/蜂窩技術

- 無線傳輸方式

- 4G

- 無線上網

- 5G

- 專用 LTE/5G 網路

- 主要優點

- 無線挑戰和注意事項

- 5G 的潛在用例

- 無線/5G相機

- 無線

- 5G

第 6 章 其他值得注意的技術驅動因素

- 影像品質/解析度

- 市場採用與演變

- 特定於應用的解析度要求

- 技術考慮

- 弱光/紅外線/夜視

- 超低照度相機技術

- 整合紅外線攝影機技術及應用

- 特殊低照度相機

- 多感測器裝置

- 概述和優點

- 市場採用與演變

- 技術考慮

- 先進的威脅偵測系統

- 簡介和特殊威脅偵測類別

- 市場驅動因素與動態

- 特色供應商和市場產品

- 整合和互通性

- 互通性的好處

- 向開放平台演進

- ONVIF標準

- 視訊監控、實體安全和樓宇系統集成

第七章 地緣政治緊張局勢與貿易壁壘

- 美國/中國趨勢

- 美國未來可能出台的法規

- 中國政府實施的相互貿易限制

- 其他貿易壁壘:依國家及地區劃分

- 貿易壁壘的影響

- 烏克蘭戰爭

第八章供應鏈趨勢

- 反思疫情的影響

- 成本上漲對企業利潤帶來壓力

- 視訊監控供應鏈現狀

- 建構面向未來的供應鏈彈性

第 9 章 永續性

- 視訊監控系統對環境的影響

- 製造商可持續發展措施和承諾

- 利用影片促進永續發展舉措

- 開發有彈性且面向未來的監控系統

第 10 章 技能、人才與勞動力

- 主要問題

- 新的機會

第十一章 網路安全

- 主要威脅和漏洞

- 重大網路安全事件

- 供應鏈風險

- 監理與合規

- 違規和漏洞揭露

- 緩解最佳實踐

第 12 章資料隱私與道德

- 隱私考慮

- 隱私權政策

- 臉部辨識挑戰和法規

- 道德實施與人工智慧偏見

第十三章 併購

- 實體安全市場的併購記錄

- 2018年以來主要併購交易

- 截至2022年9月的主要交易

- 截至2023年9月底的併購交易

- 併購趨勢及其影響

第14章 策略聯盟

- 實體安全市場過去的策略聯盟

- 新策略聯盟有效期限至2023年9月底

- 策略聯盟的趨勢及其影響

第十五章投資趨勢

- 投資動態

- 截至2022年9月的主要交易

- 投資交易截至2023年9月

- 投資趨勢及其意義一覽

This report is an in-depth study providing a detailed market analysis of video surveillance, with a specific focus on revenues generated by cameras, video storage, software & analytics.

It is a comprehensive overview of the current and anticipated landscape of the video surveillance market. Drawing on in-depth expertise in the fields of Physical Security, IoT, Cyber Security, and Artificial Intelligence, our analysis aims to empower professionals across the industry - from manufacturers to system integrators, from security consultants to end-users.

This report is the first instalment of a two-part series covering Physical Security Technology. Part 2, covering Access Control Systems, is to be published later in Q4 2023. Both these reports are included in “Memoori's 2023 Premium Subscription Service”.

Key Questions Addressed:

- What is the size and structure of the global video surveillance market? How is the market broken down into cameras, storage, software and analytics? Where are the dominant geographic markets in the world? How are sales split between 16 different industry verticals?

- What are the main drivers for industry growth? How will the market grow over the next 5 years? Which technologies are helping to reshape this market and create new business models?

- How are mergers, acquisitions and investments impacting the industry? How does acquisition activity stack up against previous years both in terms of value and volume? How much investment has the market attracted from venture capital and private equity this year?

Within its 219 Pages and 19 Charts, This Report Presents All the Key Facts and Draws Conclusions, so you can understand what is Shaping the Future of the Video Surveillance Industry:

- Total global revenues for video surveillance equipment and software at factory gate prices, reached an estimated $30.4 billion in 2022. This represents healthy 4.5% growth over 2021, albeit lower than the 11.7% rebound in 2021 following pandemic impacts. For the 6-year period between 2022-2028, the market is projected to expand at a 5.7% CAGR, reaching $44.8 billion by 2028.

- The market has seen a major surge in the adoption of AI-enabled cameras capable of edge processing over the past 2-3 years. These cameras come equipped with various AI-powered functionalities, ranging from basic facial recognition in low-end models to more advanced capabilities like 4K resolution, object classification, behaviour analysis and people tracking in high-end models. Our latest estimates forecast that the percentage of network security cameras shipping with built-in AI capabilities will rise steadily from around 18% in 2022 to over 50% by 2028.

- Several interlinked factors are fueling strong demand growth globally for video surveillance solutions. Expanding criminal and terrorist threats have compelled both public and private entities to ramp up security monitoring. However, the video surveillance industry has faced significant supply chain disruptions, product shortages, and cost inflation during the pandemic recovery. Surging demand has outstripped manufacturers' production capacity, especially for key components like semiconductors.

This report provides valuable information into how physical security companies can develop their business strategy through mergers, acquisitions, and alliances.

Geopolitical tensions between China and the West have stirred up the video surveillance market, especially impacting leading Chinese vendors Hikvision and Dahua. US bans prohibit government agencies from purchasing their equipment, while export controls limit access to American technology and participation in US capital markets. The US and its allies cite concerns around data security, human rights controversies, and intellectual property practices.

M&A trends point toward increased competition for small vendors, a pivot from hardware to software, the rise of intelligent video, acceleration of cloud adoption, simplified integrated security offerings, and the competitive advantage of global scale.

Investment trends reveal a focus on both scaling mature firms and investing in disruptive startups. Priorities include AI, cloud migration, geographic expansion, and regulatory adaptability. The market remains open to innovation but cautious given economic conditions.

Who Should Buy This Report?

The information in this report will be of value to all those engaged in managing, operating, and investing in electronic security technology companies (and their advisors) around the world. In particular, those wishing to acquire, merge or sell companies will find its contents particularly useful. Want to know more?

Table of Contents

Preface

Executive Summary

1. The Structure & Shape of the Video Surveillance Business

- 1.1. Video Surveillance Market Structure

- 1.2. Company Classifications & Market Share

- 1.3. Market Dynamics (Porter's Five Forces Analysis)

- 1.4. Sales & Distribution Channels

2. The Video Surveillance Market

- 2.1. Video Surveillance Adoption & Investment

- 2.1.1. Market Operation Conditions

- 2.1.2. Key Adoption Drivers

- 2.1.3. Physical Security Spending Plans & Budgets

- 2.2. Video Surveillance Market Size & Growth Forecasts

- 2.3. Market Size, Growth & Trends by Major Region

- 2.3.1. North America

- 2.3.2. Latin America & The Caribbean

- 2.3.3. China

- 2.3.4. The Rest of Asia Pacific

- 2.3.5. Europe

- 2.3.6. Middle East & Africa

- 2.4. Market Size & Trends by Vertical

- 2.4.1. Offices

- 2.4.2. Healthcare

- 2.4.3. Education

- 2.4.4. Retail

- 2.4.5. Hospitality

- 2.4.6. Industrial

- 2.4.7. Public Infrastructure & City Surveillance

- 2.4.8. Data Centers

- 2.4.9. Transportation

- 2.5. Video Cameras

- 2.6. Video Surveillance Cameras

- 2.6.1. Market Size & Growth Trends

- 2.6.2. Market Dynamics

- 2.6.3. Key Players & Vendor Landscape

- 2.7. Body Worn Cameras

- 2.7.1. Market Size & Growth Trends

- 2.7.2. Market Dynamics

- 2.7.3. Key Players & Vendor Landscape

- 2.8. Thermal Cameras

- 2.8.1. Market Size & Growth Trends

- 2.8.2. Market Dynamics

- 2.8.3. Key Players & Vendor Landscape

- 2.9. Video Surveillance Software & Analytics

- 2.9.1. Market Size & Growth Trends

- 2.9.2. Market Dynamics

- 2.9.3. Key Players & Vendor Landscape

- 2.10. VSaaS & Cloud

- 2.10.1. Market Dynamics

- 2.10.2. VSaaS Business Models and Competitive Landscape

- 2.10.3. Technology and Operational Insights

- 2.10.4. Cost and Regulatory Factors

- 2.11. Video Storage Hardware & Services

- 2.11.1. Market Size & Growth Trends

- 2.11.2. Market Dynamics

- 2.11.3. Key Players & Vendor Landscape

3. IP Connectivity & the IoT

- 3.1. The Convergence of IP and IoT

- 3.2. The Benefits of IoT-Enabled Video Surveillance

- 3.3. IoT Growth & Adoption Trends

- 3.4. Challenges Associated with IoT Adoption

- 3.5. The Role of Systems Integrators

4. AI & Machine Learning

- 4.1. Market Growth & Adoption

- 4.2. Applications & Use Cases

- 4.2.1. Safety and Security-Related Applications

- 4.2.2. Additional Applications Providing Wider Benefits

- 4.2.3. Encoding & Compression

- 4.3. Edge Devices and Hardware Enablers

- 4.4. Hardware Enablers: AI Chips, AI NVRs, and AI Cameras

- 4.1.1. AI Chips

- 4.4.2. AI Network Video Recorders (NVRs)

- 4.4.3. AI Cameras

- 4.5. The AI Vendor Landscape

- 4.6. New Product Releases

5. Wireless & Cellular Technology

- 5.1. Wireless Transmission Methods

- 5.1.1. 4G

- 5.1.2. WiFi

- 5.1.3. 5G

- 5.1.4. Private LTE/5G Networks

- 5.2. Key Benefits

- 5.3. Challenges & Considerations for Wireless

- 5.4. Potential Use Cases for 5G

- 5.5. Wireless & 5G Cameras

- 5.5.1. Wireless

- 5.5.2. 5G

6. Other Notable Technology Drivers

- 6.1. Image Quality / Resolution

- 6.1.1. Market Adoption and Evolution

- 6.1.2. Application-Specific Resolution Requirements

- 6.1.3. Technical Considerations

- 6.2. Low Light / Infra-Red / Night Vision

- 6.2.1. Super Low Light Camera Technology

- 6.2.2. Integrated IR Camera Technology and Applications

- 6.2.3. Speciality Low Light Cameras

- 6.3. Multi-Sensor Devices

- 6.3.1. Overview and Benefits

- 6.3.2. Market Adoption & Evolution

- 6.3.3. Technical Considerations

- 6.4. Advanced Threat Detection Systems

- 6.4.1. Introduction and Specialized Threat Detection Categories

- 6.4.2. Market Drivers & Dynamics

- 6.4.3. Notable Vendors & Market Offerings

- 6.5. Integration & Interoperability

- 6.5.1. Benefits of Interoperability

- 6.5.2. The Evolution Towards Open Platforms

- 6.5.3. ONVIF Standards

- 6.5.4. Integration Between Video Surveillance, Physical Security and Building Systems

7. Geopolitical Tensions & Trade Barriers

- 7.1. US/China Dynamics

- 7.1.1. Potential Future US Restrictions

- 7.1.2. Reciprocal Chinese Government Trade Restrictions

- 7.2. Trade Barriers by Other Countries and Regions

- 7.3. Implications of Trade Barriers

- 7.3.1. Impact on Chinese Manufacturers

- 7.3.2. Strategic Responses of Chinese Manufacturers

- 7.3.3. The Realities of Trading in China for non-Chinese firms

- 7.3.4. Corporate Responses to Chinese Video Surveillance Controversies

- 7.3.5. Implications for Non-Chinese Vendors

- 7.3.6. Long-Term Impacts on Global Supply Chains

- 7.3.7. Potential for New Competitors

- 7.3.8. Uncertain Future Direction

- 7.4. The War in Ukraine

8. Supply Chain Trends

- 8.1. A Retrospective of Pandemic Impacts

- 8.2. Rising Costs Squeeze Company Margins

- 8.3. The Current State of Video Surveillance Supply Chains

- 8.4. Building Supply Chain Resilience for the Future

9. Sustainability

- 9.1. The Environmental Impact of Video Surveillance Systems

- 9.2. Manufacturers' Sustainability Efforts and Commitments

- 9.3. Leveraging Video for Sustainability Initiatives

- 9.4. Developing Resilient and Future-Proof Surveillance Systems

10. Skills, Talent & Labor

- 10.1. Key Challenges

- 10.2. Emerging Opportunities

11. Cybersecurity

- 11.1. Key Threats and Vulnerabilities

- 11.2. Major Cybersecurity Incidents

- 11.3. Supply Chain Risks

- 11.4. Regulations and Compliance

- 11.5. Breach & Vulnerability Disclosure

- 11.6. Mitigation Best Practices

12. Data Privacy & Ethics

- 12.1. Privacy Considerations

- 12.2. Privacy Regulations

- 12.3. Facial Recognition Challenges & Regulations

- 12.4. Ethical Implementation and AI Bias

13. Mergers & Acquisitions

- 13.1. Historic M&A Performance in the Physical Security Market

- 13.2. Key M&A Deals Since 2018

- 13.3. Key Deals to the end of September 2022

- 13.4. M&A Deals to the end of September 2023

- 13.5. M&A Trends and Implications

- 13.5.1. Notable Trends

- 13.5.2. Implications

14. Strategic Alliances

- 14.1. Historic Strategic Alliances in the Physical Security Market

- 14.2. New Strategic Alliances to the end of September 2023

- 14.3. Strategic Alliance Trends and Implications

15. Investment Trends

- 15.1. Investment Dynamics

- 15.2. Key Deals to the end of September 2022

- 15.3. Investment Deals to the end of September 2023

- 15.4. Investment Trend Observations & Implications

List of Charts and Figures

- Fig 1.1 - Video Surveillance Market Structure

- Fig 1.2 - Video Surveillance Sales by Major Grouping, Number of Companies, % of Global Sales in 2022

- Fig 1.3 - Market Share of Global Video Surveillance Sales by Major Vendor 2022

- Fig 1.4 - Average Revenue for Group A, B, C & D Companies

- Fig 1.5 - Video Surveillance Market: Porter's Five Forces Analysis

- Fig 2.1 - The Security Market Index (SMI)

- Fig 2.2 - The Global Market for Video Surveillance 2019 to 2028 ($b)

- Fig 2.3 - The Global Market for Video Surveillance by Category 2019 to 2028 ($b)

- Fig 2.4 - Video Surveillance Sales by Region in 2022

- Fig 2.5 - Video Surveillance Sales by Region 2019 to 2028 ($b)

- Fig 2.6 - Estimated Distribution of Video Surveillance Solutions by Building Type in 2023

- Fig 2.7 - Global Sales of Video Surveillance Cameras by Type 2019 to 2028 ($b)

- Fig 2.8 - Global Video Surveillance Camera Market - Analog and IP Camera Market Share 2019 to 2028

- Fig 2.9 - Global Sales of Video Management Software (VMS) & Analytics 2019 to 2028 ($b)

- Fig 2.10 - Global Sales of Video Storage Hardware & Services 2019 to 2028 ($b)

- Fig 4.1 - Global AI Video Surveillance Camera Shipments, % of Overall Video Surveillance Camera Shipments 2022 to 2028

- Fig 7.1 - US Trade Restrictions Against Chinese Video Surveillance Companies: A Timeline

- Fig 13.1 - Security Deals Completed from 2002 to 2022, Estimated Total Value of Deals ($m)

- Fig 14.1 - Strategic Alliances 2008 to 2023