|

市場調查報告書

商品編碼

1074645

全球數字油田市場分析2022-2032:應用(陸上/海上油田)/解決方案/過程預測、區域/主要國家分析、主要公司、COVID-19恢復情景Digital Oilfield Market Report 2022-2032: Forecasts by Application (Onshore/Offshore Oilfield), by Solution, by Process, Regional & Leading National Market Analysis, Leading Companies, and COVID-19 Recovery Scenarios |

||||||

預計 2022 年至 2032 年,全球數字油田市場將大幅增長,2022 年將達到 258.21 億美元以上。引入和利用數字技術的成本降低和效率提升效果是市場的主要驅動因素之一。

本報告對全球數字油田市場進行分析,分析技術概況、市場基本結構/最新情況、主要推動/制約因素、市場規模估計/預測值(2022 -2032)),按應用/解決方案/流程和按地區/主要國家/地區劃分的詳細趨勢、主要公司概況、COVID-19 的影響和恢復情況等。

圖表示例

目錄

第1章分析概述

第2章執行摘要

第3章數字油田產業結構

- 概覽

- 數字油田的結構

- 智慧數字油田

- 核心網絡

- 交通網絡

- 邊緣網絡

- 數字油田關鍵技術

- 大數據分析

- IIoT(工業物聯網)

- 移動設備

第4章世界市場動態

- DROC 分析

- 市場驅動因素

- 市場製約因素

- 全球市場的機會

- 全球市場的挑戰

- SWOT分析

- PEST 分析

- 波特五力分析

- COVID-19 的影響

第5章全球數字油田市場分析

- 全球市場展望

- 估計和預測全球市場規模

- COVID-19 之前的市場情景

- COVID-19 之後的市場情景(V 型/U 型/W 型/L 型複蘇分析)

- 市場規模估計和預測:按地區

- 市場規模估計和預測:按應用

- 陸上油田

- 海上油田

- 市場規模估計和預測:按解決方案

- 硬件

- 軟件服務

- 數據存儲

- 市場規模估計和預測:按流程

- 存款優化

- 鑽孔優化

- 流程優化

- 安全管理

第6章北美數字油田市場分析

- 北美市場前景

- 估計和預測市場規模

- 市場規模估計和預測:按國家/地區分類

- 市場規模估計和預測:按應用

- 市場規模估計和預測:按解決方案

- 市場規模估計和預測:按流程

- 美國數字油田市場分析

- 加拿大數字油田市場分析

- 墨西哥數字油田市場分析

第7章歐洲數字油田市場分析

- 歐洲市場展望

- 估計和預測市場規模

- 市場規模估計和預測:按國家/地區分類

- 市場規模估計和預測:按應用

- 市場規模估計和預測:按解決方案

- 市場規模估計和預測:按流程

- 德國數字油田市場分析

- 英國數字油田市場分析

- 法國數字油田市場分析

- 意大利數字油田市場分析

- 西班牙數字油田市場分析

- 其他歐洲國家數字油田市場分析

第8章亞太數字油田市場分析

- 亞太市場展望

- 估計和預測市場規模

- 市場規模估計和預測:按國家/地區分類

- 市場規模估計和預測:按應用

- 市場規模估計和預測:按解決方案

- 市場規模估計和預測:按流程

- 中國數字油田市場分析

- 印度數字油田市場分析

- 日本數字油田市場分析

- 韓國數字油田市場分析

- 澳大利亞數字油田市場分析

- 其他亞太國家數字油田市場分析

第9章拉丁美洲、中東和非洲(LAMEA)數字油田市場分析

- LAMEA 市場展望

- 估計和預測市場規模

- 市場規模估計和預測:按國家/地區分類

- 市場規模估計和預測:按應用

- 市場規模估計和預測:按解決方案

- 市場規模估計和預測:按流程

- 巴西數字油田市場分析

- 南非數字油田市場分析

- 沙特阿拉伯數字油田市場分析

- 土耳其數字油田市場分析

- 阿拉伯聯合酋長國 (UAE) 數字油田市場分析

- 其他LAMEA國家數字油田市場分析

第10章主要公司簡介

- Baker Hughes

- 公司快照

- 公司簡介

- 公司財務概況

- 企業產品基準

- 企業最新動態

- Halliburton

- Schlumberger

- Weatherford

- ABB

- Siemens

- Rockwell automation

- Nov Inc

- Schneider Electric SE

- FutureOn

- 3gig

- Blue River Analytics

- HUVR

- L&T

- EVINSYS INC

- PwC

- OleumTech

- Infosys

- Intel

- Cognizant

第11章 結論及建議

第12章 用語集

Title:

Digital Oilfield Market Report 2022-2032

Forecasts by Application (Onshore Oilfield, Offshore Oilfield), by Solution (Hardware, Software & Service, Data Storage), by Process (Reservoir Optimization, Drilling Optimization, Process Optimization, Safety Management, Other) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Recovery Scenarios.

The Digital Oilfield Market Report 2022-2032: This report will prove invaluable to leading firms striving for new revenue pockets if they wish to better understand the industry and its underlying dynamics. It will be useful for companies that would like to expand into different industries or to expand their existing operations in a new region.

The increasing need for manufacturing improvements, along with the broad adoption of digital technology in industrial processes, has generated new opportunities

The global oil and gas sector has lately seen a significant shift in supply economics, which has echoed across the supply chain. The increasing need for manufacturing improvements, along with the broad adoption of digital technology in industrial processes, has generated new opportunities to significantly reduce supply chain costs and inefficiencies. These possibilities are encapsulated in Digital Oilfield Technologies, which are a set of tools and disciplines merged into advanced software to improve operating efficiency. The digital oilfield enables operators to immediately identify efficiencies by utilising the data at their disposal, allowing them to better manage their operations and improve corporate performance.

Regional Market Insight

North America's digital oilfield market share will grow dramatically as a result of increased investments in developing advanced automated technology

North America's digital oilfield market share will grow dramatically as a result of increased investments in developing advanced automated technology for well operations. The simplicity with which data may be collected and analysed, as well as the deployment of effective wireless technologies, are all essential factors that promote technology adoption.

Recent advances in the digital oilfield in Europe and throughout the world have shifted the emphasis from technology to commercial acumen. Businesses must invest in cutting-edge technology that can manage real-time operations and offer access to previously untapped resources in order to remain competitive. The Digital Oilfields Concept has become a vital component of a successful business model for large oil and gas corporations; it is also essential to raise awareness of the current Digital Oilfield market for smaller producers.

What Are These Questions You Should Ask Before Buying A Market Research Report?

- How is the digital oilfield market evolving?

- What is driving and restraining the digital oilfield market?

- How will each digital oilfield submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2032?

- How will the market shares for each digital oilfield submarket develop from 2022 to 2032?

- What will be the main driver for the overall market from 2022 to 2032?

- Will leading digital oilfield markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

- How will the market shares of the national markets change by 2032 and which geographical region will lead the market in 2032?

- Who are the leading players and what are their prospects over the forecast period?

- What are the digital oilfield projects for these leading companies?

- How will the industry evolve during the period between 2020 and 2032? What are the implication of digital oilfield projects taking place now and over the next 10 years?

- Is there a greater need for product commercialisation to further scale the digital oilfield market?

- Where is the digital oilfield market heading? And how can you ensure you are at the forefront of the market?

- What can be the best investment options for new product and service lines?

- What are the key prospects for moving companies into a new growth path? C-suite?

You need to discover how this will impact the digital oilfield market today, and over the next 10 years:

- Our 387-page report provides 234 tables and 231 charts/graphs exclusively to you.

- The report highlights key lucrative areas in the industry so you can target them - NOW.

- Contains in-depth analyse of global, regional and national sales and growth

- Highlights for you the key successful trends, changes and revenue projections made by your competitors

This report tells you TODAY how the digital oilfield market will develop in the next 10 years, and in-line with the variations in COVID-19 economic recession and bounce. This market is more critical now than at any point over the last 10 years.

Forecasts to 2032 and other analyses reveal the commercial prospects

- In addition to revenue forecasting to 2032, our new study provides you with recent results, growth rates, and market shares.

- You find original analyses, with business outlooks and developments.

- Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising digital oilfield prices and recent developments.

This report includes data analysis and invaluable insight into how COVID-19will affect the industry and your company. Four COVID-19 recovery patterns and their impact, namely, V, L, W and U are discussed in this report.

Global Digital Oilfield Market (COVID Impact Analysis) by Application

- Onshore Oilfield

- Offshore Oilfield

Global Digital Oilfield Market (COVID Impact Analysis) by Solution

- Hardware

- Software & Service

- Data Storage

Global Digital Oilfield Market (COVID Impact Analysis) by Process

- Reservoir Optimization

- Drilling Optimization

- Process Optimization

- Safety Management

- Other Solution

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for 4 regional and 20 leading national markets:

North America Digital Oilfield Market, 2022 to 2032 Market Outlook

- U.S. Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Canada Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Mexico Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

Europe Digital Oilfield Market, 2022 to 2032 Market Outlook

- Germany Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Spain Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- United Kingdom Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- France Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Italy Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Rest of Europe Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

Asia Pacific Digital Oilfield Market, 2022 to 2032 Market Outlook

- China Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Japan Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- India Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Australia Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- South Korea Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Rest of Asia Pacific Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

LAMEA Digital Oilfield Market, 2022 to 2032 Market Outlook

- Brazil Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Turkey Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Saudi Arabia Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- South Africa Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- UAE Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

- Rest of Latin America, Middle East and Africa Digital Oilfield Market, 2022 to 2032 Market Forecast & COVID Impact Analysis

The report also includes profiles and for some of the leading companies in the Digital Oilfield Market, 2022 to 2032, with a focus on this segment of these companies' operations.

Leading companies and the potential for market growth:

- 3GiG

- ABB Ltd

- Baker Hughes

- Blue River Analytics

- Cognizant

- EVINSYS INC

- Futureon AS

- Halliburton

- Huvr Inc.

- Infosys Limited

- Intel Corporation

- Larsen & Toubro Ltd

- NOV Inc.,

- OleumTech

- PricewaterhouseCoopers

- Rockwell Automation, Inc.

- Schlumberger

- Schneider Electric SE

- Siemens AG

- Weatherford

Overall world revenue for Digital Oilfield Market, 2022 to 2032 in terms of value the market will surpass US$25821 million in 2022, our work calculates. We predict strong revenue growth through to 2032. Our work identifies which organizations hold the greatest potential. Discover their capabilities, progress, and commercial prospects, helping you stay ahead.

How the Digital Oilfield Market, 2022 to 2032 Market report helps you?

In summary, our 387-page report provides you with the following knowledge:

- Revenue forecasts to 2032 for Digital Oilfield Market, 2022 to 2032 Market, with forecasts for application, solution, process each forecasted at a global and regional level- discover the industry's prospects, finding the most lucrative places for investments and revenues

- Revenue forecasts to 2032 for 4 regional and 20 key national markets - See forecasts for the Digital Oilfield Market, 2022 to 2032 market in North America, Europe, Asia-Pacific and LAMEA. Also forecasted is the market in the US, Canada, Mexico, Brazil, Germany, France, UK, Italy, China, India, Japan, and Australia among other prominent economies.

- Prospects for established firms and those seeking to enter the market- including company profiles for 20 of the major companies involved in the Digital Oilfield Market, 2022 to 2032 Market.

Find quantitative and qualitative analyses with independent predictions. Receive information that only our report contains, staying informed with this invaluable business intelligence.

Information found nowhere else

With our newly report title, you are less likely to fall behind in knowledge or miss out on opportunities. See how our work could benefit your research, analyses, and decisions. Visiongain's study is for everybody needing commercial analyses for the Digital Oilfield Market, 2022 to 2032 Market and leading companies. You will find data, trends and predictions.

Visiongain is a trading partner with the US Federal Government.

Table of Contents

1. Report Overview

- 1.1 Introduction to Digital Oilfield Market

- 1.2 Global Digital Oilfield Market Overview

- 1.3 What are the Objectives of this Report?

- 1.4 What is the Scope of the Report?

- 1.5 Digital Oilfield Market Definition

- 1.6 Why You Should Read This Report

- 1.7 What This Report Delivers

- 1.8 Key Questions Answered By This Analytical Report Include:

- 1.9 Who is This Report for?

- 1.10 Research Methodology

- 1.10.1 Primary Research

- 1.10.2 Secondary Research

- 1.10.3 Market Evaluation & Forecasting Methodology

- 1.11 Frequently Asked Questions (FAQs)

- 1.12 Associated Visiongain Reports

- 1.13 About Visiongain

2 Executive Summary

3 Digital Oilfield Industry Structure

- 3.1 Overview

- 3.1 Structure of Digital Oilfield

- 3.2 The Smart Digital Oilfield

- 3.2.1 Core Network

- 3.2.2 Transport Network

- 3.2.3 Edge Network

- 3.3 Key Digital Oilfield Technologies

- 3.3.1 Big data and analytics

- 3.3.2 The Industrial Internet of Things (IIoT)

- 3.3.3 Mobile devices

4 Global Market Dynamics

- 4.1 DROCs

- 4.1.1 Market Driving Factors

- 4.1.1.1 Market Competition is Acting as the Driver in the Industry

- 4.1.1.2 Investment in Digital Initiatives are Aiding Businesses Reach Greater Heights

- 4.1.1.3 Digital Supports In The Optimization Of Core Companies

- 4.1.2 Market Restraining Factors

- 4.1.2.1 There Are Several Challenges That Arise With Implementing Digital Technology

- 4.1.2.2 Integration Of Humans And Systems Is Challenging To Achieve

- 4.1.3 Opportunities in the Global Market

- 4.1.3.1 In Oil And Gas Industry, Digital Twins are Becoming More Prevalent

- 4.1.3.2 Defining a Blueprint for Attaining Carbon Reduction Targets

- 4.1.4 Challenges in the Global Market

- 4.1.4.1 Understanding The Actual Requirement is Becoming a Challenge

- 4.1.4.2 The Vast Volume of Data Gathered From the Sites Makes it Tough to Keep Track of

- 4.1.1 Market Driving Factors

- 4.2 SWOT Analysis

- 4.2.1 Market Strengths

- 4.2.1.1 Digital technology has a wide range of uses in the oil and gas sector

- 4.2.1.2 Oil and gas firms can use digital oilfields to remotely monitor and manage crucial operations at production facilities

- 4.2.1.3 With the introduction of the Internet of Things, digital oilfield technologies have gained traction

- 4.2.2 Market Weaknesses

- 4.2.2.1 Technical expertise and leadership are both lacking

- 4.2.2.2 Cyber Attacks Pose a Risk to Digital Oilfields

- 4.2.2.3 Certain regions, such as hostile areas and distant areas, have minimal connection

- 4.2.3 Opportunities in the Market

- 4.2.3.1 Ability to adjust output levels at operating platforms based on predicted demand and even failure scenarios

- 4.2.3.2 Decrease in the likelihood of production halts or disasters

- 4.2.3.3 Establishing new services that generate additional income streams and outlets

- 4.2.4 Threats in the Market

- 4.2.4.1 Security risks in digital oilfields

- 4.2.4.2 Well-established firms run the danger of losing their conventional business to newer competitors

- 4.2.1 Market Strengths

- 4.3 PEST Analysis

- 4.4 Porter's Analysis

- 4.4.1 Industry Rivalry

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Bargaining Power of Suppliers

- 4.4.5 Threat of Substitutes

- 4.5 COVID-19 Impact

5 Global Digital Oilfield Market Analysis

- 5.1 Global Market Outlook

- 5.2 Global Market Size Estimation and Forecast

- 5.2.1 Pre-COVID-19 Market Scenario

- 5.2.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 5.3 Regional Market Size Estimation and Forecast

- 5.3.1 Pre-COVID-19 Market Scenario

- 5.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 5.4 Global Market Size Estimation and Forecast by Application

- 5.4.1 Onshore Oilfield

- 5.4.2 Offshore Oilfield

- 5.4.3 Pre-COVID-19 Market Scenario

- 5.4.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 5.5 Global Market Size Estimation and Forecast by Solution

- 5.5.1 Hardware

- 5.5.2 Software and service

- 5.5.3 Data Storage

- 5.5.4 Pre-COVID-19 Market Scenario

- 5.5.5 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 5.6 Global Market Size Estimation and Forecast by Process

- 5.6.1 Reservoir optimization

- 5.6.2 Drilling optimization

- 5.6.3 Process Optimization

- 5.6.4 Safety management

- 5.6.5 Pre-COVID-19 Market Scenario

- 5.6.6 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

6 North America Digital Oilfield Market Analysis

- 6.1 North America Market Outlook

- 6.2 North America Market Size Estimation and Forecast

- 6.2.1 Pre-COVID-19 Market Scenario

- 6.2.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 6.3 Country Market Size Estimation and Forecast

- 6.3.1 Pre-COVID-19 Market Scenario

- 6.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 6.4 North America Market Size Estimation and Forecast by Application

- 6.4.1 Pre-COVID-19 Market Scenario

- 6.4.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 6.5 North America Market Size Estimation and Forecast by Solution

- 6.5.1 Pre-COVID-19 Market Scenario

- 6.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 6.6 North America Market Size Estimation and Forecast by Process

- 6.6.1 Pre-COVID-19 Market Scenario

- 6.6.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 6.7 US Digital Oilfield Market Analysis

- 6.7.1 Schlumberger has launched a solution for 3D reservoir imaging during drilling.

- 6.7.2 To prevent critical equipment failures, Apache employs predictive maintenance.

- 6.7.3 Pre-COVID-19 Market Scenario

- 6.7.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 6.8 Canada Digital Oilfield Market Analysis

- 6.8.1 The oil and gas business in Canada is undergoing a technological revolution.

- 6.8.2 Suncor Energy Inc. will get a cloud solution package from Microsoft Canada.

- 6.8.3 Pre-COVID-19 Market Scenario

- 6.8.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 6.9 Mexico Digital Oilfield Market Analysis

- 6.9.1 Mexico Oil and Gas Industry Outlook

- 6.9.2 The world's first permanent subsea distributed acoustic sensing system is installed in the Gulf of Mexico.

- 6.9.3 Pre-COVID-19 Market Scenario

- 6.9.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

7 Europe Digital Oilfield Market Analysis

- 7.1 Europe Market Outlook

- 7.2 Europe Market Size Estimation and Forecast

- 7.2.1 Pre-COVID-19 Market Scenario

- 7.2.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.3 Country Market Size Estimation and Forecast

- 7.3.1 Pre-COVID-19 Market Scenario

- 7.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.4 Europe Market Size Estimation and Forecast by Application

- 7.4.1 Pre-COVID-19 Market Scenario

- 7.4.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.5 Europe Market Size Estimation and Forecast by Solution

- 7.5.1 Pre-COVID-19 Market Scenario

- 7.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.6 Europe Market Size Estimation and Forecast by Process

- 7.6.1 Pre-COVID-19 Market Scenario

- 7.6.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.7 Germany Digital Oilfield Market Analysis

- 7.7.1 Germany has to pursue technical innovation so as to cope with market volatility

- 7.7.2 Siemens is pursuing new solutions and expanding its digital footprint throughout the area.

- 7.7.3 Pre-COVID-19 Market Scenario

- 7.7.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.8 UK Digital Oilfield Market Analysis

- 7.8.1 UK Oil and Gas Industry Profile

- 7.8.2 Collaboration is helping North Sea oil and gas companies save lead times and inventory costs.

- 7.8.3 Pre-COVID-19 Market Scenario

- 7.8.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.9 France Digital Oilfield Market Analysis

- 7.9.1 Organizations in France are leveraging technology improvements and partnering with other businesses

- 7.9.2 In France, Total will establish a new Digital Factory.

- 7.9.3 Pre-COVID-19 Market Scenario

- 7.9.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.10 Italy Digital Oilfield Market Analysis

- 7.10.1 Italy Oil Production and Consumption

- 7.10.2 ENI has teamed up with PI System for digital transformation

- 7.10.3 Pre-COVID-19 Market Scenario

- 7.10.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.11 Spain Digital Oilfield Market Analysis

- 7.11.1 Spain is a net exporter of oil

- 7.11.2 Upstream Operations at Repsol are Using Cognitive Computing.

- 7.11.3 Pre-COVID-19 Market Scenario

- 7.11.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 7.12 Rest of Europe Digital Oilfield Market Analysis

- 7.12.1 BOGA nations seek to put a stop to oil and gas exploration.

- 7.12.2 Norway is a significant oil producer in the European Union.

- 7.12.3 Pre-COVID-19 Market Scenario

- 7.12.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

8 Asia-Pacific Digital Oilfield Market Analysis

- 8.1 Asia-Pacific Market Outlook

- 8.2 Asia-Pacific Market Size Estimation and Forecast

- 8.2.1 Pre-COVID-19 Market Scenario

- 8.2.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.3 Country Market Size Estimation and Forecast

- 8.3.1 Pre-COVID-19 Market Scenario

- 8.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.4 Asia-Pacific Market Size Estimation and Forecast by Application

- 8.4.1 Pre-COVID-19 Market Scenario

- 8.4.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.5 Asia-Pacific Market Size Estimation and Forecast by Solution

- 8.5.1 Pre-COVID-19 Market Scenario

- 8.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.6 Asia-Pacific Market Size Estimation and Forecast by Process

- 8.6.1 Pre-COVID-19 Market Scenario

- 8.6.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.7 China Digital Oilfield Market Analysis

- 8.7.1 China Oil and Gas Industry

- 8.7.2 CNOOC is turning the country's offshore oil and gas production digital and smart.

- 8.7.3 Pre-COVID-19 Market Scenario

- 8.7.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.8 India Digital Oilfield Market Analysis

- 8.8.1 India's Oil Production and Consumption

- 8.8.2 Pre-COVID-19 Market Scenario

- 8.8.3 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.9 Japan Digital Oilfield Market Analysis

- 8.9.1 Japan is a major energy importer

- 8.9.2 Pre-COVID-19 Market Scenario

- 8.9.3 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.10 South Korea Digital Oilfield Market Analysis

- 8.10.1 South Korea Oil and Gas Industry Profile

- 8.10.2 Energy Holdings is building over a digital oilfield

- 8.10.3 Pre-COVID-19 Market Scenario

- 8.10.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.11 Australia Digital Oilfield Market Analysis

- 8.11.1 Australia Makes Little Yet Substantial Input To Global Oil And Gas Supplies.

- 8.11.2 Pre-COVID-19 Market Scenario

- 8.11.3 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 8.12 Rest of Asia-Pacific Digital Oilfield Market Analysis

- 8.12.1 Pre-COVID-19 Market Scenario

- 8.12.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

9 LAMEA Digital Oilfield Market Analysis

- 9.1 LAMEA Market Outlook

- 9.1.1 African companies are adopting digital oilfield solutions to achieve long-term success

- 9.2 LAMEA Market Size Estimation and Forecast

- 9.2.1 Pre-COVID-19 Market Scenario

- 9.2.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.3 Country Market Size Estimation and Forecast

- 9.3.1 Pre-COVID-19 Market Scenario

- 9.3.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.4 LAMEA Market Size Estimation and Forecast by Application

- 9.4.1 Pre-COVID-19 Market Scenario

- 9.4.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.5 LAMEA Market Size Estimation and Forecast by Solution

- 9.5.1 Pre-COVID-19 Market Scenario

- 9.5.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.6 LAMEA Market Size Estimation and Forecast by Process

- 9.6.1 Pre-COVID-19 Market Scenario

- 9.6.2 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.7 Brazil Digital Oilfield Market Analysis

- 9.7.1 Brazil Oil Profile

- 9.7.2 Petrobras will be one of the world's first corporations to deploy Orbit 60

- 9.7.3 Pre-COVID-19 Market Scenario

- 9.7.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.8 South Africa Digital Oilfield Market Analysis

- 9.8.1 The African oil and gas sector is rigorously implementing digital technologies

- 9.8.2 Pre-COVID-19 Market Scenario

- 9.8.3 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.9 Saudi Arabia Digital Oilfield Market Analysis

- 9.9.1 Saudi Aramco Is Modernizing Its Operations Using Digital Technologies.

- 9.9.2 Aramco and Seeq sign a digitization deal.

- 9.9.3 Pre-COVID-19 Market Scenario

- 9.9.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.10 Turkey Digital Oilfield Market Analysis

- 9.10.1 Turkey has substantial Oil and Gas Expenses

- 9.10.2 Pre-COVID-19 Market Scenario

- 9.10.3 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.11 UAE Digital Oilfield Market Analysis

- 9.11.1 UAE Oil Production

- 9.11.2 UAE is seeking solutions for its upstream oil and gas industry

- 9.11.3 Pre-COVID-19 Market Scenario

- 9.11.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

- 9.12 Rest of LAMEA Digital Oilfield Market Analysis

- 9.12.1 Kuwait is the major oil producer.

- 9.12.2 Columbia Pipeline Group is leading the market in smart pipeline technology by collaborating with Accenture and GE.

- 9.12.3 Pre-COVID-19 Market Scenario

- 9.12.4 Post-COVID-19 Market Scenarios (V, W, U, L-Shaped Recovery Analysis)

10 Leading Company Profiles

- 10.1 Baker Hughes

- 10.1.1 Company Snapshot

- 10.1.1 Company Overview

- 10.1.2 Company Financial Profile

- 10.1.3 Company Product Benchmarking

- 10.1.4 Company Recent Developments

- 10.2 Halliburton

- 10.2.1 Company Snapshot

- 10.2.2 Company Overview

- 10.2.3 Company Financial Profile

- 10.2.4 Company Product Benchmarking

- 10.2.5 Company Recent Developments

- 10.3 Schlumberger

- 10.3.1 Company Snapshot

- 10.3.2 Company Overview

- 10.3.3 Company Financial Profile

- 10.3.4 Company Product Benchmarking

- 10.3.5 Company Recent Developments

- 10.4 Weatherford

- 10.4.1 Company Snapshot

- 10.4.2 Company Overview

- 10.4.3 Company Financial Profile

- 10.4.4 Company Product Benchmarking

- 10.4.5 Company Recent Developments

- 10.5 ABB

- 10.5.1 Company Snapshot

- 10.5.2 Company Overview

- 10.5.3 Company Financial Profile

- 10.5.4 Company Product Benchmarking

- 10.5.5 Company Recent Developments

- 10.6 Siemens

- 10.6.1 Company Snapshot

- 10.6.2 Company Overview

- 10.6.3 Company Financial Profile

- 10.6.4 Company Product Benchmarking

- 10.6.5 Company Recent Developments

- 10.7 Rockwell automation

- 10.7.1 Company Snapshot

- 10.7.2 Company Overview

- 10.7.3 Company Financial Profile

- 10.7.4 Company Product Benchmarking

- 10.7.5 Company Recent Developments

- 10.8 Nov Inc

- 10.8.1 Company Snapshot

- 10.8.2 Company Overview

- 10.8.3 Company Financial Profile

- 10.8.4 Company Product Benchmarking

- 10.8.5 Company Recent Developments

- 10.9 Schneider Electric SE

- 10.9.1 Company Snapshot

- 10.9.2 Company Overview

- 10.9.3 Company Financial Profile

- 10.9.4 Company Product Benchmarking

- 10.9.5 Company Recent Developments

- 10.10 FutureOn

- 10.10.1 Company Snapshot

- 10.10.2 Company Overview

- 10.10.3 Company Product Benchmarking

- 10.10.4 Company Recent Developments

- 10.11 3gig

- 10.11.1 Company Snapshot

- 10.11.2 Company Overview

- 10.11.3 Company Product Benchmarking

- 10.11.4 Company Recent Developments

- 10.12 Blue River Analytics

- 10.12.1 Company Snapshot

- 10.12.2 Company Overview

- 10.12.3 Company Product Benchmarking

- 10.13 HUVR

- 10.13.1 Company Snapshot

- 10.13.2 Company Overview

- 10.13.3 Company Product Benchmarking

- 10.13.4 Company Recent Developments

- 10.14 L&T

- 10.14.1 Company Snapshot

- 10.14.2 Company Overview

- 10.14.3 Company Financial Profile

- 10.14.4 Company Product Benchmarking

- 10.14.5 Company Recent Developments

- 10.15 EVINSYS INC

- 10.15.1 Company Snapshot

- 10.15.2 Company Overview

- 10.15.3 Company Product Benchmarking

- 10.15.4 Company Recent Developments

- 10.16 PwC

- 10.16.1 Company Snapshot

- 10.16.2 Company Overview

- 10.16.3 Company Product Benchmarking

- 10.16.4 Company Recent Developments

- 10.17 OleumTech

- 10.17.1 Company Snapshot

- 10.17.2 Company Overview

- 10.17.3 Company Product Benchmarking

- 10.17.4 Company Recent Developments

- 10.18 Infosys

- 10.18.1 Company Snapshot

- 10.18.2 Company Overview

- 10.18.3 Company Financial Profile

- 10.18.4 Company Product Benchmarking

- 10.18.5 Company Recent Developments

- 10.19 Intel

- 10.19.1 Company Snapshot

- 10.19.2 Company Overview

- 10.19.3 Company Financial Profile

- 10.19.4 Company Product Benchmarking

- 10.19.5 Company Recent Developments

- 10.20 Cognizant

- 10.20.1 Company Snapshot

- 10.20.2 Company Overview

- 10.20.3 Company Financial Profile

- 10.20.4 Company Product Benchmarking

- 10.20.5 Company Recent Developments

11 Conclusion and Recommendations

- 11.1 Conclusion

- 11.2 Recommendation

12 Glossary Terms

List of Tables

- Table 1. Global Digital Oilfield Market Forecast, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 2. Global Digital Oilfield Market Snapshot, 2022 & 2032 (US$million, CAGR %)

- Table 3. Global Digital Oilfield Packaging Market PEST Analysis 2022

- Table 4. Global Digital Oilfield Market Forecast, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 5. Global Digital Oilfield Market Forecast, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 6. Global Digital Oilfield Market Forecast, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 7. Global Digital Oilfield Market Forecast, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 8. Global Digital Oilfield Market Forecast, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 9. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 10. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 11. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 12. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 13. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 14. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 15. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 16. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 17. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 18. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 19. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 20. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 21. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 22. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 23. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 24. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 25. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 26. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 27. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 28. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 29. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 30. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 31. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 32. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 33. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 34. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 35. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 36. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 37. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 38. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 39. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 40. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 41. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 42. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 43. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 44. North America Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 45. North America Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 46. North America Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 47. North America Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 48. North America Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 49. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 50. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 51. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 52. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 53. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 54. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 55. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 56. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 57. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 58. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 59. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 60. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 61. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 62. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 63. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 64. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 65. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 66. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 67. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 68. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 69. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 70. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 71. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 72. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 73. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 74. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 75. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 76. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%))(W - Shaped Recovery)

- Table 77. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 78. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 79. Europe Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 80. Europe Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 81. Europe Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 82. Europe Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 83. Europe Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 84. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 85. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 86. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 87. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 88. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 89. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 90. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 91. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 92. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 93. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 94. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 95. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 96. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 97. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 98. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 99. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 100. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 101. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 102. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 103. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 104. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 105. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 106. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 107. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 108. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 109. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 110. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 111. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 112. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 113. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 114. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 115. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 116. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 117. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 118. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 119. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 120. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 121. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 122. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 123. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 124. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 125. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 126. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 127. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 128. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 129. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 130. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 131. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 132. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 133. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 134. Asia-Pacific Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 135. Asia-Pacific Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 136. Asia-Pacific Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 137. Asia-Pacific Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 138. Asia-Pacific Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 139. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 140. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 141. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 142. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 143. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 144. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 145. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 146. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 147. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 148. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 149. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 150. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 151. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 152. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 153. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 154. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 155. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 156. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 157. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 158. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 159. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 160. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 161. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 162. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 163. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 164. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 165. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 166. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 167. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 168. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 169. Australia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 170. Australia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 171. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 172. Australia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 173. Australia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%) (L - Shaped Recovery)

- Table 174. Rest of Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 175. Rest of Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 176. Rest of Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 177. Rest of Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 178. Rest of Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 179. LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 180. LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 181. LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 182. LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 183. LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 184. LAMEA Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 185. LAMEA Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 186. LAMEA Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 187. LAMEA Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 188. LAMEA Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 189. LAMEA Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 190. LAMEA Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 191. LAMEA Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 192. LAMEA Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 193. LAMEA Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 194. LAMEA Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 195. LAMEA Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 196. LAMEA Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 197. LAMEA Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 198. LAMEA Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 199. LAMEA Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 200. LAMEA Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 201. LAMEA Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 202. LAMEA Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 203. LAMEA Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 204. Brazil Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 205. Brazil Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 206. Brazil Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 207. Brazil Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 208. Brazil Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 209. South Africa Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 210. South Africa Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 211. South Africa Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 212. South Africa Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 213. South Africa Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 214. Saudi Arabia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 215. Saudi Arabia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 216. Saudi Arabia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 217. Saudi Arabia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 218. Saudi Arabia Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 219. Turkey Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 220. Turkey Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 221. Turkey Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 222. Turkey Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 223. Turkey Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 224. UAE Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 225. UAE Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 226. UAE Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 227. UAE Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

- Table 228. UAE Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

- Table 229. Rest of LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%))

- Table 230. Rest of LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (V - Shaped Recovery)

- Table 231. Rest of LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (W - Shaped Recovery)

- Table 232. Rest of LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (U - Shaped Recovery)

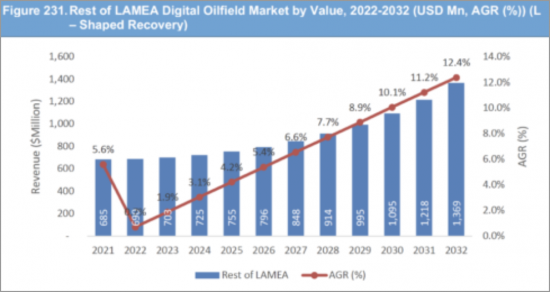

- Table 233. Rest of LAMEA Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%), CAGR(%)) (L - Shaped Recovery)

List of Figures

- Figure 1. Global Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 2. Global Digital Oilfield Market Segmentation

- Figure 3. Digital Oilfield Structure Model

- Figure 4. Oil and Gas Data Pipeline

- Figure 5. Oil and Gas Data Pipeline

- Figure 6. DROCs

- Figure 7. SWOT Analysis

- Figure 1. Porters Five Forces

- Figure 2. Global Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 3. Global Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 4. Global Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 5. Global Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 6. Global Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 7. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%))

- Figure 8. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 9. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 10. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 11. Global Digital Oilfield Market by Region, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 12. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%))

- Figure 13. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 14. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 15. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 16. Global Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 17. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 18. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 19. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 20. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 21. Global Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 22. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%))

- Figure 23. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 24. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 25. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 26. Global Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 27. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 28. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 29. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 30. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 31. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 32. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%))

- Figure 33. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 34. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 35. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 36. North America Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 37. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%))

- Figure 38. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 39. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 40. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 41. North America Digital Oilfield Market by Application, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 42. North America Digital Oilfield Marketby Solution, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 43. North America Digital Oilfield Marketby Solution, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 44. North America Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 45. North America Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 46. North America Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 47. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%))

- Figure 48. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 49. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 50. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 51. North America Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 52. North America Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 53. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 54. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 55. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 56. US Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 57. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 58. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 59. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 60. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 61. Canada Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 62. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 63. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 64. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 65. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 66. Mexico Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 67. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 68. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 69. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 70. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 71. Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 72. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%))

- Figure 73. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 74. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 75. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 76. Europe Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 77. Europe Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%))

- Figure 78. Europe Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 79. Europe Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 80. Europe Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 81. Europe Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 82. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 83. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 84. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 85. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 86. Europe Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 87. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%))

- Figure 88. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 89. Europe Digital Oilfield Marketby Process, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 90. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 91. Europe Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 92. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 93. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 94. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 95. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 96. Germany Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 97. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 98. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 99. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 100. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 101. UK Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 102. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 103. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 104. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 105. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 106. France Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 107. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 108. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 109. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 110. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 111. Italy Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 112. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 113. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 114. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 115. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 116. Spain Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 117. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 118. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 119. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 120. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 121. Rest of Europe Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 122. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 123. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 124. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 125. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 126. Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 127. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%))

- Figure 128. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 129. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 130. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 131. Asia-Pacific Digital Oilfield Market by Country, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 132. Asia-Pacific Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%))

- Figure 133. Asia-Pacific Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 134. Asia-Pacific Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 135. Asia-Pacific Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 136. Asia-Pacific Digital Oilfield Market by Application , 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 137. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%))

- Figure 138. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 139. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 140. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 141. Asia-Pacific Digital Oilfield Market by Solution, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 142. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%))

- Figure 143. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 144. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 145. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 146. Asia-Pacific Digital Oilfield Market by Process, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 147. China Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 148. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 149. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 150. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 151. China Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 152. India Asia-Pacific Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 153. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 154. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 155. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 156. India Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 157. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 158. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 159. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 160. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 161. Japan Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)

- Figure 162. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%))

- Figure 163. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (V - Shaped Recovery)

- Figure 164. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (W - Shaped Recovery)

- Figure 165. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (U - Shaped Recovery)

- Figure 166. South Korea Digital Oilfield Market by Value, 2022-2032 (USD Mn, AGR (%)) (L - Shaped Recovery)