|

市場調查報告書

商品編碼

1269624

氫燃料電池小客車的全球市場,2023年Global Market for Hydrogen Fuel Cell Passenger Vehicles, 2023 |

||||||

至2022年末世界銷售了近6萬台的氫燃料電池小客車。其中3萬台以上在2021年和2022年銷售,今後預計大幅成長。亞太地區和歐洲,引進的速度加速。在美國,除了加州,尤其是聯邦層面的對策不足,這個技術的引進遲滯。

本報告提供全球氫燃料電池小客車市場相關調查,市場概要,以及各地區的趨勢,競爭情形,及加入此市場的主要企業簡介等資訊。

目錄

第1章 概要與範圍

第2章 概要

- 簡介

- 氫的特徵

- 市場發展

- 市場成長

- 銷售額和收益

第3章 市場趨勢

- 氫燃料電池小客車(FCV)的優點

- 電池技術的優勢

- 氫燃料電池小客車(FCV)的優點與缺點

第4章 FCV的成長的影響因素

- 跟氣候變動的戰鬥

- 政府和世界組織的參與

- 新興氫生態系統

第5章 銷售/租賃

- 全球銷售/租賃

- 亞太地區的銷售/租賃

- EMEA的銷售/租賃

- 美國的銷售/租賃

第6章 亞太地區的FCV銷售

- 概要

- 澳洲

- 中國

- 印度

- 日本

- 馬來西亞

- 韓國

- 紐西蘭

- 其他

第7章 歐洲(北歐除外)各國的FCV銷售

- 概要

- 奧地利

- 比利時

- 捷克

- 愛沙尼亞

- 法國

- 德國

- 義大利

- 拉脫維亞

- 荷蘭

- 波蘭

- 斯洛維尼亞

- 西班牙

- 瑞士

- 英國

- 除去其他歐洲各國(北歐)

第8章 北歐各國

- 丹麥

- 芬蘭

- 冰島

- 挪威

- 瑞典

第9章 中東、非洲的FCV銷售

- 以色列

- 其他的中東各國

第10章 北美的FCV銷售

- 美國

- 美國西海岸

- 東海岸

- 加拿大

第11章 CALA的FCV銷售

- 巴西

- 其他

第12章 亞太地區的汽車廠商

- Great Wall Motor Company Ltd.

- Grove Hydrogen Automotive

- Honda Motor Company

- Hyundai Motor Company

- Kia

- Mahindra & Mahindra

- Mazda

- Mitsubishi Motors

- Nissan

- SAIC Motor

- Suzuki Motors

- Tata Motors

- Toyota

- BAIC Motor

- 其他

第13章 歐洲的汽車廠商

- BMW

- Daimler

- Jaguar Land Rover Automotive

- Pininfarina S.p.A

- Stellantis N.V.

- Renault

- Riversimple Movement Ltd

- Symbio

- Volkswagen

- 其他

第14章 南北美洲的汽車廠商

- Ford

- General Motors

- Ronn Motor Group

- 其他

第15章 FCV銷售/收益預測

- 銷售台數、租賃台數

- 收益預測

第16章 結論

- 市場趨勢

- 市場投入

- 氫FCV和BEV的比較

- 政府所扮演的角色

- FCV生態系統

- 市場預測

- 下一步

Executive Summary

Close to 60 thousand hydrogen fuel cell passenger vehicles were sold worldwide by the end of 2022. More than 30 thousand of these vehicles were sold in the past two years - 2021 and 2022 - reflecting significant traction in the uptake of these vehicles,

The speed of deployments has accelerated in Asia-Pacific and Europe. With the exception of California, the United States has fallen behind in implementing this technology, particularly because of a lack of action at the federal level.

Information Trends believes that the only impediment to the adoption of these vehicles in any region is the unavailability of hydrogen stations. The sales of these vehicles are taking place rapidly in regions that have well-deployed hydrogen fueling infrastructures.

More than half of the fuel cell vehicles sold so far have been in Korea because it has the densest hydrogen fueling infrastructure of any major market. Other regions with strong sales of fuel cell vehicles are Japan and California where significant deployments of hydrogen stations have taken place.

Several automakers, both start-ups and established players, have been making inroads into the fuel cell passenger vehicle market. Hyundai's Nexo has been a clear winner among fuel cell vehicles rolled out so far. Nexo's only other major competitor in the market has been Toyota's Mirai. But as the market gains traction, other major automakers are jumping onto the bandwagon.

Honda is preparing to re-enter this market, beginning with the U.S., where it will launch a fuel cell vehicle in 2024 that will be based on its Honda CR-V. BMW will start mass-producing and selling fuel cell vehicles developed jointly with Toyota in the second half of this decade.

The country with the most automakers making inroads into the fuel cell passenger vehicle market is China. Until now rollouts in the country have mostly been technical demonstrations, mainly because of a lack of hydrogen stations.

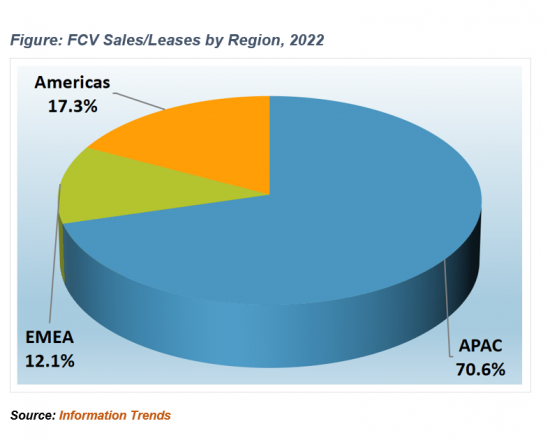

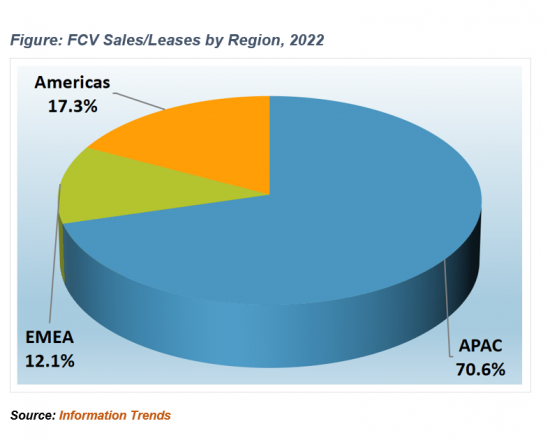

Figure 1 shows the share of passenger hydrogen fuel vehicles by region as of year-end 2022.

As fueling infrastructures further expand in the second half of 2020s, hydrogen FCVs will begin to garner greater market acceptance, giving them a more pervasive presence in the market. By 2030, sufficient hydrogen fueling infrastructures will be in place in several regions of the world, giving a boost to the market for these vehicles.

Scope of the Study

Fuel cell technology can be used in virtually every kind of transportation: cars, trucks, buses, forklifts, motorcycles, bicycles, airplanes, boats, submarines, and trams. However, the market is witnessing significant activity in three major types of hydrogen-driven vehicles:

- Passenger FCVs

- Light-duty commercial FCVs

- Fuel cell buses and trucks

The focus of this study is light-duty passenger vehicles, such as sedans, SUVs, and minivans. The study does not cover commercial vehicles.

Unless otherwise stated, all references to hydrogen FCVs in this study imply passenger vehicles. Information Trends defines a light-duty vehicle as one that has a gross weight of up to six metric tons or a North American Class 5 gross vehicle weight rating.

This study conducts an in-depth examination of this emerging market, including an analysis of the strategies of major players with respect to product rollouts and market penetration. The study provides market forecasts for both unit sales/leases and revenue through 2037. The average prices of these vehicles are declining while automakers keep adding more features and enhancements.

Hydrogen FCVs being produced by the automakers fall into one of the following classifications:

- Hydrogen hybrids: These are like gasoline hybrids, but instead of gasoline, they use hydrogen. These vehicles generate electricity through regenerative braking which is either used immediately or stored in the battery until it is needed. The FCVs that have been rolled out by Toyota, Hyundai, and Honda are hydrogen fuel cell hybrids.

- Hydrogen plug-in hybrids: Like gasoline plug-in hybrids, these vehicles allow the battery to be charged from an electric outlet. The Mercedes Benz GLC F-Cell was the only vehicle to hit the market that was a plug-in hydrogen fuel cell hybrid, but now other automakers are coming out with these vehicles.

Table of Contents

1.0. Summary and Scope

- 1.1. Executive Summary

- 1.2. Scope of the Study

- 1.3. Abbreviations

2.0. Overview

- 2.1. Introduction

- 2.2. Characteristics of Hydrogen

- 2.3. Market Developments

- 2.4. Market Growth

- 2.5. Sales and Revenue

3.0. Market Developments

- 3.1. Advantages of Hydrogen FCVs

- 3.1.1. Rapid and Standardized Fueling

- 3.1.2. Ability to Travel Longer Distances

- 3.1.3. Capability of Carrying Heavier Loads

- 3.2. Strengths of Battery Technology

- 3.3. Pros and Cons of Hydrogen FCVs

- 3.3.1. Pros of Hydrogen FCVs

- 3.3.2. Cons of Hydrogen FCVs

4.0. Factors Impacting Growth of FCVs

- 4.1. Need to Combat Climate Change

- 4.1.1. Greenhouse Gas Emissions

- 4.1.2. Paris Climate Treaty

- 4.2. Engagement of Governments & Global Organizations

- 4.2.1. Regulatory Requirements

- 4.2.2. Government Mandates

- 4.2.3. Subsidies and Incentives

- 4.3. Emerging Hydrogen Ecosystem

- 4.3.1. Cost of Hydrogen

- 4.3.2. Buildout of Hydrogen Fueling Stations

- 4.3.3. Falling Costs of FCV Ownership

5.0. Sales/Leases

- 5.1. Global Sales/Leases

- 5.1.1. Global Sales/Leases by Region

- 5.1.2. Global Sales/Leases by Automaker

- 5.1.3. Global Sales/Leases by Model

- 5.2. APAC Sales/Leases

- 5.3. EMEA Sales/Leases

- 5.4. Americas Sales/Leases

6.0. APAC FCV Launches

- 6.1. Overview

- 6.2. Australia

- 6.2.1. Overview

- 6.2.2. Industry Organizations

- 6.2.3. Government Policies and Initiatives

- 6.2.4. Hydrogen FCVs Rollout

- 6.2.5. Assessment

- 6.3. China

- 6.3.1. Overview

- 6.3.2. Industry Organizations

- 6.3.3. Government Policies and Initiatives

- 6.3.4. Hydrogen FCV Rollout

- 6.3.5. Assessment

- 6.4. India

- 6.4.1. Overview

- 6.4.2. Industry Organizations

- 6.4.3. Government Policies and Initiatives

- 6.4.4. Hydrogen FCV Rollout

- 6.4.5. Assessment

- 6.5. Japan

- 6.5.1. Overview

- 6.5.2. Industry Organizations

- 6.5.3. Government Policies and Initiatives

- 6.5.4. Hydrogen FCV Rollout

- 6.5.5. Assessment

- 6.6. Malaysia

- 6.6.1. Overview

- 6.6.2. Industry Organizations

- 6.6.3. Government Policies and Initiatives

- 6.6.4. Hydrogen FCV Rollout

- 6.6.5. Assessment

- 6.7. South Korea

- 6.7.1. Overview

- 6.7.2. Industry Organizations

- 6.7.3. Government Policies and Initiatives

- 6.7.4. Hydrogen FCV Rollout

- 6.7.5. Related Initiatives

- 6.8. New Zealand

- 6.8.1. Overview

- 6.8.2. Industry Organizations

- 6.8.3. Government Policies and Initiatives

- 6.8.4. Hydrogen FCV Rollout

- 6.8.5. Related Initiatives

- 6.9. Other Countries

- 6.9.1. Thailand

- 6.9.2. Nepal

- 6.9.3. Other Locations

7. European (Except Nordic) Countries FCV Launches

- 7.1. Overview

- 7.2. Austria

- 7.2.1. Overview

- 7.2.2. Industry Organizations

- 7.2.3. Government Policies and Initiatives

- 7.2.4. Hydrogen FCV Rollout

- 7.2.5. Assessment

- 7.3. Belgium

- 7.3.1. Overview

- 7.3.2. Industry Organizations

- 7.3.3. Government Policies and Initiatives

- 7.3.4. Hydrogen FCV Rollout

- 7.3.5. Assessment

- 7.4. Czech Republic

- 7.4.1. Overview

- 7.4.2. Industry Organizations

- 7.4.3. Government Policies and Initiatives

- 7.4.4. Hydrogen FCV Rollout

- 7.4.5. Assessment

- 7.5. Estonia

- 7.5.1. Overview

- 7.5.2. Industry Organizations

- 7.5.3. Government Policies and Initiatives

- 7.5.4. Hydrogen FCV Rollout

- 7.5.5. Assessment

- 7.6. France

- 7.6.1. Overview

- 7.6.2. Industry Organizations

- 7.6.3. Government Policies and Initiatives

- 7.6.4. Hydrogen FCV Rollout

- 7.6.5. Assessment

- 7.7. Germany

- 7.7.1. Overview

- 7.7.2. Industry Organizations

- 7.7.3. Government Policies and Initiatives

- 7.7.4. Hydrogen FCV Rollout

- 7.7.5. Assessment

- 7.8. Italy

- 7.8.1. Overview

- 7.8.2. Industry Organizations

- 7.8.3. Government Policies and Initiatives

- 7.8.4. Hydrogen FCV Roll Out

- 7.8.5. Assessment

- 7.9. Latvia

- 7.9.1. Overview

- 7.9.2. Industry Organizations

- 7.9.3. Government Policies and Initiatives

- 7.9.4. Hydrogen FCV Rollout

- 7.9.5. Assessment

- 7.10. The Netherlands

- 7.10.1. Overview

- 7.10.2. Industry Organizations

- 7.10.3. Government Policies and Initiatives

- 7.10.4. Hydrogen FCV Rollout

- 7.10.5. Assessment

- 7.11. Poland

- 7.11.1. Overview

- 7.11.2. Industry Organizations

- 7.11.3. Government Policies and Initiatives

- 7.11.4. Hydrogen FCV Rollout

- 7.11.5. Assessment

- 7.12. Slovenia

- 7.12.1. Overview

- 7.12.2. Industry Organizations

- 7.12.3. Government Policies and Initiatives

- 7.12.4. Hydrogen FCV Rollout

- 7.12.5. Assessment

- 7.13. Spain

- 7.13.1. Overview

- 7.13.2. Industry Organizations

- 7.13.3. Government Policies and Initiatives

- 7.13.4. Hydrogen FCV Rollout

- 7.13.5. Assessment

- 7.14. Switzerland

- 7.14.1. Overview

- 7.14.2. Industry Organizations

- 7.14.3. Government Policies and Initiatives

- 7.14.4. Hydrogen FCV Rollout

- 7.14.5. Assessment

- 7.15. The U.K.

- 7.15.1. Overview

- 7.15.2. Industry Organizations

- 7.15.3. Government Policies and Initiatives

- 7.15.4. Hydrogen FCV Rollout

- 7.15.5. Assessment

- 7.16. Other European (Except Nordic) Countries

- 7.16.1. Slovakia

- 7.16.2. Bulgaria

- 7.16.3. Luxembourg

- 7.16.4. Russia

- 7.16.5. Ireland

- 7.16.6. Lithuania

8.0. Nordic Region

- 8.1. Denmark

- 8.1.1. Overview

- 8.1.2. Industry Organizations

- 8.1.3. Government Policies and Initiatives

- 8.1.4. Hydrogen FCV Rollout

- 8.1.5. Assessment

- 8.2. Finland

- 8.2.1. Overview

- 8.2.2. Industry Organizations

- 8.2.3. Government Policies and Initiatives

- 8.2.4. Hydrogen FCV Rollout

- 8.2.5. Assessment

- 8.3. Iceland

- 8.3.1. Overview

- 8.3.2. Industry Organizations

- 8.3.3. Government Policies and Initiatives

- 8.3.4. Hydrogen FCV Rollout

- 8.3.5. Assessment

- 8.4. Norway

- 8.4.1. Overview

- 8.4.2. Industry Organizations

- 8.4.3. Government Policies and Initiatives

- 8.4.4. Hydrogen FCV Rollout

- 8.4.5. Assessment

- 8.5. Sweden

- 8.5.1. Overview

- 8.5.2. Industry Organizations

- 8.5.3. Government Policies and Initiatives

- 8.5.4. Hydrogen FCV Rollout

- 8.5.5. Assessment

9.0. Middle East & Africa FCV Launches

- 9.1. Israel

- 9.1.1. Overview

- 9.1.2. Industry Organizations

- 9.1.3. Government Policies & Initiatives

- 9.1.4. Hydrogen FCV Rollout

- 9.1.5. Assessment

- 9.2. Other Middle East Countries

- 9.2.1. Saudi Arabia

- 9.2.2. United Arab Emirates

- 9.2.3. Turkey

- 9.2.4. South Africa

10.0. North America FCV Launches

- 10.1. U.S.

- 10.1.1. Overview

- 10.1.2. Industry Organizations

- 10.1.3. Government Policies and Initiatives

- 10.1.4. Nationwide Hydrogen FCV Rollout

- 10.2. U.S. West Coast

- 10.2.1. Overview

- 10.2.2. Industry Organizations

- 10.2.3. Government Policies and Initiatives

- 10.2.4. Hydrogen FCV Rollout

- 10.2.5. Assessment

- 10.3. East Coast

- 10.3.1. Overview

- 10.3.2. Industry Organizations

- 10.3.3. Government Policies and Initiatives

- 10.3.4. Hydrogen FCV Rollout

- 10.3.5. Assessment

- 10.4. Canada

- 10.4.1. Overview

- 10.4.2. Industry Organizations

- 10.4.3. Government Policies and Initiatives

- 10.4.4. Hydrogen FCV Rollout

- 10.4.5. Assessment

11.0. CALA FCV Launches

- 11.1. Brazil

- 11.1.1. Introduction

- 11.1.2. Industry Organizations

- 11.1.3. Government Policies and Initiatives

- 11.1.4. Hydrogen FCV Rollout

- 11.1.5. Assessment

- 11.2. Other CALA Countries

12.0. Asia-Pacific Automakers

- 12.1. Great Wall Motor Company Ltd.

- 12.1.1. Introduction

- 12.1.2. Hydrogen FCV Rollouts

- 12.1.3. Key Partnerships

- 12.1.4. Strategic Direction

- 12.2. Grove Hydrogen Automotive

- 12.2.1. Introduction

- 12.2.2. Hydrogen FCV Rollouts

- 12.2.3. Key Partnerships

- 12.2.4. Strategic Direction

- 12.3. Honda Motor Company

- 12.3.1. Introduction

- 12.3.2. Hydrogen FCV Rollout

- 12.3.3. Key Partnerships

- 12.3.4. Hydrogen FCV Pricing

- 12.3.5. Hydrogen FCV Sales/Leases

- 12.3.6. Strategic Direction

- 12.4. Hyundai Motor Company

- 12.4.1. Introduction

- 12.4.2. Hydrogen FCV Roll Out

- 12.4.3. Hydrogen FCV Sales/Leases

- 12.4.4. Key Partnerships139

- 12.4.5. Strategic Direction

- 12.5. Kia

- 12.5.1. Introduction

- 12.5.2. Hydrogen FCV Rollouts

- 12.5.3. Key Partnerships

- 12.5.4. Strategic Direction

- 12.6. Mahindra & Mahindra

- 12.6.1. Introduction

- 12.6.2. Hydrogen FCV Rollouts

- 12.6.3. Key Partnerships

- 12.6.4. Strategic Direction

- 12.7. Mazda

- 12.7.1. Introduction

- 12.7.2. Hydrogen FCV Rollouts

- 12.7.3. Key Partnerships

- 12.7.4. Strategic Direction

- 12.8. Mitsubishi Motors

- 12.8.1. Introduction

- 12.8.2. Hydrogen FCV Rollouts

- 12.8.3. Key Partnerships

- 12.8.4. Strategic Direction

- 12.9. Nissan

- 12.9.1. Introduction

- 12.9.2. Hydrogen FCV Rollouts

- 12.9.3. Key Partnerships

- 12.9.4. Strategic Direction

- 12.10. SAIC Motor

- 12.10.1. Introduction

- 12.10.2. Hydrogen FCV Rollouts

- 12.10.3. Key Partnerships

- 12.10.4. Hydrogen FCV Pricing

- 12.10.5. Strategic Direction

- 12.11. Suzuki Motors

- 12.11.1. Introduction

- 12.11.2. Hydrogen FCV Rollouts

- 12.11.3. Key Partnerships

- 12.11.4. Strategic Direction

- 12.12. Tata Motors

- 12.12.1. Introduction

- 12.12.2. Hydrogen FCV Rollouts

- 12.12.3. Key Partnerships

- 12.12.4. Strategic Direction

- 12.13. Toyota

- 12.13.1. Introduction

- 12.13.2. Hydrogen FCV Rollouts

- 12.13.3. Hydrogen FCV Sales/Leases

- 12.13.4. Hydrogen FCV Pricing

- 12.13.5. Key Partnerships

- 12.13.6. Strategic Direction

- 12.14. BAIC Motor

- 12.14.1. Introduction

- 12.14.2. Hydrogen FCV Rollout

- 12.14.3. Key Partnerships

- 12.14.4. Strategic Direction

- 12.15. Other APAC Automakers

- 12.15.1. Aiways Automobiles

- 12.15.2. Changan Automobile

- 12.15.3. Chery Automobile

- 12.15.4. Dongfeng Motor

- 12.15.5. FAW Group

- 12.15.6. GAC Motor

- 12.15.7. H2X Global

- 12.15.8. Haima Automobile

13.0. European Automakers

- 13.1. BMW

- 13.1.1. Introduction

- 13.1.2. Hydrogen FCV Rollouts

- 13.1.3. Key Partnerships

- 13.1.4. Strategic Direction

- 13.2. Daimler

- 13.2.1. Introduction

- 13.2.2. Hydrogen FCV Rollouts

- 13.2.3. Key Partnerships

- 13.2.4. Strategic Direction

- 13.3. Jaguar Land Rover Automotive

- 13.3.1. Introduction

- 13.3.2. Hydrogen FCV Rollouts

- 13.3.3. Key Partnerships

- 13.3.4. Strategic Direction

- 13.4. Pininfarina S.p.A.

- 13.4.1. Introduction

- 13.4.2. Hydrogen FCV Rollouts

- 13.4.3. Key Partnerships

- 13.4.4. Strategic Direction

- 13.5. Stellantis N.V.

- 13.5.1. Introduction

- 13.5.2. Hydrogen FCV Rollouts

- 13.5.3. Key Partnerships

- 13.5.4. Strategic Direction

- 13.6. Renault

- 13.6.1. Introduction

- 13.6.2. Hydrogen FCV Rollouts

- 13.6.3. Key Partnerships

- 13.6.4. Strategic Direction

- 13.7. Riversimple Movement Ltd.

- 13.7.1. Introduction

- 13.7.2. Hydrogen FCV Rollouts

- 13.7.3. Key Partnerships

- 13.7.4. Strategic Direction

- 13.8. Symbio

- 13.8.1. Introduction

- 13.8.2. Hydrogen FCV Rollouts

- 13.8.3. Key Partnerships

- 13.8.4. Strategic Direction

- 13.9. Volkswagen

- 13.9.1. Introduction

- 13.9.2. Hydrogen FCV Rollouts

- 13.9.3. Key Partnerships

- 13.9.4. Strategic Direction

- 13.10. Others

- 13.10.1. Ferrari

- 13.10.2. H2O E-mobile GmbH

- 13.10.3. HMC Group

- 13.10.4. NamX

- 13.10.5. Ineos Automotive Ltd.

- 13.10.6. Microcab

- 13.10.7. Viritech

14.0. Americas Automakers

- 14.1. Ford

- 14.1.1. Introduction

- 14.1.2. Hydrogen FCV Rollouts

- 14.1.3. Key Partnerships

- 14.1.4. Strategic Direction

- 14.2. General Motors

- 14.2.1. Introduction

- 14.2.2. Hydrogen FCV Rollouts

- 14.2.3. Key Partnerships

- 14.2.4. Strategic Direction

- 14.3. Ronn Motor Group

- 14.3.1. Introduction

- 14.3.2. Hydrogen FCV Rollouts

- 14.3.3. Key Partnerships

- 14.3.4. Strategic Direction

- 14.4. Others

- 14.4.1. Hyperion

- 14.4.2. Glickenhaus

15.0. FCVs Sales/Revenue Forecast

- 15.1. Unit Sales/Leases

- 15.1.1. Factors Impacting Sales/Leases

- 15.1.2. Global Unit Sales/Leases Overview

- 15.1.3. Global Unit Sales/Leases Forecast

- 15.1.4. APAC Unit Sales/Leases Forecast

- 15.1.5. EMEA Unit Sales/Leases Forecast

- 15.1.6. Americas Unit Sales/Leases Forecast

- 15.2. Revenue Forecast

- 15.2.1. Pricing Trends

- 15.2.2. Global Revenue Forecast

- 15.2.3. APAC Revenue Forecast

- 15.2.4. EMEA Revenue Forecast

- 15.2.5. Americas Revenue Forecast

16. Conclusions

- 16.1. Market Trends

- 16.2. Market Launches

- 16.3. Hydrogen FCVs vs. BEVs

- 16.4. Role of Governments

- 16.5. FCVs Ecosystem

- 16.6. Market Outlook

- 16.7. Next Steps

Figures

- Figure 1: FCV New Sales/Leases by Region, 2022

- Figure 2: Annual Global FCV Sales/Leases, 2014-2022

- Figure 3: APAC FCV Sales/Leases, 2014-2022

- Figure 4: EMEA FCV Sales/Leases, 2014-2020

- Figure 5: Americas FCV Sales/Leases, 2014-2020

- Figure 6: Global FCV Sales/Leases Share by Major Region, 2014-2022

- Figure 7: Global FCV Sales/Leases Share by Major Region, 2022

- Figure 8: Global FCV Sales/Leases Share by Automaker, 2014-2022

- Figure 9: Global FCV Sales/Leases Share by Automaker, 2022

- Figure 10: Global FCV Sales/Leases Share by Model, 2014-2020

- Figure 11: Global FCV Sales/Leases Share by Model, 2022

- Figure 12: APAC FCV Sales/Leases Share by Model, 2014-2022

- Figure 13: APAC FCV Sales/Leases Share by Model, 2022

- Figure 14: EMEA FCV Sales/Leases Share by Model, 2014-2022

- Figure 15: EMEA FCV Sales/Leases Share by Model, 2022

- Figure 16: Americas FCV Sales/Leases Share by Model, 2014-2022

- Figure 17: Americas FCVs Sales/Leases Share by Model, 2022

- Figure 18: Honda Clarity FC Sales/Leases Share by Region, 2014-2022

- Figure 19: Honda Clarity FC Sales/Leases Share by Region, 2022

- Figure 20: Hyundai FCV Sales/Leases Share by Region, 2014-2022

- Figure 21: Hyundai FCV Sales/Leases Share by Region, 2022

- Figure 22: Toyota Mirai Sales/Leases Share by Region, 2014-2022

- Figure 23: Toyota Mirai Sales/Leases Share by Region, 2022

- Figure 24: Global Aggregate FCV Unit Sales/Leases, 2022-2037

- Figure 25: CAGR of Aggregate FCVs Sales Globally, 2022-2037

- Figure 26: APAC Aggregate FCV Unit Sales/Leases, 2022-2037

- Figure 27: CAGR of Aggregate FCVs in APAC, 2022-2037

- Figure 28: EMEA Aggregate FCV Unit Sales/Leases, 2022-2037

- Figure 29: CAGR of Aggregate FCVs in EMEA, 2022-2037

- Figure 30: Americas Aggregate FCV Unit Sales/Leases, 2022-2037

- Figure 31: CAGR of Aggregate FCVs in Americas, 2022-2037

- Figure 32: CAGR of FCV Sales Revenue Globally, 2022-2037

- Figure 33: APAC FCV Sales/Leases Revenue in USD, 2022-2037

- Figure 34: CAGR of FCV Sales Revenue in APAC, 2022-2037

- Figure 35: CAGR of FCV Sales Revenue in EMEA, 2022-2037

- Figure 36: Americas FCV Sales/Leases Revenue in USD, 2022-2037

Tables

- Table 1: Global FCV Sales/Leases by Major Region, 2014-2022

- Table 2: Global FCV Sales/Leases by Automaker, 2014-2022

- Table 3: Global FCV Sales/Leases by Model, 2014-2022

- Table 4: APAC FCV Sales/Leases by Model, 2014-2022

- Table 5: EMEA FCV Sales/Leases by Model, 2014-2022

- Table 6: Americas FCV Sales/Leases by Model, 2014-2022

- Table 7: Honda Clarity Fuel Cell Sales/Leases, 2014-2022

- Table 8: Hyundai's Combined FCV Sales/Leases, 2014-2022

- Table 9: Hyundai Nexo Sales/Leases, 2014-2022

- Table 10: Hyundai Tucson ix35 FCEV Sales/Leases, 2014-2022

- Table 11: Toyota Mirai Sales/Leases, 2014-2022

- Table 12: Global FCV Sales/Leases by Major Region, 2014-2037

- Table 13: Global Cumulative FCV Sales/Leases by Major Region, 2022-2029

- Table 14: Global Cumulative FCV Sales/Leases by Major Region, 2030-2037

- Table 15: APAC Cumulative FCV Sales/Leases by Region/Country, 2022-2029

- Table 16: APAC Cumulative FCV Sales/Leases by Region/Country, 2030-2037

- Table 17: EMEA Cumulative FCV Sales/Leases by Region/Country, 2022-2029

- Table 18: EMEA Cumulative FCV Sales/Leases by Region/Country, 2030-2037

- Table 19: Americas Cumulative FCV Sales/Leases by Region/Country, 2022-2029

- Table 20: Americas Cumulative FCV Sales/Leases by Region/Country, 2030-2037

- Table 21: Global FCV Revenue by Major Region, 2022-2029

- Table 22: Global FCV Revenue by Major Region, 2030-2037

- Table 23: APAC FCV Revenue by Region/Country, 2022-2029

- Table 24: APAC FCV Revenue by Region/Country, 2030-2037

- Table 25: EMEA FCV Revenue by Region/Country, 2022-2029

- Table 26: EMEA FCV Revenue by Region/Country, 2030-2037

- Table 27: Americas FCV Revenue by Region/Country, 2022-2029

- Table 28: Americas FCV Revenue by Region/Country, 2030-2037