|

市場調查報告書

商品編碼

1434531

多重身分驗證市場:依身分驗證、元件、身分驗證等級、部署、產業 - 2023-2030 年全球預測Multi-factor Authentication Market by Authentication (Password-Based Authentication, Passwordless Authentication), Component (Hardware, Services, Software), Level of Authentication, Deployment, Industry - Global Forecast 2023-2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

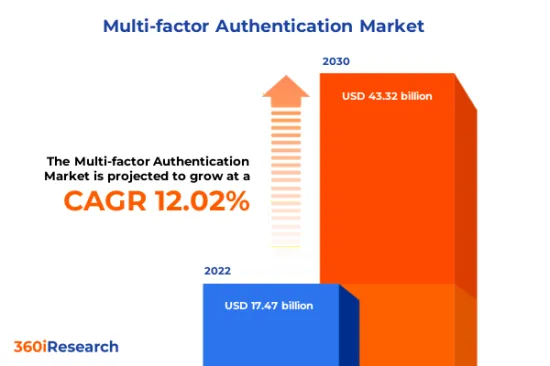

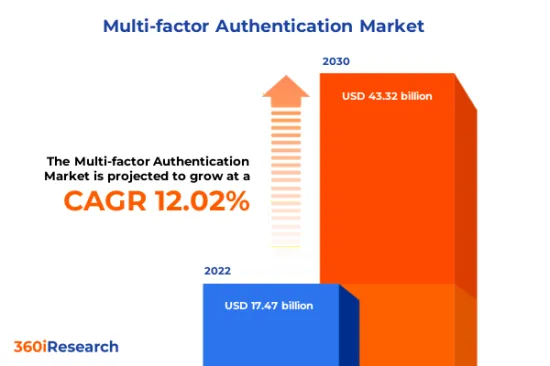

預計2022年多因素認證市場規模為174.7億美元,預計2023年將達195億美元,2030年將達到433.2億美元,複合年成長率為12.02%。

多重身份驗證的全球市場

| 主要市場統計 | |

|---|---|

| 基準年[2022] | 174.7億美元 |

| 預測年份 [2023] | 195億美元 |

| 預測年份 [2030] | 433.2億美元 |

| 複合年成長率(%) | 12.02% |

多重身份驗證是一種安全通訊協定,指示使用者在存取系統或應用程式之前使用多個獨立因素來驗證其身份。這種先進的身份驗證機制可以防止用戶帳戶和敏感資訊被未經授權的個人洩露,從而大大增強了數位安全性。全球企業的快速數位化增加了對互連系統和資料共用的依賴,使它們更容易受到網路攻擊。 《一般資料保護規範》(GDPR) 規定了嚴格的安全措施來保護資料,進一步需要包括多因素身份驗證在內的強大身份驗證機制。此外,消費者隱私權意識的增強正在推動企業採用多因素身份驗證來增強客戶群之間的信任。然而,實施和管理多因素身份驗證的複雜性可能會阻止一些組織採用這些解決方案。此外,對使用者不便的擔憂,尤其是生物識別方法,也會阻礙最終使用者的廣泛接受。然而,生物辨識技術的進步和自適應身分驗證機制的出現預計將在未來幾年為多因素身分驗證市場創造成長機會。

區域洞察

由於對安全法規的強烈關注、網路安全投資舉措的激增以及數位交易增加導致的資料外洩問題日益嚴重,美洲地區的多因素身份驗證市場正在經歷強勁成長。地方政府框架正在探索透過各種策略夥伴關係加強網路基礎設施的機會。由於一般資料保護規範 (GDPR) 等嚴格的資料保護規範,歐洲對多因素身分驗證解決方案的需求龐大。在中東,由於金融服務業的迅速擴張以及對敏感資訊和關鍵基礎設施的威脅日益增加,對多因素身份驗證解決方案的需求不斷增加。在非洲,企業正在採用多因素身份驗證解決方案,以降低數位交易和金融服務興起相關的風險。非洲開發銀行採取了各種舉措,透過促進官民合作關係和能力建設來加強非洲大陸的網路安全生態系統。亞太地區經濟體正在積極投資生物辨識和臉部認證等先進身分驗證技術。同時,在亞太地區的已開發經濟體中,領先的科技公司不斷創新多因素身分驗證解決方案。在亞洲新興國家,由於政府主導,數位環境正在迅速發展,進一步增加了對多因素身分驗證解決方案的需求。

FPNV定位矩陣

FPNV定位矩陣對於評估多因素認證市場至關重要。我們檢視與業務策略和產品滿意度相關的關鍵指標,以對供應商進行全面評估。這種深入的分析使用戶能夠根據自己的要求做出明智的決策。根據評估,供應商被分為四個成功程度不同的像限:前沿(F)、探路者(P)、利基(N)和重要(V)。

市場佔有率分析

市場佔有率分析是一種綜合工具,可以對多重身分驗證市場中供應商的現狀進行深入而詳細的研究。全面比較和分析供應商在整體收益、基本客群和其他關鍵指標方面的貢獻,以便更好地了解公司的績效及其在爭奪市場佔有率時面臨的挑戰。此外,該分析還提供了對該行業競爭特徵的寶貴見解,包括在研究基準年觀察到的累積、分散主導地位和合併特徵等因素。這種詳細程度的提高使供應商能夠做出更明智的決策並制定有效的策略,從而在市場上獲得競爭優勢。

該報告對以下幾個方面提供了寶貴的見解:

1-市場滲透率:提供有關主要企業所服務的市場的全面資訊。

2-市場開拓:我們深入研究利潤豐厚的新興市場並分析其在成熟細分市場的滲透率。

3- 市場多元化:提供有關新產品發布、開拓地區、最新發展和投資的詳細資訊。

4-競爭力評估與資訊:對主要企業的市場佔有率、策略、產品、認證、監管狀況、專利狀況、製造能力等進行全面評估。

5- 產品開發與創新:提供對未來技術、研發活動和突破性產品開發的見解。

本報告解決了以下關鍵問題:

1-多因素認證市場的市場規模和預測是多少?

2-在多重身分驗證市場的預測期內,需要考慮投資哪些產品、細分市場、應用程式和領域?

3-多因素認證市場的技術趨勢和法律規範是什麼?

4-多重身分驗證市場主要供應商的市場佔有率為何?

5-進入多因素認證市場的適當型態和策略手段是什麼?

目錄

第1章 前言

第2章調查方法

第3章執行摘要

第4章市場概況

第5章市場洞察

- 市場動態

- 促進因素

- 全球安全漏洞和網路攻擊呈上升趨勢

- 在 BFSI 產業不斷發展的數位形勢中,對 MFA 的需求不斷成長

- 各企業自備設備的採用率增加

- 抑制因素

- 與多因素身份驗證相關的高成本和技術限制

- 機會

- 引入先進的多重身份驗證解決方案

- 為元宇宙環境採用高階身份驗證框架

- 任務

- 開放原始碼MFA 軟體的可用性和相容性以及安全漏洞

- 促進因素

- 市場區隔分析

- 身份驗證:企業擴大採用無密碼身份驗證來防止網路攻擊

- 組件:用於多因素身份驗證的硬體產品系列的進步

- 認證等級:擴大雙因素認證在中小企業的應用

- 部署:在雲端進階部署多重身分驗證,經濟高效、快速實施

- 產業:多因素身分驗證廣泛應用於銀行、金融服務和保險業,以確保交易安全。

- 市場趨勢分析

- 政府致力於美洲資料保護和 MFA 技術的突破性進展

- 日益增加的網路攻擊負擔和不斷變化的數位形勢正在推動亞太地區對多因素身份驗證的需求

- 歐洲、中東和非洲數位轉型的快速發展和強大的資料安全標準

- 高通膨的累積效應

- 波特五力分析

- 價值鍊和關鍵路徑分析

- 法律規範

第6章 多重身分驗證市場:透過身分驗證

- 基於密碼的身份驗證

- 無密碼身份驗證

第 7 章 多重身分驗證市場:按組成部分

- 硬體

- 服務

- 軟體

第 8 章 多重身分驗證市場:依身分驗證級別

- 五因素認證

- 四因素認證

- 三因素認證

- 雙因素認證

第 9 章 多重身分驗證市場:按部署

- 在雲端

- 本地

第10章多重身分驗證市場:依行業

- 航太和國防

- 汽車和交通

- 銀行、金融服務和保險

- 建築、建築、房地產

- 消費品和零售

- 教育

- 能源和公共

- 政府和公共部門

- 醫療保健和生命科學

- 資訊科技和通訊

- 製造業

- 媒體與娛樂

- 旅行和招待

第11章美洲多重身分驗證市場

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美國

第12章亞太多重身份驗證市場

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 菲律賓

- 新加坡

- 韓國

- 台灣

- 泰國

- 越南

第13章 歐洲、中東和非洲多因素認證市場

- 丹麥

- 埃及

- 芬蘭

- 法國

- 德國

- 以色列

- 義大利

- 荷蘭

- 奈及利亞

- 挪威

- 波蘭

- 卡達

- 俄羅斯

- 沙烏地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公國

- 英國

第14章競爭形勢

- FPNV定位矩陣

- 市場佔有率分析:主要企業

- 主要企業競爭情境分析

- 併購

- 合約、合作和夥伴關係

- 新產品發布和功能增強

- 投資、資金籌措

- 獎項/獎勵/擴展

第15章競爭產品組合

- 主要公司簡介

- 3M Company

- Amazon Web Services, Inc.

- aPersona, Inc.

- Authy by TWILIO, INC.

- Broadcom Inc.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- Entrust Corporation

- ForgeRock, Inc.

- Fortinet, Inc.

- Fujitsu Limited

- FusionAuth

- Google LLC by Alphabet Inc.

- HCL Technologies Limited

- Imperva, Inc.

- International Business Machines Corporation

- JumpCloud Inc.

- LastPass US LP

- LogMeOnce

- ManageEngine by Zoho Corporation Pvt. Ltd.

- Microsoft Corporation

- miniOrange Security Software Pvt Ltd.

- NEC Corporation

- Okta, Inc.

- OneSpan Inc.

- Open Text Corporation

- Ping Identity Corporation

- Quest Software Inc.

- Red Hat, Inc.

- RSA Security LLC

- Rublon sp. z oo

- Safran SA

- Salesforce, Inc.

- SAP SE

- Schneider Electric SE

- SecureAuth Corporation

- Silverfort, Inc.

- Thales Group

- Uniqkey A/S

- Verizon Communications Inc.

- VMware, Inc.

- WatchGuard Technologies, Inc.

- Yubico AB

- 主要產品系列

第16章附錄

- 討論指南

- 關於許可證和定價

[198 Pages Report] The Multi-factor Authentication Market size was estimated at USD 17.47 billion in 2022 and expected to reach USD 19.50 billion in 2023, at a CAGR 12.02% to reach USD 43.32 billion by 2030.

Global Multi-factor Authentication Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2022] | USD 17.47 billion |

| Estimated Year [2023] | USD 19.50 billion |

| Forecast Year [2030] | USD 43.32 billion |

| CAGR (%) | 12.02% |

Multi-factor authentication is a security protocol that directs users to verify their identities using multiple independent factors before gaining access to a system or an application. The advanced authentication mechanism significantly enhances digital security by preventing unauthorized individuals from compromising user accounts or sensitive information. The rapid digitization of businesses worldwide has increased dependence on interconnected systems and data sharing, leading to greater cyber-attack vulnerability. The General Data Protection Regulation (GDPR) mandates stringent security measures for data protection, which further necessitates robust authentication mechanisms, including multi-factor authentication. Additionally, growing awareness of consumer privacy rights encourages enterprises to adopt multi-factor authentication to enhance trust among their customer base. However, the complexity of implementing and managing multi-factor authentication may deter some organizations from adopting these solutions. Additionally, concerns around user inconvenience, particularly with biometric identification methods, might inhibit widespread acceptance among end users. Nevertheless, advancements in biometric technologies and the emergence of adaptive authentication mechanisms are expected to create growth opportunities for the multi-factor authentication market in the coming years.

Regional Insights

The Americas represents a highly developing multi-factor authentication market owing to the strong focus on security regulations, an upsurge in investment initiatives around cybersecurity, and growing concern over data breaches due to increased digital transactions. The regional governmental frameworks are exploring opportunities to strengthen the cyberinfrastructure through various strategic partnerships. In Europe, multi-factor authentication solutions are witnessing significant demand due to stringent data protection norms such as the General Data Protection Regulation (GDPR). The Middle East has seen increased demand for multi-factor authentication solutions due to its rapidly expanding financial services sector and escalating threats targeting sensitive information and critical infrastructure. In Africa, organizations adopt multi-factor authentication solutions to mitigate the risks of increased digital transactions and financial services. The African Development Bank has taken various initiatives to strengthen the continent's cybersecurity ecosystem by promoting public-private partnerships and capacity building. The economies in the Asia-Pacific region are actively investing in advanced authentication technologies such as biometrics and facial recognition. Meanwhile, the Asia-Pacific region's developed economies involve major tech companies continually driving innovation in multi-factor authentication solutions. The rapidly evolving digital landscape in emerging Asian economies driven by government initiatives further expands the demand for multi-factor authentication solutions.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Multi-factor Authentication Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Multi-factor Authentication Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Multi-factor Authentication Market, highlighting leading vendors and their innovative profiles. These include 3M Company, Amazon Web Services, Inc., aPersona, Inc., Authy by TWILIO, INC., Broadcom Inc., Cisco Systems, Inc., Cloudflare, Inc., Entrust Corporation, ForgeRock, Inc., Fortinet, Inc., Fujitsu Limited, FusionAuth, Google LLC by Alphabet Inc., HCL Technologies Limited, Imperva, Inc., International Business Machines Corporation, JumpCloud Inc., LastPass US LP, LogMeOnce, ManageEngine by Zoho Corporation Pvt. Ltd., Microsoft Corporation, miniOrange Security Software Pvt Ltd., NEC Corporation, Okta, Inc., OneSpan Inc., Open Text Corporation, Ping Identity Corporation, Quest Software Inc., Red Hat, Inc., RSA Security LLC, Rublon sp. z o.o., Safran S.A., Salesforce, Inc., SAP SE, Schneider Electric SE, SecureAuth Corporation, Silverfort, Inc., Thales Group, Uniqkey A/S, Verizon Communications Inc., VMware, Inc., WatchGuard Technologies, Inc., and Yubico AB.

Market Segmentation & Coverage

This research report categorizes the Multi-factor Authentication Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Authentication

- Password-Based Authentication

- Passwordless Authentication

- Component

- Hardware

- Services

- Software

- Level of Authentication

- Five-Factor Authentication

- Four Factor Authentication

- Three Factor Authentication

- Two Factor Authentication

- Deployment

- On-Cloud

- On-Premises

- Industry

- Aerospace & Defense

- Automotive & Transportation

- Banking, Financial Services & Insurance

- Building, Construction & Real Estate

- Consumer Goods & Retail

- Education

- Energy & Utilities

- Government & Public Sector

- Healthcare & Life Sciences

- Information Technology & Telecommunication

- Manufacturing

- Media & Entertainment

- Travel & Hospitality

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Multi-factor Authentication Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Multi-factor Authentication Market?

3. What are the technology trends and regulatory frameworks in the Multi-factor Authentication Market?

4. What is the market share of the leading vendors in the Multi-factor Authentication Market?

5. Which modes and strategic moves are suitable for entering the Multi-factor Authentication Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Multi-factor Authentication Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing number of security breaches and cyber attacks worldwide

- 5.1.1.2. Growing need for MFA in evolving digital landscape of BFSI sector

- 5.1.1.3. Rising adoption of bring your own device across companies

- 5.1.2. Restraints

- 5.1.2.1. High cost and technical limitations associated with multi-factor authentication

- 5.1.3. Opportunities

- 5.1.3.1. Emergence of advanced multi-authentication solutions

- 5.1.3.2. Adoption of advanced authentication framework for metaverse environment

- 5.1.4. Challenges

- 5.1.4.1. Availability of open-source MFA software coupled with compatibility and security gap

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Authentication: Increasing adoption of passwordless authentication by enterprises to prevent cyber attacks

- 5.2.2. Component: Advancing product portfolio of hardware used for multi-factor authentication

- 5.2.3. Level of Authentication: Expanding application of two-factor authentication among small and medium enterprises

- 5.2.4. Deployment: High deployment of on-cloud multi-factor authentication due to their cost-efficiency and quick implementation

- 5.2.5. Industry: Extensive use of multi-factor authentication across banking, financial services, and insurance industry to safeguard transactions

- 5.3. Market Trend Analysis

- 5.3.1. Government initiatives for data protection and breakthroughs in MFAs technologies in the Americas

- 5.3.2. Growing burden of cyberattacks and evolving digital landscape creating need for multi-factor authentication in the Asia-Pacific

- 5.3.3. Burgeoning digital transformation coupled with robust data security standards in the EMEA region

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Multi-factor Authentication Market, by Authentication

- 6.1. Introduction

- 6.2. Password-Based Authentication

- 6.3. Passwordless Authentication

7. Multi-factor Authentication Market, by Component

- 7.1. Introduction

- 7.2. Hardware

- 7.3. Services

- 7.4. Software

8. Multi-factor Authentication Market, by Level of Authentication

- 8.1. Introduction

- 8.2. Five-Factor Authentication

- 8.3. Four Factor Authentication

- 8.4. Three Factor Authentication

- 8.5. Two Factor Authentication

9. Multi-factor Authentication Market, by Deployment

- 9.1. Introduction

- 9.2. On-Cloud

- 9.3. On-Premises

10. Multi-factor Authentication Market, by Industry

- 10.1. Introduction

- 10.2. Aerospace & Defense

- 10.3. Automotive & Transportation

- 10.4. Banking, Financial Services & Insurance

- 10.5. Building, Construction & Real Estate

- 10.6. Consumer Goods & Retail

- 10.7. Education

- 10.8. Energy & Utilities

- 10.9. Government & Public Sector

- 10.10. Healthcare & Life Sciences

- 10.11. Information Technology & Telecommunication

- 10.12. Manufacturing

- 10.13. Media & Entertainment

- 10.14. Travel & Hospitality

11. Americas Multi-factor Authentication Market

- 11.1. Introduction

- 11.2. Argentina

- 11.3. Brazil

- 11.4. Canada

- 11.5. Mexico

- 11.6. United States

12. Asia-Pacific Multi-factor Authentication Market

- 12.1. Introduction

- 12.2. Australia

- 12.3. China

- 12.4. India

- 12.5. Indonesia

- 12.6. Japan

- 12.7. Malaysia

- 12.8. Philippines

- 12.9. Singapore

- 12.10. South Korea

- 12.11. Taiwan

- 12.12. Thailand

- 12.13. Vietnam

13. Europe, Middle East & Africa Multi-factor Authentication Market

- 13.1. Introduction

- 13.2. Denmark

- 13.3. Egypt

- 13.4. Finland

- 13.5. France

- 13.6. Germany

- 13.7. Israel

- 13.8. Italy

- 13.9. Netherlands

- 13.10. Nigeria

- 13.11. Norway

- 13.12. Poland

- 13.13. Qatar

- 13.14. Russia

- 13.15. Saudi Arabia

- 13.16. South Africa

- 13.17. Spain

- 13.18. Sweden

- 13.19. Switzerland

- 13.20. Turkey

- 13.21. United Arab Emirates

- 13.22. United Kingdom

14. Competitive Landscape

- 14.1. FPNV Positioning Matrix

- 14.2. Market Share Analysis, By Key Player

- 14.3. Competitive Scenario Analysis, By Key Player

- 14.3.1. Merger & Acquisition

- 14.3.1.1. Belgian Identity App itsme Buys Fellow Belgian Multi-Factor Authentication Firm nextAuth

- 14.3.2. Agreement, Collaboration, & Partnership

- 14.3.2.1. iProov Partners with Cybernetica to Deliver Digital Signing and Authentication Solutions to Governments and Financial Services Organizations

- 14.3.2.2. Fujitsu and Misawa Homes Start Joint Trials for Personalized and Secure Living Spaces using Continuous Authentication Technology

- 14.3.2.3. IFES and Google Announce Partnership to Foster Digital Security for Democracy

- 14.3.2.4. PwC India and Secret Double Octopus Announce a Strategic Partnership to Promote Passwordless and Desktop MFA for Compliance

- 14.3.2.5. ForgeRock Announces a Strategic Partnership with Secret Double Octopus to Extend Passwordless and Multi-factor Authentication Capabilities in the Enterprise

- 14.3.3. New Product Launch & Enhancement

- 14.3.3.1. Microsoft Releases System-Preferred Multifactor Authentication

- 14.3.3.2. Cisco Unveils New Solution to Rapidly Detect Advanced Cyber Threats and Automate Response

- 14.3.3.3. Entrust Launches Zero Trust Ready Solutions for Passwordless Authentication, Next-Generation HSM, and Multi-Cloud Key Compliance

- 14.3.3.4. Microsoft Rolls out New Feature to MFA app, Prevents Spam Attacks

- 14.3.3.5. ForgeRock's Next-Generation Authenticator App is Now Available

- 14.3.4. Investment & Funding

- 14.3.4.1. Biometric Wearable Provider Token Snares USD 30 Million in Funding Raise

- 14.3.5. Award, Recognition, & Expansion

- 14.3.5.1. Hyperspace Technologies Secures Patent for Blockchain-Driven Multi-Factor Authentication

- 14.3.5.2. ZKX Solutions Announces Issuance of New U.S. Patent on a Novel Multi-Factor Authentication System

- 14.3.5.3. Keyless and Synpulse partner to bring anti-phishing MFA to the UK

- 14.3.1. Merger & Acquisition

15. Competitive Portfolio

- 15.1. Key Company Profiles

- 15.1.1. 3M Company

- 15.1.2. Amazon Web Services, Inc.

- 15.1.3. aPersona, Inc.

- 15.1.4. Authy by TWILIO, INC.

- 15.1.5. Broadcom Inc.

- 15.1.6. Cisco Systems, Inc.

- 15.1.7. Cloudflare, Inc.

- 15.1.8. Entrust Corporation

- 15.1.9. ForgeRock, Inc.

- 15.1.10. Fortinet, Inc.

- 15.1.11. Fujitsu Limited

- 15.1.12. FusionAuth

- 15.1.13. Google LLC by Alphabet Inc.

- 15.1.14. HCL Technologies Limited

- 15.1.15. Imperva, Inc.

- 15.1.16. International Business Machines Corporation

- 15.1.17. JumpCloud Inc.

- 15.1.18. LastPass US LP

- 15.1.19. LogMeOnce

- 15.1.20. ManageEngine by Zoho Corporation Pvt. Ltd.

- 15.1.21. Microsoft Corporation

- 15.1.22. miniOrange Security Software Pvt Ltd.

- 15.1.23. NEC Corporation

- 15.1.24. Okta, Inc.

- 15.1.25. OneSpan Inc.

- 15.1.26. Open Text Corporation

- 15.1.27. Ping Identity Corporation

- 15.1.28. Quest Software Inc.

- 15.1.29. Red Hat, Inc.

- 15.1.30. RSA Security LLC

- 15.1.31. Rublon sp. z o.o.

- 15.1.32. Safran S.A.

- 15.1.33. Salesforce, Inc.

- 15.1.34. SAP SE

- 15.1.35. Schneider Electric SE

- 15.1.36. SecureAuth Corporation

- 15.1.37. Silverfort, Inc.

- 15.1.38. Thales Group

- 15.1.39. Uniqkey A/S

- 15.1.40. Verizon Communications Inc.

- 15.1.41. VMware, Inc.

- 15.1.42. WatchGuard Technologies, Inc.

- 15.1.43. Yubico AB

- 15.2. Key Product Portfolio

16. Appendix

- 16.1. Discussion Guide

- 16.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. MULTI-FACTOR AUTHENTICATION MARKET RESEARCH PROCESS

- FIGURE 2. MULTI-FACTOR AUTHENTICATION MARKET SIZE, 2022 VS 2030

- FIGURE 3. MULTI-FACTOR AUTHENTICATION MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. MULTI-FACTOR AUTHENTICATION MARKET DYNAMICS

- FIGURE 7. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2022 VS 2030 (%)

- FIGURE 8. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2022 VS 2030 (%)

- FIGURE 10. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2022 VS 2030 (%)

- FIGURE 12. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2022 VS 2030 (%)

- FIGURE 14. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2022 VS 2030 (%)

- FIGURE 16. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. AMERICAS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 18. AMERICAS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. UNITED STATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 20. UNITED STATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. ASIA-PACIFIC MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 22. ASIA-PACIFIC MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 23. EUROPE, MIDDLE EAST & AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 24. EUROPE, MIDDLE EAST & AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 25. MULTI-FACTOR AUTHENTICATION MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 26. MULTI-FACTOR AUTHENTICATION MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. MULTI-FACTOR AUTHENTICATION MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. MULTI-FACTOR AUTHENTICATION MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 6. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY PASSWORD-BASED AUTHENTICATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY PASSWORDLESS AUTHENTICATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 9. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY HARDWARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY SERVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY SOFTWARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 13. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY FIVE-FACTOR AUTHENTICATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY FOUR FACTOR AUTHENTICATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY THREE FACTOR AUTHENTICATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY TWO FACTOR AUTHENTICATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 18. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY ON-CLOUD, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY ON-PREMISES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 21. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AEROSPACE & DEFENSE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY BANKING, FINANCIAL SERVICES & INSURANCE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY BUILDING, CONSTRUCTION & REAL ESTATE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY CONSUMER GOODS & RETAIL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY EDUCATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY ENERGY & UTILITIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY GOVERNMENT & PUBLIC SECTOR, BY REGION, 2018-2030 (USD MILLION)

- TABLE 29. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY HEALTHCARE & LIFE SCIENCES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 30. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INFORMATION TECHNOLOGY & TELECOMMUNICATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 31. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY MANUFACTURING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 32. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY MEDIA & ENTERTAINMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 33. MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY TRAVEL & HOSPITALITY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 34. AMERICAS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 35. AMERICAS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 36. AMERICAS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 37. AMERICAS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 38. AMERICAS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 39. AMERICAS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 40. ARGENTINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 41. ARGENTINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 42. ARGENTINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 43. ARGENTINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 44. ARGENTINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 45. BRAZIL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 46. BRAZIL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 47. BRAZIL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 48. BRAZIL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 49. BRAZIL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 50. CANADA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 51. CANADA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 52. CANADA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 53. CANADA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 54. CANADA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 55. MEXICO MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 56. MEXICO MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 57. MEXICO MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 58. MEXICO MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 59. MEXICO MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 60. UNITED STATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 61. UNITED STATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 62. UNITED STATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 63. UNITED STATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 64. UNITED STATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 65. UNITED STATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 66. ASIA-PACIFIC MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 67. ASIA-PACIFIC MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 68. ASIA-PACIFIC MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 69. ASIA-PACIFIC MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 70. ASIA-PACIFIC MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 71. ASIA-PACIFIC MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 72. AUSTRALIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 73. AUSTRALIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 74. AUSTRALIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 75. AUSTRALIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 76. AUSTRALIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 77. CHINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 78. CHINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 79. CHINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 80. CHINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 81. CHINA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 82. INDIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 83. INDIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 84. INDIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 85. INDIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 86. INDIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 87. INDONESIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 88. INDONESIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 89. INDONESIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 90. INDONESIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 91. INDONESIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 92. JAPAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 93. JAPAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 94. JAPAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 95. JAPAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 96. JAPAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 97. MALAYSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 98. MALAYSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 99. MALAYSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 100. MALAYSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 101. MALAYSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 102. PHILIPPINES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 103. PHILIPPINES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 104. PHILIPPINES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 105. PHILIPPINES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 106. PHILIPPINES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 107. SINGAPORE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 108. SINGAPORE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 109. SINGAPORE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 110. SINGAPORE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 111. SINGAPORE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 112. SOUTH KOREA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 113. SOUTH KOREA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 114. SOUTH KOREA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 115. SOUTH KOREA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 116. SOUTH KOREA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 117. TAIWAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 118. TAIWAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 119. TAIWAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 120. TAIWAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 121. TAIWAN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 122. THAILAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 123. THAILAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 124. THAILAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 125. THAILAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 126. THAILAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 127. VIETNAM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 128. VIETNAM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 129. VIETNAM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 130. VIETNAM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 131. VIETNAM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 132. EUROPE, MIDDLE EAST & AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 133. EUROPE, MIDDLE EAST & AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 134. EUROPE, MIDDLE EAST & AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 135. EUROPE, MIDDLE EAST & AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 136. EUROPE, MIDDLE EAST & AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 137. EUROPE, MIDDLE EAST & AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 138. DENMARK MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 139. DENMARK MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 140. DENMARK MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 141. DENMARK MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 142. DENMARK MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 143. EGYPT MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 144. EGYPT MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 145. EGYPT MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 146. EGYPT MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 147. EGYPT MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 148. FINLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 149. FINLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 150. FINLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 151. FINLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 152. FINLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 153. FRANCE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 154. FRANCE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 155. FRANCE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 156. FRANCE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 157. FRANCE MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 158. GERMANY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 159. GERMANY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 160. GERMANY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 161. GERMANY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 162. GERMANY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 163. ISRAEL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 164. ISRAEL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 165. ISRAEL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 166. ISRAEL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 167. ISRAEL MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 168. ITALY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 169. ITALY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 170. ITALY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 171. ITALY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 172. ITALY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 173. NETHERLANDS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 174. NETHERLANDS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 175. NETHERLANDS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 176. NETHERLANDS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 177. NETHERLANDS MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 178. NIGERIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 179. NIGERIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 180. NIGERIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 181. NIGERIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 182. NIGERIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 183. NORWAY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 184. NORWAY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 185. NORWAY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 186. NORWAY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 187. NORWAY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 188. POLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 189. POLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 190. POLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 191. POLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 192. POLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 193. QATAR MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 194. QATAR MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 195. QATAR MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 196. QATAR MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 197. QATAR MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 198. RUSSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 199. RUSSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 200. RUSSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 201. RUSSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 202. RUSSIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 203. SAUDI ARABIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 204. SAUDI ARABIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 205. SAUDI ARABIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 206. SAUDI ARABIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 207. SAUDI ARABIA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 208. SOUTH AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 209. SOUTH AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 210. SOUTH AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 211. SOUTH AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 212. SOUTH AFRICA MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 213. SPAIN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 214. SPAIN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 215. SPAIN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 216. SPAIN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 217. SPAIN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 218. SWEDEN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 219. SWEDEN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 220. SWEDEN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 221. SWEDEN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 222. SWEDEN MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 223. SWITZERLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 224. SWITZERLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 225. SWITZERLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 226. SWITZERLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 227. SWITZERLAND MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 228. TURKEY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 229. TURKEY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 230. TURKEY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 231. TURKEY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 232. TURKEY MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 233. UNITED ARAB EMIRATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 234. UNITED ARAB EMIRATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 235. UNITED ARAB EMIRATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 236. UNITED ARAB EMIRATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 237. UNITED ARAB EMIRATES MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 238. UNITED KINGDOM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 239. UNITED KINGDOM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY COMPONENT, 2018-2030 (USD MILLION)

- TABLE 240. UNITED KINGDOM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY LEVEL OF AUTHENTICATION, 2018-2030 (USD MILLION)

- TABLE 241. UNITED KINGDOM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 242. UNITED KINGDOM MULTI-FACTOR AUTHENTICATION MARKET SIZE, BY INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 243. MULTI-FACTOR AUTHENTICATION MARKET, FPNV POSITIONING MATRIX, 2022

- TABLE 244. MULTI-FACTOR AUTHENTICATION MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 245. MULTI-FACTOR AUTHENTICATION MARKET LICENSE & PRICING