|

市場調查報告書

商品編碼

1413921

電子濕化學品市場:按類型、型態、應用和最終用途 - 2024-2030 年全球預測Electronic Wet Chemicals Market by Type (Acetic Acid, Ammonium hydroxide, Hydrochloric acid), Form (Gas, Liquid, Solid), Application, End-Use - Global Forecast 2024-2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

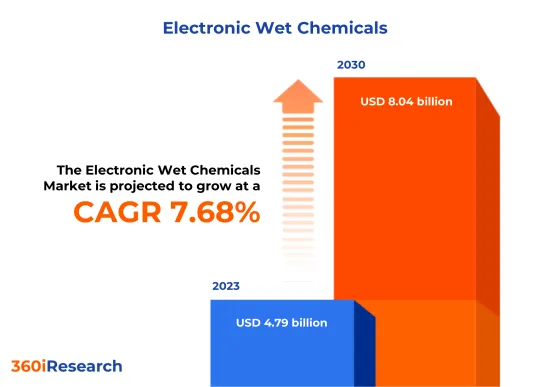

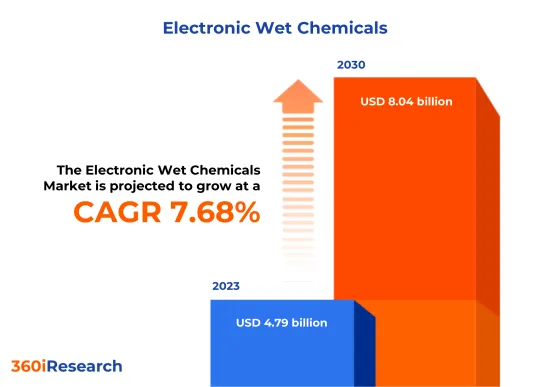

預計2023年電子濕化學品市場規模為47.9億美元,2024年預估達51.2億美元,2030年將達80.4億美元,複合年成長率為7.68%。

全球電子濕化學品市場

| 主要市場統計 | |

|---|---|

| 基準年[2023] | 47.9億美元 |

| 預測年份 [2024] | 51.2億美元 |

| 預測年份 [2030] | 80.4億美元 |

| 複合年成長率(%) | 7.68% |

電子濕化學品主要用於半導體製造,其中高純度化學品用於晶圓加工和積體電路(IC)製造。科技的進步正在增加全球對電子設備的需求,而電子產品對濕化學品的需求也迅速增加。可再生能源投資的快速增加和太陽能發電產業的擴張也增加了對電子濕化學品的需求。人工智慧、物聯網和 5G 技術的普及推動了半導體產業的成長,為市場成長做出了貢獻。然而,電子濕化學品市場的挑戰主要是由於嚴格的環境法規,需要對永續實踐進行大量投資。此外,全球供應鏈中斷和原物料價格波動也為市場穩定帶來風險。此外,電子元件向小型化的轉變和電動車(EV)市場的快速成長正在為該市場創造重大機會。軟性電子、穿戴式技術和高效能運算的創新預計將為市場成長開闢新的途徑。

區域洞察

美國和加拿大因其蓬勃發展的半導體產業和大型科技公司的存在而成為電子濕化學品極為重要的國家。消費者對電子產品和先進技術的高需求正在推動美洲地區對電子濕化學品的需求。歐盟 (EU) 強調了電子濕化學品的多元化市場,各國重點關注電子製造的不同方面。歐洲、中東和非洲地區的大學和產業之間的商業性研究和合作正在蓬勃發展,重點是推動符合嚴格性能標準的電子材料技術。中東地區是電子濕化學品的新興市場,主要發展於電子製造領域。儘管非洲地區的電子濕化學品市場仍處於起步階段,但由於該大陸經濟狀況的改善以及行動電話和電子設備的普及不斷提高,成長機會已經顯現。在中國、台灣、韓國和日本等國家電子產業快速擴張的推動下,亞太地區在電子濕化學品市場中佔據主導地位。由於電子和化學領域的持續創新和大規模研發投資,該地區對高純度電子濕化學品的需求不斷增加。

FPNV定位矩陣

FPNV定位矩陣對於評估電子濕化學品市場至關重要。我們檢視與業務策略和產品滿意度相關的關鍵指標,以對供應商進行全面評估。這種深入的分析使用戶能夠根據自己的要求做出明智的決策。根據評估,供應商被分為四個成功程度不同的像限:前沿(F)、探路者(P)、利基(N)和重要(V)。

市場佔有率分析

市場佔有率分析是一種綜合工具,可以對電子濕化學品市場供應商的現狀進行深入而深入的研究。全面比較和分析供應商在整體收益、基本客群和其他關鍵指標方面的貢獻,以便更好地了解公司的績效及其在爭奪市場佔有率時面臨的挑戰。此外,該分析還提供了對該行業競爭特徵的寶貴考察,包括在研究基準年觀察到的累積、分散主導地位和合併特徵等因素。這種詳細程度的提高使供應商能夠做出更明智的決策並制定有效的策略,從而在市場上獲得競爭優勢。

本報告在以下方面提供了寶貴的見解:

1-市場滲透率:提供有關主要企業所服務的市場的全面資訊。

2-市場開拓:我們深入研究利潤豐厚的新興市場,並分析它們在成熟細分市場中的滲透率。

3- 市場多元化:提供有關新產品發布、開拓地區、最新發展和投資的詳細資訊。

4-競爭力評估與資訊:對主要企業的市場佔有率、策略、產品、認證、監管狀況、專利狀況、製造能力等進行全面評估。

5- 產品開發與創新:提供對未來技術、研發活動和突破性產品開發的見解。

本報告解決了以下關鍵問題:

1-電子濕化學品市場的市場規模與預測是多少?

2-在電子濕化學品市場的預測期間內,有哪些產品、細分市場、應用和領域需要考慮投資?

3-電子濕化學品市場的技術趨勢與法律規範是什麼?

4-電子濕化學品市場主要廠商的市場佔有率為何?

5-進入電子濕化學品市場的合適型態和策略手段是什麼?

目錄

第1章 前言

第2章調查方法

第3章執行摘要

第4章市場概況

第5章市場洞察

- 市場動態

- 促進因素

- 全球對電子設備的需求增加

- 半導體技術的技術進步

- 電動車的普及和電動車電池技術的進步

- 抑制因素

- 電子濕化學品儲存處理問題

- 機會

- 電子濕化學生產製程的持續研發工作與進步

- 微型化和奈米技術在電子設備中的重要性日益增加

- 任務

- 對電子濕化學品安全性和純度的擔憂

- 促進因素

- 市場區隔分析

- 類型:根據功能使用不同類型的化學品

- 格式:電子產品中液體濕化學品的採用率已提高 由於其多功能性而被廣泛使用。

- 應用:在半導體產業的廣泛應用

- 最終用途:增加醫療和消費品產業的採用

- 市場趨勢分析

- 高通膨的累積效應

- 波特五力分析

- 價值鍊和關鍵路徑分析

- 法律規範

第6章電子濕化學品市場:依類型

- 醋酸

- 氫氧化銨

- 鹽酸

- 氫氟酸

- 過氧化氫

- 異丙醇

- 硝酸

- 磷酸

- 磷酸

- 硫酸

第7章電子濕化學品市場:依型態

- 氣體

- 液體

- 固體的

第8章電子濕化學品市場:依應用

- IC封裝

- 基板

- 半導體

第9章電子濕化學品市場:依最終用途

- 汽車、航太和國防

- 消費品

- 藥品

第10章 北美、南美洲電子濕化學品市場

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美國

第11章亞太地區電子濕化學品市場

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 菲律賓

- 新加坡

- 韓國

- 台灣

- 泰國

- 越南

第12章歐洲、中東和非洲電子濕化學品市場

- 丹麥

- 埃及

- 芬蘭

- 法國

- 德國

- 以色列

- 義大利

- 荷蘭

- 奈及利亞

- 挪威

- 波蘭

- 卡達

- 俄羅斯

- 沙烏地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公國

- 英國

第13章競爭形勢

- FPNV定位矩陣

- 市場佔有率分析:主要企業

- 主要企業競爭情境分析

- 併購

- 新產品發布和功能增強

第14章競爭產品組合

- 主要公司簡介

- Alfa Chemistry

- Asia Union Electronic Chemical Corp.

- Avantor Inc.

- BASF SE

- Borregaard AS

- Celanese Corporation

- Chang Chun Group

- Daicel Corporation

- Daikin Industries Ltd.

- DERIVADOS DEL FLUOR by Minersa Group

- Eastman Chemical Company

- Fujifilm Holdings Corporation

- GAB Neumann GmbH by Mersen Group

- Honeywell International Inc.

- Ineos

- Kanto Chemical Co. Inc.

- LANXESS

- Linde PLC

- Merck KGaA

- Mitsubishi Chemical Corporation

- Otto Chemie Pvt. Ltd.

- Sarex overseas

- Sinochem

- Solvay SA

- Stella Chemifa Corporation

- Technic Inc.

- TNC Industrial Co., Ltd.

- Transene Company, Inc.

- Yingpeng Chemical Co., Ltd.

- 主要產品系列

第15章附錄

- 討論指南

- 關於許可證和定價

[188 Pages Report] The Electronic Wet Chemicals Market size was estimated at USD 4.79 billion in 2023 and expected to reach USD 5.12 billion in 2024, at a CAGR 7.68% to reach USD 8.04 billion by 2030.

Global Electronic Wet Chemicals Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2023] | USD 4.79 billion |

| Estimated Year [2024] | USD 5.12 billion |

| Forecast Year [2030] | USD 8.04 billion |

| CAGR (%) | 7.68% |

Electronic wet chemicals are primarily used in semiconductor manufacturing, where high-purity chemicals are employed for wafer processing and integrated circuits (IC) production. The rising demand for electronic devices worldwide spurred by technological advancements is surging demand for electronic wet chemicals. The surging investments in renewable energy contributed to the expansion of the photovoltaic industry also increased the need for electronic wet chemicals. The growth in the semiconductor industry due to the proliferation of AI, IoT, and 5G technologies is contributing to market growth. However, the electronic wet chemicals market faces challenges primarily from stringent environmental regulations, which necessitate significant investments in sustainable practices. In addition, global supply chain disruptions and fluctuating raw material prices pose risks to market stability. Moreover, the shifting focus towards the miniaturization of electronic components and the burgeoning electric vehicles (EV) market presents significant opportunities in the market space. Innovations in flexible electronics, wearable technology, and high-performance computing are expected to open new avenues for market growth.

Regional Insights

In the Americas region, the United States and Canada stand as pivotal countries for electronic wet chemicals, given their significant semiconductor industry and the presence of key technology companies. High consumer demand for electronic goods and advanced technologies drive the need for electronic wet chemicals in the Americas region. The European Union highlights a diverse market for electronic wet chemicals, with different countries focusing on various aspects of electronics manufacturing. Commercial research and collaborations across universities and industries are prevalent in the EMEA region, focusing on advancing electronic materials technology to meet stringent performance standards. The Middle East region has an emerging market for electronic wet chemicals, primarily due to its developing electronics manufacturing sector. Africa's regional market for electronic wet chemicals is nascent but displays opportunities for growth with the continent's rising economic status and increasing mobile and electronic penetration. The Asia Pacific region dominates the electronic wet chemicals market, fueled by the rapid expansion of the electronics sector in countries including China, Taiwan, South Korea, and Japan. The demand for high-purity electronic wet chemicals is escalating in the region due to ongoing innovations and significant R&D investments in the electronics and chemical sector.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Electronic Wet Chemicals Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Electronic Wet Chemicals Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Electronic Wet Chemicals Market, highlighting leading vendors and their innovative profiles. These include Alfa Chemistry, Asia Union Electronic Chemical Corp., Avantor Inc., BASF SE, Borregaard AS, Celanese Corporation, Chang Chun Group, Daicel Corporation, Daikin Industries Ltd., DERIVADOS DEL FLUOR by Minersa Group, Eastman Chemical Company, Fujifilm Holdings Corporation, GAB Neumann GmbH by Mersen Group, Honeywell International Inc., Ineos, Kanto Chemical Co. Inc., LANXESS, Linde PLC, Merck KGaA, Mitsubishi Chemical Corporation, Otto Chemie Pvt. Ltd., Sarex overseas, Sinochem, Solvay S.A., Stella Chemifa Corporation, Technic Inc., TNC Industrial Co., Ltd., Transene Company, Inc., and Yingpeng Chemical Co., Ltd..

Market Segmentation & Coverage

This research report categorizes the Electronic Wet Chemicals Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Type

- Acetic Acid

- Ammonium hydroxide

- Hydrochloric acid

- Hydrofluoric acid

- Hydrogen peroxide

- Isopropyl Alcohol

- Nitric acid

- Phosphoric acid

- Phosphoric Acid

- Sulfuric acid

- Form

- Gas

- Liquid

- Solid

- Application

- IC Packaging

- PCB

- Semiconductor

- End-Use

- Automotive Aerospace & Defence

- Consumer Goods

- Medical

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Electronic Wet Chemicals Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Electronic Wet Chemicals Market?

3. What are the technology trends and regulatory frameworks in the Electronic Wet Chemicals Market?

4. What is the market share of the leading vendors in the Electronic Wet Chemicals Market?

5. Which modes and strategic moves are suitable for entering the Electronic Wet Chemicals Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Electronic Wet Chemicals Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing demand for electronic devices worldwide

- 5.1.1.2. Technological advancements in semiconductor technology

- 5.1.1.3. Rising adoption of electric vehicles and advancements in EV battery technology

- 5.1.2. Restraints

- 5.1.2.1. Storage and handling issues of electronic wet chemicals

- 5.1.3. Opportunities

- 5.1.3.1. Ongoing R&D initiatives & advancements production process of electronic wet chemicals

- 5.1.3.2. Rising emphasis on miniaturization and nanotechnology in electronic devices

- 5.1.4. Challenges

- 5.1.4.1. Safety & purity concerns for electronic wet chemicals

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Type: Diverse types of chemicals used based on functionality

- 5.2.2. Form: Enhanced adoption of liquid electronic wet chemicals are widely utilized for their versatility

- 5.2.3. Application: Broad scope of applications in semiconductor industry

- 5.2.4. End-Use: Increasing adoption in medical & consumer goods industry

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Electronic Wet Chemicals Market, by Type

- 6.1. Introduction

- 6.2. Acetic Acid

- 6.3. Ammonium hydroxide

- 6.4. Hydrochloric acid

- 6.5. Hydrofluoric acid

- 6.6. Hydrogen peroxide

- 6.7. Isopropyl Alcohol

- 6.8. Nitric acid

- 6.9. Phosphoric acid

- 6.10. Phosphoric Acid

- 6.11. Sulfuric acid

7. Electronic Wet Chemicals Market, by Form

- 7.1. Introduction

- 7.2. Gas

- 7.3. Liquid

- 7.4. Solid

8. Electronic Wet Chemicals Market, by Application

- 8.1. Introduction

- 8.2. IC Packaging

- 8.3. PCB

- 8.4. Semiconductor

9. Electronic Wet Chemicals Market, by End-Use

- 9.1. Introduction

- 9.2. Automotive Aerospace & Defence

- 9.3. Consumer Goods

- 9.4. Medical

10. Americas Electronic Wet Chemicals Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Electronic Wet Chemicals Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Electronic Wet Chemicals Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. FPNV Positioning Matrix

- 13.2. Market Share Analysis, By Key Player

- 13.3. Competitive Scenario Analysis, By Key Player

- 13.3.1. Merger & Acquisition

- 13.3.1.1. Fujifilm Completes Acquisition of Electronic Chemicals Business from Entegris; Rebranded as FUJIFILM Electronic Materials Process Chemicals

- 13.3.2. New Product Launch & Enhancement

- 13.3.2.1. Lanxess Launches New Mixed-Bed Resin For Ultra-Pure Water in Semiconductor Production

- 13.3.2.2. Alfa Chemistry Launches High Purity Wet Chemicals for Semiconductor Industry

- 13.3.1. Merger & Acquisition

14. Competitive Portfolio

- 14.1. Key Company Profiles

- 14.1.1. Alfa Chemistry

- 14.1.2. Asia Union Electronic Chemical Corp.

- 14.1.3. Avantor Inc.

- 14.1.4. BASF SE

- 14.1.5. Borregaard AS

- 14.1.6. Celanese Corporation

- 14.1.7. Chang Chun Group

- 14.1.8. Daicel Corporation

- 14.1.9. Daikin Industries Ltd.

- 14.1.10. DERIVADOS DEL FLUOR by Minersa Group

- 14.1.11. Eastman Chemical Company

- 14.1.12. Fujifilm Holdings Corporation

- 14.1.13. GAB Neumann GmbH by Mersen Group

- 14.1.14. Honeywell International Inc.

- 14.1.15. Ineos

- 14.1.16. Kanto Chemical Co. Inc.

- 14.1.17. LANXESS

- 14.1.18. Linde PLC

- 14.1.19. Merck KGaA

- 14.1.20. Mitsubishi Chemical Corporation

- 14.1.21. Otto Chemie Pvt. Ltd.

- 14.1.22. Sarex overseas

- 14.1.23. Sinochem

- 14.1.24. Solvay S.A.

- 14.1.25. Stella Chemifa Corporation

- 14.1.26. Technic Inc.

- 14.1.27. TNC Industrial Co., Ltd.

- 14.1.28. Transene Company, Inc.

- 14.1.29. Yingpeng Chemical Co., Ltd.

- 14.2. Key Product Portfolio

15. Appendix

- 15.1. Discussion Guide

- 15.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. ELECTRONIC WET CHEMICALS MARKET RESEARCH PROCESS

- FIGURE 2. ELECTRONIC WET CHEMICALS MARKET SIZE, 2023 VS 2030

- FIGURE 3. ELECTRONIC WET CHEMICALS MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. ELECTRONIC WET CHEMICALS MARKET SIZE, BY REGION, 2023 VS 2030 (%)

- FIGURE 5. ELECTRONIC WET CHEMICALS MARKET SIZE, BY REGION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 6. ELECTRONIC WET CHEMICALS MARKET DYNAMICS

- FIGURE 7. ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2023 VS 2030 (%)

- FIGURE 8. ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 9. ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2023 VS 2030 (%)

- FIGURE 10. ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 11. ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2023 VS 2030 (%)

- FIGURE 12. ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 13. ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2023 VS 2030 (%)

- FIGURE 14. ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 16. AMERICAS ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY STATE, 2023 VS 2030 (%)

- FIGURE 18. UNITED STATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY STATE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 21. EUROPE, MIDDLE EAST & AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 23. ELECTRONIC WET CHEMICALS MARKET, FPNV POSITIONING MATRIX, 2023

- FIGURE 24. ELECTRONIC WET CHEMICALS MARKET SHARE, BY KEY PLAYER, 2023

LIST OF TABLES

- TABLE 1. ELECTRONIC WET CHEMICALS MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2023

- TABLE 3. ELECTRONIC WET CHEMICALS MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL ELECTRONIC WET CHEMICALS MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 6. ELECTRONIC WET CHEMICALS MARKET SIZE, BY ACETIC ACID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. ELECTRONIC WET CHEMICALS MARKET SIZE, BY AMMONIUM HYDROXIDE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. ELECTRONIC WET CHEMICALS MARKET SIZE, BY HYDROCHLORIC ACID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. ELECTRONIC WET CHEMICALS MARKET SIZE, BY HYDROFLUORIC ACID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. ELECTRONIC WET CHEMICALS MARKET SIZE, BY HYDROGEN PEROXIDE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. ELECTRONIC WET CHEMICALS MARKET SIZE, BY ISOPROPYL ALCOHOL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. ELECTRONIC WET CHEMICALS MARKET SIZE, BY NITRIC ACID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. ELECTRONIC WET CHEMICALS MARKET SIZE, BY PHOSPHORIC ACID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. ELECTRONIC WET CHEMICALS MARKET SIZE, BY PHOSPHORIC ACID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. ELECTRONIC WET CHEMICALS MARKET SIZE, BY SULFURIC ACID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 17. ELECTRONIC WET CHEMICALS MARKET SIZE, BY GAS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. ELECTRONIC WET CHEMICALS MARKET SIZE, BY LIQUID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. ELECTRONIC WET CHEMICALS MARKET SIZE, BY SOLID, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 21. ELECTRONIC WET CHEMICALS MARKET SIZE, BY IC PACKAGING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. ELECTRONIC WET CHEMICALS MARKET SIZE, BY PCB, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. ELECTRONIC WET CHEMICALS MARKET SIZE, BY SEMICONDUCTOR, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 25. ELECTRONIC WET CHEMICALS MARKET SIZE, BY AUTOMOTIVE AEROSPACE & DEFENCE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. ELECTRONIC WET CHEMICALS MARKET SIZE, BY CONSUMER GOODS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. ELECTRONIC WET CHEMICALS MARKET SIZE, BY MEDICAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. AMERICAS ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 29. AMERICAS ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 30. AMERICAS ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 31. AMERICAS ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 32. AMERICAS ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 33. ARGENTINA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 34. ARGENTINA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 35. ARGENTINA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 36. ARGENTINA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 37. BRAZIL ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 38. BRAZIL ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 39. BRAZIL ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 40. BRAZIL ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 41. CANADA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 42. CANADA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 43. CANADA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 44. CANADA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 45. MEXICO ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 46. MEXICO ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 47. MEXICO ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 48. MEXICO ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 49. UNITED STATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 50. UNITED STATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 51. UNITED STATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 52. UNITED STATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 53. UNITED STATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 54. ASIA-PACIFIC ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 55. ASIA-PACIFIC ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 56. ASIA-PACIFIC ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 57. ASIA-PACIFIC ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 58. ASIA-PACIFIC ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 59. AUSTRALIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 60. AUSTRALIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 61. AUSTRALIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 62. AUSTRALIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 63. CHINA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 64. CHINA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 65. CHINA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 66. CHINA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 67. INDIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 68. INDIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 69. INDIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 70. INDIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 71. INDONESIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 72. INDONESIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 73. INDONESIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 74. INDONESIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 75. JAPAN ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 76. JAPAN ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 77. JAPAN ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 78. JAPAN ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 79. MALAYSIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 80. MALAYSIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 81. MALAYSIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 82. MALAYSIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 83. PHILIPPINES ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 84. PHILIPPINES ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 85. PHILIPPINES ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 86. PHILIPPINES ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 87. SINGAPORE ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 88. SINGAPORE ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 89. SINGAPORE ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 90. SINGAPORE ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 91. SOUTH KOREA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 92. SOUTH KOREA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 93. SOUTH KOREA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 94. SOUTH KOREA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 95. TAIWAN ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 96. TAIWAN ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 97. TAIWAN ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 98. TAIWAN ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 99. THAILAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 100. THAILAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 101. THAILAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 102. THAILAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 103. VIETNAM ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 104. VIETNAM ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 105. VIETNAM ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 106. VIETNAM ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 107. EUROPE, MIDDLE EAST & AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 108. EUROPE, MIDDLE EAST & AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 109. EUROPE, MIDDLE EAST & AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 110. EUROPE, MIDDLE EAST & AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 111. EUROPE, MIDDLE EAST & AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 112. DENMARK ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 113. DENMARK ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 114. DENMARK ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 115. DENMARK ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 116. EGYPT ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 117. EGYPT ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 118. EGYPT ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 119. EGYPT ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 120. FINLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 121. FINLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 122. FINLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 123. FINLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 124. FRANCE ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 125. FRANCE ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 126. FRANCE ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 127. FRANCE ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 128. GERMANY ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 129. GERMANY ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 130. GERMANY ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 131. GERMANY ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 132. ISRAEL ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 133. ISRAEL ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 134. ISRAEL ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 135. ISRAEL ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 136. ITALY ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 137. ITALY ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 138. ITALY ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 139. ITALY ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 140. NETHERLANDS ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 141. NETHERLANDS ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 142. NETHERLANDS ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 143. NETHERLANDS ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 144. NIGERIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 145. NIGERIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 146. NIGERIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 147. NIGERIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 148. NORWAY ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 149. NORWAY ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 150. NORWAY ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 151. NORWAY ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 152. POLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 153. POLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 154. POLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 155. POLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 156. QATAR ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 157. QATAR ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 158. QATAR ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 159. QATAR ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 160. RUSSIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 161. RUSSIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 162. RUSSIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 163. RUSSIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 164. SAUDI ARABIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 165. SAUDI ARABIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 166. SAUDI ARABIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 167. SAUDI ARABIA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 168. SOUTH AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 169. SOUTH AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 170. SOUTH AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 171. SOUTH AFRICA ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 172. SPAIN ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 173. SPAIN ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 174. SPAIN ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 175. SPAIN ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 176. SWEDEN ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 177. SWEDEN ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 178. SWEDEN ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 179. SWEDEN ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 180. SWITZERLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 181. SWITZERLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 182. SWITZERLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 183. SWITZERLAND ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 184. TURKEY ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 185. TURKEY ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 186. TURKEY ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 187. TURKEY ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 188. UNITED ARAB EMIRATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 189. UNITED ARAB EMIRATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 190. UNITED ARAB EMIRATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 191. UNITED ARAB EMIRATES ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 192. UNITED KINGDOM ELECTRONIC WET CHEMICALS MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 193. UNITED KINGDOM ELECTRONIC WET CHEMICALS MARKET SIZE, BY FORM, 2018-2030 (USD MILLION)

- TABLE 194. UNITED KINGDOM ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 195. UNITED KINGDOM ELECTRONIC WET CHEMICALS MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 196. ELECTRONIC WET CHEMICALS MARKET, FPNV POSITIONING MATRIX, 2023

- TABLE 197. ELECTRONIC WET CHEMICALS MARKET SHARE, BY KEY PLAYER, 2023

- TABLE 198. ELECTRONIC WET CHEMICALS MARKET LICENSE & PRICING