|

市場調查報告書

商品編碼

1413895

羊絨服飾市場:按產品、供應商、等級、分銷管道和最終用戶 - 2024-2030 年全球預測Cashmere Clothing Market by Product (Pants & Trousers, Sweaters & Coats, Tees & Polo), Source (Cashmere Goats, Pashmina Goats), Grades, Distribution Channel, End User - Global Forecast 2024-2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

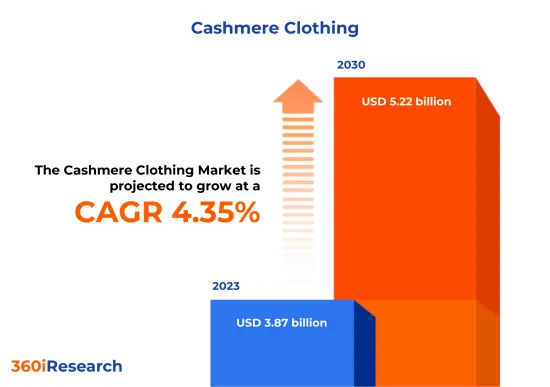

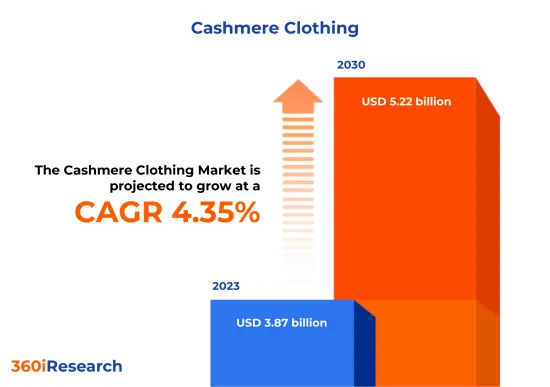

預計2023年羊絨服飾市場規模為38.7億美元,預計2024年將達40.4億美元,2030年將達到52.2億美元,複合年成長率為4.35%。

全球羊絨服飾市場

| 主要市場統計 | |

|---|---|

| 基準年[2023] | 38.7億美元 |

| 預測年份 [2024] | 40.4億美元 |

| 預測年份 [2030] | 52.2億美元 |

| 複合年成長率(%) | 4.35% |

羊絨服飾市場包括由羊絨山羊絨製成的服裝,並以毛衣、外套和配件等各種產品瞄準奢華時尚愛好者。在可支配收入不斷成長、奢侈品的吸引力以及全球時尚意識人群的推動下,這個市場主要以私人和私人為主,透過專賣店、百貨公司、線上平台和奢侈品牌經銷店管道瞄準消費者。隨著永續實踐的接受和對開拓市場的滲透,這個市場的機會已經成熟,而產品個人化正在成為一種新興趨勢。然而,該行業面臨羊絨供不應求、集中生產、合成纖維的競爭以及道德問題等挑戰。創新致力於永續和道德採購、提高耐用性、纖維混紡以提高成本效益,以及羊絨運動服的推出,推動奢華服飾的負責任而時尚的未來。展現力量。

區域洞察

以美國在消費者對奢侈品的喜愛和有意識的製造實踐的推動下擁有強勁的市場,而加拿大在較小規模上也反映了類似的趨勢。在亞太地區,中國作為主要消費國和供應國發揮關鍵作用,人口日益富裕,以及為了提高品質和永續性。我也經歷過。另一方面,日本是一個品牌忠誠度較高、重視傳統和工藝的市場,而印度則憑藉傳統「pashmina」工藝與現代時尚情感的融合而展現出成長潛力。多元化的 EMEA(歐洲、中東和非洲)地區仍然是一個強大的市場,歐盟國家青睞高品質和永續的羊絨。非洲是一個新興市場,但其年輕且具有時尚意識的人民顯示出了未來性。最近關於羊絨加工的專利證明了全行業的創新,重點是提高耐用性和手感,並且在不犧牲品質的情況下尋求成本效益的羊絨混紡布料的投資趨勢正在增加。我們正在將重點轉向向數位管道和電子商務策略的重大轉變反映了疫情後購物行為的變化。

FPNV定位矩陣

FPNV定位矩陣對於評估羊絨服飾市場至關重要。我們檢視與業務策略和產品滿意度相關的關鍵指標,以對供應商進行全面評估。這種深入的分析使用戶能夠根據自己的要求做出明智的決策。根據評估,供應商被分為四個成功程度不同的像限:前沿(F)、探路者(P)、利基(N)和重要(V)。

市場佔有率分析

市場佔有率分析是一種綜合工具,可以對羊絨服飾市場供應商的現狀進行深入而詳細的研究。全面比較和分析供應商在整體收益、基本客群和其他關鍵指標方面的貢獻,以便更好地了解公司的績效及其在爭奪市場佔有率時面臨的挑戰。此外,該分析還提供了對該行業競爭特徵的寶貴考察,包括在研究基準年觀察到的累積、分散主導地位和合併特徵等因素。這種詳細程度的提高使供應商能夠做出更明智的決策並制定有效的策略,從而在市場上獲得競爭優勢。

本報告在以下方面提供了寶貴的見解:

1-市場滲透率:提供有關主要企業所服務的市場的全面資訊。

2-市場開拓:我們深入研究利潤豐厚的新興市場,並分析它們在成熟細分市場中的滲透率。

3- 市場多元化:提供有關新產品發布、開拓地區、最新發展和投資的詳細資訊。

4-競爭力評估與資訊:對主要企業的市場佔有率、策略、產品、認證、監管狀況、專利狀況、製造能力等進行全面評估。

5- 產品開發與創新:提供對未來技術、研發活動和突破性產品開發的見解。

本報告解決了以下關鍵問題:

1-羊絨服飾市場規模及預測是多少?

2-羊絨服飾市場預測期間需要考慮投資的產品、細分市場、應用和領域有哪些?

3-羊絨服飾市場的技術趨勢和法律規範是什麼?

4-羊絨服飾市場主要廠商的市場佔有率是多少?

5-進入羊絨服飾市場適合的型態和策略手段有哪些?

目錄

第1章 前言

第2章調查方法

第3章執行摘要

第4章市場概況

第5章市場洞察

- 市場動態

- 促進因素

- 更喜歡優質舒適的服飾

- 拓展全球線上和電子商務分銷管道

- 促進永續和環保羊絨羊毛生產的舉措

- 抑制因素

- 存在假冒仿冒品羊絨服飾產品

- 機會

- 提高羊絨服飾的美觀和品質的進展

- 策略性廣告和行銷活動以及與名人的合作

- 任務

- 與羊絨羊毛生產相關的問題

- 促進因素

- 市場區隔分析

- 產品:輕量級升級需求量大

- 資料來源:Pashmina 在紡織業中受到高度重視,這意味著它是一種奢侈品。

- 等級:消費者對 A 級羊絨的偏好影響著尋求高階奢華服裝的挑剔買家的購買決策。

- 分銷管道:店內人員推銷是詳細了解產品品質和工藝的常用方法。

- 最終用途:羊絨服飾的優質特性強調了為女性使用者提供多種產品的可得性。

- 市場趨勢分析

- 高通膨的累積效應

- 波特五力分析

- 價值鍊和關鍵路徑分析

- 法律規範

第6章羊絨服飾市場:分產品

- 褲子和褲子

- 毛衣和外套

- 茶與馬球

第7章 羊絨服飾市場:依來源分類

- 絨山羊

- 帕什米納山羊

第8章羊絨服飾市場:依等級

- A級

- B級

- C級

第9章羊絨服飾市場:依通路分類

- 離線

- 線上的

第10章羊絨服飾市場:依最終用戶分類

- 孩子們

- 男性

- 女士

第11章 美洲羊絨服飾市場

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美國

第12章亞太羊絨服飾市場

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 菲律賓

- 新加坡

- 韓國

- 台灣

- 泰國

- 越南

第13章歐洲、中東及非洲羊絨服飾市場

- 丹麥

- 埃及

- 芬蘭

- 法國

- 德國

- 以色列

- 義大利

- 荷蘭

- 奈及利亞

- 挪威

- 波蘭

- 卡達

- 俄羅斯

- 沙烏地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公國

- 英國

第14章競爭形勢

- FPNV定位矩陣

- 市場佔有率分析:主要企業

- 主要企業競爭情境分析

- 合約、合作和夥伴關係

- 新產品發布和功能增強

第15章競爭組合

- 主要公司簡介

- Alyki Cashmere

- Aran Sweater Market

- Autumn Cashmere, Inc.

- Brunello Cucinelli SpA

- Burberry Limited

- Citizen Cashmere Ltd.

- Corso Vannucci srl

- Dawson Forte Cashmere.

- Ermenegildo Zegna NV

- GOBI Cashmere Europe GmbH

- Gold Brothers

- Harrods Ltd.

- Hermes International SA

- Huzhou Zhenbei Cashmere Products Co., Ltd.

- Jennie Cashmere Inc.

- JM Knitwear Pvt. Ltd.

- John Hanly and Co Ltd

- Kering SA

- Kiki de Montparnasse

- Loro Piana SPA

- LVMH Moet Hennessy Louis Vuitton

- Malo spa

- Naked Cashmere

- Om Cashmeres

- Pringle of Scotland Ltd.

- Sofia Cashmere

- TSE & Cashmere House, Inc.

- White+Warren

- 主要產品系列

第16章附錄

- 討論指南

- 關於許可證和定價

[197 Pages Report] The Cashmere Clothing Market size was estimated at USD 3.87 billion in 2023 and expected to reach USD 4.04 billion in 2024, at a CAGR 4.35% to reach USD 5.22 billion by 2030.

Global Cashmere Clothing Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2023] | USD 3.87 billion |

| Estimated Year [2024] | USD 4.04 billion |

| Forecast Year [2030] | USD 5.22 billion |

| CAGR (%) | 4.35% |

The market for cashmere clothing, encompassing apparel crafted from the fleece of cashmere goats, caters to enthusiasts of luxury fashion with an array of products including sweaters, coats, and accessories. With demand fuelled by higher disposable incomes, luxury appeal, and a globally fashion-aware demographic, this market serves primarily personal wear consumers through channels like specialty stores, department stores, online platforms, and high-end brand outlets. The market's opportunities are ripe in the embrace of sustainable practices and the penetration of untapped markets, while personalization of products surfaces as a new trend. The industry, however, navigates challenges such as the scarce supply of cashmere, labor-intensive production, competition from synthetic fabrics, and ethical concerns. Innovations are directed at sustainable and ethical sourcing, improved durability, fiber blending for cost-effectiveness, and the introduction of cashmere active-wear, indicating a thrust towards a responsible yet stylish future in luxury wear.

Regional Insights

In the Americas, with the United States at the forefront, there is a robust market driven by consumers' affinity for luxury items and conscious manufacturing practices, trends similarly reflected on a smaller scale in Canada. The Asia Pacific region, led by China's key role as both a major consumer and supplier, is experiencing a surge in demand linked to increased wealth and an emphasis on production enhancements for better quality and sustainability. Meanwhile, Japan showcases a highly brand-loyal market that values heritage and craftsmanship, and India demonstrates growth potential with its fusion of traditional "Pashmina" craftsmanship and contemporary fashion sensibilities. In the diverse EMEA region, European Union countries maintain a strong market with a preference for high-quality, sustainably sourced cashmere, while the Middle East thrives on an appetite for luxury and exclusivity. Africa, although an emerging market, shows promise with its youthful and style-conscious population. Industry-wide innovation is evidenced by recent patents in cashmere processing that focus on durability and texture improvements, while investment trends pivot towards cashmere-blended fabrics for cost-effectiveness without sacrificing quality. The significant shift towards digital channels and e-commerce strategies reflects the changing landscape of shopping behaviors post the pandemic.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Cashmere Clothing Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Cashmere Clothing Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Cashmere Clothing Market, highlighting leading vendors and their innovative profiles. These include Alyki Cashmere, Aran Sweater Market, Autumn Cashmere, Inc., Brunello Cucinelli S.p.A., Burberry Limited, Citizen Cashmere Ltd., Corso Vannucci srl, Dawson Forte Cashmere., Ermenegildo Zegna N.V., GOBI Cashmere Europe GmbH, Gold Brothers, Harrods Ltd., Hermes International S.A., Huzhou Zhenbei Cashmere Products Co., Ltd., Jennie Cashmere Inc., JM Knitwear Pvt. Ltd., John Hanly and Co Ltd, Kering S.A., Kiki de Montparnasse, Loro Piana S.P.A., LVMH Moet Hennessy Louis Vuitton, Malo spa, Naked Cashmere, Om Cashmeres, Pringle of Scotland Ltd., Sofia Cashmere, TSE & Cashmere House, Inc., and White + Warren.

Market Segmentation & Coverage

This research report categorizes the Cashmere Clothing Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Product

- Pants & Trousers

- Sweaters & Coats

- Tees & Polo

- Source

- Cashmere Goats

- Pashmina Goats

- Grades

- Grade A

- Grade B

- Grade C

- Distribution Channel

- Offline

- Online

- End User

- Kids

- Men

- Women

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Cashmere Clothing Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Cashmere Clothing Market?

3. What are the technology trends and regulatory frameworks in the Cashmere Clothing Market?

4. What is the market share of the leading vendors in the Cashmere Clothing Market?

5. Which modes and strategic moves are suitable for entering the Cashmere Clothing Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Cashmere Clothing Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Preference for premium and comfortable clothing items

- 5.1.1.2. Expansion of online and e-commerce distribution channels across the world

- 5.1.1.3. Efforts to promote sustainable and eco-friendly production of cashmere wool

- 5.1.2. Restraints

- 5.1.2.1. Presence of fake and counterfeit cashmere clothing goods

- 5.1.3. Opportunities

- 5.1.3.1. Advancements to improve the aesthetic appeal and quality of cashmere clothing items

- 5.1.3.2. Strategic advertising and marketing activities and collaborations with celebrities

- 5.1.4. Challenges

- 5.1.4.1. Issues associated with the production of cashmere wool

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Product: Upscaling lightweight versions are more in demand

- 5.2.2. Sources: Pashmina signifies extremely valuable and represents luxury in the fabric industry

- 5.2.3. Grades: Consumer preferences towards Grade A cashmere influences purchasing decisions amongst discerning buyers seeking high-end luxury wear

- 5.2.4. Distribution Channel: In-store personal selling are commonly used practice for detailed understanding of the product's quality and craftsmanship

- 5.2.5. End-Use: Premiumness of cashmere clothing emphasizes wide range of product availability for women users

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Cashmere Clothing Market, by Product

- 6.1. Introduction

- 6.2. Pants & Trousers

- 6.3. Sweaters & Coats

- 6.4. Tees & Polo

7. Cashmere Clothing Market, by Source

- 7.1. Introduction

- 7.2. Cashmere Goats

- 7.3. Pashmina Goats

8. Cashmere Clothing Market, by Grades

- 8.1. Introduction

- 8.2. Grade A

- 8.3. Grade B

- 8.4. Grade C

9. Cashmere Clothing Market, by Distribution Channel

- 9.1. Introduction

- 9.2. Offline

- 9.3. Online

10. Cashmere Clothing Market, by End User

- 10.1. Introduction

- 10.2. Kids

- 10.3. Men

- 10.4. Women

11. Americas Cashmere Clothing Market

- 11.1. Introduction

- 11.2. Argentina

- 11.3. Brazil

- 11.4. Canada

- 11.5. Mexico

- 11.6. United States

12. Asia-Pacific Cashmere Clothing Market

- 12.1. Introduction

- 12.2. Australia

- 12.3. China

- 12.4. India

- 12.5. Indonesia

- 12.6. Japan

- 12.7. Malaysia

- 12.8. Philippines

- 12.9. Singapore

- 12.10. South Korea

- 12.11. Taiwan

- 12.12. Thailand

- 12.13. Vietnam

13. Europe, Middle East & Africa Cashmere Clothing Market

- 13.1. Introduction

- 13.2. Denmark

- 13.3. Egypt

- 13.4. Finland

- 13.5. France

- 13.6. Germany

- 13.7. Israel

- 13.8. Italy

- 13.9. Netherlands

- 13.10. Nigeria

- 13.11. Norway

- 13.12. Poland

- 13.13. Qatar

- 13.14. Russia

- 13.15. Saudi Arabia

- 13.16. South Africa

- 13.17. Spain

- 13.18. Sweden

- 13.19. Switzerland

- 13.20. Turkey

- 13.21. United Arab Emirates

- 13.22. United Kingdom

14. Competitive Landscape

- 14.1. FPNV Positioning Matrix

- 14.2. Market Share Analysis, By Key Player

- 14.3. Competitive Scenario Analysis, By Key Player

- 14.3.1. Agreement, Collaboration, & Partnership

- 14.3.1.1. Artwell uses Haelixa tech to authenticate cashmere from Inner Mongolia

- 14.3.2. New Product Launch & Enhancement

- 14.3.2.1. Sustainable Clothing Brands LE CASHMERE and RE; CODE Launching via Circular Library in Venice, California on Famous Abbot Kinney Blvd.

- 14.3.2.2. United Colors of Benetton launches premium men's cashmere line in India

- 14.3.1. Agreement, Collaboration, & Partnership

15. Competitive Portfolio

- 15.1. Key Company Profiles

- 15.1.1. Alyki Cashmere

- 15.1.2. Aran Sweater Market

- 15.1.3. Autumn Cashmere, Inc.

- 15.1.4. Brunello Cucinelli S.p.A.

- 15.1.5. Burberry Limited

- 15.1.6. Citizen Cashmere Ltd.

- 15.1.7. Corso Vannucci srl

- 15.1.8. Dawson Forte Cashmere.

- 15.1.9. Ermenegildo Zegna N.V.

- 15.1.10. GOBI Cashmere Europe GmbH

- 15.1.11. Gold Brothers

- 15.1.12. Harrods Ltd.

- 15.1.13. Hermes International S.A.

- 15.1.14. Huzhou Zhenbei Cashmere Products Co., Ltd.

- 15.1.15. Jennie Cashmere Inc.

- 15.1.16. JM Knitwear Pvt. Ltd.

- 15.1.17. John Hanly and Co Ltd

- 15.1.18. Kering S.A.

- 15.1.19. Kiki de Montparnasse

- 15.1.20. Loro Piana S.P.A.

- 15.1.21. LVMH Moet Hennessy Louis Vuitton

- 15.1.22. Malo spa

- 15.1.23. Naked Cashmere

- 15.1.24. Om Cashmeres

- 15.1.25. Pringle of Scotland Ltd.

- 15.1.26. Sofia Cashmere

- 15.1.27. TSE & Cashmere House, Inc.

- 15.1.28. White + Warren

- 15.2. Key Product Portfolio

16. Appendix

- 16.1. Discussion Guide

- 16.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. CASHMERE CLOTHING MARKET RESEARCH PROCESS

- FIGURE 2. CASHMERE CLOTHING MARKET SIZE, 2023 VS 2030

- FIGURE 3. CASHMERE CLOTHING MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. CASHMERE CLOTHING MARKET SIZE, BY REGION, 2023 VS 2030 (%)

- FIGURE 5. CASHMERE CLOTHING MARKET SIZE, BY REGION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 6. CASHMERE CLOTHING MARKET DYNAMICS

- FIGURE 7. CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2023 VS 2030 (%)

- FIGURE 8. CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 9. CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2023 VS 2030 (%)

- FIGURE 10. CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 11. CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2023 VS 2030 (%)

- FIGURE 12. CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 13. CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2023 VS 2030 (%)

- FIGURE 14. CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 15. CASHMERE CLOTHING MARKET SIZE, BY END USER, 2023 VS 2030 (%)

- FIGURE 16. CASHMERE CLOTHING MARKET SIZE, BY END USER, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 17. AMERICAS CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 18. AMERICAS CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 19. UNITED STATES CASHMERE CLOTHING MARKET SIZE, BY STATE, 2023 VS 2030 (%)

- FIGURE 20. UNITED STATES CASHMERE CLOTHING MARKET SIZE, BY STATE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 21. ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 22. ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 23. EUROPE, MIDDLE EAST & AFRICA CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 24. EUROPE, MIDDLE EAST & AFRICA CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 25. CASHMERE CLOTHING MARKET, FPNV POSITIONING MATRIX, 2023

- FIGURE 26. CASHMERE CLOTHING MARKET SHARE, BY KEY PLAYER, 2023

LIST OF TABLES

- TABLE 1. CASHMERE CLOTHING MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2023

- TABLE 3. CASHMERE CLOTHING MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL CASHMERE CLOTHING MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 6. CASHMERE CLOTHING MARKET SIZE, BY PANTS & TROUSERS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. CASHMERE CLOTHING MARKET SIZE, BY SWEATERS & COATS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. CASHMERE CLOTHING MARKET SIZE, BY TEES & POLO, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 10. CASHMERE CLOTHING MARKET SIZE, BY CASHMERE GOATS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. CASHMERE CLOTHING MARKET SIZE, BY PASHMINA GOATS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 13. CASHMERE CLOTHING MARKET SIZE, BY GRADE A, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. CASHMERE CLOTHING MARKET SIZE, BY GRADE B, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. CASHMERE CLOTHING MARKET SIZE, BY GRADE C, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 17. CASHMERE CLOTHING MARKET SIZE, BY OFFLINE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. CASHMERE CLOTHING MARKET SIZE, BY ONLINE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 20. CASHMERE CLOTHING MARKET SIZE, BY KIDS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. CASHMERE CLOTHING MARKET SIZE, BY MEN, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. CASHMERE CLOTHING MARKET SIZE, BY WOMEN, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. AMERICAS CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 24. AMERICAS CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 25. AMERICAS CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 26. AMERICAS CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 27. AMERICAS CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 28. AMERICAS CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 29. ARGENTINA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 30. ARGENTINA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 31. ARGENTINA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 32. ARGENTINA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 33. ARGENTINA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 34. BRAZIL CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 35. BRAZIL CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 36. BRAZIL CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 37. BRAZIL CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 38. BRAZIL CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 39. CANADA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 40. CANADA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 41. CANADA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 42. CANADA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 43. CANADA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 44. MEXICO CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 45. MEXICO CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 46. MEXICO CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 47. MEXICO CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 48. MEXICO CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 49. UNITED STATES CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 50. UNITED STATES CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 51. UNITED STATES CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 52. UNITED STATES CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 53. UNITED STATES CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 54. UNITED STATES CASHMERE CLOTHING MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 55. ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 56. ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 57. ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 58. ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 59. ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 60. ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 61. AUSTRALIA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 62. AUSTRALIA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 63. AUSTRALIA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 64. AUSTRALIA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 65. AUSTRALIA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 66. CHINA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 67. CHINA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 68. CHINA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 69. CHINA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 70. CHINA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 71. INDIA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 72. INDIA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 73. INDIA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 74. INDIA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 75. INDIA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 76. INDONESIA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 77. INDONESIA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 78. INDONESIA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 79. INDONESIA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 80. INDONESIA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 81. JAPAN CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 82. JAPAN CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 83. JAPAN CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 84. JAPAN CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 85. JAPAN CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 86. MALAYSIA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 87. MALAYSIA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 88. MALAYSIA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 89. MALAYSIA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 90. MALAYSIA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 91. PHILIPPINES CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 92. PHILIPPINES CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 93. PHILIPPINES CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 94. PHILIPPINES CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 95. PHILIPPINES CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 96. SINGAPORE CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 97. SINGAPORE CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 98. SINGAPORE CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 99. SINGAPORE CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 100. SINGAPORE CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 101. SOUTH KOREA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 102. SOUTH KOREA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 103. SOUTH KOREA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 104. SOUTH KOREA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 105. SOUTH KOREA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 106. TAIWAN CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 107. TAIWAN CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 108. TAIWAN CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 109. TAIWAN CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 110. TAIWAN CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 111. THAILAND CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 112. THAILAND CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 113. THAILAND CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 114. THAILAND CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 115. THAILAND CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 116. VIETNAM CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 117. VIETNAM CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 118. VIETNAM CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 119. VIETNAM CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 120. VIETNAM CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 121. EUROPE, MIDDLE EAST & AFRICA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 122. EUROPE, MIDDLE EAST & AFRICA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 123. EUROPE, MIDDLE EAST & AFRICA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 124. EUROPE, MIDDLE EAST & AFRICA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 125. EUROPE, MIDDLE EAST & AFRICA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 126. EUROPE, MIDDLE EAST & AFRICA CASHMERE CLOTHING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 127. DENMARK CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 128. DENMARK CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 129. DENMARK CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 130. DENMARK CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 131. DENMARK CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 132. EGYPT CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 133. EGYPT CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 134. EGYPT CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 135. EGYPT CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 136. EGYPT CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 137. FINLAND CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 138. FINLAND CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 139. FINLAND CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 140. FINLAND CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 141. FINLAND CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 142. FRANCE CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 143. FRANCE CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 144. FRANCE CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 145. FRANCE CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 146. FRANCE CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 147. GERMANY CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 148. GERMANY CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 149. GERMANY CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 150. GERMANY CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 151. GERMANY CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 152. ISRAEL CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 153. ISRAEL CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 154. ISRAEL CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 155. ISRAEL CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 156. ISRAEL CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 157. ITALY CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 158. ITALY CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 159. ITALY CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 160. ITALY CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 161. ITALY CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 162. NETHERLANDS CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 163. NETHERLANDS CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 164. NETHERLANDS CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 165. NETHERLANDS CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 166. NETHERLANDS CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 167. NIGERIA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 168. NIGERIA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 169. NIGERIA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 170. NIGERIA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 171. NIGERIA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 172. NORWAY CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 173. NORWAY CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 174. NORWAY CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 175. NORWAY CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 176. NORWAY CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 177. POLAND CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 178. POLAND CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 179. POLAND CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 180. POLAND CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 181. POLAND CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 182. QATAR CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 183. QATAR CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 184. QATAR CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 185. QATAR CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 186. QATAR CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 187. RUSSIA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 188. RUSSIA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 189. RUSSIA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 190. RUSSIA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 191. RUSSIA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 192. SAUDI ARABIA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 193. SAUDI ARABIA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 194. SAUDI ARABIA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 195. SAUDI ARABIA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 196. SAUDI ARABIA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 197. SOUTH AFRICA CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 198. SOUTH AFRICA CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 199. SOUTH AFRICA CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 200. SOUTH AFRICA CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 201. SOUTH AFRICA CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 202. SPAIN CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 203. SPAIN CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 204. SPAIN CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 205. SPAIN CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 206. SPAIN CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 207. SWEDEN CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 208. SWEDEN CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 209. SWEDEN CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 210. SWEDEN CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 211. SWEDEN CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 212. SWITZERLAND CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 213. SWITZERLAND CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 214. SWITZERLAND CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 215. SWITZERLAND CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 216. SWITZERLAND CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 217. TURKEY CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 218. TURKEY CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 219. TURKEY CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 220. TURKEY CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 221. TURKEY CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 222. UNITED ARAB EMIRATES CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 223. UNITED ARAB EMIRATES CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 224. UNITED ARAB EMIRATES CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 225. UNITED ARAB EMIRATES CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 226. UNITED ARAB EMIRATES CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 227. UNITED KINGDOM CASHMERE CLOTHING MARKET SIZE, BY PRODUCT, 2018-2030 (USD MILLION)

- TABLE 228. UNITED KINGDOM CASHMERE CLOTHING MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 229. UNITED KINGDOM CASHMERE CLOTHING MARKET SIZE, BY GRADES, 2018-2030 (USD MILLION)

- TABLE 230. UNITED KINGDOM CASHMERE CLOTHING MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 231. UNITED KINGDOM CASHMERE CLOTHING MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 232. CASHMERE CLOTHING MARKET, FPNV POSITIONING MATRIX, 2023

- TABLE 233. CASHMERE CLOTHING MARKET SHARE, BY KEY PLAYER, 2023

- TABLE 234. CASHMERE CLOTHING MARKET LICENSE & PRICING