|

市場調查報告書

商品編碼

1411310

硬體安全模組市場:按類型、部署類型、應用程式、最終用戶 - 2023-2030 年全球預測Hardware Security Modules Market by Type (LAN-Based, PCI-Based, USB-Based), Deployment Type (On-Cloud, On-Premise), Application, End-User - Global Forecast 2023-2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

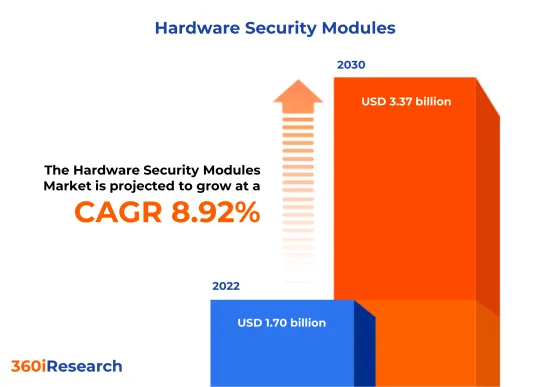

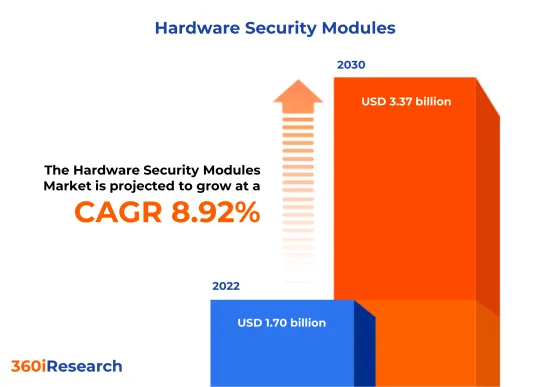

預計2022年硬體安全模組市場規模為17億美元,2023年將達18.4億美元,2030年將達33.7億美元,複合年成長率為8.92%。

全球硬體安全模組市場

| 主要市場統計 | |

|---|---|

| 基準年[2022] | 17億美元 |

| 預測年份 [2023] | 18.4億美元 |

| 預測年份 [2030] | 33.7億美元 |

| 複合年成長率(%) | 8.92% |

硬體安全模組 (HSM) 是一種實體運算設備,用於保護和管理數位金鑰並提供加密處理以實現可靠的身份驗證。這些模組傳統上以插入卡或外部設備的形式直接連接到電腦或網路伺服器。 HSM 市場包括在需要資料保護以滿足合規性標準並防止資料外洩的行業中銷售和部署這些設備。 HSM 可應用於多個領域,包括銀行和金融服務、政府、技術和通訊、工業和公共產業、零售和醫療保健。 HSM 可協助管理加密金鑰、提供加密功能並保護加密金鑰的生命週期。 HSM 的最終用戶範圍從大型企業到尋求確保資料保護和交易安全的小型企業。 HSM 市場的成長受到許多因素的影響,例如嚴格的監管標準、數位轉型、網路攻擊的增加以及雲端基礎的服務的採用。儘管存在成長潛力,HSM 市場仍面臨一些限制和挑戰。對於中小型企業來說,採購和管理 HSM 的成本很高。此外,將 HSM 整合到現有系統可能很複雜,並且需要專業知識。然而,市場上的創新和研究正在不斷推進,包括採用增強 HSM 功能的新技術,例如多因素身份驗證方法和改進的生物識別安全性。此外,對抗量子密碼演算法的研究以確保為後量子密碼學的未來做好準備,正在為業務成長創造新的機會。

區域洞察

由於跨國公司的大量存在、合規性要求較高以及網路安全威脅意識的增強,美洲(尤其是北美)正在大力採用硬體安全模組 (HSM)。美國和加拿大在銀行、金融、醫療保健和政府部門實施 HSM 解決方案方面處於領先地位。在生產方面,美洲有幾家主要的 HSM 製造商設計和製造複雜的 HSM 解決方案。該地區因其創新的網路安全方法和對研發 (R&D) 的大量投資而獲得認可,為先進的 HSM 技術做出了貢獻。歐洲、中東和非洲 (EMEA) 是 HSM 的成熟市場,擁有嚴格的法規結構,例如一般資料保護規範 (GDPR),要求採取強力的安全措施。在中東和非洲,成長是由 IT 支出增加和逐步轉向數位化所推動的。在亞太地區,網路攻擊的快速增加、經濟的不斷發展以及產業數位化的不斷增強正在推動 HSM 採用的快速成長。在印度和中國等新興國家,由於電子商務和金融科技服務的擴張,對 HSM 的需求迅速增加,需要先進的安全措施來保護交易和資料。

FPNV定位矩陣

FPNV定位矩陣對於評估硬體安全模組市場至關重要。我們檢視與業務策略和產品滿意度相關的關鍵指標,以對供應商進行全面評估。這種深入的分析使用戶能夠根據自己的要求做出資訊的決策。根據評估,供應商被分為四個成功程度不同的像限:前沿(F)、探路者(P)、利基(N)和重要(V)。

市場佔有率分析

市場佔有率分析是一種綜合工具,可對硬體安全模組市場中供應商的現狀進行深入而詳細的研究。全面比較和分析供應商在整體收益、基本客群和其他關鍵指標方面的貢獻,以便更好地了解公司的績效及其在爭奪市場佔有率時面臨的挑戰。此外,該分析還提供了對該行業競爭特徵的寶貴考察,包括在研究基準年觀察到的累積、分散主導地位和合併特徵等因素。這種詳細程度的提高使供應商能夠做出更資訊的決策並制定有效的策略,從而在市場上獲得競爭優勢。

該報告對以下幾個方面提供了寶貴的見解:

1-市場滲透率:提供有關主要企業所服務的市場的全面資訊。

2-市場開拓:我們深入研究利潤豐厚的新興市場,並分析它們在成熟細分市場中的滲透率。

3- 市場多元化:提供有關新產品發布、開拓地區、最新發展和投資的詳細資訊。

4-競爭評估與資訊:對主要企業的市場佔有率、策略、產品、認證、監管狀況、專利狀況、製造能力等進行全面評估。

5- 產品開發與創新:提供對未來技術、研發活動和突破性產品開發的見解。

本報告解決了以下關鍵問題:

1-硬體安全模組市場的市場規模和預測是多少?

2-在硬體安全模組市場的預測期內,有哪些產品、細分市場、應用程式和領域需要考慮投資?

3-硬體安全模組市場的技術趨勢和法律規範是什麼?

4-硬體安全模組市場主要廠商的市場佔有率是多少?

5-進入硬體安全模組市場適合的型態和戰略手段有哪些?

目錄

第1章 前言

第2章調查方法

第3章執行摘要

第4章市場概況

第5章市場洞察

- 市場動態

- 促進因素

- 隨著資料外洩和網路攻擊的增加,數位轉型工作也在增加

- 標準法規和標準執行,以保護整個組織的敏感資料

- 跨企業更採用雲端服務

- 抑制因素

- 安裝和更新硬體安全模組的成本較高

- 機會

- 更多創新硬體安全模組介紹

- 5G技術在硬體安全模組的介紹

- 任務

- 硬體安全模組的密碼演算法和實體安全問題

- 促進因素

- 市場區隔分析

- 類型:網路環境廣泛的企業對基於 LAN 的 HSM 的需求不斷成長

- 部署類型:大規模採用具有遠端存取功能的雲端基礎的HSM

- 應用程式:增加應用層級加密的使用,無需依賴作業系統加密機制即可提供細粒度的資料安全性

- 最終用戶:消費品和零售業擴大使用 HSM,以支援安全交易和安全資訊點 (POS) 系統

- 市場趨勢分析

- 美國各地存在著高投資流量以及強力的法規結構

- 亞太全部區域資料量流量增加,中小型企業擴大採用雲端服務

- 歐洲、中東和非洲地區硬體安全模組的持續進步和網路攻擊的增加

- 高通膨的累積效應

- 波特五力分析

- 價值鍊和關鍵路徑分析

- 法律規範

第6章硬體安全模組市場:按類型

- 基於區域網路

- 基於PCI

- USB底座

第 7 章. 硬體安全模組市場:依部署類型

- 在雲端

- 本地

第8章硬體安全模組市場:依應用分類

- 應用層級加密

- 認證

- 程式碼和文檔簽名

- 資料庫加密

- 付款流程

- PKI 和資訊管理

- 安全通訊端層和傳輸層安全

第 9 章 硬體安全模組市場:依最終用戶分類

- 航太和國防

- BFSI

- 消費品和零售

- 能源和公共

- 政府和公共部門

- 醫療保健和生命科學

- 資訊科技和通訊

- 製造業

- 交通設施

第10章美洲硬體安全模組市場

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美國

第11章 亞太地區硬體安全模組市場

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 菲律賓

- 新加坡

- 韓國

- 台灣

- 泰國

- 越南

第12章歐洲、中東和非洲硬體安全模組市場

- 丹麥

- 埃及

- 芬蘭

- 法國

- 德國

- 以色列

- 義大利

- 荷蘭

- 奈及利亞

- 挪威

- 波蘭

- 卡達

- 俄羅斯

- 沙烏地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公國

- 英國

第13章競爭形勢

- FPNV定位矩陣

- 市場佔有率分析:主要企業

- 主要企業競爭情境分析

- 合約、合作和夥伴關係

- 新產品發布和功能增強

- 獎項/獎勵/擴展

第14章競爭產品組合

- 主要公司簡介

- ACE Technology

- Adweb Technologies Pvt. Ltd.

- Akeyless Security Ltd.

- Amazon Web Services, Inc.

- Atos SE

- Axiado Corporation

- Cogito Group Pty Ltd.

- Crypto4A

- DTS Systeme GmbH

- Efficient INDIA

- ellipticSecure by Elliptic Consulting

- Entrust Corporation

- ETAS GmbH by Robert Bosch GmbH

- Fortanix

- Futurex LP

- Google LLC by Alphabet Inc.

- Infineon Technologies AG

- International Business Machines Corporation

- JISA Softech Pvt. Ltd.

- Kryptoagile Solutions Pvt. Ltd.

- Marvell Technology, Inc.

- Microchip Technology Incorporated

- Microsoft Corporation

- Nitrokey GmbH

- PKI Solutions LLC

- Sansec

- Securosys SA

- STMicroelectronics International NV

- Thales Group

- The Yubico Group Company

- Utimaco Management GmbH

- Zymbit Inc.

- 主要產品系列

第15章附錄

- 討論指南

- 關於許可證和定價

[195 Pages Report] The Hardware Security Modules Market size was estimated at USD 1.70 billion in 2022 and expected to reach USD 1.84 billion in 2023, at a CAGR 8.92% to reach USD 3.37 billion by 2030.

Global Hardware Security Modules Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2022] | USD 1.70 billion |

| Estimated Year [2023] | USD 1.84 billion |

| Forecast Year [2030] | USD 3.37 billion |

| CAGR (%) | 8.92% |

Hardware security modules, or HSMs, are physical computing devices that safeguard and manage digital keys for robust authentication and provide crypto processing. These modules traditionally come as a plug-in card or an external device that attaches directly to a computer or network server. The market for HSMs encompasses the sales and deployment of these devices across industries that require data protection to meet compliance standards and prevent data breaches. HSMs find application in various fields such as banking and financial services, government, technology and communications, industrial and manufacturing, energy and utilities, retail, healthcare, and more. They are instrumental in managing encryption keys, providing cryptographic functions, and securing the lifecycle of cryptographic keys. End-users of HSMs range from large enterprises to small and medium businesses that aim to protect their data and ensure transaction security. The growth of the HSMs market is influenced by numerous factors, such as stringent regulatory standards, digital transformation, increasing incidences of cyberattacks, and adoption of cloud-based services. Despite the potential growth, the HSM market faces several limitations and challenges. The procurement and management of HSMs can be cost-prohibitive for small and medium-sized businesses. Integrating HSMs with existing systems can also be complex, requiring specialized expertise. However, the market is witnessing development in innovation and research, such as employing emerging technologies that enhance HSM capabilities, such as improvements in multi-factor authentication methods and biometric security. Furthermore, research in quantum-resistant cryptographic algorithms to ensure future readiness for post-quantum cryptography is creating new opportunities for business growth.

Regional Insights

The Americas, particularly North America, show a robust adoption of hardware security modules (HSMs) due to a strong presence of multinational companies, high compliance requirements, and increased awareness of cybersecurity threats. The United States and Canada lead in implementing HSM solutions across banking, finance, healthcare, and government sectors. Regarding production, the Americas houses several leading HSM manufacturers that design and produce sophisticated HSM solutions. The region is recognized for its innovative approach to cybersecurity and substantial investment in research and development (R&D), contributing to advanced HSM technologies. EMEA presents a mature market for HSMs, with stringent regulatory frameworks such as the General Data Protection Regulation (GDPR) mandating strong security practices. European countries demonstrate keen investment in HSMs for sectors such as finance, healthcare, and government services, while in the Middle East and Africa, the growth is linked with increasing IT spending and a gradual shift towards digitization. APAC is witnessing rapid growth in HSM adoption, driven by the escalating number of cyber-attacks, growing economic development, and increasing digitalization of industries. Emerging economies such as India and China see a surge in HSM demand due to the expansion of eCommerce and fintech services, necessitating heightened security measures for transactions and data protection.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Hardware Security Modules Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Hardware Security Modules Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Hardware Security Modules Market, highlighting leading vendors and their innovative profiles. These include ACE Technology, Adweb Technologies Pvt. Ltd., Akeyless Security Ltd., Amazon Web Services, Inc., Atos SE, Axiado Corporation, Cogito Group Pty Ltd., Crypto4A, DTS Systeme GmbH, Efficient INDIA, ellipticSecure by Elliptic Consulting, Entrust Corporation, ETAS GmbH by Robert Bosch GmbH, Fortanix, Futurex LP, Google LLC by Alphabet Inc., Infineon Technologies AG, International Business Machines Corporation, JISA Softech Pvt. Ltd., Kryptoagile Solutions Pvt. Ltd., Marvell Technology, Inc., Microchip Technology Incorporated, Microsoft Corporation, Nitrokey GmbH, PKI Solutions LLC, Sansec, Securosys SA, STMicroelectronics International N.V., Thales Group, The Yubico Group Company, Utimaco Management GmbH, and Zymbit Inc..

Market Segmentation & Coverage

This research report categorizes the Hardware Security Modules Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Type

- LAN-Based

- PCI-Based

- USB-Based

- Deployment Type

- On-Cloud

- On-Premise

- Application

- Application-level Encryption

- Authentication

- Code & Document Signing

- Database Encryption

- Payment Processing

- PKI & Credential Management

- Secure Sockets Layer & Transport Layer Security

- End-User

- Aerospace & Defense

- BFSI

- Consumer Goods & Retail

- Energy & Utilities

- Government & Public Sector

- Healthcare & Lifescience

- IT & Telecommunications

- Manufacturing

- Transportation

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Hardware Security Modules Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Hardware Security Modules Market?

3. What are the technology trends and regulatory frameworks in the Hardware Security Modules Market?

4. What is the market share of the leading vendors in the Hardware Security Modules Market?

5. Which modes and strategic moves are suitable for entering the Hardware Security Modules Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Hardware Security Modules Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing digital transformation initiatives with the rise in data breaches and cyberattacks

- 5.1.1.2. Enforcement of standard regulations and standards to protect sensitive data across organizations

- 5.1.1.3. Growing adoption of cloud services across business

- 5.1.2. Restraints

- 5.1.2.1. High cost of installing and updating hardware security modules

- 5.1.3. Opportunities

- 5.1.3.1. Growing introduction of innovative hardware security modules

- 5.1.3.2. Introduction of 5G technology in hardware security modules

- 5.1.4. Challenges

- 5.1.4.1. Cryptographic algorithm and physical security issues with hardware security modules

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Type: Rising demand for LAN-based HSMs in enterprises with extensive networked environments

- 5.2.2. Deployment Type: Significant adoption of cloud-based HSMs owing to remote accessibility

- 5.2.3. Application: Growing use of application-level encryption for granular data security without relying on operating system encryption mechanisms

- 5.2.4. End-User: Growing utilization of HSMs in consumer goods & retail to support secure transactions and protect point-of-sale (POS) systems

- 5.3. Market Trend Analysis

- 5.3.1. Presence of high investment flow coupled with robust regulatory framework across Americas

- 5.3.2. Increasing data volume traffic and growing adoption of cloud services by SMEs across the Asia-Pacific region

- 5.3.3. Ongoing advancements in hardware security modules coupled with increasing cyber attacks in the EMEA region

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Hardware Security Modules Market, by Type

- 6.1. Introduction

- 6.2. LAN-Based

- 6.3. PCI-Based

- 6.4. USB-Based

7. Hardware Security Modules Market, by Deployment Type

- 7.1. Introduction

- 7.2. On-Cloud

- 7.3. On-Premise

8. Hardware Security Modules Market, by Application

- 8.1. Introduction

- 8.2. Application-level Encryption

- 8.3. Authentication

- 8.4. Code & Document Signing

- 8.5. Database Encryption

- 8.6. Payment Processing

- 8.7. PKI & Credential Management

- 8.8. Secure Sockets Layer & Transport Layer Security

9. Hardware Security Modules Market, by End-User

- 9.1. Introduction

- 9.2. Aerospace & Defense

- 9.3. BFSI

- 9.4. Consumer Goods & Retail

- 9.5. Energy & Utilities

- 9.6. Government & Public Sector

- 9.7. Healthcare & Lifescience

- 9.8. IT & Telecommunications

- 9.9. Manufacturing

- 9.10. Transportation

10. Americas Hardware Security Modules Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Hardware Security Modules Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Hardware Security Modules Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. FPNV Positioning Matrix

- 13.2. Market Share Analysis, By Key Player

- 13.3. Competitive Scenario Analysis, By Key Player

- 13.3.1. Agreement, Collaboration, & Partnership

- 13.3.1.1. Episode Six Expands its Partnership with MYHSM by Utimaco to Deliver its Services to New Clients in New Regions

- 13.3.1.2. Beetel Teletech Join Forces with Utimaco

- 13.3.1.3. Taurus Deepens Its Collaboration with Thales

- 13.3.2. New Product Launch & Enhancement

- 13.3.2.1. Thales Group Launches Cloud-based Payment HSM Service to Help Accelerate Adoption of Cloud Payments Infrastructure

- 13.3.2.2. Luna T-Series Hardware Security Module 7.13.0 Release Announcement

- 13.3.2.3. AWS announces AWS Payment Cryptography

- 13.3.2.4. Crypto4A's QxHSM is Set to Enhance the Hardware Security Module

- 13.3.2.5. Entrust Launches Zero Trust Ready Solutions for Passwordless Authentication, Next-Generation HSM, and Multi-Cloud Key Compliance

- 13.3.2.6. Securosys Launches Cloud-Aware Primus Hsm For Hashicorp Vault

- 13.3.2.7. Marvell Launches LiquidSecurity 2 Module to Empower HSM-as-a-Service for the Multi-Cloud Era

- 13.3.3. Award, Recognition, & Expansion

- 13.3.3.1. ETAS and Infineon Receive NIST CAVP Certification for ESCRYPT CycurHSM Implemented on AURIX Microcontrollers

- 13.3.1. Agreement, Collaboration, & Partnership

14. Competitive Portfolio

- 14.1. Key Company Profiles

- 14.1.1. ACE Technology

- 14.1.2. Adweb Technologies Pvt. Ltd.

- 14.1.3. Akeyless Security Ltd.

- 14.1.4. Amazon Web Services, Inc.

- 14.1.5. Atos SE

- 14.1.6. Axiado Corporation

- 14.1.7. Cogito Group Pty Ltd.

- 14.1.8. Crypto4A

- 14.1.9. DTS Systeme GmbH

- 14.1.10. Efficient INDIA

- 14.1.11. ellipticSecure by Elliptic Consulting

- 14.1.12. Entrust Corporation

- 14.1.13. ETAS GmbH by Robert Bosch GmbH

- 14.1.14. Fortanix

- 14.1.15. Futurex LP

- 14.1.16. Google LLC by Alphabet Inc.

- 14.1.17. Infineon Technologies AG

- 14.1.18. International Business Machines Corporation

- 14.1.19. JISA Softech Pvt. Ltd.

- 14.1.20. Kryptoagile Solutions Pvt. Ltd.

- 14.1.21. Marvell Technology, Inc.

- 14.1.22. Microchip Technology Incorporated

- 14.1.23. Microsoft Corporation

- 14.1.24. Nitrokey GmbH

- 14.1.25. PKI Solutions LLC

- 14.1.26. Sansec

- 14.1.27. Securosys SA

- 14.1.28. STMicroelectronics International N.V.

- 14.1.29. Thales Group

- 14.1.30. The Yubico Group Company

- 14.1.31. Utimaco Management GmbH

- 14.1.32. Zymbit Inc.

- 14.2. Key Product Portfolio

15. Appendix

- 15.1. Discussion Guide

- 15.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. HARDWARE SECURITY MODULES MARKET RESEARCH PROCESS

- FIGURE 2. HARDWARE SECURITY MODULES MARKET SIZE, 2022 VS 2030

- FIGURE 3. HARDWARE SECURITY MODULES MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. HARDWARE SECURITY MODULES MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. HARDWARE SECURITY MODULES MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. HARDWARE SECURITY MODULES MARKET DYNAMICS

- FIGURE 7. HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2022 VS 2030 (%)

- FIGURE 8. HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2022 VS 2030 (%)

- FIGURE 10. HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2022 VS 2030 (%)

- FIGURE 12. HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2022 VS 2030 (%)

- FIGURE 14. HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 16. AMERICAS HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES HARDWARE SECURITY MODULES MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 18. UNITED STATES HARDWARE SECURITY MODULES MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. EUROPE, MIDDLE EAST & AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 23. HARDWARE SECURITY MODULES MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 24. HARDWARE SECURITY MODULES MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. HARDWARE SECURITY MODULES MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. HARDWARE SECURITY MODULES MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL HARDWARE SECURITY MODULES MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 6. HARDWARE SECURITY MODULES MARKET SIZE, BY LAN-BASED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. HARDWARE SECURITY MODULES MARKET SIZE, BY PCI-BASED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. HARDWARE SECURITY MODULES MARKET SIZE, BY USB-BASED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 10. HARDWARE SECURITY MODULES MARKET SIZE, BY ON-CLOUD, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. HARDWARE SECURITY MODULES MARKET SIZE, BY ON-PREMISE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 13. HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION-LEVEL ENCRYPTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. HARDWARE SECURITY MODULES MARKET SIZE, BY AUTHENTICATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. HARDWARE SECURITY MODULES MARKET SIZE, BY CODE & DOCUMENT SIGNING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. HARDWARE SECURITY MODULES MARKET SIZE, BY DATABASE ENCRYPTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. HARDWARE SECURITY MODULES MARKET SIZE, BY PAYMENT PROCESSING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. HARDWARE SECURITY MODULES MARKET SIZE, BY PKI & CREDENTIAL MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. HARDWARE SECURITY MODULES MARKET SIZE, BY SECURE SOCKETS LAYER & TRANSPORT LAYER SECURITY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 21. HARDWARE SECURITY MODULES MARKET SIZE, BY AEROSPACE & DEFENSE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. HARDWARE SECURITY MODULES MARKET SIZE, BY BFSI, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. HARDWARE SECURITY MODULES MARKET SIZE, BY CONSUMER GOODS & RETAIL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. HARDWARE SECURITY MODULES MARKET SIZE, BY ENERGY & UTILITIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. HARDWARE SECURITY MODULES MARKET SIZE, BY GOVERNMENT & PUBLIC SECTOR, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. HARDWARE SECURITY MODULES MARKET SIZE, BY HEALTHCARE & LIFESCIENCE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. HARDWARE SECURITY MODULES MARKET SIZE, BY IT & TELECOMMUNICATIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. HARDWARE SECURITY MODULES MARKET SIZE, BY MANUFACTURING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 29. HARDWARE SECURITY MODULES MARKET SIZE, BY TRANSPORTATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 30. AMERICAS HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 31. AMERICAS HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 32. AMERICAS HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 33. AMERICAS HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 34. AMERICAS HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 35. ARGENTINA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 36. ARGENTINA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 37. ARGENTINA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 38. ARGENTINA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 39. BRAZIL HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 40. BRAZIL HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 41. BRAZIL HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 42. BRAZIL HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 43. CANADA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 44. CANADA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 45. CANADA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 46. CANADA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 47. MEXICO HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 48. MEXICO HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 49. MEXICO HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 50. MEXICO HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 51. UNITED STATES HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 52. UNITED STATES HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 53. UNITED STATES HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 54. UNITED STATES HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 55. UNITED STATES HARDWARE SECURITY MODULES MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 56. ASIA-PACIFIC HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 57. ASIA-PACIFIC HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 58. ASIA-PACIFIC HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 59. ASIA-PACIFIC HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 60. ASIA-PACIFIC HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 61. AUSTRALIA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 62. AUSTRALIA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 63. AUSTRALIA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 64. AUSTRALIA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 65. CHINA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 66. CHINA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 67. CHINA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 68. CHINA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 69. INDIA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 70. INDIA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 71. INDIA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 72. INDIA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 73. INDONESIA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 74. INDONESIA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 75. INDONESIA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 76. INDONESIA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 77. JAPAN HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 78. JAPAN HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 79. JAPAN HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 80. JAPAN HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 81. MALAYSIA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 82. MALAYSIA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 83. MALAYSIA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 84. MALAYSIA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 85. PHILIPPINES HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 86. PHILIPPINES HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 87. PHILIPPINES HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 88. PHILIPPINES HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 89. SINGAPORE HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 90. SINGAPORE HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 91. SINGAPORE HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 92. SINGAPORE HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 93. SOUTH KOREA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 94. SOUTH KOREA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 95. SOUTH KOREA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 96. SOUTH KOREA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 97. TAIWAN HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 98. TAIWAN HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 99. TAIWAN HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 100. TAIWAN HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 101. THAILAND HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 102. THAILAND HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 103. THAILAND HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 104. THAILAND HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 105. VIETNAM HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 106. VIETNAM HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 107. VIETNAM HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 108. VIETNAM HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 109. EUROPE, MIDDLE EAST & AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 110. EUROPE, MIDDLE EAST & AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 111. EUROPE, MIDDLE EAST & AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 112. EUROPE, MIDDLE EAST & AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 113. EUROPE, MIDDLE EAST & AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 114. DENMARK HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 115. DENMARK HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 116. DENMARK HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 117. DENMARK HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 118. EGYPT HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 119. EGYPT HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 120. EGYPT HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 121. EGYPT HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 122. FINLAND HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 123. FINLAND HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 124. FINLAND HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 125. FINLAND HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 126. FRANCE HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 127. FRANCE HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 128. FRANCE HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 129. FRANCE HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 130. GERMANY HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 131. GERMANY HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 132. GERMANY HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 133. GERMANY HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 134. ISRAEL HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 135. ISRAEL HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 136. ISRAEL HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 137. ISRAEL HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 138. ITALY HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 139. ITALY HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 140. ITALY HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 141. ITALY HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 142. NETHERLANDS HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 143. NETHERLANDS HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 144. NETHERLANDS HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 145. NETHERLANDS HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 146. NIGERIA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 147. NIGERIA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 148. NIGERIA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 149. NIGERIA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 150. NORWAY HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 151. NORWAY HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 152. NORWAY HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 153. NORWAY HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 154. POLAND HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 155. POLAND HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 156. POLAND HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 157. POLAND HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 158. QATAR HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 159. QATAR HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 160. QATAR HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 161. QATAR HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 162. RUSSIA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 163. RUSSIA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 164. RUSSIA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 165. RUSSIA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 166. SAUDI ARABIA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 167. SAUDI ARABIA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 168. SAUDI ARABIA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 169. SAUDI ARABIA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 170. SOUTH AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 171. SOUTH AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 172. SOUTH AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 173. SOUTH AFRICA HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 174. SPAIN HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 175. SPAIN HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 176. SPAIN HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 177. SPAIN HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 178. SWEDEN HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 179. SWEDEN HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 180. SWEDEN HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 181. SWEDEN HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 182. SWITZERLAND HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 183. SWITZERLAND HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 184. SWITZERLAND HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 185. SWITZERLAND HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 186. TURKEY HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 187. TURKEY HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 188. TURKEY HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 189. TURKEY HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 190. UNITED ARAB EMIRATES HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 191. UNITED ARAB EMIRATES HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 192. UNITED ARAB EMIRATES HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 193. UNITED ARAB EMIRATES HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 194. UNITED KINGDOM HARDWARE SECURITY MODULES MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 195. UNITED KINGDOM HARDWARE SECURITY MODULES MARKET SIZE, BY DEPLOYMENT TYPE, 2018-2030 (USD MILLION)

- TABLE 196. UNITED KINGDOM HARDWARE SECURITY MODULES MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 197. UNITED KINGDOM HARDWARE SECURITY MODULES MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 198. HARDWARE SECURITY MODULES MARKET, FPNV POSITIONING MATRIX, 2022

- TABLE 199. HARDWARE SECURITY MODULES MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 200. HARDWARE SECURITY MODULES MARKET LICENSE & PRICING