|

市場調查報告書

商品編碼

1108746

亞太照明市場The Lighting Fixtures Market in Asia Pacific |

||||||

亞太地區燈具市場(7 個國家:印度尼西亞、馬來西亞、菲律賓、新加坡、韓國、泰國、越南)將在 2021 年達到 62.64 億美元的出廠價。這個數字不包括燈具(傳統燈具和 LED 燈具),估計還有 15.33 億美元,使照明(燈具 + 燈具)總銷售額達到約 78 億美元。

本報告探討了亞太地區照明市場,提供了消費/住宅和技術/專業照明數據以及從生產、國際貿易和市場規模(2016-2021 年)到 2025 年的趨勢。預測、主要公司和更多其他資訊。

亮點

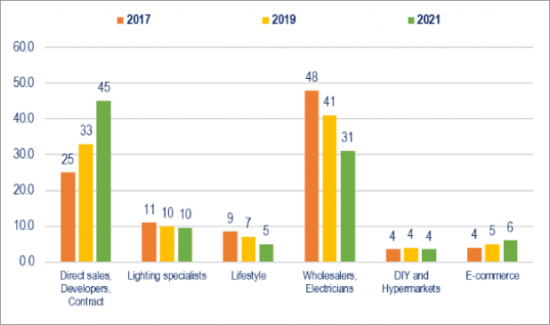

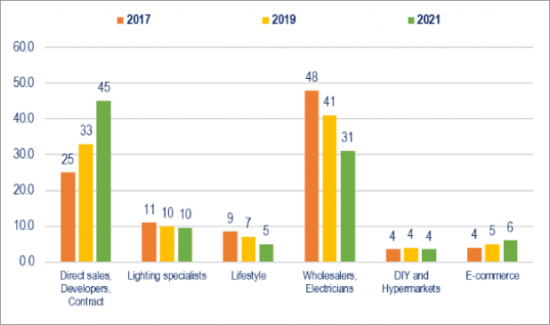

按分銷渠道劃分的亞太地區照明設備銷售細分:按行業估算(2017 年、2019 年、2021 年)價值份額

主要刊載公司

Alto Lighting、Aplico、Artemide、Artolite、AZ E-Lite、Azcor Lighting、Boonthavorn Lighting、CARA Lighting、Changi Light、Chor Rungsang Lighting、Chunil、Davico、Dien Quang Lamp、Dongmyung Lighting - Raat、Duc Hau Long、Eglo、ELM Lighting、Erco、EVE Lighting、Fagerhult、Fluxlite、Focus Vina、Fokus Indo Lighting、Fosera Lighting、FSL Lighting、Fumaco、Goodlite、Hannochs、Hanssem、Hapulico Lighting、Hikari、Honyar、Hori Lighting、Kangsan Lighting、Krisbow、Kum Kang Electric、L&E Lighting and Equipment、Lamptan、Leedarson、LeKise、Ligman、Lumens、Maltani Lighting、MLS - Ledvance、Neo-Neon、NVC、Opple、PAK Lighting、Rang Dong、RZB、Saka Lighting、Signify、Solarens Ledindo、Sunil Elecomm、Tan Phat、Ushio Lighting、Wooree Lighting、XaLoTho、Yankon、Zumtobel

內容

- 亞太地區(7 個國家)照明市場 - 照明行業概覽:照明設備生產、國際貿易、消費、燈具貿易和消費、整體照明市場估計

- 到 2025 年各國家和整個亞太地區的照明市場預測

- 競爭系統:主要參與者。總照明、燈具、燈具、住宅/消費類、商業/建築、工業和戶外照明市場、基於 LED 的照明主要參與者的估計銷售數據和市場份額、公司概況概述

- 按款式、產品類型、應用、樣本公司分銷渠道和行業估計劃分的照明燈具銷售額細分

- 每個亞太城市樣本的照明需求

- 國家/地區分析:印度尼西亞、馬來西亞、菲律賓、新加坡、韓國、泰國、越南

接受調查的國家/地區

- 市場規模、活動趨勢和預測:照明燈俱生產、消費、國際貿易、照明市場趨勢預測和各項經濟指標

- 國際貿易:按國家和目的地/原產地地理區域劃分的燈具進出口流量數據,以及燈具的國際貿易。

- 競爭體系:各市場的國內外主要公司的照明銷售數據和市場佔有率估計值,公司簡介概要

- 光源:LED 照明細分市場和傳統光源

- 分佈:主要分銷渠道、照明工程施工企業、照明設計工作室、各城市照明需求概況

- 經濟指標:每個經濟指標的數據和預測

The report, now at its fifth edition, analyses the Lighting fixtures market in 7 Asian Pacific countries (Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam), a market with an estimated consumption (at factory prices) that, in 2021, amounts to USD 6.3 billion.

The Study provides data and trend (2016-2021) on the production, the international trade and the market size of the lighting fixtures industry, broken down by consumer/residential and technical/professional lighting (divided in architectural/commercial, industrial, and outdoor). An overview of the top players in the lamps lighting market is also provided. Forecasts up to 2025 for the lighting fixtures market and selected economic indicators are included for each considered countries.

The first chapter offers an overview of the lighting industry in Asia Pacific (7 country) as a whole, ranking the top companies as total lighting sales (including: Lighting fixtures, LED and Conventional lamps), as lighting fixtures sales by segment (consumer/professional, indoor/outdoor), specific products and applications (downlights, projectors, high bays, etc.; hospitality, retail, healthcare, street lighting, etc.), light sources (LED share), distribution channels.

After a first glance of the Asian Pacific lighting market as a whole, the report is structured as follows, for each country:

- Paragraph I Market size, activity trend and forecast offers an overview of the lighting fixtures industry with data on production, consumption and international trade for the period 2016-2021 and forecast up to 2025.

- Paragraph II International trade provides detailed tables on lighting fixtures exports and imports, by country and by geographical area of destination/origin, highlighting the main destination for lighting fixtures exports and the top lighting fixtures importers, and data on international trade of lamps, pointing out the percentage share of LED based lamps on total exported and imported lamps.

- Paragraph III Competitive system offers an insight into the leading local and foreign players present in each market via detailed tables showing sales data and market shares and short company profiles.

- Paragraph IV Light sources provides an estimated breakdown of lighting fixtures sales by light sources (penetration rate of the LED lighting segment versus conventional lighting sources).

- Paragraph V Distribution channels gives an overview of the main distribution channels. A selection of architectural companies involved in the lighting business, a selection of the main associations and trade fairs, a focus on the most relevant cities for each country are also included.

- Paragraph VI Economic indicators provides data and forecasts for selected macroeconomic indicators, population and social trends, and building activity.

Highlights:

Breakdown of lighting fixtures sales in Asia Pacific by distribution channels. Sector estimate, 2017, 2019 and 2021. Percentage share in value

The lighting fixtures market in Asia Pacific (7 countries considered, in alphabetical order: Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam) was estimated to worth US$ 6,264 million at factory prices, for the year 2021.

The above mentioned value does not include lamps (Conventional and LED lamps), which are estimated to worth an additional US$ 1,533 million, while the overall lighting turnover (fixtures + lamps) is around US$ 7.8 billion.

Over 60% the share of LED based lighting fixtures.

Around 3% of these luminaires and lamps are today connected, but this share could easily to reach somewhat 10% in a 3-4 year span.

Top 50 players hold almost 40% of the lighting fixtures market in Asia Pacific.

Among the major players: Eve, Hannochs, Hansol, Ledvance, L&E, Maltani, Panasonic, Rang Dong, Signify, Tan Phat, Tospo. These players register an average 6% sales growth during 2021.

South Korea is by far the main market in the region (US$ 2.3 billion), followed by Vietnam and Thailand.

Vietnam is the country with an higher share of trade (both exports and imports). An increasing share of the Asian Pacific market for lighting fixtures is handled on a Project basis.

Selected Companies

Alto Lighting, Aplico, Artemide, Artolite, AZ E-Lite, Azcor Lighting, Boonthavorn Lighting, CARA Lighting, Changi Light, Chor Rungsang Lighting, Chunil, Davico, Dien Quang Lamp, Dongmyung Lighting - Raat, Duc Hau Long, Eglo, ELM Lighting, Erco, EVE Lighting, Fagerhult, Fluxlite, Focus Vina, Fokus Indo Lighting, Fosera Lighting, FSL Lighting, Fumaco, Goodlite, Hannochs, Hanssem, Hapulico Lighting, Hikari, Honyar, Hori Lighting, Kangsan Lighting, Krisbow, Kum Kang Electric, L&E Lighting and Equipment, Lamptan, Leedarson, LeKise, Ligman, Lumens, Maltani Lighting, MLS - Ledvance, Neo-Neon, NVC, Opple, PAK Lighting, Rang Dong, RZB, Saka Lighting, Signify, Solarens Ledindo, Sunil Elecomm, Tan Phat, Ushio Lighting, Wooree Lighting, XaLoTho, Yankon, Zumtobel.

Table of Contents

- Lighting market in Asia Pacific (7 Countries) - Lighting industry at a glance: Lighting fixtures production, international trade and consumption; trade and consumption of Lamps, estimates of total lighting market.

- Lighting market forecasts up to 2025, by country and for Asia Pacific as a whole

- Competitive system: the top players. Estimated sales data and market shares of the leading companies for: Total Lighting, Lamps, Lighting fixtures, Residential/ Consumer, Commercial/ Architectural, Industrial and Outdoor Lighting markets, LED-based lighting. Short company profiles.

- Breakdown of lighting fixtures sales by style, products type, applications, distribution channels for a sample of companies and sector estimates.

- Lighting demand in a selected sample of Asian-Pacific cities

- COUNTRY ANALYSIS: Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam

For each country considered:

- Market size, activity trend and forecast: lighting fixtures time series on production, consumption and international trade. Forecast on the trend of the lighting market and selected economic indicators.

- International trade: export and import flows of lighting fixtures by country and by geographical area of destination/origin, and data on international trade of lamps.

- Competitive system: estimated lighting sales data and market shares among the major local and international players present in each market, as well as short company profiles

- Light sources: LED lighting segment versus conventional lighting sources

- Distribution: overview of the main distribution channels and selection of architectural companies involved in the lighting business and lighting design studios. Lighting demand in selected cities

- Economic indicators: data and forecasts for selected economic indicators