|

市場調查報告書

商品編碼

1135125

歐洲家庭辦公家具市場Home Office Furniture Market in Europe |

||||||

遠程工作正在從根本上改變家庭和工作環境,並且正在成為一種設計比以往更多的混合空間的綜合方式。 COVID-19 大流行為雇主和僱員創造了更大的靈活性,使他們能夠在不同的地點工作,在家和辦公室之間移動。

本報告分析了歐洲家庭辦公家具市場,包括整體市場規模和未來前景、按地區和產品類別劃分的詳細趨勢、基本市場結構、主要驅動因素和主要參與者。除了調查概況外,我們還在還要考慮遠程工作的普及和使用趨勢以及對家庭辦公家具市場的影響(使用的家具、產品滿意度、購買過程等)。

亮點

您通常在哪裡工作?

受訪者細分

歐洲家庭辦公家具市場現在價值 22 億歐元(基於最終用戶價格)。這是一個蓬勃發展的行業,尤其是在 2020 年之後,由於對定期或偶爾在家工作的人的需求增加。德國是歐洲最大的家庭辦公家具市場,其次是英國和法國。

隨著對家庭辦公家具及設備的投資增加,參與家庭辦公用品業務的公司包括傳統辦公家具製造商、家居家具製造商、軟體家具製造商、辦公椅製造商、RTA家具製造商等,分佈在不同的品類.

分析的主要公司

本報告涵蓋的主要歐洲家庭辦公家具製造商和分銷商:ACTIU、Actona、Alsapan、亞馬遜、Arper、Bisley、BoConcept、Bolia、BRW Black Red White、Composad. srl、Conforama、 DAMS 家具、Duphin、Estel、Fellows、Flokk、Forte、Gautier、Habitat、Haworth、Home24、宜家、Interstuhl、Leroy Merlin、Made.com、Maisons du Monde、Marks and Spencer、Martela、Miller-Knoll、Nowy Styl、Parisot , Sedus Stoll, Steelcase, Szynaka, Tecno, Topstar, Tvilum, USM, Vitra, Vivonio

內容

分析方法和執行摘要

第一章基礎資料

- 市場趨勢和數據:按國家/地區分類

- 歐洲家庭辦公家具:市場規模(基於最終用戶價格)

- 家用辦公家具/辦公家具/家用家具的消費

- 家用辦公家具市場:按地區劃分

- 家庭辦公家具消費量:按國家/地區分類

- 家庭辦公家具消費量,預測

第 2 章家用辦公家具:按地區和國家劃分的業務成果

- 北歐(丹麥、芬蘭、挪威、瑞典)

- 北歐家庭辦公家具消費

- 遠程工作和宏觀經濟指標

- 西歐(比利時、法國、荷蘭、英國)

- DACH(奧地利、德國、瑞士)

- 南歐(希臘、意大利、葡萄牙、西班牙)

- 中歐和東歐(保加利亞、克羅地亞、塞浦路斯、捷克共和國、愛沙尼亞、匈牙利、立陶宛、拉脫維亞、馬耳他、波蘭、羅馬尼亞、斯洛伐克、斯洛文尼亞)

第 3 章需求驅動因素

- 歐洲辦公室佔用和靈活的辦公空間

- 家庭工作者

第 4 章分銷和產品

- 家居辦公家具零售系統

- 辦公家具與家用辦公家具的比較

- 按地區和國家/地區劃分的比例和分佈

- 產品

- 家用辦公家具:按產品細分(座椅、書桌、櫥櫃/其他家具)

第 5 章競爭體系:歐洲家庭辦公家具公司

- 市場特徵和集中度

- 歐洲領先的家用辦公家具經銷商

- 樣品經銷商的銷售

- 歐洲領先的家用辦公家具製造商

- 樣品製造商的銷售

第 6 章遠程辦公:CSIL 分析結果

- 示例

- 混合工作方式:工作場所、家庭和辦公空間

- 遠程辦公:適應房間、遠程辦公方式和家庭環境的變化

- 家具:座椅、書桌、工作工具、儲物用品

- 對家庭辦公環境的滿意度

- 購買流程:購買的家庭辦公產品、預算、渠道、購買意向

附錄:提及的公司列表 - 活動、產品/專業、聯繫信息等。

Remote working is becoming a consolidated method, which is radically changing the connection between home and work environments and taking to the design of ever more hybrid spaces. The pandemic led to increased flexibility for both employers and employees, allowing people to work from different places, with the working week split between home and the office.

The new edition of the CSIL report "Home office furniture market in Europe" analyses the evolution of the working from home furniture segment, present scenario and growth prospects, and it is structured in two parts:

PART 1. HOME OFFICE FURNITURE IN EUROPE: BASIC DATA, BUSINESS PERFORMANCE AND COMPETITION

This part deals with the market size at end-user prices and forecasts of the home office furniture sector in Europe, demand drivers, estimated sales by country, leading manufacturers and distributors.

The “Home office furniture consumption in Europe” is provided by geographical area (Northern Europe, Western Europe, Central Europe DACH, Southern Europe, Central-Eastern Europe) divided according to their geographical proximity and similarity in market characteristics, and by European markets.

Distribution of home office furniture in Europe: shares and evolution of the distribution channels (Office Furniture Dealers, Home Furniture Dealers, Large Scale Retail, E-commerce, DIY, Other), estimated sales of home office furniture for 70 selected leading distributors in Europe and short profiles of the main players.

Breakdown of the Home office furniture market in Europe by product segment (Seats, Desks, Cabinets/Other furnishings)

Competition: market features, concentration and leading manufacturers of home office furniture with total revenues and estimated sales in home office for a sample of 75 leading furniture and office furniture manufacturers in Europe and short profiles of selected companies and insights on how marketing policy and logistic system have been re-addressed in order to achieve the home-office furniture business.

PART 2. WORKING FROM HOME. THE END-USER EXPERIENCE

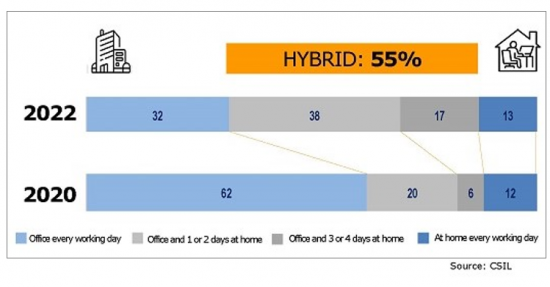

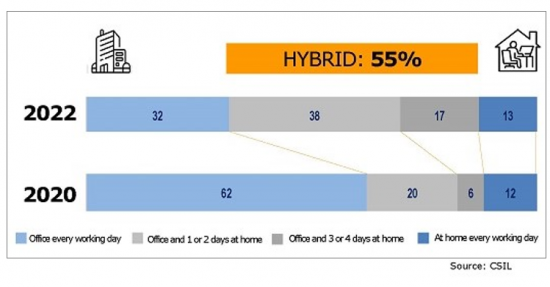

In the period May-July 2022, CSIL conducted a survey on a sample of end-users, of different ages and occupations, collecting the opinions of over 400 respondents from all over Europe. A previous survey to a similar target and geography has been made in mid-2020. Results of both surveys are shown to show changes that have occurred in the meantime.

The survey goes in-depth into the following aspects:

- Hybrid working: Usual working location and teleworking;

- Modifications of the domestic space and rooms used while working from home;

- Furniture used in the home workstations;

- Level of satisfaction with the home office environment (internet connection, sound/noise, privacy, lighting, desking seating);

- Purchasing process (home office products purchased, budget spent, channels and retail brands).

KEY QUESTIONS ANSWERED IN THIS STUDY:

- What is the home office furniture market size in Europe?

- What is the incidence of this segment in the European countries?

- What are the products involved and their features?

- What companies produce and sell for this segment?

CONSIDERED PRODUCTS: Seating (Swivel chairs with or without castors used for home offices, other kind of ergonomic chairs), Standard desks (Desks of different dimensions like the ones used in offices, free-standing or wall-mounted desks or part of a cabinet/bookcases system), HAT (Height Adjustable Tables or 'sit-stand' desks), Small home office desks (Desks of small dimension with integrated storage or not), Cabinets and Storage (Bookcases, pedestals, single cabinets, cabinet systems).

GEOGRAPHICAL AREA COVERED:

- Northern Europe (Denmark, Finland, Norway and Sweden)

- Western Europe (Belgium-Lux, France, Ireland, Netherlands and the United Kingdom)

- Central Europe DACH (Germany, Austria and Switzerland)

- Southern Europe (Greece, Italy, Portugal and Spain)

- Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovakia, Slovenia)

Highlights:

Where do you work, normally?

Breakdown of respondents

The home office furniture market in Europe currently amounts to EUR 2.2 billion at end-user prices. It is a booming segment whose growth results from the increasing demand by people working from home, regularly or occasionally, especially since 2020. Germany is the largest home office furniture market in Europe, followed by the United Kingdom and France.

With the disposition to invest more in home office furniture and equipment, the number of actors participating in the home office supply business multiplies into different categories: traditional manufacturers of office furniture, home furniture, upholstered furniture, office chairs, and RTA furniture producers.

Selected companies mentioned:

Among the Home office furniture manufacturers and distributors in Europe, this report includes the following ones: ACTIU, Actona, Alsapan, Amazon, Arper, Bisley, BoConcept, Bolia, BRW Black Red White, Composad srl, Conforama, DAMS Furniture, Dauphin, Estel, Fellowes, Flokk, Forte, Gautier, Habitat, Haworth, Home24, IKEA, Interstuhl, Leroy Merlin, Made.com, Maisons du Monde, Marks and Spencer, Martela, Miller-Knoll, Nowy Styl, Parisot, Sedus Stoll, Steelcase, Szynaka, Tecno, Topstar, Tvilum, USM, Vitra, Vivonio.

TABLE OF CONTENTS

METHODOLOGY AND EXECUTIVE SUMMARY

1. BASIC DATA

- 1.1. Market evolution and figures by country

- Home Office Furniture in Europe. Market size at end-user prices

- Consumption of Home Office Furniture, Office furniture and Home Furniture

- Home Office Furniture market by geographical region

- Home office furniture consumption by country

- 1.2. Consumption of Home Office Furniture, forecasts

2. HOME OFFICE FURNITURE: BUSINESS PERFORMANCE BY GEOGRAPHICAL REGION AND COUNTRY

- 2.1. Northern Europe (Denmark, Finland, Norway, Sweden)

- Home office furniture consumption in Northern Europe

- Remote working and macroeconomic indicators

- 2.2. Western Europe (Belgium, France, Netherland, United Kingdom)

- Home office furniture consumption in Western Europe

- Remote working and macroeconomic indicators

- 2.3. DACH (Austria, Germany, Switzerland)

- Home office furniture consumption in DACH region

- Remote working and macroeconomic indicators

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- Home office furniture consumption in Southern Europe

- Remote working and macroeconomic indicators

- 2.5. Central Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovakia, Slovenia)

- Home office furniture consumption in Central Eastern Europe

- Remote working and macroeconomic indicators

3. DEMAND DRIVERS

- 3.1. European office take-up and flexible office spaces

- 3.2. Home-based workers

4. DISTRIBUTION AND PRODUCTS

- 4.1. Home office furniture retail system

- Office furniture and Home Office furniture comparison

- Percentage shares and distribution by geographical area and countries

- 4.2. Products

- Home office furniture by product segment (Seats, Desks, Cabinets/Other furnishings)

5. COMPETITIVE SYSTEM: HOME OFFICE FURNITURE PLAYERS IN EUROPE

- 5.1. Market features and concentration

- 5.2. Leading distributors of home office furniture in Europe

- Sales in a sample of leading distributors of home office furniture

- 5.3. The leading manufacturers of home office furniture in Europe

- Sales in a sample of leading manufacturers of home office furniture

6. WORKING FROM HOME: RESULTS OF THE CSIL SURVEY

- 6.1. The sample

- 6.2. Hybrid working: Working location, Home and Office spaces

- 6.3. Working from home: Rooms, Changes to accommodate WFH practices and Home environment

- 6.4. Furniture: Seating, Desking, Work tools and Storage products

- 6.5. Level of satisfaction with the home office environment

- 6.6. The purchasing process: Home office purchased, budget, channels and intention to buy