|

市場調查報告書

商品編碼

1341917

泰國服裝製造業:2023-2032Thailand Garment Manufacturing Industry Research Report 2023-2032 |

||||||

泰國是東南亞第二大經濟體,人均GDP約6,600美元,定位為中高收入國家。 到2022年底,該國人口將達到7080萬,勞動力成本低廉,勞動力充足。 15歲及以上的勞動人口超過4024萬,最低日工資約為10美元。

泰國紡織業擁有廣泛的價值鏈,有2000多家服裝和紡織公司主要集中在曼谷和泰國東部。 該行業對泰國的國內生產總值和出口收入發揮著至關重要的作用。 泰國在家用紡織品的生產、設計和營銷方面表現出色,作為絲綢和紗線製造國而享譽全球。 此外,我們在符合國際標準的環保整理、染色和印花服務方面表現出色,但仍有進一步改進的空間。

泰國紡織產品主要出口到美國、日本、英國、俄羅斯和中國。 由於COVID-19期間外部需求減少,作為國家經濟促進力的紡織和服裝行業在2020年經歷了低迷。 大約 3,000 家工廠已轉向生產口罩和個人防護裝備,以應對經濟危機。 然而,泰國紡織業在2021年復蘇並恢復了全部製造能力,泰國的服裝廠和紡織廠以100%的製造能力重新啟動運營。 2021年和2022年,由於越南、柬埔寨、印度尼西亞、印度、歐洲和美國等服裝生產地區的需求,泰國對美國的服裝出口激增。

2021年,隨著疫情影響消退,泰國開始放鬆監管措施。 因此,泰國紡織服裝業出口在2021年和2022年迅速恢復。 歷年紡織品服裝出口額分別為65.26億美元和68.5億美元,比上年增長13.53%和4.96%。

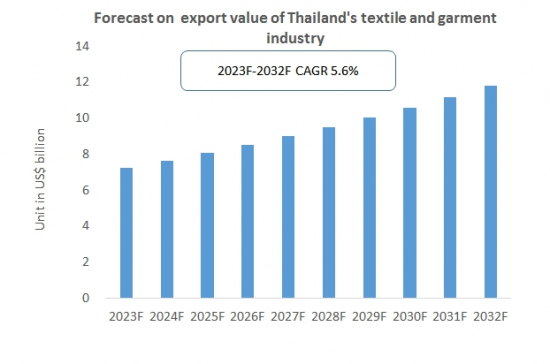

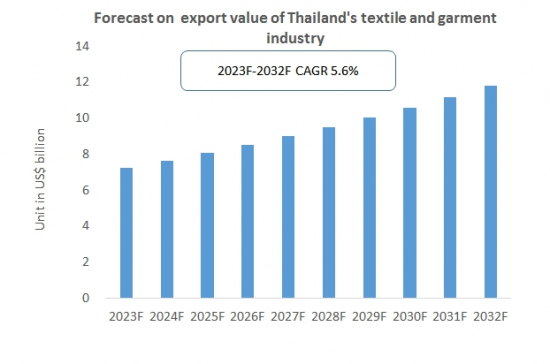

總體而言,在全球紡織服裝行業向東南亞轉移的推動下,全球服裝市場蘊藏著巨大的商機,並處於穩步上升的軌道。 泰國紡織服裝業在泰國政府的支持和推動下正在快速發展,前景廣闊。 預計2032年泰國紡織品和服裝出口額將增長至118億美元,2023年至2032年復合年增長率為5.6%。

本報告對泰國服裝製造業進行調查,分析泰國服裝行業的經濟和政策環境、市場影響因素和市場機會、市場規模趨勢和預測,並對主要服裝企業進行分析等進行總結。

目錄

第 1 章泰國服裝產業發展概況

- 定義和分類

- 主要產品分析

- COVID-19 感染對泰國服裝業的影響

第 2 章泰國服裝製造業分析:2018-2023

- 泰國服裝業發展環境

- 經濟環境

- 政策環境

- 社會環境

- 泰國服裝供應分析:2018-2022

- 泰國服裝行業主要外資來源分析

- 服裝製造

- 泰國市場服裝需求分析

- 服裝的主要消費群體

- 泰國國內服裝市場規模

第 3 章泰國紡織服裝行業進出口分析

- 導入

- 原材料進口

- 主要進口來源

- 導出

- 泰國服裝業出口分析

- 主要出口目的地

第 4 章泰國服裝行業競爭狀況

- 進入泰國服裝業的壁壘

- 政府政策

- 銷售渠道

- 品牌牆

- 泰國服裝業的競爭結構

第 5 章泰國服裝製造業成本與價格分析

- 泰國服裝製造成本分析:2018-2022

- 原材料成本

- 人員成本分析

- 泰國服裝價格分析

第 6 章泰國主要服裝製造企業概況

- Toray Industries (Thailand) Co. Ltd. Toray Group

- NaRaYa

- Jaspal

- Thai Wacoal

- Disaya

第 7 章泰國服裝製造業展望:2023-2032

- 影響泰國服裝製造業發展的因素

- 促進因素/市場機會

- 威脅/挑戰

- 展望/市場機會

- 預測競爭格局

- 供應預測

- 原材料進口預測

- 服裝出口預測

- 需求預測

- 整體市場需求預測

- 需求預測:按不同類別

Thailand, as the second-largest economy in Southeast Asia, boasts a per capita GDP of approximately US$6,600, positioning it as a middle to high-income country. The country's population stood at 70.8 million by the end of 2022, and it possesses a robust labor force characterized by low labor costs. With over 40.24 million people aged 15 and above in the workforce, Thailand sustains a minimum daily wage of approximately US$10.

SAMPLE VIEW

The textile industry in Thailand encompasses a comprehensive value chain, with more than 2,000 apparel and textile companies operating, primarily concentrated in Bangkok and eastern Thailand. This sector plays a pivotal role in contributing to the country's GDP and export earnings. Thailand stands out for its proficiency in the production, design, and marketing of home textiles, earning a global reputation as a silk producer and yarn manufacturer. Moreover, the nation excels in eco-friendly finishing, dyeing, and printing services that meet international standards, although there is room for further improvement.

Thailand's textile exports are primarily directed towards the United States, Japan, the United Kingdom, Russia, and China. The country's two economic drivers, the textile and garment industry, experienced a downturn in 2020 due to reduced foreign demand during the COVID-19 pandemic. Approximately 3,000 factories pivoted to producing masks and PPE protective clothing to survive the economic challenges. However, the Thai textile industry rebounded in 2021, restoring production to full capacity, and Thai garment and textile factories resumed operations at 100% capacity. The years 2021 and 2022 witnessed a surge in Thailand's apparel exports to the United States, driven by demand from apparel-producing regions like Vietnam, Cambodia, Indonesia, India, Europe, and U.S. garment factories.

In 2021, Thailand began relaxing control measures as the pandemic's impact waned. This, in turn, led to a rapid recovery of Thailand's textile and apparel industry exports in 2021 and 2022. During these years, textile and apparel exports amounted to US$6,526 million and US$6,850 million, respectively, representing year-on-year increases of 13.53% and 4.96%.

Overall, the global garment market presents substantial opportunities, with a steady upward trajectory fueled by the relocation of the global textile and apparel industry to Southeast Asia. Thailand's textile and apparel sector is experiencing rapid growth, supported and promoted by the Thai government, suggesting a promising future. CRI anticipates that Thailand's textile and apparel exports will reach US$11.8 billion by 2032, with a Compound Annual Growth Rate (CAGR) of 5.6% from 2023 to 2032.

Topics covered:

- Thailand Garment Industry Overview

- The economic and policy environment of the Thai garment industry

- What is the impact of COVID-19 on the Thai garment industry?

- Thailand Garment Industry Market Size 2018-2022

- Analysis of major Thai garment companies

- Key Drivers and Market Opportunities in Thailand's Garment Industry

- What are the key drivers, challenges and opportunities for the Thai garment industry during the forecast period 2023-2032?

- Which are the key players in the Thailand Garment Industry market and what are their competitive advantages?

- What is the expected revenue of Thailand Garments Industry market during the forecast period of 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Thailand Garment Industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the Thai garment industry?

Table of Contents

1 Overview of the Development of Thailand's Garment Industry

- 1.1 Definitions and Classifications

- 1.2 Analysis of Major Products

- 1.3 Impact of COVID-19 on Thailand's Garment Manufacturing Industry

2 Analysis on Garment Manufacturing Industry in Thailand, 2018-2023

- 2.1 Development Environment of Thailand's Garment Industry

- 2.1.1 Economic Environment

- 2.1.2 Policy Environment

- 2.1.3 Social Environment

- 2.2 Thailand Garment Supply Analysis 2018-2022

- 2.2.1 Analysis of Major Foreign Investment Sources in Thailand's Garment Manufacturing Industry

- 2.2.2 Clothing Production

- 2.3 Thailand Market Demand Analysis for Garment

- 2.3.1 Major Consumer Groups of Clothing

- 2.3.2 Size of Thailand's Domestic Garment Market

3 Thailand Textile and Clothing Industry Import and Export Analysis

- 3.1 Imports

- 3.1.1 Import of Raw Materials

- 3.1.2 Main Sources of Imports

- 3.2 Exports

- 3.2.1 Export Analysis of Thailand's Garment Industry

- 3.2.2 Main Export Destinations

4 Competition Status of Garment Manufacturing Industry in Thailand

- 4.1 Barriers to Entry in Thailand's Clothing Industry

- 4.1.1 Government Policies

- 4.1.2 Sales Channels

- 4.1.3 Brand Barriers

- 4.2 Competitive Structure of Thailand's Garment Manufacturing Industry

- 4.2.1 Bargaining Power of Raw Material Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Competition within the Garment Industry

- 4.2.4 Potential Entrants

- 4.2.5 Alternatives

5 Analysis on Cost and Price in Garment Manufacturing Industry in Thailand

- 5.1 Thailand Garment Manufacturing Cost Analysis 2018-2022

- 5.1.1 Cost of Raw Materials

- 5.1.2 Labor Cost Analysis of Thailand's Garment Manufacturing Industry

- 5.2 Thailand Clothing Price Analysis

6 Overview of Major Garment Manufacturing Companies in Thailand

- 6.1 Toray Industries (Thailand) Co. Ltd. Toray Group

- 6.1.1 Business Profile

- 6.1.2 Main Products

- 6.1.3 Modes of Operation

- 6.2 NaRaYa

- 6.2.1 Business Profile

- 6.2.2 Main Products

- 6.2.3 Modes of Operation

- 6.3 Jaspal

- 6.3.1 Business Profile

- 6.3.2 Main Products

- 6.3.3 Modes of Operation

- 6.4 Thai Wacoal

- 6.4.1 Business Profile

- 6.4.2 Main Products

- 6.4.3 Modes of Operation

- 6.5 Disaya

- 6.5.1 Business Profile

- 6.5.2 Main Products

- 6.5.3 Modes of Operation

7 Thailand Garment Manufacturing Outlook, 2023-2032

- 7.1 Factors Influencing the Development of Thailand's Garment Manufacturing Industry

- 7.1.1 Drivers and Market Opportunities in Thailand Garment Manufacturing Industry

- 7.1.2 Threats and Challenges Facing Thailand's Garment Manufacturing Industry

- 7.1.3 Industry Prospects and Market Opportunities

- 7.2 Competitive Landscape Forecast for Thailand Garment Manufacturing Industry

- 7.3 Supply Forecast of Garment Manufacturing in Thailand, 2023-2032

- 7.3.1 Thailand Garment Manufacturing Raw Material Import Forecast 2023-2032

- 7.3.2 Thailand's Garment Export Forecast 2023-2032

- 7.4 Thailand Garment Manufacturing Market Demand Forecast 2023-2032

- 7.4.1 Overall Market Demand Forecast for Garment Manufacturing in Thailand, 2023-2032

- 7.4.2 Demand Forecast for Thailand Garment Manufacturing Segment 2023-2032

List of Charts

- Chart Classification of Garment Manufacturing

- Chart Garment Manufacturing Industry Chain Analysis

- Chart Garment Manufacturing Raw Materials Source Analysis

- Chart Thailand's Textile and Garment Exports, 2018-2022

- Chart Product Sales Revenue of Textile Industry in Thailand 2018-2022

- Chart 2018-2022 Textile Fiber Production in Thailand

- Chart 2018-2022 Thailand Garment Manufacturing Apparent Consumption Analysis

- Chart Toray Industries (Thailand) Co. Ltd. Toray Group Basic Information

- Chart NaRaYa Basic Information

- Chart Jaspal Basic Information

- Chart Thai Wacoal Basic Information

- Chart Disaya Basic Information

- Chart 2023-2032 Thailand Cotton Import Forecasts

- Chart 2023-2032 Forecast of Thailand's Garment Exports