|

市場調查報告書

商品編碼

1364091

SDS(軟體定義衛星):第三版Software-Defined Satellites, 3rd Edition |

||||||

由於整個價值鏈的技術進步,衛星產業的容量需求和容量正在激增。 這種成長是由不斷變化的客戶需求和季節性波動推動的,推動了地面、雲端和衛星網路管理的創新。 為了保持競爭力並獲得市場優勢,營運商和製造商正在轉向 SDS(軟體定義衛星)作為設計的關鍵轉變。

全球連接和多樣化網路應用對衛星星座的需求不斷增長,正在推動衛星製造的成長。 這種成長的特點是硬體標準化和軟體功能增強,重點是模組化和適應性強的平台。 雖然非 GEO 星座演變成複雜的網絡,但 GEO 衛星有助於更好地協調軌道和頻段。 這些多樣化的需求帶來了機遇,例如發射後自適應任務設定檔、以客戶為中心的要求、託管有效負載和衛星即服務 (SataaS)。

主要功能

預測資料

- 世界

- GEO 訂單/製造收入

- GEO 發射次數/發射收入

- 非 GEO 訂單數量/製造收入

- 非 GEO 發射次數/發射收入

上市公司

- Airbus

- Amazon

- Astranis

- Boeing

- E-space

- Intelsat

- Lockheed Martin

- OneWeb, Saturn Satellite,

- SDA

- SES

- SpaceX

- SWISSto12

- Telesat

- Thaicom

- Thales

- Alenia Space

本報告研究了未來 10 年對 GEO 和非 GEO SDS(軟體定義衛星)的需求,包括主要趨勢、訂單、製造收入、發射、發射收入以及製造商和營運商的策略。我總結。

目錄

第 1 章執行摘要

第二章世界趨勢

- 全球範圍內:超過 23,000 個訂單和發布,預計到 2032 年將產生 900 億美元的收入機會

- GEO:訂單接近 200 個,累計製造和上市收入到 2032 年將達到 520 億美元

- 非 GEO:2032 年 23,000 筆訂單累計收入將達到 380 億美元

- 全球範圍內:由於延誤、缺貨和數量減少,短期收入下降

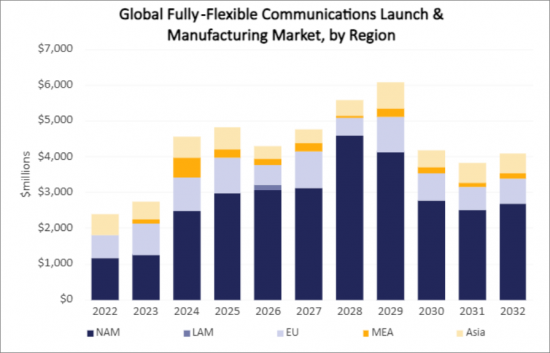

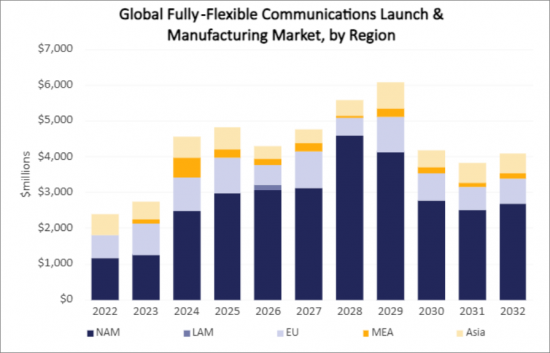

- 全球:2032年北美和亞洲將佔全球柔性通訊衛星製造收入的近47%

第 3 章製造商和營運商策略

- 當前市場狀況

- 趨同趨勢

- 客戶需要客製化服務來增強服務並保持策略優勢,從而推動 SDS 的採用

- 行動性為 SDS 部署帶來了更高的靈活性要求

- SDS 的採用受到新車隊策略、機會和成長的推動,但受到複雜性和轉換成本的阻礙

- SDS平台

- SDS:決策樹案例研究

第 4 章附錄

第 5 章關於作者與 Analysys Mason

Report Summary:

NSR's “Software-Defined Satellites, 3rd Edition (SDS3) ” report analyzes global demand for flexible, software-defined satellites for GEO & Non-GEO over the next decade.

The satellite industry is witnessing a surge in capacity demand and capabilities due to technological advancements throughout its value chain. This growth is driven by changing customer needs and seasonal fluctuations, prompting innovations in ground, cloud, and satellite network management. To stay competitive and achieve market dominance, operators and manufacturers are turning to software-defined satellites as a significant shift in design. NSR's “Software-Defined Satellites, 3rd Edition” report offers an in-depth analysis of this market trend, highlighting key manufacturers, their offerings, and the impact on satellite communications over the next decade.

The rising demand for satellite constellations, aimed at global connectivity and diverse network applications, is fueling growth in satellite manufacturing. This growth is characterized by hardware standardization and enhanced software capabilities, emphasizing modular and adaptable platforms. While Non-GEO constellations are evolving into intricate networks, GEO satellites are fostering better coordination across orbits and frequency bands. This varied demand is opening doors for opportunities like adaptable mission profiles post-launch, customer-centric requirements, hosted payloads, and satellite-as-a-service, all of which could benefit from more versatile satellites.

NSR's “SDS3” answers critical questions regarding the Software Defined Satellite market:

- How are software-defined satellites transforming the current satellite communications market?

- What are the primary drivers behind the increasing demand for satellite constellations?

- How are GEO and Non-GEO satellites adapting to the changing demands of the industry?

- In what ways can more flexible satellites better cater to the emerging needs of the satellite market?

Who Should Purchase this Report:

- Investors and Financial Institutions

- Government Agencies

- Satellite Operators

- Satellite Manufacturers and Integrators

- Launch Service Providers

- Launch Vehicle Manufacturers

- Launch Brokers and Integrators

- Sub-system and Component Manufacturers

- Ground Systems Manufacturers and Service Providers

- Regulatory Agencies and Policy Makers

- Data Analytics Companies

- Anyone Seeking the Industry's Most Comprehensive and Actionable Analysis of Global Software-Defined Satellites

Key Features:

NSR's “Software-Defined Satellites, 3rd Edition (SDS3) ” report provides a comprehensive assessment of the market through an analysis of the communications application, further segmented into 5 regions across all satellite mass categories, all flexibility types, for both GEO and Non-GEO.

Analysis and Assessment Includes:

Forecast Data

- Global

- GEO Orders & Manufacturing Revenues

- GEO Launches & Launch Revenues

- Non-GEO Orders & Manufacturing Revenues

- Non-GEO Launches & Launch Revenues

Companies Mentioned in this Report:

Airbus, Amazon, Astranis, Boeing, E-space, Intelsat, Lockheed Martin, OneWeb, Saturn Satellite, SDA, SES, SpaceX, SWISSto12, Telesat, Thaicom, Thales, Alenia Space.

Table of Contents

Table of Contents

List of Exhibits

About this report

1. Executive Summary

2. Worldwide trends

- 2.1. Worldwide: 23,000+ orders and launches representing a $90 billion revenues opportunity by 2032

- 2.2. GEO: Nearly 200 orders, generating $52 billion in cumulative manufacturing & launch revenues by 2032

- 2.3. Non-GEO: 23,000 "orders" generating $38 billion in cumulative revenues by 2032

- 2.4. Worldwide: Delays, shortages, and lower mass drive down revenues in near-term

- 2.5. Worldwide: North America and Asia will together account for almost 47% of the total flexible communications satellite manufacturing revenue worldwide by 2032

3. Manufacturer & Operator Strategy

- 3.1. State of the Market

- 3.2. Converging Trends

- 3.3. Customers need for tailored offerings to strengthen service and maintain strategic advantage drives adoption of SDS

- 3.4. Mobility driving higher flexibility requirements for adoption of software defined satellites

- 3.5. The adoption of software-defined satellites is driven by new fleet strategies, opportunities and growth but restrained by complexity & switching costs

- 3.6. Software-Defined Satellite Platforms

- 3.7. Software-Defined Satellites: Decision Tree Case Study

4. Appendix

- 4.1. Market Forecasts

- 4.1.1. Global Communications

- 4.1.2. GEO Communications

- 4.1.3. Non-GEO Communications

- 4.2. Definitions

- 4.6 Definitions

- 4.7. Definitions and Overview - Regions and Verticals

- 4.8. Definitions - Acronyms

5. About the authors and Analysys Mason

- 5.1. About the authors

- 5.2. Global leaders in TMT management consulting

- 5.3. Our research services

- 5.4 Our areas of expertise

List of Exhibits

1. Executive Summary

- 1.1. Global Communications Satellites Flexibility

2. Worldwide trends

- 2.1. Global Communications Satellite Flexibility Market

- 2.2. Global Communications Orders, by Flexibility

- 2.3. GEO Communications Orders, by Flexibility

- 2.4. Non-GEO Communications Orders, by Flexibility

- 2.5. Non-GEO Communications Launch and Manufacturing Market, by Flexibility

- 2.6. Global Communications Satellite Flexibility Market Comparison

- 2.7. Global Communications Cumulative 2022-2032 Orders & Manufacturing Revenues

3. Manufacturer & Operator Strategy

- 3.1. GEO Communications Satellite Orders by Operator Region

- 3.2. 2022 GEO Communications Satellite Orders

- 3.3. 2023 GEO Communications Satellite Orders

- 3.4. Software-Defined Satellites: Converging Trends

- 3.5. Software-Defined Satellites: Converging Drivers

- 3.6. Operational requirements driving flexibility

- 3.7. On-board flexibility requirements by application

- 3.8. GEO Satellite Manufacturers Platforms - Flexibility Assessment

- 3.9 Non-GEO Constellations - Flexibility Assessment

- 3.10. GEO Operator Decision Tree

4. Appendix

- 4.1. Global Communications Orders, by Flexibility

- 4.2. Global Fully-Flexible Communications Launch & Manufacturing Market, by Region

- 4.3. Global Partially-Flexible Communications Launch & Manufacturing Market, by Region

- 4.4. GEO Communications Orders, by Flexibility

- 4.5. GEO Fully-Flexible Communications Launch & Manufacturing Market, by Region

- 4.6. GEO Partially-Flexible Communications Launch & Manufacturing Market, by Region

- 4.7. Non-GEO Communications Orders, by Flexibility

- 4.8. Non-GEO Fully-Flexible Communications Launch & Manufacturing Market, by Region

- 4.9. Non-GEO Partially-Flexible Communications Launch & Manufacturing Market, by Region

- 4.10. Characteristics of Software-Defined Satellites