|

市場調查報告書

商品編碼

1445873

國防衛星通訊 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Satellite Communication in the Defense Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

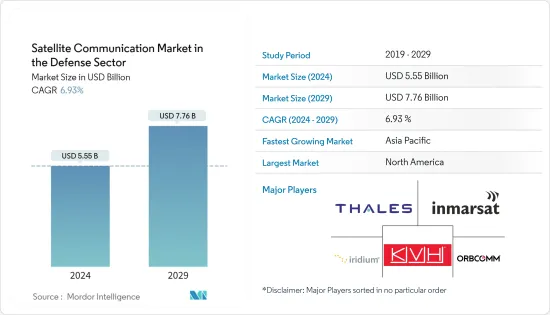

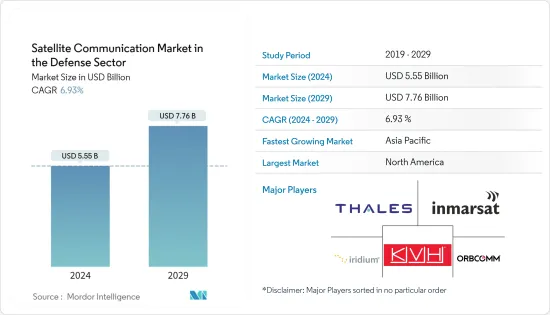

國防衛星通訊市場預計將從 2024 年的 55.5 億美元成長到 2029 年的 77.6 億美元,預測期內(2024-2029 年)CAGR為 6.93%。

主要亮點

- 衛星通訊正被用於國防工業的大量應用、寬頻覆蓋範圍的擴展、5G通訊系統的建立、各種有線和無線技術的整合和融合、地球觀測、國防和安全以及監視應用。

- 對寬頻通訊的需求正在快速成長,並且不限於單一地區。這種需求的例子就是使用者在固定地點和運動中運行的飛機、船舶和車輛上的連接要求。這三個平台需要在其旅行行程中保持持續的連接,這些行程經常經過大城市和人口稀少地區的服務不足部分。預計此類發展將促進市場擴張。

- 據衛星產業協會(SIA)稱,由於GNSS市場和網路設備的擴大,地面設備收入大幅成長,而客戶設備投資和資源則持平或略有下降,表明行動衛星通訊(MOST)將成為研究的整體市場的基本成長點。

- 由於發射衛星傳輸資料的整個過程高度敏感,網路安全已成為衛星通訊的主要關注點。此外,課題還在於此類網路安全威脅可能產生的負面影響,因為這些漏洞對任務至關重要。面臨網路安全威脅的關鍵任務漏洞包括發射系統、通訊、遙測、追蹤和指揮以及任務完成。衛星通訊在衛星的整個生命週期中對安全網路功能的過度依賴使其成為一個嚴重的問題,從而阻礙了其採用。

- 在大流行期間,可以看到通訊衛星為新部署的野戰醫院提供基本服務。在 COVID-19 期間,有幾個人得到了國防和軍隊的幫助。衛星還提供通訊服務以確保業務連續性,主要用於自助加油站、零售 POS 的信用卡/金融卡授權以及庫存管理。

國防部門衛星通訊市場趨勢

遙感驅動市場

- 遙感幫助國防、軍事和航空航太提供多種類型的資料。為了避免船舶撞上冰山時沉沒,航行船舶使用風浪資訊、航線分析、船舶接近度和 GPS 等遙感技術。許多衛星每天繞著地球運行,收集可用於定位遺失或損壞的飛機的資料。

- 幾千年來,遙感一直被用作一種監視方法。第一次世界大戰之前,遠端感測器已被使用,將它們連接到熱氣球並讓它們飛越目標城市。遙感是由具有多種功能的專用衛星進行的。光學衛星、雷達成像衛星、紫外線和紅外線成像衛星以及訊號攔截通訊衛星只是少數例子。

- 與傳統形式的監視相比,遙感具有顯著的優勢,因為它可以提供可見光以外的光波長的高解析度影像。這些資料還可用於追蹤敵軍行動、制定戰略決策和評估戰術威脅。

- 由於科學技術的快速發展以及軍事活動對其的依賴,對更大連接和更高解析度成像的需求超出了軍方使用軍方擁有的衛星技術的能力。美國軍方作為世界上最大的軍隊,從那時起就主要依賴商業衛星能力來實現軍事目的。

- 此外,未來幾年推動國防部門衛星通訊市場成長的主要因素之一是人工智慧在衛星通訊中在地基監視中的應用。此外,對遙感和監測應用不斷成長的需求,以及政府建立間諜衛星網路的計劃,將推動市場需求。海上安全風險的增加、國防部門投資的增加以及對世界許多地區政治不穩定的日益擔憂正在推動市場。

預計亞太地區成長率最高

- 該地區正在見證各種創新和研發投資,以加強國防組織的衛星通訊。例如,2021年12月,日本政府批准了2022年5.4兆日圓(472億美元)的國防開支。這筆資金也將用於購買新的國防裝備。

- 同樣,韓國也在大力加強防禦能力。 2022 年 4 月,韓國國防計畫管理局宣布開發隱形無人機、衛星和其他軍事裝備,以應對即將到來的威脅。該計劃是該國增強國防和安全能力政策優先事項的一部分。韓國已撥款 2,664 億韓元(2.2 億美元)支持新型隱形無人機和軍事資產的開發。

- 例如,印度是衛星節目最大的消費者之一,近年來在充分發揮視訊市場潛力方面取得了重大進展。儘管 DTH 在印度非常受歡迎,但 Reliance JIO 等企業的低成本選擇正在成為廣播領域的競爭對手。根據印度電信監理局統計,截至2021年9月,印度DTH服務用戶數為6,889萬戶;然而,這個數量正在逐漸減少。

- 據 IBEF(印度品牌股權基金會)稱,印度政府一直在嘗試增加機場數量,以適應不斷擴大的空中交通。截至 2020 年,印度有 153 個營運機場。到 2040 會計年度,印度計劃將營運機場數量增加到 190-200 個。此外,該行業不斷成長的需求也增加了現役飛機的數量。到2027年,飛機數量預計將達到1,100架。

- 由於對機上娛樂的投資不斷增加,全球航空衛星通訊 (SATCOM) 市場的定位是改善飛行營運和連接。印度和中國等國家預計將推動航空衛星通訊市場。

國防部門衛星通訊產業概況

衛星通訊市場由多個全球和區域參與者組成,由於許多大型參與者的存在,在競爭激烈的市場空間中爭奪注意力。該市場對新參與者設置了很高的進入壁壘,影響了獲得吸引力的機會。此市場的特點是產品差異化程度適中、產品滲透率不斷提高、競爭水準較高。一般來說,產品是作為硬體提供,使得該產品看起來像是產品服務的一部分。

- 2022 年1 月-泰雷茲(67%)和李奧納多(33%)的合資企業泰雷茲阿萊尼亞航太公司(Thales Alenia Space)表示,已與韓國航空航太和國防公司LIG Nex1 簽署契約,為其提供先進技術的數位處理器。GEO-KOMPSAT-3 通訊衛星。 Ka 波段靈活寬頻通訊系統有效負載包括一個高效、完全可重新編程的數位處理器,該處理器分別透過數位通道器單元 (DCU) 和板載處理單元 (OBPU) 部分結合透明和再生訊號處理。

- 2022 年 1 月 - 動態定位系統製造商 Navis Engineering 宣布提供 KVH Watch 服務,以實現設備的遠端監控;該公司宣布,海事動態定位 (DP) 控制系統製造商 Navis Engineering 已加入 KVH Watch 解決方案合作夥伴計劃,提供 KVH Watch 雲端連線服務。

- 2021 年 12 月 - Inmarsat 宣布發射其首顆 Inmarsat-6 衛星 I-6 F1。它是由三菱重工(MHI)從日本 JAXA 種子島太空中心發射的。這些衛星將為 ELERA 的變革性 L 波段服務提供增強的容量和新技術進步,以及額外的 Global Xpress (GX) 高速寬頻容量。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- 評估 COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 海上威脅增加與海上安全政策模糊

- 對軍事和國防衛星通訊解決方案的需求增加

- 市場限制

- 衛星通訊的網路安全威脅

- 對高成本衛星設備的依賴

第 6 章:市場區隔

- 依類型

- 地面設備

- 服務

- 依應用

- 監控與追蹤

- 遙感

- 災難復原

- 其他應用

- 依地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- Thales Group

- Inmarsat Communications

- Iridium Communications Inc.

- KVH Industries Inc.

- Orbcomm Inc.

- Cobham PLC

- Thuraya Telecommunications Company (Al Yah Satellite Communications Company PJSC)

- ViaSat Inc.

- ST Engineering iDirect

- L3Harris Technologies Inc.

第 8 章:投資分析

第 9 章:市場的未來

The Satellite Communication Market in the Defense is expected to grow from USD 5.55 billion in 2024 to USD 7.76 billion by 2029, at a CAGR of 6.93% during the forecast period (2024-2029).

Key Highlights

- Satellite communication is being used for a plethora of applications across the defense industry, an extension of broadband coverage, setting up of 5G communications systems, integration and convergence of diverse wired and wireless technologies, earth observation, defense and security, and surveillance applications.

- The need for broadband communications is growing at a fast pace, and it isn't limited to a single region. Connectivity requirements for users' aboard aircraft, ships, and vehicles operating at fixed places and in motion are examples of such demand. These three platforms require constant connectivity along their travel itineraries, which frequently pass through underserved portions of big cities and less populated areas. Such developments are projected to boost the market's expansion.

- According to the Satellite Industry Association (SIA), ground equipment revenues have increased significantly due to the expansion of GNSS markets and network equipment, while customer equipment investments and resources have remained flat or slightly declining, indicating that mobile satellite communication (MOST) will become a fundamental growth point of the overall market studied.

- Cybersecurity has become a major concern for satellite communication as the entire process of launching a satellite to transmit data is highly sensitive. Further, the challenge lies in the negative impact that such cybersecurity threats can potentially have as the vulnerabilities are mission-critical. The mission-critical vulnerabilities exposed to cybersecurity threats include the launch systems, communications, telemetry, tracking and command, and mission completion. The over-dependency of satellite communication on secure cyber capabilities across the lifespan of the satellite makes it a serious concern, thus, hindering its adoption.

- During the pandemic, communications satellites can be seen providing essential services to freshly deployed field hospitals. Several people were helped by the defense and military during COVID-19. Satellites also provided communication services to ensure business continuity, which was mostly used in self-serve petrol stations, credit/debit card authorizations for retail POS, and inventory management.

Defense Sector Satellite Communication Market Trends

Remote Sensing to Drive the Market

- Remote sensing aids defense, military, and aerospace in providing many types of data. To avoid sinking when a ship hits an iceberg, navigating ships use remote sensing technology such as wind-wave information, routing analysis, ship proximity, and GPS. Many satellites orbit the Earth every day, collecting data that can be useful in locating lost or destroyed aircraft.

- For millennia, remote sensing has been utilized as a surveillance method. Remote sensors were used before the First World War by connecting them to hot air balloons and flying them over target cities. Remote sensing is being carried out by specialized satellites with a wide range of capabilities. Optical satellites, radar imaging satellites, ultraviolet and infrared imagery satellites, and signal intercepting communication satellites are only a few instances.

- Remote sensing offers significant advantages over traditional forms of surveillance in that it may provide high-resolution imagery of light wavelengths other than visible light. This data can also be utilized to track enemy force movements, make strategic decisions, and assess tactical threats.

- The need for greater connection and higher-resolution imaging was beyond the military's ability to meet using military-owned satellite technologies due to the fast growth of science and technology and the dependency of military activities on it. The United States Military, being the world's largest military, has relied largely on commercial satellite capabilities for military purposes since then.

- Furthermore, one of the primary factors driving the satellite communication market growth in the defense sector over the next few years is the application of AI in satellite communication for earth-based surveillance. Furthermore, the rising demand for remote sensing and monitoring applications, as well as governments' plans to establish a network of spy satellites, will drive market demand. Increased seaborne security risks, increased defense sector investments, and growing concerns about political instability in many parts of the world are driving the market.

Asia-Pacific is Projected to Register the Highest Growth Rate

- The region is witnessing various innovations and investments in research and development to strengthen satellite communication in defense organizations. For instance, in December 2021, the Japanese government approved JPY 5.4 trillion (USD 47.2 billion) defense spending for 2022. The funding will also be used to buy new defense equipment.

- Similarly, South Korea is also rigorously strengthening its defense capabilities. In April 2022, The defense program administration of South Korea announced to development of stealth drones, satellites, and other military equipment to address upcoming threats. This plan is a part of the country's policy priorities to enhance its defense and security capabilities. South Korea has allocated KRW 266.4 billion (USD 220 million) to back the development of new stealth drones and military assets.

- India, for example, is one of the largest consumers of satellite programming and has made significant progress in recent years in realizing its full video market potential. Though DTH is immensely popular in India, low-cost options from businesses like Reliance JIO are becoming competitors in the broadcasting space. According to the Telecom Regulatory Authority of India, as of September 2021, there were 68.89 million DTH services subscribers in India; however, this volume is reducing gradually.

- According to the IBEF (Indian Brand Equity Foundation), the Government of India has been attempting to increase the number of airports to accommodate expanding air traffic. India had 153 operating airports as of 2020. By FY40, India plans to increase the number of operational airports to 190-200. Furthermore, the sector's growing demand has increased the number of planes in service. By 2027, the number of aircraft is predicted to reach 1,100.

- As a result of growing investment in in-flight entertainment, the global aviation satellite communication (SATCOM) market is positioned for improved flight operations and connectivity. Countries like India and China are expected to drive the aviation SATCOM market.

Defense Sector Satellite Communication Industry Overview

The satellite communication market comprises several global and regional players, vying for attention in a highly competitive market space due to the presence of many large players. The market poses high barriers to entry for new players, impacting the opportunities to be able to gain traction. This market is characterized by moderate product differentiation, increasing levels of product penetration, and high levels of competition. Generally, the product is offered as hardware, making the offering look like a part of the product's service.

- January 2022 - Thales Alenia Space, a joint venture between Thales (67%) and Leonardo (33%), stated that it had signed a contract with LIG Nex1 Co. Ltd, a South Korean aerospace and defense company, to provide an advanced technology Digital Processor for the GEO-KOMPSAT-3 communications satellite. The Ka-band Flexible Broadband Communication System payload includes an efficient, completely reprogrammable Digital Processor that combines transparent and regenerative signal processing via Digital Channelizer Units (DCU) and On-Board Processing Units (OBPU) portions, respectively.

- January 2022 - Navis Engineering, a dynamic positioning systems manufacturer, announced to offer KVH Watch services to enable remote monitoring of equipment; the company announced that Navis Engineering, maritime dynamic positioning (DP) control system manufacturer, has joined the KVH Watch Solution Partner program to offer KVH watch cloud connect services.

- December 2021 - Inmarsat announced the launch of its first Inmarsat-6 satellite, I-6 F1. It was launched by Mitsubishi Heavy Industries (MHI) from the JAXA Tanegashima Space Center in Japan. The satellites will offer enhanced capacity and new technological advances for ELERA's transformational L-band services, alongside additional Global Xpress (GX) high-speed broadband capacity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Seaborne Threats and Ambiguous Maritime Security Policies

- 5.1.2 Rise in Demand for Military and Defense Satellite Communication Solutions

- 5.2 Market Restraints

- 5.2.1 Cybersecurity Threats to Satellite Communication

- 5.2.2 Reliance on High-cost Satellite Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ground Equipment

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Surveillance and Tracking

- 6.2.2 Remote Sensing

- 6.2.3 Disaster Recovery

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thales Group

- 7.1.2 Inmarsat Communications

- 7.1.3 Iridium Communications Inc.

- 7.1.4 KVH Industries Inc.

- 7.1.5 Orbcomm Inc.

- 7.1.6 Cobham PLC

- 7.1.7 Thuraya Telecommunications Company (Al Yah Satellite Communications Company P.J.S.C)

- 7.1.8 ViaSat Inc.

- 7.1.9 ST Engineering iDirect

- 7.1.10 L3Harris Technologies Inc.