|

市場調查報告書

商品編碼

1439883

二氧化矽:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Silica - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

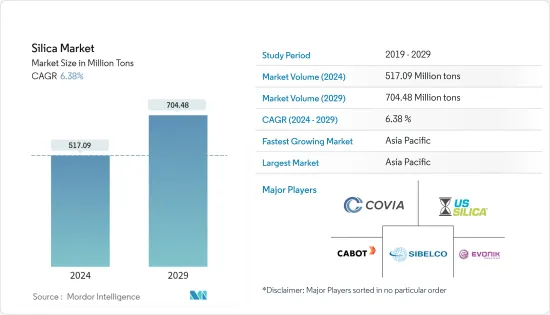

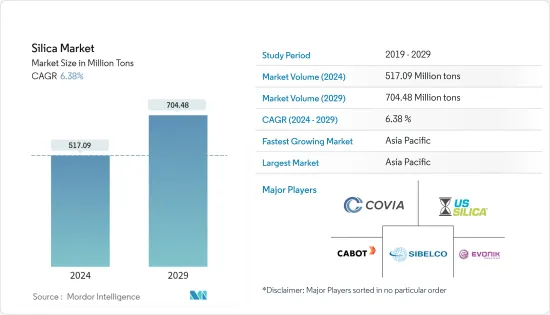

預計2024年二氧化矽市場規模為5,1709萬噸,預計2029年將達70,448萬噸,預測期(2024-2029年)複合年成長率為6.38%。

二氧化矽的主要消費領域是建設產業。隨著COVID-19感染疾病後一些建設活動的恢復,二氧化矽的需求正在重回正軌,預計這將使建設產業的二氧化矽市場保持平衡。優質混凝土使用量的增加預計也將在未來幾年推動市場發展。二氧化矽在電子產品中的使用是可能推動市場的另一個主要因素。

主要亮點

- 各種最終用戶對沉澱二氧化矽的需求不斷增加以及建設活動的快速擴張可能會推動二氧化矽市場的成長。

- 另一方面,替代產品的競爭預計將阻礙市場成長。

- 綠色輪胎的興起以及電動車和自動駕駛汽車的日益普及預計將在所研究的市場中創造新的機會。

- 由於中國、日本和印度的高需求,預計亞太地區將主導二氧化矽市場。

二氧化矽市場趨勢

建設產業的需求不斷成長

- 二氧化矽是各種建築和建築產品的主要成分之一。為了提高耐用性和結構完整性,全穀二氧化矽用於地板材料、砂漿、特殊水泥、屋頂瓦、瀝青混合物、防滑表面和其他工業材料。

- 亞太地區主導全球建設活動。由於建設增加,該地區已從 COVID-19 疾病的影響中迅速恢復,特別是在中國、印度、日本和印尼等國家。未來五年至2025年,中國將投資1.43兆美元用於大型建設計劃。

- 根據美國人口普查局和美國住房與城市發展部,截至 2021 年 12 月,獲得建築許可證授權的私人住宅單元總合1,873,000 套,經季節調整後的年成長率為 1,873,000 套。

- 與 2020 年 7 月相比,2021 年 7 月歐元區建築業產出成長 3.3%,歐盟建築業產出成長 3.8%。與 2020 年 11 月相比,2021 年 11 月的建築產量以歐元計算成長了 0.5%,以歐盟計算成長了 1.3%。

- 埃及政府計劃在年終前遷往開羅以東 30 英里的龐大「新行政首都」。新首都的建設是為了緩解開羅的交通堵塞,緩解交通堵塞,並為該國提供現代化的基礎設施。這個耗資 450 億美元的計劃包括新機場、政府辦公大樓、住宅、商業區和綠地。

- 所有上述因素都可能推動預測年內矽砂的需求。

亞太地區預計將主導市場

- 預計亞太地區將成為二氧化矽消費的主導市場,因為中國和印度在建築、建築、電子和玻璃製造等最終用戶產業中佔據市場主導地位。

- 中國的建築業正在迅速擴張。根據中國國家統計局預計,2021年中國建築業產值將達29.31兆元。

- 截至2025年的五年,中國計劃投資1.43兆美元用於重大建設計劃。據國家發展和改革委員會(NDRC)稱,上海計劃要求未來三年總投資387億美元。同時,廣州新簽基礎建設計劃16個,總金額80.9億美元。

- 未來7年,印度預計在住宅方面投資超過1.3兆美元,將建造6,000萬套新住宅。到 2024 年,經濟適用住宅供應量預計將增加約 70%。

- 為籌備 2025 年大阪世博會,日本建設產業預計將蓬勃發展。八重洲重建計劃包括一棟 61 層樓、390 公尺高的辦公大樓,預計分別於 2023 年和 2027 年竣工。

- 由於上述所有因素,預計亞太地區將在預測期內主導市場。

二氧化矽產業概況

二氧化矽市場是分散的,有國內和國際參與者。研究市場的主要企業(未指定)包括 Covia Holdings LLC、Silica 美國、Sibelco、Cabot Corporation 和 Evonik Industries AG。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 各種最終用途對沉澱二氧化矽的需求不斷增加

- 建設活動迅速擴大

- 抑制因素

- 替代產品的競爭

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 技術簡介

第5章市場區隔

- 類型

- 非晶質

- 熱原/發煙

- 水合作用

- 結晶

- 石英

- 鱗石英

- 方矽石

- 非晶質

- 最終用戶產業

- 建築與建造

- 頁岩油和天然氣

- 玻璃製造

- 水處理

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- AGSCO Corp.

- AMS Applied Material Solutions

- Cabot Corporation

- China-Henan Huamei Chemical Co. Ltd

- Covia Holdings Corporation

- Denka Company Limited

- Evonik Industries AG

- Heraeus Holding

- Kemitura Group AS

- Merck KGaA

- Madhu Silica Pvt. Ltd

- Mitsubishi Chemical Corporation

- Nouryon

- OCI COMPANY Ltd

- PPG Industries Inc.

- Sibelco

- Tokuyama Corporation

- US Silica

- Wacker Chemie AG

- WR Grace &Co.-Conn.

第7章市場機會與未來趨勢

- 綠色輪胎的崛起仍在繼續

- 擴大電動車和自動駕駛汽車的採用

The Silica Market size is estimated at 517.09 Million tons in 2024, and is expected to reach 704.48 Million tons by 2029, growing at a CAGR of 6.38% during the forecast period (2024-2029).

The primary consumer for silica is the construction industry; with the restart of a few construction activities after the COVID-19 pandemic, the demand for silica is coming back on track, Which is expected to balance the market for silica in the construction industry. Increasing high-quality concrete usage is also expected to drive the market in the upcoming years. The use of silica in electronics is another major factor that is likely to drive the market.

Key Highlights

- The increasing demand for precipitated silica for different end users and rapidly expanding construction activities are likely to drive the growth of the silica market.

- On the flip side, competition from substitute products is expected to hinder the market growth.

- The growing emergence of green tires and the increasing adoption of electric and self-driving cars are expected to unveil new opportunities for the market studied.

- Asia-Pacific is expected to dominate the silica market due to the high demand from China, Japan, and India.

Silica Market Trends

Increasing Demand from the Building and Construction Industry

- Silica is one of the primary components in various building and construction products. For improved durability and structural integrity, whole-grain silica is used in flooring, mortars, specialty cement, roofing shingles, asphalt mixtures, skid-resistant surfaces, and other industrial materials.

- The Asia-Pacific region is dominating construction activities across the world. The area is registering a fast recovery after the COVID-19 impact, due to increasing construction in China, India, Japan, and Indonesia, among others. China is investing USD 1.43 trillion in significant construction projects in the next five years till 2025.

- According to the US Census Bureau and the US Department of Housing and Urban Development, privately-owned residential units permitted by building permits totaled 1,873,000 in December 2021, a seasonally adjusted annual rate of 1,873,000.

- Building output increased by 3.3% in the eurozone and 3.8% in the EU in July 2021 compared to July 2020. In November 2021, construction output increased by 0.5% in the euro and 1.3% in the EU compared to November 2020.

- The Egyptian government plans to relocate to a vast "New Administrative Capital" 30 miles east of Cairo by the end of 2022. The new capital is being built to relieve Cairo's overcrowding, reduce traffic congestion, and provide the country with modern infrastructure. The USD 45 billion projects will include a new airport, government offices, residential areas, business districts, and green spaces.

- All the above factors will likely propel the demand for silica sand during the forecast years.

Asia-Pacific Region Expected to Dominate the Market

- The Asia-Pacific region is expected to be the dominant market in silica consumption, as China and India dominate the market for the end-user industries, such as building and construction, electronics, and glass manufacturing.

- China's building industry is expanding at a rapid pace. China's construction production is estimated to be worth CNY 29.31 trillion in 2021, according to the National Bureau of Statistics of China.

- China plans to invest USD 1.43 trillion in key construction projects for five years till 2025. The Shanghai plan, according to the National Development and Reform Commission (NDRC), calls for a total investment of USD 38.7 billion over the next three years. Guangzhou, on the other hand, signed 16 new infrastructure projects for USD 8.09 billion.

- Over the next seven years, India is expected to invest over USD 1.3 trillion in housing, with 60 million new homes being built. In 2024, the rate of affordable housing availability is predicted to increase by roughly 70%.

- The Japanese construction industry is predicted to boom as the country prepares to host the World Expo in Osaka, Japan, in 2025. The Yaesu redevelopment project, which includes a 61-story, 390-meter tall office tower, is scheduled to be completed in 2023 and 2027, respectively.

- Due to all the above-mentioned factors, the Asia-Pacific region is expected to dominate the market during the forecast period.

Silica Industry Overview

The silica market is fragmented, with both international and domestic players. The major companies (not in any particular) in the market studied include Covia Holdings LLC, US Silica, Sibelco, Cabot Corporation, and Evonik Industries AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand of Precipitated Silica for Different End Uses

- 4.1.2 Rapidly Expanding Construction Activities

- 4.2 Restraints

- 4.2.1 Competition from Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Amorphous

- 5.1.1.1 Pyrogenic/Fumed

- 5.1.1.2 Hydrated

- 5.1.2 Crystalline

- 5.1.2.1 Quartz

- 5.1.2.2 Tridymite

- 5.1.2.3 Cristobalite

- 5.1.1 Amorphous

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Shale Oil and Gas

- 5.2.3 Glass Manufacturing

- 5.2.4 Water Treatment

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East And Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGSCO Corp.

- 6.4.2 AMS Applied Material Solutions

- 6.4.3 Cabot Corporation

- 6.4.4 China-Henan Huamei Chemical Co. Ltd

- 6.4.5 Covia Holdings Corporation

- 6.4.6 Denka Company Limited

- 6.4.7 Evonik Industries AG

- 6.4.8 Heraeus Holding

- 6.4.9 Kemitura Group AS

- 6.4.10 Merck KGaA

- 6.4.11 Madhu Silica Pvt. Ltd

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Nouryon

- 6.4.14 OCI COMPANY Ltd

- 6.4.15 PPG Industries Inc.

- 6.4.16 Sibelco

- 6.4.17 Tokuyama Corporation

- 6.4.18 US Silica

- 6.4.19 Wacker Chemie AG

- 6.4.20 WR Grace & Co.-Conn.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Emergence of Green Tires

- 7.2 Growth in the Adoption of Electric Cars and Self-driving Cars