|

市場調查報告書

商品編碼

1438110

智慧型電視:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smart TV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

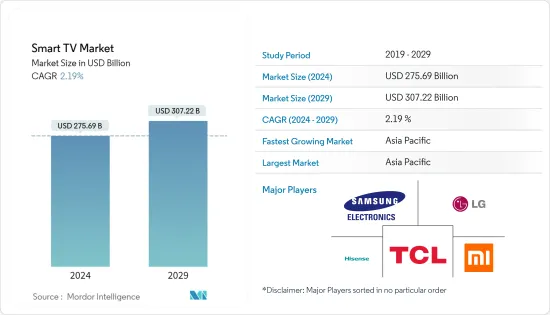

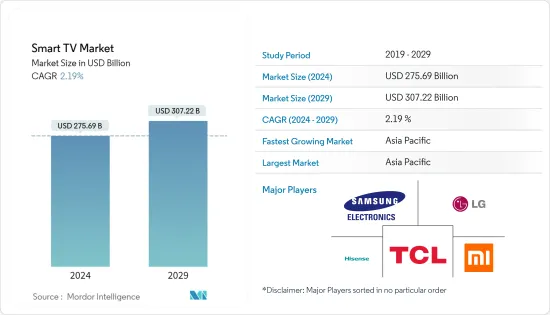

2024年智慧電視市場規模估計為2756.9億美元,預計到2029年將達到3072.2億美元,在預測期間(2024-2029年)以2.19%的複合年增長率增長。

網際網路普及的提高、技術的快速進步、產品價格的下降以及廣播行業的數位轉型是推動智慧型電視市場成長的關鍵因素。

主要亮點

- 在第四代工業世代資格賽中,連網型電視製造商競相推出其在用戶介面、內容集中和應用開發方面的最新創新成果,包括配備可運行應用程式和Widgets以及串流視訊的作業系統的智慧型電視。音樂。具有整合網際網路功能的智慧型電視提供大量先進的運算功能和連接性。智慧型電視的當前功能允許消費者搜尋、聊天、查看、共用、更新和下載內容。智慧型電視製造商預計未來五年將重點關注體驗設計。

- 在智慧型電視上為消費者提供即用型內容對於需求激增至關重要。印度和中國等國家擁有龐大的中低收入消費群。價格最佳化為中低價格分佈價格分佈的電視製造商創造了多種機會。 Apple TV、Amazon Fire TV 和 Google Chromecast 等串流媒體正在改變消費者的觀看體驗。多家製造商已與 OTT( Over-the-Top)內容和設備供應商合作,無需機上盒即可提供各種功能。例如,TCL公司與Roku公司合作推出4K HDR Roku電視。智慧型電視現在允許用戶運行以前為智慧型手機開發的應用程式。

- 預計 4K 超高清區隔市場將在預測期內顯著成長。這些電視的較低價格正在吸引消費者並刺激新興市場的需求。這一成長可能與創新功能有關,例如採用杜比數位音效的更高解析度和更高影像質量,可在更大的螢幕大小上提供影院體驗。 4K 電視超高清 (UHD) 中量子點 LED (QLED) 等創新技術的採用預計將在預測期內推動該產業的需求。與其他電視相比,屬於該範圍的電視具有更高的普及。 4K 電視也採用了高動態範圍 (HDR) 和廣色域 (WCG) 等螢幕技術。

- 近年來,中央情報局開發了一些針對智慧型電視的嚴重安全漏洞,導致智慧電視被駭。一些流行的智慧型電視製造商,例如 LG 和三星,會收集大量有關用戶正在觀看的內容的資訊,從而允許廣告商將廣告定位到觀看者以及他們接下來觀看的內容,這將幫助您提出提案。 FBI 建議在未使用的智慧型電視攝影機上貼上黑膠帶,透過更新的修補程式和修復程式讓智慧型電視保持最新狀態,並閱讀隱私權政策以更好地了解智慧型電視的功能。

- COVID-19感染疾病對所有消費者的生活方式和日常生活產生了重大影響。居家令和在家工作的要求將家庭視訊消費推向了前所未有的水平,Netflix 和 Amazon Prime Video 等視訊串流平台在全球範圍內的收視率激增。對線上內容傳送的關注和冠狀病毒限制的逐步放鬆預計將擴大客戶群,這預計將有助於市場成長。

- 然而,在供應方面,邊境關閉影響了供應鏈,對市場產生了負面影響。例如,TCL 的面板製造子公司華星光電 (CSOT) 在新冠肺炎 (COVID-19)感染疾病中心武漢設有工廠。因此,TCL 難以運作其面板製造工廠。然而,根據阿維雲《2021 年全球電視品牌出貨月度資料報告》(AVC),中國電子企業 TCL 的銷售量大幅成長,2021 年上半年出貨為 1,110 萬台。三星引領市場。出貨預計與前一年同期比較2,080萬台。

- 此外,世界各地的旅行限制正在放鬆,業務正在恢復正常。市場動態的變化和消費者行為向數位內容的轉變預計將推動市場成長。

智慧型電視市場趨勢

QLED預計將大幅成長

- QLED代表量子發光二極體。 QLED 面板的工作原理與 LED 電視相同。背光由數百或數千個 LED 組成,可照亮各個像素。 QLED 透過採用奈米粒子(量子點)來增強單一像素的亮度和顏色,從而對標準 LED 進行了改進。結果是顏色更加鮮豔。 QLED 聯盟由三星、海信和 TCL 組成,致力於推進量子點的發展,以支持市場成長和新產品開發。該市場的成長主要歸功於過去一年中著名供應商的發布。由於採用率不斷提高,QLED 面板預計將保持最高的市場佔有率,因為它們提供其他類型面板無法提供的各種功能。

- 例如,OLED和QLED都很昂貴,但一些最便宜的OLED價格約為1,800美元,而一些QLED的起價為1,000美元。 此外,55英寸是OLED的最小螢幕尺寸,而QLED可以比這小得多。 QLED的創新、更深的黑色、更好的色彩和更寬的視角解決了傳統LED和LCD技術的三大問題,進一步推動了市場需求。 三星是唯一一家沒有OLED的製造商,但相信該公司的QLED技術同樣出色,可以提供最高質量的圖像。 該公司是第一家推出QLED面板的供應商。 LG、松下和索尼等其他供應商正在為其高端設備選擇OLED顯示器。

- 然而,OLED 面板不使用均勻的背光,因此 QLED 無法產生與更昂貴的 OLED 電視完全相同的深黑色水平。相反,每個像素都是一個 LED,可以打開或關閉以產生顏色或完全黑暗。透過完全關閉 LED,OLED 避免了背光造成的光污染,這種光污染會使 LED 電視上的東西看起來有點灰色。

- 隨著領先的智慧型電視製造商推出使用相同技術的新產品,QLED 顯示器越來越受歡迎,預計這將在預測期內推動該區隔市場的成長。例如,三星宣布將在國內市場(韓國)推出全新系列QLED智慧型電視-QT67系列。這些是三星製造的首款獲得一流能源效率等級的 QLED。同樣,2021年4月,小米在印度推出了一款全新的Android智慧型電視Mi QLED TV 75。這款智慧型電視型號配備 75 吋顯示螢幕,支援超高清 (4K) 解析度和 120Hz 更新率,是該公司迄今為止最大的電視型號。

- 2021 年 12 月,三星電子宣布了與串流媒體巨頭 Netflix 持續合作的最新進展,以預覽由 MTV Entertainment Studios Did 製作的熱門節目《艾米麗在巴黎》第二季的發布。三星最新的高級產品線突破了創新的界限,展示了該品牌將時尚與旗艦創新和工藝相結合的能力。三星產品包括 The Serif TV 和 The Sero TV。

亞太地區預計將出現顯著成長

- 亞太地區是智慧型電視的主要市場。由於最終用戶以及印度、中國和日本等新興經濟體對智慧型電視的需求不斷成長,預計在預測期內將繼續佔據主導地位。消費者可支配淨收入的增加是該地區持續需求的關鍵因素。這一成長也歸功於 Amazon Prime Video、Netflix 和 HOOQ 等 OTT VOD 平台在全部區域的日益普及。這些設備的支援內容(例如高清視訊、高清機上盒和遊戲)的可用性進一步成為需求生成的催化劑。

- 中國公司的存在對於這些市場上產品的競爭性定價至關重要,其中許多公司與電子商務平台合作提供產品。第三方服務供應商透過幫助確保消費者選擇這些產品來間接支持市場。在亞太地區,印度是對供應商最具吸引力的市場。 2022 年 1 月,三星電子在 CES 2022 之前發布了最新的 MICRO LED、Neo QLED 和生活風格電視。憑藉畫質和音質的進步、更多的螢幕大小選擇、可自訂的配件和升級的介面,2022 年的螢幕將有助於實現「螢幕無處不在,螢幕為每個人」的願景,並提供真實的沉浸式圖像、沉浸式聲音和超級體驗。- 個人化體驗。

- 2021 年 12 月,三星電子宣佈,2022 年的部分 4K 和 8K 電視和遊戲顯示器將支援新的 HDR10+ GAMING 標準,為遊戲玩家提供身臨其境且響應靈敏的 HDR 遊戲體驗。 該新標準由 HDR10+ Technologies LLC 開發,為遊戲開發人員提供了為遊戲玩家提供引人入勝且一致的 HDR 遊戲體驗所需的工具,而無需針對不同的輸入源(例如遊戲機和 PC)在不同的顯示技術之間手動調整。

- 印度擁有龐大的CRT電視和可升級的非智慧電視安裝基數,並吸引了領先的智慧電視製造商的注意,這些製造商專注於提供適合印度客戶需求的產品。

- 市場佔有率相對較小的公司專注於電子商務平台將其產品推向市場。例如,塔塔集團旗下的量販店連鎖店 Chroma 於 2021 年與亞馬遜合作,為印度客戶推出了一系列內建 Fire 裝置的新智慧電視。該產品將包括來自 5,000 多個應用程式的所有串流內容,包括 Amazon Prime Video、Netflix、YouTube、Disney+Hotstar、Zee5 和 SonyLiv。

智慧型電視產業概況

儘管智慧型電視市場由多家參與者組成,但目前還沒有一家公司在市場佔有率方面佔據主導地位。最近消費者的興趣如此濃厚,該行業被認為是利潤豐厚的投資機會。公司正在投資未來技術以獲得大量專業知識,從而有可能實現永續的競爭優勢。該市場的主要企業包括 LG 電子公司、三星電子和索尼公司。

- 2021 年 4 月 - 三星推出超優質 Neo QLED 電視系列,採用近乎無邊框的 Infinity One 設計和真實的畫質,帶來影院般的觀看體驗。該系列包括5 種尺寸:85 英寸(2 米16 厘米)、75 英寸(1 米89 厘米)、65 英寸(1 米63 厘米)、55 英寸(1 米38 厘米)和50 英寸(1 米25 厘米)。 Neo QLED 電視配備了三星獨特的強大 Neo Quantum 處理器,具有增強的升級功能。 Neo Quantum 處理器可使用多達 16 個經過 AI 升級和深度學習技術訓練的不同神經網路模型來最佳化 4K 和 8K 影像輸出的影像質量,無論輸入品質如何。

- 2021 年 5 月 - OnePlus 在 Flipkart 上推出了 40 吋(100 公分)智慧電視 Y 系列。新款 OnePlus Y 系列 100 公分(40 吋)全高清 LED 智慧型 Android 電視 (40FA1A00) 的規格與 43 吋版本類似。 OnePlus TV 40Y1 將配備 20W 立體聲揚聲器,支援杜比音效、64 位元處理器,搭配 1GB RAM 和 8GB 內部儲存。該裝置運行 Android TV 9.0,支援 Oxygen Play,並配備伽瑪引擎,可增加動態對比度以提高影像品質。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間敵對的強度

- 產業相關人員分析

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

- 技術簡介

第5章市場動態

- 市場促進因素

- 新興國家的可支配所得正在增加

- 視訊點播服務呈上升趨勢

- 市場課題

- 高速網路在新興國家尚未普及

第6章市場區隔

- 依解析度類型

- HD/FHD

- 4K

- 8K

- 依尺寸(英吋)

- 大於32

- 39-43

- 48-50

- 55-60

- 65歲以下

- 依面板類型

- 液晶

- OLED

- QLED

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 印度

- 東南亞

- 拉丁美洲

- 中東和非洲

第7章供應商市場佔有率分析

- 供應商市場佔有率電視市場

第8章 競爭形勢

- 公司簡介

- Samsung Electronics Co. Ltd

- LG Electronics

- TCL

- Hisense

- Xiaomi

第9章投資分析

第10章市場的未來

The Smart TV Market size is estimated at USD 275.69 billion in 2024, and is expected to reach USD 307.22 billion by 2029, growing at a CAGR of 2.19% during the forecast period (2024-2029).

The growing internet penetration, rapid technological advancements, declining product prices, and the digital transformation of the broadcasting industry are among the major factors driving the growth of the smart TV market.

Key Highlights

- With the preliminaries of the fourth industry generation, connected TV manufacturers are competing for the latest innovations in the user interface, content aggregation, and application development, such as smart TVs that come with an operating system that can run apps and widgets and stream videos and music. Set with unified internet capabilities, smart TVs offer numerous advanced computing abilities and connectivity. Smart TVs' current capabilities allow consumers to search, chat, browse, share, update, and download content. Manufacturers of smart TVs are expected to focus on experience design over the next five years.

- The availability of content that is ready for consumers to consume on their smart TVs has been critical in the demand surge. Countries like India and China have a considerable consumer base at low- and middle-income levels. Price optimization has offered a range of opportunities for TV manufacturers in small to mid-high price ranges. Streaming media such as Apple TV, Amazon Fire TV, and Google Chromecast are changing the consumers' viewing experience. Several manufacturers are teaming up with OTT (over-the-top) content and device providers to offer various features with no requirement of a set-top box. For instance, TCL Corporation collaborated with Roku Inc. and introduced a 4K HDR Roku TV. Smart TVs have made it possible for users to run applications developed earlier for smartphones.

- The 4K UHD segment is expected to grow significantly over the forecast period. The drop in the prices of these TVs is drawing customers and triggering demand across emerging economies. The increase can be associated with innovative features, such as high resolution and high picture quality, with Dolby Digital sound that provides a theater experience on larger screen sizes. The adoption of innovative technologies, such as quantum dot LEDs (QLEDs), across the ultra-high-definition (UHD) in 4K TVs, is expected to fuel the segment's demand during the forecast period. Televisions belonging to this range have high penetration rates when compared to others. 4K TVs also pack in screen technology, such as high dynamic range (HDR) and wide color gamut (WCG).

- In recent years, the Central Intelligence Agency developed some of the significant security vulnerabilities targeting smart TVs, which were stolen. Some of the popular smart TV manufacturers, such as LG and Samsung, collect tons of information about what users are watching, help advertisers better target ads against their viewers, and suggest what to watch next. The FBI recommends placing black tape over an unused smart TV camera, keeping smart TV up-to-date with updated patches and fixes, and reading the privacy policy to understand better what the smart TV is capable of.

- The COVID-19 pandemic has drastically impacted the lifestyles and routines of all consumers. Shelter-in-place orders and work-at-home mandates have driven in-home video consumption to unprecedented levels, with the video streaming platforms, such as Netflix and Amazon Prime Video, registering a spike in viewership worldwide. A strong focus on online content delivery and the gradual ease of COVID restrictions are anticipated to help widen the customer base, thereby contributing to the market's growth.

- However, in terms of supply, the market is negatively affected due to the closing of borders, which is affecting the supply chain. For instance, TCL's panel manufacturing subsidiary, CSOT, has its facility in Wuhan, which was the epicenter of the COVID-19 outbreak. Thus, TCL struggled to run the panel manufacturing facility. However, according to Avi Cloud's Global TV Brand Shipment Monthly Data Report-2021 (AVC), TCL, a Chinese electronics business, saw a spike in sales, with 11.1 million devices shipped in the first half of 2021. Samsung led the market with an expected shipment of 20.8 million units, up by 11.9% Y-o-Y.

- Moreover, travel restrictions are being eased out in different parts of the world, and businesses are returning to normal. The changing market dynamics and shifting consumer behavior toward digital content are expected to boost the market's growth.

Smart TV Market Trends

QLED is Expected to Witness Significant Growth

- QLED stands for quantum light-emitting diode. QLED panels work the same way as LED TVs. There is a backlight built from hundreds or thousands of LEDs that light the individual pixels. QLED improves on standard LED by employing nanoparticles (quantum dots) to supercharge the brightness and color of these individual pixels. The result is a more vibrant color. QLED Alliance consists of Samsung, Hisense, and TCL, devoted to furthering the Quantum Dot cause, which is aiding in the market's growth and new product development. The market is mainly growing due to vendor releases noticed in the past year. QLED panel is expected to retain the highest market share due to increased adoption, as it comprises various features that other panel types are unable to offer.

- For instance, although both OLED and QLED are costly, some of the cheapest OLEDs cost around USD 1,800, while the starting price of some QLEDs is USD 1,000. Moreover, 55 inches is the smallest screen size for OLEDs, while QLEDs can be much lower. QLED's innovations, deeper blacks, better colors, and wider viewing angles tackle three traditional LED and LCD technology problems, further driving the market demand. Samsung is the only manufacturer without an OLED set as it believes that its QLED technology is just as capable, giving the best quality picture. It was the first vendor to debut the QLED panel. Other vendors, such as LG, Panasonic, and Sony, have chosen OLED displays for their high-end sets.

- However, QLEDs cannot produce precisely the same level of inky blacks as pricier OLED TVs because OLED panels do not use a uniform backlight. Instead, each pixel is an LED that can be switched on and off to create colors or total darkness. By switching the LEDs off completely, OLED avoids the light pollution from the backlight that makes things look a little grey on LED TVs.

- The QLED display is gaining traction with leading smart TV manufacturers unveiling new products using the same technology, which is expected to drive the segment's growth during the forecast period. For instance, Samsung announced the launch of a new series of QLED Smart TVs, the QT67 range, in its domestic market (South Korea). These are the first QLEDs from Samsung to achieve a first-class energy efficiency rating. Similarly, in April 2021, Xiaomi launched a new Android-powered smart TV, the Mi QLED TV 75, in India. The smart TV model sports a 75-inch display that supports Ultra-HD (4K) resolution and a 120Hz refresh rate, which is the company's largest TV model to date.

- In December 2021, Samsung Electronics Co. Ltd announced the latest development in its ongoing partnership with the streaming giant, Netflix, to herald the release of the second season of its hit show, Emily in Paris, produced by MTV Entertainment Studios. Samsung's latest line of premium products is set to push the boundaries of innovation, showcasing the brands' ability to combine style with flagship innovation and craftmanship. Some of the Samsung products include The Serif TVs and The Sero TVs.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific is the dominating market for smart TVs. It is expected to continue its dominance over the forecast period, owing to the growing demand for smart TVs by end-users and the emerging economies of India, China, and Japan. The increasing net disposable income of consumers has been a significant factor for continued demand in the region. The growth is also attributed to the rising popularity of OTT VOD platforms, such as Amazon Prime Video, Netflix, and HOOQ, across the region. The availability of supporting content for these devices, such as HD videos, HD set-top boxes, and games, has further acted as a catalyst in demand generation.

- The presence of the Chinese players has been critical in the competitive pricing of products in these markets, many of which have entered partnerships with e-commerce platforms to offer their products. Third-party service providers have helped ensure that consumers opt for these products, indirectly helping the market. In Asia-Pacific, India is the most attractive market for vendors. In January 2022, Samsung Electronics Co. Ltd unveiled its newest MICRO LED, Neo QLED, and Lifestyle TVs ahead of CES 2022. With advancements in the picture and sound quality, more screen size options, customizable accessories, and an upgraded interface, the 2022 screens bring the vision of 'Screens Everywhere, Screens for All' closer to reality with life-like images, immersive sound, and hyper-personalized experiences.

- In December 2021, Samsung Electronics Co. Ltd announced that select 2022 4K and 8K TVs and gaming monitors would support the new HDR10+ GAMING standard, delivering an immersive, ultra-responsive HDR gaming experience to gamers. This new standard, developed by HDR10+ Technologies LLC, gives game developers the tools they need to provide gamers with a compelling and consistent HDR gaming experience without manual calibration across various display technologies for different input sources, including consoles and PCs.

- India has a large installed base of CRT and non-smart TVs, which can be upgraded and have attracted the attention of major smart TV manufacturers focusing on offering products that suits the requirements of the Indian customers.

- The companies with relatively smaller market presence are focusing on the e-commerce platform to launch their products in the market. For instance, in 2021, Tata Group-owned electronics store chain Croma entered a partnership with Amazon to launch a new range of smart TVs with built-in fire devices for customers in India. The product is expected to have all streaming content from over 5,000 apps, including Amazon Prime Video, Netflix, YouTube, Disney + Hotstar, Zee5, and SonyLiv.

Smart TV Industry Overview

The smart TV market consists of several players, but none of them currently dominate the market in terms of market share. This industry is being viewed as a lucrative investment opportunity due to the enormous consumer interest witnessed recently. The companies are investing in future technologies to gain substantial expertise, which may enable them to achieve a sustainable competitive advantage. Some of the major players in the market include LG Electronics Inc., Samsung Electronics Co. Ltd, and Sony Corporation.

- April 2021 - Samsung launched its ultra-premium Neo QLED TV range, which has a nearly bezel-less Infinity One Design and true-to-life picture quality for a cinematic viewing experience. The line-up will be available in 5 sizes: 85-inch (2m 16cm), 75-inch (1m 89cm), 65-inch (1m 63cm), 55-inch (1m 38cm), and 50-inch (1m 25cm). Neo QLED TVs come with Samsung's proprietary, powerful Neo Quantum Processor with enhanced upscaling capabilities. Using up to 16 different neural network models, each trained in AI upscaling and deep learning technology, the Neo Quantum Processor can optimize picture quality to 4K and 8K picture output regardless of the input quality.

- May 2021 - OnePlus launched a 40-inch (100 cm) smart television under its Y-series on Flipkart. The new OnePlus Y Series 100 cm (40 inches) Full HD LED Smart Android TV (40FA1A00) has similar specifications as the 43-inch variant. The OnePlus TV 40Y1 will be equipped with 20 W stereo speakers with Dolby Audio, a 64-bit processor paired with 1GB RAM, and 8 GB internal storage. The device runs Android TV 9.0 with Oxygen Play support and features Gamma Engine, which adds dynamic contrast and improves picture quality.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Disposable Income Across Emerging Economies

- 5.1.2 Rising Trend of Video-on-Demand Service

- 5.2 Market Challenges

- 5.2.1 Lack of High-speed Internet Penetration in Emerging Economies

6 MARKET SEGMENTATION

- 6.1 By Resolution Type

- 6.1.1 HD/FHD

- 6.1.2 4K

- 6.1.3 8K

- 6.2 By Size (in inches)

- 6.2.1 Greater than 32

- 6.2.2 39-43

- 6.2.3 48-50

- 6.2.4 55-60

- 6.2.5 Less than 65

- 6.3 By Panel Type

- 6.3.1 LCD

- 6.3.2 OLED

- 6.3.3 QLED

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 India

- 6.4.3.2 Southeast Asia

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 VENDOR MARKET SHARE ANALYSIS

- 7.1 Vendor Market Share Television Market

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Samsung Electronics Co. Ltd

- 8.1.2 LG Electronics

- 8.1.3 TCL

- 8.1.4 Hisense

- 8.1.5 Xiaomi