|

市場調查報告書

商品編碼

1432850

農業收割機械:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Agricultural Harvesting Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

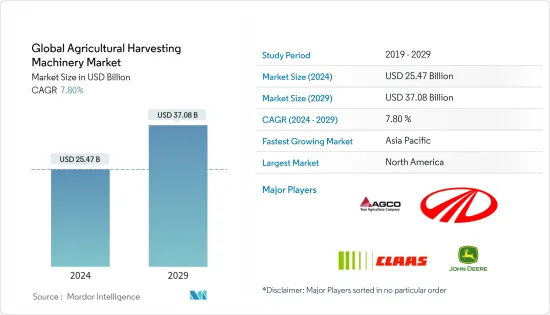

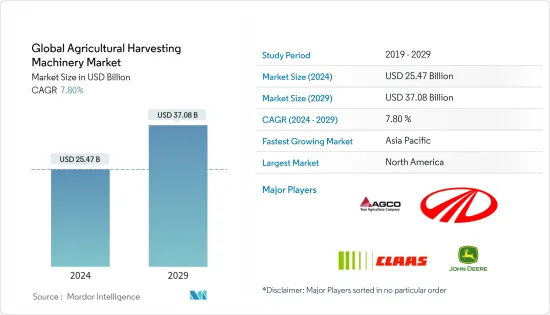

預計2024年全球農業收割機械市場規模為254.7億美元,預計2029年將達370.8億美元,在預測期內(2024-2029年)複合年成長率為7.80%,預計將成長。

主要亮點

- 在印度等新興經濟體,農業勞動力稀缺、農機技術進步以及政府支持農機購買的各種補貼政策正在推動收割機械市場的成長。

- 高昂的初始資本成本和農民對傳統種植方法的偏好限制了市場的成長。

- Deere & Company(約翰迪爾)、AGCO Corporation、CNH Industrial NV、Mahindra & Mahindra Limited 是該市場的一些主要企業。

收割機械市場趨勢

精密農業實現高品質收成

由於需要高品質收割以提高產量和生產率,收割機配備了多種先進功能,包括用於監控收割負載的增強型電子感測、雲端基礎的產量處理和品質地圖。農業技術正在不斷發展。據CEMA稱,新銷售的農業機械和收割機中有70%至80%配備了精密農業技術。對配備技術開發工具的收割機的需求不斷成長進一步體現在歐洲等地區聯合收割機的進口總額,從2016年的341萬美元增加到2018年的4.1億美元,增加到1000萬美元。因此,持續的精密農業趨勢預計將在預測期內增加對收割機的需求。

亞太地區是一個快速成長的市場

由於不斷成長的工業部門的利潤豐厚的機會,農業活動的勞動力資源嚴重短缺,這是推動該地區收割機等農業機械設備成長的主要因素。除此之外,各國政府也向農民提供補貼,以投資更好的設備,以有效滿足更高的生產力需求。例如,印度政府透過 Rashtriya Krishi Vikas Yojna (RKVY) 等計畫和國家糧食安全任務 (NFSM) 下的機械化計畫在該國啟動了各種農業機械化計畫。透過這些計劃,政府向農民提供補貼,鼓勵他們購買收割機等農業機械。因此,隨著更多國際公司在預測期內擴大在該地區的業務,推出收割機,收割機的需求預計將進一步增加。

收割機產業概況

全球收割機市場分散,國際參與者和眾多區域參與者在該市場運作。 Deere & Company(約翰迪爾)、AGCO Corporation、CNH Industrial NV 和 Mahindra & Mahindra Limited 是該市場的一些主要企業。這些參與者將產品創新作為關鍵策略,推出具有針對不同地區顧客需求的功能的收割機。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 透過機器

- 聯合收割機

- 飼料收割機

- 甘蔗收割機

- 其他收割機

- 依地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 併購

- 公司簡介

- Deere & Company

- CNH Industrial

- AGCO Corporation

- CLAAS KGaA mbH

- Mahindra & Mahindra(Tractors)

- Krone NA, Inc.

- Yanmar Co., Ltd.

- KUBOTA Corporation

- Tractors and Farm Equipment Limited

- Bernard Krone Holding GmbH & Co. KG

第7章 市場機會及未來趨勢

The Global Agricultural Harvesting Machinery Market size is estimated at USD 25.47 billion in 2024, and is expected to reach USD 37.08 billion by 2029, growing at a CAGR of 7.80% during the forecast period (2024-2029).

Key Highlights

- The acute shortage of farm labor, the technological advancements in agricultural machinery and various government backedsubsidy policies supporting the purchase of farming machinery in developing economies such as India is driving the market growth for harvestors.

- The high initial capital cost and more inclination of farmers towards traditinal plowing methods are some of the factors restraining the market growth.

- Deere & Company (John Deere), AGCO Corporation, CNH Industrial N.V and Mahindra & Mahindra Limited are some of the major players who have their presence in this market.

Harvesting Machinery Market Trends

Precision Farming for Quality Harvest

The need for quality harvest with an increased yield and productivity has led to the evolution of several advanced farming technologies in harvesters, such as increased electronic sensing to monitor harvest load, cloud-based processing for yield, and quality maps, among others. According to CEMA, 70%-80% of the new agricultural machinery and harvesters sold have been found to be equipped with precision farming technology. The increasing demand for harvesters equipped with technologically developed tools is further reflected through the total import value of combine harvesters in the region such as Europe, where imports rose from USD 3.41 million in 2016 to USD 4.10 million in 2018. As such, the ongoing trend of precision farming is projected to increase the demand for harvesters duing the forecast period.

Asia Pacific is the Fastest growing market

The acute shortage of labor resources for agricultural activities, owing to the lucrative opportunities in the growing industrial sector, is the major factor driving the growth of agricultural machinery equipment, such as harvesters in the region. In additin to this various governments are providing subsidies to farmers for investing in better equipment to efficiently meet the needs for higher productivity. For instance, Government of India inititated various farm mechanization programs in the country through the schemes, such Rashtriya Krishi Vikas Yojna (RKVY) and Mechanisation, under the National Food Security Mission (NFSM). Through these schemes, the government is encouraging farmers to purchase farm machinery, such as harvesters, by providing a subsidy. Thus, the demand for harvestor machines is projected to increase further with number of international companies launching their harvesting machinery by expanding their business in the region during the forecast period.

Harvesting Machinery Industry Overview

The global harvesting machinery market is fragmented with the presence of international players and numerous regional players operating in this market. Deere & Company (John Deere), AGCO Corporation, CNH Industrial N.V and Mahindra & Mahindra Limited are some of the major players who have their presence in this market. These players are using product innovation as their key strategy by launching harvestors with tailored featurescatering the needs of customers across various regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porters five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Machinery

- 5.1.1 Combine Harvester

- 5.1.2 Forage Harvester

- 5.1.3 Sugar cane Harvester

- 5.1.4 Other Harvestors

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 US

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 UK

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Deere & Company

- 6.3.2 CNH Industrial

- 6.3.3 AGCO Corporation

- 6.3.4 CLAAS KGaA mbH

- 6.3.5 Mahindra & Mahindra (Tractors)

- 6.3.6 Krone NA, Inc.

- 6.3.7 Yanmar Co., Ltd.

- 6.3.8 KUBOTA Corporation

- 6.3.9 Tractors and Farm Equipment Limited

- 6.3.10 Bernard Krone Holding GmbH & Co. KG