|

市場調查報告書

商品編碼

1403926

頻譜成像:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Hyperspectral Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

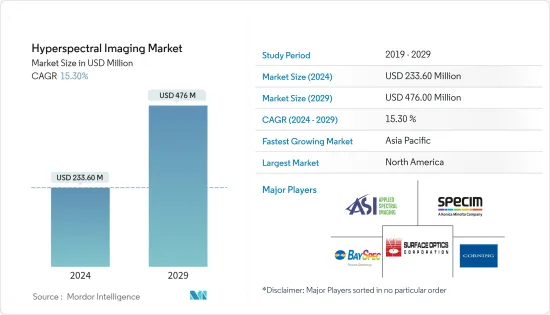

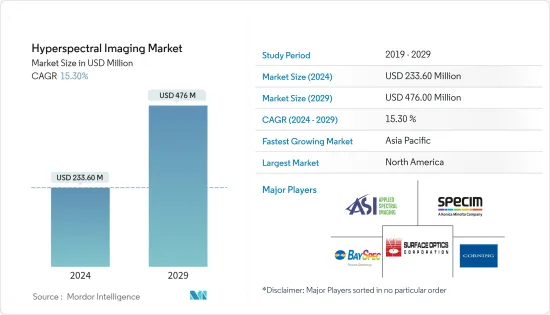

根據預測,2024年高頻譜成像市場規模將達到2.336億美元,2029年將達到4.76億美元,在預測期內(2024-2029年)複合年成長率為15.30%。

頻譜成像捕捉並處理多種波長的影像。人眼看到三個可見光頻譜(即紅色、綠色和藍色)的光。另一方面,頻譜成像將頻譜分為多個頻寬,覆蓋可見光和近紅外線區域。在頻譜成像中,每個影像像素都具有頻譜資訊,並且該資訊作為3D值添加到2D空間影像中,產生稱為超立方體資料的3D資料立方體。

主要亮點

- 頻譜成像 (HSI) 是一項強大的技術,為光學成像增添了新的維度。 HSI 已經使用了 10 多年。然而,直到2015年,與頻譜、紅外線和雷射雷達等其他成像技術相比,它仍然相對不為人所知。如今,它不僅在最初設計的氣象和冶金領域變得流行,而且在化學分析、農業、軍事和國防領域也越來越普及。

- 頻譜成像系統 (HIS) 在醫療診斷中的使用也顯著成長。現有系統無法無縫整合到手術工作流程中,也無法提供即時、即時的回饋,而這對於支援手術期間的有效決策至關重要。各種研究人員致力於開發提供增強視覺的系統,使臨床醫生能夠在手術過程中清楚地看到重要的組織資訊。

- 食品和農業、國防和天氣等 HSI 應用對資料準確性和一致性的需求日益成長,推動了市場對頻譜影像處理的需求。 HSI 使用強大的分析程序,這對於食品和農業等應用的成像技術至關重要。

- 頻譜成像是一種廣泛使用的科學和工業技術,但商業裝置高成本且龐大,使得它們對於基礎研究來說不切實際。由於成本高昂,大多數中小企業無法在其業務活動中實施HSI解決方案。

- 由於 COVID-19大流行,頻譜成像市場不斷成長,因為該技術可以成為分析 COVID-19 皮疹的強大工具。例如,頻譜成像技術提供者 HinaLea Imaging(加州埃默里維爾)正在使用其先進的高光譜頻譜系統來評估與 COVID-19 感染相關的皮膚觀察的預後價值。

頻譜成像市場趨勢

醫療保健領域預計將呈現強勁的市場成長

- HSI 技術在醫療保健領域的利用至關重要。預計該行業投資的增加也將推動該行業的成長。醫療保健產業正在經歷大規模的數位轉型,這些技術預計將對該產業產生重大影響。

- 例如,2023年6月,Hypervision Surgical獲得了650萬歐元的種子資金,用於支援利用人工智慧、超快簡介高頻譜影像處理和臨床邊緣運算的手術影像處理和資料分析平台的開發(689萬美元)。這項技術使不可見的事物變得可見,使外科醫生能夠做出更準確、更自信的決策,最終改善患者的治療效果。該公司將利用這筆資金獲得美國和歐洲監管部門的批准,並與領先的外科醫生、大西洋兩岸的知名外科中心以及戰略合作夥伴合作,以確保成功的市場啟動和順利的臨床整合。用於擴大與產業夥伴的合作。

- 此外,手持式 HS 感測器正迅速被引入醫療保健業務中,例如在門診手術中心對健康或患病組織進行快速無創評估,以及在緊急救援行動中廣泛使用小型無人機或無人機。 。

- 最近,頻譜成像技術已廣泛用於檢測癌細胞,因為內部惡性通常與周圍的健康組織相似。例如,HSI也用於檢測其他病症和疾病,例如齲齒和人類喉部黏膜的變化。頻譜範圍為 1,000 至 2,500 nm 的 HSI 已用於對 12 顆具有不同程度自然病變的拔除牙齒進行齲齒檢測和識別。

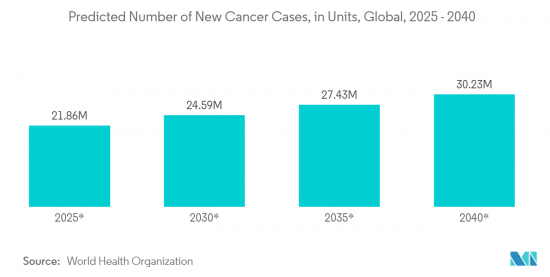

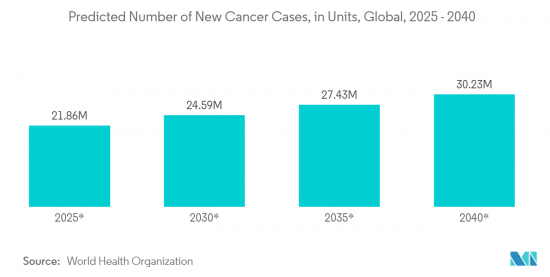

- 癌症患者的增加預計將推動一些地區的市場。例如,美國癌症協會估計,2022年美國將總合新增236,740例肺癌和支氣管癌病例。據估計,佛羅裡達州的此類病例數量最多。

- 由於頻譜成像是一種非接觸、非電離和無標定的成像方式,因此在可預見的幾年裡,醫療保健領域的產品開發預計將推動對頻譜成像的需求。

預計北美將佔據較大市場佔有率

- 區域監控創新的增加預計將推動市場成長。該地區的一些國家正在大力投資監控,例如美國。

- 監視不僅限於軍隊。它還包括多個執法機構,利用先進技術在白天和夜間監控和追蹤多個個人和車輛,並監控該地區的事件。這些新發展預計將增加頻譜成像系統和儀器的採用。

- 此外,美國在軍事上的支出也遠高於世界其他國家。在2023年3月發布的2024會計年度預算提案中,拜登政府要求為國防部撥款8420億美元,比2023會計年度增加260億美元,比2022會計年度增加1000億美元等級。提高了。

- 在阿富汗戰場上,美國軍方正在使用高光譜頻譜來發現通常隱藏在視線之外的物體,成像器偽裝的坦克或簡易炸彈工廠的廢氣。我們拆除了一千磅炸藥。

- 除美國外,加拿大也在增加軍費開支。此外,隨著美國的重點從中東和阿富汗轉向亞太國家特別是中國的緊迫威脅,加拿大作為北美防空司令部、北約和所謂「北約」成員的一部分,做為五眼資訊共用聯盟的一份子,也對軍費開支產生壓力。

頻譜成像產業概況

頻譜成像市場是分散的。主導市場的主要公司包括 Applied Spectral、Imaging Inc.、BaySpec Inc.、Specim Spectral Imaging Ltd.、Corning Incorporated 和 Surface Optics Corporation。合作與收購、研發高投入、新產品推出等是這些公司為維持市場地位所採取的主要成長策略。

2023年4月,Photonics宣布計畫收購紅外線相機公司Telops。在此次收購之前,Photonis 最近收購了比利時短波紅外線 (SWIR) 相機製造商 Zenix。合併後的集團預計將憑藉其在組件製造方面豐富的專業知識、廣泛的地理覆蓋範圍和先進的技術力,為企業對企業客戶提供「獨特的高階成像產品」。

2023 年 3 月,總部位於班加羅爾的太空新興企業Pixel 宣布已獲得為期五年的契約,為美國國家偵察組織 (NRO) 提供技術頻譜影像。 Pixxel很可能透過使用目前在軌和未來衛星群的探路者系統進行建模模擬和資料評估來提供技術頻譜成像(HSI)遙感能力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 技術進步

- 對資料準確性和一致性的需求不斷增加

- 市場抑制因素

- 使用頻譜成像相關的高成本

- 專利分析

第 6 章技術簡介 - 應用

- 監控

- 遙感

- 機器視覺/光學

- 醫療診斷/調查

第7章市場區隔

- 按最終用戶產業

- 食品/農業

- 衛生保健

- 防禦

- 採礦/測量

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第8章競爭形勢

- 公司簡介

- Applied Spectral Imaging Inc.

- BaySpec Inc.

- Specim Spectral Imaging Ltd

- Corning Incorporated

- Surface Optics Corporation

- Headwall Photonics Inc.

- Resonon Inc.

- HyperMed Imaging Inc.

- Norsk Elektro Optikk AS

- Cubert GmbH

- XIMEA GmbH

- HinaLea Imaging(TruTag Technologies Inc.)

- ITRES Research Limited

第9章供應商定位分析-頻譜成像

第10章投資分析

第11章市場機會與未來展望

The Hyperspectral Imaging Market size is estimated at USD 233.60 million in 2024, and is expected to reach USD 476 million by 2029, growing at a CAGR of 15.30% during the forecast period (2024-2029).

Hyperspectral imaging captures and processes an image at many wavelengths. A human eye sees the light in three visible spectrum bands (i.e., red, green, and blue). In contrast, hyperspectral imaging divides the spectrum into various bands, covering the visible and near-infrared ranges. In hyperspectral imaging, every image pixel carries spectral information, which is added as a third dimension of values to the two-dimensional spatial image, thereby generating a three-dimensional data cube referred to as hypercube data.

Key Highlights

- Hyperspectral imaging (HSI) is a robust technology that adds a new dimension to optical imaging. HSI has been employed for more than a decade now. However, until 2015, it was still moderately unknown compared to other imaging technologies, such as multispectral, infrared, and LiDAR. It is now gaining traction in the chemical analysis, agriculture, and military and defense sectors, in addition to the meteorology and metal sectors for which it was initially designed.

- The use of hyperspectral imaging systems (HIS) has also grown significantly in medical diagnostics. Existing systems do not allow for seamless integration into the surgical workflow, nor do they provide real-time instantaneous feedback crucial to support effective decision-making during surgery. Various researchers aim to develop a system that provides clinicians with an augmented vision for clear visualization of vital tissue information throughout the surgery.

- The increasing need for data accuracy and consistency in HSI applications, such as food and agriculture, defense, and weather, is driving the demand for hyperspectral imaging in the market. HSI uses robust analytical procedures critical for imaging technology in applications such as food and agriculture.

- Hyperspectral imaging is a broadly used technology for scientific and industrial purposes, but the high cost and large size of commercial setups have made them impractical for basic research. Due to their high cost, most small and medium-sized companies cannot implement HSI solutions for their business activities.

- With the outburst of COVID-19, the hyperspectral imaging market grew as this technology could have been a prominent tool for analyzing COVID-19 rashes. For example, hyperspectral imaging technology provider HinaLea Imaging (Emeryville, CA) joined a research program to explore the prognostic value of skin findings associated with COVID-19 infection utilizing the company's advanced hyperspectral imaging system.

Hyperspectral Imaging Market Trends

Healthcare Sector Expected to Witness Robust Market Growth

- The utilization of HSI technology in the healthcare sector is of utmost importance. Moreover, the increasing number of investments in the sector is expected to propel the growth of this domain. The healthcare sector is undergoing a large-scale digital transformation, and these technologies are expected to influence the domain significantly.

- For instance, in June 2023, Hypervision Surgical received EUR 6.5 million (USD 6.89 million) in seed funding to support its development of a surgical imaging and data analytics platform leveraging AI, ultra-fast snapshot hyperspectral imaging, and clinical edge computing. This technology makes the invisible visible, empowering surgeons to make confident decisions with enhanced precision, ultimately improving patient outcomes. The company stated that the funds would be used to attain regulatory clearance in the United States and Europe and expand collaborations with leading surgeons, renowned surgical centers, and strategic industry partners on both sides of the Atlantic to ensure a successful market launch and smooth integration into clinical practice.

- Moreover, handheld HS sensors are being rapidly implemented in healthcare operations for applications such as rapid non-invasive assessment of healthy or diseased tissue in ambulatory surgery centers and the wider use of miniaturized drones or UAVs for emergency rescue efforts, to name a few.

- Recently, hyperspectral imaging technology has been extensively incorporated for cancer cell detection since internal malignant tumors usually look similar to the healthy tissues around them. For instance, HSI is also being used to detect other illnesses and diseases, such as dental caries and altered mucosa of the human larynx. HSI in the 1,000-2,500 nm spectral range is being used for dental caries detection and identification in 12 extracted teeth with different degrees of the natural lesion.

- The increase in cancer cases in some regions is expected to drive the market. For instance, the American Cancer Society estimated that in 2022, there were a total of 236,740 new cases of lung and bronchus cancer in the United States. The highest number of these cases was estimated to be in the state of Florida.

- Product developments in the healthcare sector in the forecasted years are expected to drive the demand for hyperspectral imaging owing to its non-contact, non-ionizing, and label-free imaging modality.

North America is Expected to Hold Significant Market Share

- Increasing regional surveillance innovations are expected to drive the market's growth. The region is marked by the presence of countries, such as the United States, that have significant investments in surveillance.

- The surveillance is not limited to the military. It includes several law enforcement agencies that leverage advanced technology to monitor and track multiple individuals or vehicles during the day and at night and surveil the events in an area. Such new deployments are anticipated to increase the adoption of hyperspectral imaging systems and devices.

- Moreover, the United States has a significantly higher military expenditure than the rest of the world. In the budget proposed for the fiscal year 2024, released in March 2023, the Biden administration requested USD 842 billion for the Department of Defense (DoD), an increase of USD 26 billion over FY 2023 levels and USD 100 billion more than FY 2022.

- The US army had removed many thousand pounds of explosives from the battlefields in Afghanistan by using hyperspectral imagers to spot objects typically hidden from view, such as tanks draped in camouflage or emissions from an improvised bomb-making factory.

- Apart from the United States, Canada has also increased its military spending. Further, the shift in the focus of the United States from the Middle East and Afghanistan to more imminent threats from Asia-Pacific countries, especially China, created pressure on Canada's military funding as part of its membership in NORAD, NATO, and the so-called Five Eyes Intelligence-sharing Alliance.

Hyperspectral Imaging Industry Overview

The market for hyperspectral imaging is fragmented. A few major dominant players in this market are Applied Spectral, Imaging Inc., BaySpec Inc., Specim Spectral Imaging Ltd., Corning Incorporated, and Surface Optics Corporation. Partnerships and acquisitions, high investments in R&D, new product launches, etc., are the major growth strategies these companies adopt to sustain themselves in the market.

In April 2023, Photonics announced that it was planning to acquire the infrared camera firm Telops. The deal follows Photonis' recent acquisition of the Belgian short-wave infrared (SWIR) camera maker Xenics. The merged group is expected to provide "unique high-end imaging products" to business-to-business customers owing to wide-ranging expertise in component manufacturing, a broad geographical reach, and advanced technological capabilities.

In March 2023, Bengaluru-based space startup Pixxel announced it received a five-year contract for supplying technical hyperspectral imagery to the United States National Reconnaissance Organization (NRO). Pixxel will likely provide technical hyperspectral imagery (HSI) remote sensing capabilities through modeling simulation and data evaluation using its currently on-orbit pathfinder systems and future constellations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements

- 5.1.2 Increasing Demand for Data Accuracy and Consistency

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with the Use of Hyperspectral Imaging

- 5.3 Patent Analysis

6 TECHNOLOGY SNAPSHOT - APPLICATIONS

- 6.1 Surveillance

- 6.2 Remote Sensing

- 6.3 Machine Vision/Optical

- 6.4 Medical Diagnostics/Research

7 MARKET SEGMENTATION

- 7.1 By End-user Vertical

- 7.1.1 Food and Agriculture

- 7.1.2 Healthcare

- 7.1.3 Defense

- 7.1.4 Mining and Metrology

- 7.1.5 Other End-user Verticals

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Applied Spectral Imaging Inc.

- 8.1.2 BaySpec Inc.

- 8.1.3 Specim Spectral Imaging Ltd

- 8.1.4 Corning Incorporated

- 8.1.5 Surface Optics Corporation

- 8.1.6 Headwall Photonics Inc.

- 8.1.7 Resonon Inc.

- 8.1.8 HyperMed Imaging Inc.

- 8.1.9 Norsk Elektro Optikk AS

- 8.1.10 Cubert GmbH

- 8.1.11 XIMEA GmbH

- 8.1.12 HinaLea Imaging (TruTag Technologies Inc.)

- 8.1.13 ITRES Research Limited