|

市場調查報告書

商品編碼

1378206

Mini LED BLU顯示器:最新趨勢分析(2024年)2024 New Mini LED BLU Display Trend Analysis |

||||||

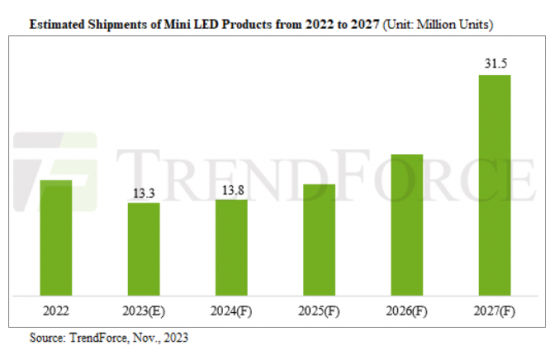

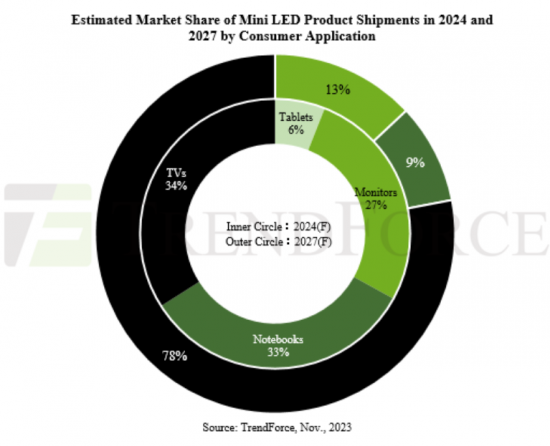

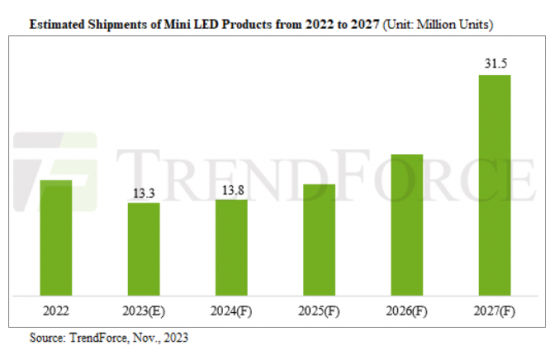

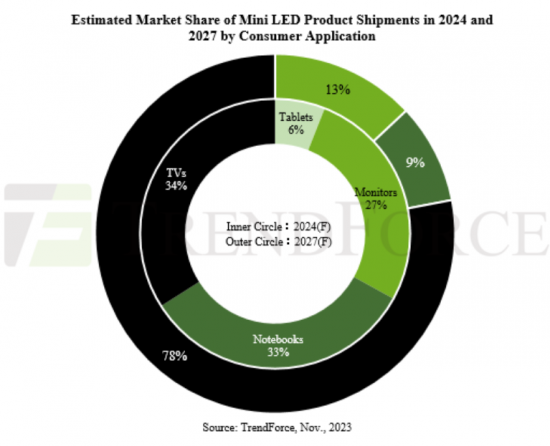

由於CE產品需求下降,預計2023年Mini LED產品出貨量將減少至13,337,000顆。不過,市場將在2024年復甦,出貨量達到13,792,000台,預計這種成長趨勢將持續到2027年。此外,預計2027年出貨量將達到31,453,000台,2023年至2027年複合年增長率約為23.9%。

Mini LED電視前景看好,出貨量預計將持續成長。預計2024年出貨量將達621萬台,較上年成長53.5%。此外,預計2023年至2027年的複合年增長率約為56.7%,到2027年出貨量預計將達到2,440萬台,約佔電視市場總量的12.1%。

IT用Mini LED顯示器預計出貨量為29.6萬台。由於顯示器有多種外形尺寸,例如 COB 和 POB,因此成本結構更加靈活。待OLED顯示器市場逐漸飽和以及Mini LED成本持續下降後,Mini LED顯示器預計在2026年至2027年進入成長期,2027年市場滲透率將大幅提升,預計約3.1 %。

本報告調查了全球Mini LED BLU顯示器市場,提供了配備Mini LED BLU的產品的需求、出貨量和滲透率、Mini LED BLU的技術趨勢和市場動態以及應用(TV、IT、汽車、 VR產品)。)總結了詳細分析、主要公司的舉措、成長前景等。

目錄

第一章 全球照明市場趨勢

- Mini LED BLU TV出貨量及滲透率

- Mini LED BLU 的類型以及電視 LED 的需求

- Mini LED BLU顯示器出貨量及滲透率

- Mini LED BLU 的類型以及顯示器 LED 的需求

- Mini LED BLU NB出貨量及滲透率

- Mini LED BLU類型及NB對LED的需求

- Mini LED BLU平板電腦出貨量及滲透率

- Mini LED BLU 類型和平板電腦 LED 需求

- Mini LED BLU VR耳機出貨量及滲透率

- Mini LED BLU 類型和 VR 耳機的 LED 需求

- Mini LED BLU在CE產品應用上的滲透率

- CE產品應用Mini LED BLU出貨量

- Mini LED BLU 所需的 LED (COB) 數量

第二章 Mini LED BLU技術趨勢及市場動態

- Mini LED背光市場供應鏈

- 晶片製造商資本配置

- LED晶片廠商:HC SemiTek

- LED晶片生產廠商: San'an

- 中游企業資本佈局

- 設備公司:HOSON

- LED封裝公司:Everlight

- LED封裝公司:Lextar

- LED封裝公司:Hongli

- LED封裝公司:MTC

- LED封裝公司:Nationstar

- LED封裝公司:Refond

- LED封裝公司:APT Electronic

- LED封裝公司:Jufei

- LED玻璃基板製造商:WG Tech

- LED模組公司:SmileLighting

- LED模組公司:MLED

- LED模組公司:Longli

- 申請公司:BOE

- 申請公司:TCL

- TCL X11G Max:規格分析

- 申請公司:Tianma

- 應用公司:Hisense

- POB/COB/COG技術分析

- COB製程及技術成熟度分析

- PCB板分析

第三章 Mini LED背光電視及OLED市場發展

- 充滿活力的品牌景觀:Mini LEDTV

- Mini LEDTV概述

- Mini LED背光電視趨勢分析

- 下一代Mini LED背光/OLED電視市場:數量

- 下一代Mini LED背光/OLED電視市場:價格差異

- 各品牌Mini LED BLU TV出貨量

- Samsung VD:液晶電視面板採購策略轉變

- Samsung VD:電視產品組合細分

- OLED 電視市場佔有率:依品牌分類

- 65吋4K電視面板:各種顯示技術的成本比較

- 全球電視出貨量預測

- OLED和QLED電視出貨量預測

- 面板價格比較:55吋LCD Open Cell vs OLED

- 面板價格比較:55吋LCD Open Cell vs OLED

- 白光OLED:技術開發與結構最佳化

- QD OLED:技術開發與結構優化

第四章 IT產業Mini LED背光及OLED市場發展

- 品牌動態:Mini LED MNT/NB

- Mini LED MNT概述

- Mini LED背光MNT趨勢分析

- 下一代Mini LED背光/OLED MNT市場:數量

- 下一代Mini LED背光/OLED MNT市場:價格差異

- 中國COG Mini LED背光MNT規格/價格分析

- 每個品牌的 Mini LED BLU 顯示器出貨數量

- World Monitor/AIO設定出貨預測

- OLED顯示器出貨量預測

- OLED顯示器類型和尺寸分佈

- 4K MNT面板:與各種顯示技術的成本比較

- Mini LED NB概述

- Mini LED背光NB趨勢分析

- 次世代Mini LED背光/OLED NB市場:數量

- 次世代Mini LED背光/OLED NB市場:價差

- 各品牌Mini LED BLU筆記型電腦出貨量

- 全球筆記型電腦出貨量預測

- Apple 的 MacBook、iPad 和 iMac 顯示技術計劃

- FHD NB面板:各種顯示技術的成本比較

- OLED NB滲透率預測

- OLED筆記型電腦滲透率:依品牌劃分

- 下一代Mini LED背光/OLED平板電腦市場:數量

- 下一代Mini LED背光/OLED平板市場:價格差異

- 平板電腦面板成本比較:依各種顯示技術

- 印度下一代Mini LED背光/OLED顯示器分析:按數量

- 印度下一代Mini LED背光/OLED顯示器分析:價格差異

- 巴西下一代 Mini LED 背光/OLED 顯示器分析:按數量

- 巴西下一代Mini LED背光/OLED顯示器分析:價格差異

- 新AMOLED晶圓廠投資計劃

- AMOLED能力和產品計劃

- OLED新技術在IT應用的應用:eLEAP

- 面向 IT 應用的新型 OLED 技術:Tandem

- OLED NB面板標記能力分析

第五章車用顯示Mini LED背光市場發展

- 智慧座艙趨勢

- 汽車顯示技術概述

- 汽車顯示背光分析

- Mini LED/HDR 汽車顯示器:規格和供應鏈

- Mini LED/HDR 車載顯示器時間表和規格

- NIO ET7/ET5/ES7車載顯示器:規格與成本分析

- Roewe RX5車載顯示器:規格與成本分析

- Cadillac LYRIQ 車載顯示器:規格和成本分析

- 汽車顯示器成本分析:邊緣式/直下式

- 汽車背光源LED規格分析

- 汽車背光LED產品:規格與價格分析

- 車用顯示器用Mini LED/HDR:驅動IC規格分析

- 汽車顯示供應鏈流程分析

- HUD 市場出貨量:產品與區域市場分析

- HUD市場出貨量:產品技術分析

- HUD公司市佔率分析

- HUD產品規格及價格分析

- HUD產品價格分析

- AR-HUD技術分析

- 3D AR-HUD產品趨勢

- AR-HUD OEM供應鏈與產品規格分析

- HUD市場價值鏈分析

第六章 頭戴式VR顯示器Mini LED背光市場發展

- VR產品分析:Oculus Quest Pro

- VR產品分析:SonyPlayStation VR 2

- VR產品分析:HTC VIVE Focus 3/Pico 4 Pro

TrendForce's "2024 New Mini LED BLU Display Trend Analysis" report reveals that due to declining demand in consumer electronics, shipments of Mini LED products are expected to decrease to 13.337 million units in 2023. However, the market is projected to rebound in 2024, with shipments estimated at 13.792 million units, and the growth trend is expected to continue through 2027. This decline is part of a larger trend of decreasing prices for Mini LED products, setting the stage for sustained growth in shipments. The report predicts that by 2027, shipments could reach as high as 31.453 million units, with a CAGR of approximately 23.9% from 2023 to 2027.

In the television sector, despite the robust increase in LCD panel prices and the continued high depreciation costs of OLED products, Mini LED component prices are on a downward trend. Now, apart from the relatively small-scale and still early-stage glass-based Mini LEDs, the costs of various other Mini LED TV panels are lower than those of White OLED and QD OLED. Thus, TrendForce maintains that Mini LEDs remain the most effective and optimal solution for enhancing contrast. Against this backdrop, the forecast for Mini LED TVs is positive, with an expected continuous growth in shipment volumes. Shipments are projected to reach 6.21 million units by 2024, marking a 53.5% YoY increase. Moving forward to 2027, shipment volumes are projected to hit 24.4 million units, capturing roughly 12.1% of the overall TV market. The CAGR for this segment from 2023 to 2027 is projected to be around 56.7%.

In IT applications, Mini LED monitor shipments are estimated at 296,000 units in 2023. Due to the diverse range of form factors available for monitors, including COB and POB, the cost structure is more flexible. After the market for OLED monitors gradually saturates and the costs of Mini LEDs continue to decrease, Mini LED monitors are expected to enter a growth phase between 2026 and 2027, with a significant increase in market penetration expected by 2027, estimated at around 3.1%.

Notably, as RGB OLED continues to expand, both Mini LED tablets and notebooks are facing potential threats and both applications are expected to reach an inflection point this year. The shipment volume for Mini LED notebooks is estimated to decrease by approximately 39% YoY. Meanwhile, with the 12.9-inch iPad Pro expected to be discontinued in 2024, the shipment volume of Mini LED tablets is expected to decrease by about 15.6% YoY, making these two the only applications expected to decline.

For the automotive market, even though inflation in Europe and the US is slowing down in 2023, the global economy remains weak. Automakers are stimulating demand through price reductions, inadvertently leading to a price war across the entire automotive market. However, the adoption of Mini LEDs in automotive displays is gradually expanding. With the development of smart cockpits, there is a trend towards a higher-end upgrade of in-car screens.

TrendForce investigations reveal that automakers, including BMW, Mercedes-Benz, Volvo, NIO, Roewe, and Li Auto are actively entering the Mini LED automotive display market. Mini LED COB technology, which uses blue LED combined with QD/phosphor, will compete with Mini LED POB/OLED display technology in the automotive display market.

Table of Contents

Chapter 1. Global Lighting Market Trend

- 2023-2027 Shipment and Penetration Rate for Mini LED BLU TVs

- 2023-2027 Mini LED BLU Types and LED Demand for TVs

- 2023-2027 Shipment and Penetration Rate for Mini LED BLU Monitors

- 2023-2027 Mini LED BLU Types and LED Demand for Monitors

- 2023-2027 Shipment and Penetration Rate for Mini LED BLU NBs

- 2023-2027 Mini LED BLU Types and LED Demand for NBs

- 2023-2027 Shipment and Penetration Rate for Mini LED BLU Tablets

- 2023-2027 Mini LED BLU Types and LED Demand for Tablets

- 2023-2027 Shipment and Penetration Rate for Mini LED BLU VR Headsets

- 2023-2027 Mini LED BLU Types and LED Demand for VR Headsets

- Penetration Rates of Mini LED BLUs in Consumer Electronics Applications

- Shipments of Mini LED BLUs in Consumer Electronics Applications

- Quantity Demanded of LED (COB) for Mini LED BLU Applications

Chapter 2. Mini LED BLU Technology Trends and Market Dynamics

- Supply Chain Of Mini LED Backlight Market

- Capital Distributions among Chip Manufacturers

- LED Chip Manufacturers: HC SemiTek

- LED Chip Manufacturers: San'an

- Midstream Player' Capital Layout

- Equipment Player: HOSON

- LED Package Player: Everlight

- LED Package Player: Lextar

- LED Package Player: Hongli

- LED Package Player: MTC

- LED Package Player: Nationstar

- LED Package Player: Refond

- LED Package Player: APT Electronic

- LED Package Player: Jufei

- LED Glass Substrate Manufacturers: WG Tech

- LED Module Player : SmileLighting

- LED Module Player : MLED

- LED Module Player : Longli

- Application Player: BOE

- Application Player: TCL

- TCL X11G Max: Specs analysis

- Application Player: Tianma

- Application Player: Hisense

- Analysis Of POB / COB / COG Technology

- COB Process & Technology Maturity Analysis

- Analysis Of PCB Substrate

Chapter 3. Development of the TV Application Market for Mini LED Backlight and OLED

- Brand Landscape Dynamic: Mini LED TV

- Mini LED TV Overview

- Trend Analysis of Mini LED Backlight TV

- Analysis of Next-gen Mini LED-backlit/OLED TVs in Each Market by Quantity

- Analysis of Next-gen Mini LED-backlit/OLED TVs in Each Market by Price Difference

- 2022-2023 Shipments of Mini LED BLU TVs among Brands

- Samsung VD's Strategy Shift for Sources of LCD TV Panel Procurement

- A Breakdown of Samsung VD's TV Portfolio in 2023

- 2022-2023 OLED TV Market Share by Brands

- 65" 4K TV Panels Cost Comparison with Different Display Technologies

- 2023-2028 Estimates of Global TV Shipments

- 2023-2027 Shipment Estimates for OLED and QLED TVs

- Panel price comparison: 55" LCD Open Cell VS. OLED

- Panel price comparison: 55" LCD Open Cell VS. OLED

- White OLED: Technological Development and Structural Optimization

- QD OLED: Technological Development and Structural Optimization

Chapter 4. Development of the IT Application Market for Mini LED Backlight and OLED

- Brand Landscape Dynamic: Mini LED MNT/NB

- Mini LED MNT Overview

- Trend Analysis of Mini LED Backlight MNT

- Analysis of Next-gen Mini LED-backlit/OLED MNTs in Each Market by Quantity

- Analysis of Next-gen Mini LED-backlit/OLED MNTs in Each Market by Price Difference

- Specs/Price Analysis of COG Mini LED-backlit MNTs in China

- 2022-2023 Shipments of Mini LED BLU Monitors among Brands

- 2023-2027 Global Monitor/AIO Set Shipment Forecast

- 2022-2025 OLED Monitor Shipment Forecast

- OLED Monitor Type and Size Distribution

- 31.5" 4K MNT Panels Cost Comparison with Different Display Technologies

- Mini LED NB Overview

- Trend Analysis of Mini LED Backlight NB

- Analysis of Next-gen Mini LED-backlit/OLED NBs in Each Market by Quantity

- Analysis of Next-gen Mini LED-backlit/OLED NBs in Each Market by Price Difference

- 2022-2023 Shipments of Mini LED BLU Notebooks among Brands

- 2023-2026 Global Notebook PC Shipment Forecast

- Apple's Display Technology Plan for MacBook, iPad, and iMac

- 15.6" FHD NB Panels Cost Comparison with Different Display Technologies

- 2022-2024 OLED NB Penetration Rate Forecast

- 2023 OLED Notebook Penetration Rate by Brands

- Analysis of Next-gen Mini LED-backlit/OLED Tablets in Each Market by Quantity

- Analysis of Next-gen Mini LED-backlit/OLED Tablets in Each Market by Price Difference

- 12.9" Tablet Panels Cost Comparison with Different Display Technologies

- Analysis of Next-gen Mini LED-backlit/OLED Displays in India by Quantity

- Analysis of Next-gen Mini LED-backlit/OLED Displays in India by Price Difference

- Analysis of Next-gen Mini LED-backlit/OLED Displays in Brazil by Quantity

- Analysis of Next-gen Mini LED-backlit/OLED Displays in Brazil by Price Difference

- New AMOLED Fab Investment Plan

- AMOLED Capacity and Product Planning

- New OLED Technology in IT applications - eLEAP

- New OLED Technology in IT applications - Tandem

- Panel Marker Ability Analysis for OLED NB

Chapter 5. Development of the Automotive Display Market for Mini LED Backlight

- Smart Cockpit Trend

- Automotive Display Technology Overview

- 2023-2027 Automotive Display Backlight Analysis

- 2022 Mini LED / HDR Automotive Display- Specification and Supply Chain

- 2022-2025 Mini LED / HDR Automotive Display Schedule and Specification

- NIO ET7 / ET5 / ES7 Automotive Display- Specification and Cost Analysis

- Roewe RX5 Automotive Display- Specification and Cost Analysis

- Cadillac LYRIQ Automotive Display- Specification and Cost Analysis

- 2023 Automotive Display Cost Analysis- Edge / Direct Type

- 2023 Automotive Backlight LED Specification Analysis

- 2023 Automotive Backlight LED Product Specification and Price Analysis

- Mini LED / HDR Automotive Display- Driver IC Specification Analysis

- Automotive Display Supply Chain Flow Analysis

- 2023-2027 HUD Market Shipment- Product vs. Regional Market Analysis

- 2023-2027 HUD Market Shipment- Product Technology Analysis

- 2021-2022 HUD Player Market Share Analysis

- 2023 HUD Product Specification and Price Analysis

- 2023 HUD Product Price Analysis

- AR-HUD Technology Analysis

- 3D AR-HUD Product Trend

- AR-HUD OEM Supply Chain and Product Specification Analysis

- HUD Market Value Chain Analysis

Chapter 6. Development of the Head-mounted VR Display Market for Mini LED Backlight

- Virtual Reality Product Analysis- Oculus Quest Pro

- Virtual Reality Product Analysis- Sony PlayStation VR 2

- Virtual Reality Product Analysis- HTC VIVE Focus 3 / Pico 4 Pro