|

市場調查報告書

商品編碼

1266271

運營商中立部門的2022年的OPEX電費及燃料費對劇增:對許多運營商中立部門經營者來說電費及燃料費是最大的運營成本,佔OPEX (ex-D&A) 的最大80%Energy Costs Spike 2022 Opex for Carrier-neutral Sector: For Many Carrier-neutral Operators, Energy is Largest Operational Expense and Can Account for Up to 80% of Opex (ex-D&A), Costs Surged in 2022 for Many |

||||||

電費及燃料費,佔基礎設施專門的運營商中立的網路運營商工作業者 (CNNO) 的運營成本用的大部分,OPEX (ex-D&A) 的30%以上,電費及燃料費花費最大80%。

本報告提供手機訊號塔,資料中心,光纖網路業者的能源支出相關資料,其資料的意義和關於今後方向性的論述。

圖表

調查對像

刊載企業

|

|

目錄

- 摘要

- CNNO:比其他業者類型更能源密集型

- 網路的永續性:需要從CNNO開始

- 影響

- 附錄

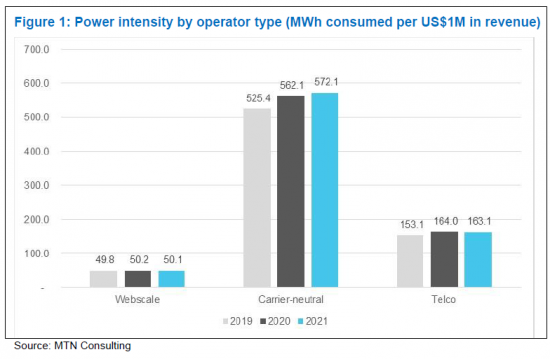

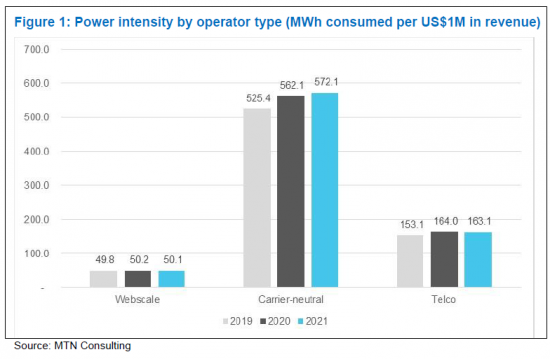

This brief presents data on energy spending by operators of cell towers, data centers, and fiber networks, and discusses the implications of the data and likely future directions. Utilities represent a large portion of operating expenses for these infrastructure-focused companies, which we track as "carrier-neutral network operators" (CNNOs). CNNOs also spend more than other types of operators. Webscale spending on power is miniscule relative to their size, less than 1% of opex (ex-D&A). Telcos spend a few % of opex (ex-D&A) on utilities. But CNNOs can spend more than 30% and up to 80% of opex (ex-D&A) on utilities.

VISUALS

Coverage

Companies mentioned:

|

|

Table of Contents

- Summary

- CNNOs are more energy-intensive than other operator types

- Sustainability in networks needs to start with CNNOs

- Implications

- Appendix

List of Figures

- Figure 1: Power intensity by operator type (MWh consumed per US$1M in revenue)

- Figure 2: Utilities spend as a % of opex (excluding depreciation & amortization), 2020-22

- Figure 3: Utilities vs. D&A costs as a percentage of total opex, 2022